NFTs for Real-World Assets

The opportunity in real-world asset tokenization is unparalleled: Hundreds of trillions of dollars in assets, processes, and businesses are ripe for tokenization.

This blog dives deep into the tokenization opportunities that are uniquely unlocked by non-fungible tokens, also known as NFTs.

The Evolution of NFTs

Today, NFTs are mostly used for digital art, collectibles, and in-game assets. The benefits are clear: By attaching visual metadata such as an image (which can be either static or dynamic) to an NFT, users can own a digital art piece or collectible in a way that wasn’t possible before blockchain technology.

The opportunity in digitized collectibles, art, and other digital media forms has clearly been proven. From NFT profile picture collections and in-game NFTs to algorithmically generated NFT art, collectors from around the world have been inspired by this cutting-edge method for making digital-native media permanent.

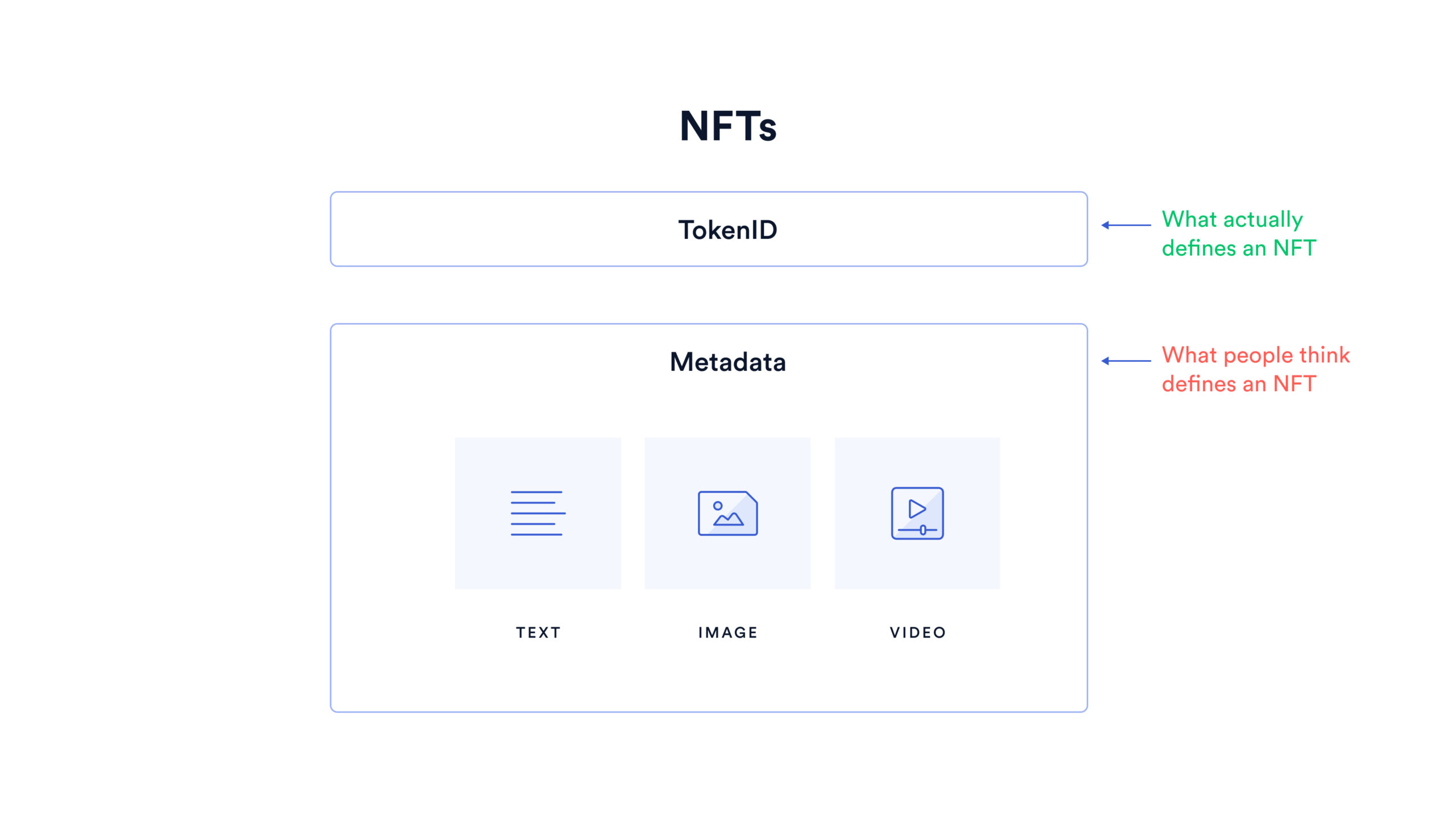

But that’s not all NFTs are good for. While many think the image that’s attached to an NFT is the NFT itself, NFT images are simply one form of metadata that can be attached to an NFT. Virtually any form of data can be attached to an NFT and updated over time, if desired. NFTs with updating metadata are called dynamic NFTs.

