What Crypto Is Really About

This is Part 1 of a two-part series on the future of trust. Read Part 2, Cryptographic Truth: The Future of Trust-Minimized Computing and Record-Keeping, for a walkthrough of the cryptographic fundamentals that underpin blockchain technology and how Chainlink oracles extend the reach of cryptographic guarantees to the off-chain world.

The word “trust” is a heavily debated term in the blockchain industry, where engineers often refer to zero-trust interaction systems, trustless transactions, and other trust-minimized technologies. Though personal interpretations of its meaning in blockchain both vary and overlap, trust will always be at the center of understanding what crypto is really about.

Deriving from the Old Norse word traust, meaning “confidence” and also “shelter,” trust has historically referred to the amount of belief one has that people and processes will stay true to their commitments. Trust is foundational to well-functioning societies: high-trust societies generally have increased economic activity and greater social harmony thanks to reduced counterparty risk and fairer dispute resolution.

Unfortunately, trust in the institutions responsible for facilitating core social and economic activities is beginning to break down. For instance, Gallup polls indicate that the U.S. population’s confidence in many of the country’s major institutions has been declining over the past 45 years. While the scope of distrust varies across industries and nations, it’s clear from the current negative sentiment toward established systems that people are searching for more equitable solutions.

Blockchains, cryptocurrency, smart contracts, and oracles have emerged as new technologies for coordinating social and economic activities in a more secure, transparent, and accessible manner. Most importantly, these technologies are revealing the power of cryptographic guarantees—what we often call cryptographic truth—in restoring users’ trust in everyday interactions.

Note: We use the word “app” in a broad sense to refer to any interface for interacting with a company, government, or other users on the same platform, whether it be an application you download on your phone or a website. Additionally, when explaining blockchains, we focus on permissionless blockchains (e.g. Ethereum, Bitcoin) given their widespread adoption as opposed to permissioned blockchains.

Problem: A Breakdown in Societal Trust

The breakdown of trust in traditional institutions and processes is apparent in many aspects of modern societies. Listed below are four problems causing distrust, which directly impact quality of life and economic prosperity.

Centralized Ownership of Data and Processes

One outcome of the way the Internet was originally architected is that applications (apps) are mostly centralized. A centralized entity typically owns an app’s intellectual property (IP), controls its backend computing, makes key decisions on its future development, and profits from any data and revenue generated. This centralization creates an unequal relationship between users and apps that can easily be abused and fuel distrust.

For example, apps can often unilaterally censor the actions of users. Though such actions may be justified as clear violations of terms of service agreements such as the removal of illicit activities, there are many instances where censorship is based on subjective interpretations of vague policies. This puts into question the platform’s credible neutrality—no discrimination for or against any specific people—particularly in situations when the platform’s own financial interests are at stake, external political or social pressure is applied, or users’ personal opinions don’t directly align with the platform’s own. Such forces have resulted in polarizing debates as to whether social media, financial services, content streaming, and various other platforms are justified in censoring or not censoring certain content.

Centralization also leads to power structures where small groups of people largely control how platform revenue is distributed and the direction of development while users are left without much say. Though it’s true that owners generally start and manage apps and are to an extent responsible for their success, it’s also true that users often provide immense value to apps as content creators. For instance, users give social media platforms value through the material they generate, which is monetized directly by app developers via advertising. This undoubtedly makes users question whether or not they are getting fair compensation and representation.

Users are also becoming more concerned about having to trust apps with their sensitive data. Since users often have to create accounts to interact with apps, the apps are responsible for storing users’ personal information. This centralized storage model opens up a single point of attack for hackers that has resulted in numerous data breaches, as was the case with Equifax, for example. It’s also why apps are able to monetize users’ data without sharing revenue with users. As many have suggested, “if it’s free, then you’re the product” is the basis for most Web2 economic models.

No Shared Sense of Truth

A further reason for distrust is the fact that participants in a social or economic relationship don’t always operate with reference to the same source of truth. For instance, there are many business relationships where all participants maintain their own set of records. Not only can an honest mistake from a single participant lead to a lengthy reconciliation process, but it’s possible for parties to intentionally falsify their records in an attempt to delay the agreement, escape their obligations, or present a false sense of success to their counterparties.

Look no further than the Wirecard scandal, which saw many financial services companies take losses when the German company Wirecard was found to be engaging in fraudulent accounting practices to cover up €1.9 billion in missing funds from its balance sheet. Similarly, the 2007-2008 financial crisis severely impacted the global financial industry, largely because of a poor shared understanding regarding its systemic overexposure to toxic mortgage-backed securities (MBS) and MBS-linked derivatives.

Underpinning this dynamic is the fact that users don’t always understand the legal relationship they have with an institution. Though the misunderstanding could be interpreted as the fault of users for not reading terms of service agreements, it’s fair to ask whether users should be expected to take time to read and understand long contracts with dense legal jargon that’s purposely vague in order to enable a range of interpretations. When things are going well, misunderstandings may never manifest. However, when unexpected events occur, users often learn that their relationship with an institution is not quite what they thought. Unclear legal relationships are why many traders were blindsided when they learned Robinhood could halt purchases of the GME stock during a period of high trade volume, or why Greek citizens were shocked in 2015 when their banks informed them that they were only allowed to withdraw €60 a day from ATMs.

