Chainlink and CF Benchmarks Launch the CF Bitcoin Interest Rate Curve (CF BIRC)

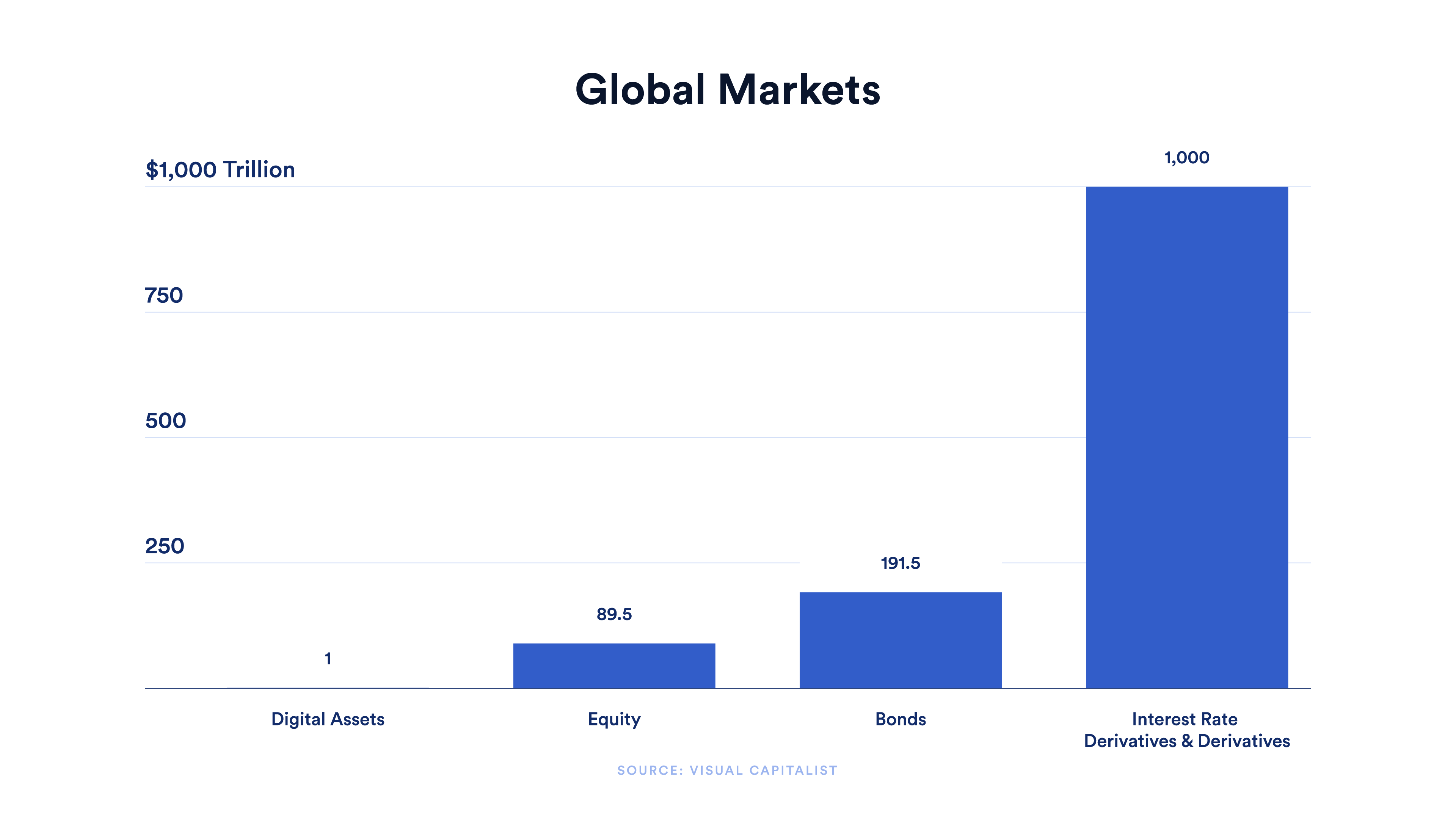

The growth of the Web3 economy has been extraordinary, with the combined market capitalization of digital assets reaching $1T for the first time a little more than a decade after the birth of the asset class. With the growing adoption of decentralized finance (DeFi) and the rise of increasingly sophisticated financial products catering to both individuals and institutions, the infrastructure supporting the smart contract economy needs to keep pace with the rising demand.

