The Chainlink Network in 2023

Firstly, we’d like to once again thank our community for their continued interest in, and support of our work, as well as the many developers, node operators, partners, and data providers who have all actively devoted their time and effort to helping build Chainlink into the critical Web3 infrastructure it is today. Thank you.

Over the past year, Chainlink’s secure and reliable infrastructure supported the Web3 ecosystem through periods of rapid growth and industry-defining challenges, ranging from the continued adoption of DeFi as an alternative global financial system to the collapse of once-trusted crypto platforms. I think we should all be very proud that this critical infrastructure has withstood these various challenges and continued to operate as expected, keeping DeFi and the entire blockchain industry safe by securely enabling tens of trillions of dollars in onchain transaction value.

One of my favorite quotes from Seneca has always been: “A gem cannot be polished without friction, nor a man perfected without trials.” The unique technical and economic challenges the blockchain industry has presented over the past year have only served to harden Chainlink into the most secure, reliable, and connected infrastructure for DeFi and many other verticals underpinned by trust-minimized applications. I am also happy to say that the Chainlink Network is continuing to experience many key network effects, is becoming more reliable/secure by the day, and is therefore even more able to overcome the challenges to come.

I strongly believe that the demand for cryptographic truth and cryptographic guarantees in general is greater than ever. I also strongly believe that as the world becomes less predictable (global economic crisis/inflation), less reliable (increased downtime, leaks, and cyber attacks), and less safe for users to rely solely on unverifiable trust (insolvent centralized exchanges), the demand for the cryptographic truth/guarantees generated by Chainlink will continually increase. The recent mass adoption of proof of reserves is one clear example of how rapidly our industry and even the larger global economy can switch from being comfortable with the unverifiable promises of a well-known brand (e.g. FTX), to requiring a form of cryptographic truth (e.g. verifiable proof of reserves) as the new minimum for using an application at all.

This recent transition to cryptographic truth in the form of proof of reserves is just one small example of how trust-minimized applications backed by cryptographic truth are the future of how both our industry and the larger global economy will work. This trend is why Chainlink has continued to see rapid adoption among leading smart contract teams and top global enterprises, all of which are leveraging Chainlink to meet the growing demand for trust-minimized applications, as explained in more detail during this recent SmartCon 2022 presentation:

Below are some of the most significant milestones showing the community’s massive progress building Chainlink in 2022, as well as an outlook on key markets and innovations that the Chainlink Network is well-positioned to enable in 2023 and beyond.

