Why Nobody Really Uses Web3… Yet

Web3 represents a fundamental evolution of the Internet as we know it today, replacing centralized gatekeepers and intermediaries with decentralized protocols and community-retained ownership. The properties inherent to Web3 are highly attractive to crypto-natives who live and breathe crypto. However, we must also acknowledge the following point:

Web3 is still a niche industry that has not reached mainstream adoption.

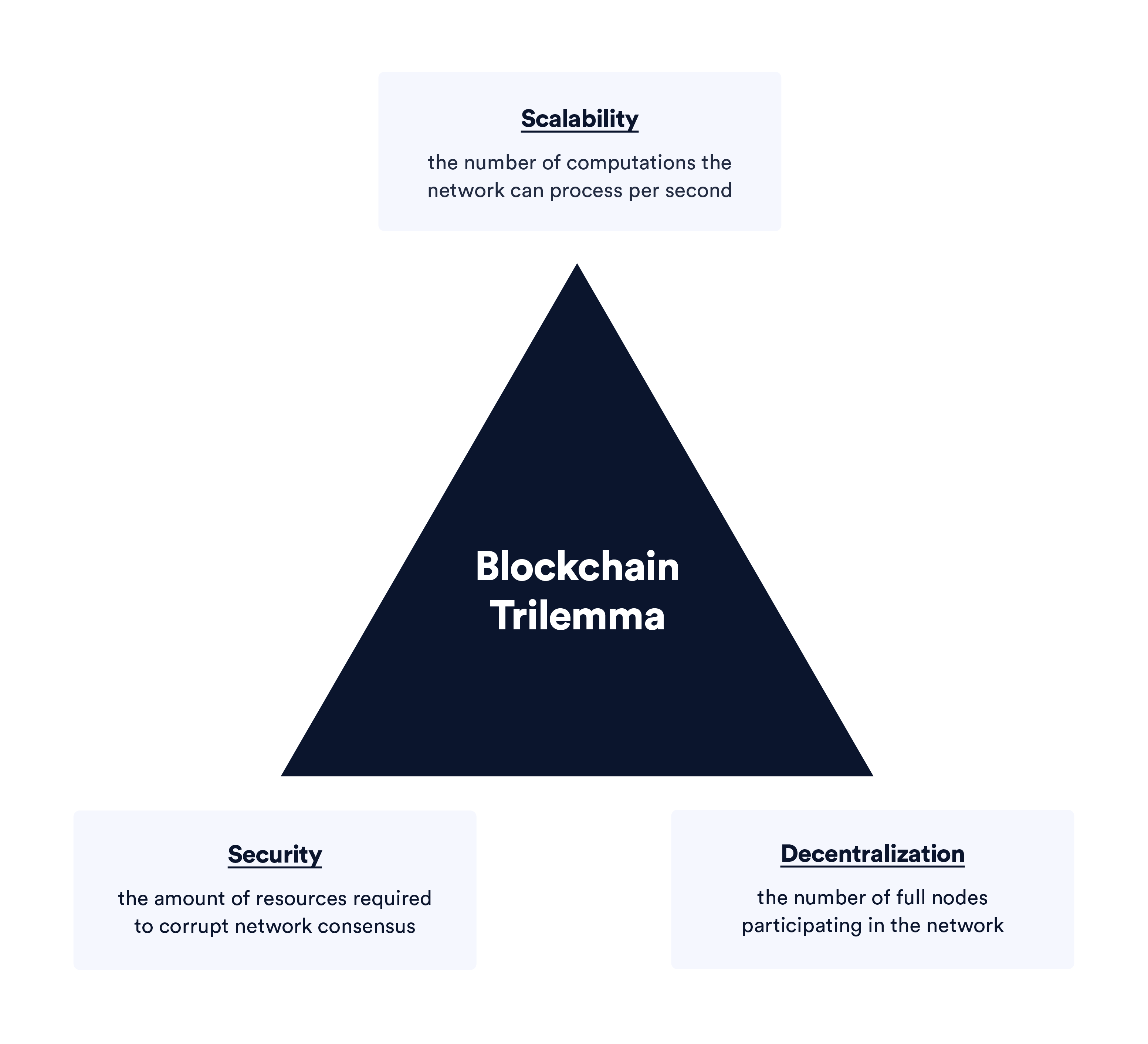

While the underlying technology backing Web3 is very real, there is a reason why your grandma is probably not yet an active Web3 user. And while limitations around blockchain scalability are most often cited for the lack of adoption—usually with a reminder of just how early we truly are—I believe that’s only one of a number of reasons why Web3 is not on the mind of the average consumer.

In this blog post, I’ll provide my own perspective around the six major reasons why Web3 has not yet reached mainstream adoption and what can be done to realize this technology’s true benefits for society.

1. Esoteric Techno-Babble

Web3 can be a difficult concept to explain to newcomers, particularly because there is no universal definition. Everyone has their own interpretation of its most valuable properties. This inevitably leads to questions such as: “Why should I care about Web3?” and “How can Web3 benefit me in my daily life?”

Various properties of Web3 are commonly mentioned—decentralization, censorship resistance, immutability, transparency, etc. Such explanations often include overly technical breakdowns of Web3 infrastructure, littered with industry jargon and techno-babble.

making Web 2.0 hard to understand@Airbnb is a centralized marketplace allowing owners of non-fungible physical spaces to fractionalize and sell time-bound access to buyers whose transactions are enabled with credit cards and priced in fungible currencies (USD or native).

