Chainlink Product Update: Q1 2024

Introduction

CCIP Has Officially Entered GA

Today, we are excited to announce that the Chainlink Cross-Chain Interoperability Protocol (CCIP) has officially entered general availability (GA). We now invite everyone from developers, to startups, to enterprises to use CCIP on mainnet for secure cross-chain token transfers and arbitrary messaging. And GA is only the start. Over the coming months, we are focusing on adding support for more tokens, integrating more blockchains, and building advanced functionalities as part of CCIP’s long-term roadmap.

There has been a lot of excitement and anticipation since the early access mainnet launch of CCIP last year, and in particular around the transition to GA. While we have been eager to get CCIP into the hands of all developers, we are seeing our strategy to focus on security and reliability paying off with developers and our partners. Users adopt CCIP over other cross-chain solutions because it has the highest level of security and reliability, along with the unique fact that it introduces little-to-no additional trust assumptions for protocols already using another service on the Chainlink platform. Putting out the best product is how you settle the land long term, and it’s why we took extra time to ensure the underlying architecture has multiple layers of reliability, redundancy, and fault and disaster tolerance. We’ve also been building CCIP in constant communication with users, both from DeFi and TradFi, to get the foundation right and continually add the features users need most.

In order to ensure a secure and successful GA launch, we’ve been working hard to increase CCIP’s scalability and user adoption while not compromising on its security and reliability. Some notable highlights from Q1 that enabled GA include the launch of Transporter as a hyper-secure and easy-to-use bridging app for consumers, the addition of lock and unlock functionality to enable support for tokens such as native ETH, the introduction of optimized pricing to drive further cross-chain volume and adoption, the integration of CCIP as the exclusive cross-chain infrastructure for WEMIX, the adoption of CCIP as the canonical cross-chain infrastructure of Metis, built-in support for native USDC transfers through CCIP, and more.

These new functionalities, along with increased resource prioritization directed towards CCIP, a 900%+ growth in the number of cross-chain transactions, and a 4,000%+ growth in cross-chain transfer volume processed by CCIP during Early Access in Q1 2024 compared to Q4 2023, made now the right time to release GA.

We appreciate our community’s patience, and GA is just the beginning. We have been impressed by the diversity of the use cases that our community has experimented with, and now that CCIP is GA, we will be able to unlock the full potential of our community’s imagination. We have an exciting roadmap ahead, which we look forward to building with all of you. We remain focused on CCIP as our top priority moving forward given the scope and size of the cross-chain market and its ability to generate user fees.

Chainlink in Capital Markets

Since the beginning of this year, the Chainlink Labs team has been meeting with financial and government leaders in major global financial centers including Dubai, Abu Dhabi, Hong Kong, Singapore, London, and Sydney. We’ve met with well over 100 of the world’s largest financial institutions, including global banks, asset management firms, central clearing and settlement systems, national exchanges, and central banks to discuss the challenges and opportunities for the mass adoption of tokenized institutional and real-world assets (RWAs).

Through these discussions, it is becoming clear that Chainlink is essential infrastructure that can unlock the $500 trillion tokenized asset opportunity by enabling end-to-end transactions for institutional tokenized assets. The Chainlink platform is the only platform capable of addressing the data, cross-chain, and compliance requirements facing institutions in realizing their tokenized asset strategy. We dive deeper into the technical challenges facing capital markets institutions along with how Chainlink’s solutions drive blockchain adoption within capital markets in another section below.

We expect to share more exciting news in the near future on some of the work we’ve been doing to help bring institutions onchain. In the meantime, here is Sergey’s recent perspective on the adoption of blockchain technology within capital markets and how the Chainlink platform uniquely addresses the core requirements of institutions regarding tokenized assets.

Enhancing Platform Economics

In parallel to accelerating the adoption of the Chainlink platform, we’re also actively enhancing Chainlink’s economics from multiple angles to drive toward long-term sustainability and increased cryptoeconomic security. This includes onboarding additional Build and Scale participants, implementing technical solutions to reduce the operating costs of services, reducing payment friction for developers, and more. We are also actively focused on deploying a system that will enable Build projects to make their tokens claimable by participants in the Chainlink ecosystem, including stakers. We expect to share more details in the near future on how the Build claims mechanism is being built.

