Chainlink Product Update: Q3 2023

Web3 gives developers new superpowers: developers can now create apps that cannot be shut down, cannot cheat (code is law), and can secure massive amounts of value. These apps provide consumers with new types of verifiable guarantees, such as verifiable ownership of their assets and data. Practically, they can now interact with financial services where they can verify the use of funds and the solvency of the institution, they can buy insurance where they can verify how the payouts will not be withheld arbitrarily, they can use trading apps where they can verify their trades will not be stopped at the worst moment for them.

While DeFi (verifiable finance), NFTs (verifiable art), and gaming (verifiable outcomes) were the first markets where these principles were pioneered, what we are seeing now is that virtually every market is being radically reinvented through the lens of verifiability.

As it becomes more technically feasible to integrate these verifiability layers within existing apps and business models, consumers will come to expect these properties as table stakes, very much like they expect any business to offer a mobile app. Verifiability will become a key competitive differentiator, especially in a world that’s currently struggling to discern what’s true and what’s false.

The key to accelerating the transition to the verifiable web is to make it easy for all developers to integrate these properties into their existing systems. For this to happen, the main problem that needs to be solved is to connect heterogeneous systems together: blockchains with Web2 systems, and blockchains with one another. This is the problem that Chainlink solves, by providing a standard connectivity layer in the form of a decentralized computing platform that developers can use to create verifiable applications.

Capital markets in particular are at their own inflection point, as many of the world’s leading financial institutions and market infrastructure providers collaborate with Chainlink to realize the benefits of onchain finance and asset tokenization. Financial institutions are connecting their legacy systems directly to blockchains, proceeding to a technological jump to simpler, more efficient, more secure infrastructure.

Whether you are an individual developer, a Web3-native project, or an established institution, it’s abundantly clear that there’s currently a massive opportunity to innovate and have a lasting impact on the digital lives of people around the world by building verifiable applications and high-integrity markets.

The following product update will look at the progress made across Chainlink services in Q3 2023 and provide insights into future developments. We’ll also be hosting a Q&A on the Chainlink Official Discord related to this product update on Wednesday, October 18 at 12:00 PM ET. Please use this form to submit a question. We’ll be collecting questions until 12:00 PM ET on Monday, October 16.

Please note that all future-facing comments are subject to change based on user feedback, shifts in consumer demand, strategic determination, and various other unforeseen challenges and opportunities. The goal of this product update is to provide insight into previous releases and current thinking based on ongoing research and development, but it is not a definitive product roadmap; it’s an attempt to balance transparency with the need to remain agile in this dynamic industry, which moves fast and is constantly evolving.

Cross-Chain

Cross-Chain Interoperability Protocol (CCIP)

Product Description

Chainlink Cross-Chain Interoperability Protocol (CCIP) is the global standard for cross-chain communication. It establishes a universal connection between public and private blockchains so that arbitrary data, tokens, or instructions alongside tokens (i.e., programmable) can be sent between chains.

Current Focus

The industry is increasingly coalescing around the tokenization of real-world assets (RWAs) as Web3’s next killer use case. As a natural evolution of digital finance, asset tokenization can bring more liquidity, efficiency, and transparency to capital markets, as well as make hundreds of trillions of dollars in assets held within traditional financial infrastructure compatible with blockchain networks and applications.

The focus of CCIP is to create a cross-chain communication standard akin to TCP/IP for the Internet, which connects institutions to blockchains using their existing infrastructure, connects public and private blockchains together, and facilitates cross-chain delivery vs. payment (DvP) via atomic settlement. As the industry’s most secure and decentralized blockchain interoperability protocol, CCIP not only provides a gateway for financial institutions to seamlessly access and transact with digital assets across blockchains, but it also gives Web3-native projects level-5 cross-chain security, which they can build innovative cross-chain use cases on top of.

Chainlink Co-Founder Sergey Nazarov explains in the video below why Chainlink is the only cross-chain protocol with level-5 security, featuring multiple layers of decentralization and onchain risk management.

Recent Deployments

- Expanded CCIP’s cross-chain connectivity to three new public blockchain mainnets: Arbitrum, Base, and BNB Chain.

- Swift, Chainlink, and more than a dozen of the world’s largest financial institutions engaged in an industry collaboration to demonstrate how banks and market infrastructure providers could instruct the movement of tokenized assets between any public or private blockchain via a combined solution of Swift messaging standards and CCIP. Importantly, the collaboration showcased how financial institutions can interact with tokenized assets and move them cross-chain, with CCIP serving as the single integration point that requires little-to-no modification of their existing infrastructure. Read the full Swift results report for more details.