— 𝙋𝙝𝙞𝙨𝙝𝙁𝙤𝙤𝙙。𝙚𝙩𝙝 ⭕️ (@PatrickWorkman) November 7, 2022

Although such explanations can be useful in understanding the core values of Web3 and its underlying technical implementation details, these are all simply a means to an end. The real question that must be answered is: How can these esoteric concepts and intangible values ultimately translate into Web3 applications that the average consumer can understand and is interested in engaging with?

Naturally, to answer such a question, one must be able to point to clear real-world use cases.

2. Circular Circus Contagion

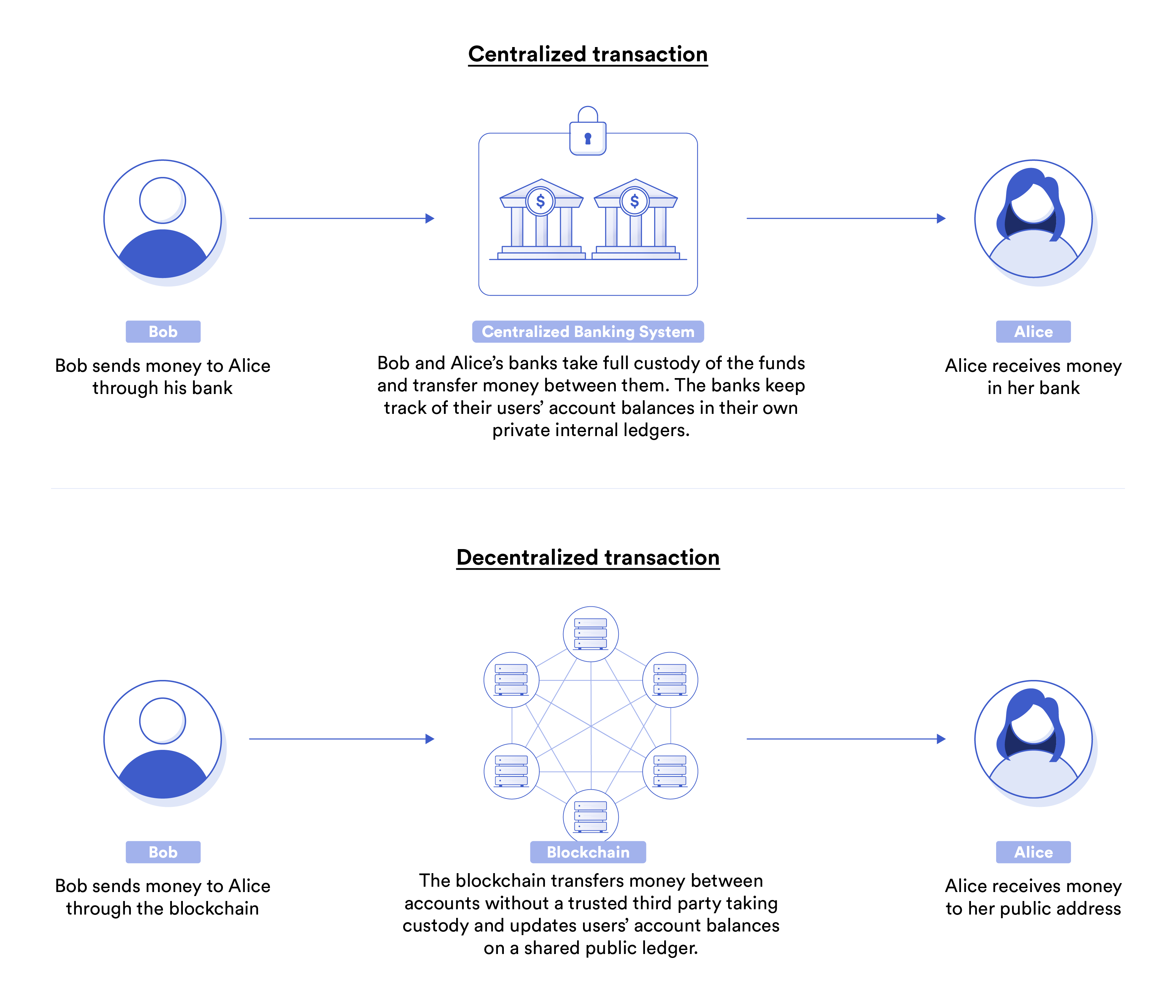

The first major Web3 application was the creation of digital tokens (e.g. Bitcoin) with predefined monetary policies and built-in peer-to-peer payment capabilities—all without the need for a centralized middleman. While digital tokens are attractive to many, tokens that exist to be simply transferred from one person to another are fairly limited in their utility, with clear trade-offs in terms of volatility and limited acceptance by merchants compared to traditional currencies.

