Chainlink Product Update: Q1 2023

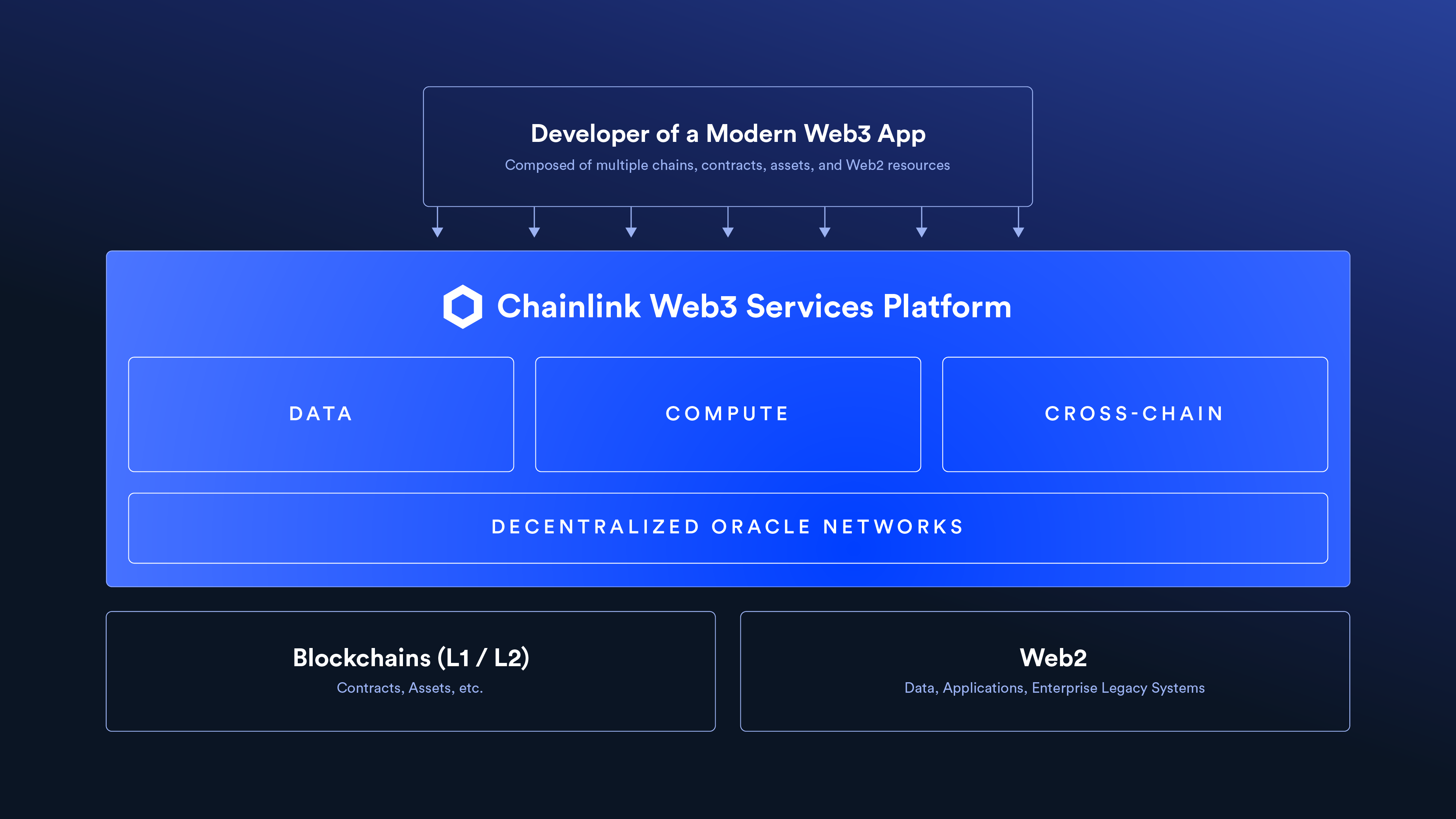

Today more than ever, we are seeing the inevitability of Web3. Building a world that is more provably fair, where people are in control of their assets and their data, has never been more important. But for the promise of Web3 to fully materialize, and for it to have maximum real-world impact, Web3 needs to be connected.

There are three inherent disconnects around blockchain technology:

- Data. Blockchains are isolated from Web2 data and systems.

- Computation. Blockchains are only suitable for certain types of computation and need access to off-chain computation environments to truly scale.

- Interoperability. Blockchains can’t communicate effectively with other blockchains.

Chainlink solves this connectivity problem by giving developers seamless access to external data, off-chain computation, and cross-chain interoperability.