- The Depository Trust and Clearing Corporation (DTCC), which processes over $2+ quadrillion in securities annually, announced its collaboration with Chainlink on using Chainlink services such as CCIP to uncover new opportunities to propel the digital asset ecosystem forward for the benefit of market participants and the broader industry. Read this article from DTCC’s Stephen Prosperi to learn more.

- The Australia and New Zealand Banking Group Ltd (ANZ), the largest institutional bank in Australia with over $1 trillion in assets under management, worked with Chainlink to demonstrate cross-chain tokenized asset settlement transactions using CCIP and ANZ-issued stablecoins and tokenized assets. Check out the following case study to learn more.

“The value and the message moving together is revolutionary. That’s a real breakthrough.”—Nigel Dobson, Banking Services Lead at ANZ, at Sibos 2023

What’s Next

- Expand access to CCIP by transitioning to Mainnet General Availability (GA), with developers being able to start using CCIP on mainnet permissionlessly.

- Expand CCIP chain support to include additional public and private blockchains.

- Continue modularizing the underlying Chainlink tech stack so Chainlink services can be more quickly integrated with new blockchains in an iterative manner, particularly by automating deployment processes without compromising on security or reliability.

- Explore how the Risk Management Network can support additional conditions to adapt to new cross-chain attack vectors and adversaries.

Data

Data Streams and Data Feeds

Product Description

Chainlink’s suite of data products provides smart contracts with a secure and reliable source of truth or metadata about an external event such as an asset price change or sports event outcome.

Current Focus

Chainlink data products unlocked the first wave DeFi by providing developers with an onchain source of verifiably secure and reliable data such as Price Feeds. Since then, Chainlink data products have expanded to support new data types, new blockchains and layer-2 networks, and low-latency use cases through the launch of Chainlink Data Streams.