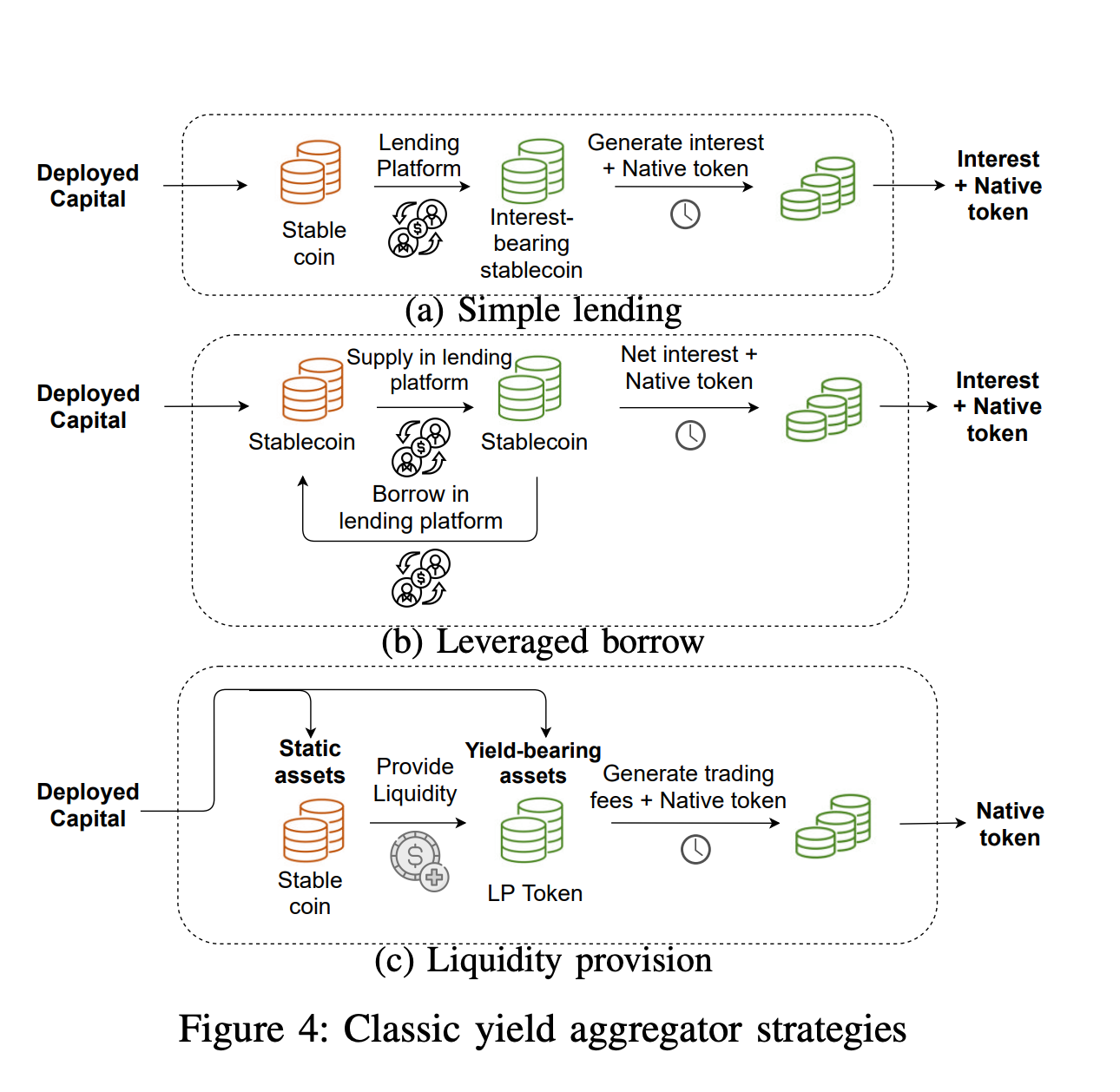

Without an obvious systemic failure in the traditional financial system, the value proposition of minting and transferring tokens alone isn’t sufficient. This realization is ultimately what led to the creation of the next clear Web3 use case: Decentralized Finance (DeFi). DeFi extends the utility of digital tokens beyond simple value transfer to also include their use in financial primitives that consumers are already accustomed to, such as lending, borrowing, exchanging, and hedging.

However, given that many DeFi applications are still primarily focused on tokens, a circular economy of speculating on tokens whose value is in part derived from monetizing speculation is created. This is not a surprise given that Web3 natives who already hold tokens are the clear initial product-market-fit of DeFi products, but if a consumer isn’t already an owner of a crypto token, DeFi seems more akin to a casino than an alternative financial system.

Tokenized Assets To The Rescue?

This isn’t to say that all of DeFi today is purely circular in nature. Stablecoins, a type of token pegged in value to another asset such as a fiat currency, have enabled the creation of what can be considered “programmable dollars,” which can be transacted globally and settled in seconds. Digital dollars are far more relevant to the average consumer today, as their lives already revolve around acquiring, saving, and spending such currency.

There are $140B worth of stablecoins today that can be used within DeFi applications, enabling the DeFi ecosystem to become more useful and relevant to consumers, such as through the creation of on-chain savings accounts. In applying the valuable properties of Web3 to assets that consumers already use today, the “why” of Web3 becomes more self-evident.

1/ Stablecoins are the Trojan Horse that will bring smart contracts to the masses

Why?