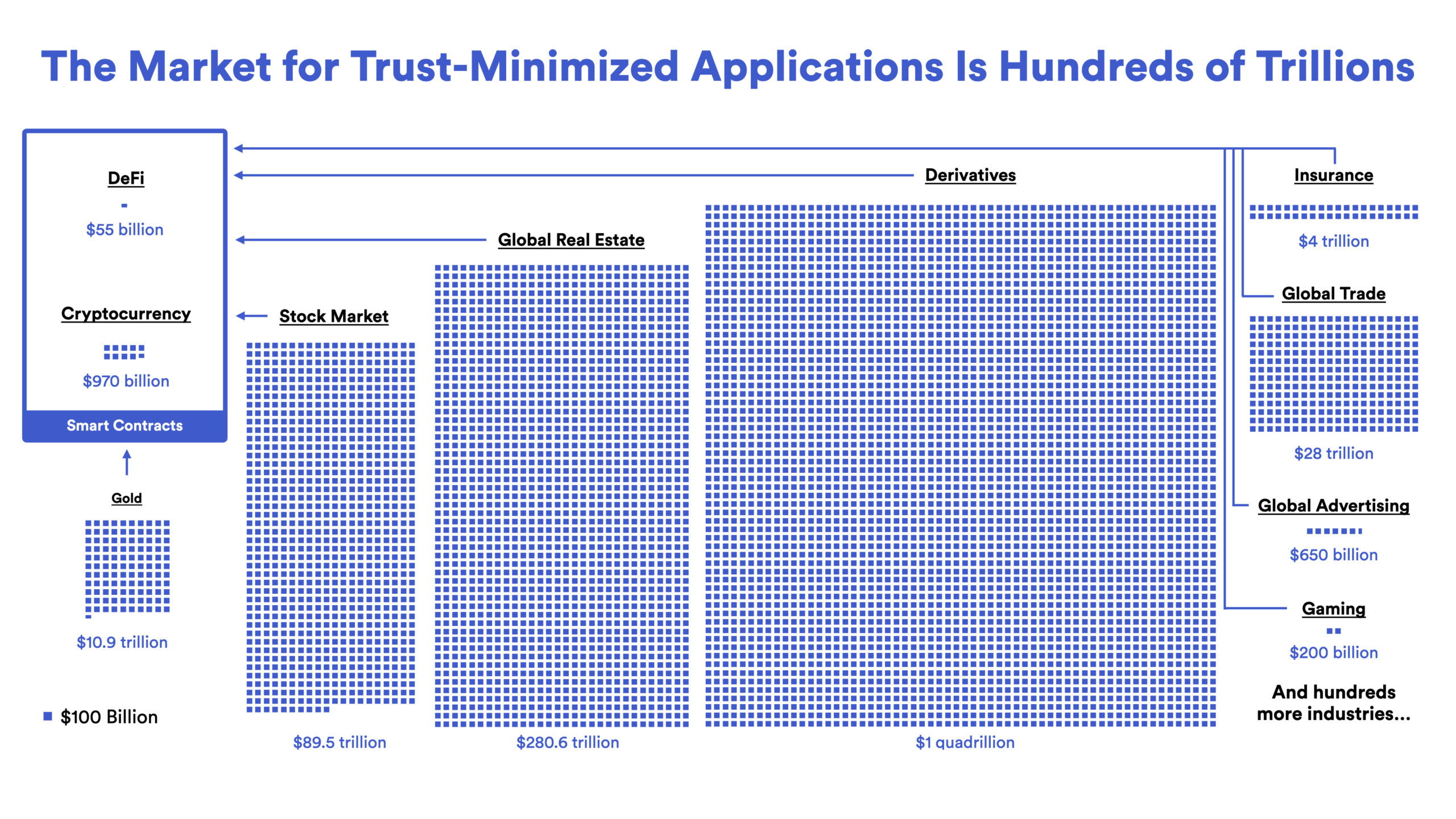

As the industry-standard Web3 services platform, Chainlink enables Web3 developers to build the next wave of use cases and empowers Web2 companies to bring Web3 into their existing technology stacks. This unlocks the multi-trillion dollar opportunity that is Web3 by providing developers, startups, entrepreneurs, and established businesses with the ability to disrupt and reinvent a range of industries from finance and payments to gaming, insurance, carbon markets, and beyond.

In the following product update, we will share our progress since outlining our platform vision at SmartCon 2022. Our goal is to bring more transparency and insight into the development of Chainlink as a platform. We do so by providing a quick summary of each product, sharing recent deployments since last September, and showcasing areas of current research and development that are actively being explored for future product iterations.

This Thursday, March 23 at 1PM ET, we’ll be hosting a Q&A on the Chainlink Official Discord related to this product update. Please use this form to submit a question and tune into the Q1 Product Q&A channel. We’ll be collecting questions up until 11:59PM ET tonight, Tuesday, March 21.

Please note that all future-facing comments are subject to change based on user feedback, shifts in consumer demand, strategic determination, and various other unforeseen challenges. The goal of this product update is to provide insight into current thinking, but it is not a definitive product roadmap; it’s an attempt to balance transparency with the need to remain agile in this dynamic industry, which moves fast and is constantly evolving.

