The Three Requirements of Tokenized Real-World Assets (RWAs) Solved by Chainlink

Onchain finance offers a more verifiable, efficient, and accessible way for the global financial system to operate. That’s why the world’s largest banks and financial market infrastructures are exploring tokenization. Swift, the standard messaging network connecting 11K+ banks, collaborated with Chainlink and over 10 leading institutions—including Euroclear, Clearstream, BNP Paribas, BNY Mellon, and Citi—to successfully demonstrate a secure and scalable way to connect multiple blockchains. DTCC, the world’s largest securities settlement system that processes $2+ quadrillion annually, is actively working with Chainlink to bring capital markets onchain. Additionally, Australia and New Zealand Banking Group Limited (ANZ), a leading Australian bank with $1T+ in AUM, utilized Chainlink CCIP to demonstrate a cross-currency, cross-chain purchase of tokenized assets.

The future of finance is onchain, and it’s likely to feature hundreds of public and private blockchains that support trillions of dollars worth of tokenized real-world assets (RWAs), including tokenized financial instruments and other assets such as real estate, commodities, and artworks.

To realize the full benefits of onchain finance, tokenized RWAs require three key capabilities. They must be able to:

- Be enriched with real-world information.

- Be securely transferred cross-chain.

- Connect to offchain data regardless of which chain they’re moved to.