They’re the probably the first and only real-world use-case of crypto today that is fully sustainable and rapidly scaling

A 🧵 on #Stablecoins and how they’ll take over the global economy pic.twitter.com/CdwPTsI8si

— Zach Rynes | CLG (@ChainLinkGod) May 23, 2022

Beyond stablecoins, I believe this general approach of on-chain financial skeuomorphism—where existing real-world financial primitives are emulated and re-implemented on-chain—provides a clear path to introducing Web3 applications to the general population in a manner that is actually relevant to their daily lives.

In particular, tokenized real-world assets (RWAs), of which stablecoins are a subset, present an opportunity to short circuit the circular speculation loop that exists in DeFi. They can encapsulate real estate, corporate/government bonds, revenue-sharing agreements, commodities, and any other asset within the traditional financial economy. Tokenized RWAs are not without trade-offs though, specifically in terms of decentralization and trust-minimization. However, Web3 applications that support RWAs can expand Web3’s value proportion by an order of magnitude.

1/ Tokenized Real-World Assets (RWAs) is how #DeFi will scale to a global level

A 🧵 covering my thoughts on the opportunities and challenges this present

— Zach Rynes | CLG (@ChainLinkGod) July 2, 2022

3. Hyper-Financialization

While DeFi, stablecoins, and RWAs provide immense opportunities for expanding Web3 into the mainstream, something to consider is that the average consumer doesn’t really care that much about finance. They may not use many financial services or care about the technical nuances of how financial products are settled on the backend. At the end of the day, they just want to engage in commerce, such as using their credit card to purchase some groceries. If the primary pitch of Web3 is based on hyper-financialization, then a large segment of the total addressable market will be missed entirely.

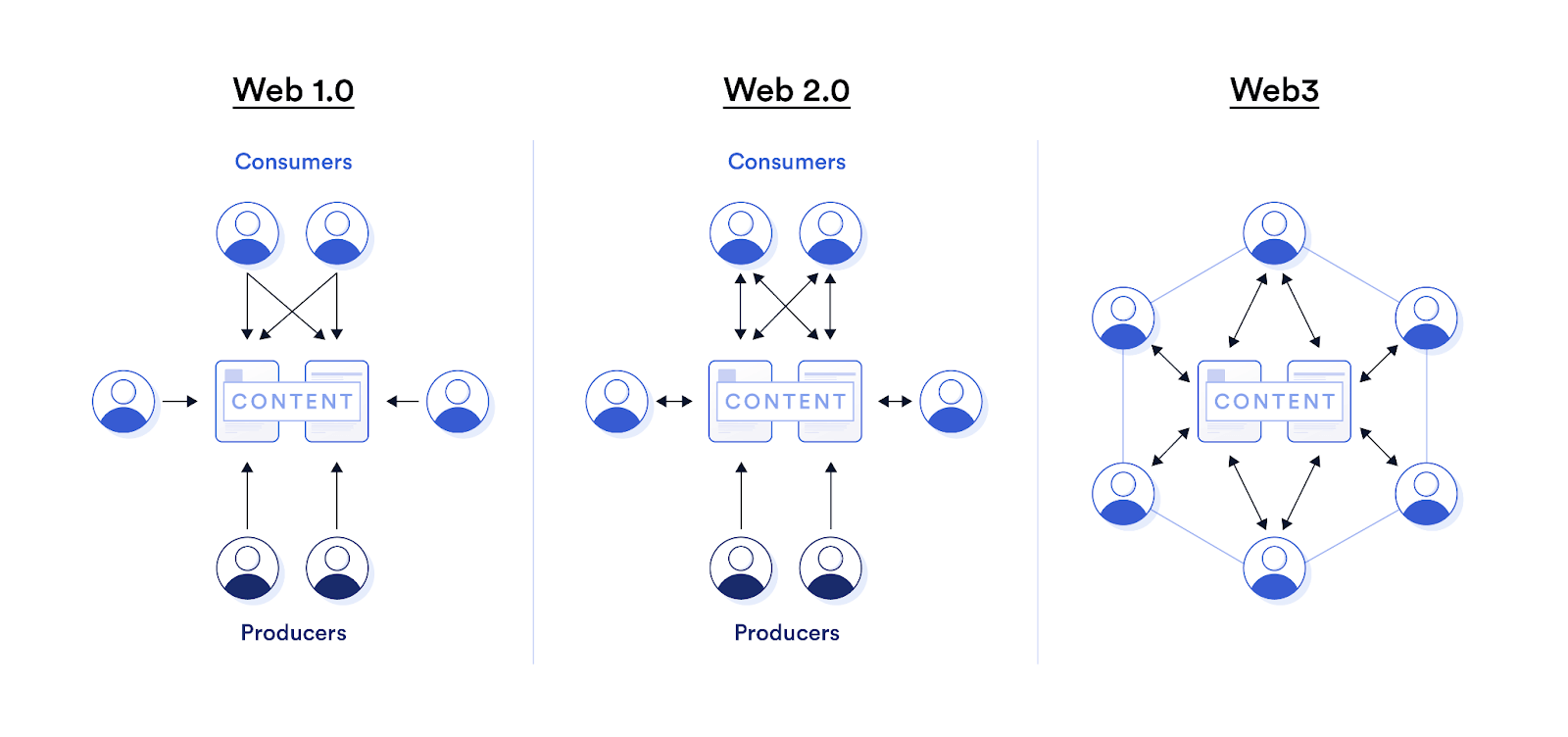

This is where much of the confusion regarding Web3 is derived. If Web3 is a “decentralized version of the existing Internet,” where are all the typical Internet use cases we’re used to? What about messaging, social media, video streaming, online commerce, or the blog you’re reading right now?