Data

Data Feeds and Data Products

Chainlink Price Feeds are the industry standard for obtaining secure and reliable asset prices. The launch of Chainlink Price Feeds has catalyzed DeFi ecosystems on the 16 blockchains they are currently deployed on, enabling over \$7 trillion in transaction value since the start of 2022.

However, DeFi is still only scratching the surface of its potential. There is still so much data that can be brought on-chain, and with each new segment of data, whole industries can be disrupted and immense value created. We are looking to expand Chainlink’s data platform footprint in many areas, particularly by adding more data feeds onto more chains and through a new mechanism to enable the on-chain derivatives market.

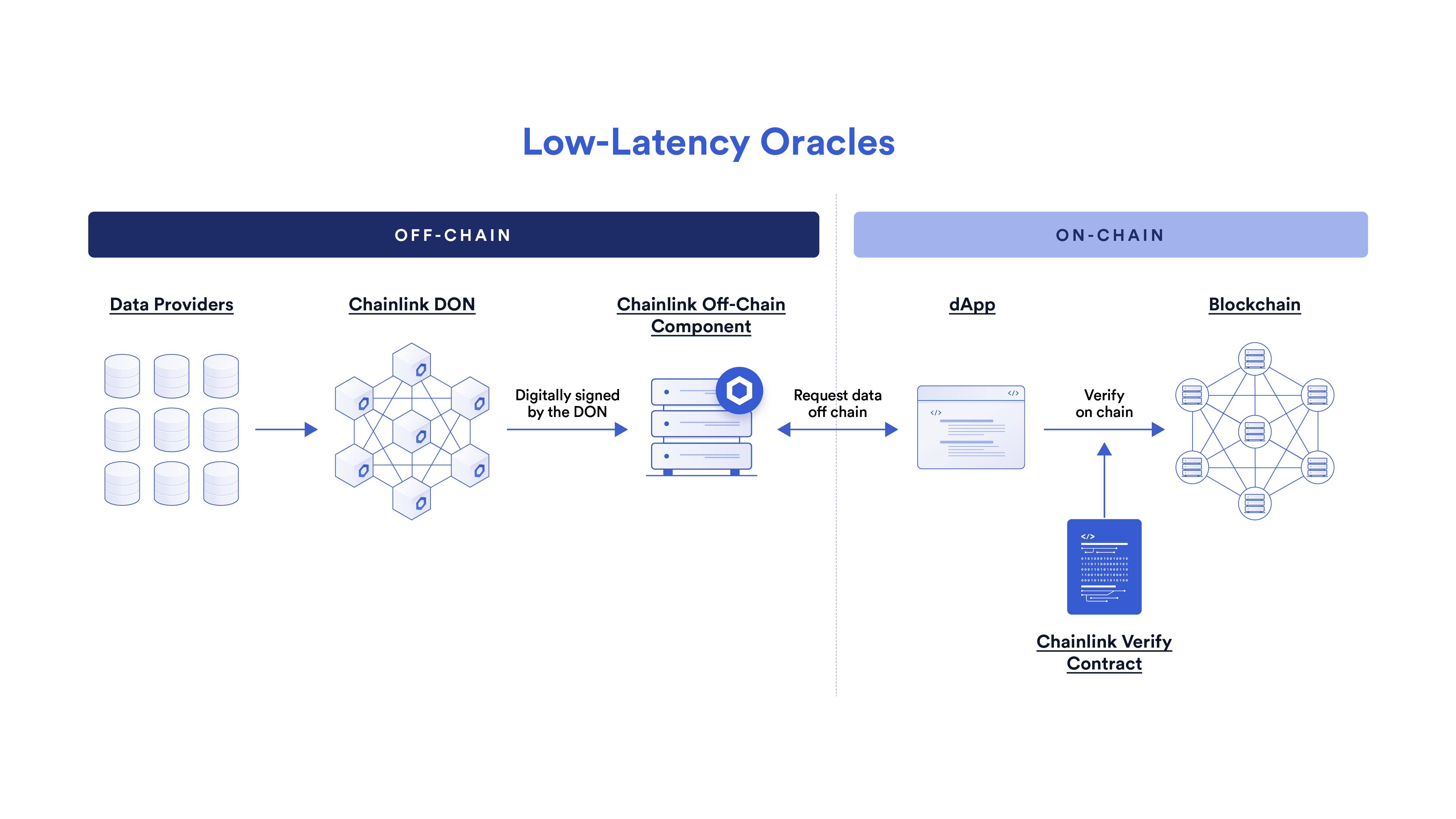

In traditional finance, derivative markets are orders of magnitude larger than spot markets, representing over $1 quadrillion in notional value within the global economy. In order to unleash the growth potential of DeFi, on-chain derivatives need to expand. Facilitating this growth requires additional types of data being made available on-chain in a reliable manner (including metadata) and a new way of delivering data on-chain (e.g., low latency).