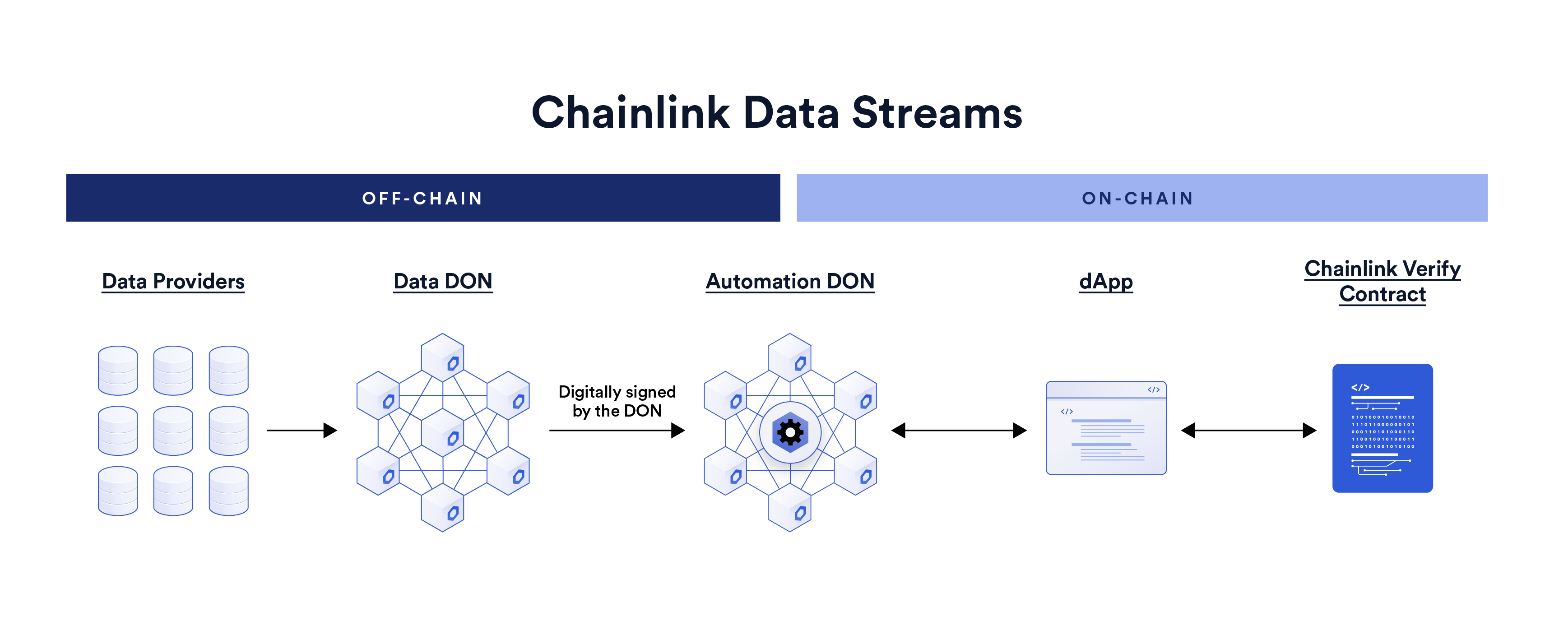

Chainlink Data Streams and Chainlink Data Feeds are distinct services that offer unique value for different use cases. Chainlink Data Feeds are the industry standard push-based oracle solution, providing regular updates directly onchain based on certain conditions being met. Chainlink Data Feeds are ideal for supporting use cases where dApps need to read data that is already written onchain (i.e., they are designed around reference contracts). Alternatively, Chainlink Data Streams leverage a pull-based oracle design that makes high-frequency data available to DeFi protocols offchain, which they can consume onchain as desired. Data Streams enable protocols with latency-dependent use cases to execute trading strategies that require near real-time data accuracy while maintaining end-to-end trust-minimization.

One area where Chainlink Data Streams are in demand is DeFi derivatives, as there are a growing number of teams building derivatives solutions. We continue to work closely with a range of different DeFi protocols and blockchain ecosystems, including the GMX and Offchain Labs teams, to understand their exact needs and pain points as we further cement Chainlink Data Streams as the industry-standard low-latency oracle solution.

Recent Deployments

- Launched Chainlink Data Streams, the all-in-one data solution for the DeFi industry, on mainnet. By combining high-frequency market data and automated execution, Chainlink Data Streams unlock a new generation of ultra-fast and user-friendly derivatives products with decentralized and transparent infrastructure. Chainlink Data Streams are seeing accelerating market demand, with GMX V2 already live on mainnet, multiple projects live on testnet, and many more eager to get started.

- Launched market liquidity and volatility data such as bid/ask spread as part of the Data Streams solution. These unique data types enable a new era of automated onchain risk management, and support new product offerings that further accelerate DeFi innovation and growth. Users can bundle these data sets with price data for increased cost efficiency.

- Launched real-world asset Data Feeds for protocols such as Backed Finance to support the use of its bTokens within DeFi. Chainlink launched Price Feeds for IBO1, IBTA, and CSPX, each of which track real-world assets.

- Launched Chainlink Data Feeds on Base mainnet to help accelerate the growth of the Coinbase-incubated layer-2 network. Base joined the Chainlink SCALE program earlier in the year, making Chainlink data and services available to developers at a lower cost by covering certain operating costs of Chainlink services deployed on the network. Several DeFi protocols are already leveraging Chainlink Data Feeds on Base, including Aave, Balancer, Compound, QiDao, and Moonwell.

“Chainlink Data Streams allow GMX to deliver maximum speed, security, and reliability at scale and without compromise. They are essential infrastructure to unlock the future of highly performant, reliable, and decentralized onchain derivatives.”—X, Development Core Contributor to GMX.

What’s Next

- Integrate Chainlink Data Services on additional blockchains and layer-2 networks, with an initial focus on those who have joined the Chainlink SCALE program, which includes new zkEVM layer-2 networks.

- Expand Chainlink Data Streams to Mainnet General Availability (GA) to enable all developers to integrate the service permissionlessly, as well as continue adding more data providers to Data Streams for increased decentralization and provide display support for Data Streams on https://data.chain.link/.

- Continue to evolve the underlying architecture of Chainlink Data Feeds to make the solution progressively even more scalable and gas-efficient. This involves launching the next version of OCR (3.0).

- Improve the user experience of Data Feeds by developing an intuitive user interface that supports batching multiple requests into a single onchain call.

- Enable Data Feeds to deliver multiple data points, such as bid/ask and volatility data alongside price data, onchain to further expand the breadth of data points available to developers.

- Expand support for additional real-world asset datasets based on user demand, such as commodities, carbon markets, and real estate.

Proof of Reserve

Product Description

Chainlink Proof of Reserve (PoR) provides autonomous, reliable, and timely verification of cross-chain and offchain reserves that back tokenized assets and wrapped assets.

