Announcing General Availability for CCIP

We’re excited to announce that the Chainlink Cross-Chain Interoperability Protocol (CCIP) has officially entered general availability (GA).

Any developer can now permissionlessly use CCIP to securely transfer onboarded tokens cross-chain, send arbitrary messages to smart contracts on another integrated blockchain, or simultaneously send data and value together through CCIP’s unique support for Programmable Token Transfers. Supported blockchains include Arbitrum, Avalanche, Base, BNB Chain, Ethereum, Kroma, Optimism, Polygon, and WEMIX, with many more to come in the future.

CCIP’s arbitrary messaging capabilities enable developers to create cross-chain smart contracts that can send data to and trigger function calls on smart contracts deployed on other blockchains while CCIP’s token transfers enable both users and smart contracts to transfer tokens cross-chain such as ETH, USDC, LINK, and more. Additional blockchains and tokens will continue to be onboarded. If you are a token issuer and are interested in listing your token on CCIP, reach out here. We are also working on enabling simpler, more streamlined, and more self-serve processes for onboarding token issuers to significantly decrease onboarding time and improve the overall developer experience.

CCIP GA is taking place at a key moment in time, made possible by the introduction of several new in-demand features, including a hyper-secure bridging application, as well as an acceleration in the number of integrations and the cross-chain volume processed. Some notable milestones, deployments, and highlights we’ve been working towards over the past few months that paved the way for a secure launch of CCIP GA include:

- Launching Transporter, a hyper-secure and intuitive bridging app—built in association with the Chainlink Foundation, with support from Chainlink Labs. Transporter enables anyone to easily and securely transfer their token cross-chain via CCIP. Start using Transporter today.

- Introducing support for Native ETH token transfers through the addition of a new “lock and unlock” token transfer mechanism, which complements the existing “burn and mint” and “lock and mint” methods of transfer.

- Updating CCIP’s pricing model to make CCIP one of the most cost-efficient options for securely and reliably transferring a wide range of tokens and messages cross-chain, ultimately accelerating transaction volume, high-value use cases, and overall cross-chain adoption.

- Adding token transfer support for USDC, one of the most widely used stablecoins in DeFi, through a collaboration between Circle and Chainlink. Notably, CCIP supports native USDC, meaning dApps, developers, and users can interact with the canonical USDC token, resolving liquidity fragmentation and providing a superior user experience. Furthermore, CCIP’s unique support for Programmable Token Transfers means smart contracts can transfer USDC along with additional instructions on what to do with the tokens once they arrive on the destination chain.

- Realizing 900%+ growth in the number of cross-chain transactions and a 4,000%+ growth in cross-chain transfer volume processed by CCIP during the Early Access phase in Q1 2024 compared to Q4 2023. We have also seen multiple transactions of ~$1M USDC, showcasing CCIP’s ability to secure large amounts of value over an extended period of time

- Aave, the largest DeFi lending market by TVL, announced an integration of CCIP to enable cross-chain transfers of the decentralized stablecoin GHO. The integration is currently live on various testnet networks and will enhance GHO’s utility and accessibility once deployed on mainnet.

- Witnessing increased transaction volume from dApps building on top of CCIP, including XSwap—a cross-chain protocol and Chainlink Build member—and Kryptomon—a multi-chain, NFT-driven game saga.

- Metis selected CCIP as its canonical token bridge infrastructure for new tokens. By upgrading to CCIP, users of Metis’ layer-2 network will realize faster token transfers from Metis to Ethereum (from seven days down to minutes) and benefit from Programmable Token Transfers.

- WEMADE, one of South Korea’s largest game developers, integrated CCIP on WEMIX mainnet as its exclusive cross-chain infrastructure. CCIP now connects the AAA game NIGHT CROWS across six chains.

To learn how CCIP helps the industry overcome the historical exploits that have plagued the cross-chain ecosystem, check out the video below to see Chainlink Co-Founder Sergey Nazarov explain how CCIP is the only interoperability protocol with level-5 cross-chain security. For a deeper dive, you can also read the blog The Five Levels of Cross-Chain Security.

Developers Can Get Started in Seconds Using the CCIP Local Simulator

We believe that enabling developers to build quicker helps the entire ecosystem grow faster. That’s why we’ve also developed a simulator that allows you to build with CCIP on your local machine directly in Hardhat or Anvil (Foundry).