Network and Community Milestones

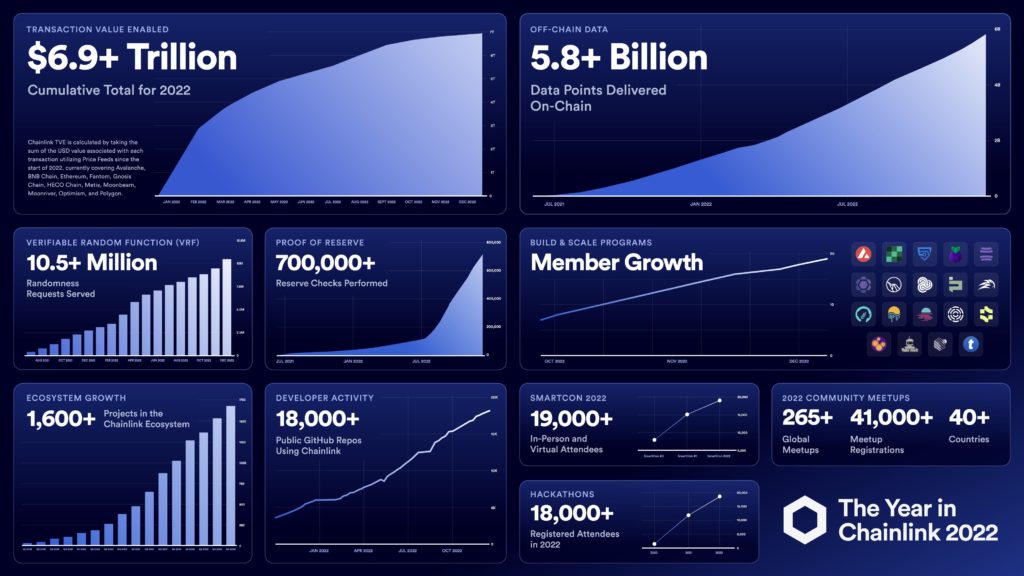

- Tens of trillions in Transaction Value Enabled (TVE). TVE is the sum of the USD value of all transactions enabled by a protocol. TVE is an advanced flow metric that provides insight into Chainlink’s role as key Web3 infrastructure, now with over 1,000 oracle networks launched and natively supporting more than a dozen major blockchains.

- 5.8+ billion data points delivered on-chain. Cumulatively, Chainlink Data Feeds have delivered billions of data points to on-chain reference contracts, helping fuel dApp innovation across multiple blockchains and layer-2 environments.

- 700,000+ verifications of off-chain and cross-chain reserves. Chainlink Proof of Reserve is providing much-needed transparency around the reserves backing stablecoins, wrapped tokens, and other digital assets.

- 1,600+ projects in the Chainlink ecosystem. The Chainlink ecosystem is now one of the largest ecosystems in Web3, with projects in categories as wide-ranging as DeFi, NFTs, gaming, and insurance integrating Chainlink oracle services for secure off-chain data, proof of reserves, randomness, automation, and more.

- 1,000+ oracle networks launched. Chainlink’s vast network of networks continues to expand to support new asset categories, including cryptocurrencies, commodities, FX rates, and, more recently, NFT floor prices with the mainnet launch of Chainlink NFT Floor Pricing Feeds, supported by Coinbase Cloud.

- 10.5+ million randomness requests served. Chainlink VRF has established itself as a foundational tool for the blockchain gaming and NFT space, powering provably fair experiences across hundreds of applications.

- 18,000+ public GitHub repositories using Chainlink. Developer adoption and activity are on the rise, with a growing number of GitHub repositories referencing one or more Chainlink services. Chainlink hackathons have played a significant role in onboarding and accelerating the progress of Web3 developers, bringing in tens of thousands of registrants in 2022.

- 19,000+ SmartCon 2022 attendees (in-person and virtual). The Chainlink community connected across more than 40 countries this year and converged on NYC in September for the first-ever in-person SmartCon, which brought together industry luminaries and thousands of attendees from around the world to discover the latest breakthroughs in Web3.