To alleviate the limitation in data access, we are aiming to bring new types of industry-rate data products to market. Each new data type will be a tool in the DeFi developer toolbox, making it possible to unlock new markets such as interest rate swaps markets, improved risk management, and ultimately a new generation of products and use cases.

We are also aiming to help DeFi overcome latency and frontrunning risks that currently persist within DeFi through the development of a new low-latency oracle design that’s more gas efficient and supports low-latency update speeds. This will expand the frontier of potential dApp use cases, especially for derivatives protocols that are currently constrained by latency, frontrunning, and on-chain costs.

Recent Deployments:

- NFT Floor Price Feeds launched on Ethereum mainnet in collaboration with Coinbase Cloud, introducing tamper-proof floor pricing data for NFT collections. This empowers developers to bring DeFi composability to NFTs by creating new products and services, such as lending and borrowing services based on NFT collateral.

- Chainlink Price Feeds are now available on StarkNet and Base testnets for developers to start building and testing DeFi protocols. These integrations are coupled with StarkWare and Base joining the Chainlink Scale program.

What’s Next:

- The expansion of data products available through feeds, such as making additional industry index and rate data available on-chain. This includes volatility measures for digital assets (e.g., realized volatility that enables users to adjust asset valuations to their respective volatility). Furthermore, we are looking at continued expansion into real-world asset price coverage, such as non-US ETFs.

- In addition to existing Chainlink Price Feeds, which deliver a single data point around asset prices, we plan to publish additional data points via the low-latency oracle infrastructure at the same time as the CL_price, mainly the CL_ask and CL_bid. CL_ask and CL_bid give the prevailing prices on the ask side and bid side of the aggregated market and how far away they are from the CL_price. This represents the liquidity conditions in the market at the time the benchmark price is calculated, particularly in terms of the tightness of spreads and the shape of the balance/imbalance of bid and ask. DeFi protocols can use the additional information to adjust the behavior of their risk logic and detect abnormal liquidity events that could impact the UX of their users.

- Mainnet release of the CF Bitcoin Interest Rate Curve (BIRC)—in Association With CF Benchmarks. BIRC serves as a standard market gauge of current and forecasted Bitcoin interest rates that is representative of economic reality, replicable by market participants, and resistant to manipulation. BIRC provides DeFi markets with a reliable standard interest rate benchmark that allows them to price lending and borrowing activities, perform asset valuations, recalibrate leveraged positions, and create swaps markets.

- The introduction of a Digital Asset Classification system, which utilizes CF Benchmark’s Digital Asset Classification Structure (CF DACS) to segment the digital asset ecosystem coherently along industry standards. CF DACS will allow users to complete more in-depth analysis for portfolio allocation and risk mitigation. The idea is to incorporate this data into the future frontend display to bring standardization to token categorization.

- Continued development of the low-latency oracle architecture.

- Further development and testing of a Staked ETH APR feed. This feed would represent the “cost of capital” or the “risk-free” rate of return for ETH and provide a better understanding of the Ethereum economy, allowing investors with staked ETH positions to swap the variable return from staking for a fixed return using tokenized interest rate swaps. It also can be used to power other derivatives contracts and financial risk models.

- Continued expansion of Chainlink Data Feeds to new blockchains, with prioritization based on market demand and blockchains joining the Scale program.

- Enhanced frontend displays for data.chain.link, with better visualizations, more details and data points about Price Feeds, and an improved user experience.

Please don’t hesitate to reach out if you are interested in integrating any of these Data Feeds into your protocol.

Functions

Bringing your own data on-chain has been a top ask from the Chainlink developer community for a long time. 80% of Chainlink hackathon winners required the ability to leverage external data sources, and most real-world use cases in Web3 are not possible because developers don’t have a simple way to connect their smart contract to their preferred Web2 infrastructure.