Compared to traditional finance, however, the size of the digital asset debt market is negligible. Part of the reason for this is the lack of industry-wide benchmarks to help participants make data-driven decisions and better manage risk.

Information asymmetry regarding interest rates is leading to suboptimal outcomes when it comes to structuring and managing debt products. A lack of consensus on benchmark interest rates hinders the ability to determine asset valuations and can lead to poor risk allocation measures. It’s also a prominent factor in the lack of a productive interest rate derivatives market. This uncertainty is unproductive for traditional financial institutions and is holding back the adoption of digital asset markets until market-wide information standards like base rates can be referenced.

To help combat this issue, Chainlink and CF Benchmarks are collaborating to launch a first-of-its-kind product in the Web3 economy: the CF Bitcoin Interest Rate Curve—in Association With Chainlink (CF BIRC).

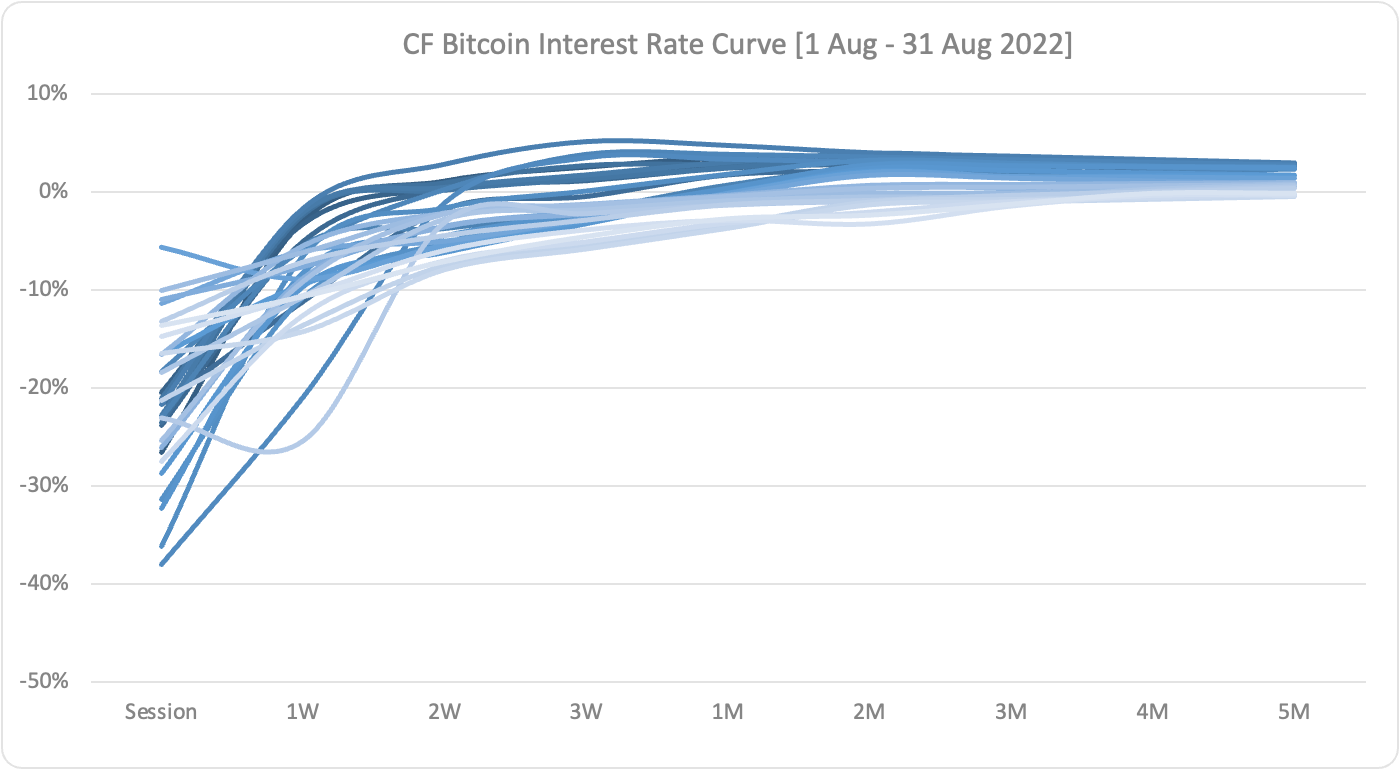

CF BIRC is a replicable, market-representative, and manipulation-resistant benchmark providing a standard market gauge of current and forecasted Bitcoin interest rates over a set of maturities: 1-day, 1-week, 2-week, 3-week, 1-month, 2-month, 3-month, 4-month, and 5-month, with future versions to cover longer maturities as debt markets start to price longer future risks.

The introduction of CF BIRC seeks to enable more predictable lending and borrowing, increased capital efficiency, and a more robust foundation upon which digital asset derivatives markets can grow. Importantly, CF BIRC also seeks to enable financial institutions to participate in digital asset markets by providing a standardized benchmark for Bitcoin interest rates.

The Role of Interest Rates in the Economy

Interest rates are foundational to a productive, growing economy. These economic indicators represent a percentage fee paid by a borrower to a lender based on the level of confidence the lender has that they will get their principal back. When interest rates are high, money is more expensive to borrow, and when interest rates are low, money is cheaper to borrow. The resources that enter the economy through debt can be used to fuel increased productivity and economic growth. Interest rates also show how confident participants are in the economy as a whole. But how should the market know what counts as a cheap or expensive way to borrow?

