How Chainlink Unlocks the Full Capabilities of Tokenization for Capital Markets

Chainlink is the core infrastructure that capital markets need to advance tokenization from the proof-of-concept stage to the production stage. Chainlink’s role in supporting capital markets is necessary across three key tokenization use cases:

- Enabling secondary markets for tokenized assets by allowing them to settle on any blockchain, public or private.

- Facilitating Delivery vs. Payment (DvP) workflows with cash/deposit tokens by performing single-chain or cross-chain atomic transactions and eliminating trade failure by ensuring the irrevocable exchange of assets across blockchains.

- Synchronizing on-chain to off-chain systems by supporting communication between legacy infrastructure and blockchains.

Below, we explore the current state of tokenization within capital markets and introduce Chainlink before looking at real-world examples of how financial institutions are using Chainlink to unlock the full potential of tokenization.

The Current State of Tokenization

Tokenization efforts in capital markets have predominantly remained in the proof-of-concept stage since 2017. While some institutions have announced the tokenization of traditional assets such as bonds, these experiments have mainly focused on the initial issuance of assets. For instance, an investment bank, serving as an asset issuer, might tokenize a bond note, acquire it, and quickly mature the note. Other successful use cases, particularly those related to intraday banking and financial transactions (e.g., Broadridge’s DLR and HQLAx) are specific to particular applications and are managed by a single centralized entity that oversees the entire technology process.

Both of these examples underscore a common issue: friction caused by a lack of seamless connectivity across various ecosystems and applications. Most notably, asset managers and asset owners have been largely absent from active participation even though they are critical to creating sufficient liquidity. Their involvement necessitates robust enterprise-grade infrastructure, which establishes the essential connections needed to facilitate a secondary market. This interoperability infrastructure should seamlessly integrate with existing internal systems without major disruptions. Ultimately, each added piece of connectivity will enhance the overall utility of blockchain-based financial products.