Chainlink Economics 2.0

The Launch of Staking v0.1

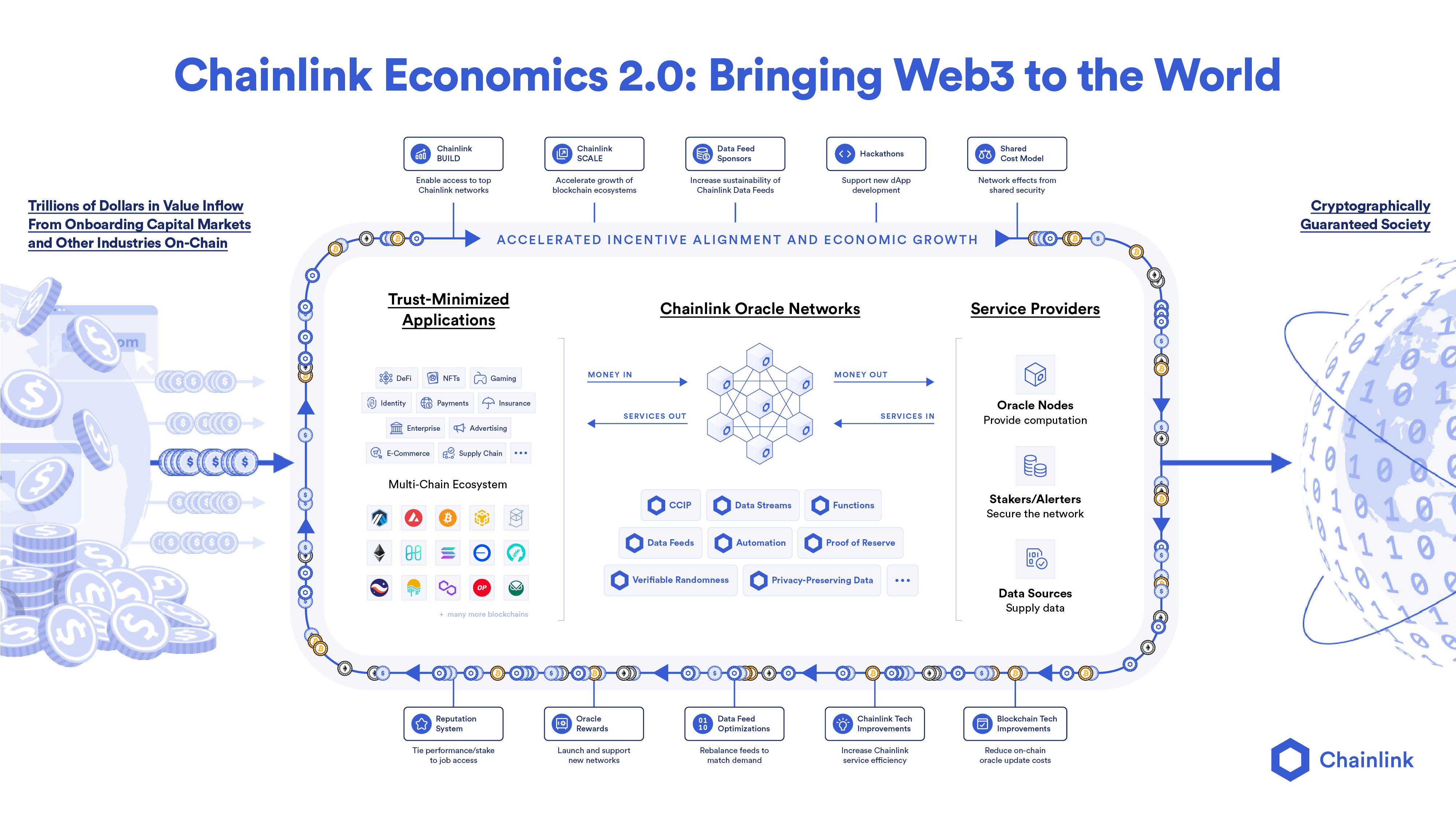

Chainlink Economics 2.0 is the beginning of a new era in increased oracle security, sustainable value capture, and long-term adoption for the Chainlink Network. Economics 2.0 consists of an array of initiatives, including the Chainlink Build Program, the Chainlink Scale Program, and most notably, Chainlink Staking. The initial v0.1 implementation of Chainlink Staking launched on Ethereum mainnet on December 6, enabling the community to put their LINK to work to help secure the Chainlink Network and the broader Web3 ecosystem.

The initial Community allotment of 22.5M LINK was filled within three hours of General Access launch, with stakers committing over 8M LINK to the protocol in the first 45 minutes after it opened. The launch of staking was a pivotal moment for the network, and its continued rollout will help drive a virtuous cycle of innovation and adoption for Chainlink and Web3 at large.

Expanding the Chainlink Network Monetization Model

Beyond Chainlink Build, Scale, and Staking, a new Economics 2.0 initiative is the expansion of the Chainlink Network monetization model. This may encompass fee-sharing, usage-based fees, or subscription models for dApps and protocols that use Chainlink services. Additional structures may also be explored in the future as the Chainlink ecosystem evolves to expand the value capture opportunities for Chainlink service providers. Establishing a compelling monetization model for Chainlink oracle services will help meet the Web3 ecosystem’s need for strong oracle security while also supporting the long-term sustainability of the Chainlink Network.