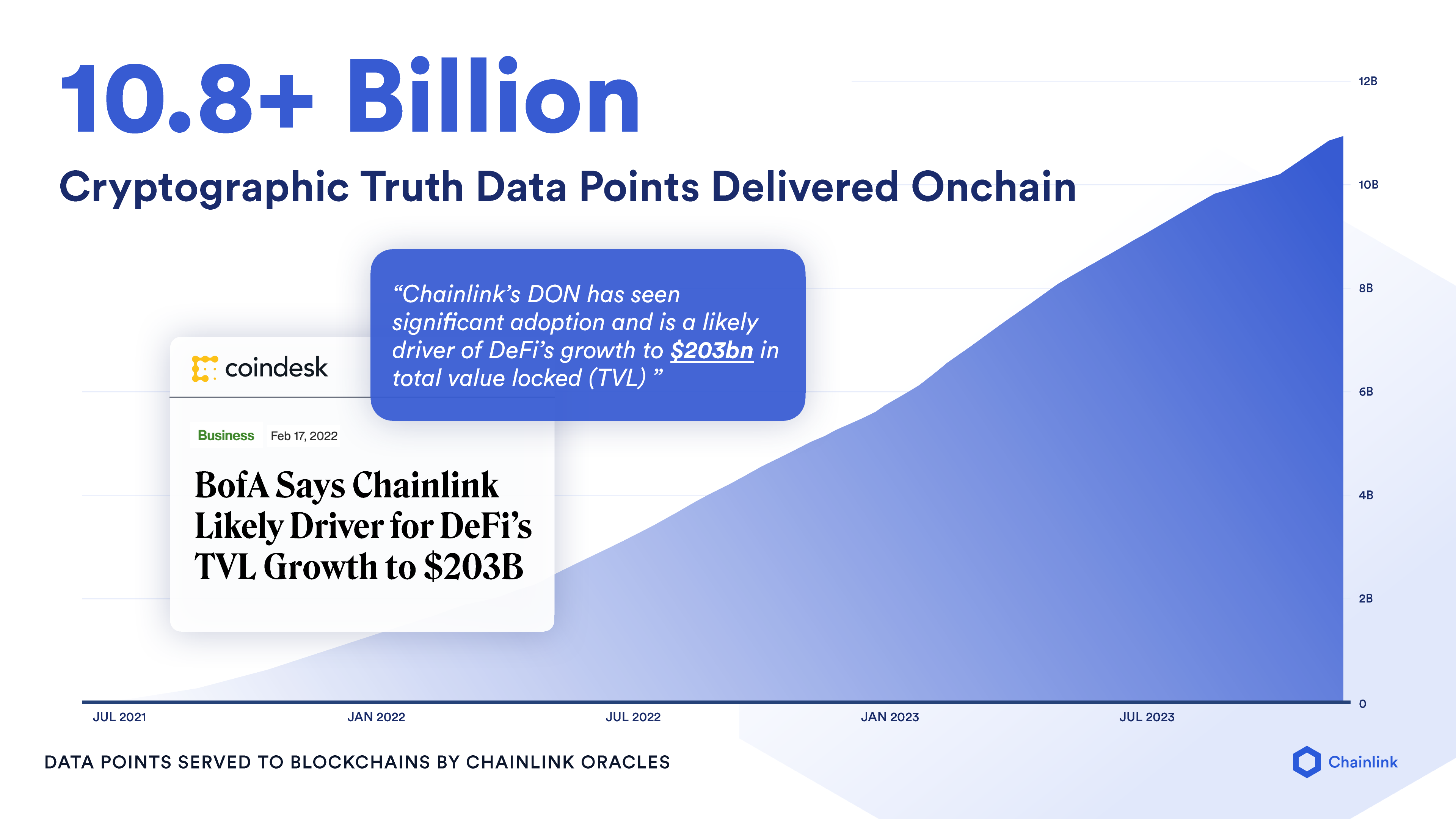

As a decentralized computation platform that has enabled over $8.8 trillion in transactional value, Chainlink is the only fully featured platform that can solve each of these requirements for tokenized real-world assets while maintaining the high level of security required by institutions.

Stage 1: Enriching RWAs With Real-World Information

Tokenized RWAs require much more than a token minted to represent the underlying asset. One of the primary benefits of digital assets is that they are programmable containers of information that can be enriched with all of the information and logic that banks, protocols, and customers require in order to interact with the asset, including proof of reserves, automated corporate actions, identity data, active risk management, settlement requirements, and daily net asset value (NAV).

Since the industry moved from paper-based assets to electronic assets in the mid-1970s, there has not been any meaningful innovation in how the market interacts with these assets. Typically these traditional “static” assets represent an identifier in a database, information is collected and viewed through a Bloomberg terminal (information asymmetry), and risk management is done reactively, e.g. through central bank backstops or clearing houses.

With blockchain technology and Chainlink services, we have an opportunity to create assets that both remove information asymmetry and have proactive risk management features. We can compress all the fragmented information and processes into one cohesive asset.

Having brought 10.8B+ data points onchain, Chainlink services are the industry standard for enriching RWAs with offchain data. Some of these services include:

- Proof of Reserve—Autonomous, reliable, and timely verifications enable consumers, monetary authorities, asset issuers, and onchain applications to monitor cross-chain or offchain reserves backing tokenized RWAs. This provides them with enhanced transparency and enables circuit breakers to be implemented, protecting users if the value of offchain assets diverges from assets tokenized onchain.

- Identity—Establishing the identity of counterparties and asset owners is necessary in order for banks, asset managers, and their customers to transact with each other in a regulatory-compliant manner. DECO is a privacy-preserving oracle protocol in development that utilizes zero-knowledge technology to enable institutions and individuals to prove the provenance and verify ownership of tokenized RWAs without revealing personal information to third parties.

- Data Streams and Data Feeds—Underpin onchain markets with a secure and decentralized source of financial market data around commodities, equities, forex, indices, economic data, business financials, cryptocurrencies, and more.

- Functions—Any offchain event or data can be synchronized or published onchain, such as standing settlement instructions, corporate actions, proxy voting, ESG data, dividends and interest, and NAV.

