Chainlink Data Streams Launch on Mainnet: A Low-Latency Oracle Solution for DeFi

We are excited to announce the launch of Chainlink Data Streams—the all-in-one data solution for the DeFi industry, combining low-latency data delivery and automated trade execution to unlock a new generation of ultra-fast and user-friendly derivatives products.

Chainlink Data Streams have now entered Mainnet Early Access on Arbitrum, where leading DeFi protocol GMX is using them in production to help power a highly performant and secure decentralized perpetual futures exchange. Users can sign up for Mainnet Early Access to Chainlink Data Streams below.

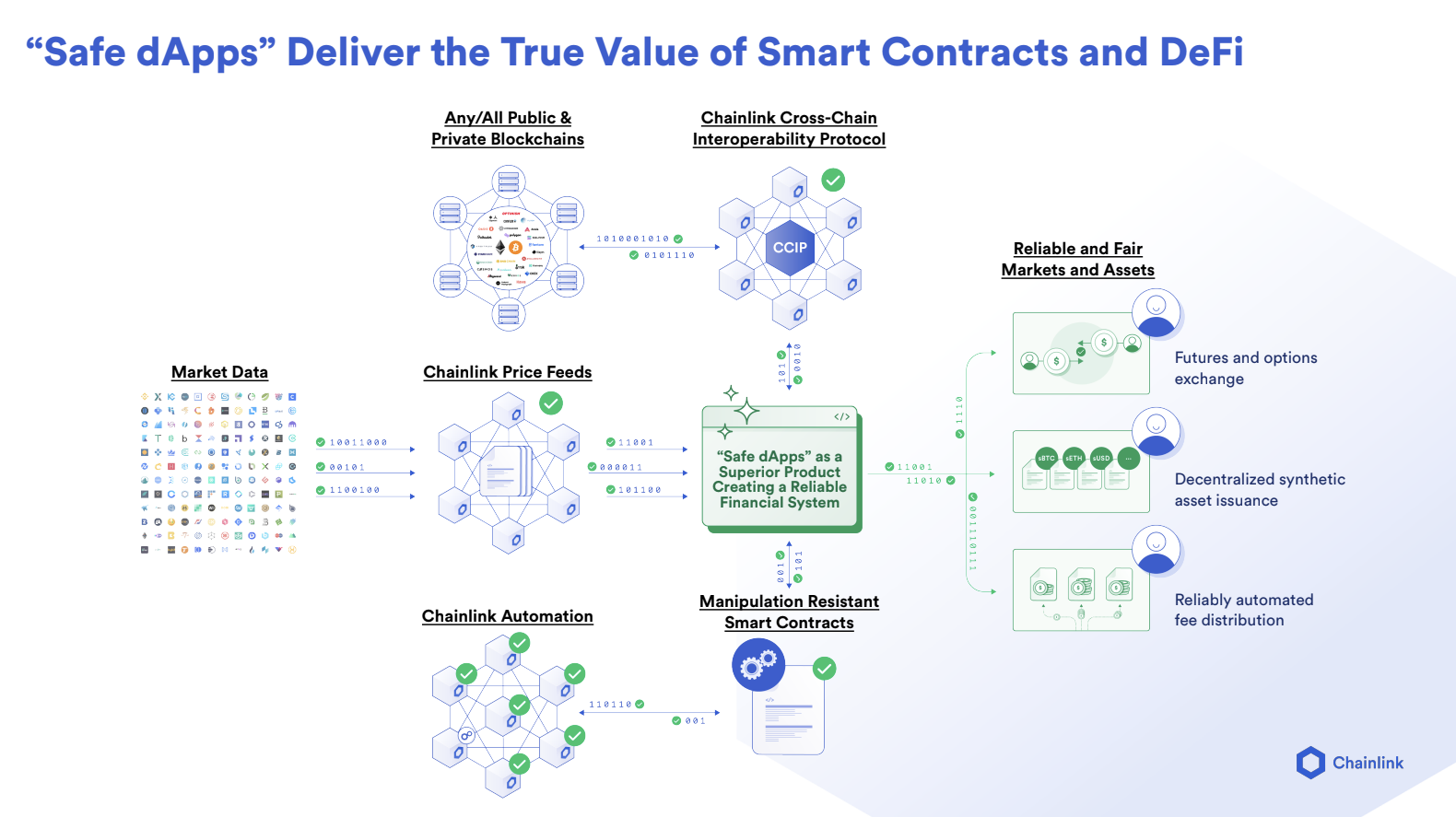

With Chainlink Data Streams, decentralized applications (dApps) now have on-demand access to high-frequency market data backed by decentralized and transparent infrastructure. This innovation enables DeFi protocols, such as derivatives dApps, to deliver a centralized exchange (CEX)-like user experience with onchain execution faster than ever before—all without compromising on Web3 values.