Previously, developers had to build with CCIP directly on a testnet, which often meant having to wait 10+ minutes just to test a single cross-chain message or token transfer. In this initial simulator version, you can now build, deploy, and execute CCIP token transfers and arbitrary messages on a local Hardhat or Anvil (Foundry) network, both with and without forking. This greatly speeds up development, as CCIP messaging and token transfer transaction times have now been reduced to seconds. You can install and start building using the CCIP Local Simulator today by visiting the Chainlink GitHub.

Unlock Global Markets for Tokenized Assets With CCIP and Other Chainlink Services

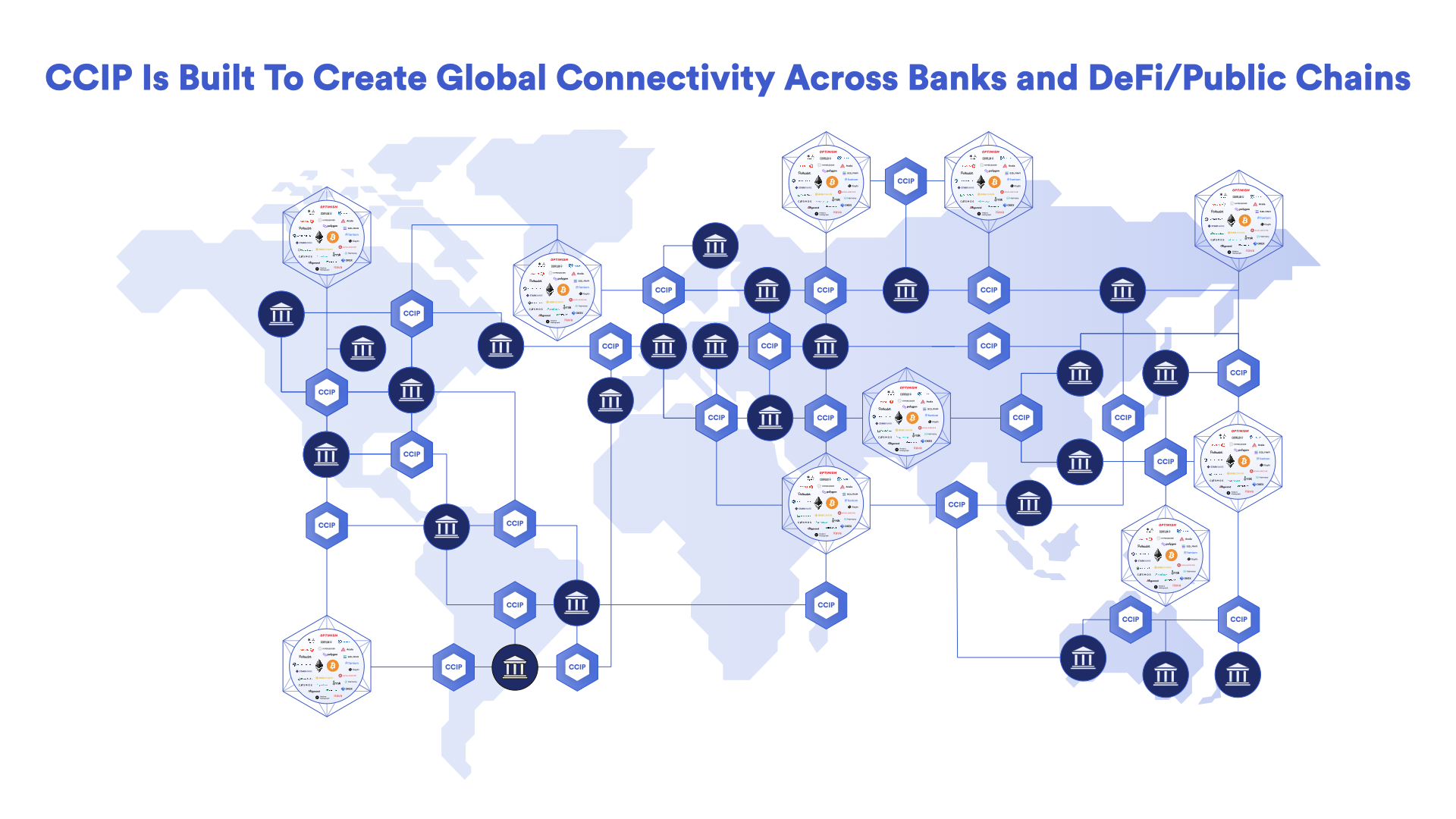

CCIP solves the obvious need for tokenized assets to seamlessly move across public and private blockchains, which is critical to facilitating liquidity by enabling parties to connect from different blockchain ecosystems. However, CCIP is also part of the broader Chainlink platform that features the essential data, computation, and connectivity resources needed to create secure and compliant tokenized real-world assets (RWAs) within robust and liquid global markets. Chainlink is the only platform capable of addressing the data, cross-chain, and compliance requirements facing institutions as part of a single offering for tokenized assets.

For example, through the Chainlink platform, developers can combine CCIP, Data Feeds, and Proof of Reserve to address the three requirements of tokenized real-world assets. Data Feeds or Data Streams can be used to supply asset pricing data (e.g., NAV) and other necessary metadata such as identity (e.g., KYC/AML) information; Proof of Reserve can be used to verify the offchain reserves collateralizing the onchain assets; and CCIP can be used to make the asset cross-chain enabled. Importantly, this combination can ensure the asset continues to be updated with price, proof of reserve, and other key data no matter what blockchain the tokenized asset ends up on. The end result is a Unified Golden Record across blockchains for tokenized assets, which brings trust to onchain assets given that anyone can verify without a doubt their current and historical state.

Furthermore, Chainlink is capable of integrating with the mission-critical existing back-office systems, messaging standards, and infrastructure already used by institutions, dramatically reducing the operational cost and complexity of tokenized assets. Chainlink has already demonstrated that institutions can successfully use existing interfaces and messaging standards to interact with tokenized assets across all blockchains through CCIP’s blockchain abstraction layer (as seen in Swift’s blockchain interoperability collaboration and ANZ Bank’s cross-chain settlement case study).