The same misunderstanding is often true regarding the relationship users think they have with social media apps, particularly with regard to how their data is collected and shared and how the app’s algorithm determines what they see in their news feeds. Algorithms in particular have fueled distrust because of their opaque nature, with users unable to understand why some material takes preference while other material is not shown at all. This lack of clarity naturally leads to users suggesting political bias or undisclosed influences around the news that’s deemed real and credible and the news that isn’t, further causing a breakdown of trust.

Lack of Enforcement and Accountability

Disputes are inevitable in certain circumstances, so when they arise it’s critical to resolve them in a manner that’s generally seen as fair. The challenge, however, is that larger institutions often have asymmetrical advantages in dispute resolution processes. This is particularly worrisome in contracts between established institutions and retail users, where the institution knows they have more leeway to renege on their stated commitments given that the user doesn’t have the time, capital, or influence to mount a successful lawsuit. In fact, in some developing countries, the legal system is so unreliable in the face of powerful influences and bribery that certain economic relationships are simply not practical.

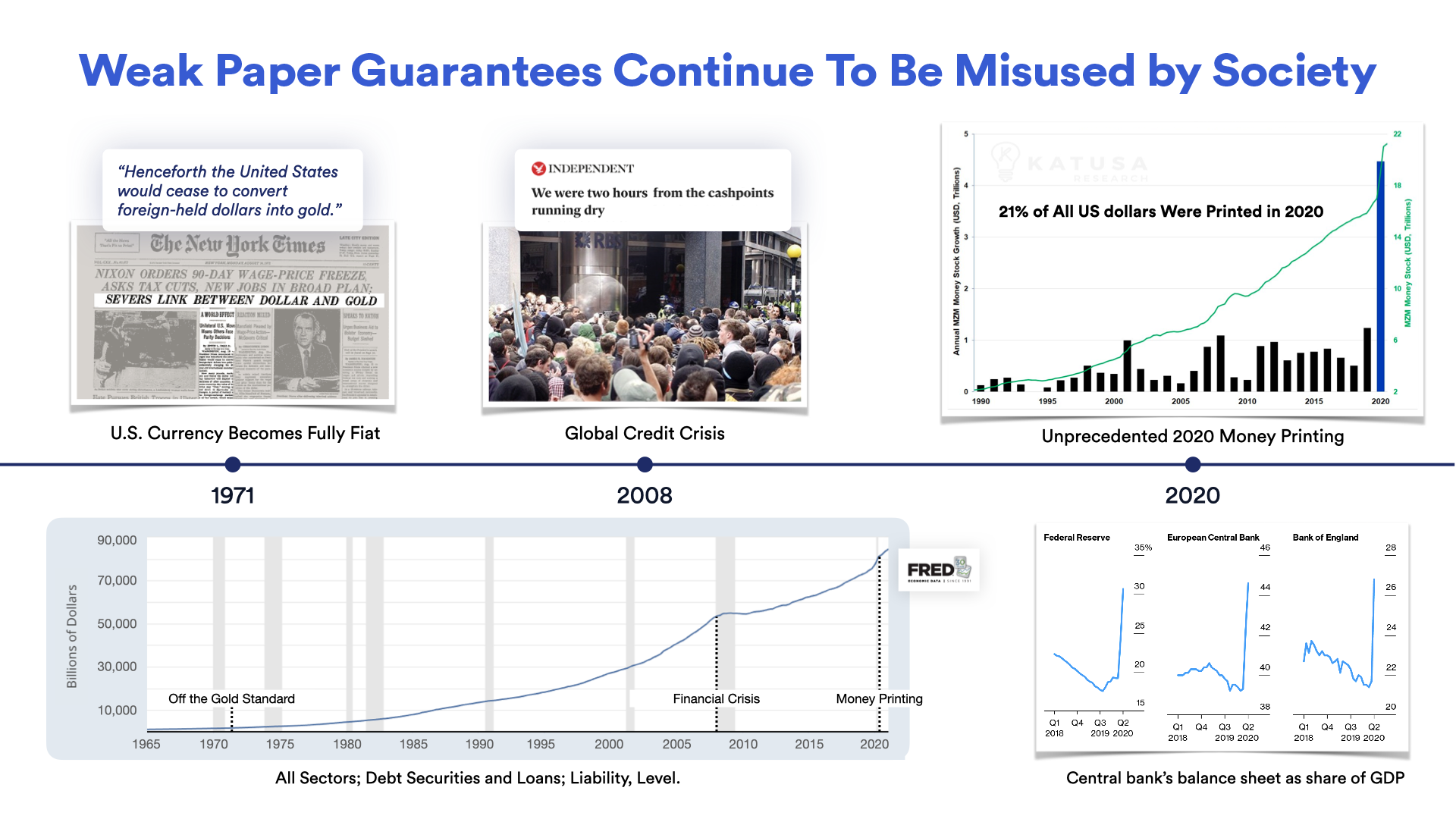

Mistrust in dispute resolution processes is also subject to a dynamic where an institution becomes so powerful and integrated within a society that it becomes “too big to fail”—a phrase used to describe institutions that governments will bail out after they make poor decisions because their failure presents too much systemic risk. The term was originally derived from the public bailout of large banking and financial services companies that went bankrupt due to overexposure to toxic MBS assets during the 2007-2008 financial crisis. It could be argued that a similar dynamic can be seen today in a seeming lack of accountability from governments and central banks, as high inflation and increasing economic inequality takes hold despite their stated goals of controlling inflation and promoting economic stability.