Chainlink: Connecting Today’s Infrastructure to Blockchain Networks

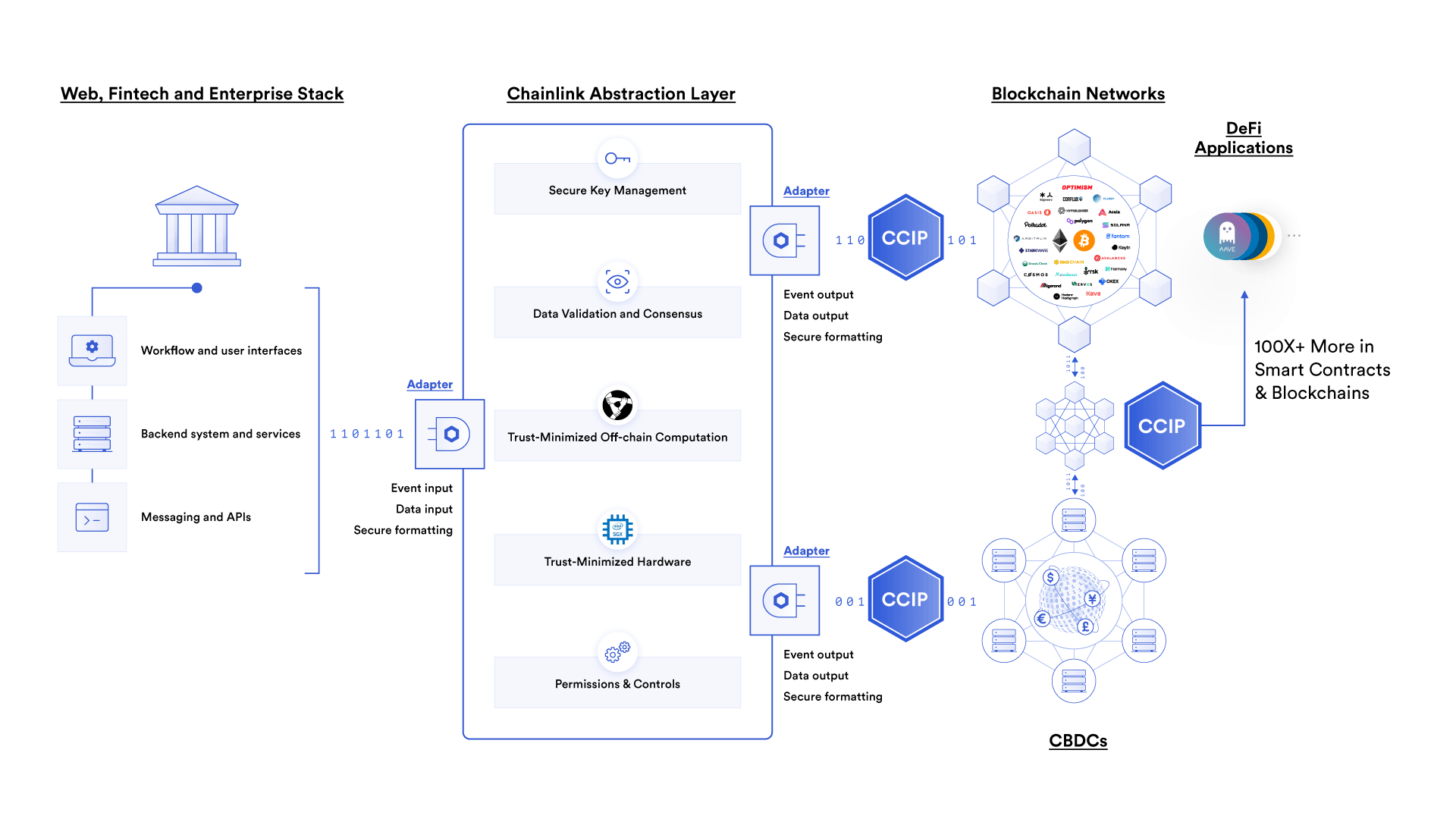

Chainlink is enterprise-grade infrastructure that empowers financial institutions to make the necessary connections between blockchains (on-chain) and their existing infrastructure (off-chain). If your existing tech stack needs to do “blockchain stuff,” simply integrate it with Chainlink to connect with public and private blockchains.

Chainlink offers a suite of services that facilitate the transfer of data and tokens across blockchains, bidirectional communication between blockchains and external systems, and a multitude of other computational services for privacy, automation, and more. Three Chainlink services particularly relevant to tokenization within capital markets include:

- Cross-Chain Interoperability Protocol (CCIP)—The blockchain interoperability protocol that serves as an abstraction layer and cross-chain messaging protocol enabling existing infrastructure to both communicate with blockchains and instruct smart contracts to send arbitrary data and transfer tokens across any public or private blockchain.

- Proof of Reserve—Decentralized networks that verify or attest to the cross-chain or off-chain reserves backing tokenized assets, resulting in a transparent on-chain audit trail for consumers, asset issuers, and smart contract-based applications.

- Functions—A way for institutions to service any asset on any blockchain by synchronizing off-chain events or data to trigger on-chain actions. Any off-chain events or data can be synchronized, such as standing settlement instructions, corporate actions, proxy voting, ESG data, dividends and interest, and net asset values.

Chainlink has successfully enabled over $12 trillion in transaction value for blockchain applications. The Chainlink Network’s unparalleled security standards are pioneered by a world-class research team and enforced by decentralized oracle networks (DONs) made up of independent, Sybil-resistant nodes operated by leading enterprises such as Deutsche Telekom MMS and Swisscom. Chainlink’s defense-in-depth approach to development has resulted in a multi-year history of high uptime and tamper-proof security, even during the industry’s most volatile and unpredictable conditions.

Real-World Use Cases for Tokenization Enabled by Chainlink

The following section is broken down into three use cases: secondary markets, DvP, and on-chain/off-chain synchronization.

Secondary Markets

Secondary markets are essential for capital markets to function efficiently. They facilitate liquidity and price discovery by providing a platform for investors to buy and sell previously issued financial instruments. Currently, financial markets utilize central securities depositories (CSDs) and custodian banks to maintain records of security holdings. These securities can freely move from one custody bank to another via a set of messaging standards instructed from various front, middle, and back office systems. This interconnected infrastructure not only supports the functioning of secondary markets but also contributes to the overall stability and resilience of the global financial system.

Chainlink enables a secondary market for tokenized assets in three distinct ways:

1. Connects buyers and sellers with accounts on different blockchain platforms

Business Context

Most bonds and illiquid assets trade via over-the-counter (OTC) markets because they are heterogeneous in nature. For the tokenization of bonds and illiquid assets to reach the production stage, the same liquidity platforms (e.g., MarketAxess and TradeWeb) need to be able to list these tokens from a market maker’s inventory or allow them to set prices. A component in how a market maker sets prices is based on liquidity risk—how quickly can they sell their inventory to clean their books by the end of the trading day? To maximize liquidity and achieve attractive spreads in pricing that mirror or improve upon traditionally issued assets, tokenized assets must be able to be settled on any blockchain that asset managers and owners desire to use.

Chainlink’s Role

- Chainlink CCIP provides financial institutions with a single integration gateway through which to communicate with any public or private blockchain.

- Chainlink CCIP enables a tokenized asset to become available on any blockchain, transforming it from a single-chain asset to an any-chain asset.

- Chainlink CCIP facilitates secure cross-chain DvP settlement via atomic transactions.