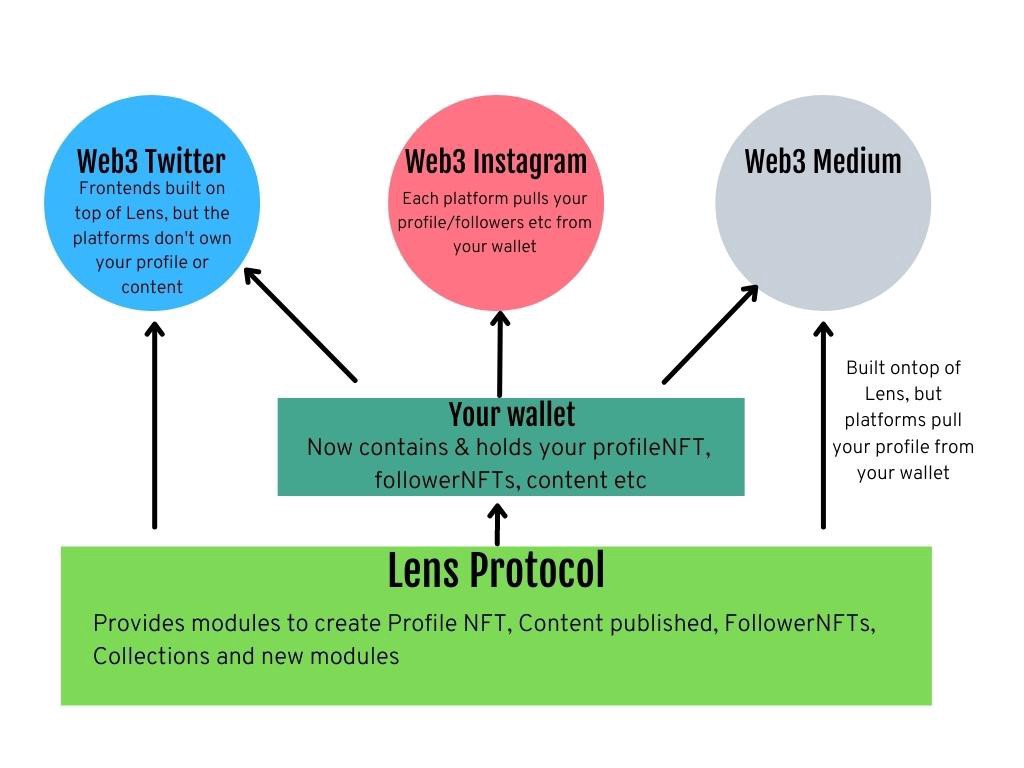

Non-financial use cases of Web3 are still in their nascent stages, but some clear use cases are appearing. For example, a Web3 implementation of a social media platform can take the form of a decentralized protocol where users are able to truly own their own online profile, including all of the content they’ve produced and their following/follower social graphs. Their profiles can then be ported across a variety of frontend interfaces with different content moderation policies.

Lens Protocol by Aave is one example of a decentralized social graph protocol that is aiming to achieve exactly this. With interactions stored on the Polygon PoS blockchain, a user’s social graph can be ported across applications. The ability to own your own social identity is a powerful Web3 primitive that can directly address concerns with existing platforms that feature manipulative content selection algorithms and oppressive de-platforming tactics.

Decentralized social media may or may not be the definitive killer non-financial Web3 application. Instead, it could be the creator economy, gaming, the metaverse, DAOs, or any other number of use cases. What is clear, however, is that we must expand our industry beyond pure hyper-financialization.