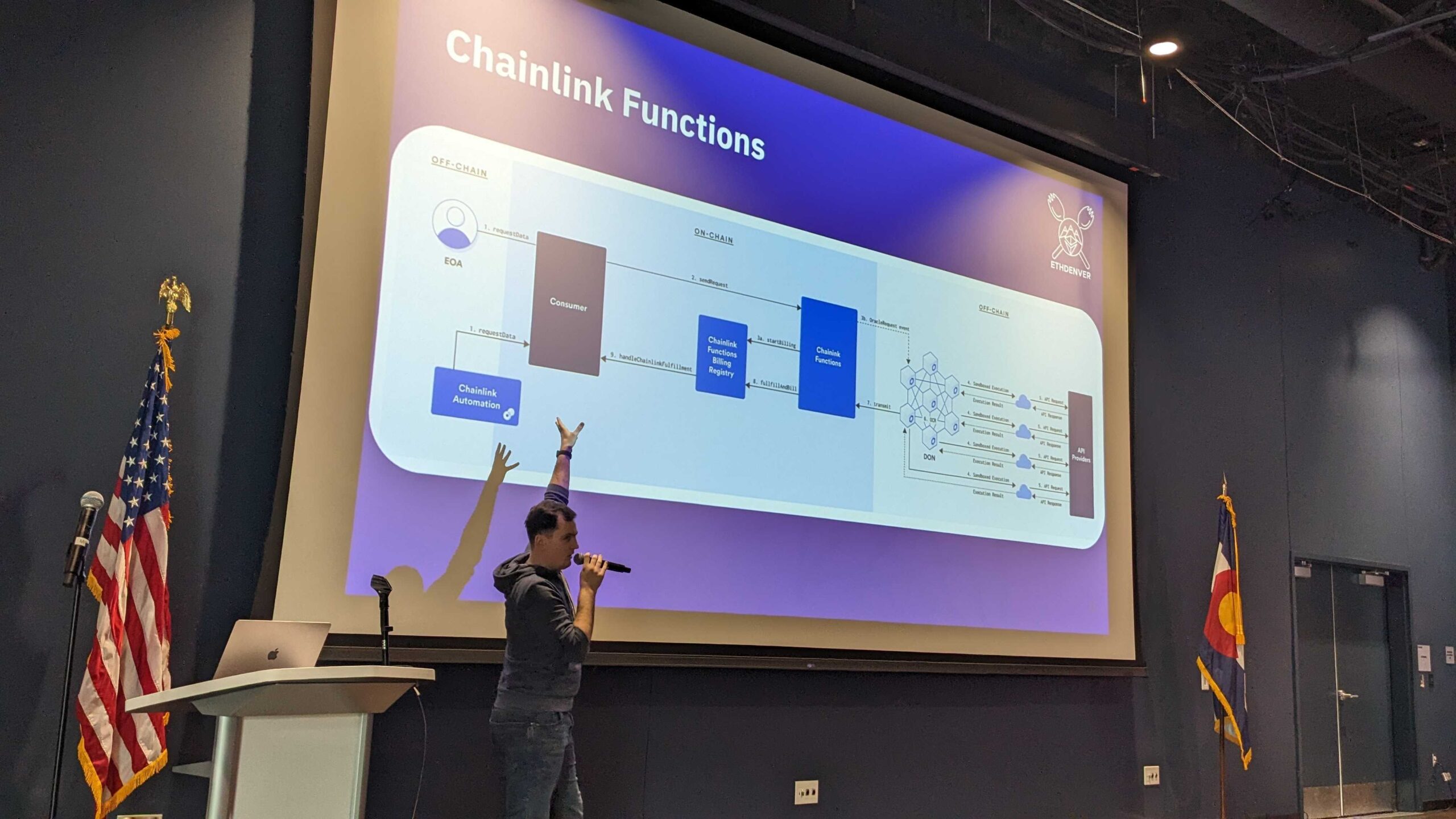

Chainlink Functions is a powerful new Web3 serverless developer platform that allows developers to connect their decentralized applications (dApps) and smart contracts to any Web2 API and run custom computations on API data in minutes using Chainlink’s highly secure and reliable network. This can be done with just a few lines of code and without the need to manage any additional infrastructure.

With integrations for Amazon Web Services (AWS), Meta, the Associated Press (AP), and more, Functions opens a whole new chapter for the Chainlink platform. Until now, Web3 developers couldn’t connect their smart contracts to existing Web2 APIs to access social media signals, AI computation, messaging services, and more. Conversely, the 30 million Web2 developers couldn’t leverage their existing Web2 infrastructure when building a Web3 app. Chainlink Functions solves this problem by providing the missing piece developers need to build these powerful hybrid “on-chain/off-chain” applications.

For example use cases, visit usechainlinkfunctions.com and the developer tutorial 5 Ways To Use Chainlink Functions in Your Decentralized Applications. If you are ready to start building, check out the Chainlink Functions developer documentation and apply for access.

Recent Deployments:

- Chainlink Functions Beta recently launched on Polygon Mumbai and Ethereum Sepolia testnets.

- Leading Web2 platforms, cloud, and data providers such as AWS, Meta, Google Cloud, and the AP have collaborated on example use cases to showcase how developers can use Chainlink Functions to easily connect Web2 APIs and cloud services to their smart contracts.

- Numerous projects are already testing Functions across a wide range of Web3 verticals, from AI integrations to DAO governance, including Block Scholes, ChainML, Dopex, Nusic, Thirdweb, and more.

What’s Next:

- Collect developer feedback during the beta period to inform what changes, if any, should be made to Functions to improve the developer experience and utility.

- After feedback is collected and incorporated, deploy Functions onto blockchain mainnets for general availability and extend accessibility over time to additional blockchains based on demand.

- Introduce additional functionality and enhanced tooling to improve the developer experience, such as off-chain triggers and configurable DON sizes.

Proof of Reserve

There is a tremendous push to put more assets on-chain and increase their inherent utility by making them composable and programmable. But between gold, real estate, commodities, and currencies, which account for more than \$46T of asset value in the world, only \$18B is tokenized today. A key consideration in bringing assets on-chain securely is being able to verify their level of collateralization.