Inefficient Multi-Step Processes

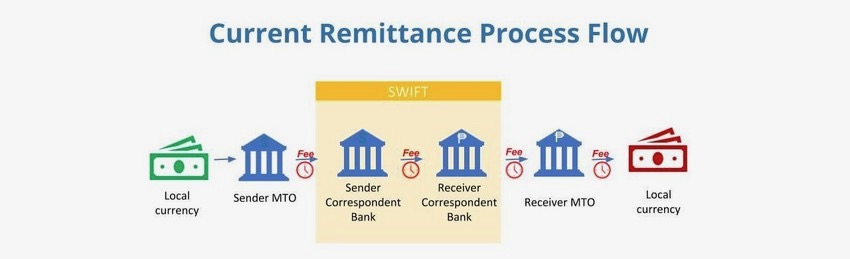

Through the addition of trusted third parties and manual verification techniques, the risks of low-trust social and economic relationships can be somewhat offset. However, these processes involve increased costs, longer wait times, and additional trust assumptions. One industry subject to such inefficiencies is international remittances, where a $200 dollar transaction in 2020 incurred on average a 6.5% fee and sometimes took more than 24 hours to settle. Technically, remittances could be near-instant given advancements in digital technology, but not all banks trust each other. Thus, payments have to be routed through several correspondent banks to get to their final destination, incurring fees and extending the settlement time along the way.

Solution: Blockchain and Oracle-Based Trust Networks

Instead of counterparties having to trust each other or a third party to follow through on their stated commitments, what if the infrastructure facilitating their interaction could guarantee fair outcomes? And what if that infrastructure had no central administrator or owner?

In order to meet these goals, this infrastructure would have to embody two key design principles: minimally extractive coordination and trust-minimized execution.

- Minimally extractive coordination is when infrastructure facilitates interactions between users with minimal, non-value additive rent-seeking. Unlike a for-profit company, the facilitator here has no financial agenda besides connecting users. For example, a financial marketplace that enables users to buy and sell assets with minimal transaction fees.

- Trust-minimized execution refers to a process that’s facilitated in a manner where the probability of it operating correctly is so statistically high that it can almost be considered guaranteed. In a sense, the user doesn’t have to trust the infrastructure. Instead, the infrastructure is built to be deterministic, meaning all potential variables that could influence the process are removed or decreased to the point where it’s highly unlikely to not execute exactly as written/coded. Some have even referred to this type of infrastructure as trustless, although one can argue that nothing is truly trustless.