Chainlink currently powers hundreds of leading dApps that generate a significant portion of DeFi revenue. Moreover, the Chainlink ecosystem is now in a place where it can provide oracle services with greater security, speed, and quality in exchange for dApps paying more for such services. Ultimately, an expanded monetization model enables Chainlinked dApps and protocols to differentiate themselves in the competitive Web3 landscape through advanced oracle properties and prioritized access to new oracle technology. This model aims to align the success of participating dApps with the Chainlink Network’s economics and will represent a significant expansion of economic opportunity in the Chainlink Network. Combined with the continuation of Chainlink Build—an Economics 2.0 initiative where projects commit multiple percentage points of their total token supply as fees—service providers in the Chainlink ecosystem, such as stakers, can contribute to and benefit from the expansion of Web3 that’s underpinned by Chainlink.

As Chainlink Staking expands to support a greater scope of Data Feeds and oracle services, and Chainlinked dApps and protocols generate greater amounts of fees, a portion of the fees paid into the Chainlink ecosystem will go to service providers, such as LINK stakers, for helping secure those oracle services.

Enhancing the Chainlink Network Payment Model

In order to support an expanded monetization model, we are in the process of architecting an enhanced payment model across Chainlink services. The goal of this initiative is to make payment significantly easier for dApps and developers that consume Chainlink services, resulting in users paying more fees to Chainlink service providers. To minimize friction in collecting fees, payments can be made in LINK, or in certain cases, in other assets, including native tokens, at a higher rate compared to LINK payments. Payments in other assets can then be converted into LINK, resulting in a total increase in LINK consumption. This improved and low-friction payment model will ideally result in larger amounts of total user fees being paid to Chainlink service providers over time, including LINK stakers once user fee rewards for Chainlink Staking is implemented. While this economic model is still being developed, the vision is a Chainlink economy of cross-ecosystem alignment that drives deeper value capture for service providers, increased utility and cryptoeconomic security for dApps, and long-term sustainability for the Chainlink Network as a whole.

Exploring Market Demand for 2023

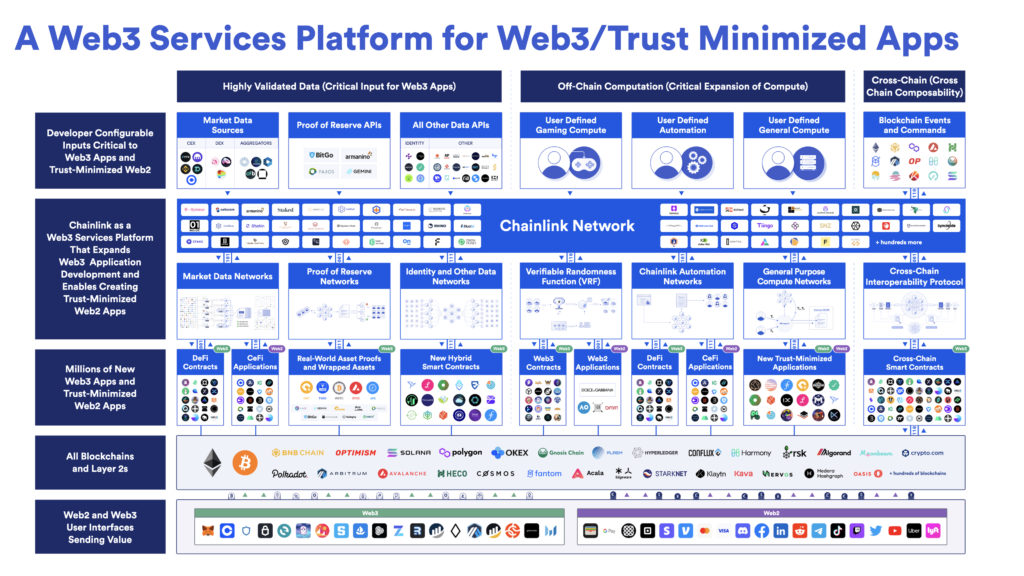

Beyond the network, community, and cryptoeconomic milestones above, Chainlink has made significant progress in expanding its oracle infrastructure to enable new on-chain markets. There are three main categories of activity that we remain highly active and interested in:

- Moving information/market data and commands/event messages from traditional systems into blockchains, effectively making Chainlink a key conduit for all commands and information both to and from all blockchains.