Interest rate benchmarks—sometimes called base rates—are the foundational instruments upon which debt markets are built. These benchmarks are used as indicators of interest rate risk over a set of maturities, typically ranging from a day to multiple years. The most well-known example of an interest rate benchmark is London Interbank Offered Rate (LIBOR), which defines the benchmark interest rate at which global banks lend to one another.

LIBOR gives a firm sense to the market of what a good lending/borrowing rate is. If participants don’t have a benchmark to gauge their interest rate against, it becomes more difficult to create trust and sustain long-term growth in the economy. LIBOR and other similar base rates—such as its successor, the Secured Overnight Financing Rate (SOFR)—give a firm sense of the rate at which banks lend to one another, which is why they have been crucial to the growth of global lending and borrowing markets.

CF BIRC: The North Star of Bitcoin Interest Rates

CF BIRC is foundational financial infrastructure designed to help propel Web3 toward its next wave of adoption. As a market-wide benchmark for Bitcoin debt markets, CF BIRC allows participants to gauge the interest rates they are receiving and hedge against interest rate risk. Prior to CF BIRC, there was no industry-wide interest rate benchmark that allowed investors to meaningfully discern interest rate risk across platforms in digital asset markets. Without a good market-wide comparison, risk is misjudged, capital isn’t efficiently allocated, and the growth of the market is hindered.

As a market-wide interest rate benchmark, CF BIRC introduces several major benefits:

- Transparency—Lenders and borrowers have the market benchmark available and can use it as a base rate when making market decisions.

- Consistency—The Curve’s normalized methodology and daily rates introduce more consistency and predictability to the ebb and flow of digital asset markets.

- Clarity—Market participants can better quantify the risks of using certain protocols and products based on current and predicted baseline interest rates.