Example Workflow Utilizing Chainlink CCIP

- Asset Manager A needs to sell BondToken, which is currently issued on Public Chain 1 and held by a fund custodian.

- A trader at Asset Manager A logs into MarketAxess to look at bid/ask spreads from dealers in OTC markets. The dealers can quote tighter spreads because they know this asset is enabled with Chainlink CCIP, meaning it’s an any-chain asset that can be settled on any public or private blockchain.

- The trader pays a small spread, and BondToken is moved from Public Chain 1 to Private Chain 1 for the dealer to hold in inventory.

- Asset Manager B using Private Chain 2 is looking to buy BondToken.

- The dealer makes a price and they agree. CCIP moves the BondToken from Private Chain 1 to Private Chain 2.

2. Easily integrates legacy infrastructure with blockchain networks

Business Context

Financial market participants have been slow to adopt new technologies like blockchains because many still utilize legacy systems. Massive value is secured by these systems, and the cost and risk of replacing or developing new connectivity are exceptionally high.

The past several years have seen hundreds of blockchain proof of concepts with financial institutions. However, very few have made it to production, largely due to issues with integrating blockchains into core business infrastructure. This connectivity problem is exacerbated by the increasing number of available blockchain ecosystems that they may have to interact with.

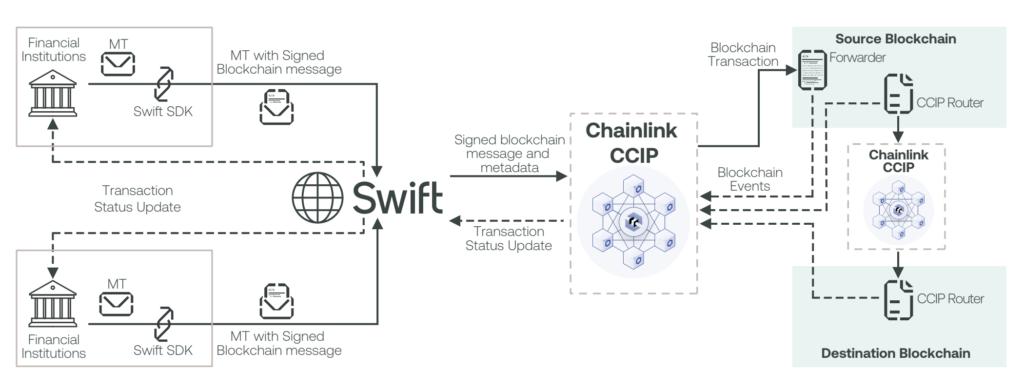

Chainlink’s Role

- Chainlink CCIP connects existing infrastructure to any blockchain so that financial institutions wouldn’t have to modify legacy systems. This enables financial institutions to interact with tokenized assets from existing infrastructure, such as through Swift messages, APIs, mainframes, and other legacy formats.

“More than a dozen major financial institutions and market infrastructures joined the project, including Australia and New Zealand Banking Group Limited (ANZ), BNP Paribas, BNY Mellon, Citi, Clearstream, Euroclear, Lloyds Banking Group, SIX Digital Exchange (SDX), and The Depository Trust & Clearing Corporation (DTCC) … By leveraging existing Swift infrastructure and Chainlink CCIP, the collaboration demonstrated the ability to transfer tokenised value efficiently and securely across public and private blockchains, using standardised messaging formats and proven business processes.”

—Connecting blockchains: Overcoming fragmentation in tokenised assets, Swift 2023

Example Scenarios Enabled by CCIP

- My order management system can only speak via Swift messages to instruct orders, so I’d like to talk to any blockchain through Swift.

- As a bank custodian, I’d like to talk to any blockchain via my wallet infrastructure or client applications.

- My middle office needs confirmations and status updates regarding token movements; i.e., pending, complete, or failed.

- I’d like to post data to a smart contract on a blockchain from an FTP server or Excel spreadsheet.

- I’d like to post data to a smart contract on a blockchain from a mainframe MQ connection.

3. Provides a blockchain interoperability standard for the capital markets industry

Business Context

When navigating the dynamic realm of information technology, large financial institutions are inherently compelled to lean heavily on three foundational pillars: standards, reliability, and security. Standards provide the common language for collaboration, reliability instills confidence in the service continuum, and security protects against malicious threats.

A blockchain interoperability standard is critical to supporting a robust global market for tokenized assets. However, attempts at interoperability have historically been controlled by a central party, involved fragmented tech stacks, or required financial institutions to do point-to-point integrations with each new private or public chain their counterparties want to interact on. With hundreds of blockchains in existence and more likely to come, financial institutions need a blockchain interoperability standard that’s adopted across the industry.

Chainlink’s Role

- Chainlink CCIP is enterprise-grade infrastructure that enables financial institutions to standardize how they issue, acquire, and settle tokenized assets between one another.