Stage 2: Enabling Liquidity With Cross-Chain Interoperability

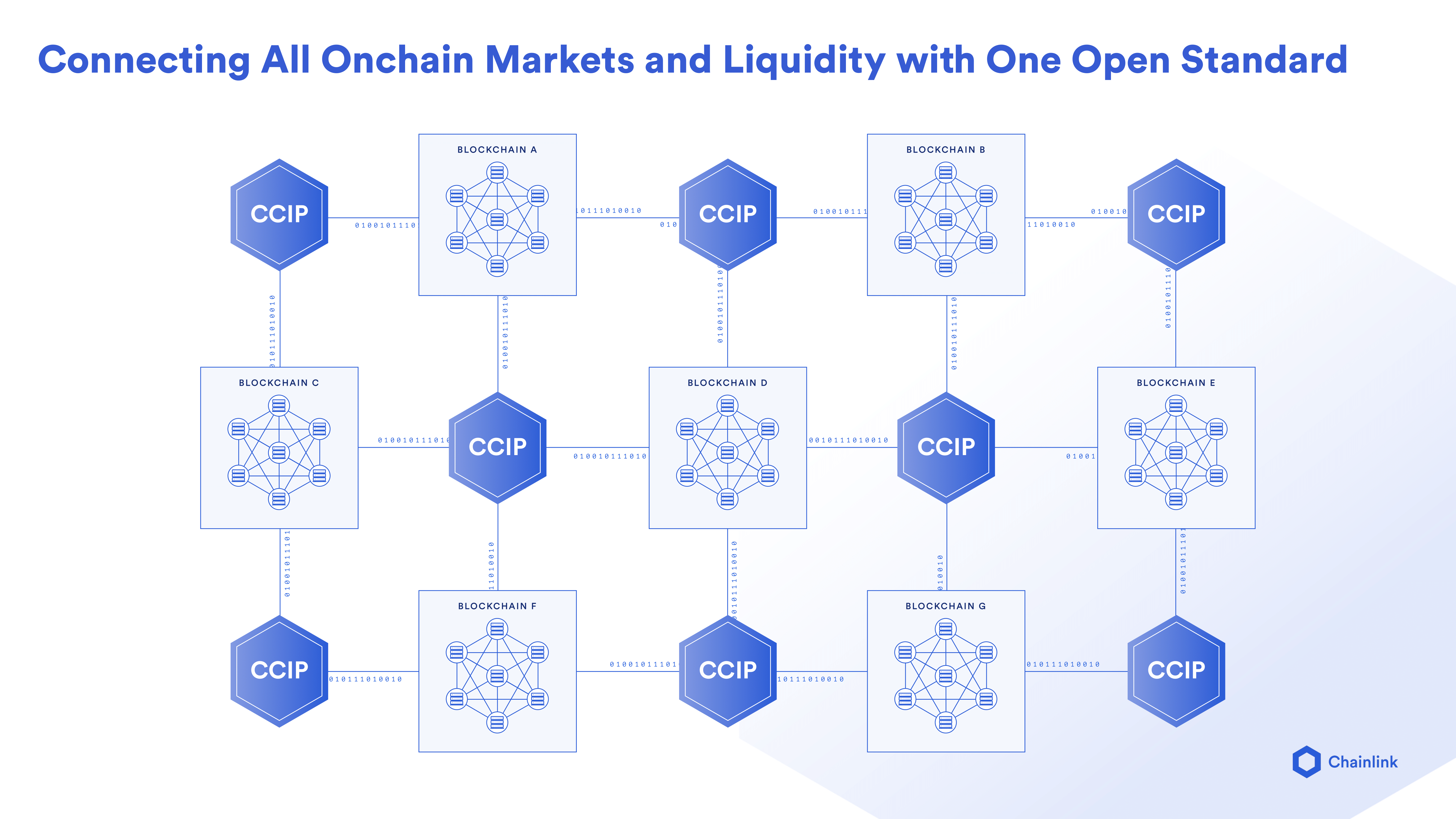

Banks, financial market infrastructures, and Web3 protocols are increasingly recognizing that there will be hundreds to potentially thousands of different blockchain networks, particularly if there is specialization around catering to specific asset classes and geographies. Without a secure blockchain interoperability standard, this would lead to fragmented islands of liquidity that prevent the growth of new onchain markets.

As a blockchain interoperability standard, the Chainlink Cross-Chain Interoperability Protocol (CCIP) will serve a similar role to TCP/IP. However, instead of connecting the world’s information, CCIP will enable smart contracts to securely transfer the world’s value across public and private blockchain networks—creating an Internet of Contracts where value is automatically exchanged when certain conditions are met.

Critically for institutions, CCIP provides a single integration gateway to connect backend infrastructure to blockchain networks. In doing so, institutions are able to save time, cut costs, reduce risk, and launch new products faster since they don’t have to directly integrate with each individual chain. They only need CCIP as an abstraction layer that connects to and across all chains.

Operating at the highest level of cross-chain security, CCIP is the only solution that meets the strict security standards of capital markets. This is partly why both Swift and ANZ collaborated with Chainlink on the usage of CCIP for cross-chain tokenized asset settlement. As a universal blockchain interoperability standard, CCIP enables RWAs to flow seamlessly between blockchains, broadening accessibility and deepening global market liquidity.