The introduction of CF BIRC is significant for digital asset markets because interest rates have an outsized impact on the broader financial markets. Interest rates are a core input into any valuation model and DeFi protocols price risk into their yield rates. However, if there’s no benchmark to compare against, participants essentially have to guess their level of interest rate risk, while factoring in smart contract risk, protocol-specific utilization risk, and other market risks.

The methodology behind CF BIRC aims to ensure the following guiding principles:

- The rates should be representative of economic reality;

- The results should be replicable by market participants; and

- The calculation of the curve should be tamper-resistant.

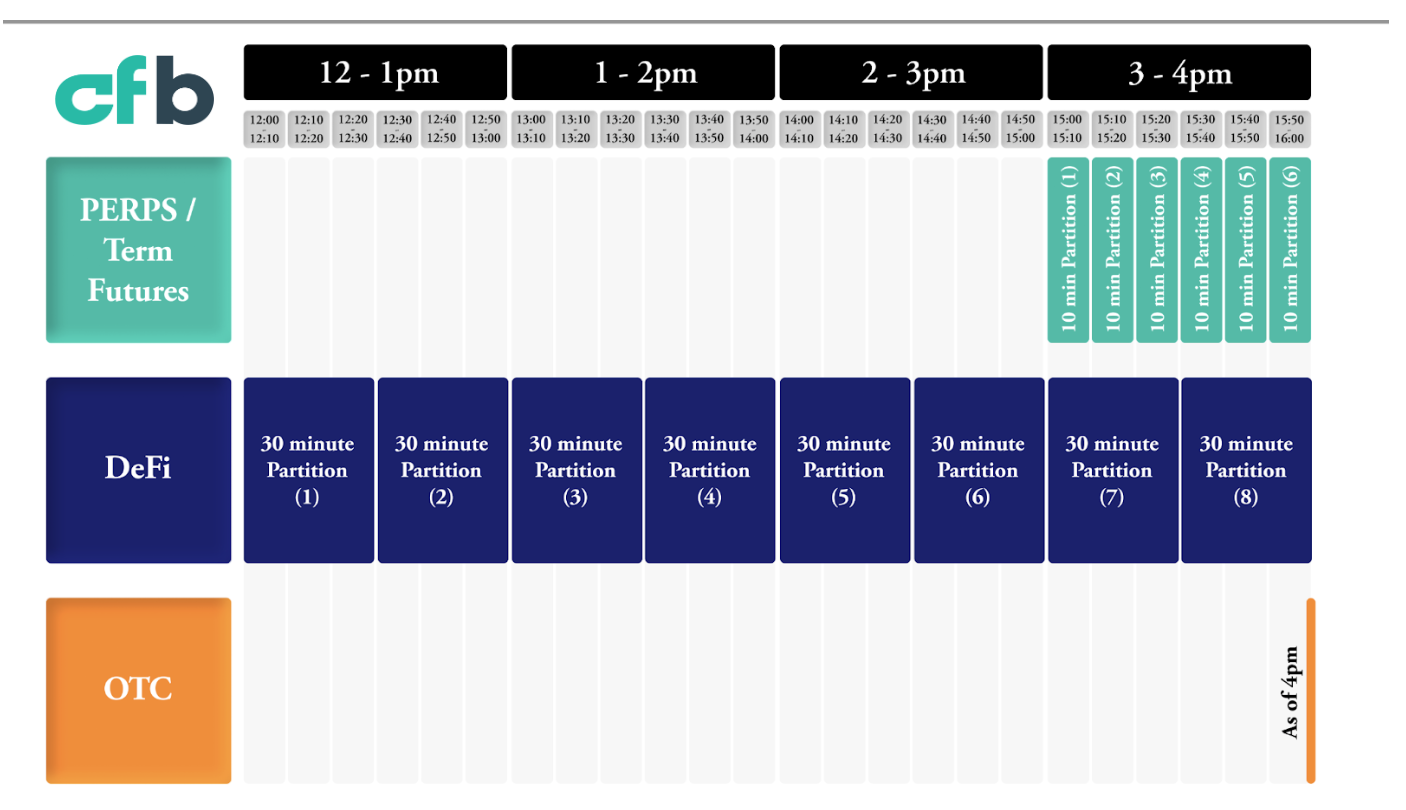

CF BIRC incorporates a wide range of data sources, including OTC lending desks, DeFi lending pools, and perpetual futures markets, making the curve reflective of the Bitcoin lending market as a whole.