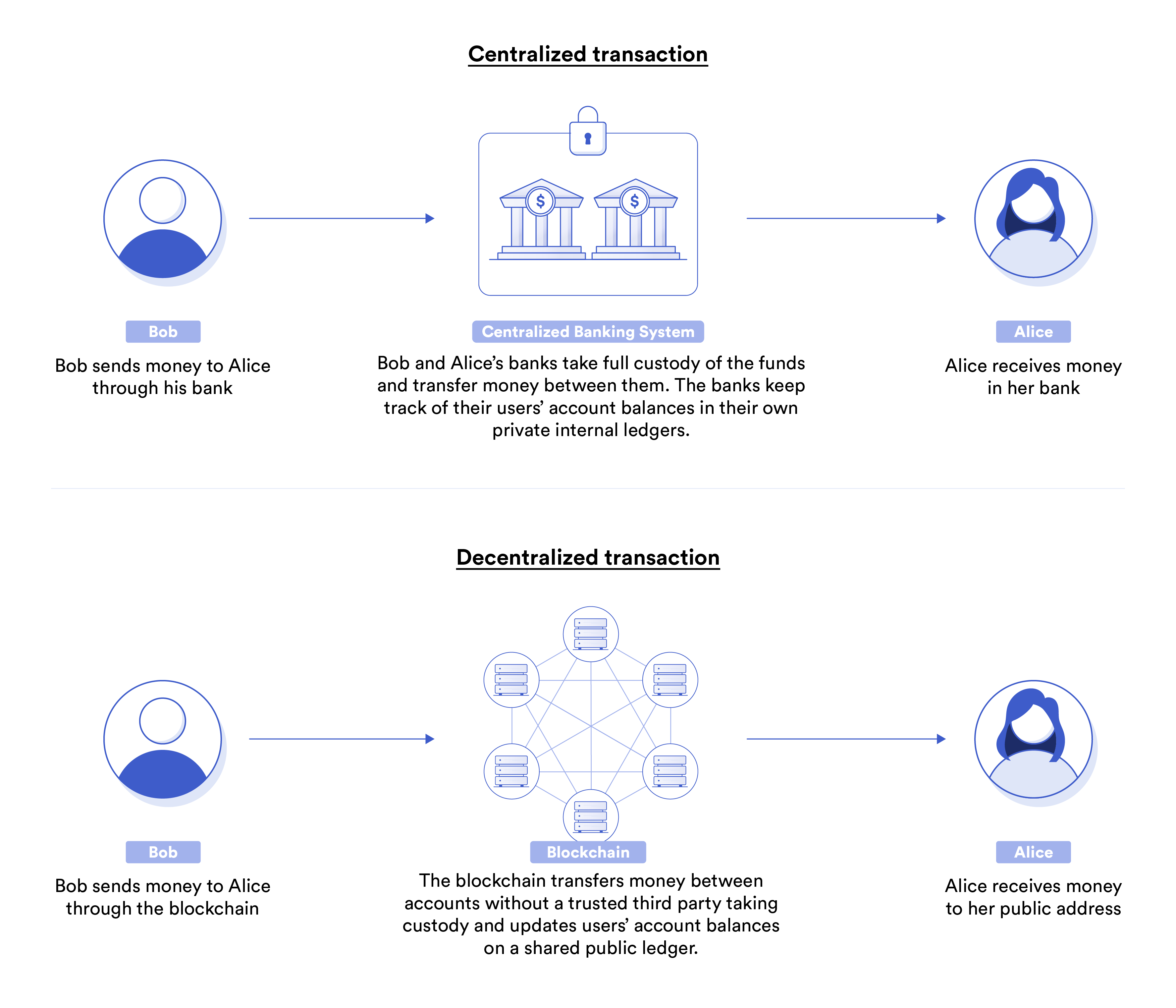

Blockchains combine these two properties, serving as minimally extractive coordinators that execute code in a trust-minimized manner. Blockchains provide such properties because they do not have central administrators, but are decentralized computer networks that are financially incentivized to maintain an accurate ledger of who owns specific data and assets on the network. Every time someone creates a new asset, transfers an existing asset to another user, or stores data on the blockchain, a decentralized network of nodes must form a consensus around the validity of each interaction before it’s approved. For instance, if a user wants to send money from one account to another, the blockchain will verify that the user has enough money to fund the transaction before executing it.

Decentralized consensus and cryptography are combined in blockchains to form the basis for cryptographic truth—validation of new transactions based on the verification of historical information already stored in the blockchain ledger and deemed true. In this sense, blockchains are deterministic, since approving new transactions doesn’t require new or external information.

For a deeper understanding of blockchains, refer to these articles: What is Blockchain Technology? and Blockchains and Oracles: Similarities, Differences, and Synergies.

While many recognize blockchains for supporting cryptocurrency-based payment systems, blockchains enable much greater utility through their support for smart contracts. Smart contracts are “if x, then y” programs that run on blockchains in a tamper-proof manner. Developers use one or more smart contracts to create decentralized applications (dApps), with the smart contracts essentially representing the terms and conditions that users must abide by when interacting with the dApp. For a deep dive on smart contracts, check out this article: What Is a Smart Contract?