The defining feature of an NFT is actually its TokenID, a unique 1-of-1 barcode that distinguishes the NFT from any other token on the blockchain it is on. This unique property, alongside the inherent benefits of tokenization, makes NFTs a perfect fit for many of the assets that exist today outside of the blockchain economy.

How Asset Tokenization Works

“Asset tokenization” refers to the use of smart contract and blockchain technology to represent ownership or rights to an asset (or liability) as a tradable, onchain token.

In the context of real-world assets (RWAs), asset tokenization refers to the process of reformatting assets outside of a blockchain, often called an “offchain” asset, into a token format. Once tokenized, there are inherent efficiencies in storing, updating, and transferring assets across multiple parties. Additionally, it becomes much easier to create liquid markets around these assets.

How an asset gets tokenized can vary. Many real-world assets today, like cash, are purely digital, requiring interoperability between the existing systems that custody these assets and blockchain networks. Other assets, such as gold, are physical, requiring a third-party custodian to physically store the asset as proof that each token corresponds to some amount of stored gold. While all tokenized assets gain the efficiencies mentioned above, the path to tokenization—and the specific token standard/architecture each asset uses—can differ wildly based on the nature of the asset itself.

The Advantages of Using NFTs For Real-World Assets

NFTs are best suited for unique assets that can’t be easily represented by fungible tokens. A clear example of this is tokenized real estate, where each building is fundamentally different from another building, whether in size, age, location, wear-and-tear, or other characteristics.

The advantages of using NFTs are obvious when considering the needs of unique asset types such as real estate. At its core, an NFT is simply two things: TokenID and metadata.

- TokenID: A unique barcode helps differentiate one asset from another. For example, two houses that are side by side would have different tokenIDs.

- Metadata: Data that describes the NFT. For example, a real-estate NFT could track addresses, renovations, past sales, and more. As mentioned above, NFT metadata can be continuously updated.

Another key consideration in using NFTs for real-world asset tokenization is fractionalization. The vast majority of fungible tokens can be fractionalized down (i.e., owning 1.534 of a token). NFTs are non-fungible, making them well-suited for assets that are either best represented as a single, non-fractional token to start or often owned solely by a single entity.

Applications of NFTs in Real-World Assets

Broadly speaking, the applications of NFTs for real-world assets can be broken down into two main categories:

- 1:1 tokenized representations of physical assets

- Ownership of unique assets requiring up-to-date metadata

Physical Collectibles Turned Digital

One of the largest opportunity areas for real-world asset NFTs is physical collectibles such as art, cards, shoes, watches, sports memorabilia, and more, which collectively represent an estimated $462 billion in value.

While this market is still in its nascent stages when it comes to tokenization, there is an increasing wave of projects that aim to offer tokenized representations of physical collectibles. The most important aspect of any real-world asset tokenization is making a verifiable connection between the physical asset itself and its tokenized form. For example, Courtyard is a project that mints tokenized Pokémon cards by asking users to send their cards to a trusted third-party solution for verification and storage—heavily mitigating the chance that the card is damaged, lost, stolen, or simply does not exist. The tokenized cards are then sent to the user to be freely displayed, traded, and sold on NFT marketplaces.

A simpler example would be to imagine the state of fine art today. A person might own an art piece that’s stored, verified, and tokenized by a museum. When the person wishes to sell their fine art piece, the painting itself would not move—the token would be sold to signify the transfer of ownership. This process can be mirrored across any collectible and is today a leading path for hundreds of billions of dollars of physical collectibles to join the Web3 economy as NFTs.

Unique Assets Requiring Custom, Updating Metadata

NFTs are also a good fit for unique assets that require custom—and often updating—metadata. A brand-new climate asset whose value depends on the amount of carbon credits it generates over time. A car with metadata on its ongoing mileage and vehicle history. A 12-month rental agreement with $2,600 in cash flow every month, updated monthly. A patent with an expiration date 10 years from now.

The ability to continuously update an NFT’s metadata over time with relevant information about an asset is critical for many asset types. Tokenizing these assets also provides outsized benefits to the entire market by reducing information asymmetry with fully onchain metadata, enabling automatic pricing based on standardized metadata parameters, and empowering better price discovery across similar assets due to increased liquidity and accessibility.

The Role of Chainlink in Asset-Backed NFTs

The Chainlink Network connects the world to blockchains, and blockchains to the world.