The following product update will look at the progress made across Chainlink services in Q1 2024 and provide insight into future developments. We’ll also be hosting a Q&A related to this product update on the official Chainlink YouTube on May 3 at 12PM ET. Please use this form to submit a question. We’ll be collecting questions until 12PM ET on April 26.

Please note that all future-facing comments are subject to change based on user feedback, shifts in consumer demand, strategic determination, and various other unforeseen challenges and opportunities. The goal of this product update is to provide insight into previous releases and current thinking based on ongoing research and development, but it is not a definitive product roadmap; it’s an attempt to balance transparency with the need to remain agile in this dynamic industry, which moves fast and is constantly evolving.

Cross-Chain

CCIP

Product Description

Chainlink Cross-Chain Interoperability Protocol (CCIP) is the global standard for cross-chain interoperability. It establishes a universal connection between public and/or private blockchains so that tokens, arbitrary data, or data alongside tokens can be exchanged between blockchains.

Recent Deployments

- Launched CCIP GA, enabling all developers to use arbitrary data messaging and transfer integrated tokens.

- Built in association with the Chainlink Foundation, with support from Chainlink Labs, Transporter was launched. Transporter is a highly secure app that allows anyone to bridge their tokens across blockchains with complete peace of mind.

- Launched a new token transfer mechanism for CCIP called lock and unlock, in addition to the current “burn and mint” and “lock and mint” methods. CCIP’s support for lock and unlock enables native ETH to be transferred cross-chain through WETH token pools. This marks the first instance of a lock and unlock mechanism being implemented in CCIP.

- Introduced a new pricing model to make CCIP one of the most cost-efficient options for securely and reliably transferring a wide range of tokens and messages cross-chain, ultimately accelerating transaction volume, high-value use cases, and overall cross-chain adoption.

- Saw a 900%+ growth in the number of cross-chain transactions and a 4,000%+ growth in transfer volume processed by CCIP in Q1 2024 compared to Q4 2023, with high transaction volumes originating from dApps such as XSwap and Kryptomon.

- Aave, the largest DeFi lending market by TVL, announced an integration of CCIP to enable cross-chain transfers of the decentralized stablecoin GHO. The integration is currently live on various testnet networks and will enhance GHO’s utility and accessibility once deployed on mainnet.

- WEMADE, one of South Korea’s prominent game developers, announced the mainnet integration of CCIP as the exclusive cross-chain infrastructure for its gaming mega ecosystem WEMIX, specifically to support cross-chain data and value transfer for its omnichain network unagi(x).

- Metis announced that it’s integrating Chainlink CCIP as its canonical token bridge infrastructure, starting with an initial focus on bridging leading stablecoins from Ethereum mainnet onto the Metis network.

- Launched mainnet support for native USDC to enable cross-chain transfers of one of the most widely adopted stablecoins in DeFi and within cross-chain bridges. CCIP’s unique support for Programmable Token Transfers means smart contracts can transfer USDC along with additional instructions on what to do with the tokens once they arrive on the destination chain.

- Integrated CCIP on mainnet with Kroma’s layer-2 network, expanding CCIP’s support for onchain gaming ecosystems.

- Migrated the L2 testnet deployments of CCIP from Goerli to Sepolia testnet.

- Improved operational tooling to realize increased capacity for CCIP GA.

- Launched the CCIP Local Simulator to enable developers to quickly build and iterate on their cross-chain dApps. The CCIP Local Simulator reduces CCIP message and token transfer times during the building phase from 10+ minutes to less than a second. You can install and start building using the CCIP Local Simulator today by visiting the Chainlink GitHub.

What’s Next

- Expand CCIP to additional blockchains—including the first non-EVM integration—as well as list additional tokens, with a specific focus on widely-bridged assets.

- Enable simpler and more streamlined processes for onboarding token issuers to decrease onboarding time and improve the overall developer experience significantly.

