Sustainable Oracle Economics Are Critical to the Success of Web3

The beginning of Web3 was all about experimentation around how decentralized systems could replace failing trust models in society. From that experimentation came a focus on product-market fit and growing the user base to a point where it became clear Web3 was a legitimate technological movement that wasn’t going away. Judging by the growing amount of development, the floodgates of innovation have opened and Web3 is here to stay.

Although the industry still has a lot of experimentation and growth left to do, the next step in its evolution is to establish sustainable economic systems that ensure the infrastructure backing Web3 not only continues to operate securely but expands to onboard the next billion users. The next wave of adoption may not be far away either given the increasing interest from traditional capital market players in Web3 infrastructure as a way to reduce their operating costs, build new revenue streams, and meet growing client demand for tokenized assets.

If even a small fraction of the value held within traditional financial systems is converted into an on-chain format, trillions of dollars worth of new value could flow into Web3 economies. So if the Web3 ecosystem is to be secure and reliable enough to seamlessly support this large wave of new users, asset types, and liquidity, it is critical to establish a holistic Web3 economic model that ensures each layer of the Web3 tech stack can operate sustainably.

The following blog will look closely at the makeup of the Web3 economy, particularly how value flows between layers of the technology stack and why it’s necessary to make such value flows sustainable. It will then focus specifically on the importance of sustainable oracle economics and how Chainlink is leading the charge in creating a sustainable oracle economy that can benefit the whole of Web3.

The Makeup of the Web3 Economy

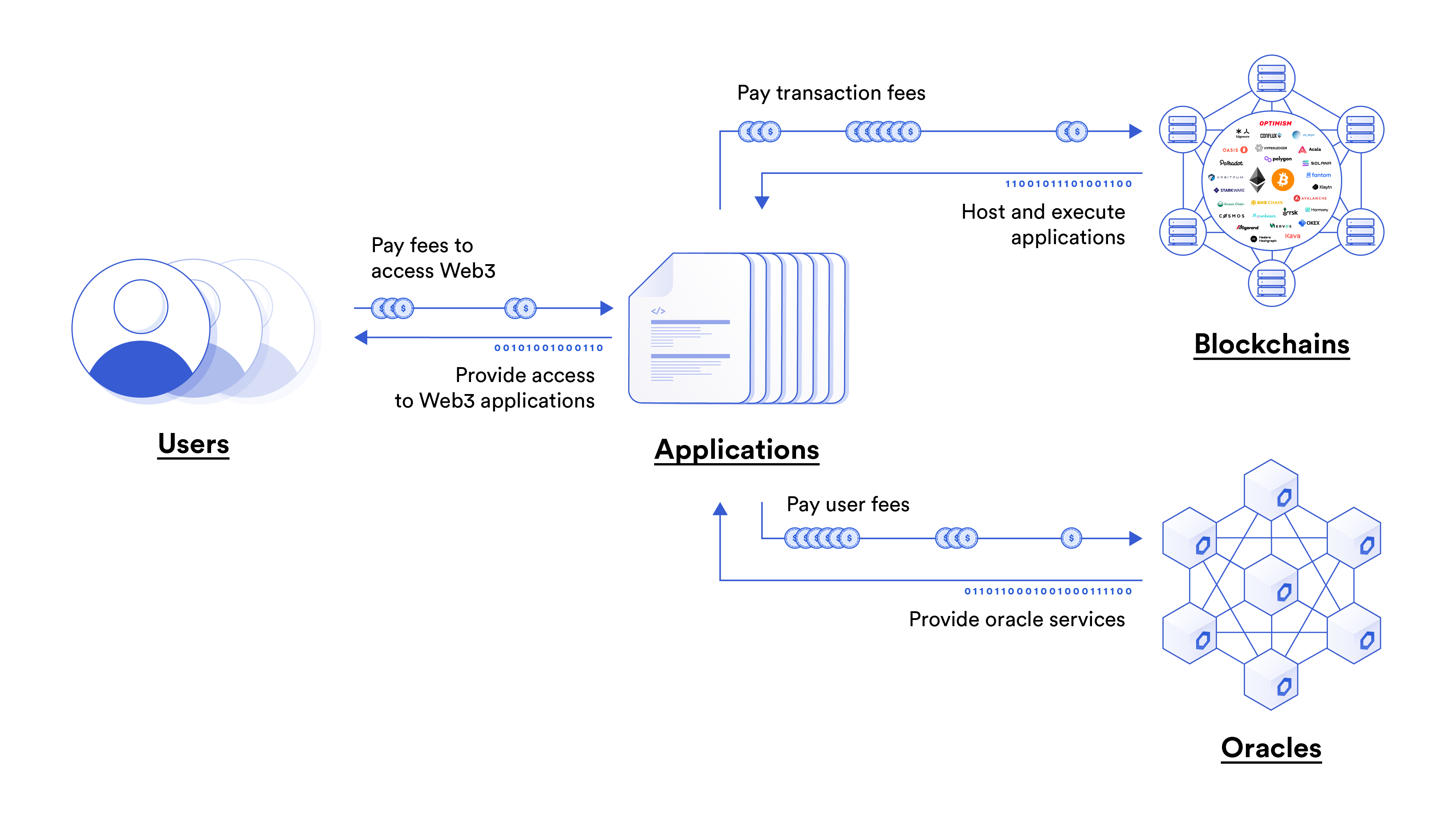

To understand oracle economics, we first need to analyze the makeup of the Web3 economy. Web3 primarily consists of three layers of technology: blockchains, applications, and oracles. If a Web3 economy is to be sustainable, each layer of technology must earn fees from users and/or other layers, and then use those fees to support their continued operation.