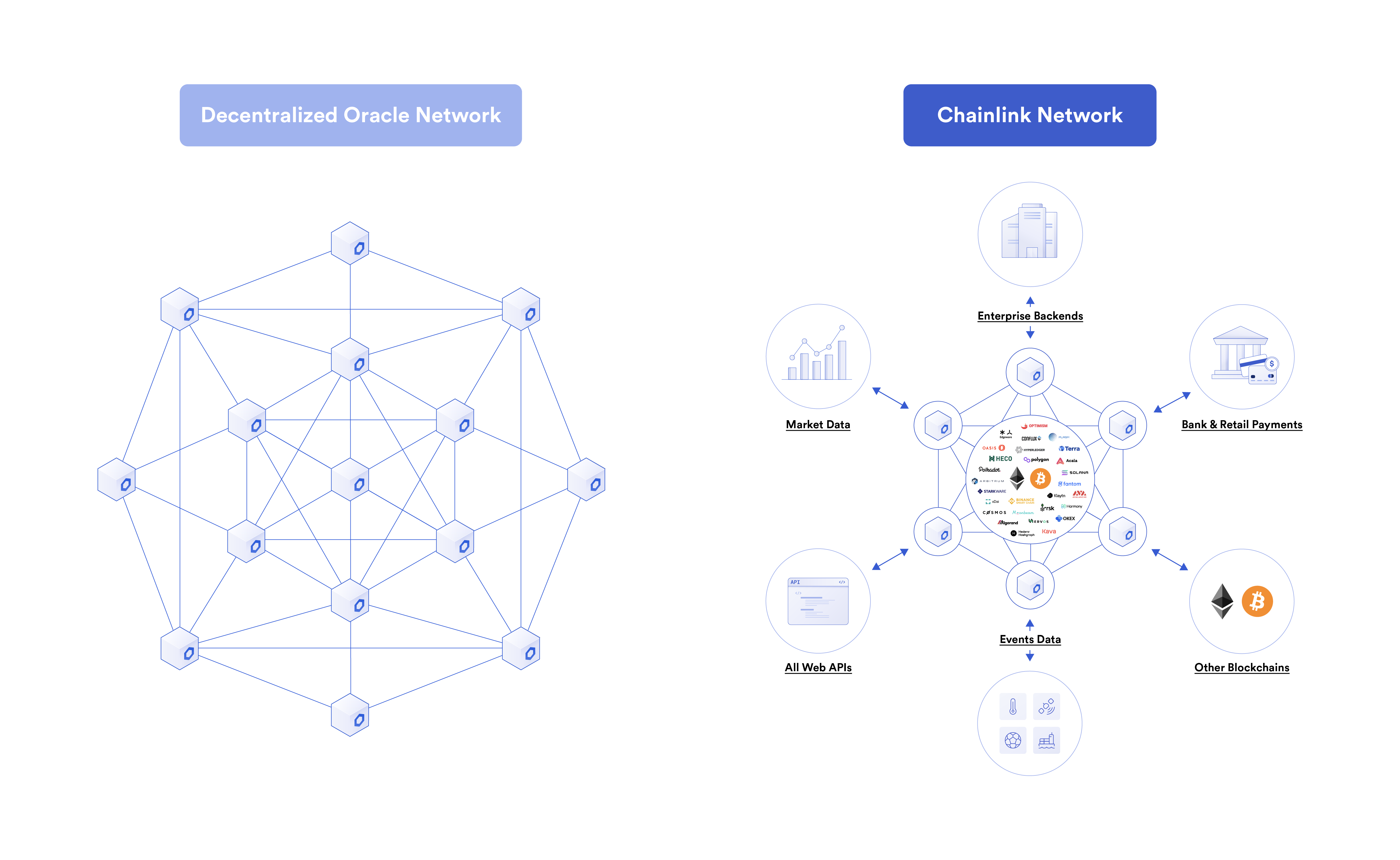

Oracles are critical to creating advanced dApps. Because of the way blockchains are secured, they are inherently disconnected from the outside world—akin to a computer without the Internet. Oracles are supporting infrastructure for blockchains that allow them to interact with external data and systems. In doing so, oracles enable smart contracts to use external data to trigger their execution (e.g. sports match results to settle a wager), send data to external systems for settlement (e.g. payment messages to execute a bank payment), interoperate with smart contracts on other blockchains, and perform computations not possible or practical to do on a blockchain. In this regard, oracles enable hybrid smart contracts—combining on-chain code with off-chain code to form a single application.

Chainlink pioneered decentralized oracle networks (DONs) in order to bring trust-minimized properties to oracle services and enable competitive marketplaces that mitigate rent-seeking extraction from oracle providers. The result has been an explosion in new smart contract use cases enabled by Chainlink DONs, such as in Decentralized Finance (DeFi), Non-Fungible Tokens (NFTs), Play-to-Earn gaming (P2E), decentralized insurance, and more.

To learn more about oracles and Chainlink, refer to these articles: What is a Blockchain Oracle? and What is Chainlink? A Beginners Guide.

The combination of blockchains and oracles provides an end-to-end trust network for coordinating economic and social activities. Blockchains act as tamper-proof backends for codifying, tracking, and enforcing digital contracts while oracles enable smart contracts to accurately verify real-world events, seamlessly interact with legacy systems, and securely interoperate across blockchains. This model shifts applications and digital contracts from probabilistic and human-mediated to deterministic and verified through decentralized consensus.

Future: Societal Trust Restored by the Power of Cryptographic Truth

By applying blockchain and oracle-powered trust networks to the original problems outlined above, it becomes possible to build a world based on truth, where processes and people stick to their agreements and records are highly reliable.

Self-Ownership of Data and Decentralized Ownership of Processes

One of the biggest benefits of blockchain technology is the decentralization of the apps/institutions responsible for facilitating social or economic activity. Blockchain technology can create credibly neutral platforms where the ability for platforms to arbitrarily censor users because of financial, political, or social pressures is largely removed. Once the terms and conditions are coded into smart contracts and stored on the blockchain, the relationship between the users and dApps is transparent to all and cannot be overridden by either party or a central administrator.

Decentralized system design also removes intermediaries as custodians. Instead, the blockchain is akin to a non-custodial facilitator, where all the data produced by dApps is publicly viewable and immutable, and the users have direct control of their data/assets via private keys that only they possess. For instance, anyone can view the entire transaction history of the Bitcoin ledger and anyone can custody and send their Bitcoin to other users on the network without a bank.

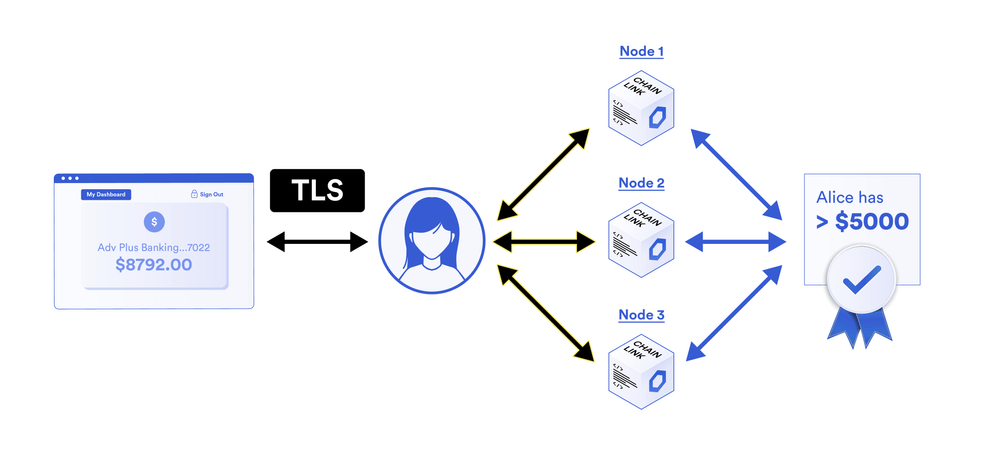

Additionally, privacy-preserving oracle solutions are emerging, such as Chainlink’s DECO, which is being built to allow users to prove sensitive information to dApps without revealing it publicly. For example, a user could prove they live in a certain jurisdiction or that their bank balance is above a certain amount without revealing their address or exact balance to the dApp—ultimately removing the responsibility from dApps to store credentials while still making use of them.

