Solving Deep-Seated Trust Problems in Derivatives Using Chainlink-Enabled Smart Contracts

Thank you to Daniel Goodman of SwapChain.io for helping to review this article and for providing insights into the derivatives industry.

A derivative is a financial instrument that derives its value based on an underlying asset or entity. Derivatives are deeply ingrained across global industries and used to hedge operational risk, manage exposure to price movements, gain access to typically inaccessible assets or markets, and more.

Derivatives are the largest market in the world by notional value and estimated to be between $500 trillion to $1.2 quadrillion. It is a high stakes and deeply interconnected environment that requires substantial overhead to establish trust between counterparties and intensive regulation to avoid major imbalances that lead to systemic risk for the global financial system.

Chainlink-enabled smart contracts bring a paradigm shift to the derivatives market that is centered around low overhead trust, deterministic execution/settlement, and information parity between parties. These new derivative smart contracts can not only help prevent a global catastrophe, but also enhance derivatives’ operational functionality by improving multi-party efficiency through automation and increasing the market size through lower entry barriers and customizable options.

Understanding the Derivatives Market

The derivatives industry is split into two categories: exchange-traded derivatives and over-the-counter (OTC) derivatives.

Exchange-traded derivatives are standard, regulated products sold on exchanges to companies or individuals. They are digitized into standard formats (buyer, seller, amount, etc.) and regulated by governmental organizations such as the Commodities Futures Trading Commission (CFTC) in the U.S. Exchange-traded derivatives currently make up about 15-25% of the total derivatives market. Some of the largest derivatives exchanges in the world include the CME Group, Eurex, and the Korea Exchange.

Most exchanges implement a central counterparty clearing house (CCP), which is made up of several clearing members (excluding the exchange, which is often a separate legal entity), all of which contribute capital to an insurance fund. The CCP conducts a process called trade novation in which the clearing house is inserted between every order crossed on an exchange. The CCP is the buyer to every seller and the seller to every buyer, or more specifically for derivatives, the short to every long and the long to every short.

OTC derivatives are products negotiated between two or more parties with customizable terms mutually agreed upon without the need for an exchange. Unlike exchange-traded derivatives, OTC derivatives are usually not digitized into standard formats, but rather stored as PDF paper contracts in both parties’ databases. OTC markets make up roughly 75-85% of the total derivatives market and are not available to retail investors. Instead, the OTC market is mostly comprised of large banks and sophisticated parties like hedge funds that make deals with one another.