- Prepare and implement architectural upgrades to improve CCIP’s scalability, functionality, cost efficiency, and user experience.

- Continue to engage with capital market partners on making it easier for them to utilize Chainlink services and interact with chains via legacy infrastructure through CCIP and the blockchain abstraction layer. This empowers financial institutions further to unlock new tokenized assets and blockchain technology use cases.

Data

Data Feeds

Product Description

Chainlink Data Feeds are the industry-standard push-based oracle solution that provides smart contracts with a reliable and accurate source of truth about external events such as cryptocurrency price changes, real-world asset valuations, sports outcomes, or weather events.

Recent Deployments

- Partnered with Paxos and PayPal to launch a Data Feed for PayPal USD (PYUSD), which was quickly adopted by leading lending protocols such as Aave.

- Developed a risk categorization framework so developers can better understand the relative market risks associated with different assets supported by Data Feeds.

- Released the Chainlink DeFi Yield (CDY) Index Report, a new in-development data product that calculates DeFi asset yields on lending protocols that are underpinned by Chainlink oracles. The CDY Index represents the onchain gold standard for market coverage and data structuring methodology. With the CDY Index, capital markets institutions can access and analyze the DeFi yield market and compare it to traditional fixed-income markets. The transparency of the CDY Index also enables institutions to create novel products leveraging the advantages of transparent and decentralized finance infrastructure.

What’s Next

- Expand Data Feeds to more blockchains, with prioritization based on participation in the Chainlink Scale program.

Data Streams

Product Description

Chainlink Data Streams is a pull-based, low-latency, and credibly neutral oracle solution that provides latency-sensitive protocols such as perpetual futures access to high-frequency market data offchain that can be retrieved at any time and verified onchain.

Recent Deployments

- Deployed Data Streams for initial user testing on Avalanche testnet.

- Integrated with Vertex, a leading decentralized exchange, on Arbitrum Mainnet.

- Delivered key reliability and scalability upgrades that prepare Data Streams for broader blockchain deployments and user onboarding.

- Revamped data.chain.link to include real-time data from Data Streams and historical graphs for both Streams and Feeds.

What’s Next

- Rollout support to additional Ethereum layer-2 networks.

- Improve the cost-efficiency of combining Data Streams and Chainlink Automation.

- Expand support for alternative usage models such as easier cross-margining.

- Enrich information on data.chain.link for Streams and Feeds by integrating trading volume, cryptocurrency market cap data, and bid/asks to Streams graphs.

- Expand to provide additional feeds and coverage for real-world financial assets.

- Build capacity to support different report schemas that give developers deeper resolution of data related to the assets they support.

Proof of Reserve

Product Description

Chainlink Proof of Reserve provides autonomous, reliable, and timely reporting of cross-chain and offchain reserves that back tokenized assets and wrapped assets.

What’s Next

- Continue to work with asset issuers on how to bring more onchain verifiability of key information about tokenized assets and funds—such as granular detail on individual assets, asset types, fund composition, and collateral—which in turn can help increase consumer trust in these novel asset types, enhance onchain programmability, and relay key information like fund performance.

- Continue to work with capital markets institutions, prioritizing use cases for tokenized assets such as secure minting and minting governance to protect against malicious minting attacks and to provide programmatic assurances that underlying assets are correctly collateralized.

DECO

Product Description

Chainlink DECO enables users to prove the authenticity of private data received over a TLS session to one or more verifiers. Additionally, it allows proving arbitrary statements over this private data without revealing the data itself. DECO can be used to bring private data or privacy-preserving statements about them on-chain without revealing any authentication credentials.

Recent Deployments

- Introduced the DECO Playground at an IC3 hackathon and made it available to key partners so they could begin testing it and provide feedback on its product direction.

What’s Next

- Expand the DECO Playground to more testers and continue to harden the codebase based on feedback and new insights.

Compute

Automation

Product Description

Chainlink Automation is the industry standard for developers who need highly reliable, gas-efficient, decentralized, and performant smart contract automation to build next-generation dApps.

Recent Deployments

- Integrated Chainlink Automation on Base mainnet and Optimism Sepolia testnet, expanding access to more onchain ecosystems.