Chainlink Data Streams Unleash the Next Evolution in DeFi Innovation

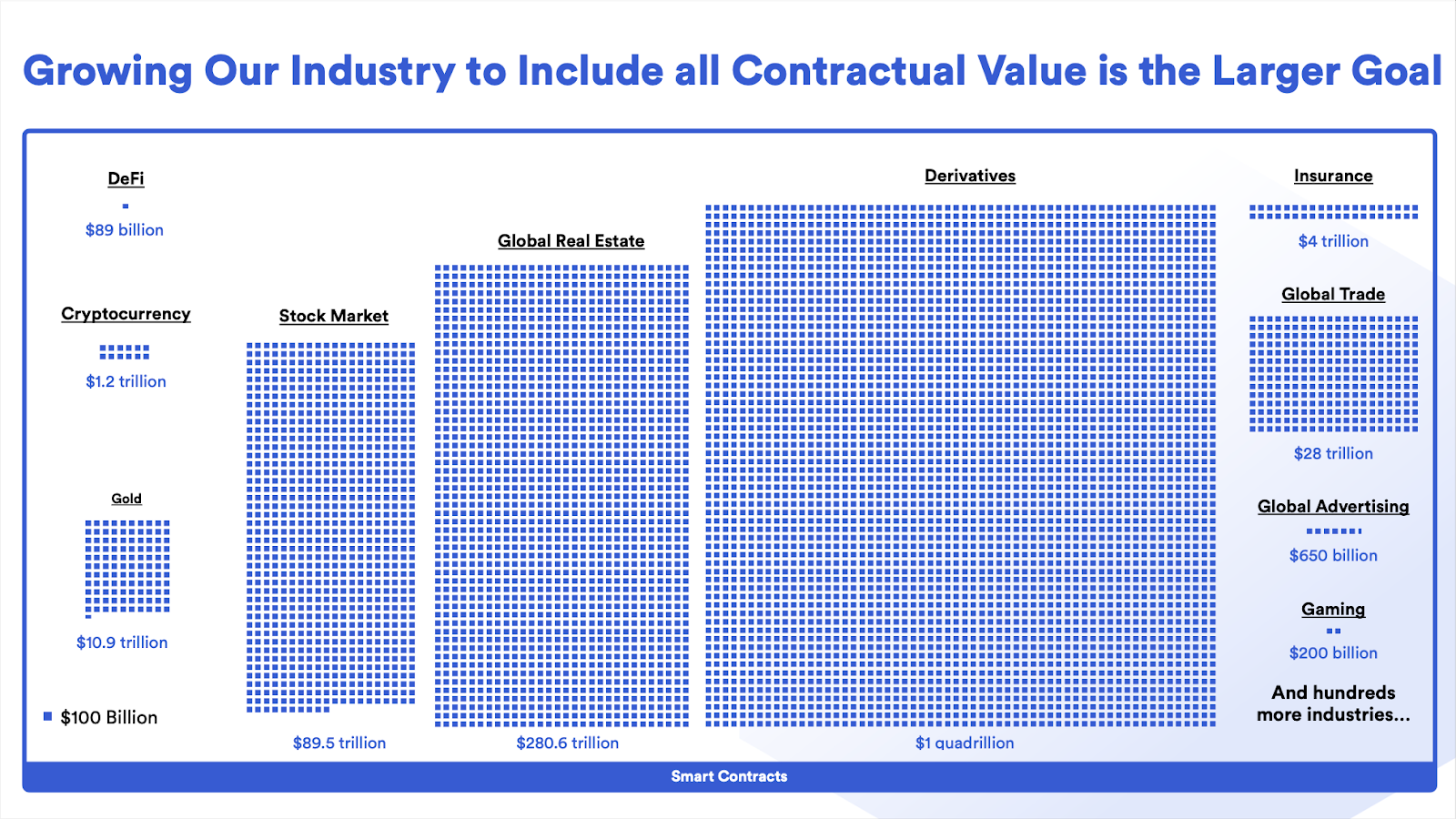

Within the over quintillion-dollar balance sheet of global assets, derivatives represent over $1 quadrillion in notional value. By comparison, the DeFi derivatives market represents only a tiny fraction of that.

The DeFi market has yet to reach its potential, in part because applications like derivatives dApps are extremely sensitive to latency. Any delay in data, even just a few seconds, can negatively impact the user experience by exposing the application to frontrunning.

Latency is an inherent challenge of decentralized networks because geographically distributed networks of nodes take time to reach consensus and finalize updates. Web3’s latency problem has historically required DeFi derivatives protocols to make tradeoffs between their security and reliability and their execution speed and user experience.

With Chainlink Data Streams, dApps can now have both trust-minimized infrastructure and performant execution. This enables the DeFi derivatives market to take a seismic leap forward since developers can create products with a superior user experience by delivering lower slippage, reduced fees, faster settlement times, and built-in protection against toxic flow, adverse selection, and frontrunning—all while benefiting from the same battle-tested oracle security and high-quality data that Chainlink is known for.