Industry Benefits

Establishing CCIP as a blockchain interoperability standard across capital markets will enable financial institutions to realize a multitude of benefits.

- Standardized Messaging: Consistency in communication reduces errors, misunderstandings, and the need for manual intervention.

- Automation and Straight-Through Processing (STP): Transactions can flow seamlessly from initiation to settlement without the need for manual intervention at each step.

- Global Reach: Seamless communication and transactions between entities in different countries facilitate cross-border trading, payments, and investments.

- Reduced Operational Costs: Standardized messaging and automation lower operational costs by reducing the need for manual data entry and validation.

- Integration with Other Systems: Messages can be integrated with other financial systems and platforms, such as trade matching, risk management, and order management systems.

Delivery vs. Payment (DvP)

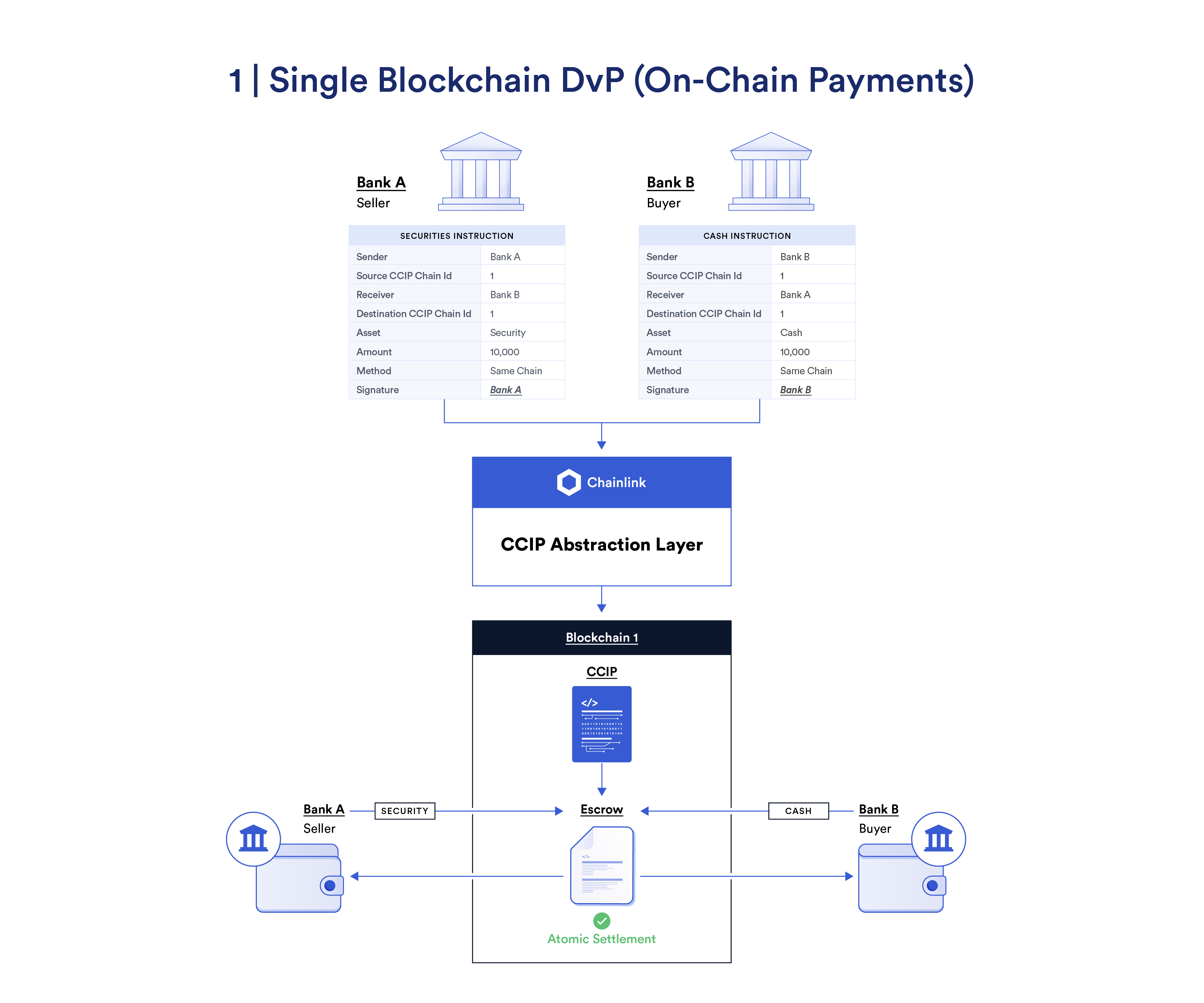

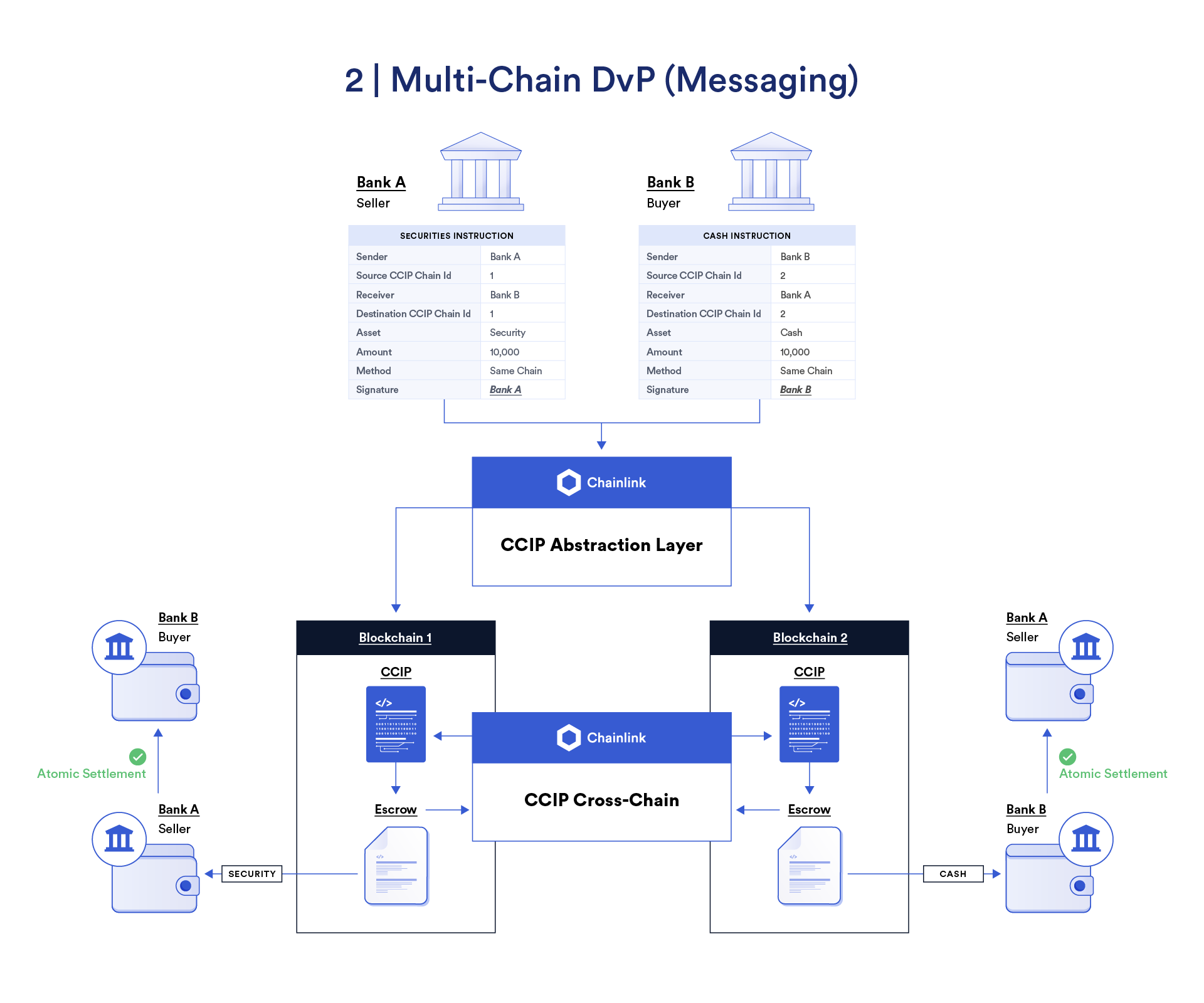

Delivery versus Payment (DvP) is a crucial concept in financial transactions, particularly in securities markets. It reduces counterparty and settlement risks by ensuring that the transfer of assets and the corresponding payment occur simultaneously. DvP plays a pivotal role in maintaining the integrity of transactions, preventing scenarios where one party delivers assets without receiving the agreed-upon payment, or vice versa. Solving DvP on blockchains is critical to unlocking the full potential of tokenized assets because it enables the issuance of more asset classes on-chain.

Real-World Example

For a fully functioning digital asset ecosystem to exist, the cash leg of transactions must be incorporated into various DvP workflows. Banks and central banks are poised to start issuing cash tokens—e.g., tokenized cash deposits and central bank digital currencies (CBDCs)—likely using their own proprietary private chains to start. Their customers, primarily asset managers, and owners must be able to freely use these cash tokens to purchase assets on other blockchain ecosystems. However, settlement risk first needs to be minimized if cash tokens are to increase in utility.