Current Focus

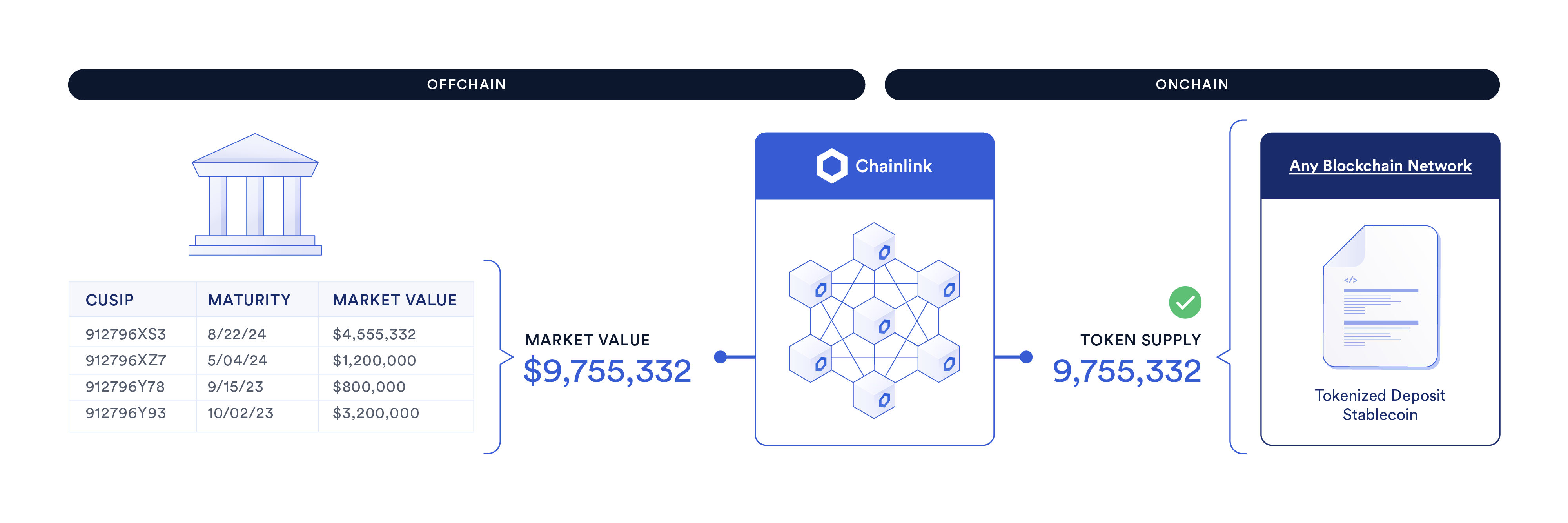

For tokenized assets to be reliably used onchain, they need Proof of Reserve Data Feeds that attest to their backing by assets held offchain in custody accounts or cross-chain by smart contracts. Chainlink Proof of Reserve is focused on securely providing data that attests to the value of reserves backing stablecoins, tokenized real-world assets, and liquid staking tokens (LSTs), ultimately connecting the real world with the onchain world and enhancing the utility of DeFi-native assets.

Recent Deployments

- Matrixdock integrated Chainlink Proof of Reserve to help ensure that its Short-Term Treasury Bill Token (STBT) supply is sufficiently backed by short-term U.S. Treasury bills held in reserve prior to minting new SBT tokens. The integration leverages a third-party external auditor, The Network Firm, to attest to the amount of collateral held offchain.

- Harris & Trotter LLP, a top-tier accountancy firm and leader in the digital asset space, announced that it will be providing third-party attestations to Chainlink Proof of Reserve. This takes the form of calculating the value of both fiat and investment assets stored offchain and attesting to Chainlink nodes the total value of reserves.

“[With Chainlink Proof of Reserve], at any given moment, anyone can verify the number of STBT tokens and the dollar value of the assets in the bank account.” —Ben Stani, business development and sales lead at Matrixport

What’s Next

- Work with tokenized asset issuers to launch more Proof of Reserve Data Feeds, particularly for stablecoins and fixed-income assets.

- Continue to strengthen risk monitoring for Proof of Reserve Data Feeds, as well as onboard more auditors who can attest to the value of offchain assets.

DECO

Product Description

Chainlink DECO is a privacy-preserving oracle protocol that enables individuals and businesses to prove the provenance of data coming from a particular data source to an oracle, as well as prove arbitrary statements on that data in zero-knowledge.

Current Focus

The Chainlink Labs Research Team has been collaborating with teams across the industry and academia to explore use cases such as identity verification and risk scoring and test DECO’s compatibility with different data sources. At SmartCon 2023, Chainlink Labs Research Engineer Alexandru Topliceanu demoed the DECO playground for a use case involving verifying that a particular user is a member of a Discord guild. Additionally, the Research Team has been focused on Ethereum-optimized attestations and introducing support for ARM processors.

What’s Next

- The DECO playground is being opened up beyond select academic and industry partners. Sign up here to register your interest.

Compute

Automation

Product Description

Chainlink Automation is the industry standard for developers who need highly reliable, decentralized, and performant smart contract automation to build next-generation dApps.