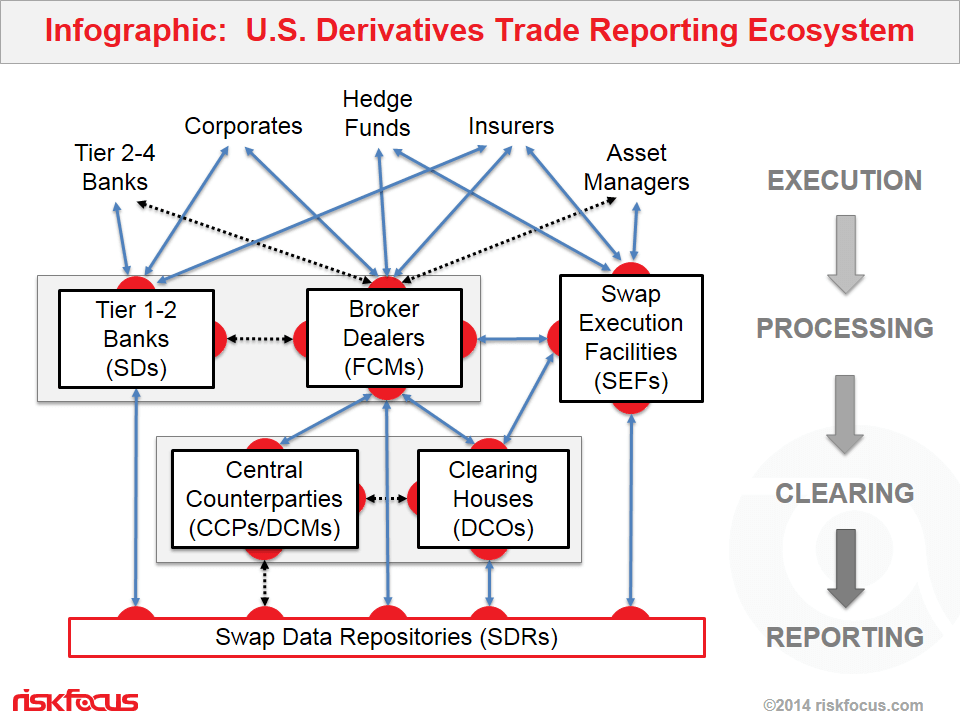

While the OTC market is technically not regulated, most major OTC participants are members of the International Swaps and Derivatives Association (ISDA), a trade organization that created a standard contract called the ISDA Master Agreement. The ISDA Master Agreement is used by 820 members in 57 countries as “the standard contract used to govern all over-the-counter (OTC) derivatives transactions entered into between the parties.” Additional regulatory and standardization changes were made as a result of the 2008 Financial Crisis, specifically Dodd-Frank which mandated that interest rate swaps and credit default swaps (which make up a large percentage of the OTC market) be cleared by a central counterparty and that trades be reported to global repositories.

Virtually anything of value can be used as underlying in the construction of a derivatives product including assets, data points, or even events. The most popular underlying includes fixed income, foreign exchange, credit, equities, and commodities. There are many types of derivatives products that can be created using these underlying values. According to the Bank for International Settlements (BIS), the four most common ones are forwards/futures, options, and swaps.

- Forwards/Futures – A forward is a non-standardized contract (OTC) between two parties that allows one party to buy an asset on a particular date at a specified price in the future. A futures contract is very similar to a forward, but is standardized and offered on an exchange by a clearing house instead of written specifically by the two parties, as with a forward.Example: A food processing company wants to hedge against the price of wheat rising, so they negotiate a futures contract with another party that allows them to purchase 100 tons of wheat six months from now at the current price of $200 per metric ton.

- Options – An options contract is a financial agreement between a buyer and seller that gives the purchaser, for a premium, the option to buy an asset at a particular price before its agreed-upon maturity date. Instead of being forced to purchase the asset by a particular date, as with a futures contract, the purchaser instead buys the option to do so.Example: An investment bank wants to hedge against the U.S. dollar rising in relation to the Euro, so they purchase an options contract for a premium that gives them the option to convert USD to Euros at a fixed rate of 1 USD to .90 Euro over the next two years.

- Swap – A swap is a contract between two parties that allows them to exchange cash flows of certain financial instruments such as bonds with particular interest rates. Swaps are financial instruments sold in OTC markets for businesses and not offered to retail investors on exchanges.Example: A new steel company with an unknown credit rating is paying 5% on an adjustable-rate loan, while a more established steel company is paying a 4% fixed rate. They can enter into a swap contract allowing them to swap interest rates for a specified amount of time. The new steel company could reduce exposure to interest rate fluctuations on their loan, while the established steel company could increase exposure to interest rate fluctuations under the assumption they could attain an interest rate lower than their fixed 4% over time.

An Industry In Need Of Trust

Due to the high-value and competitive nature of derivatives, there are several key risks that market participants must strongly consider — all stemming from the fundamental lack of trust between parties.

Counterparty Risk

In a multi-party agreement, the risk that the other party will not fulfill their contractual obligations is referred to as counterparty risk. In derivatives contracts, the risk of late payments or the other party walking away from an already agreed upon deal is all too common. The monetary value of these contracts can make or break a firm, so there’s a high incentive to delay payments in order to buy more time in the market to try and offset the unrealized loss. This is particularly a problem in certain OTC markets where there are weaker regulations, less standardization, and no central clearing house.

For example, during the 2008 Financial Crisis, many OTC dealers delayed payments to clients who shorted the housing market in order to establish similar positions to cover these liabilities. Delayed settlement can reduce payouts due to changes in underlying values between the agreed upon settlement and actual settlement date.

Avoiding payments can also be the result of negligence, as keeping track of all the various terms and conditions of millions of contracts with different counterparties, simultaneously across multiple networks and with 100% uptime, is extremely complex. When companies don’t receive in-full or on-time payments, it greatly affects capital flows, skews budget calculations, and results in extra time and money spent on litigating disputes.