To learn more about the tokenized asset megatrend, check out our definitive guide to tokenized assets and watch Chainlink Co-Founder Sergey Nazarov’s keynote speech at Hong Kong’s Web3 Festival where he breaks down what it takes to bring capital markets institutions onchain and what’s needed to merge the DeFi and TradFi worlds into a single Internet of Contracts. For more information on how Chainlink solves fundamental problems for capital market institutions throughout the lifecycle of tokenized assets, read the capital markets section of the Q1 2024 Product Update blog.

Continually Expanding CCIP to Realize the Full Vision of Onchain Finance

The launch of CCIP GA is not the end state—it’s simply the beginning. We are actively working on adding support for a greater number of tokens and blockchains, creating more advanced functionality, and building a more scalable foundation for the underlying protocol. We look forward to enabling a seamless cross-chain ecosystem, but importantly, one that prioritizes security above all else. Only by ensuring the highest level of security can value and data flow between blockchains and smart contracts as easily as data flows across the Internet today.

Reduced friction between blockchains will not only enable DeFi to grow in value but also expand the value of tokenized assets within traditional capital markets, with the goal to eventually merge public and private blockchains into a unified onchain financial system through the cross-chain standard of CCIP.

If you want to dive deeper into CCIP:

- Read the CCIP Developer Documentation

- Read 5 Ways To Build Cross-Chain Applications With CCIP

- Watch a CCIP Masterclass Series

- Learn about CCIP’s Defense-In-Depth Security

To learn more about Chainlink, visit chain.link, subscribe to the Chainlink newsletter, and follow Chainlink on Twitter, YouTube, and Reddit.

Disclaimer: This post is for informational purposes only and contains statements about the future, including anticipated product features, development, and timelines for the rollout of these features. These statements are only predictions and reflect current beliefs and expectations with respect to future events; they are based on assumptions and are subject to risk, uncertainties, and changes at any time. There can be no assurance that actual results will not differ materially from those expressed in these statements, although we believe them to be based on reasonable assumptions. All statements are valid only as of the date first posted. These statements may not reflect future developments due to user feedback or later events and we may not update this post in response. Chainlink CCIP is a messaging protocol which does not hold or transfer any assets. Please review the Chainlink Terms of Service, which provides important information and disclosures.