- Helped transition users to Automation v2 so they benefit from increased compute capacity, improved reliability, and enhanced security.

- Launched a Debugger Script to make it easy for developers to diagnose and directly address issues with their registered upkeeps.

What’s Next

- Expand Automation to more chains, with prioritization based on Scale partners.

- Improve payment UX by supporting onchain payments in both native gas tokens and LINK to make it easier for developers to manage treasury operations as they build dApps with Automation. In parallel, work is underway on a payment abstraction solution where fee payments made in alternative assets are automatically converted into LINK.

- Make log triggers generally available so all users have the ability to trigger onchain executions based on event emission via a decentralized automation network.

Functions

Product Description

Chainlink Functions is a Web3 serverless developer platform that enables developers to connect their smart contracts to any external data source and run custom computations in minutes.

Recent Deployments

- Telefonica launched with Chainlink Functions to provide developers access to their OpenGateway and SimSwap protection API.

- Launched Functions on the Base blockchain.

- Updated Functions’ billing model to USD-based pricing, where the premium portion of the fee is denominated in a USD amount of LINK, in addition to the LINK amount paid to cover gas costs of the Functions “fulfill” transaction, resulting in more predictable pricing for Functions users.

What’s Next

- Improve the ability for developers to deploy and manage Functions from the Chainlink Functions UI, such as utilizing debugging tools for faster troubleshooting.

- Create a tighter integration between Functions and Automation for quicker development and a simplified developer experience.

- Enable higher limits for Functions, such as for computation time and callback gas.

VRF

Product Description

Chainlink Verifiable Random Function (VRF) is the industry-standard source of provably fair and tamper-proof randomness.

Recent Deployments

- Finished development of VRF v2.5 in preparation for deploying it on all supported chains. VRF v2.5 is a new version of VRF that improves payment UX by supporting onchain payments in both native gas tokens and LINK and implements upgradability. In parallel, work is underway on a payment abstraction solution where fee payments made in alternative assets are automatically converted into LINK.

What’s Next

- Deploy VRFv2.5 on currently supported chains and across more L1s and L2s.

- Improve the developer experience by enabling self-service via tooling and other UI features.

Capital Markets

In parallel to our work within DeFi and the crypto-native Web3 universe, we’ve been actively working with some of the largest financial institutions in the world on the adoption of blockchain technology for tokenized assets—a multi-hundred trillion dollar opportunity. With these discussions, we found that Chainlink is the only platform that has the potential to enable institutions to develop customized, compliant, and future-proof blockchain applications and complete end-to-end, cross-chain tokenized asset transactions.

Chainlink solves three fundamental problems throughout the lifecycle of institutional tokenized assets:

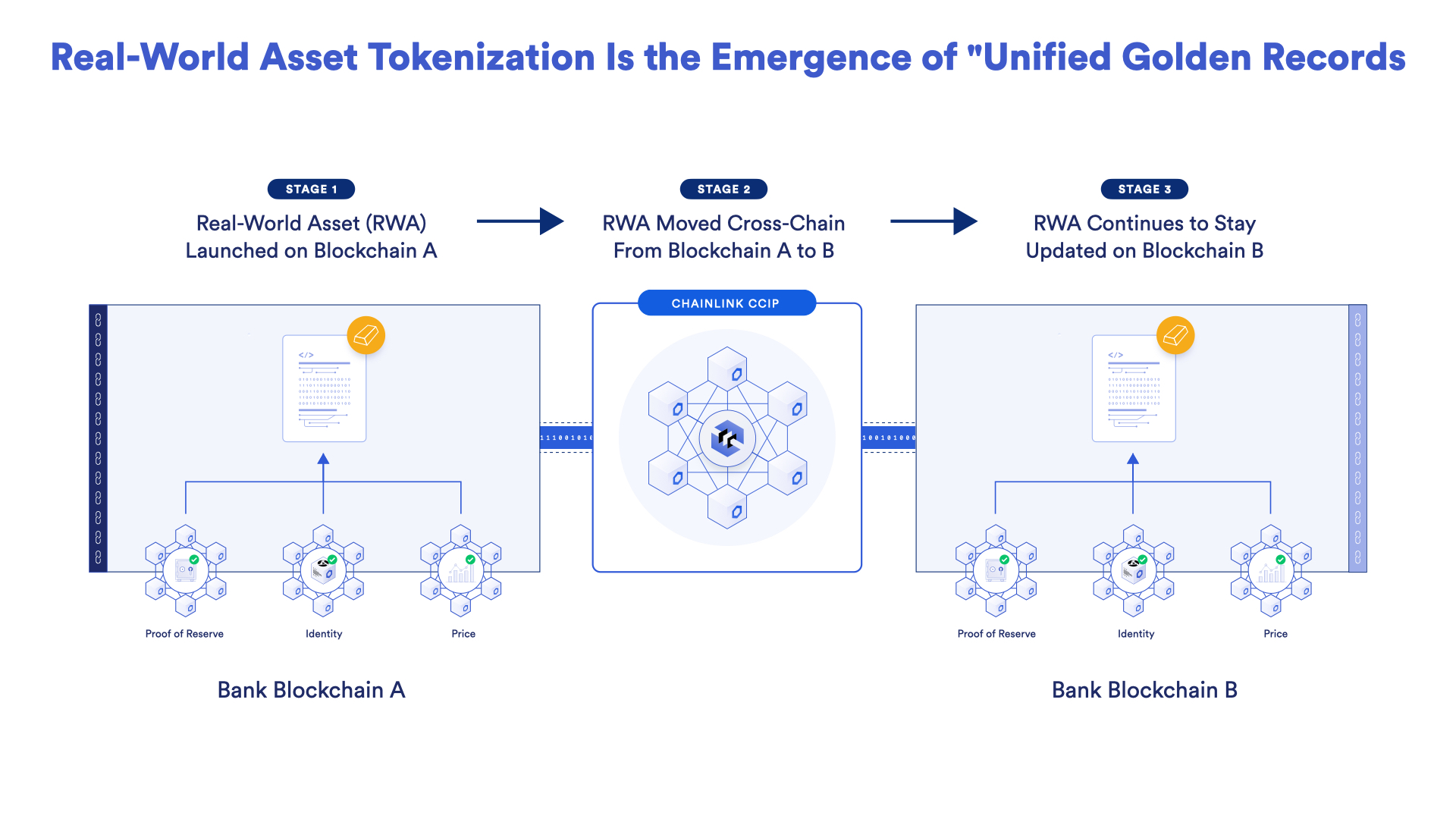

- The data and compliance problem. Tokenized real-world assets need to be enriched with real-world information and data that are necessary for the tokenized asset to come into existence and be used in a compliant manner, such as market pricing, reference data, AML/KYC data, identity data, and proof of reserves. Chainlink is the market leader in bringing all of this real-world data on-chain securely, enabling a Unified Golden Record through programmable tokenized assets, smart contracts, and the up-to-date and reliable data they need to exist.