“Just like key standards such as TCP/IP remade a fragmented early Internet into the single global Internet we all know and use today, we are making CCIP to connect the fragmented public blockchain landscape and the growing bank chain ecosystem into a single Internet of Contracts.”—Chainlink Co-Founder, Sergey Nazarov

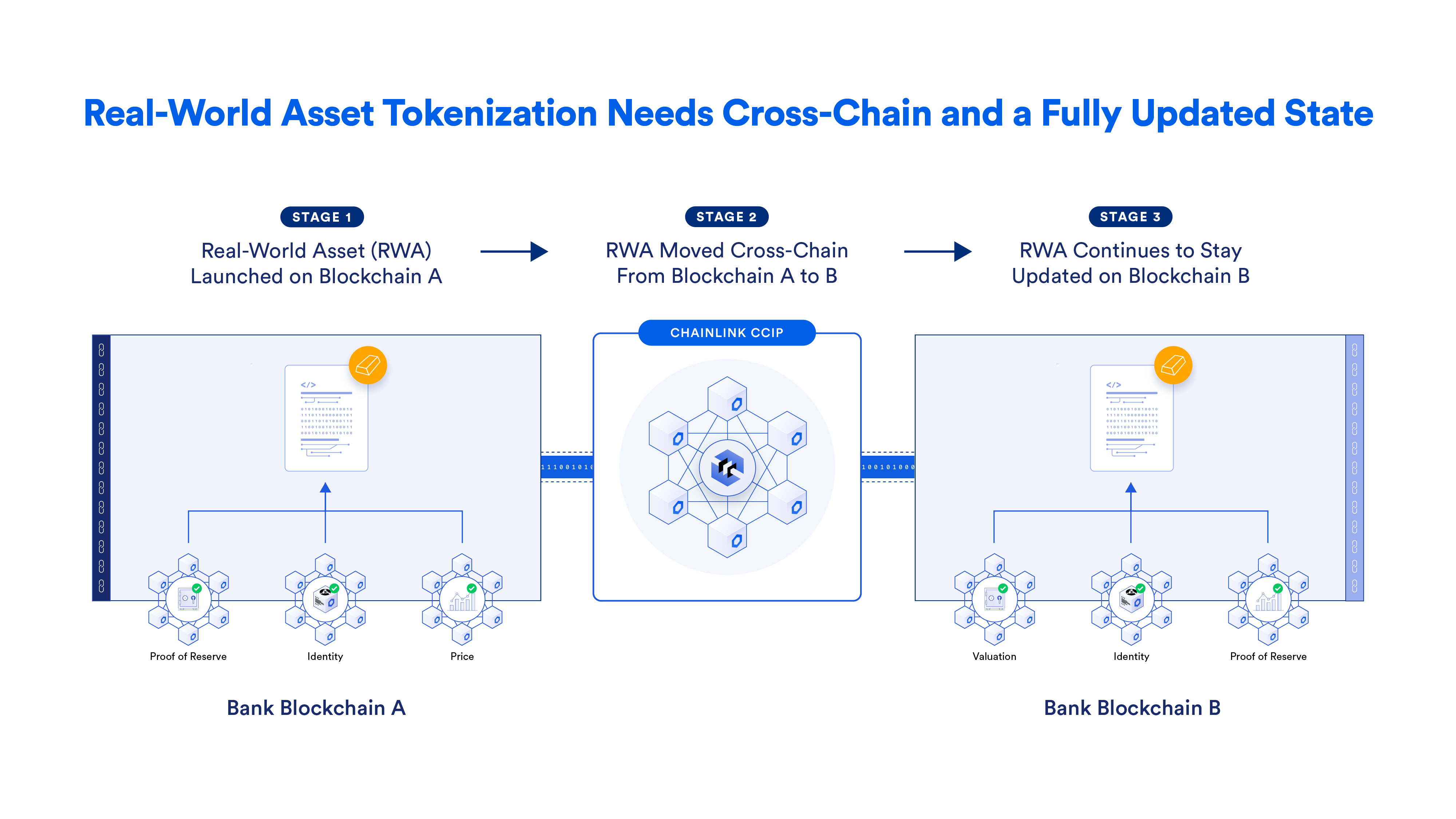

Stage 3: Keeping RWAs Updated as They Move Cross-Chain To Maintain the Golden Record

