Tokenized Real-World Assets (RWAs): Scaling Onchain Finance to a Global Level

What is the fundamental goal of crypto? Is it to facilitate short-term token speculation via capital rotation games and inflationary rewards? Or is it to improve how society functions by creating a more transparent, accessible, and efficient global economy?

Most crypto-native readers would probably agree that it’s some variation of the latter. However, when looking at the current state of crypto, it’s easy to see why it has a poor reputation amongst the general public. Unbounded speculation reigns supreme, whereas tangible real-world use cases that benefit the average consumer have so far been few and far between.

What needs to change in order for crypto to move beyond its speculation-centric phase and begin delivering real utility to a broader audience?

It is my belief that the tokenization of real-world assets (RWAs)—blockchain-based digital tokens that represent physical and traditional financial assets—is the fuel that’s needed to propel the crypto industry into the mainstream. With $867T in traditional markets ready to be disrupted by blockchain-based technologies, the opportunity to systematically improve global economies is real.

This blog is my thesis on RWAs.

The Current State of Onchain Finance

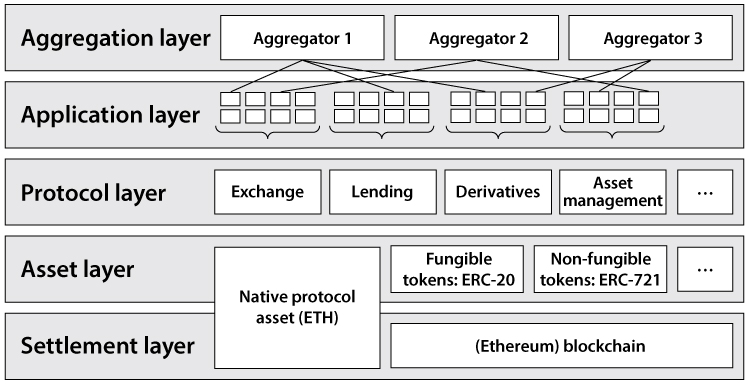

The core value proposition of public blockchains is to solve coordination problems by serving as a decentralized, credibly neutral settlement layer that any application can be permissionlessly deployed upon. Blockchain applications operate exactly as programmed without human intermediation, are auditable by anyone in real-time, and can be seamlessly composed into other blockchain applications.

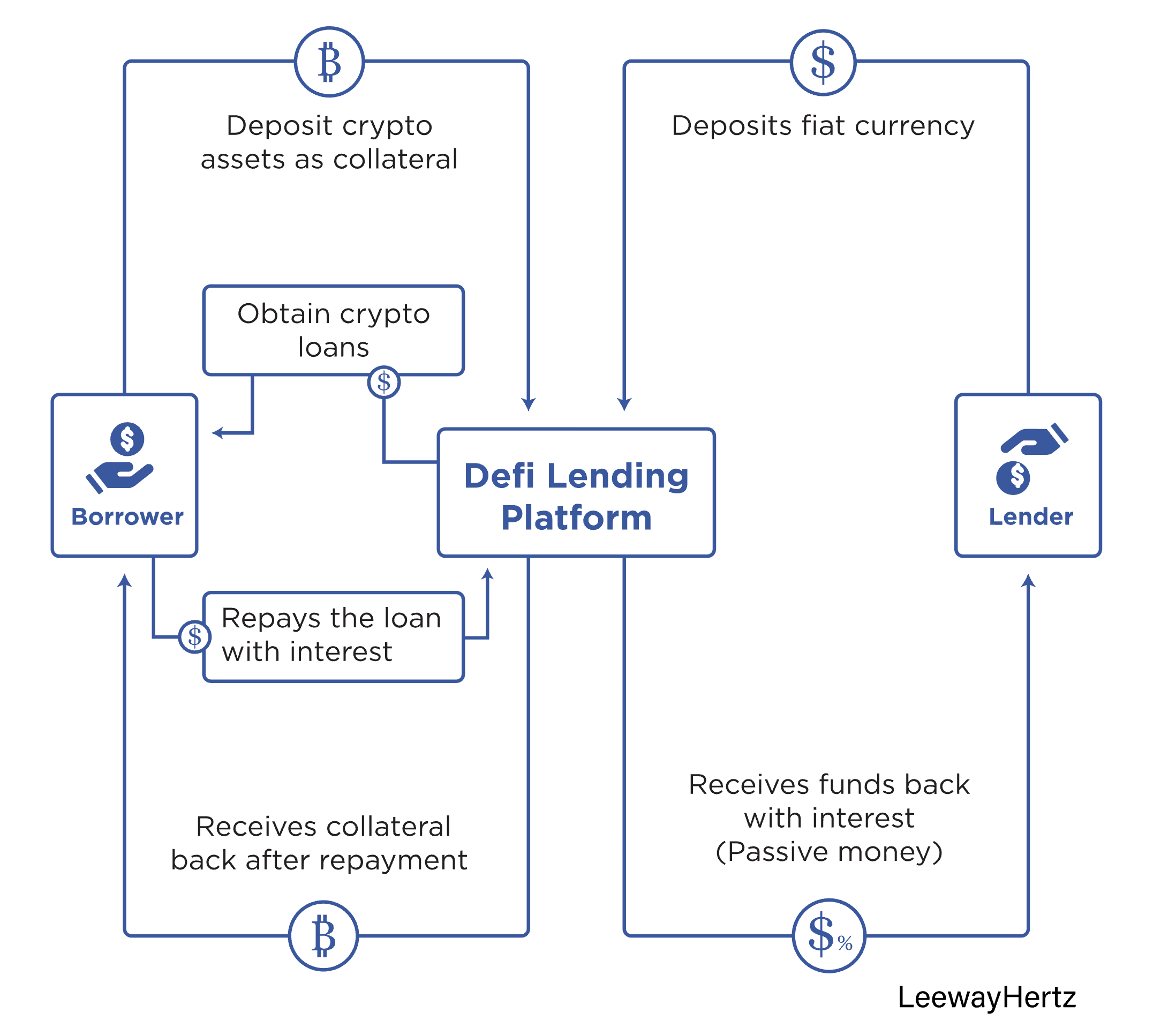

The initial application of blockchains was the creation and movement of tokens, which represent a unit of value (e.g. BTC). However, it was the creation of DeFi (decentralized finance), also referred to as onchain finance, that showcased the true potential of public blockchains. In particular, onchain financial applications benefit from the following properties:

- Atomic settlement: The combination of cryptography and decentralized consensus leads to strong finality guarantees of economic transactions—mitigating double-spend attacks and fraud in a tamper-resistant manner, thereby increasing capital efficiency and reducing systemic risks.

- Transparency: Public block explorers and data dashboards provide granular and clear insight into the risk exposure and collateralization of the onchain finance ecosystem as a whole. Furthermore, the source code of applications are open-source and can be reviewed by anyone.

- User control: Non-custodial asset management is achieved through private keys, allowing onchain applications to interface with assets in a trust-minimized manner. Decentralized autonomous organizations (DAOs) also allow for collective ownership of assets and applications.