Chainlink’s Role

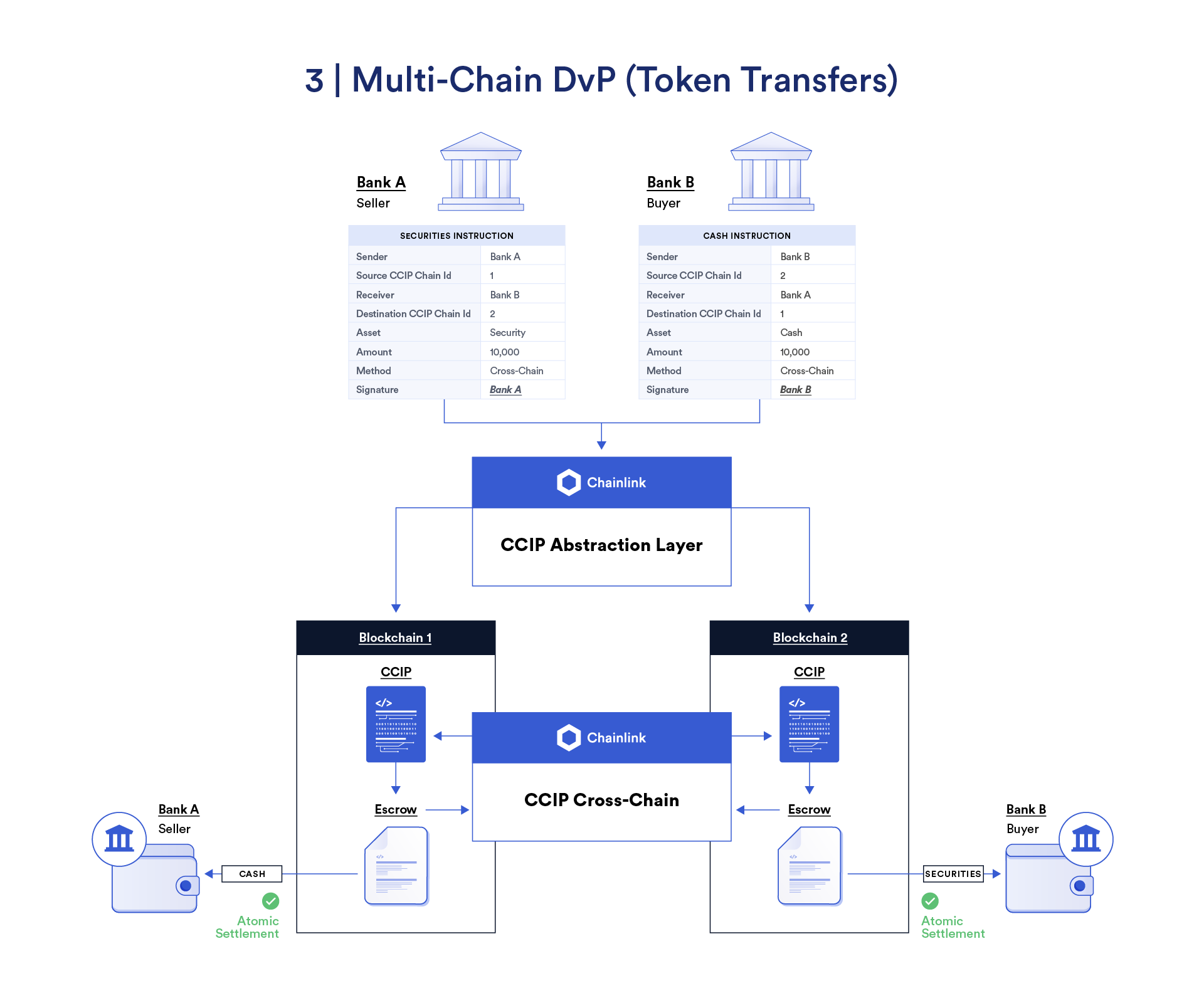

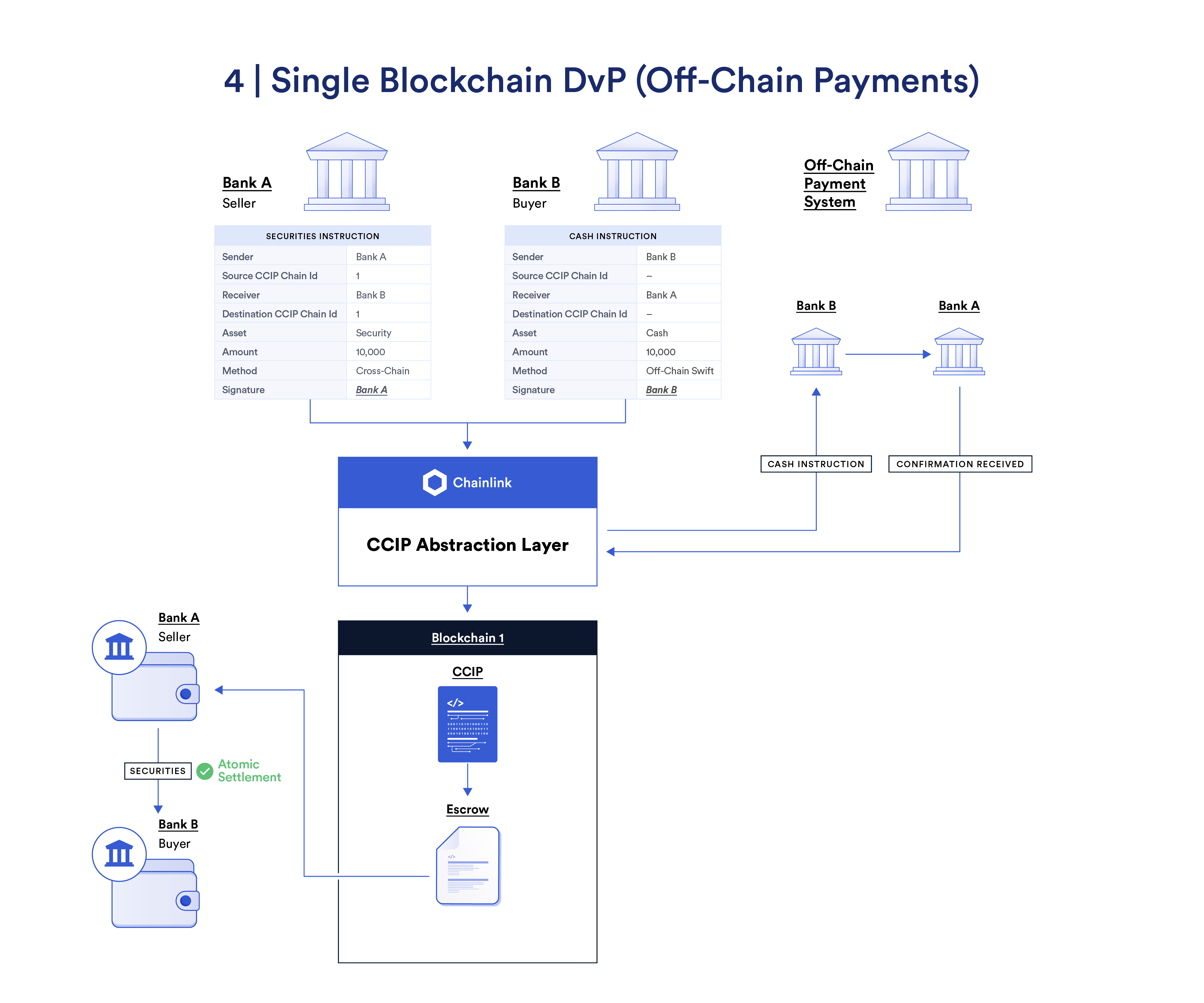

- CCIP manages all single-chain and cross-chain atomic settlement scenarios that involve tokenized securities and tokenized cash. CCIP supports a multitude of interoperability primitives that can be used to build a wide range of cross-chain workflows (see below diagram for examples) and eliminate trade failure during cross-chain asset swaps.

Key Steps

- Bank A issues an institutional deposit coin called BankCoin on Private Chain (i.e., the cash chain), which is backed by cash and short-term fixed-income instruments.

- Asset Manager A is a client of Bank A and maintains a cash position of $5M in a fund that they hold as BankCoin on Private Chain.

- Bank B issues BondToken on Public Chain 1 (i.e., the Token Chain).

- Asset Manager B is a client of Bank B and purchased BondToken in the primary issuance and is holding in one of their funds.

- Asset Manager B wishes to sell BondToken, as their fund has net redemptions on the day, and investors want their cash as fast as possible.

- Asset Manager A and Asset Manager B match on an OTC platform. Token instructions are then sent to CCIP to facilitate an atomic DvP transaction of BondToken for BankCoin.

Four Example DvP Settlement Workflows Using CCIP

Off-Chain and On-Chain Synchronization

Establishing synchronization between off-chain legacy systems and on-chain blockchain ecosystems holds profound benefits, serving as a linchpin for operational efficiency, transparency, regulatory compliance, and enhanced customer experiences. Some examples include:

- Operational Efficiency: Real-time updates across internal systems based on blockchain events or asset reconciliation between off-chain and on-chain records.