Blockchains

Blockchains are the underlying ledgers of the economy, responsible for storing and updating who owns which assets/data, as well as storing and executing the smart contract code underpinning blockchain applications.

Blockchains need users to make transactions on their ledgers, with the network transaction fees and MEV generated by those transactions flowing to miners/validators as a reward for maintaining the blockchain’s operation. While transaction fees may come from peer-to-peer payments in the chain’s native coin, smart contract-enabled blockchains generate most of the transaction fees and MEV rewards from the usage of applications they support. Additionally, settlement-focused blockchains generate transaction fees from layer-2 networks (e.g., rollups) that settle on their network.

Generally, the more successful a blockchain application/rollup ecosystem becomes, the more transaction fees that flow into the blockchain network, and thus the greater the incentive to secure the system. In essence, transaction fees represent the sustainable security budget of the blockchain, especially if block rewards are programmed to reduce over time.

Applications

Applications are the actual products and services that provide value to users in Web3, such as enabling someone to borrow stablecoins in a lending market, buy an NFT on an exchange, or purchase a policy from a decentralized insurance platform.

Applications need users to pay for their products and services, with user fees serving as revenue to fund their ongoing operations. Applications have a variety of operations to support, whether it be protocol development, management of risk exposure, or maintenance of its token economics. Even governance tokens, which oversee modifications to an application, need to consider token economic solutions and value capture (e.g., control over the protocol’s treasury); otherwise, governance attacks can become cheaper, putting the protocol at risk. While some entirely immutable, public good applications exist without any value capture, they are very rare given that most applications have operating costs and require distributed ways to modify the application, such as to implement upgrades needed to remain competitive.

The application layer encapsulates not only Web3-native applications (i.e., dApps), but also traditional companies and institutions (i.e., Web2) building hybrid solutions, such as leveraging smart contracts to improve the backend of existing business processes, issuing tokenized assets on-chain, or serving as a gateway for clients to access Web3 assets and services.

Oracles

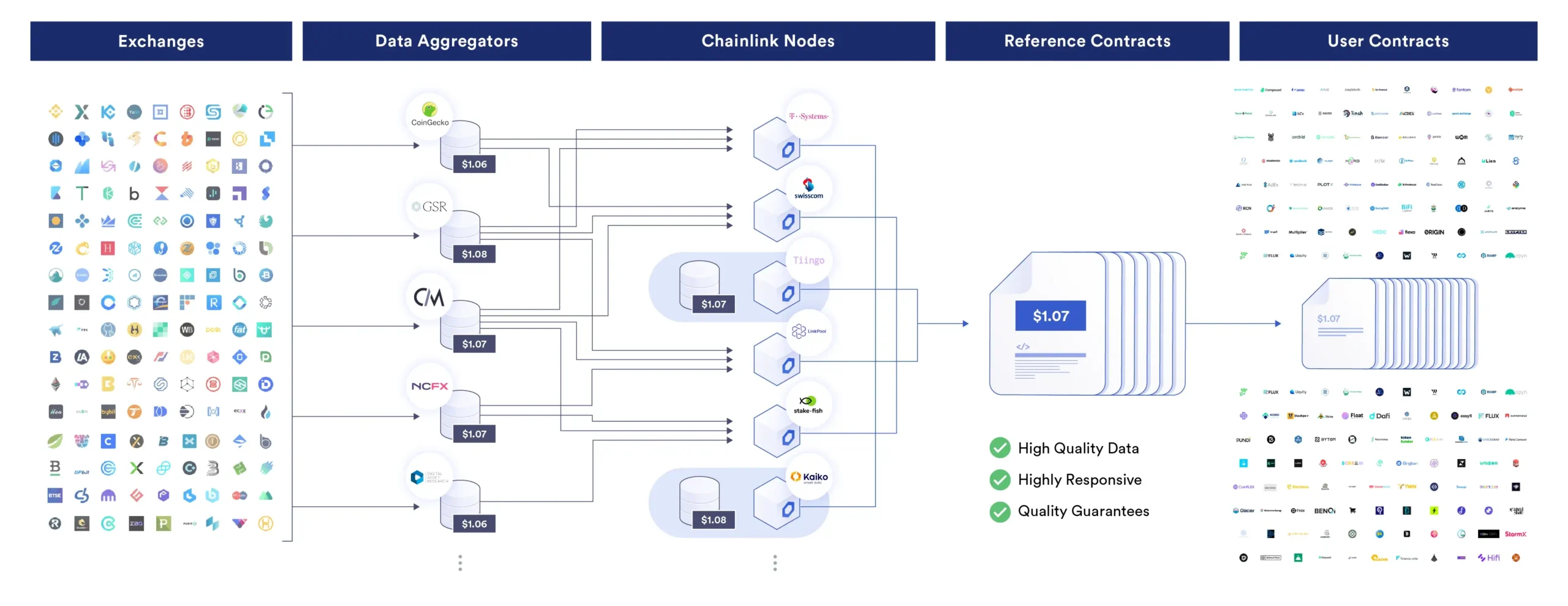

Oracles power a wide collection of trust-minimized services that applications require to function but cannot obtain on their native blockchain or from centralized infrastructure. These oracle services fall into three general categories: bi-directional communication between blockchains and external data/systems, trust-minimized off-chain computation, and data/asset interoperability across blockchains.