- Connecting all blockchains into a large interoperable network for both value transfer and smart contract interoperability. Developers should be able to connect smart contracts across multiple chains, just like they connect code across multiple clouds.

- Adding key off-chain computations that make advanced trust-minimized applications possible. Existing examples are VRF, Chainlink Automation, and zero-knowledge proofs with DECO, with many additional types of computation being worked on.

The first two priorities focus on making Chainlink into the system that moves all key information and value into, out of, and across blockchain ecosystems. There are large network effects already well underway here, with each additional integrated data source or chain making Chainlink more attractive to everyone else considering integrating. Having an easy way for developers to utilize multiple blockchains also accelerates blockchain adoption in various key industries (e.g. Banking), which then adds their value and economic activity to the blockchain industry.

The third priority continues the expansion of Chainlink into the sphere of a general-purpose trust-minimized computing environment, which does all the computations that trust-minimized applications need but cannot receive from blockchains/L2s. This third category is a large universe of increasingly important computations that preserve privacy using our zero-knowledge proof technology, increase scalability, and provide entirely new capabilities for developers.

Below are some good examples of how these priorities will create a real impact on our industry, with more to come as we learn what the market has demand for and adjust our plans to meet that demand.

Real-World Asset Tokenization and Cross-Chain Connectivity

With the growing demand for financial transparency and trust-minimization, more and more end users are moving into the blockchain economy and migrating their assets on-chain. Digitized and programmable assets not only provide greater transparency and guarantees but also increased accessibility and utility: Programmable assets can generate rewards, serve as collateral, integrate into play-to-earn games, support derivative products, and more.

As the connection point between traditional systems and blockchain systems, Chainlink holds a key position in this tokenization mega-trend. Global financial infrastructure providers are actively exploring Chainlink as an abstraction layer for accessing the blockchain economy. At SmartCon 2022, large enterprises showcased their collaboration with Chainlink, including the announcement of a proof of concept that enables widely used messages to instruct on-chain digital asset transfers via the Cross-Chain Interoperability Protocol (CCIP).

Various alpha partners, including Synthetix and others, have been involved in the initial prototyping and testing of CCIP. The protocol will have a phased launch process extending into 2023, including a series of ongoing quality assurance procedures such as penetration testing, soak testing, and multiple internal and external audits. These procedures help ensure the production version of CCIP meets the unique and complex demands of the cross-chain economy, which in 2022 saw more than \$100B in funds transferred across bridges and over \$2.5B in bridge hacks.

We know many have been eagerly anticipating the launch of CCIP. Security is our number one priority for CCIP, as it is for every Chainlink launch. We appreciate your patience and understanding and look forward to releasing CCIP in 2023 in a state that meets the functional and security demands of the growing cross-chain economy.

Proof of Reserves

As more value flows on-chain and into hybrid on-chain/off-chain applications, we’ve seen increasing demand for proof of reserves. The collapse of FTX made our ecosystem’s need for asset transparency abundantly clear. Chainlink Proof of Reserve currently provides proof of collateralization around DeFi assets and has been adopted by leading stablecoins, wrapped tokens (WBTC, eFIL), and blockchain bridges for secure minting (Aave on Avalanche). Chainlink Proof of Reserve is a key enabler of real-world asset tokenization, powering more on-chain commerce by enhancing transparency around the fiat collateral backing stablecoins (GBPT) and the physical reserves backing tokenized gold.

More assets moving on-chain and cross-chain with the security assurances of CCIP and Chainlink Proof of Reserve ultimately paves the way for Web3 developers to build new products and use cases based on these new programmable asset classes.

DeFi Derivatives and Low-Latency Data

Once assets are represented on-chain, their utility vastly increases through derivatives. A technical challenge facing the DeFi derivatives market today is the need for secure and low-latency market data. On-chain derivatives protocols require low-latency data to support high-speed trade execution and mitigate malicious Maximal Extractable Value (MEV) techniques such as frontrunning. An ultra-low-latency pull-based Chainlink oracle solution is currently being developed to help the DeFi economy overcome this challenge. This next generation of oracle architecture can reduce update latency by multiple orders of magnitude while also significantly reducing oracle network operating costs by moving the gas costs of publishing oracle reports on-chain to users and helping protect against harmful MEV practices. The DeFi derivatives market will increasingly be an area of focus as we move into 2023.