- Reduced costs: Onchain finance applications operate more efficiently and autonomously since the need for intermediaries is minimized. This facilitates low switching costs for moving capital across applications, creating an efficient market for app-level fees. Scaling technologies also make microtransactions feasible by reducing network-level fees.

- Composability: Having a common settlement layer for running autonomous code allows for permissionless composability between new and existing onchain finance applications. Developers don’t have to worry about being deplatformed, further incentivizing collaboration.

Many of the financial primitives that exist within the traditional financial economy have already been recreated in an onchain format, benefiting from the above properties. Such examples include:

- P2P payments (Lightning Network, Flexa)

- Insurance (Nexus Mutual, Unslashed)

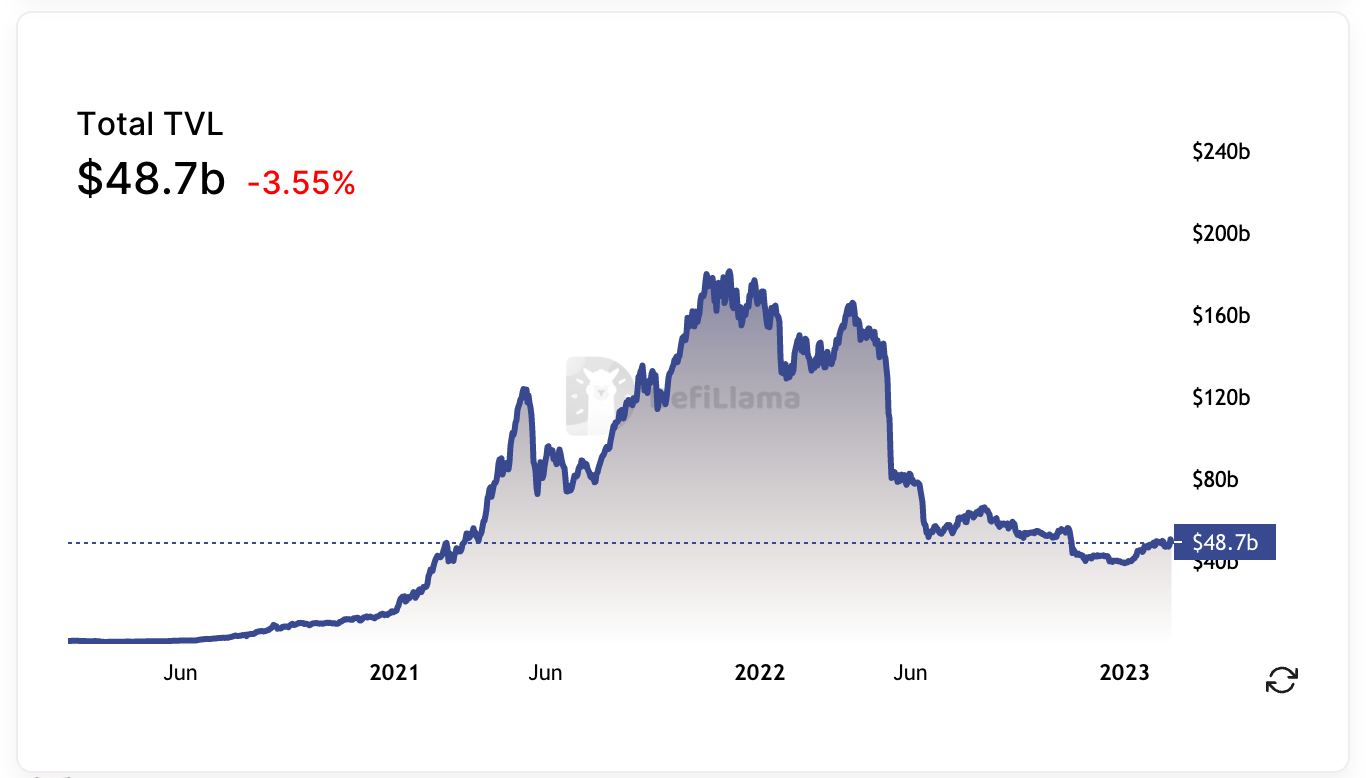

Despite the public’s perception of crypto, the onchain finance ecosystem has proven its resiliency, even when faced with periods of extreme market volatility, rapid deleveraging events, and the collapse of centralized crypto institutions such as FTX. DeFi, as of writing, has over $47B in total value locked ($180B at its peak), daily trading volumes in the billions of dollars, and daily revenue generation in the millions of dollars.

It’s clear that onchain financial systems offer tangible benefits over the status quo. However, there is one major limiting factor that prevents onchain finance from reaching a global scale: Much of DeFi is currently a circular economy that has little-to-no connection to the existing global economy of traditional businesses and services. The historical rapid growth of DeFi is largely connected to the rise of capital rotation games and unsustainable yields fueled by inflationary token rewards. This is the equivalent of using a supercomputer to play minesweeper: pure untapped potential.

There is an exception, however: stablecoins.