Oracles need successful blockchain applications to pay for oracle services, with the user fees flowing to network service providers who actively support and secure the oracle services. Given the inherent limitations of blockchains, oracles provide a wide variety of trust-minimized services to applications, such as aggregated data feeds, serverless compute environments, verifiable random numbers, smart contract automation, cross-chain messaging, proof of reserves, transaction ordering, and more.

Generally speaking, oracles are the connectivity layer that allows existing Web2 infrastructure to seamlessly connect to the Web3 economy. The user fees paid to oracle networks from applications and users support the security budget that incentivizes their secure, reliable, and accurate operation.

Kickstarting Oracle Economies

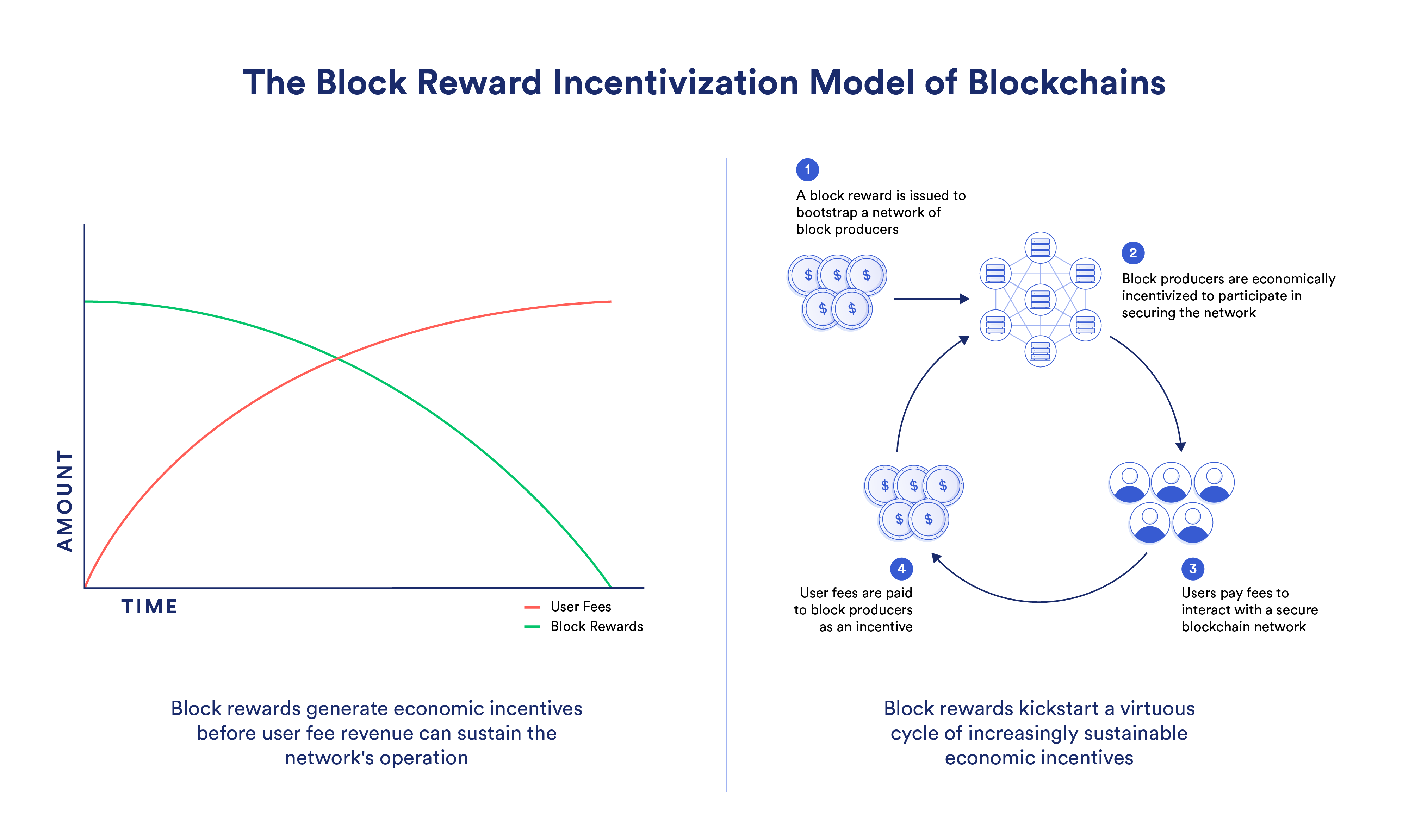

To kickstart a two-sided market, the classic chicken-and-egg problem must be overcome—without paying users, there is no economic incentive for service providers to exist; and without service providers, there are no services for users to purchase.