Chainlink Proof of Reserve provides autonomous, reliable, and timely verification of on-chain and off-chain reserves. Whether it’s proving the reserves backing bridged assets or verifying the bank reserves of a tokenized stablecoin, Chainlink Proof of Reserve is designed to provide insight into the collateral securing an on-chain asset. It’s our belief that end users will increasingly demand transparency on tokenized assets, and the use of cryptography and decentralized consensus from Proof of Reserve will be an industry standard compared to antiquated models involving trusting institutions without corresponding on-chain proof.

Recent Deployments:

- TUSD is now using Chainlink Proof of Reserve to help secure its minting function on Ethereum for increased transparency and reliability. TUSD is the first USD-backed stablecoin to programmatically control minting with real-time on-chain verification of off-chain reserves.

- AAVE and BENQI integrated cross-chain Proof of Reserve on Avalanche to help ensure bridged assets are fully collateralized before allowing users to borrow against them. Their adoption of Proof of Reserve illustrates the importance of protecting DeFi from the risks associated with bridged assets (e.g., infinite mint attacks), particularly as more protocols expand to become multi-chain.

What’s Next:

- Working with select test partners on a new proof of reserves use case involving liquid staking tokens.

- Supporting both DeFi and institutional interest in tokenized real-world assets (RWAs) to bring more value on-chain with the enhanced transparency and verifiability of Chainlink Proof of Reserve.

DECO

Privacy-sensitive data is another massive opportunity for Web3 developers. Letting consumers prove things about themselves without revealing their private information not only unlocks many valuable use cases, it constitutes a core principle of Web3.

Chainlink DECO is a privacy-preserving oracle protocol that enables individuals and businesses to prove the provenance of data coming from a particular data source to an oracle, as well as prove arbitrary statements over that data in zero-knowledge. These unique capabilities allow a vast amount of valuable data—currently locked behind Web2 APIs—to be liberated and used in a trust-minimized and privacy-preserving manner for a range of novel use cases.

We view the liberation of sensitive data as a large opportunity because it will empower individuals to use their data for new purposes while also protecting their privacy, and enable businesses to reduce trust assumptions regarding the data they rely on. We have seen an interest in DECO for use cases that revolve around identity, social media, KYC, risk scoring, finance, and health.

To learn more, check out Chainlink Labs Chief Research Officer Dahlia Malkhi’s presentation at SmartCon 2022 about recent DECO developments and user tests.

Recent Deployments:

- Four alpha testers—Teller, Clique, Burrata, and PhotoChromic—integrated an early alpha version of DECO in their real-world use cases during 2022. Based on feedback from these tests, DECO research engineers are further improving the core DECO technology.

What’s Next:

- A sandbox environment that provides a builder-friendly way for application developers to try out DECO and apply privacy-preserving oracle technology to data sources of their choice.

Compute

Automation

Securely connecting Web3 requires a highly reliable automation solution. Whether it is automated DeFi trading, liquidity position management, the liquidation of undercollateralized positions, automatic rewards distribution, or dynamic NFT events, developers need an automation solution they can rely on.

Chainlink Automation is a highly reliable and performant smart contract automation solution for developers wanting to outsource DevOps-related tasks to a decentralized oracle network. In doing so, developers can focus on perfecting and scaling their products quickly and cost effectively. Chainlink Automation is also a powerful tool for seamlessly combining multiple Chainlink services, widening the spectrum of utility and value created for developers.

Chainlink Automation is used by a wide range of projects, including Aave, Synthetix, PancakeSwap, and Benqi. Check out the numerous use cases made possible by Chainlink Automation. If you want to start building today, explore the Chainlink Automation docs for more information.

Recent Deployments:

- Chainlink Automation launched on Arbitrum mainnet, bringing a decentralized smart contract automation solution to the Ethereum layer-2 network.

What’s Next:

- Chainlink Automation 2.0 is currently being tested across numerous blockchain and layer-2 networks. Automation 2.0 is focused on providing improved security and reliability guarantees, increased gas efficiency and computation capacity, and a better developer experience.

- Enable developers to enhance their smart contract automation by connecting to other applications and data sources through one of the most commonly used standards: REST API data.

- Allow smart contracts to be automatically triggered by observing event emissions from other contracts.

VRF

Randomness is at the heart of massive markets, like the PowerBall (\$340B+), the video game industry (~\$200B), and blockchain gaming (\$5B). But legacy randomness is not provably fair, which goes against the core promise of Web3.

Chainlink Verifiable Random Function (VRF) is the industry-standard source of provably fair and tamper-proof on-chain randomness for blockchain-based applications. Chainlink VRF is currently live on five blockchains—Ethereum, Binance Smart Chain, Polygon, Avalanche, and Fantom—with adoption from NFT and gaming projects such as Gala Games, Planet IX, CyberKongz, Art Gobblers, and more.