Keeping assets updated with all relevant information as they move across the financial system will be transformative to maintaining golden records—single data points that provide all of the important information about an asset with total accuracy. We witnessed the outcomes of a system where core financial data was separated from financial instruments during the 2008 global financial crisis. Thousands of mortgages were rolled up into mortgage-backed securities (MBS), and buyers blindly trusted the level of risk that rating agencies assigned to various tranches. Not having easy access to core financial information, many didn’t inspect the credit scores, collateral levels, payment history, and other key information, or evaluate the models rating agencies had used (which had incorrectly assumed real-estate prices wouldn’t simultaneously decline nationwide).

Onchain finance can overcome this problem for global markets, but it first needs a secure blockchain interoperability standard. When RWAs move across chains, they still need to remain up to date with key data points such as price, identity, and reserves value. Therefore, a secure solution that offers both offchain and cross-chain connectivity for a wide variety of blockchains is required.

Chainlink is the only platform that solves this problem by providing complementary services that span both offchain data connectivity and cross-chain interoperability while maintaining the high security guarantees required by institutions. As a blockchain-agnostic platform, Chainlink enables RWAs to remain connected to all the necessary offchain data through services such as Proof of Reserve, Functions, and Data Streams, regardless of which chain they land on. In parallel, CCIP enables the secure transfer of RWAs between blockchains, while asset issuers and holders have the assurance that the golden onchain record will continue to be updated.

For example, Hong Kong-based financial institution ARTA TechFin is using Chainlink’s industry-standard decentralized computing platform to unlock mission-critical features for the company’s tokenized funds. Specifically, the tokenized funds are integrating Chainlink Proof of Reserve to provide clients with onchain proof of reserves, Chainlink CCIP for native cross-chain interoperability, and Chainlink Data Feeds to post the tokenized funds’ hourly net asset value (NAV) onchain on an ongoing basis for increased transparency.

As another example, a tokenized MBS that leveraged Chainlink could contain thousands of tokenized mortgages originally minted across many different bank chains. As the tokenized mortgages are transferred cross-chain to live within the onchain MBS contract, Chainlink could help ensure that each tokenized mortgage continues to be updated with all core financial data (while still protecting personal information). Before purchasing a tokenized MBS, bank clients could easily create their own models and evaluate risk using all of the primary financial data. In essence, Chainlink enables assets to be serviced as they move across blockchains.

“Onchain finance has the potential to prevent a financial crisis like what happened in 2008. With all core information contained within tokenized RWAs and easily accessible onchain, everyone can be Michael Burry.”—Chainlink Co-Founder, Sergey Nazarov