The Growth, Dominance, and Sustainability of Stablecoins

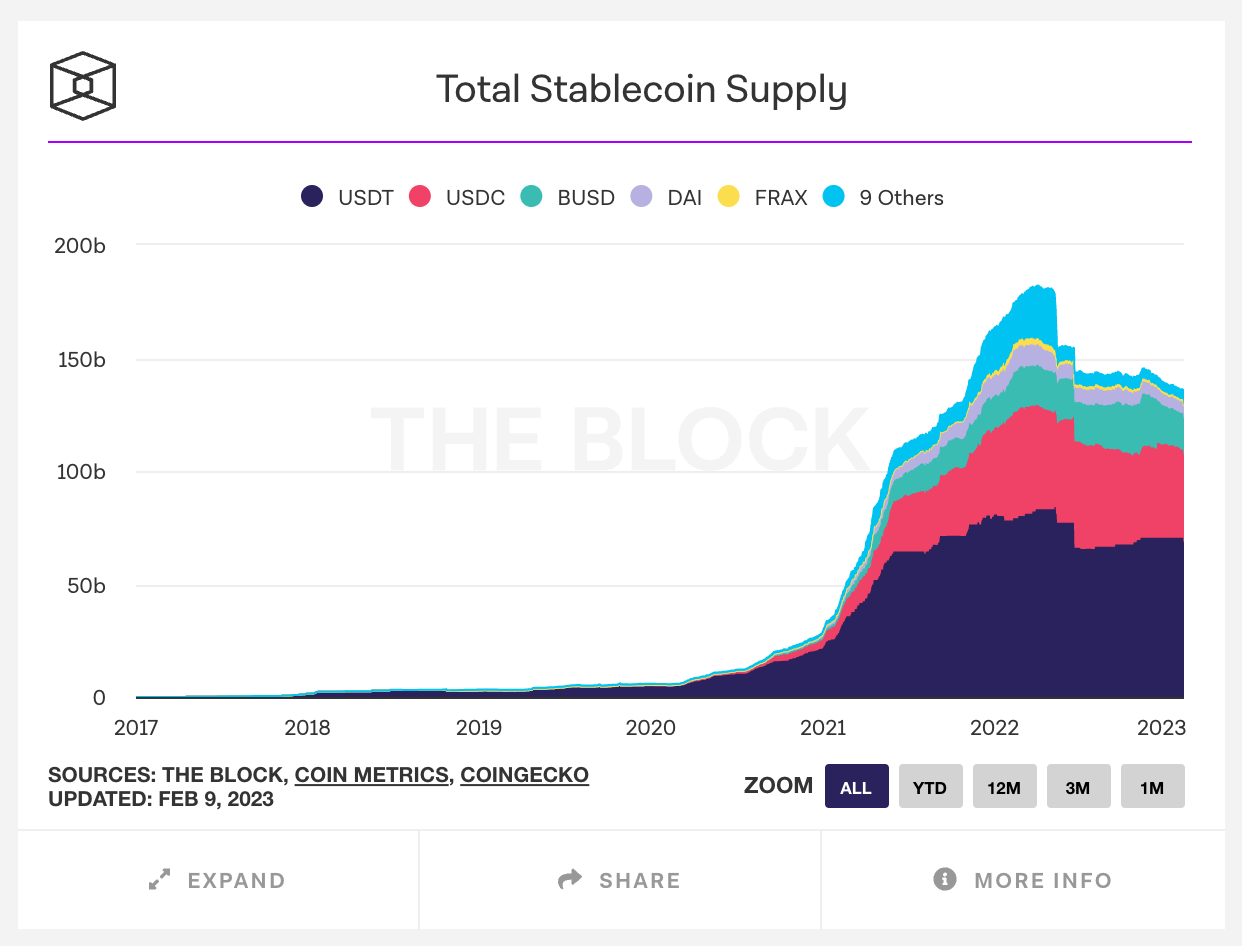

Stablecoins are a type of crypto asset that aims to keep its price pegged to the market value of an external asset, such as a fiat currency or commodity. In the majority of cases, this is the price of the US dollar. There are many mechanisms to achieve price stability, but the most widely used implementation is for a centralized institution to issue a token collateralized by US dollars held in custody offchain. The result is the tokenization of USD.

Over the past few years, the supply of stablecoins has exploded, with over $132B of stablecoins currently circulating on public blockchains, an increase of 2,222% from three years ago.

Stablecoins provide a superior version of the dollar, one that is natively digital, programmable, composable, and atomically settled. More importantly, USD-collateralized stablecoins do not require a constant inflow of capital or speculation to sustain themselves. With direct redeemability and full collateralization, the supply of stablecoins can scale up and down as the market requires without issue.

Stablecoins formally entered the market in 2014 with the introduction of Tether (USD₮). Tether was initially deployed on the Bitcoin blockchain and was created to address the inability of centralized crypto exchanges (CEXs) to obtain formal banking partners. In supporting Tether, CEXs were able to increase market liquidity by providing increased access to fiat on/off-ramps while also meeting market demand for USD-denominated trading pairs. Tether also enabled investors to reduce their exposure to crypto’s volatility without needing to return to the traditional financial system.

The launch of the Ethereum blockchain and the rise of the onchain finance ecosytem saw the usage of stablecoins expand, with stablecoins getting composed into onchain applications, primarily as a method to generate yield. While this yield was often generated from crypto leverage traders and inflationary rewards, stablecoins connected the onchain finance ecosystem back to the traditional financial economy—expanding the value proposition of crypto by orders of magnitude.

The most common type of stablecoins (USD-collateralized) are not without their trade-offs, however, specifically because they introduce trust requirements in the centralized issuer (e.g., custody, issuance, redemptions) and permission controls for regulatory compliance (e.g., KYC/AML checks during issuance/redemption and onchain blacklists). Moreover, “USD-collateralized” stablecoins are often not backed by dollars alone, but also in part by other assets including cash equivalents (e.g. US treasuries, commercial paper), secured loans, corporate bonds, and more. However, the most trusted stablecoins are backed entirely by cash and short-term US treasuries.

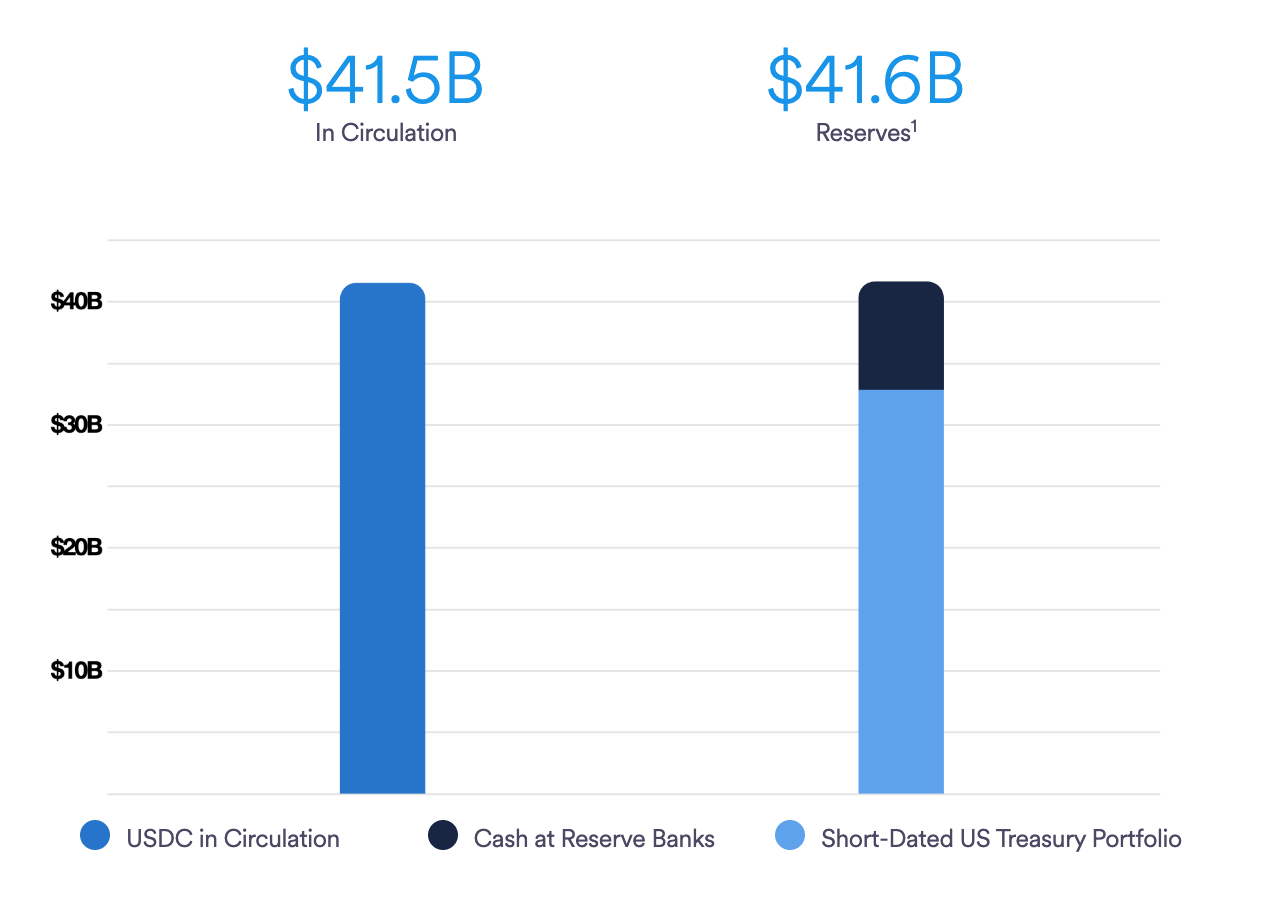

USD-collateralized stablecoins continue to improve in terms of transparency and reporting. Moody’s, a leading credit rating agency, is developing a scoring system for stablecoins based on the quality of their reserves attestations. Tether has derisked its reserves by eliminating commercial paper and phasing out secured loans. Circle’s USDC provides monthly reserve reports with attestations from leading global accounting firm Grant Thornton.