Inefficiency

For exchange-traded derivatives, a CCP acts as a highly regulated, trusted intermediary between the two parties. They reduce the counterparty, operational, settlement, market, legal and default risks in the transaction by serving as the counterparty to both parties. They provide liquidity by acting as market makers and offer security by stepping in as an escrow custodial solution.

While there are huge benefits to CCPs, there are several downsides, particularly loss of customization (since CCPs only process standardized agreements), value leakage, payment delays, and systemic risk. Using a middleman like a CCP means paying that intermediary a commission that siphons value from the transaction. It also means additional steps in the process to protect against counterparty risk, which leads to delays in the transaction date and settlement date (usually at least two days). Finally, there’s undeniable systemic risk that comes from giving one entity such power and responsibility, especially in a market as large as derivatives. While CCPs have fallback measures to protect themselves, they are still subject to the same vulnerabilities that all centralized systems share, specifically hacks, bribery, and server downtime.

For OTC markets, enabling efficient multi-party workflows is especially challenging, given the plethora of intermediaries needed to enable trust and provide liquidity. This requires substantial overhead to facilitate due to a lack of standard formatting for digital contracts widely used across the market. As Scott O’Malia, Chief Executive of ISDA points out, “The current derivatives infrastructure is hugely inefficient and costly, and there’s virtually no way to implement scalable automated solutions across the industry. That’s because each firm and platform uses its own unique set of representations for events and processes, which requires continual reconciliation of data to ensure the parties to a trade have the same information.”

Information Asymmetry

Another major problem present in derivatives markets is information asymmetry — when one party in a transaction has better information than the counterparty. Information asymmetry often occurs between the two counterparties in the transaction. One of the parties may be an insider and seek OTC derivatives to profit from this advantageous information by gaining additional exposure to certain market conditions.

Information asymmetry may also occur between a buyer/seller and the CCP. A particular party involved may have better information on the default risk of a specific contract than does the CCP. This creates incentives to try and receive favorable rates on risky contracts, putting the CCP in a vulnerable situation. If too many high-risk contracts are taken on without proper due diligence, it creates systemic risk for the global economy, especially as the world becomes more interconnected.

On the contrary, CCPs have better information on global markets and systemic risk, which can be used by insiders to take advantage of market conditions. CCPs with patented technology and private ownership are potentially vulnerable to corruption and transaction front running by more “in the know” parties.

Lack of Transparency

One of the primary reasons for information asymmetry is the lack of transparency in derivatives markets. It’s very difficult to properly define the size and value of the derivatives market as a whole, especially when a portion of the OTC market is private and unregulated. With a massive web of interconnected derivative products running on disparate systems around the world, having reliable, objective, and holistic data is virtually impossible.

The lack of a single source of truth makes it difficult to price derivatives products, calculate counterparty risk, and evaluate systemic risk. Since accurate market information is hard to source, many parties go under because they overestimate or underestimate risk. This also results in many derivatives dealers being significantly overleveraged, whereas one bad outcome on a high-value contract can lead to a chain of defaults on other investments and across markets. While global repositories for reporting trades have already been introduced post Dodd-Frank, adequate regulation is still challenging without all-encompassing global standards for transactional metadata, especially from OTC markets.

Although Warren Buffet is open about making billions using derivative products, he also understands the extreme dangers they can inflict on society. He was quoted in Berkshire Hathaway’s 2002 annual letter as saying “In our view, however, derivatives are financial weapons of mass destruction, carrying dangers that, while now latent, are potentially lethal.”

Replacing the Backend Infrastructure of Derivatives Markets with Chainlink-Enabled Smart Contracts

Chainlink-enabled smart contracts offer upgraded infrastructure for the backend systems that currently maintain, execute, and settle derivatives contracts. It moves the market from one based on multiple trusted entities, manual maintenance, and probabilistic outcomes to one facilitated by trustless third-party protocols, data-driven automation, and deterministic outcomes.

A smart contract can digitally represent the operational clauses of a paper derivatives contract using boolean logic (if x happens, pay y). It holds funds in escrow as a custodian, executes the contract, keeps records of state changes, and redundantly stores the contract across the network with perfect uptime.