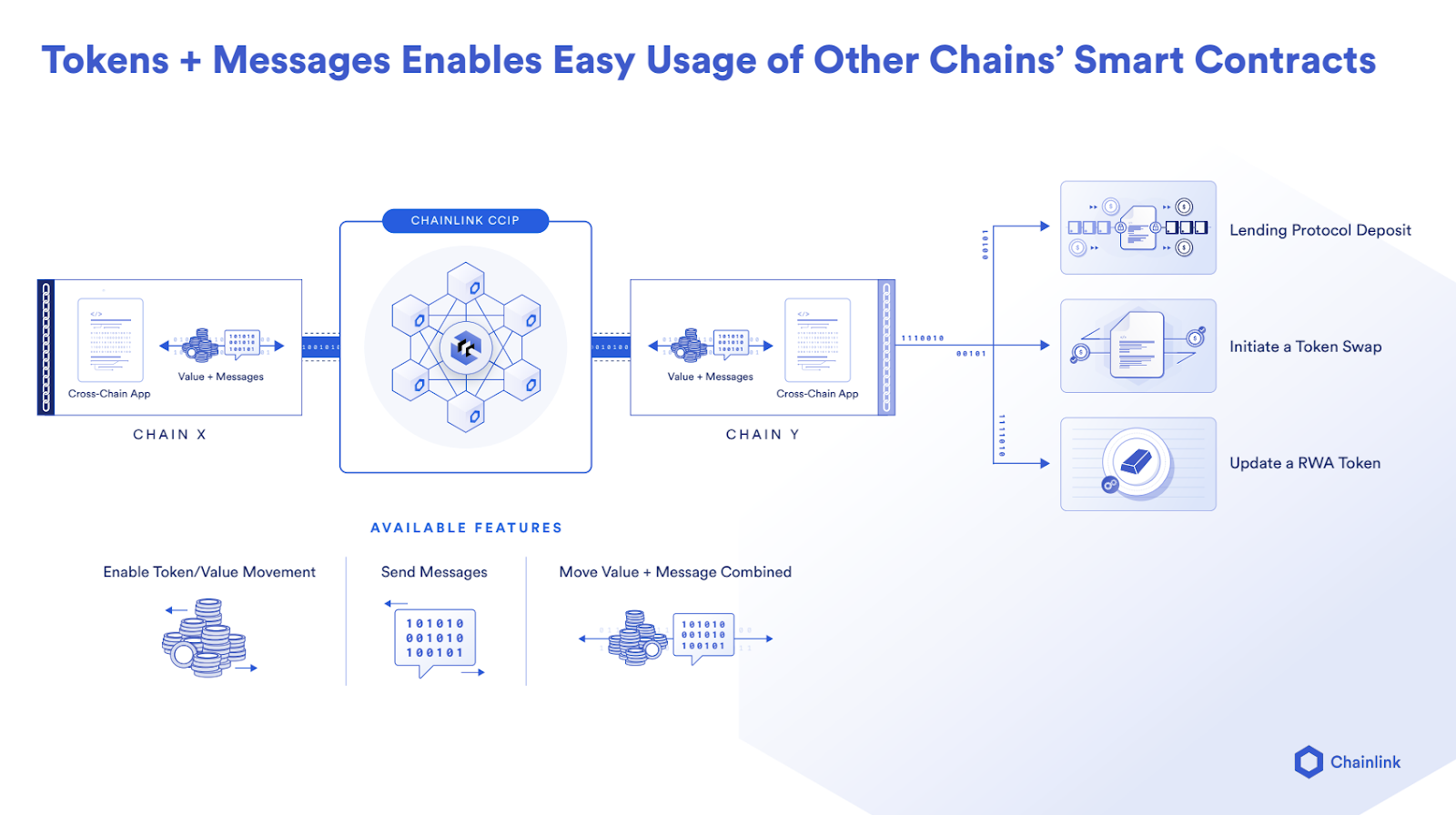

The Universal Standard Powering Programmable Token Transfers

By enabling arbitrary data, tokens, and instructions to be securely sent together between chains, CCIP makes programmable tokenized asset transfers across chains possible (i.e., move Asset X to another blockchain and deposit it into this lending platform to secure a loan). Furthermore, regardless of which chain a tokenized asset is minted on, banks and asset managers can use CCIP to interact with tokenized RWAs from across the onchain economy via their existing backend infrastructure or from a single Web3 wallet.

ANZ demonstrated using CCIP to enable their customers to purchase a tokenized asset through their portal in a single transaction—even if it was available on a different chain and denominated in a different currency. In the background, CCIP helped convert the stablecoin backed by a local currency (NZ\$DC) to another stablecoin (A\$DC), transfer the stablecoin from the source to the destination chain, purchase the tokenized asset, and send it back to the customer’s wallet on the source chain. CCIP abstracts away all of the complexity of advanced financial transactions that would otherwise take days, require manual input from multiple parties, and expose the buyer to counterparty risks.

Enabling data and value to move together across markets and between institutions is a major step forward for the global financial system, which previously required information and value to travel separately, existing within fragmented silos. This provides a path to go from a system where trades are settled T+1 and with counterparty risk to an onchain economy where trades are atomically settled near-instantly and with deterministic cryptographic guarantees.

Chainlink is already the leading platform for tokenized RWAs, powering TrueUSD stablecoin, tokenized gold product Pax Gold, and many others. Now, with world-leading institutions like Swift and DTCC exploring how CCIP can connect to their systems, CCIP is on the path to becoming a universal blockchain interoperability standard that underpins tokenized RWAs in the onchain economy.

Looking to understand the tokenization opportunity? This industry report provides a comprehensive overview of the growing tokenization market, with contributions from BCG, 21Shares, Paxos, Backed, and Chainlink. Access now.

To learn more, visit chain.link, subscribe to the Chainlink newsletter, and follow Chainlink on Twitter, YouTube, and Reddit.