Data Streams: Next Generation Speed, Chainlink Security

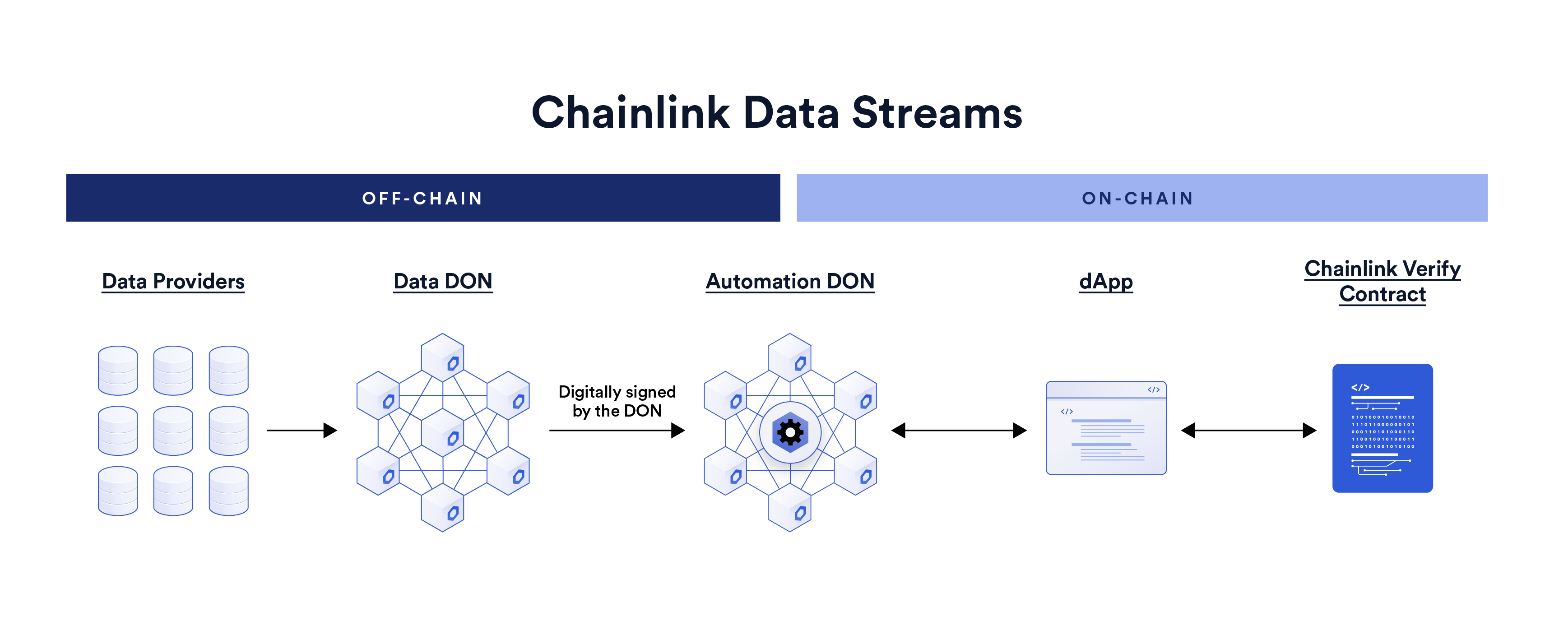

Chainlink Data Streams has two main components:

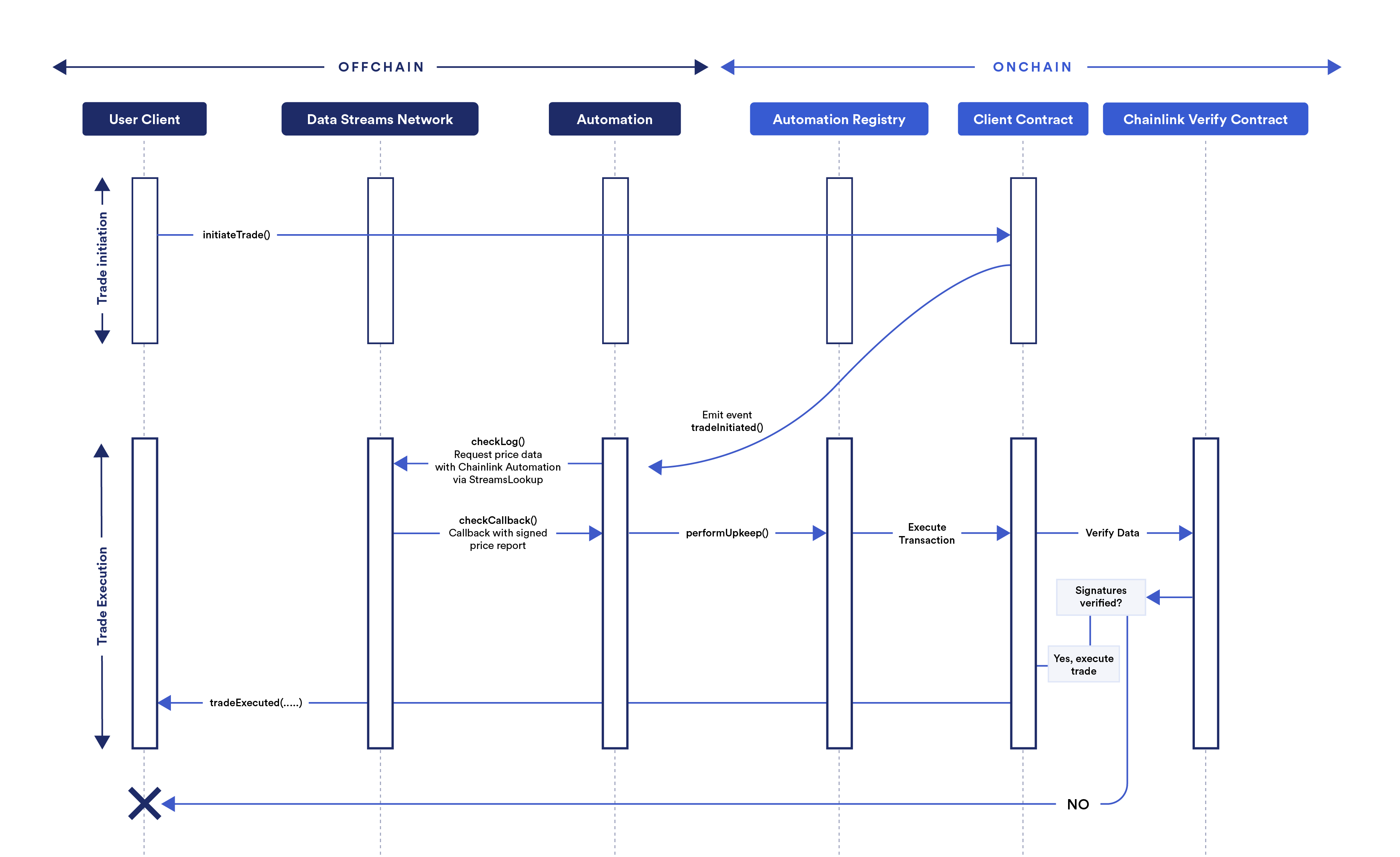

- Low-Latency Market Data: A low-latency, pull-based oracle provides a continuous stream of real-time market data that is stored offchain. dApps or users (as part of their transactions) can pull information at any time instead of waiting for data to be first posted onchain. The oracle solution is powered by Chainlink’s decentralized node infrastructure, which sources data from a multitude of premium data aggregators.

- Automated Execution: Chainlink Automation is used to detect trade submissions, retrieve the relevant price reports, and then bundle them with the trade execution. Chainlink’s decentralized automation network helps ensure near-instant onchain data delivery and decentralized execution while additional onchain validation contracts provide cryptographic verification of data.

By integrating Chainlink Data Streams, DeFi protocols can now:

Deliver superior trading experiences with sub-second price resolutions where the data used in backend processes is reflective of real-time market conditions, the automated execution infrastructure for transactions is fast and fair, and the Web3 values of security and reliability are preserved. These features enable highly performant margining systems, highly efficient liquidations, and guaranteed orders.

Enable advanced onchain risk management thanks to Data Streams’ support for a wider set of data points beyond market prices, including granular market liquidity and volatility data that enables dApps to build onchain logic for capital efficiency and dynamic updates to risk management parameters. For example, DeFi protocols can use market liquidity data to dynamically adjust bid/ask offers in real-time to mitigate risk associated with rapid changes in pricing spread across exchanges.

Protect users from exploitation through:

- Conflict-of-interest-free data where Chainlink service providers (e.g., node operators, data providers) are not financially incentivized to exploit privileged knowledge of user transactions. This protects traders and liquidity providers from malicious price manipulation and information arbitrage.

- Low-latency updates and “commit-and-reveal” architecture with sub-second data delivery, transaction privacy tools to help mitigate frontrunning, and onchain cryptographic guarantees of posted data to ensure its veracity.