Blockchains and the dApps they support are also democratizing access to their cash flows. The Ethereum blockchain, for example, is moving to a proof-of-stake consensus model where anyone in the world can stake (i.e. lock up in a non-custodial manner) its native ETH cryptocurrency in a specific smart contract in order to become a validator on the network. In becoming a validator, the user can earn a portion of the value generated by the Ethereum blockchain as a reward for validating user transactions.

Similar dynamics exist in DeFi applications like Curve, a decentralized exchange designed for low-slippage trades. Within Curve, users can choose to lock the native CRV token in a staking smart contract for up to four years, which provides them with governance rights over the dApp and a proportional percentage of 50% of all trading fee revenue generated by the dApp.

Shared Truth

Blockchains and dApps are generally open-source technologies where all users have a shared understanding of the code powering the dApp and the data generated from its operations. Essentially, the blockchain is a single, public repository of records that are made equally available to all participants, removing reconciliation disputes and making transparent any systemic risk. Transactions are also verified through a decentralized consensus mechanism as opposed to the opinion of a single user or administrator, meaning the relationship between users and dApps will follow the codified terms.

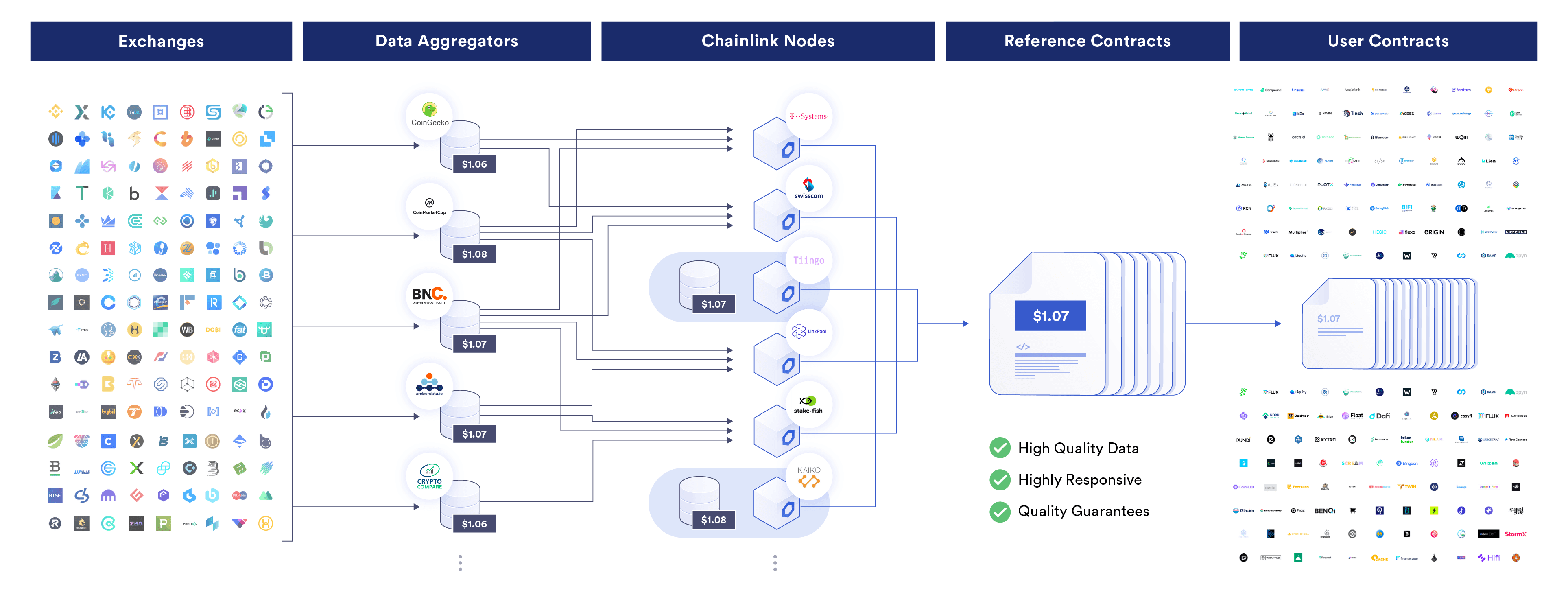

When extended to verifying external connections, oracles often use a decentralized network of nodes and numerous data sources to prevent any single point of failure in verification and execution. For example, Chainlink Price Feeds are DONs that supply real-time asset prices on blockchains to support Decentralized Finance (DeFi), a collection of dApps that provide financial services to users such as lending, derivatives, stablecoins, and more.