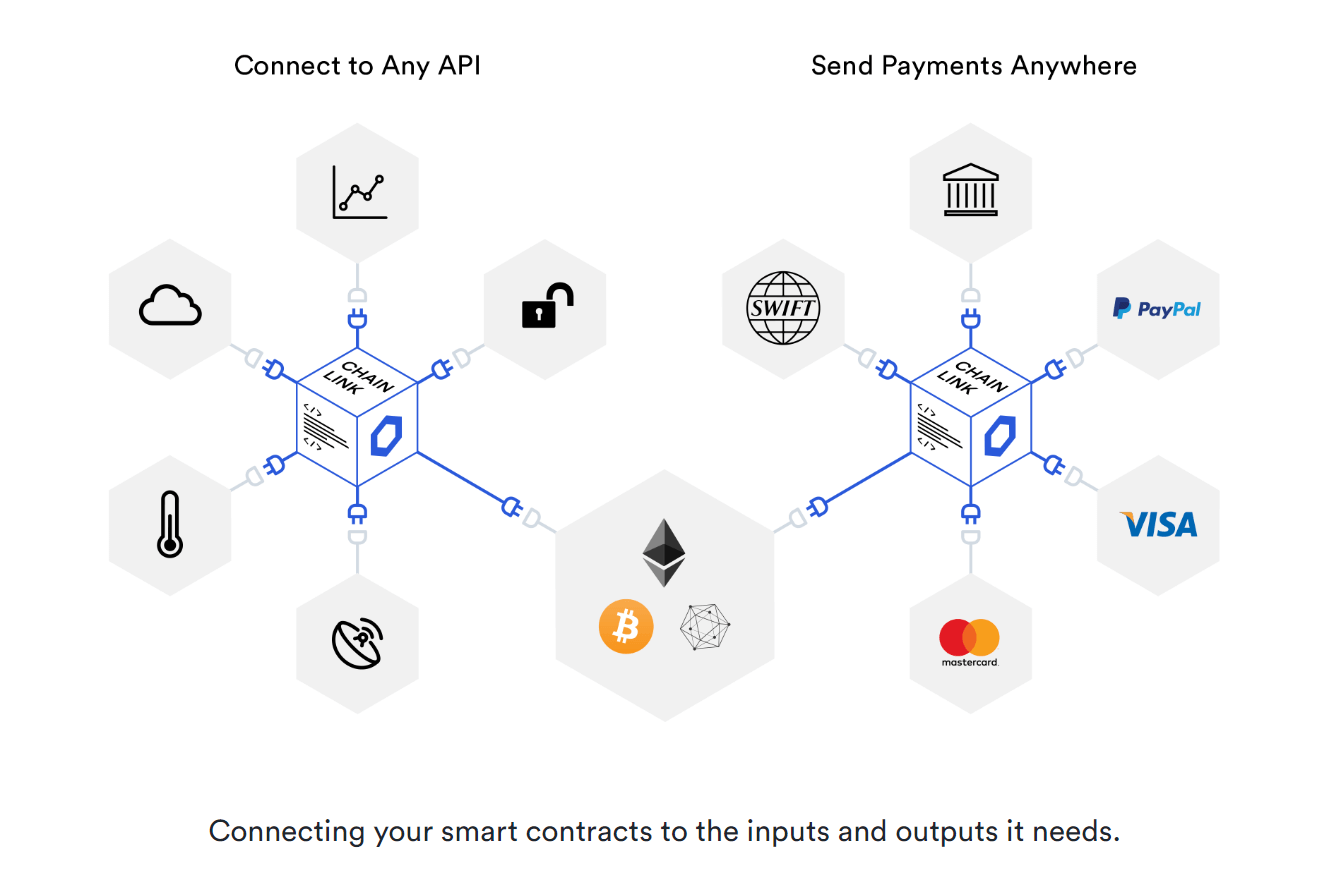

Chainlink oracles connect the smart contract to all the data inputs (x) and settlement outputs (y) it needs to function through the entire contract life cycle. They’re responsible for retrieving data about the underlying asset (market data) and connecting the smart contract to the necessary external systems needed for settlement (payment systems, regulatory compliance, audits, etc).

Chainlink stands out from competitors because it allows the smart contract to customize its external connection to inputs and outputs. One major in-demand feature only offered by Chainlink is decentralized oracles. Since smart contracts are auto-executing, decentralized oracles are vital for providing reliable and accurate information to high-value, time-sensitive contracts. Decentralization is imperative to mitigating centralized vulnerabilities that result in hacks, bribery, and server downtime. In a market as large and potentially destructive as derivatives, extra security measures should be taken to guarantee high-quality data inputs and outputs for automated digital contracts. The last scenario either party wants is for one contract triggered by faulty data to set off a chain of invalid contracts and halt financial markets.

