Accelerating CCIP Adoption Through Native ETH Cross-Chain Transfers and Optimized Pricing

Chainlink CCIP is built to be extensible and future-proof, with continual updates over time introducing enhanced functionality, new networks and tokens, and additional defense-in-depth approaches. As the onchain economy evolves, CCIP evolves with it.

To accelerate the adoption of CCIP and the cross-chain economy as a whole, we’re excited to introduce a new native token transfer mechanism to CCIP referred to as lock and unlock. This upgrade means that CCIP now supports the cross-chain transfer of native ETH between different blockchain networks, starting with Ethereum, Arbitrum, and Optimism, which is made possible by WETH lock and unlock token pools.

Alongside this upgrade, a new pricing model has been introduced that makes CCIP one of the most cost-efficient options for securely and reliably bridging a wide range of tokens, ultimately accelerating transaction volume, high-value use cases, and overall cross-chain adoption.

These updates help solidify CCIP’s position as the industry standard for cross-chain interoperability, as they provide developers greater flexibility when building cross-chain applications and users more choice when transferring their tokens cross-chain.

Unlocking Cross-Chain Liquidity Through Lock And Unlock

CCIP was built from the ground up to provide both high security for cross-chain interactions and maximum flexibility so developers can transfer tokens and/or data in a way that suits their unique cross-chain requirements. Based on this principle, CCIP launched in Mainnet Early Access last July with support for two cross-chain token transfer methods:

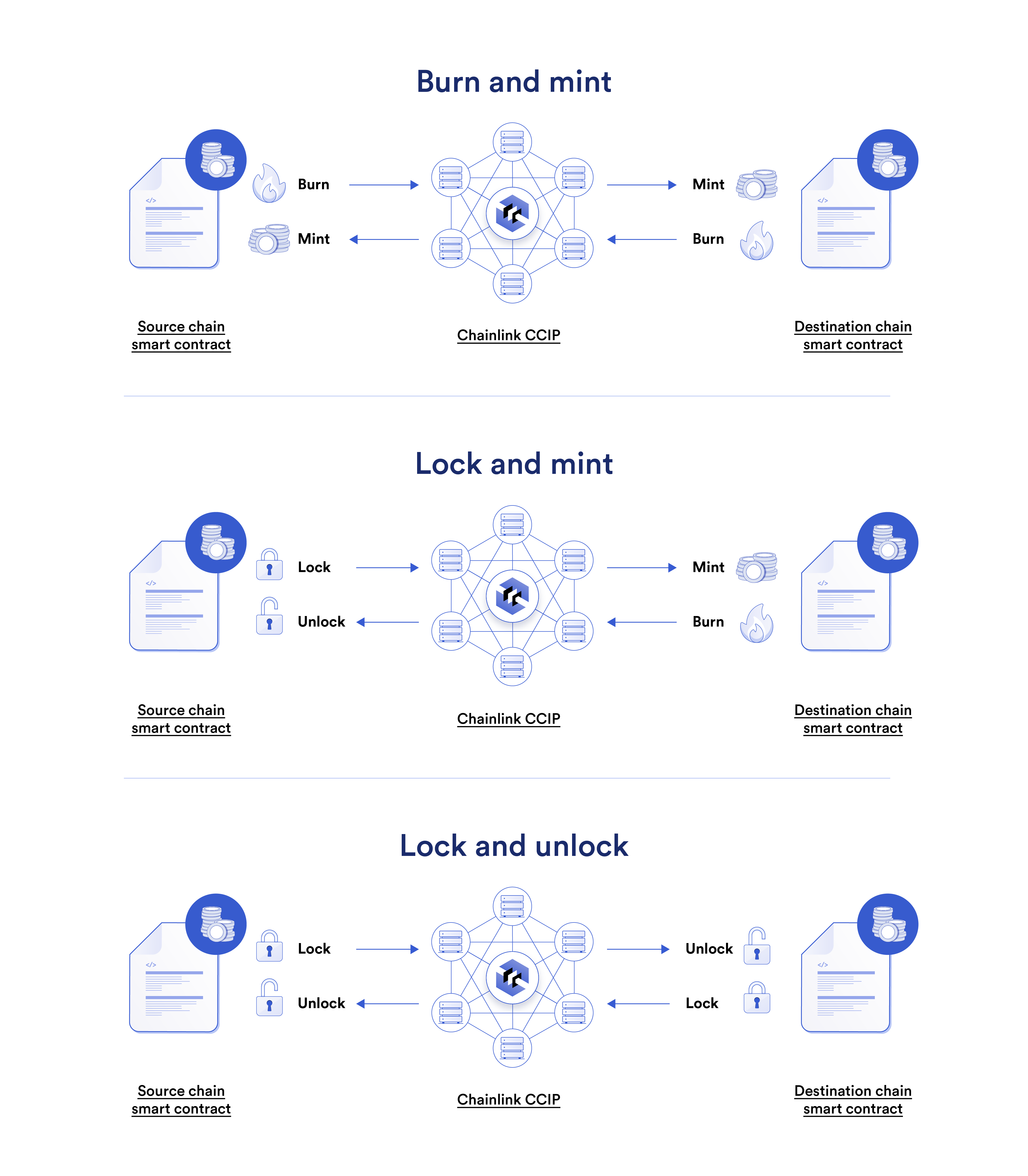

Burn and mint—Tokens are burned on a source chain, and an equivalent amount are minted on a destination chain. This enables the creation of cross-chain native tokens with a dynamic, unified supply across chains.

Lock and mint—Tokens are locked on the chain they were natively issued on, and fully collateralized “wrapped” tokens are minted on destination chains. These wrapped tokens can be transferred across other non-native destination chains via burn and mint or be burned to unlock tokens back on the original issuing source chain.