While randomness is an essential component for many applications, we see greenfield growth potential for Chainlink VRF in the gaming sector, and iGaming specifically. The iGaming market size is around \$35B, while blockchain gaming revenue for 2022 has been estimated at \$4.6B and is anticipated to rise to \$65.7B by 2027 at an annual growth rate of 70.3%. Our belief is that as these sectors grow, end users will increasingly expect randomness that is not only tamper-proof and fair but cryptographically verifiable to ensure the integrity of the outcome and user experience.

Recent Deployments and What’s Next

- A future iteration of VRF is currently being developed that can deliver additional performance and reliability via threshold signatures and a more distributed architecture.

Fair Sequencing Services

Fair Sequencing Services (FSS) is a transaction ordering solution that aims to mitigate harmful forms of MEV in order to help decentralized systems become fundamentally fairer. Harmful MEV often presents itself in malicious frontrun and sandwich attacks on ordinary DEX trades, causing unnecessary slippage, creating an invisible tax on users, and degrading the overall user experience.

FSS uses a decentralized oracle network (DON) to fairly order transactions based on one or a combination of two different techniques.

- Secure causal ordering: Users send transactions to oracle nodes that are threshold-encrypted, where the transaction content is not revealed until after the transaction ordering has been agreed upon.

- Temporal ordering: A mechanism that aims to ensure that transactions received first by the oracle network are the first to be output, helping facilitate a first-in, first-out (FIFO) ordering policy.

To learn more, check out the presentation below from Chainlink Labs Chief Scientist Ari Juels and Chainlink Labs Researcher Pawel Szalachowski at SmartCon 2022.

Recent Deployments:

- A proof of concept implementation and deployment of an FSS testbed on the Sepolia testnet.

What’s Next:

- A potential pilot deployment of FSS is being planned while FSS undergoes continued testing and improvements.

Cross-Chain

Cross-Chain Interoperability Protocol

We live in a multi-chain world, with Chainlink already live on 16 blockchains and layer-2 networks. More and more dApps are going multi-chain and adding support for seamless cross-chain operations. To date, over \$170B in value has been bridged across chains, about 70% of that in 2022 alone. This represents a massive and growing market opportunity, which encompasses cross-chain trading, lending, and governance, as well as new types of modular dApps and enterprise workflows.

The challenge, however, is that cross-chain protocols are inherently complex, given their large attack surface and multitude of variables. It’s why more than \$2 billion has been stolen due to hacks in interoperability infrastructure.