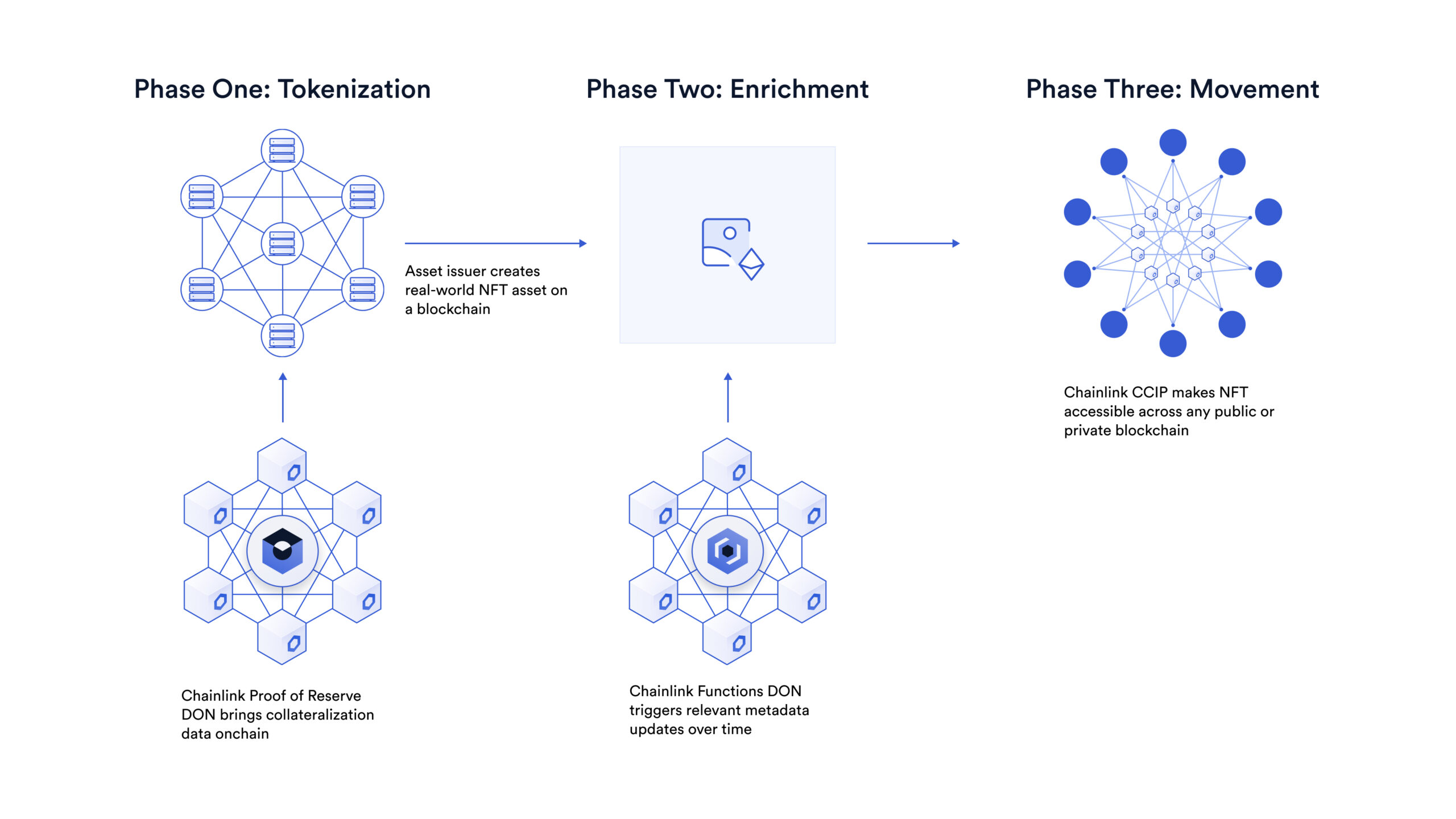

An asset-backed NFT must have a connection to its offchain counterpart. Chainlink’s role is to connect the two together, and then help facilitate the movement of that token across the entire blockchain ecosystem, providing all the data, compute, and cross-chain needs for any real-world NFT asset.

- Phase One: Tokenization. Chainlink Proof of Reserve helps verify offchain reserves and brings reserve data onchain in a decentralized manner to provide users with increased confidence that any given token is backed by its offchain counterpart.

- Phase Two: Data Enrichment. Chainlink Functions connects offchain data sources to smart contracts, which can be used to update the asset-backed NFTs with relevant metadata in a secure, reliable, and trust-minimized manner.

- Phase Three: Movement. Chainlink Cross-Chain Interoperability Protocol (CCIP) can be used to build cross-chain NFTs, or NFTs that can be moved across any chain, which unlocks even more liquidity and counterparties for asset-backed NFTs.

The Future Is On

Real-world asset tokenization is how society transitions the many assets that already exist in the world today to a superior digital format, and NFTs will play a critical role in this emerging onchain economy.

Imagine a future where every product, from a vintage wine bottle to an invaluable art piece, can be easily traced using verifiable data inputs and onchain ownership. A world where verifying a degree is as simple as sending a one-click, cryptographic proof-of-degree to an employer. The decentralized, transparent, and autonomous nature of smart contracts enables a new world of efficiencies for the assets and data that are integral to our lives. But to bring this vision to reality, the world has to connect to blockchains, and that starts with real-world asset tokenization.

Looking to understand the tokenization opportunity? This industry report provides a comprehensive overview of the growing tokenization market, with contributions from BCG, 21Shares, Paxos, Backed, and Chainlink. Access now.