Thanks to CCIP’s Programmable Token Transfers, onchain applications can not only transfer tokens cross-chain using either of the above methods, but they can also add additional data instructions on what to do with those tokens once they arrive on the destination chain. This functionality was highlighted in a recent collaboration with the Australia and New Zealand Banking Group (ANZ), showcasing how financial institutions can leverage Chainlink CCIP to provide their clients with the ability to trade and settle tokenized assets across public and private blockchains.

“This is the pinnacle of our achievement so far … The value and the message moving together is revolutionary.”—Nigel Dobson, Banking Services Lead at @ANZ_AU

At #Sibos, Chainlink Co-founder @SergeyNazarov and Nigel Dobson dive into cross-chain settlement using CCIP. pic.twitter.com/CFbhiLKz6f

— Chainlink (@chainlink) September 18, 2023

However, certain tokens like ETH—the native currency of Ethereum—are both used as the gas token for many layer-2 networks and do not have a built-in burn and mint functionality that cross-chain protocols like CCIP can plug into. An additional token transfer method is therefore required, one that does not involve burning and minting or creating wrapped tokens that can’t be unwrapped to native assets on the destination chain.

With the introduction of lock and unlock, virtually any token can now be securely transferred cross-chain via CCIP. With lock and unlock, tokens are locked on a source chain and an equivalent amount is released on a destination chain.

To support the cross-chain transfer of ETH—for example, between Ethereum and Arbitrum—ETH is wrapped to WETH and locked on Ethereum while an equivalent amount of WETH is unlocked on the layer-2 network, where it can be seamlessly unwrapped to native ETH. This received ETH can then be used to pay for network gas or deposited into DeFi applications. The process of wrapping and unwrapping WETH and ETH can be completely abstracted away as a result.

Over time, we plan to expand support for additional tokens that uniquely benefit from a lock and unlock design.

Introducing an Optimized Pricing Model for CCIP To Propel the Cross-Chain Economy

Chainlink CCIP has been built to be the blockchain interoperability standard for both the DeFi and capital markets worlds. To fully realize this goal, CCIP must remain competitive within the existing cross-chain landscape. While some protocols may choose to take shortcuts in the pursuit of growth, we have no interest in compromising on security. Instead, based on feedback from users, we believe optimizations in CCIP’s pricing model will make the protocol even more attractive for high-value use cases.

To this end, the pricing models for CCIP’s “burn and mint” and “lock and mint” token transfer mechanisms have transitioned to a flat fee premium model. The total fees for transferring tokens via CCIP are inclusive of both the destination chain gas costs incurred by CCIP, which can be a variable amount based on gas prices, and the additional premium paid to CCIP service providers.

By optimizing for higher transaction volumes, with lower per-user costs, CCIP is now one of the most cost-efficient solutions for transferring many of the most popularly bridged tokens. As CCIP gets integrated into more applications, such as bridge aggregators, this competitive advantage is anticipated to result in increased market share and the acceleration of CCIP’s adoption. Furthermore, an increase in high-value transfers helps prove the security model of CCIP, providing additional in-production proof of the protocol’s ability to serve capital markets use cases.

Ultimately, we expect that the reduction in per-user costs will lead to greater transaction volume and adoption, and thus increased fees in aggregate, furthering the economic sustainability of CCIP. In addition, we are exploring the introduction of new features catered toward users transferring large amounts of value, which opens the door to new sources of protocol monetization.

Already this pricing update has shown positive results, with a recent CCIP transaction taking place post-update that transferred nearly $1M in USDC from Arbitrum to Base via XSwap, bringing the total USD transfer volume across CCIP to over $75M. Under the previous pricing model, this transaction would have been otherwise cost-prohibitive.

“CCIP serves as the bedrock of XSwap, providing our users with unparalleled security guarantees for the cross-chain transfer of assets. With the latest optimization to CCIP’s pricing model, we have already seen an acceleration in usage, including the highest value transfer over CCIP to date,” stated Arthur, co-founder of XSwap.

Given the technical dynamics involved with “lock and unlock”, the pricing model used for this transfer type leverages a percentage fee premium model, rather than a flat fee. More information on the updated pricing model for CCIP can be read in the Chainlink docs. Work has also been underway on an automated onchain conversion mechanism in which fee payments made in alternative assets can be automatically converted into LINK.

CCIP’s Growing Momentum as the Cross-Chain Standard

Over the past few months, CCIP’s adoption has seen an acceleration in both the number of integrations and the number and value of cross-chain transactions taking place. Additionally, various blockchain ecosystems are now adopting CCIP as their canonical token bridge to reduce bridging times and boost ecosystem security.

Recent highlights include:

- Transporter, a hyper-secure, intuitive bridging application was recently launched to enable users to easily transfer their token cross-chain via CCIP.

- XSwap, a cross-chain protocol powered by CCIP and a participant in the Chainlink Build program, launched its flagship product to a growing wave of DeFi users.

- Metis, an Ethereum layer-2 rollup, selected CCIP as its official cross-chain protocol to power its canonical token bridge. By upgrading to CCIP, the Metis ecosystem will experience faster token transfers from Metis to Ethereum (from seven days down to minutes) and benefit from Programmable Token Transfers.

- Wemade, one of South Korea’s largest game developers, integrated CCIP on WEMIX mainnet as its exclusive cross-chain infrastructure. CCIP now connects the AAA game Night Crows across six chains.

- Kryptomon, a phygital trading card game, adopted CCIP to power its recent NFT migration from BNB Chain to Polygon.

Accelerating the adoption of CCIP is our number one priority for 2024. With the introduction of a new token transfer mechanism and pricing updates, we believe CCIP is better positioned than ever before to serve as the standard for any and all cross-chain activity in Web3 and beyond.