Other oracle solutions for generating shared truth include the Ledger of Record proposed by Balaji Srinivasan, former Coinbase CTO and A16Z General Partner. The Ledger of Record is a concept that uses oracles to cryptographically sign data on blockchains to prove its origin, helping establish a verifiable provenance of information. Not only would it help prevent fake news, deep fakes, and hidden news retractions, but it can be the basis for reputation systems that track the historical credibility of data sources and analysts.

Consensus-Based and Cryptographically Enforced Commitments

Because blockchains validate transactions on their networks through decentralized consensus, the asymmetrical advantages held by larger counterparties during disputes are generally removed. There is no blockchain administrator to bail dApps out or hit redo after a mistake is made. Instead, blockchains replace human administrators with decentralized networks secured by cryptography and financial incentives to make it extremely difficult to tamper with the consensus mechanism or alter previously stored data.

While blockchains and dApps can be built in a manner that enables changes, they generally require social consensus amongst many independent users as opposed to the unilateral decision-making seen in centralized Apps. This is why many dApps are governed through decentralized autonomous organizations (DAOs), where users vote on changes. In fact, many dApps have their own native token, which is used by their DAOs to decide on proposals via token-weighted votes.

A highly tamper-proof and globally accessible blockchain platform for enforcing digital contracts vastly reduces counterparty risk. Many blockchains and dApps even take it a step further by introducing automatically enforced punishments for bad behavior from participants. For instance, proof-of-stake blockchains can punish validators that act maliciously by confiscating some of their staked tokens as a form of punishment. dApps can also hold users’ capital in escrow and distribute it only after verifying certain events, making it near impossible for the losing side to forgo payment.

Decentralized oracle networks offer similar assurances by generating definitive truth—where each dApp defines exactly how they want to derive truth from the external world and what falls outside of those bounds. In this sense, oracles are more flexible in verifying external events for smart contracts, as some users may trust different data sources while others may want to pay for more decentralization of the oracle network. No matter how the users design the oracle mechanism, they must all agree that it’s sufficient to service their needs. The agreement between the users and oracles can then be made into a Service Level Agreement (SLA) smart contract to avoid tampering and automatically enforce rewards/penalties upon completion.

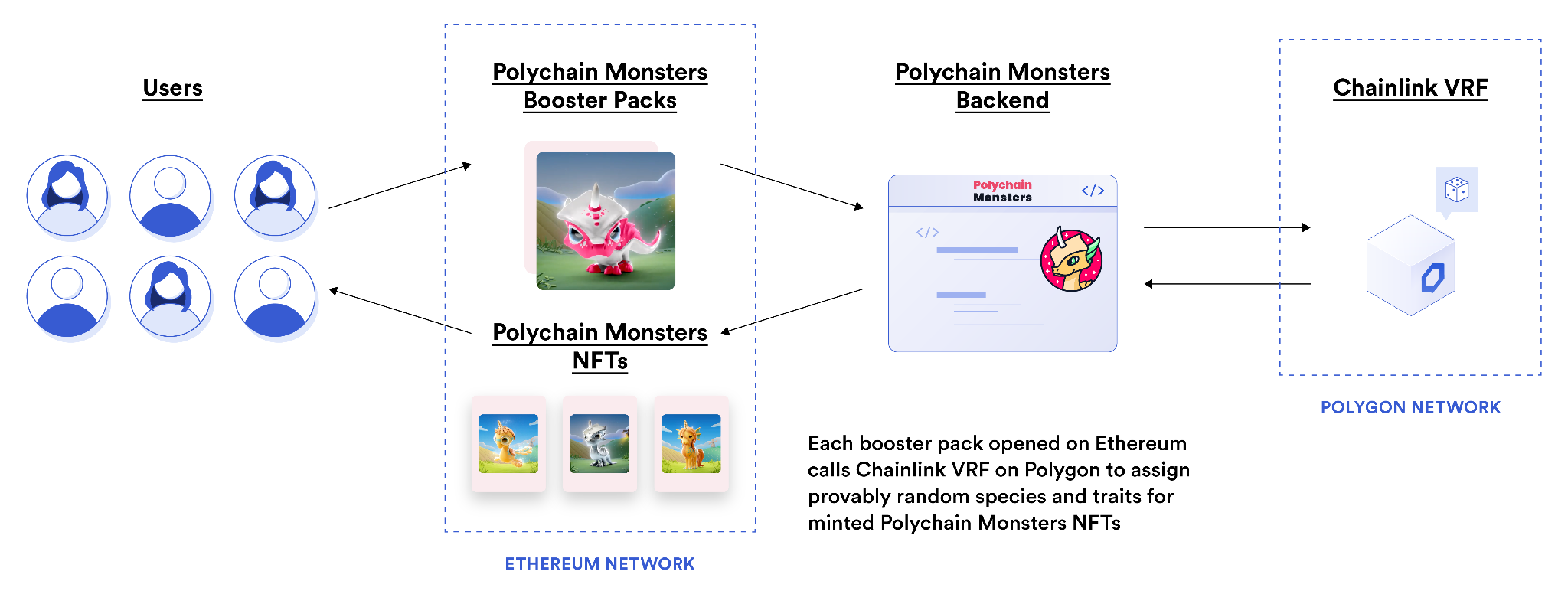

One example of an oracle service that provides definitive truth is Chainlink Verifiable Random Function (VRF). Chainlink VRF uses oracle technology to generate random numbers and cryptographic proofs off-chain. It then publishes them on-chain, where the blockchain uses the cryptographic proof to verify that the random number was not tampered with by the oracles. NFT and gaming applications use the randomness provided by Chainlink VRF to perform various on-chain functions, such as picking winners of special NFT drops and determining the content of loot boxes. Importantly, users are able to independently verify that the process is fair and unbiased, with even the game developers/NFT creators not able to influence the randomized outcome.