Another essential feature for adoption is security, both from an operational and privacy perspective. Chainlink is open-source for anyone to verify and has passed multiple independent security audits. Parties can be assured it works as written and can modify or add features as they see fit. Chainlink also is developing methods of handling privacy by working on implementations that allow oracles to run in trusted execution environments (TEEs). This would enable smart contracts to connect any enterprise system, government agency, or counterparty to the contract without exposing their systems to risk or leaking their sensitive data.

Chainlink-enabled smart contracts offer many benefits not available using current derivatives infrastructure.

Reduce Counterparty Risk

By using smart contracts as opposed to manual paper contracts, OTC markets can adopt the advantages currently present in exchange-traded markets, specifically reduced counterparty risk. Since a tamper-proof smart contract holds collateral (debit or credit) from both sides in escrow, the contract will automatically trigger settlement once it receives the proper data via Chainlink oracles. Redundantly sourced data via multiple oracles and data sources backed by penalty payment collateral becomes the arbitrator of contract execution as opposed to waiting for the counterparty to manually act. The end-to-end execution of the contract becomes deterministic based on data triggers, which substantially diminishes delayed, reduced, or non-payments.

This is particularly effective in OTC markets in which there are no standard forms for deploying digital derivatives contracts. Many market participants understand the need for these digital standards, which is why in June 2018, ISDA released its first digital iteration of the Common Domain Model (CDM) for digitizing derivatives contracts. Additionally, several legal startups/consortiums such as OpenLaw and the Accord Project are creating standard templates for digitally representing derivatives contracts. Both startups have integrated Chainlink to receive trusted off-chain data for derivatives contracts.

Streamline Contracts

As Blythe Masters, former CEO of Digital Asset articulated in a talk with PwC, blockchain-based financial smart contracts are analogous to the shift that occurred in manufacturing, where instead of making cars one at a time, industrialization offered a conveyor belt approach where each person/robot did a specific task, allowing constant simultaneous production of cars. Blockchain-based smart contracts offer a similar conveyor belt infrastructure for all parties to add their relevant data to the blockchain to complete an entire financial transaction. This provides all participants with a single reference point for operational data, ridding the market of constant reconciliation between multiple parties that keep their own records. There are several high profile entities, such as ISDA, Google, and Digital Asset, aiming to create standard operational workflows to connect all the relevant parties in a transaction: counterparties, exchanges, data, auditors, regulators, etc.

Chainlink-enabled smart contracts also automate several processes that currently require intermediaries, particularly third-party execution and custodial solutions. This is not to say that services from CCPs, such as netting, market making, and even option custodial solutions, won’t be important or in-demand, but rather that they can be add-on features instead of mandatory. This should help eliminate value extraction from unnecessary intermediaries and alleviate some of the systemic risk associated with central clearing houses being responsible for maintaining the integrity and liquidity of entire derivatives markets. Cutting out intermediaries and streamlining multiple workflows using shared infrastructure should move the time between the transaction date and settlement date closer to real time.

Move Towards Information Parity

Transparency in derivatives is not just a problem in individual deals, but also for market data about the entire industry. While this exists to some extent already, such as with the Swap Data Repository, those repositories are slightly delayed in reporting and can provide slight information advantages to those that own the repositories. Having a standard method of extracting metadata from all derivatives transactions that is both open-source and decentralized moves the whole market closer to information parity, whereas it’s much harder to game counterparties based on superior knowledge.

Since blockchains seamlessly facilitate multi-party workflows based around a single source of objective truth, market information becomes much more reliable and attainable for all parties. By incorporating TEE based oracles, market participants could confidentially share market data with each other, research groups, regulators, or into a smart contract that aggregates it all into a single overview dataset about the market. This would give everyone a truly holistic perspective of the current financial climate of derivatives based on uniform transparency standards for metadata, without revealing any party’s identity, position, or trade secrets. It gives all parties a better understanding of the market size and overall leverage, as well as enables earlier warning signals about the health of economic markets.