4. User-Experience Landmines

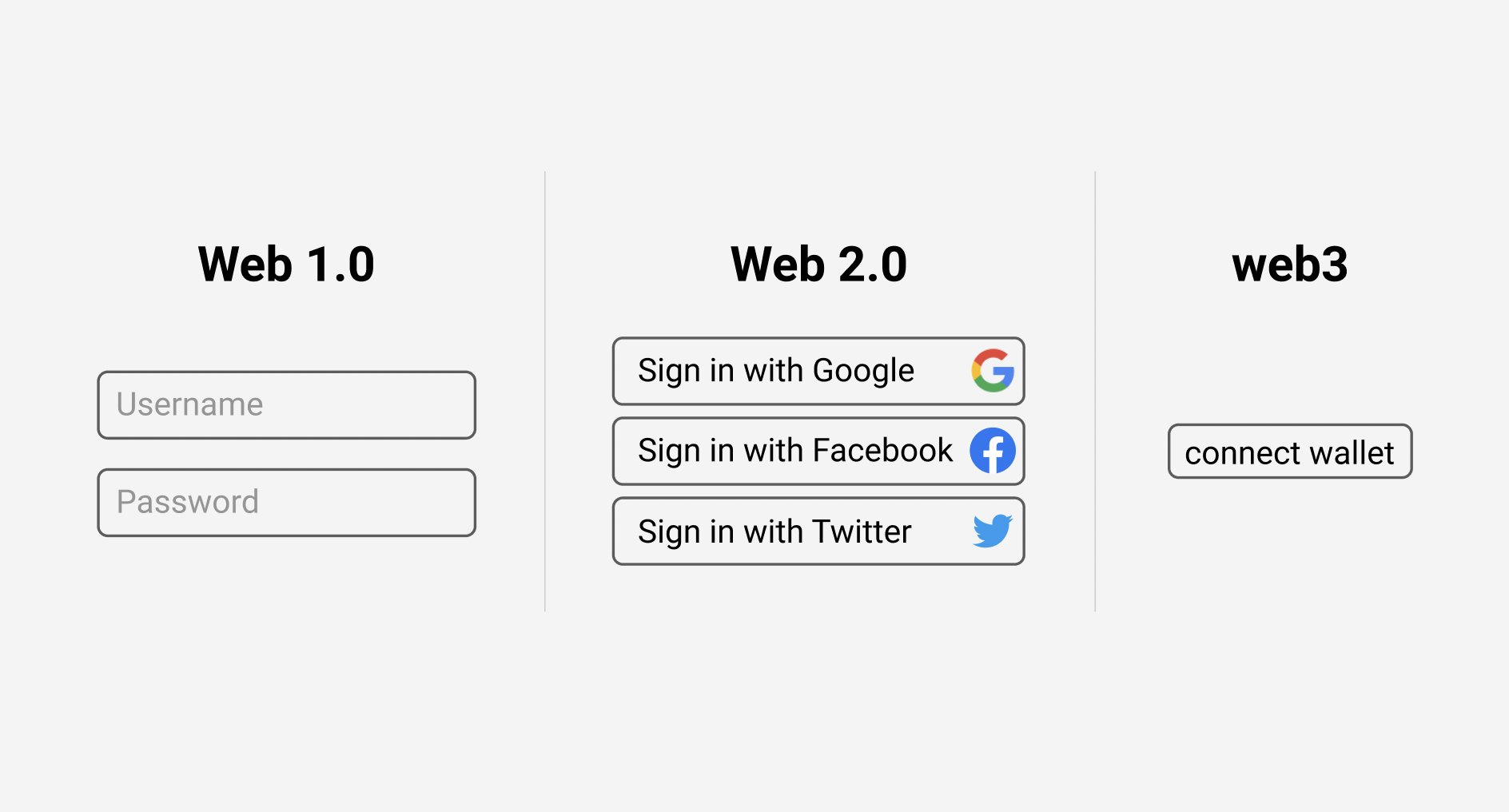

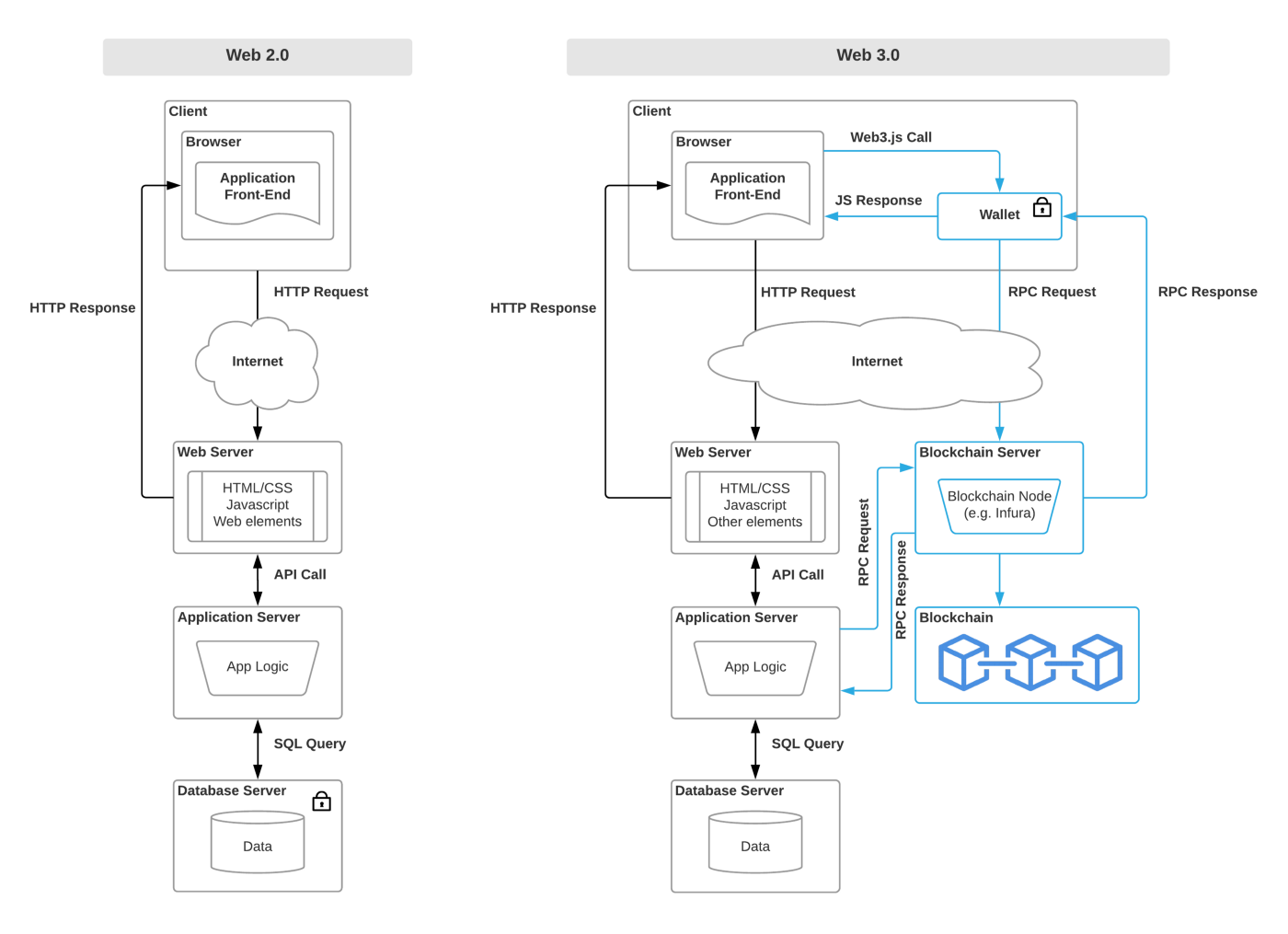

From a theoretical perspective, Web3 provides a far superior user experience (UX) over the status quo of the Internet. Rather than having to manage a plethora of unique usernames and passwords for each website or entrusting a centralized service provider, Web3 enables users to authenticate themselves via a single private key that can be universally used across any Web3-enabled application. Not only can this vastly simplify the user experience, but users can truly own their data and directly access applications without approval from centralized middlemen.

When it works, it works really well.

However, that’s only “When it works”. In practice, users have to navigate different non-compatible authentication standards, manually handle private keys and seed phrases, download and learn how to use new browser extensions or mobile wallets, and adapt all of this to conform to different blockchains with their own set of standards. The result is often frustration and confusion.

Seed phrases? ChainIDs? Gas prices? Token approvals? Reverted transactions? Finalization? These are all fairly esoteric and highly technical concepts that a Web3-native user needs to understand if they want to interact with an on-chain Web3 application today. Even once these concepts are well understood, interacting with Web3 apps often feels like walking on eggshells in the hopes that something in the interaction flow (hardware wallet -> Web3 extension -> frontend website -> RPC node -> blockchain) doesn’t break.

The poor UX of Web3 today is not the fault of any particular project or protocol. There are many ongoing efforts to unify the experience. However, it cannot be denied that the user experience of Web3 today is less than optimal. Secure private key management is also a serious responsibility, something which consumers have little to no parallel to in the Web2 world. Unfortunately, it doesn’t help that there’s no “reset password” equivalent if access to your seed phrase is lost.

With interfaces like the one below so common in Web3, it’s no wonder why the dropoff for new users is so high.