Attempts have also been made to create decentralized stablecoins. However, the collapse of undercollateralized algorithmic stablecoin TerraUSD showcased the difficulty and risk of straying from the tried-and-true USD-collateralized stablecoin model. Other decentralized (overcollateralized) stablecoins, such as MakerDAO’s DAI, have begun to incorporate other USD-collateralized stablecoins and real-world assets (RWAs) as collateral in order to maintain a $1 peg at scale.

Ultimately, the introduction and adoption of stablecoins within onchain finance has proven that there is real appetite for tokenized RWAs. I’d even venture to say it points to the start of a greater mega-trend around RWAs.

RWAs: The Assets People Want in a Superior Format

Most people are not financial experts and do not care about the intricacies of how the financial industry operates, and yet society depends on financial assets. Fiat currencies are used for commerce and savings; they are what people earn and spend. Commodities are used for consumption and the manufacturing of goods; they are what people need to live and survive. Securities are used to raise capital and create businesses that provide goods and services; they are what allows society to grow and thrive.

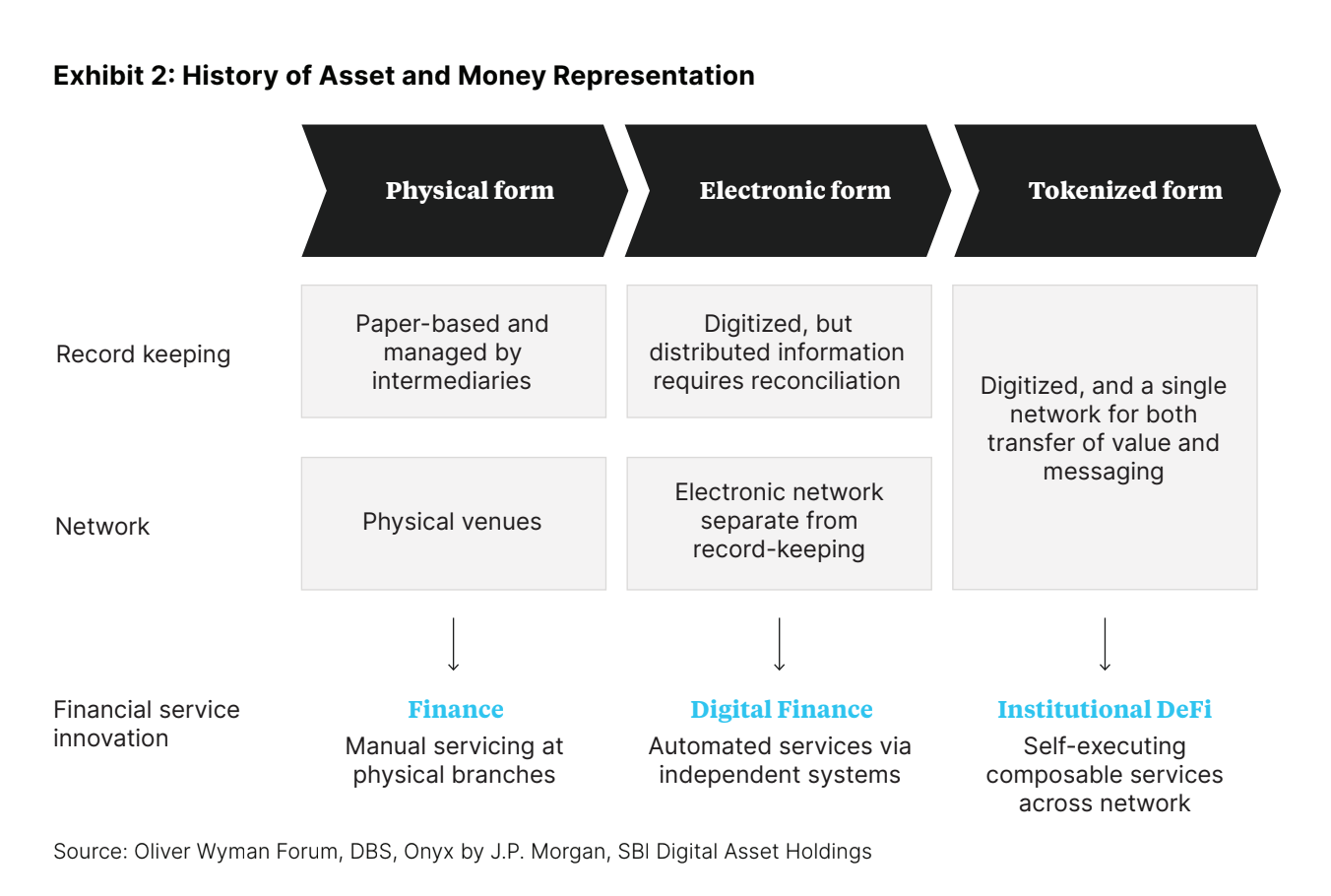

But the financial economy is not static. Starting in the Babylonian empire in 3000 BC with clay tablets to track debts before evolving into paper formats, finance has entered an almost purely digital era. Despite these transformations, the recording of financial events still takes place across siloed ledgers that must be reconciled. This results in significant inefficiencies, such as increased costs and lengthened settlement times. The lack of interoperability and the resulting fractionalized liquidity present an opportunity for the next era of finance to be around asset tokenization.

The tokenization of real-world assets and their use in onchain finance provides a number of advantages over the status-quo, many of which derive from the properties that make public blockchains and onchain finance valuable.

- Increased efficiency: A blockchain’s ledger serves as the golden source of truth, reducing friction during post-trade reconciliation. Atomic settlement also removes the need for delayed T+2 settlement, as assets can be simultaneously delivered with payment.

- Reduced costs: Self-executing autonomous protocols reduce the need for intermediaries at every step. Early results show an up to 90% reduction in the cost of bond issuance when using blockchain-based record keeping and an up to 40% reduction in fundraising costs.

- Increased transparency: Public blockchains are auditable in real-time, opening up the ability to verify the quality of asset collateral and systemic risk exposure. Disputes around record keeping can also be mitigated through public dashboards showcasing onchain activity.

- Built-in compliance: Complex compliance rulesets can be programmed directly into tokens and applications offering services involving tokens. Privacy-preserving KYC tools can be implemented to shield user privacy while remaining compliant with the relevant regulations.