- Credibly neutral execution of user transactions via Chainlink Automation prevents adverse selection, a situation where the price retrieval mechanism used by a dApp is able to select a favorable price to settle a trade or view the price in the latest price report prior to submitting a trade. Chainlink’s decentralized network of world-class node operators is incentivized to correctly execute user transactions and remains completely independent of the dApp, meaning the dApp’s developers can’t front-run traders on their own platform.

DeFi Use Cases Enhanced By Chainlink Data Streams

There are numerous use cases across DeFi for Chainlink Data Streams. For example, protocols can integrate Chainlink Data Streams to elevate the user experience of a variety of products, including:

- Perpetual Futures: Leverage low-latency market data and built-in frontrunning protection to build onchain perpetual futures protocols that compete on performance with centralized exchanges yet are powered by more transparent and decentralized infrastructure.

- Options: Create advanced financial instruments that deliver timely and precise settlement of options contracts. Additionally, make use of enriched market liquidity data to support dynamic onchain risk management logic.

- Prediction Markets: Build decentralized prediction markets that enable users to quickly act in response to real-time events, knowing the event data used in the settlement of prediction rounds is accurate.

Market Leaders Are Already Adopting Chainlink Data Streams

GMX is currently the largest decentralized perpetual exchange by total value locked (TVL) on Arbitrum and Avalanche. GMX started out running and managing its own in-house price oracle and automation infrastructure. However, this came with major operational complexity and was a huge cost and resource drain due to the challenges of maintaining data quality, scale, and security. Furthermore, it introduced additional trust assumptions that GMX ultimately sought to mitigate via decentralization. GMX determined that this initial solution was simply not sustainable, particularly as GMX further scaled up its protocol.