Overcoming this UX hurdle requires a first-principles approach of minimizing the technical nuances and risks that users are exposed to. I believe this will ultimately result in the creation of Web3 “super apps” that abstract away the various complexities inherent to Web3 infrastructure and present users only with what they need to see in order to interact in the Web3 world. Coinbase and Robinhood are just two examples of consumer-facing organizations leveraging their experience to create frictionless Web3 wallets.

In particular, Coinbase integrated a Web3 browser built directly into its main mobile app. The browser uses secure multi-party computation (MPC) to enable private keys to be generated in a distributed manner. The result is a “semi-custodial” wallet system in which a user’s private key is split across three entities, and any two portions are required to sign off on a transaction. With the user and Coinbase each holding one portion of the key, the third portion can be held as a backup in a cold-storage solution or with a trusted third party. If a user loses access to their device (and therefore their portion of the key), a recovery mechanism can be employed to regain access to the wallet.

While not as trust-minimized as a pure self-custodial solution, this type of compromise significantly improves the user experience and can be a safer solution for many users prone to accidental key loss. Other solutions, such as social recovery, also present a viable path to creating the type of UX that users are already accustomed to within the Web2 world.

5. The Dial-Up Era of Web3 Throughput

One of the most commonly referenced limitations of Web3 today is the limited scalability and high latency of widely adopted public blockchains. As I discussed in a previous blog post about the true trust model of blockchains, scalability is commonly thought of as being equivalent to increasing transaction throughput. However, a more holistic interpretation of scalability is increasing transaction throughput while maintaining a low verification cost of the blockchain’s ledger. Higher-throughput blockchains do exist, but there is still a ceiling to their transaction throughput and they often come with trade-offs in terms of decentralization, security, or reliability.

As Vitalik Buterin once said, “The Internet of money should not cost five cents per transaction.” Given the gas costs of using Ethereum over the past few years, this is a little ironic, but most people would generally agree that it is a valid statement. Even with clear tangible use cases and an improved UX, the next billion users cannot be onboarded into Web3 if transactions take eons to finalize and cost an arm and a leg.