Historically, Web3 protocols have overcome the challenge of creating a two-sided market via token subsidization to incentivize service providers to join the network (supply side) and/or users to utilize the platform (demand side). Subsidies act as an early-stage growth mechanism that allows protocols to provide a high-quality service before enough fees are generated from users to fully support the service costs. The goal is for the protocol to reach a state of sustainability where the need for subsidization is reduced by fees growing to the point where they can pay service providers in full or support economic mechanisms that offset the subsidization.

Subsidy programs can be seen throughout Web3, for example whether it’s blockchains using block rewards to incentivize validators/miners to secure their chain while their application ecosystems grow or blockchain applications rewarding participants via tokens as a way to incentivize early usage. Oracles are no different in that oracle protocols use oracle rewards to help support the creation and ongoing operation of secure and reliable oracle networks. When the operating costs of a decentralized oracle network (DON) have been subsidized, applications are afforded more time to grow their revenue due to the oracle services they rely upon being offered at a significantly reduced cost or even as a pure public good.

This oracle subsidization model has been instrumental to the growth of blockchain application ecosystems, and will likely continue to play some role in the growth of various smart contract verticals. However, it’s not a sustainable model over the long term. As the oracle protocol grows successful, it must move towards sustainable economics where its service providers are supported directly by the blockchains, applications, or users it supports.

The Operating Costs of Oracle Networks

When designing economically sustainable oracle networks, it is important to first understand their operating costs. Broadly speaking, the operating costs of oracle networks can be bucketed into four categories: on-chain node costs, off-chain node costs, cryptoeconomic security costs, and coordination costs.

On-Chain Node Costs

Oracle networks that publish oracle reports directly on-chain must pay gas fees to blockchain miners/validators in order for their transactions to be confirmed on-chain. The exact amount that oracle nodes spend on gas depends on a number of variables including the underlying gas costs of the blockchain that oracle reports are published to (determined by supply/demand of blockspace) and the frequency at which oracle reports are published on-chain (use case specific). With Chainlink Data Feeds, the publishing frequency is determined by a deviation threshold (i.e., a percentage change in an asset’s price compared to the last update) and/or a heartbeat value (i.e., the amount of time that’s passed since the previous update).

Alternatively, pull-based oracle networks that make cryptographically-signed oracle reports available off-chain shift the responsibility of paying gas fees to the applications and users. The applications or users can publish the oracle reports on-chain either directly or via an oracle automation solution. Ultimately, different users may have varying requirements around how data should be published on-chain and by whom, leading to variability in the on-chain operating costs across oracle networks.

Off-Chain Node Costs

Node operators within oracle networks also incur off-chain costs as part of their operation. These costs include but are not limited to:

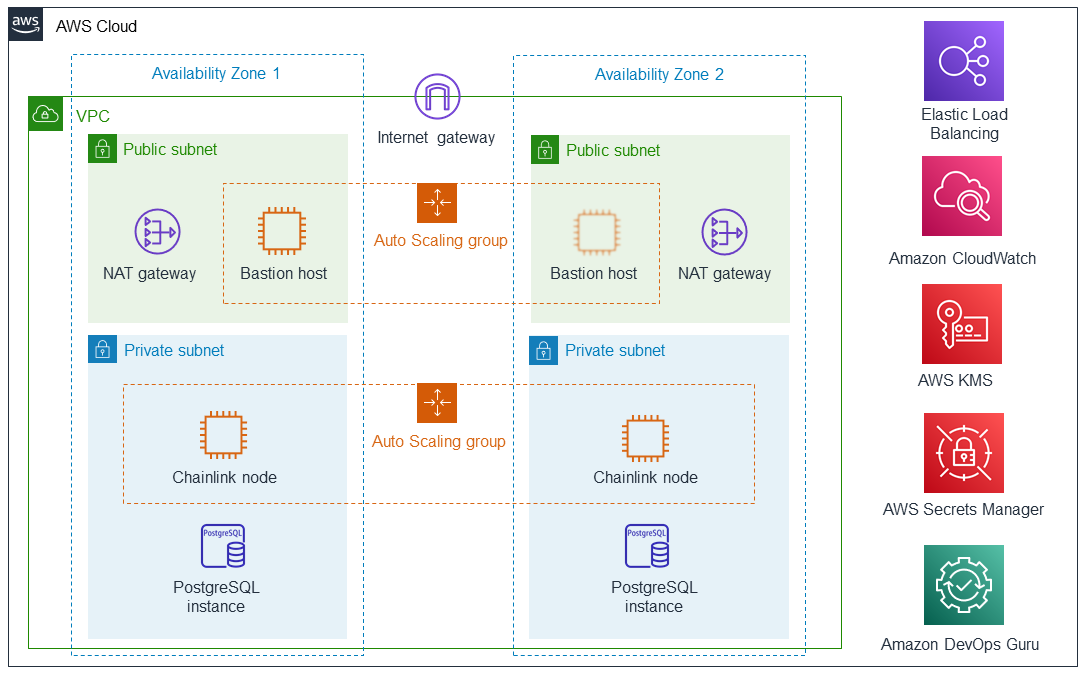

- Node infrastructure costs: Similar to how miners/validators run and manage node software to participate in a blockchain network, oracle node operators need to run and manage oracle node software to participate in an oracle network. The oracle node software handles fetching user requests, connecting to external resources, performing various forms of computation, aggregating results, and publishing the final report on-chain or making it available off-chain. The node operator can run the software on cloud infrastructure, bare-metal servers, or a combination of both, each incurring ongoing operating costs including hosting fees and/or utility costs. Reliable oracle networks may go even further by having node operators run multiple oracle nodes in parallel or maintain the ability to spin up more nodes for greater redundancy/fallback security. Generally, the more tasks an oracle node performs and nodes spun up, the more overhead a node operator incurs.