Efficient Peer-to-Peer Processes

Not only do blockchains provide higher security, reliability, and accuracy guarantees for their computations, but they operate in a peer-to-peer manner. By removing intermediaries, rent-seeking and settlement times can be reduced. This is most evident in Ethereum layer-2 scalability solutions—networks built on top of Ethereum that are optimized for lower costs and higher throughput while still deriving their security from the baselayer Ethereum blockchain. With layer-2 solutions, users can make peer-to-peer payments of any amount to anyone in the world in a matter of minutes and for less than a standard international wire fee.

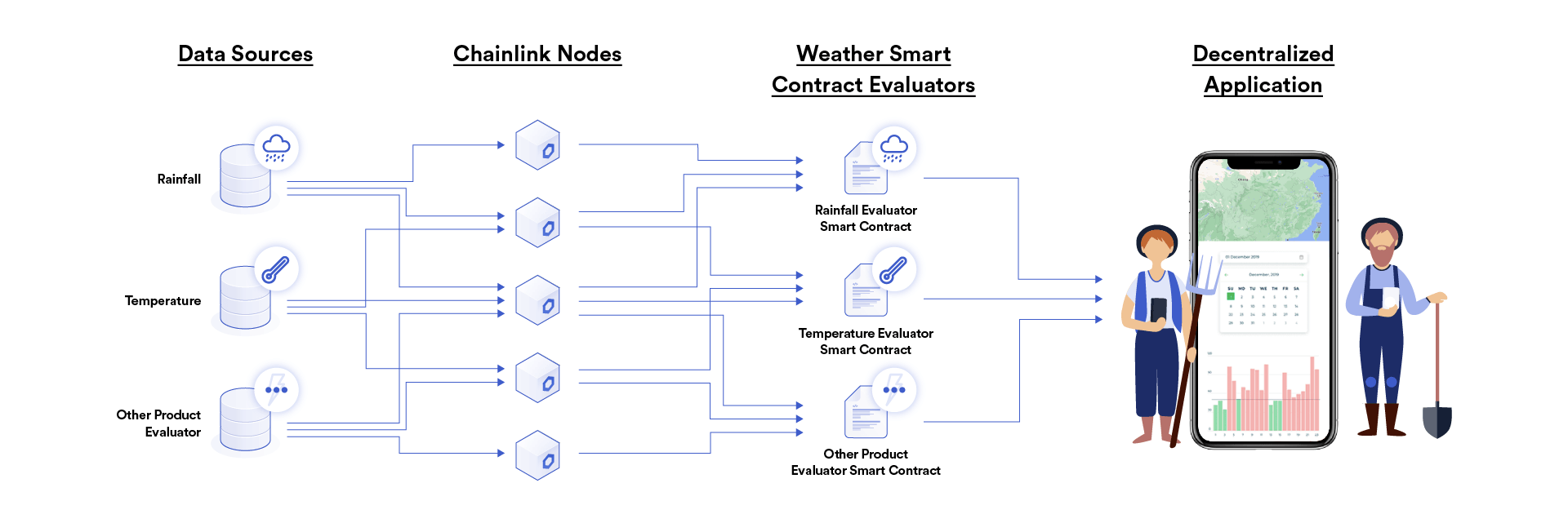

This peer-to-peer quality is also evident in new parametric insurance dApps such as those created by Arbol and Etherisc, which enable anyone to purchase weather and flight insurance, with the only requirement being an Internet connection. The smart contract settles the policy once an oracle network confirms the outcome of the specific insurable event, e.g. crop insurance settled by the amount of seasonal rainfall in a particular region or flight insurance determined by whether or not flights are canceled. Once the oracle report is delivered, the smart contract can instantly release compensation from escrow without needing any human approvals.

Start Working in the Blockchain Industry

If the innovation timeline of the Internet is any indicator, society has only just scratched the surface of what’s possible using blockchain and oracle technology. The possibilities are truly endless, and have the potential to re-establish trust in society’s most foundational social and economic processes.

If blockchain technology interests you and you want to begin working in the industry, check out our walkthrough How to Become a Smart Contract Developer to learn how to start building and explore careers at industry-leading organizations like Chainlink Labs, where there are a wide range of open technical and non-technical roles.

Learn More

If you want to familiarize yourself more with blockchain and oracle technologies, we encourage you to read through the growing list of educational materials on our blog. A good starter pack includes:

- What is Blockchain Technology?

- What Is a Smart Contract?

- What is a Blockchain Oracle?

- What is Chainlink? A Beginners Guide

If you want something more technical, we suggest you read the original Chainlink whitepaper, Chainlink 2.0 whitepaper, and developer documentation.

To learn more, visit chain.link, subscribe to the Chainlink newsletter, and follow Chainlink on Twitter, YouTube, and Reddit.