Current Focus

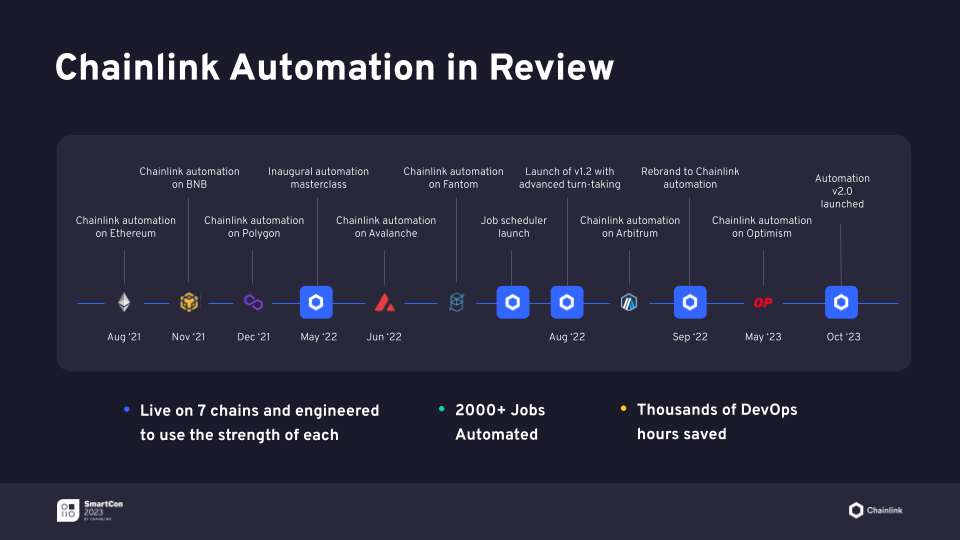

Onchain computation limits Web3’s potential because it’s often expensive, subject to price volatility and congestion, and unable to react to log events/triggers emitted onchain. Chainlink Automation enables dApp developers to overcome these limitations by providing them with a decentralized, verifiable, and predictably priced offchain computing service with enterprise-grade reliability and the ability to trigger smart contracts at specific time intervals or after conditional events.

Since its launch, the focus for Chainlink Automation has remained on developing new sets of automation triggers and features that enable developers to build more innovative applications instead of worrying about creating and managing supporting infrastructure.

Recent Deployments

- Launched Chainlink Automation 2.0 on mainnet, which transitions the protocol from a turn-taking model to a consensus mechanism—establishing a new industry standard in automation security, reliability, and decentralization. Chainlink Automation 2.0 also features support for log triggers to open up new connections between smart contracts and is seamlessly integrated with Data Streams to provide settlement automation solutions for DeFi. Developers can now offload expensive onchain computation to Chainlink Automation and still receive verifiable compute with cryptographic guarantees but at a fraction of the onchain cost, saving up to 90% in costs. Developers can also increase the amount of computation that they include in their smart contracts, opening up more advanced use cases.

- Deployed Chainlink Automation on Optimism to support builders on its layer-2 network.

“We’ve used Chainlink Automation to run basic onchain liquidators for Interest Protocol, to implement trustless onchain limit orders for Uniswap v3 in Oku, and have more applications in the works. The Chainlink Automation 2.0 network is the most dependable and decentralized platform, safeguarding and securing the value inherent in the interactions of Oku and Interest Protocol users, helping ensure their execution is both timely and secure.”—Getty Hill, Co-Founder of GFX Labs

What’s Next

- Continue expanding Chainlink Automation across layer-2 networks to enable the development of innovative dApps across more ecosystems.

- Make log triggers generally available on chains supported by Chainlink Automation.

- Provide the developer community with more tools and code samples so they can quickly and securely build real-world use cases involving Automation.