Furthermore, pull-based oracles present a path toward a more agile approach for Chainlink to support additional blockchains, allowing for more lightweight integrations compared to a full Data Feed deployment. We’ll continue to evaluate our assumptions on this approach to scaling the Chainlink Network as the multi-chain ecosystem evolves.

Expanding Trust-Minimized Off-Chain Computation

Beyond secure data delivery and connectivity, trust-minimized off-chain computation is one of Chainlink’s most powerful features. We’re continually impressed by how Web3 builders are composing various Chainlink services and configuring new oracle computations to unlock innovative, hybrid applications that power DeFi, dynamic NFTs, and other on-chain markets. Enabling developers to fully explore the vast smart contract design space is core to the vision of Chainlink as a Web3 services platform that unlocks the full potential of Web3.

In 2023, we plan to further expand Chainlink’s trust-minimized off-chain compute capabilities, specifically by improving Any API and empowering developers to customize the sourcing, computing, consensus, and delivery of off-chain resources via Chainlink DONs. This functionality will unlock a wide range of use cases, as developers will have the flexibility to independently define how Chainlink oracles trigger executions, run computations, and deliver outputs from their dApps without needing to spin up their own oracles. We already have multiple leading dApps using Chainlink oracle networks for both data and computation, with more and more existing data users seeking to solve their trust-minimized off-chain computation needs with the help of an oracle network.

Providing developers with a self-service platform for seamlessly bringing additional datasets on-chain and running new off-chain computations to meet their unique needs is key to bringing the industries of today into the emerging Web3 economy.

Adaptability Is Key to Chainlink’s Long-Term Success

As this past year has shown us, Web3 is a uniquely fast-moving industry that calls for regular adaptation to shifting market realities and evolving user needs. This ability to adapt is a skill that the Chainlink ecosystem has successfully developed and should continue to embrace.

We are building a new technology that will have an increasingly important effect on how an Internet-based society operates: cryptographic truth/guarantees as the new minimum standard for the majority of digital transactions and relationships—an \$867+ trillion market. Realizing this shift in how society works will require continual adaptation and the challenging of previous assumptions to consistently deliver the best product-market fit.

Great technologies are built through their ability to adapt to reality, which will require changes in direction based on what market realities and user needs have shifted towards. For example, we’ve already seen these shifts towards market data vs. other types of data with DeFi, along with the need to occasionally reprioritize key features that have grown in demand and therefore merit greater attention (e.g. CCIP), which will also mean the slowdown of features that decrease in demand (e.g. trusted hardware). This adaptability is essential when quickly building a complex system that seeks to service rapidly evolving user demands. We are working towards creating additional clarity on how and why certain initiatives and services are being prioritized and look forward to working with the community to make Chainlink the critical Web3 infrastructure that will continue to create a world powered by truth.

I’m deeply grateful to everyone in our community who understands what we are seeking to achieve by enabling a new era of cryptographic truth. Thank you for productively working with us to create this significant change in how the world will work.

To learn more about Chainlink and keep up-to-date with the Chainlink ecosystem, subscribe to the Chainlink newsletter and follow the official Chainlink Twitter.

—

Disclaimer: This post is for informational purposes only and contains statements about the future, including anticipated programs, products and features, developments, and timelines for the rollout of these new products and features. These statements are only predictions and reflect current beliefs and expectations with respect to future events; they are based on assumptions and are subject to risk, uncertainties, and change at any time. There can be no guarantee that any of the contemplated programs, products or features will be implemented as specified or at all nor any assurance that actual results will not differ materially from those expressed in these statements, although we believe them to be based on reasonable assumptions. All statements are valid only as of the date first posted and we may not update this post in response.