- Blockchain full nodes/RPCs: Node operators need access to fully synced blockchain full nodes in order for their oracle node to read/write data to/from blockchain networks. A node operator can opt to manage their own blockchain full node (cloud, bare-metal, or a combination) or connect to an RPC provider that provides access to externally managed blockchain full nodes. Reliable oracle networks may ensure higher uptime by requiring node operators to have connections to multiple full nodes for each supported blockchain. Generally, the more distinct blockchains a node operator supports, the more blockchain full nodes that need to be operated. Higher-throughput blockchains may require a node operator to expend more resources to maintain a fully synced copy of the ledger.

- Data provider subscriptions: Node operators that support oracle services where data is fetched from external data providers commonly require API subscriptions to obtain access to such data. Premium data sources have a premium cost attached, such as yearly subscription payments or per-usage fees. Reliable oracle networks may also increase their decentralization by having each individual node operator maintain API subscriptions to multiple data providers for a specific data point.

- Monitoring and Management: Operating oracle nodes isn’t a set-and-forget process but rather requires active management and rapid response capability given the unpredictable and non-deterministic nature of the off-chain world that oracles connect to. Therefore, reliable oracle networks often involve node operators having monitoring-related tooling and infrastructure in place to analyze and track their current and historical performance including uptime, latency, accuracy, and resource utilization. Such infrastructure can include real-time alerts, monitoring dashboards, automated tooling, and dedicated personnel needed to react in real-time to potential performance or reliability issues.

Cryptoeconomic Security Costs

To ensure nodes within an oracle network have sufficient economic incentives to remain reliable and honest, there needs to be an opportunity cost for malicious activity. One method of establishing economic incentives involves node operators earning a profit margin on their operation. This creates a future-fee opportunity that can be lost if the node operator doesn’t meet its performance requirements. It’s a similar economic incentive mechanism utilized by blockchains, where miners/validators are financially incentivized to support the chain’s ongoing operation if they want to continue earning rewards from the network in the future.

Economic incentives can be further strengthened through a staking implementation where cryptoeconomic security is generated via rewards and penalties related to an oracle node’s performance. Stakers are rewarded for their work in increasing the cryptoeconomic security of oracle services.

Coordination Costs

Oracle networks often feature actors whose role is to help coordinate research, development, launch, maintenance, and support around oracle services. These services increase the breadth, utility, and security of oracle services available for users while also reducing integration friction and ongoing management costs for users.

- Launch: The deployment of a new oracle network involves vetting and onboarding node operators, sourcing high-quality data providers, and configuring network parameters to meet specific use case requirements. While users have the option of performing these critical tasks themselves, coordinators can abstract away these processes so developers can focus on their application’s core business logic.

- Maintenance: Oracle networks benefit from continuous monitoring and upkeep to uphold their security guarantees, support reliable performance, and meet the continuously evolving needs of users. While many maintenance tasks are handled individually by node operators, coordinators help identify and address issues that may arise around a particular oracle network’s operation and dependencies.

- Research and Development: User requirements for oracles evolve over time, necessitating improvements to existing oracle services and the creation of entirely new oracle services. Coordinators contribute to the research and development of oracle services required by users, as well as improve the security, speed, and flexibility of the core oracle protocol architecture on which oracle services operate.

- Support: With new developers and projects constantly onboarding to Web3, it’s important they have support and guidance around how to use oracles to support their use cases. Through their expertise and knowledge, coordinators can assist ecosystem projects when building or integrating oracle solutions into their applications.

Coordinators effectively help kickstart and nurture oracle ecosystems while also enabling smart contract developers to outsource their oracle requirements to external teams who have the expertise in providing and helping maintain oracle solutions that meet their exact requirements. Such coordination tasks involve various costs related to labor and operating expenses.

The Risks of Poor Oracle Economics

Before showcasing how Chainlink is creating a healthy oracle economy, let’s briefly examine some of the risks that exist for oracle solutions that forgo sustainable economic solutions.

Diminishing Incentives

A naive economic design for an oracle protocol would be one that relies on subsidized rewards as the sole form of reward for service providers. While users benefit in the short term from subsidized services, they suffer the long-term consequences of exploits as a result of relying upon oracles with unstable economics. This results in weak long-term incentives for the network’s service providers, thereby weakening the network’s security because the opportunity cost of engaging in malicious activity diminishes over time.