Transparency and the ability to independently replicate the interest rate are essential to creating an industry-wide benchmark. Underpinned by the combination of Chainlink’s industry-standard infrastructure for delivering high-quality data on-chain and CF Benchmark’s years of experience producing reliable benchmarking data, CF BIRC is a public good for Bitcoin and DeFi markets upon which entirely new financial products and services can be built.

CF BIRC Example Use Cases Across CeFi and DeFi

As a reliable, transparent, and replicable industry-wide Bitcoin interest rate benchmark, CF BIRC unlocks a multitude of use cases for enterprise-grade financial services in the Web3 economy.

Lending and Borrowing

Accurate interest rates are essential for the creation of fixed income instruments and standardized risk management practices. Without an industry-specific interest benchmark, market participants may use LIBOR with an arbitrary premium on top of it to calculate interest rate risk in digital asset markets. With the introduction of CF BIRC, OTC desks, financial institutions, and DeFi lending protocols have a Web3-native benchmark to incorporate into their models.

Interest Rate Swaps

Interest rate swaps are the most popular interest rate derivative in traditional markets as they enable the exchange of fixed vs. floating interest rate risk, allowing participants to effectively hedge against interest rate risk. In addition, there are many other derivative products built on base rates, such as options and futures contracts.

The majority of interest rate risk in digital asset markets is floating or variable. Interest rate swaps available in DeFi are using protocols that offer a fixed risk instead of individually defined risk parameters set by market participants. This one-sided risk without an interest rate benchmark makes it challenging to assess the effectiveness of interest rate hedge strategies.

CF BIRC opens up the possibility of interest rate swaps for digital assets. Once interest rate swap markets are created with optimal liquidity conditions, enterprises will have more effective tools with which to mitigate interest rate risks in digital asset markets.

Asset Valuation

Interest rates are a key input to most valuation models and play an important role in determining the time value of money (TVM). An industry-wide interest rate benchmark helps futures and options exchanges and automated market maker (AMM) protocols to apply more effective risk management practices.

How Can Market Participants Use CF BIRC?

With CF BIRC available as a market-wide benchmark, digital asset market participants have a tool to help discern interest rate risk. But how can specific users benefit from referencing CF BIRC?

OTC desk managers can:

- Offer rates informed by CF BIRC for longer lending contracts.

- Consider the level of collateralization and interest risk factors when bringing in both individual and institutional investors.

- Set borrowing and lending rates with known crypto-specific data rather than rely on traditional finance base rates.

DeFi-native users can:

- Utilize CF BIRC as an economic indicator and interest rate base rate.

- Borrow by assessing OTC and LP rates against CF BIRC.

- Look for risk factors when lending based on yield percentages after base interest rates are accounted for.

Derivatives traders can:

- Assess interest rate risk before entering into a derivatives contract.

- Calculate asset valuation using market-wide interest rates, especially when it comes to longer maturity instruments.

- Hedge interest rate risk by entering into an interest rate swaps contract using CF BIRC rates.

Web3 builders can:

- Create recognized interest rate risk indicators that are widely agreed upon and help advance institutional adoption.

- Participate in market making by entering into a burgeoning swaps market that can use a base interest rate.

How To Get Started With CF BIRC

CF BIRC is a Chainlink Data Feed delivered on-chain, built according to the same security and tamper-resistance standards as other Chainlink Data Feeds that are helping to secure tens of billions of dollars of value across the smart contract economy.

If you want to integrate Chainlink, set up a call with an expert.