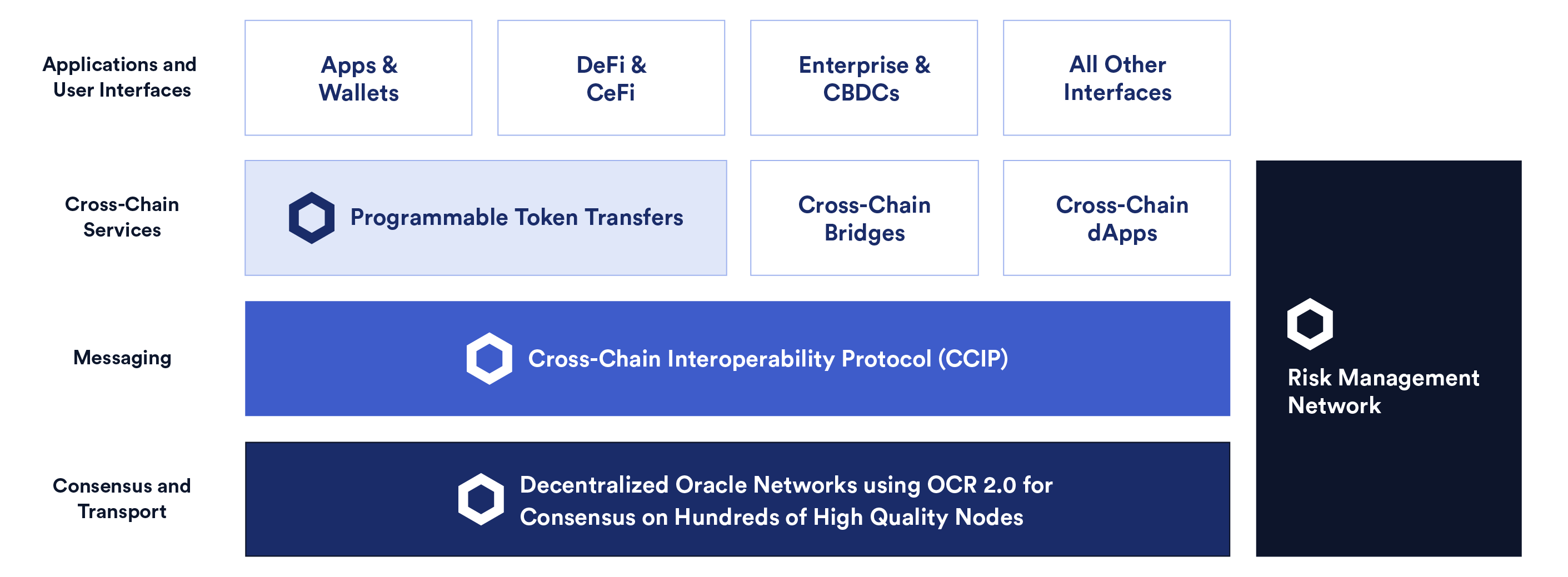

The Cross-Chainlink Interoperability Protocol (CCIP) is an open-source standard for cross-chain communication that establishes a universal connection between any public and private blockchain. CCIP is designed to allow applications and the user interfaces built on top of them to send arbitrary data, transfer tokens, or pass instructions along with tokens across blockchains (i.e. programmable token transfers). The consensus and transport layer is powered by Chainlink decentralized oracle networks, which already help secure tens of billions of dollars and have enabled \$7T+ in transaction value for dApps.

Recent Deployments:

- In October 2022, Synthetix, Aave (BGD Labs), and Qi Dao (Mai Finance) began testing an early alpha version of CCIP across three testnets.

What’s Next:

- CCIP is now being actively tested across three testnets with 25 test partners (and more to join later), involving a wide range of use cases from governance and gaming to cross-chain token transfers and NFTs. This testing phase helps ensure that the production version meets the functionality and security demands of the rapidly expanding cross-chain economy. The current version of CCIP is near feature-complete in terms of the initial mainnet implementation.

- Complete a series of external audits currently in motion to harden security prior to mainnet release.

- Launch on mainnet beta, with early access for users in the testing program prior to the general availability launch.

Chainlink Developer Community Building

Ultimately, developers will build the future of Web3, and we are here to empower them. Building the developer community is just as important as building the tools they use. We are continually amazed by the ingenuity, creativity, and perseverance of developers in the Chainlink ecosystem. Below is a list of some of the most important events, workshops, tutorials, and dev tools recently made available to the Chainlink developer community, as well as upcoming opportunities.

If you are building something cool, we want to know about it. Please reach out and email us at [email protected].

Recent Updates:

Chainlink Community Grants were awarded to support the creation of two critical developer tools:

- A Hardhat plugin that allows developers to integrate Chainlink services into Hardhat projects (https://github.com/smartcontractkit/hardhat-chainlink).

- A Chainlink Foundry toolkit to make it easy to spin up, manage, and test with a local Chainlink node (https://github.com/smartcontractkit/foundry-chainlink-plugin)

Chainlink Community Advocates ran a number of developer bootcamps and workshops at various locations around the world with the support of the Chainlink Labs Developer Relations and Community teams.

- An oracles and dynamic NFTs bootcamp on March 4 at Zhejiang University in China.

- A smart contract developer bootcamp on February 22 at Ho Chi Minh University in Vietnam.

- A Chainlink bootcamp on March 4 and 10 at the University of East London.

Chainlink also hosted and supported a number of hackathons and events.

- At ETHDenver, Chainlink hosted Camp BUIDL and was a sponsor of #BUIDLathon. Chainlink bounties were awarded to the best projects using Chainlink Functions.

- Chainlink co-sponsored hackathons with Devfolio and Superfluid. At ETHernals (by Devfolio), bounty prizes were awarded to the five best projects that used Chainlink to make a state change on the blockchain. At Superfluid’s March Wave Pool (currently taking place until the end of the month), prizes are awarded for standout projects that integrated both Chainlink and Superfluid.

Chainlink was a sponsor at ETHPorto Hackathon and awarded prizes to the best smart contract solutions using Chainlink. Chainlink Labs Developer Advocate Solange Gueiros also spoke at the main conference.

What’s Next:

- March 27-April 2: ETHSamba/ETHRio from March 27-April 2. Chainlink Labs will participate in the conference, as well as run developer workshops.

- March 20-24: Game Developers Conference (GDC). Chainlink Labs will have a booth with partners in the gaming industry as well as a demo game that merges dynamic NFTs and gaming. Chainlink Labs will also be doing a workshop for developers on March 24.

- Chainlink Labs will be running developer workshops at multiple universities in China, including Zhejiang University, Hangzhou Dianzi University Workshop, Nanjing University of Science and Technology, and Hong Kong Polytechnic University.

Conclusion

Web3 is an inevitable tectonic shift in how technology can solve the growing trust problems in society. Ultimately, Web3 gives unprecedented power to developers and superior guarantees to users, with the goal of restoring confidence in the digital relationships that define our lives.

We at Chainlink Labs are relentlessly focused on creating and enabling the creation of Web3 services on top of Chainlink. Our goal is to keep building Chainlink as the industry-standard Web3 services platform by empowering builders to connect to all the external data, computation, and interoperability needed to unlock next-generation smart contracts that reach more users across more use cases worldwide.

We have embarked on this mission together with our community. Thank you as always for your passion and dedication to building Chainlink, and we look forward to continuing to work together to build a world powered by truth.