- Transparency and Auditability: Real-time on-chain proof of reserve for off-chain assets held in custody accounts either through cryptographic verification of assets within a wallet or attestations from top-tier accounting firms.

- Regulatory Compliance: Compliance oracles enable transactions between identity-verified wallet addresses on any blockchain.

- Better Client Experiences: Financial market data (e.g., pricing) of reserve assets made available on-chain and off-chain in real-time increases user confidence in using blockchain-based financial products in commerce.

Business Context

Banks need infrastructure to verify the ownership rights of the off-chain reserve assets that collateralize tokenized assets on-chain. It must also be verified that these off-chain reserve assets are stored and managed appropriately. This requires a robust and independent monitoring framework that is outside each bank’s infrastructure and functions regardless of the issuing bank (i.e., the verifier of asset issuer’s claims about collateral assets has no conflicts of interest). The composition, valuation, and frequency of the valuation of the reserve assets are paramount to ensuring tokenization is reliable enough to be used in production.

Chainlink’s Role

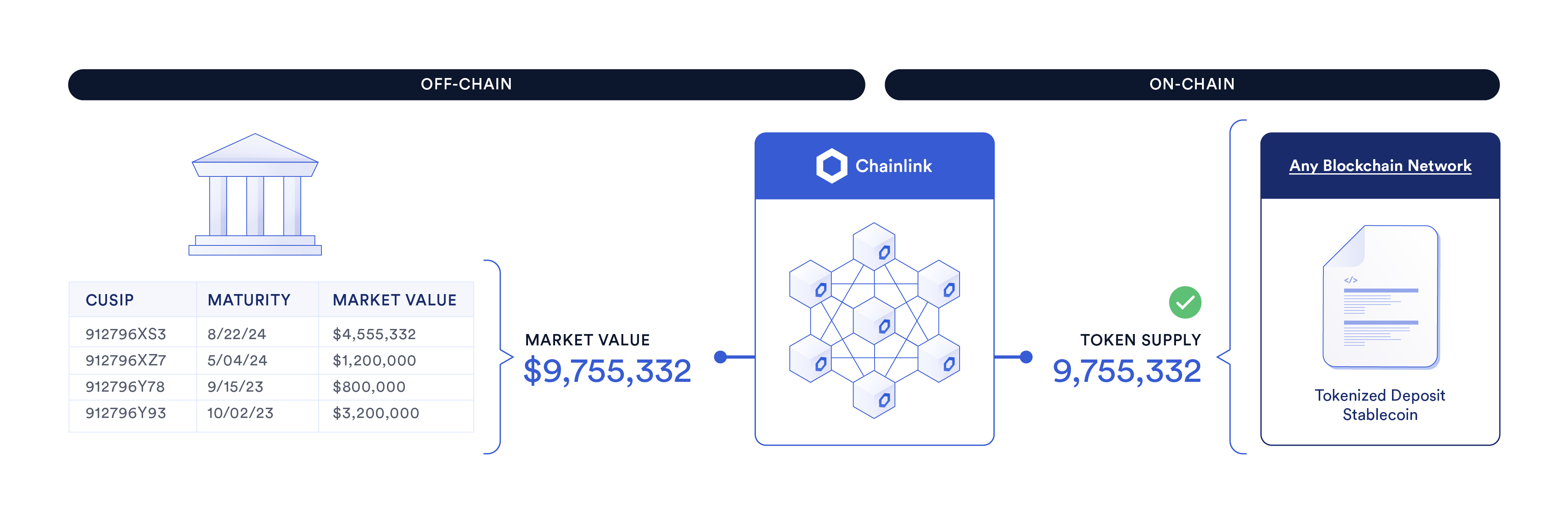

- Chainlink Proof of Reserve supplies data to blockchains for various tokenized assets and Chainlink Functions enables the off-chain data necessary to completing financial processes to be brought on-chain.

Real World Example

- Bank A wishes to tokenize a cash/deposit token for its customers to use across various blockchains.

- Bank A selects a single bank account in custody to manage a portfolio of traditional assets that back the deposit token. A mix of assets is chosen, namely cash and short-term treasury bills.

- Bank A utilizes Chainlink Proof of Reserve to provide its customers with real-time mark-to-market values of the assets that back the deposit token. The bank could provide the values themselves or provide a third-party auditor access to their custody account. This gives customers transparency and confidence in using the deposit token in capital market activities and provides security to ensure the token supply does not exceed the market value of backed assets (e.g., protects against infinite mint attacks).

Start Building Tokenization Use Cases With Chainlink

If you want to explore how your tokenized asset strategy can benefit from using Chainlink, reach out to one of our experts.

Looking to understand the tokenization opportunity? This industry report provides a comprehensive overview of the growing tokenization market, with contributions from BCG, 21Shares, Paxos, Backed, and Chainlink. Access now.