- Liquid Markets: Tokenizing assets within private markets (e.g., pre-IPO shares, real estate, carbon credits) increases the accessibility of historically illiquid markets—a market with trillions of dollars worth of largely inaccessible assets.

- Innovation: With assets and application logic existing within a common settlement layer, rather than in disconnected environments, entirely new financial products can be created. From fractionalized real estate funds to liquid revenue-sharing agreements, tokenization increases the ability to build products that were previously infeasible.

How RWAs Are Tokenized and the Challenges Involved

To leverage the aforementioned benefits, RWAs can be generated in one of two token formats. The first format is non-native tokens, where onchain tokens are issued to represent RWAs that exist and are managed offchain by a custodian. This is the most common type due to the infancy of RWAs and the ability to leverage existing financial infrastructure around asset custody. All existing USD-collateralized stablecoins have adopted this token format.

The second format is native tokens, where an onchain token is issued and serves as the RWA itself, meaning it does not represent any type of offchain asset. For example, bonds that are directly issued onchain as tokens are native RWAs, while a bond that is issued and held offchain could be tokenized as a non-native RWA.

It’s important to note that RWAs can be issued on either private or public blockchains. Private chains—where only certain verified participants can operate the chain and view its contents—offer increased control over the ledger’s entries but come with additional trust requirements, limited composability, and walled-garden access, negating many of the benefits that public blockchains bring to RWAs. However, there is a place for each type of blockchain, with the potential for many RWAs to be initially issued on private blockchains and eventually flow onto public blockchain networks.

While RWAs on public chains provide many benefits for both institutions and investors alike, there are also a number of challenges that must be considered to realize their potential:

- Regulatory clarity: The primary blocker for many financial institutions interested in tokenizing assets, particularly on public blockchains, is the lack of regulatory clarity. Certain jurisdictions, such as the EU, Switzerland, the UK, and Japan, have made tangible progress in establishing clear frameworks, while others, like the United States, are still largely a work in progress.

- Permissions: In order to comply with existing and upcoming financial regulations around public blockchains and asset tokenization, token issuers often must add permissions through the implementation of KYC/AML checks (such as during issuance/redemption or at time of transfer)—deviating from the norm in DeFi.

- Identity: The need for granular permission controls necessitates robust solutions to determine user identities and risk profiles. Decentralized Identifiers (DIDs), Verifiable Credentials (VCs), and other identity solutions are a prerequisite for most institutions stepping into RWA tokenization.

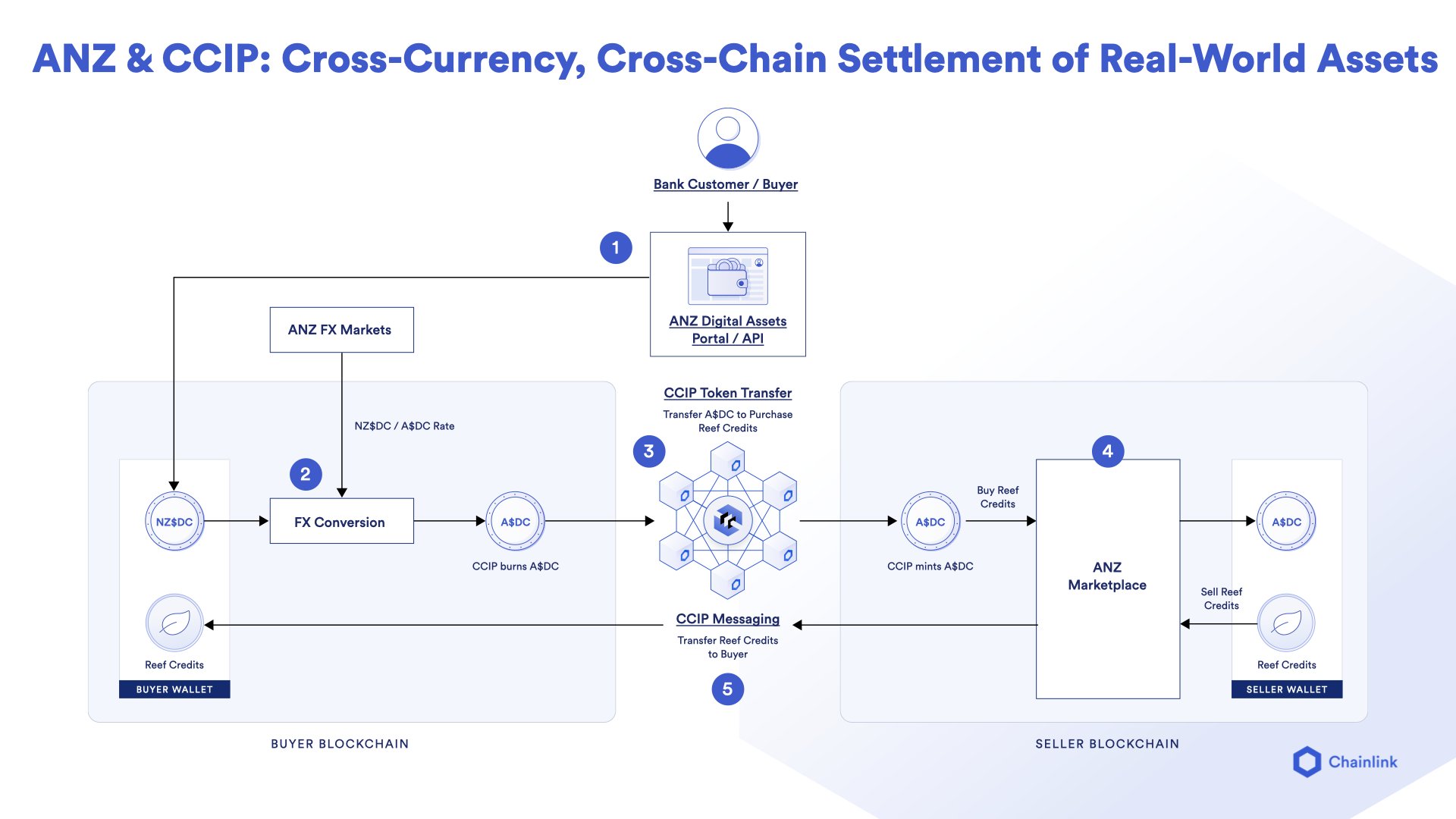

- Connectivity: The multi-chain ecosystem continues to expand, resulting in a growing collection of blockchains that institutions must plug into to access and issue RWAs. Standards such as the Cross-Chain Interoperability Protocol (CCIP) enable institutions to not only connect their existing backend systems to blockchains, but also bridge RWAs across public and private blockchains, enabling cross-chain Delivery versus Payment (DvP) workflows.

- Proof of reserves: Since RWAs represent offchain assets, onchain finance applications have limited insight into their true collateralization. Oracle solutions such as Chainlink Proof of Reserve address this challenge by delivering collateralization data onchain.

We are still in the early days of RWAs on public blockchains, but none of the above challenges are insurmountable. Continued industry collaboration, across both DeFi and TradFi, will chip away at these barriers over time in order to eventually arrive at a viable solution for onchain finance.