Functions

Product Description

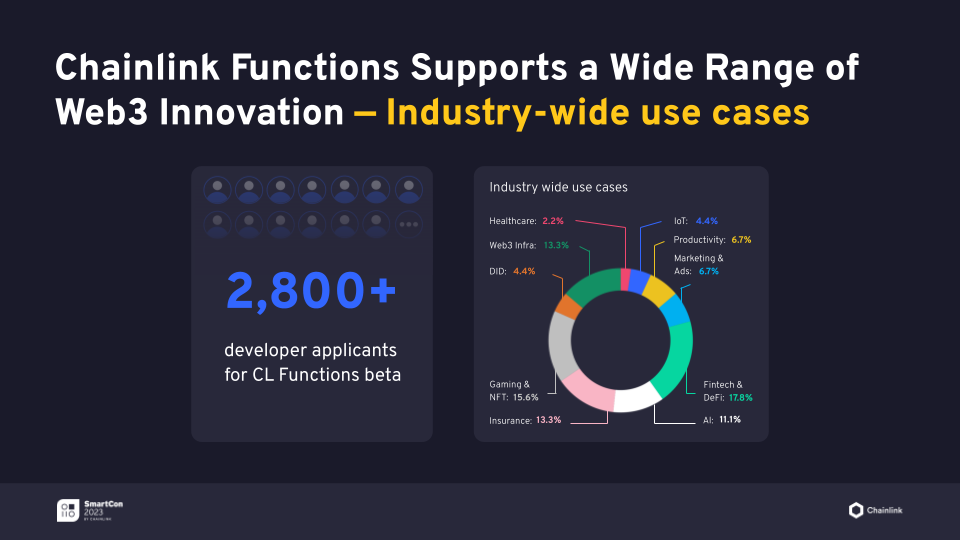

Chainlink Functions is a Web3 serverless developer platform that enables developers to connect their smart contracts to any external data source and run custom computations in minutes.

Current Focus

The Chainlink Functions Beta was launched on testnet earlier this year across several blockchains. An evolution of the Any API service, Functions makes it easier than ever for developers to combine their smart contracts with any external data or system and transform that data prior to its consumption using decentralized computation. Functions is a core piece of the Chainlink platform because it enables a wide variety of hybrid applications that leverage the best parts of Web2 and Web3. The focus of the last quarter has been adding several new features and quality-of-life upgrades to Functions.

Recent Deployments

- Launched Chainlink Functions Beta on mainnet at SmartCon 2023. With the latest version, it is now easier than ever to build new dApps. Developers can seamlessly create, fund, and manage their subscriptions using an NPM package. They can also monitor, deploy, and interact with all of their Functions through an easy-to-use UI. Additionally, developers can now configure execution time, number of requests, payload size, and other parameters, as well as control who can call their function. This enables developers to gate contract initiation and allow any EOA to trigger the Functions request. Functions also support a threshold encryption scheme to enhance API secrets’ security in a decentralized manner.

“Space and Time has natively integrated with Chainlink Functions to allow our users to send zk-proven query results onchain. The integration enables smart contracts to leverage the Space and Time data warehouse and ask data-driven questions without spending more gas onchain.”—Scott Dykstra, CTO and Co-Founder at Space and Time

What’s Next

- Expand Chainlink Functions to more chains and layer-2 networks to meet growing developer demand.

- Expand developer tooling support (e.g., libraries) and provide more control to developers on the levels of decentralization based on their usage patterns.

VRF

Product Description

Chainlink Verifiable Random Function (VRF) is the industry standard source of provably fair and tamper-proof randomness.

Current Focus

With Web3 expanding and development ecosystems like NFTs and onchain gaming gaining traction, the need for verifiable random number generation (RNG) becomes increasingly important. One notable example is MapleStory Universe—Nexon’s NFT-centered blockchain games ecosystem—which is integrating VRF to help enable provably fair game experiences on its Polygon Supernet appchain.