Switching Costs and Trust Assumptions

Another poor economic model is relying on new oracle protocols to constantly emerge that will subsidize oracle infrastructure. Such an approach is insecure for many reasons. For one, it’s not economically feasible for a single oracle protocol to subsidize users forever. Thus the economic model relies on the unpredictable assumption that a new, “free” oracle solution will always pop up. Compounded is the fact that each new oracle protocol will come to market completely untested, putting any application relying on it at serious risk of exploitation. As witnessed already in Web3, one bad oracle update can permanently damage the trust users have in an application. Furthermore, the oracle rotation model comes with constant switching costs for applications, meaning applications will have to spend precious development time and resources on changing to each new oracle solution.

Conflicts of Interest

If the oracle is “free”, or has “optional payments” with no clear path to economic sustainability, it should raise deeper questions about the service’s long-term viability and value capture. No infrastructure or service is free—either you pay for a product, or you are the product in some form or another. This is true in Web2 and can become a problem in Web3, as “free” oracles are either going to be very low quality and poorly maintained or sustained by opaque and predatory value extraction, such as leveraging information asymmetry to satisfy their own interests at the expense of the users.

On-Chain Manipulation

Developers may consider using the time-weighted average price (TWAP) or another data methodology derived from an on-chain decentralized exchange (DEX) as a “free” oracle solution. While that data is available on-chain, DEX oracles are not actually free since they require active liquidity and funding of an upkeep solution to obtain up-to-date market prices. DEX oracles can also be insecure due to their limitations in market coverage, as well as their inverse relationship between tamper resistance and latency.

The other problem is that DEX oracles are limited to price data about the on-chain tokens they support, and can only price tokens against other tokens. Ultimately, relying upon a single liquidity trading pool from a single version of a single DEX on a single blockchain introduces significant risk as it cannot be assumed that liquidity will never migrate to new venues. Computing on-chain aggregated pricing across each and every on-chain liquidity pool would introduce significant complexity and cost, and necessitate active management and oversight to account for pivots in liquidity and new sources of liquidity.

Even if liquidity is consistently sufficient, multi-block attacks and other novel attack vectors exacerbate the risks of using DEX oracle solutions. The reality is that DEXs are primarily incentivized to provide a source of market liquidity, not reliable and accurate price oracles.