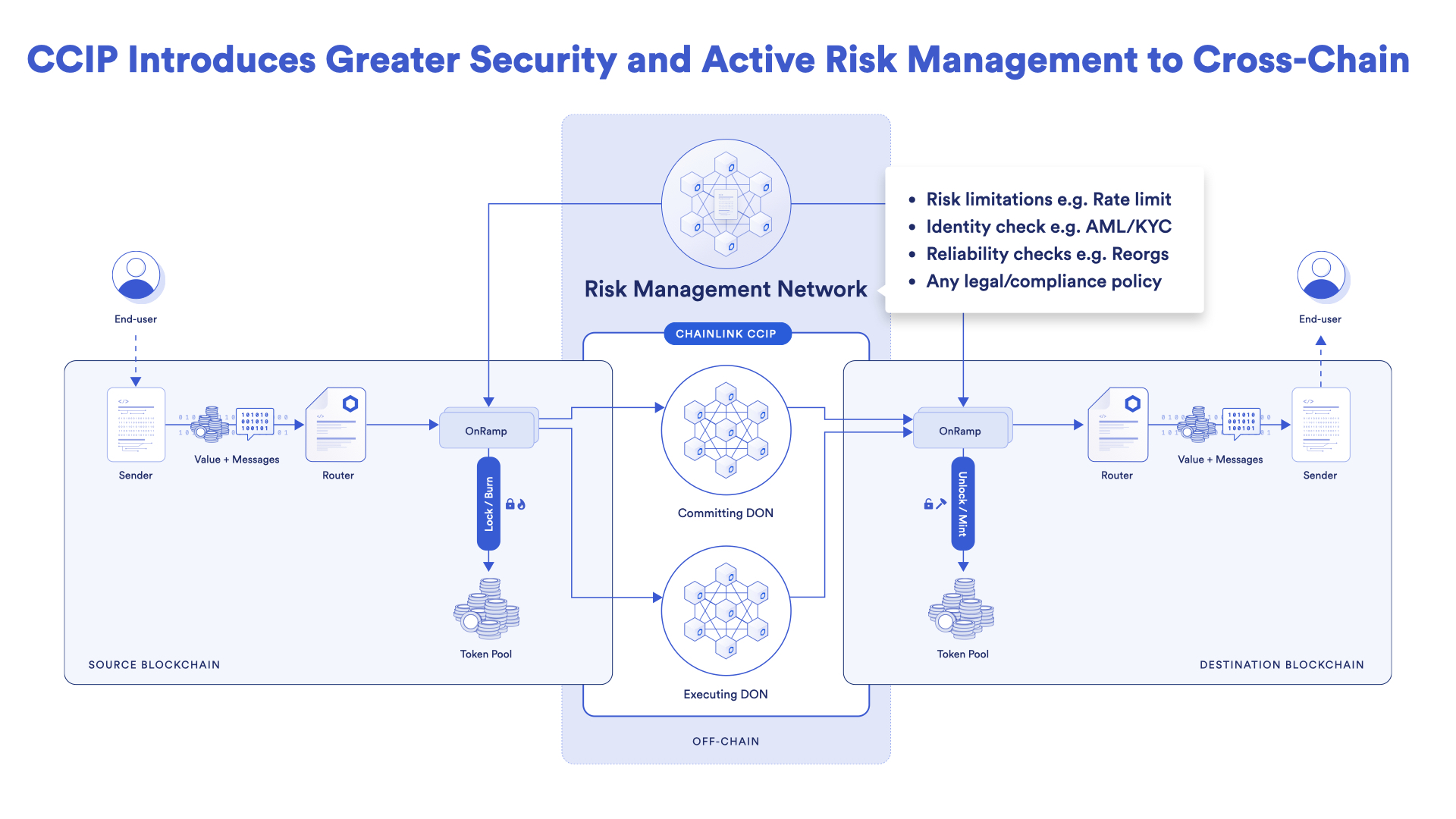

- The liquidity problem. In order to be successful, tokenized assets need secure connectivity across chains, leading to liquidity across different private and public blockchains. Providing a secure connection between various private and public chains is a key requirement for any digital asset to gain adoption. CCIP is the only cross-chain interoperability standard that connects both major Web3 public blockchains and private bank DLTs into one Internet of Contracts, opening up new markets for innovative tokenized asset products.

- The synchronization problem. Once tokenized assets are in the market and begin to move across chains as a natural part of their lifecycle, it is essential that the data that allows the asset to operate correctly—such as price, NAV, AML/KYC data, identity data, proof of reserves, and more—stays synchronized and up-to-date, no matter what chain the asset travels to. Chainlink is the only platform that includes both reliable offchain data connectivity and secure cross-chain interoperability, making Chainlink the essential enabler of a Unified Golden Record that successfully functions across chains.

Chainlink is built to solve both the technical challenges of a multi-blockchain world while allowing institutions to meet their compliance, risk management, and security requirements in a future-proof way.

- Compliance and risk management. Chainlink is the only cross-chain interoperability platform that includes a way to manage various global policies through the Risk Management Network, which can help ensure compliance with regulatory rules and organizational policies. Chainlink enables institutions to apply predefined controls and limits across transactional activity, including policies around identity, AML/KYC, legal requirements, token pools, on/off ramps, organizational restrictions, and various forms of cross-chain security mechanisms.