The Current Traction and Real-World Opportunity of RWAs

The potential market opportunity for RWAs has generated increasing interest, as demonstrated by the deployment of pilot tests by both traditional institutions and crypto-native projects. According to a 2022 Celent survey, 91% of institutional investors have signaled their interest in investing in tokenized assets. Below are a few examples of how institutions are actively engaging in the tokenization of RWAs on public blockchains.

Institutional Interest in Real-World Asset Tokenization

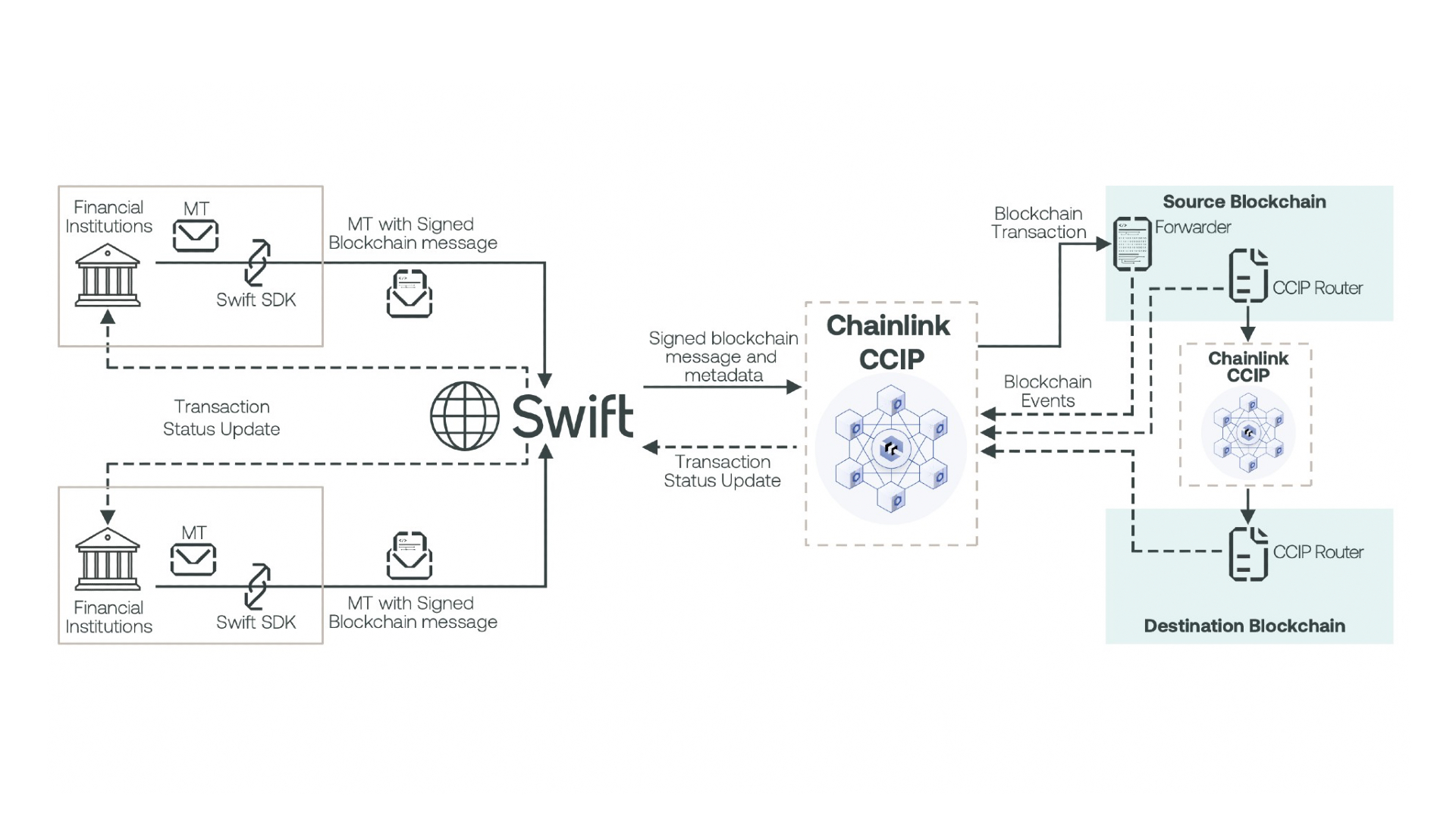

Recently, Swift collaborated with Chainlink and more than a dozen of the largest financial institutions and market infrastructure providers on how firms can leverage their existing Swift infrastructure to efficiently instruct the transfer of tokenized value over a range of public and private blockchain networks using CCIP. Participants included Australia and New Zealand Banking Group Limited (ANZ), BNP Paribas, BNY Mellon, Citi, Clearstream, Euroclear, Lloyds Banking Group, SIX Digital Exchange (SDX), and The Depository Trust & Clearing Corporation (DTCC).

Exciting news! Together with more than a dozen major financial institutions, we’ve successfully shown how the #Swift network can facilitate the transfer of tokenised assets across multiple public & private #blockchains.

𝗟𝗲𝗮𝗿𝗻 𝗺𝗼𝗿𝗲: https://t.co/L0o6meHXfd pic.twitter.com/VVtt1VnJZc— Swift (@swiftcommunity) August 31, 2023

The collaboration showcased how Chainlink CCIP could be used as an abstraction layer to enable financial institutions to connect their backend infrastructure to any public or private blockchain, as well as instruct the transfer of tokenized RWAs between different blockchains efficiently and securely.

In a recent industry case study, it was showcased how the Australia and New Zealand Banking Group (ANZ)—a leading institutional bank with $1+ trillion in total assets under management—successfully demonstrated cross-chain tokenized asset settlement with Chainlink CCIP. Using the ANZ Digital Asset Services (DAS) portal along with CCIP as an abstraction layer, the case study demonstrated how ANZ customers could use CCIP to securely transfer ANZ-issued stablecoins cross-chain to purchase nature-based assets.

Another example of financial institutions exploring the usage of RWAs is the Singapore Central Bank’s Project Guardian, which explored the use of DeFi for wholesale funding markets in late 2022. Under the first pilot, DBS Bank, JP Morgan, and SBI Digital Asset Holdings conducted foreign exchange and government bond transactions against liquidity pools composed of tokenized Singapore government securities bonds, Japanese government bonds, Japanese Yen (JPY), and Singapore Dollars (SGD).

The pilot used forked permissioned versions of the Aave lending protocol and Uniswap exchange operating on the public Polygon mainnet. The pilot resulted in JP Morgan executing its first DeFi transaction on a public blockchain, the trading of $100,000 tokenized Singapore dollar deposits (the first issuance of tokenized deposits by a bank) for tokenized yen issued by SBI Digital Asset Holdings.

WORLD! J.P. Morgan has executed its 1st *LIVE* trade on public blockchain using DeFi, Tokenized Deposits & Verifiable Credentials, part of @MAS_sg Project Guardian 🙌🚀🔥https://t.co/XI212SG4zg Many world 1sts here, & since this is public ⛓ here’s a transparent🧵on what we did:

— Ty Lobban (@TyLobban) November 2, 2022

The main objective of the pilot was to “test the feasibility of applications in asset tokenization and DeFi while managing risks to financial stability and integrity.” Utilizing a public blockchain showcased how open, interoperable networks can mitigate challenges such as fragmented liquidity and walled garden ecosystems. Furthermore, W3C Verifiable Credentials issued by trusted financial institutions demonstrated how compliance controls could be integrated within onchain applications involving RWAs.