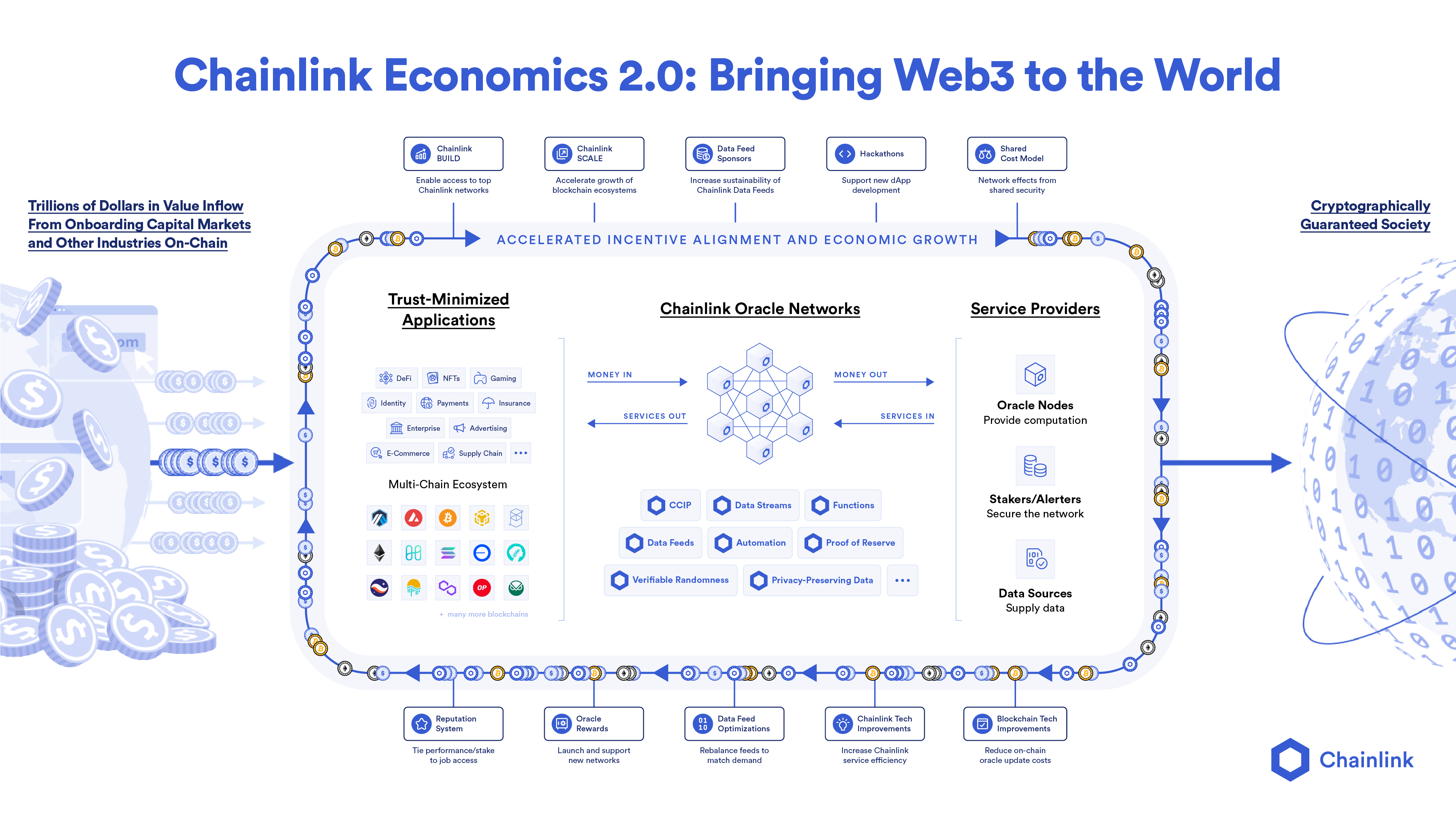

Chainlink Economics 2.0: Sustainable Oracle Economics

Chainlink is pioneering the future of oracle economics through a set of initiatives under the banner of Chainlink Economics 2.0. The initiatives can be bucketed into three components: increasing user fees, reducing operating costs, and establishing sound cryptoeconomic security.

The Chainlink Network has three general categories of service providers that need to be supported in an economically sustainable manner: node operators who perform the oracle services; coordinators who help research, develop, launch, maintain, and support oracle services; and stakers who provide cryptoeconomic security to help ensure the performance of oracle services.

Increasing The Amount of Fees Flowing Into The Chainlink Network

Earning fees from applications and users is paramount to the economic sustainability of oracle services. Chainlink Economics 2.0 has started introducing and exploring various monetization models that focus on increasing user fees and reducing friction for paying applications and users. Special consideration is being taken to account for applications being at different points in their revenue-generating lifecycle. The user fees flowing into the Chainlink Network are then paid to a variety of service providers that support the oracle infrastructure being integrated by applications.

Some of the initiatives already underway or being explored to increase user fees for the service providers supporting the Chainlink Network include:

- Usage-Based Payments: A model of payment where users pay for oracle services based on their usage. For example, Chainlink’s VRF, Automation, and Functions solutions follow a model where applications keep fee balances within an on-chain subscription contract that is drawn upon by service providers as services are consumed. There also exists a model where users pay from their wallet when executing a transaction involving an oracle service. Usage-based payments provide an easy and scalable way for applications to manage the costs of their oracle infrastructure in a self-service manner or allow applications to pass the oracle costs down directly to the end-users.

- User Fee-Sharing: An approach where applications share a portion of their generated fees with Chainlink service providers as a way to pay for the oracle services they consume. The user fee-sharing model helps account for established protocols with custom needs and where usage-based payments are not the preferred option. The first fee-sharing proposal recently passed between Chainlink and GMX, where 1.2% of the total protocol fees earned by GMX V2 and future versions will be paid to Chainlink service providers in exchange for the usage of the low-latency oracles and related technical support. As Chainlink Staking evolves to support a greater scope of oracle services, a portion of the fees from this proposal are planned to be sent directly to stakers as user fee rewards for increasing the cryptoeconomic security of Chainlink services used by GMX. The result is a tight connection between Chainlink service providers and the participating application, where the scaling of the application results in more economic incentives for the oracle services they consume, which can result in even more oracle security for the application.

- BUILD: The Chainlink BUILD program is an initiative that aims to accelerate the growth of early-stage, often pre-revenue, projects by providing enhanced access to Chainlink services and technical support in exchange for projects committing a portion of their native token supply (often 3-7%) to be paid to Chainlink service providers, including stakers. This allows applications to access oracle solutions and additional support during their initial development and adoption, serving as a growth engine and runway until they earn sustainable revenue flows that can support other pricing models.

Reducing Operating Costs for Chainlink Service Providers

In order to reduce the threshold of fees required to generate economic sustainability for oracle services, a number of operating cost reductions are being employed to make the services more affordable for consumers. Furthermore, new types of programs are being introduced that share the costs of oracle services across other ecosystem participants, particularly before user fees are high enough to sustainably cover operating costs.

Some of the initiatives already underway to reduce operating costs on the Chainlink Network include:

- OCR 2.0: Chainlink Off-Chain Reporting (OCR) 2.0 is the latest version of Chainlink’s off-chain consensus protocol that enables DONs to efficiently come to consensus about a data point or computation, and then submit the aggregated result on-chain via a single transaction (while still verifying each node’s signature on-chain). OCR 2.0 provides a shared foundation for multiple Chainlink services through the creation of a reporting plugin interface, which abstracts away the complexity of running different product-specific logic. This allows OCR to be used more efficiently and across more services.

- Low-Latency Oracles: Chainlink low-latency oracles are a pull-based oracle solution for data feeds where oracle reports are regularly generated off-chain, which users, applications, or an oracle automation solution can retrieve and submit on-chain to validate user transactions. The pull-based oracle design means oracle reports are only placed on-chain when required, rather than automatically updated on-chain based on predefined triggers. The design also shifts the responsibility of paying on-chain gas costs from the oracle node operators to the applications/users.