- Security and reliability. Chainlink has securely enabled over $10 trillion in transaction value across the entire blockchain ecosystem and has generated over 1,000 Chainlink oracle networks in production. CCIP is the only cross-chain technology that offers defense-in-depth security and is architected with multiple independent networks for executing and verifying every transaction through the Risk Management Network.

- Integration with existing systems across chains. Chainlink not only updates and moves assets across chains but also allows them to stay in sync with existing back office systems, messaging standards, and infrastructure already in use by institutions, dramatically reducing the operational cost and complexity of tokenized assets. Chainlink has demonstrated that institutions can successfully use existing interfaces and messaging standards to interact with tokenized assets across all blockchains through CCIP’s blockchain abstraction layer, as seen in Swift’s blockchain interoperability collaboration and ANZ Bank’s cross-chain settlement case study.

As the only platform for onchain data, cross-chain interoperability, and blockchain abstraction, Chainlink provides institutions with the liquidity, blockchain optionality, and robust security and compliance they need for their tokenized asset designs. For more information about Chainlink’s strategy within the capital markets, watch Sergey Nazarov’s recent presentation at Hong Kong Web3 Festival 2024.

Developer Community

Q1 2024 saw an increase in developer activity across Chainlink services. CCIP, in particular, had over 1,100 developers building and experimenting on testnets, making it the most popular cross-chain protocol for developers. One of the drivers of increased developer activities was our 62 Developer Experts—developers in the Chainlink community who are passionate about sharing their technical knowledge with the world. Our Developer Experts hosted 12 developer workshops across the world in Q1. If you want to be a Developer Expert, reach out here. Chainlink Labs also ran a successful bootcamp for educating developers globally, with 5,000 registrations that resulted in 3,400 smart contracts deployed to a testnet that used CCIP in only two weeks.

Additionally, we are continuously refining our Developer Hub and technical documentation to enhance the speed and ease with which developers can locate the information they need. These improvements are part of our commitment to ensure that resources are not only comprehensive but also intuitively organized and accessible.

As part of this commitment, we’ve released new guides in our documentation, including:

- CCIP: Send Arbitrary Data with Acknowledgment of Receipt

- CCIP: Transferring USDC tokens with Data

- Functions: ABI Encoding and Decoding

- Automation: Migrating to Automation v2

- Using Chainlink Automation with Functions

And recognizing that a large portion of our community prefers building using command-line interfaces (CLIs), we have initiated the creation of CLI-based getting started guides. We’ve already launched a guide for one of our core products, Data Streams, and are in the process of developing similar guides for all of our products.

Furthermore, we’re focused on demonstrating the transformative potential of Chainlink and blockchain technology to developers well-versed in traditional technologies yet new to blockchain. Our aim is to show how integrating these cutting-edge technologies into existing technology infrastructures can lead to the development of powerful applications. We intend to directly engage with these developers through strategically targeted content and by making our presence felt at leading technology conferences, including the Open Source Summit, React Summit, and JS Nation. An example of our strategic focus in action is one of our recent initiatives: a video guide for building NFTs. By concentrating on addressing the most prevalent questions from this audience, our goal is not just to educate but to demonstrate that our platform is the leading choice for developers new to the space.

Finally, we want to continue to support developers in various regions around the world. One area of focus is China, where we aim to start working on an end-to-end blockchain development course that includes all Chainlink services, which will be hosted completely in Chinese. We’ve also launched a second version of the Chainlink Bootcamp in Chinese and Turkish in addition to English, Spanish, and Portuguese.

Furthermore, Block Magic, the spring Chainlink Hackathon, will be going on from April 29 – June 2. Block Magic is already open for registration and features $400K+ in prizes and numerous expert-run workshops that cater to beginners all the way up to experienced smart contract developers. Sign up for Block Magic here.

To learn more about Chainlink, visit chain.link, subscribe to the Chainlink newsletter, and follow Chainlink on Twitter, YouTube, and Reddit.