“The live pilots led by industry participants demonstrate that with the appropriate guardrails in place, digital assets and decentralised finance have the potential to transform capital markets. This is a big step towards enabling more efficient and integrated global financial networks.” – Sopnendu Mohanty, Chief FinTech Officer, MAS

Additional pilots under Project Guardian are now in motion, with Standard Chartered Bank leading an initiative to explore the issuance of tokens linked to trade finance assets, while HSBC and United Overseas Bank are working on native digital issuance of wealth management products.

As another example of institutional interest, Siemens recently issued a €60 million digital bond on the public Polygon mainnet. With a maturity of one year, the digital bond was issued in accordance with Germany’s Electronic Securities Act (eWpG) and was purchased by DekaBank, DZ Bank, and Union Investment. By issuing the bond on a public blockchain, Siemens was able to remove the need for paper-based global certificates and central clearing, allowing the bond to be sold directly to investors without needing a bank to function as an intermediary.

“By moving away from paper and toward public blockchains for issuing securities, we can execute transactions significantly faster and more efficiently than when issuing bonds in the past. Thanks to our successful cooperation with our project partners, we have reached an important milestone in the development of digital securities in Germany.” – Peter Rathgeb, Corporate Treasurer at Siemens AG

DeFi Interest in Tokenizing Real-World Assets

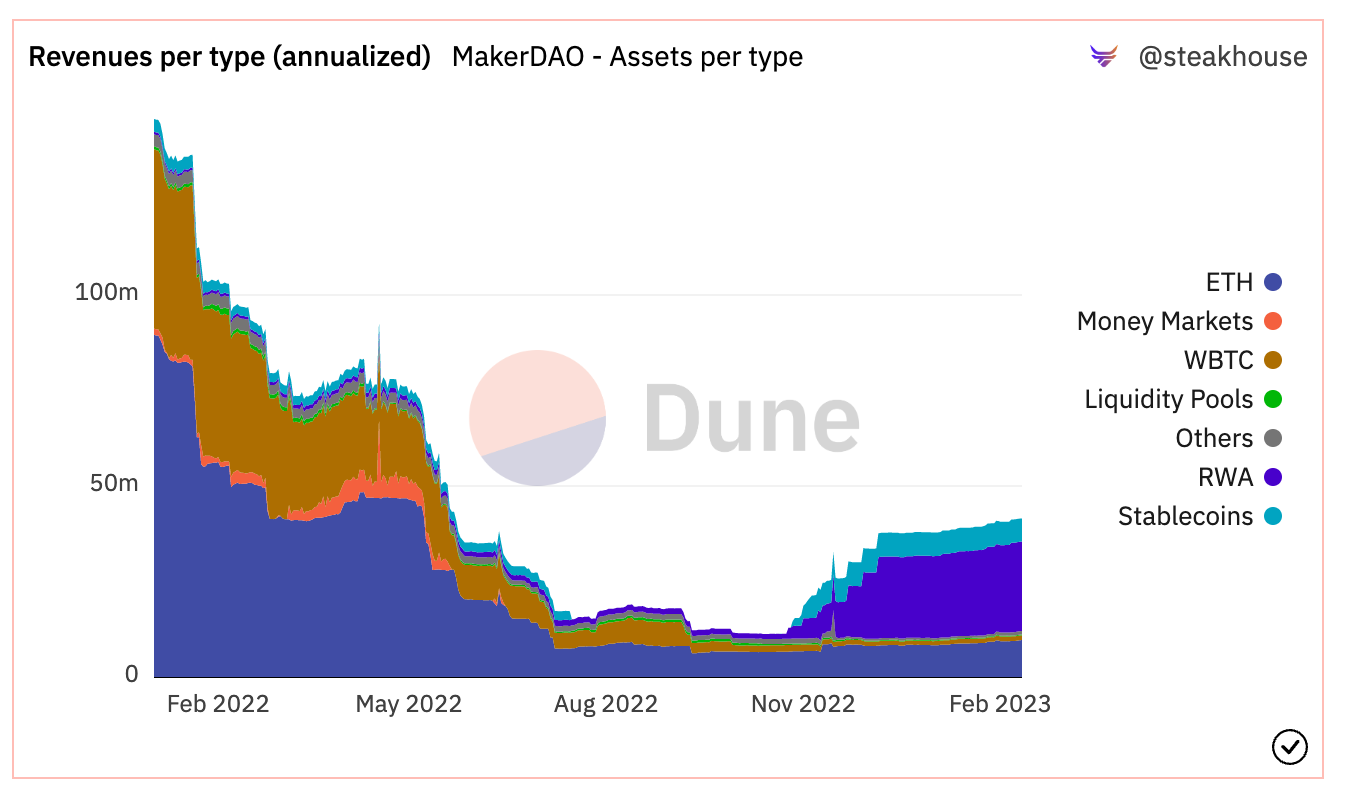

Interest in tokenizing RWAs is also strong in the existing onchain finance ecosystem, with a number of dApps having tokenized hundreds of millions of dollars worth of assets. Not only does tokenizing assets increase their addressable market, but yields in the traditional financial system (e.g. ~4% from US treasuries) are now consistently higher than existing DeFi projects (~2% from DeFi collateralized lending). This gives onchain finance protocols access to sustainable revenue opportunities.