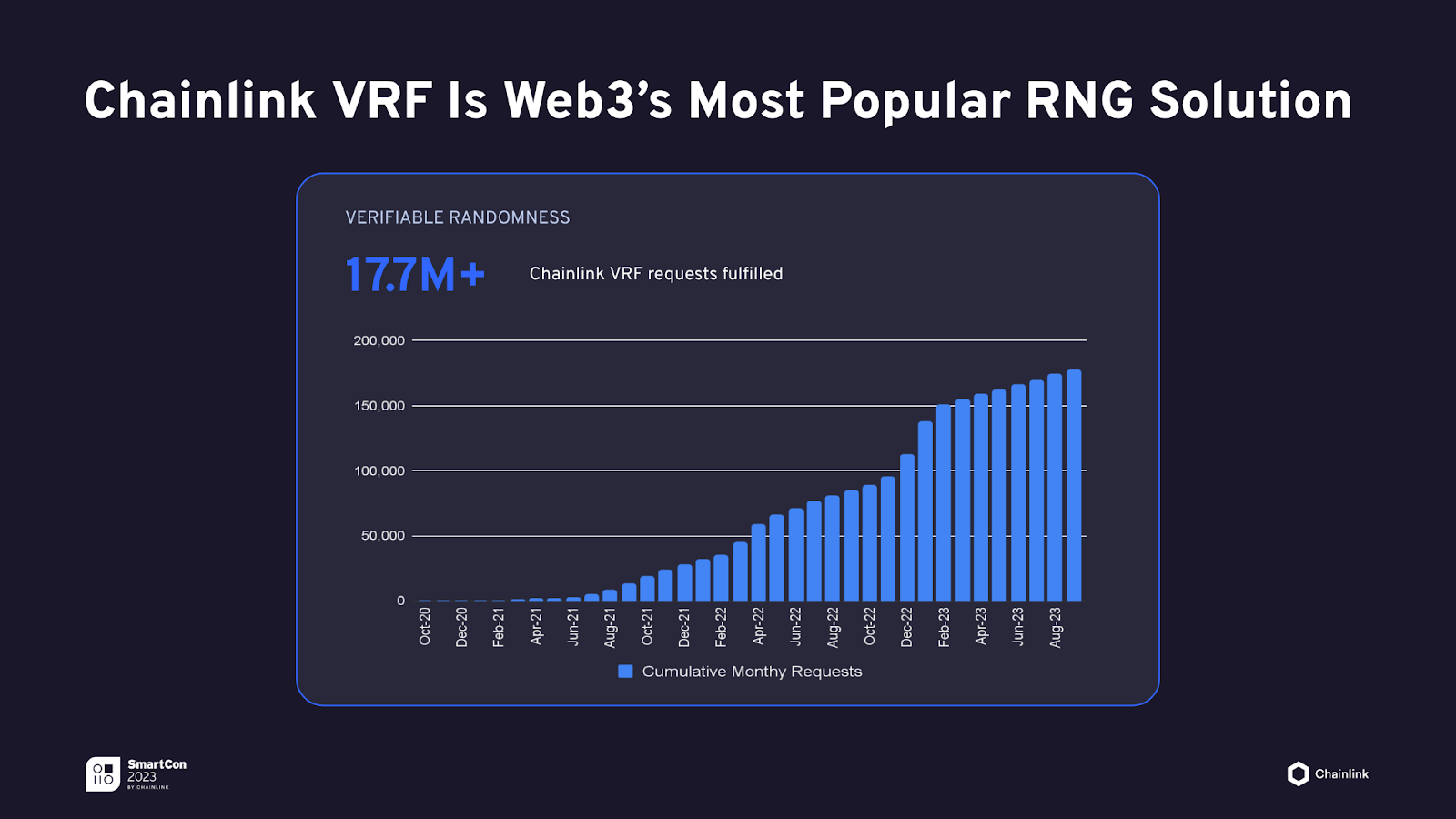

Chainlink VRF is Web3’s most widely used RNG solution, fulfilling 17.7 million requests for verifiable randomness that have serviced over 6,700 smart contracts across multiple blockchains. Chainlink VRF has also achieved end-to-end latency of close to two seconds, opening up use cases that demand high-speed responses. The current focus is to extend the success of VRF to the growing appchain world, as well as make it easy to integrate VRF with offchain systems.

What’s Next

- Launch Chainlink VRF 2.5, which will include two major improvements: an expansion of the VRF payment model to reduce payment friction and a substantial UX improvement for upgrading VRF. Reduced payment friction opens up new ways of building services on top of VRF while the new migration function will make it easy for developers to upgrade to new VRF versions. VRF 2.5 will initially be deployed on Ethereum, and then gradually rolled out across supported chains.

“MapleStory Universe is an avant-garde endeavor in the evolution of virtual worlds, seamlessly integrated with blockchain technology. The implementation must be impeccable, and Chainlink VRF epitomizes our commitment to decentralization and transparency within the forthcoming MapleStory Universe. We’re thrilled to have chosen Chainlink as the bedrock of blockchain services, empowering diverse contributors to enrich our content.”—Sunyoung Hwang, Production Director.

FSS

Product Description

Fair Sequencing Services (FSS) is a transaction ordering solution that aims to mitigate harmful forms of maximal extractable value (MEV) in order to help decentralized systems become fundamentally fairer.

Current Focus

At SmartCon 2023, Chainlink Labs Chief Scientist Ari Juels outlines the MEV problem and its impact on the blockchain ecosystem, as well as describes how Protected Order-Flow (PROF), an innovative system that can make fair transaction ordering via FSS a practical reality. PROF allows healthy competition in the MEV supply chain, while providing tamper-proof bundles of transactions that are fairly ordered by FSS.

Chainlink Developer Community

The remarkable growth of our developer community has played a key role in the positioning of Chainlink as the industry standard platform for building verifiable applications and high-integrity markets. Chainlink prides itself on being an industry leader when it comes to creating in-person and online events and providing extensive developer resources and documentation so that building with Chainlink is efficient, secure, and easy to understand for those wanting to dive deep.