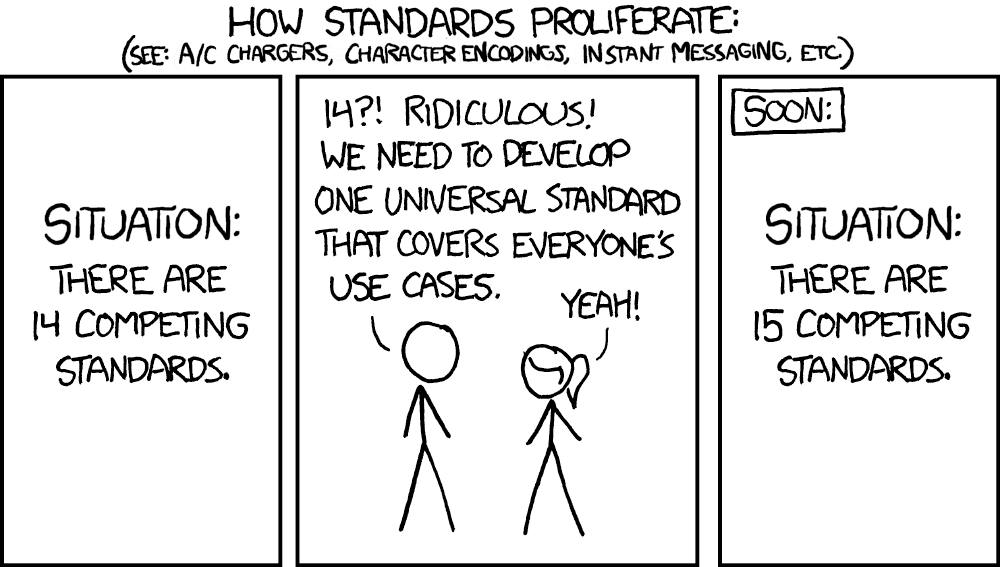

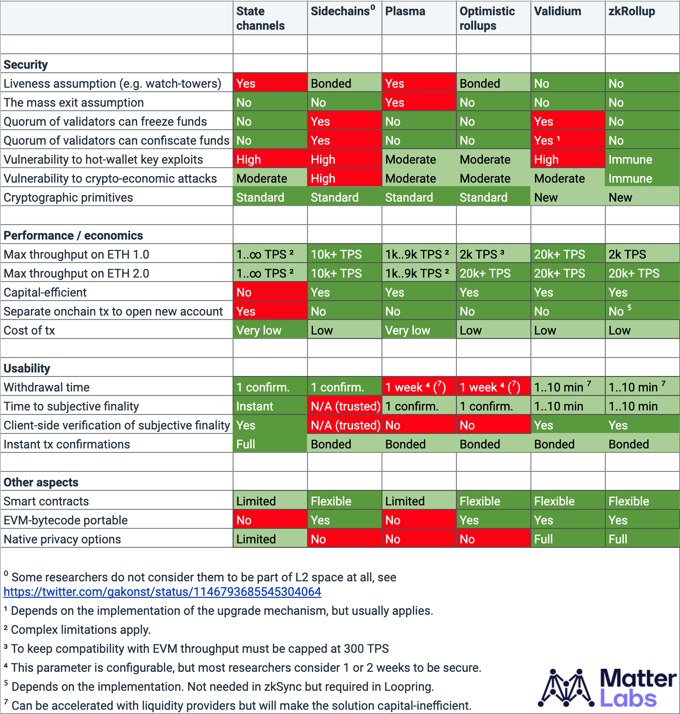

Since this is one of the more obvious roadblocks to Web3 mass adoption, many blockchains are hyper-focused on improving scalability, whether through parallelized compute, modular rollups, sidechain clusters, or other methods. Many of these solutions are still in their infancy, but I have high confidence that scalability is a technical challenge that can and will largely be overcome in the next few years. What is more unclear is what a highly scalable Web3 ecosystem might look like: a multi-chain world of independent L1s/sidechains, a multi-rollup world of layer-2 solutions, or high-throughput server-farm layer-1 blockchains? Maybe all three will coexist?

6. The Elephant In The Room

When discussing the roadblocks facing Web3, one must also address the elephant in the room: A lack of clear legal frameworks and guidance regarding crypto-assets, decentralized applications, and decentralized organizations is limiting the ability of Web3 to reach global scale. As with any new technology that radically disrupts existing industries, growing pains are inevitable, but not everything can be completely solved solely by technical means.

Without clear legal frameworks or policy guidelines, traditional institutions and organizations do not have the clarity they are used to and desire in order to feel comfortable engaging with and deploying resources into the Web3 ecosystem. Once such frameworks and guidelines are in place—achieved via industry collaboration to avoid stifling innovation—it’s far more likely that institutions and organizations will really begin their plunge into Web3 as service providers or Web3 gateways for their existing client bases.

To be clear, I am not advocating for any particular legal framework or policy guideline, but rather acknowledging the reality that Web3 mass adoption is largely tied to clear and reasonable guidance being in place. What form this will take is dependent on a large number of variables. Stifling innovation is not a viable or positive outcome for the Web3 ecosystem, but Web3 being perceived as a “wild west” environment is not conducive for long-term growth either.

Looking Ahead

Web3 represents a paradigm shift in the trust properties of applications, shifting power away from centralized intermediaries and towards deterministic and transparent software. But as with any innovative new technology, there are various roadblocks that must first be overcome before global adoption can be achieved. While there are many more bottlenecks facing mass Web3 adoption than was laid out in this blog, by addressing these aforementioned challenges head-on, Web3 will be better positioned than ever to scale its benefits across many aspects of society.

—

The opinions expressed within this post are solely the author’s and do not reflect the opinions and beliefs of the Chainlink Foundation or Chainlink Labs.