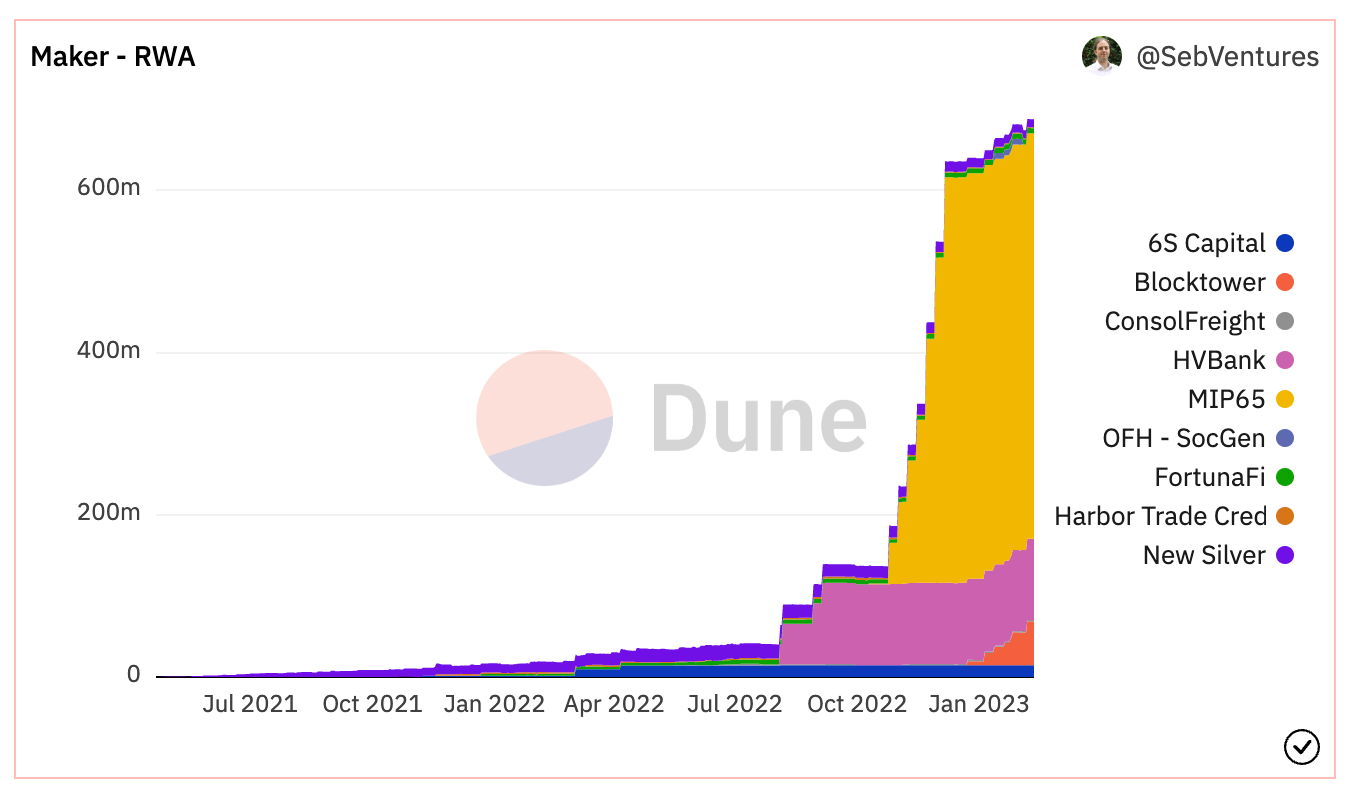

MakerDAO is a DeFi project that has arguably made the most progress in terms of RWA adoption. Currently, the protocol has $680M+ worth of RWAs backing the decentralized stablecoin DAI. By introducing RWAs as collateral, MakerDAO was able to scale the amount of DAI issued into the market, harden its peg stability, and significantly increase protocol revenue (~70% of its revenue in Dec ‘22 came from RWAs).

The bulk of MakerDAO’s RWA collateral (~$500M) comes in the form of US treasury bonds managed by Monetalis (MIP65). These assets provide the protocol a source of yield on otherwise idle USDC collateral. MakerDAO also launched a vault backed by $100M worth of loans originating from a community bank in Philadelphia called Huntingdon Valley Bank (HVB). HVB used MakerDAO to support the growth of its existing businesses and investments around real estate and other related verticals, and served as the first commercial loan participation between a US-regulated financial institution and a decentralized digital currency. In a separate vault, Société Générale borrowed $7M from MakerDAO in a position backed by €40M worth of AAA-rated bonds tokenized as OFH tokens.

A number of other protocols have also made significant strides in terms of RWA adoption, including:

- Ondo Finance—a platform for tokenized RWAs—recently tokenized short-term US treasuries, investment grade bonds, and high-yield corporate bonds. Ondo also launched Flux Finance, a lending protocol for borrowing permissionless stablecoins against the tokenized US treasuries.

- Backed—a Swiss-based startup for tokenized RWAs—recently launched its first product, bCSPX, representing tokenized S&P 500 ETF shares. Backed Tokens are freely transferable across wallets and enable 24/7 capital market trading.

- Maple Finance—a blockchain-based credit marketplace with nearly $2B in total loans issued—is planning to expand to receivables financing, which can scale up to $100M in size, as well as support US treasuries and insurance refinancing.

- Centrifuge—an onchain ecosystem for structured credit—is focused on securitizing and tokenizing previously illiquid debt, with $298M in total assets already financed. Its tokenized assets have been integrated across DeFi, including $220M of RWAs on MakerDAO.

- Goldfinch—a decentralized credit protocol—has $101M in active loan value. The platform allows for the creation of junior and senior tranches for assets focused on emerging markets, enabling risk/return profiles to be fine-tuned.

It is worth noting that RWAs have also been explored in the context of security token offerings (STOs), with 18 companies having raised a total of $380M in 2018. However, most STO offerings have historically been viewed as a limited implementation of RWAs given their focus on fundraising (i.e., an alternative to initial coin offerings or ICOs). With STOs representing more niche securities that are usually only available on permissioned platforms, their adoption has not reached the same level as RWAs on public blockchains.

Furthermore, while unsecured lending protocols have faced defaults in recent months after the collapse of FTX, (e.g. Alameda and Orthogonal Trading), this is the expected risk associated with undercollateralized loans and does not represent a failure of the credit protocols themselves. The risk simply means the yield must reflect the probability of defaults, the same as within traditional finance.

A Note on Trust Assumptions

Given that tokenized real-world assets depend on the existence of traditional financial institutions, their trust properties will likely never be the same as a onchain finance ecosystem dealing solely in crypto-native assets. Most institutions will not feel comfortable deploying trillions of dollars worth of assets on public blockchains without the necessary guardrails and permissions required to mitigate both operational and regulatory risks. Scaling onchain finance to a global level with tokenized RWAs means meeting institutions in the middle.

In parallel, it is also likely that fully permissionless onchain finance protocols, focused on crypto-native assets with little-to-no RWA interaction, will continue to exist. Such protocols can provide immense value by serving as a sandbox for financial experimentation and as an “opt-out” censorship-resistant alternative for financial services. However, without RWA support, such an ecosystem is unlikely to provide the full utility desired by average consumers.

The power of public blockchains is that they can support and serve both tokenized RWAs and crypto-native assets at the same time. It is ultimately the choice of the consumer regarding what type of assets they want to hold and what applications they wish to deploy their assets into. While tokenized RWAs, and the additional trust assumptions involved, may not be for everyone, it would be a mistake not to capitalize on the opportunity that exists.

The Path Forward

The tokenization of real-world assets provides immense opportunities for existing financial institutions and the early-stage onchain finance ecosystem. While the token-speculation use case has helped stress test existing DeFi protocols, the ecosystem is now at a stage where it needs to evolve and begin providing real utility for society. There remain many challenges ahead to realizing the true potential of RWAs, but the market opportunity presented is in the trillions, and someone will capture it.

Looking to understand the tokenization opportunity? This industry report provides a comprehensive overview of the growing tokenization market, with contributions from BCG, 21Shares, Paxos, Backed, and Chainlink. Access now.

Additional Readings:

- Connecting blockchains: Overcoming fragmentation in tokenised assets

- Cross-Chain Settlement of Tokenized Assets Using Chainlink CCIP

- Institutional DeFi: The Next Generation of Finance?

- Relevance of on-chain asset tokenization in ‘crypto winter’

- Digital assets in action: Current use cases for Financial Institutions

—

The opinions expressed within this post are solely the author’s and do not reflect the opinions and beliefs of the Chainlink Foundation or Chainlink Labs.