Better information should prevent buyers from interacting with derivatives dealers that overleverage themselves, give regulators enhanced capabilities for lowering systemic risk, and reduce the ability for participants to cheat the system based on informational advantages. It ultimately curbs manipulation and helps markets find price equilibrium.

Lower Market Barriers

Normally closed off to institutional offerings, blockchain-based smart contracts are opening up the derivatives market to a whole new wave of startups, product offerings, and data providers. This movement towards smart derivatives is often lumped into the new field of decentralized finance (DeFi). Since any company can leverage a decentralized backend, many startups are creating protocols that model derivatives contracts through conditional logic, such as futures contracts, options contracts, and eventually swaps.

DeFi projects are dropping the barrier to entry for derivatives products, giving individuals and small businesses new financial tools. They’re also bringing to market new products, such as decentralized exchanges, decentralized liquidity, standardized bespoke contracts, and decentralized autonomous organizations (“DAOs”) that offer derivatives products and share in the profits. All these products are not just for traditional markets either, but also for on-chain markets, such as for derivatives based on cryptocurrency, utility tokens (gas fees), and tokenized assets.

Chainlink oracles are also enabling data providers to monetize their current datasets and API services for use in derivatives smart contracts. Market data from companies like Reuters and Bloomberg can be monetized, as well as new providers that offer novel ways of extracting valuable data not previously available to the market. Google is a recent example of an enterprise using Chainlink to monetize its new datasets that give insights into different blockchains. This data can now be sourced by a smart derivative contract by calling their BigQuery API using a Chainlink oracle (currently live on the Testnet).

There are a variety of other DeFi startups in the derivatives space that have recently announced their plans to use Chainlink oracles to access off-chain resources. These include Wanchain for financial transactions, Market Protocol for derivatives, bZx for margin trading, Olympus Labs for futures contracts, and Katallassos for building a standard framework for finance. Crypto exchange Synthetix, crypto payment solutions Mobilim and STK, and blockchain remittance solution ETHA all plan to leverage Chainlink oracles as well. Any DeFi project can leverage the 30+ Chainlink Price Reference Data Contracts live on the Ethereum mainnet. These reference data sets provide developers with access to high-quality pricing data on-chain from popular trading pairs and have been redundantly verified by the most decentralized and secure oracle networks.

Chainlink has also introduced Mixicles, a novel approach for bringing privacy to DeFi instruments on public blockchains. To enable privacy functionality, Mixicles split the smart contract into two separate parts, on-chain and off-chain, which are both directed by oracles. Incorporating Mixicles and/or Town Crier (Chainlink’s TEE based oracle), DeFi products can be built on public blockchains with the same privacy features awarded to them on private blockchains. This opens up the door for enterprise adoption of public DeFi products, given that they can now comply with data security laws.

The Road to Automated and Trustless Innovation

Derivatives are integral to today’s society, as companies need innovative ways to hedge against uncertain market conditions to remain competitive. It ultimately benefits consumers when companies are able to prevent unnecessary risk. However, there is a clear line between hedging individual risks and creating systemic risk through overleveraging and market manipulation.

Smart contracts offer a way to transform the derivatives landscape from one run on trust by central entities with overexposure to risk to a decentralized P2P marketplace that spreads risk onto highly reliable decentralized systems. It ultimately enhances innovation by lowering entry barriers for those that need and offer derivatives products. The switch to smart contract backends shifts the market from probabilistic outcomes based on handshake agreements to deterministic automation based on unbiased data flows, maximizing capital for all companies involved. The market can finally create scalable automated solutions across the industry, based on objective information and customizable features, while still keeping sensitive transaction data hidden from outside entities.

Chainlink is at the heart of this transformation with data as the new oil fueling deterministic automation of contractual agreements. Without reliable tamperproof data, smart contracts are subject to more risk than the current centralized derivatives infrastructure. Blockchains provide high security and reliability to the storage and execution of contractual agreements, while Chainlink provides that same level of security to data flows in and out of the smart contract. It’s the last piece of the puzzle for achieving end-to-end reliability, security, and connectivity in fully automated digital agreements.

Build Your Own Price Reference Oracle Network

If you are a DeFi project or traditional institution and would like to build your own customized oracle price reference data network powered by Chainlink, please reach out to us here.

You can easily use these oracle networks to quickly and securely launch, add more capabilities to and/or just greatly improve the security of your smart contracts.