The Chainlink Staking V0.2 contest is a prime example of how a documentation should be written in order to maximize the auditors' productivity and understanding of the codebase.👏

Here is some of the information the more than 100-page documentation provides👇— Trachev Georgi (@trachevgeorgi) August 29, 2023

Hackathons and Meetups

- Every Chainlink hackathon has been larger than the previous in terms of size, participants, and projects submitted. The latest Chainlink Spring Hackathon had more than 14,000 signups and nearly 500 projects submitted.

- We’re doing more developer meetups than ever before. Over the past year, we’ve hosted over 150 workshop and networking events, reaching more than 10,000 Web3 builders and enthusiasts. The Chainlink community is also making a global impact, with 100 local Chainlink communities operating in 46 countries and 92 cities. Our success and global reach can in large part be attributed to 180 community advocates and developer experts, who serve as volunteer community ambassadors who help educate and organize their local communities all around the world. Chainlink’s community growth has led to over 44,000 total deployments involving Chainlink services since January 1, 2023.

- Chainlink’s virtual masterclasses have proven to be a big success, with strong interest from developers wanting to learn about Functions and CCIP. Between the two events, there were over 2,000 signups, with more than 250 attendees completing the masterclasses.

- SmarCon 2023 kicked off with the Chainlink Hacker House, a two-day experience sponsored by Google Cloud which drew more than 400 participants. Hacker house prize winners used the Chainlink platform’s extensive collection of services to build cross-chain governance tooling, decentralized flight insurance, and more.

Recent Updates

- Launched Chainlink QuickStarts, a new self-service resource to help developers rapidly identify Chainlink oracle solutions and smoothly integrate them into their tech stacks. With just a few clicks, developers will have access to a living library of use cases and resources to speed up their adoption, such as code samples, implementation guides, and a variety of other resources needed to take off from zero.

- Launched the Developer Resource Hub which consolidates all Chainlink resources and documentation into one central location so developers have all the relevant resources needed to build solutions with Chainlink.

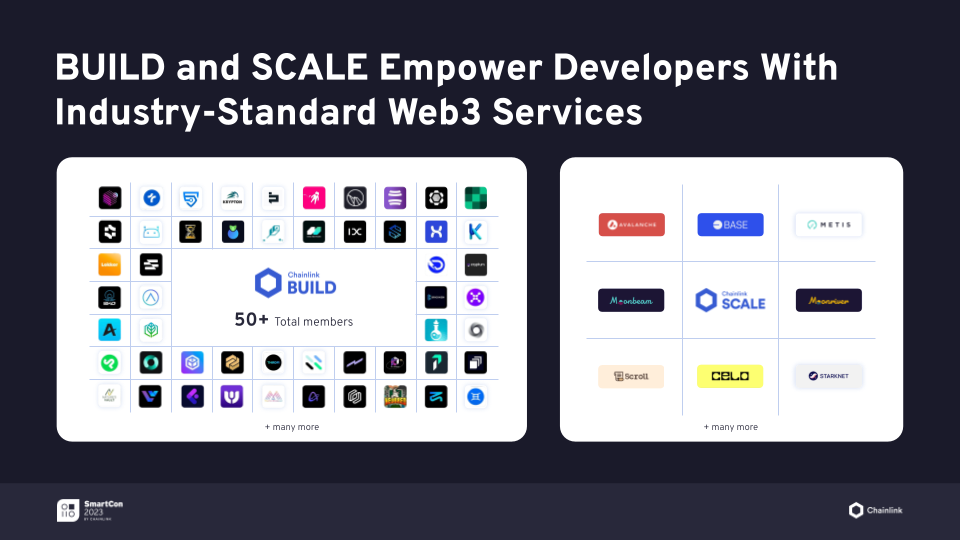

- Reached 50+ members in the Chainlink BUILD program, while the Chainlink SCALE program now includes eight different chains. Chainlink BUILD and SCALE help empower developers by providing them with verifiable Web3 services needed to build high-speed, low-cost dApps.

What’s Next

- Add multi-language support for Chainlink Docs to help the growing number of developers around the world using Chainlink. Chainlink Docs are now offered in English, Chinese, and Portuguese, with more languages to follow shortly.

The Future Is On

We’re seeing accelerated adoption of verifiability principles, as well as a technical maturation of the technological blueprint for this adoption. Web3 protocols are rapidly maturing and financial institutions are accelerating their transition to onchain finance. Consumers are beginning to demand verifiable guarantees across a wide range of aspects that make up their digital lives. It’s no longer acceptable to them to not know how their assets or their data are being handled. It’s time to build the verifiable web. Let’s build it together.

To learn more, visit chain.link, subscribe to the Chainlink newsletter, and follow Chainlink on Twitter, YouTube, and Reddit.