Once Chainlink Data Streams became available, the GMX community voted to upgrade its oracle infrastructure. GMX V2 is now leveraging Chainlink Data Streams to access high-frequency market data and automate the settlement of transactions. More specifically, GMX leverages Chainlink Data Streams to settle trades and trigger stops and liquidations.

Integrating Chainlink Data streams has enabled GMX to scale in both speed and security without having to sacrifice decentralization or build and maintain its own in-house infrastructure. GMX can now deliver a user experience that competes with centralized exchanges and focus its resources on growing its user base and core product offering.

“Chainlink Data Streams allow GMX to deliver maximum speed, security, and reliability at scale and without compromise. They are essential infrastructure to unlock the future of highly performant, reliable, and decentralized onchain derivatives.”

—X, Development Core Contributor to GMX

Following GMX’s mainnet integration of Data Streams, a growing number of DeFi protocols are integrating on the Arbitrum Goerli testnet, including ApolloX, DRX Exchange, Marquee, MUFEX, Ostium, PancakeSwap, Perennial, Ryze, SubstanceX, YFX, and Zaros.

Payment Model

The Chainlink ecosystem is currently architecting enhanced payment models to support the monetization and long-term economic sustainability of Chainlink services. One of the primary goals of this is to reduce payment friction for dApps, enterprises, and end users using Chainlink services so that fees will sustainably support Chainlink service providers over time.

Similar to CCIP, Chainlink Data Streams require a frictionless payment system to support a multitude of independent blockchains. As such, Chainlink Data Streams allows fee payments in LINK and in alternative assets, the latter currently taking the form of native blockchain gas tokens and their ERC20-wrapped versions. Payments made in alternative assets will be charged at a higher rate versus LINK payments.

In parallel, we are working on a payment abstraction solution where fee payments made in alternative assets are programmatically converted into LINK. Before this conversion mechanism is deployed, an equivalent amount of LINK (determined using the exchange rate at the time of payment) will be made claimable by service providers (e.g., node operators). Payments made in alternative assets may be withdrawn to separate onchain maintenance pools. After an onchain conversion mechanism has been deployed, alternative assets residing in maintenance pools and Data Streams contracts can be converted to LINK.

As Chainlink Staking expands over time to support more oracle services, such as Data Streams, a portion of the user fees paid for those services are planned to be directed to stakers in exchange for increasing the service’s cryptoeconomic security.

Chainlink Data Feeds and Data Streams: Purpose-Built to Meet DeFi’s Needs

Chainlink Data Streams and Chainlink Data Feeds are distinct services that offer unique value for different use cases.