- Feed Deprecation: Data Feeds within the Chainlink ecosystem are continuously evaluated for their usage and economic viability across all the networks they are deployed upon. Data Feeds that do not have publicly known users or have no clear path to sustainability may be subject to depreciation in order to eliminate unnecessary costs for the network and node operators. However, deprecated Data Feeds can be re-launched on alternative blockchains/layer-2s if there is user demand.

In addition, programs have also been introduced to provide time for applications to generate user fees needed to pay for oracle services:

- SCALE: Sustainable Chainlink Access for Layer 1 and 2 Enablement (SCALE) is an initiative designed to kickstart blockchain application ecosystems by having layer-1 and layer-2 chains cover the node operating costs of Chainlink services on their network for a period of time. SCALE facilitates cooperation between Chainlink and blockchains around their shared goal of supporting the oracle infrastructure that applications need to be successful. In return, applications have more time to build sustainable revenue flows, which can eventually support the blockchain and oracle infrastructure they utilize.

Establishing Cryptoeconomic Security with LINK

The LINK token plays a key role in the Chainlink ecosystem, specifically by increasing the cryptoeconomic security of oracle services. There are currently three domains being used or explored to establish greater cryptoeconomic security for the Chainlink Network via the LINK token.

- Payments: One cryptoeconomic security model revolves around payments for oracle services. In using LINK as payment, the fees that service providers earn for the services they provide are tied to the overall security and health of the Chainlink Network. This creates an additional incentive for service providers to perform securely and reliably. To minimize friction in collecting fees, payments can be made in LINK, or in certain cases, other assets, including native tokens, at a higher rate compared to LINK payments. Payments in other assets can then be converted into LINK for further use in the Chainlink Network.

- Stake-Based Service Security: Another cryptoeconomic security model for the Chainlink Network is stake-based security, where LINK is utilized in a staking smart contract, which can be slashed as a penalty if the oracle services don’t meet certain predefined performance requirements. In return, stakers can earn a portion of the fees paid by users and applications that use oracle services secured by the staked LINK. Stake-based security may also expand to include loss protection, where a portion of the slashed LINK can be used to compensate paying applications that are affected by an oracle service that doesn’t meet its service requirements. Stake-based security can be provided by node operator stakers and community stakers. The initial v0.1 of Staking launched in 2022, with future releases aimed at adding additional functionality and security assurances over time.

- Stake-Based Node Reputation: A third dimension of Chainlink’s cryptoeconomic security model involves leveraging staking as the basis for oracle node reputation. In simple terms—assuming other performance metrics are equal—the more LINK a node is staking, the more jobs and user fees they can earn on the network given that they are willing to put up the financial resources to back their performance. An increased amount of staked LINK is a signal of their commitment to the health of the oracle network, providing users and applications additional security guarantees on oracle services.

While the initial cryptoeconomic security model of the LINK token has been primarily based upon payments being made in LINK, the cryptoeconomic security model is expanding to place greater emphasis over time on the staking of LINK to secure Chainlink services. In return for staking LINK to provide additional cryptoeconomic security, a portion of the fees that flow into the Chainlink Network will be paid to stakers as staking expands to support those services.

Given Chainlink’s broad network effect, this economic model allows a diverse range of dApps across various blockchains and smart contract verticals to pay stakers in exchange for utilizing the Chainlink services that the stakers secure.

Achieving Increased Sustainability and Predictability Over Time

Sustainable economics for the Chainlink protocol and services built on top of it is critical to maintaining high levels of security and reliability and expanding the oracle solutions available to blockchain applications. However, reaching full sustainability will take time and involve unpredictable variables, particularly because the amount of fees paid into the Chainlink Network are largely dependent on the growth and adoption of Web3. We also believe that moving toward a more predictable longer-term release schedule, in addition to the many ongoing initiatives of Chainlink Economics 2.0, is in the best interest of the Chainlink ecosystem and will further solidify Chainlink’s long-term standing as an industry-standard Web3 platform.

Oracle Economy Sustainability Is a Prerequisite to The Success of Web3

Oracles open up a vast amount of use cases on blockchains that are simply not possible without access to external data, trust-minimized off-chain computation, and cross-chain interoperability solutions. In order to provide developers with these oracle services, it’s important to put in place sustainable economic systems between blockchains, applications, and oracles that enable all three to remain secure while still having the economic support needed to innovate. Without sustainable oracle economics, Web3 would experience a profound innovation lull, and more importantly, suffer from ecosystem-wide security risk.

Just like Chainlink spearheaded the creation and adoption of decentralized oracle services, it’s now focused on establishing sustainable oracle economics so developers, both now and in the future, have the building blocks for creating successful and secure Web3 applications. We believe that onboarding the next billion users depends on it.

—

Disclaimer: This post is for informational purposes only and contains statements about the future, including anticipated product features, development, and timelines for the rollout of these features. These statements are only predictions and reflect current beliefs and expectations with respect to future events; they are based on assumptions and are subject to risk, uncertainties, and changes at any time. There can be no assurance that actual results will not differ materially from those expressed in these statements, although we believe them to be based on reasonable assumptions. All statements are valid only as of the date first posted. These statements may not reflect future developments due to user feedback or later events and we may not update this post in response.