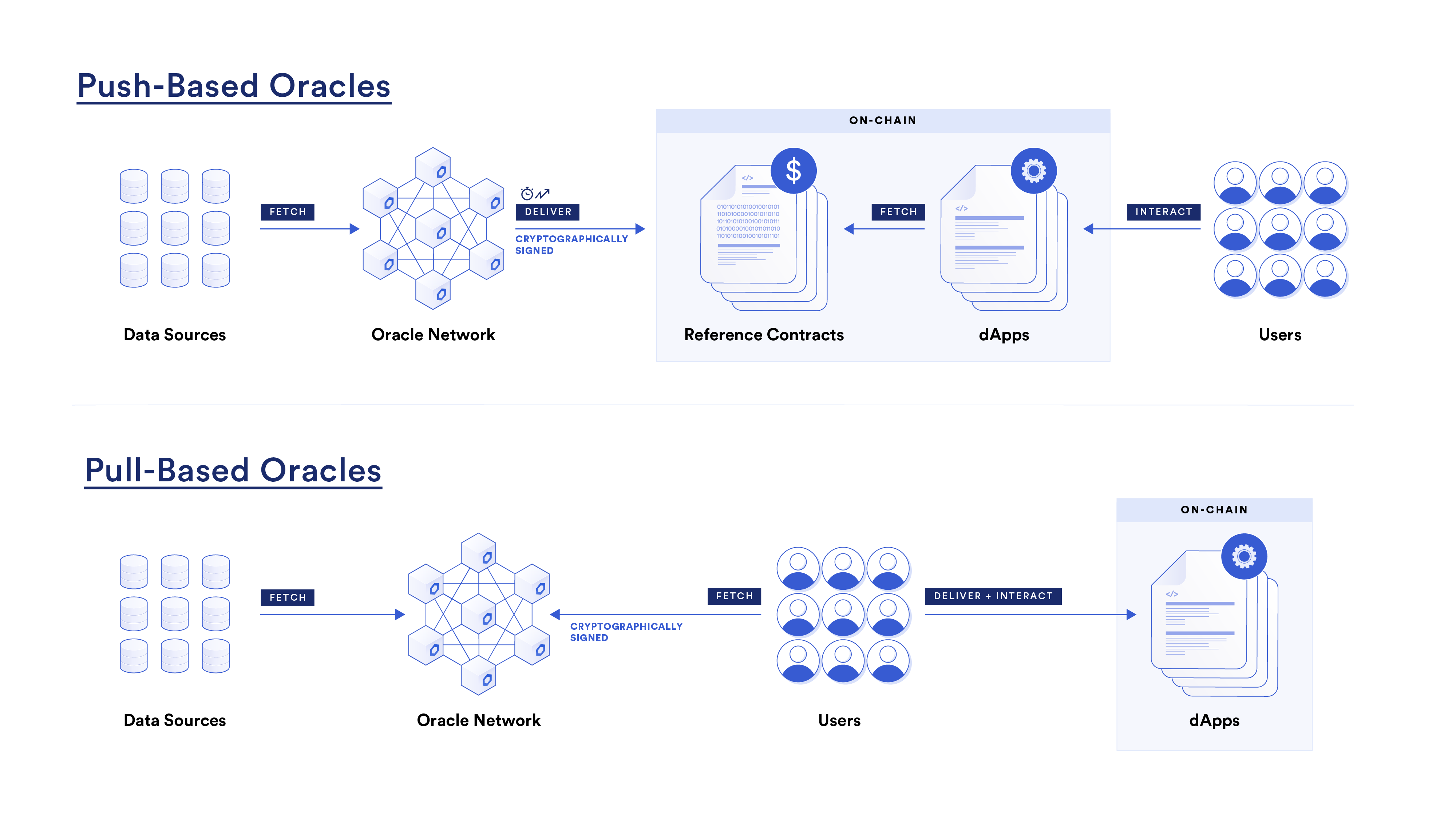

Chainlink Data Feeds are the industry standard push-based oracle solution, providing regular updates directly onchain based on certain conditions being met. For example, when the current price of an asset deviates by a defined threshold (e.g., 1%) from the last price stored in the reference contract or once a certain amount of time has passed since the last update. Chainlink Data Feeds are ideal for supporting use cases where dApps need to read data that is already written onchain (i.e., they are designed around reference contracts). Well-established protocols such as Aave, Compound, and Liquity have already chosen Chainlink Data Feeds to enable them to reference secure and reliable market data when performing critical backend functions.

Chainlink Data Streams introduce a pull-based oracle design that makes high-frequency data available to DeFi protocols offchain, which they can consume onchain as desired. Data Streams enable protocols with latency-dependent use cases to execute trading strategies that require near real-time data accuracy while maintaining end-to-end trust-minimization.

Explore Chainlink Data Streams

Chainlink Data Streams is now available in Mainnet Early Access, with progressive availability opening throughout Q4, 2023. To get started, developers should:

- Read the Developer Docs

- Demo the Hands-On Reference Application on GitHub

- Sign up for Mainnet Early Access

—

Disclaimer: This post is for informational purposes only and contains statements about the future, including anticipated product features, development, and timelines for the rollout of these features. These statements are only predictions and reflect current beliefs and expectations with respect to future events; they are based on assumptions and are subject to risk, uncertainties, and changes at any time. Chainlink Data Streams is in the “Mainnet Early Access” stage of development, which means that Chainlink Data Streams currently has limited functionality that may be changed in later versions. There can be no assurance that actual results will not differ materially from those expressed in these statements, although we believe them to be based on reasonable assumptions. All statements are valid only as of the date first posted. These statements may not reflect future developments due to user feedback or later events and we may not update this post in response. Please review the Chainlink Terms of Service, which provides important information and disclosures.