Chainlink Digital Assets Sandbox: A Turnkey Solution for Accelerating Innovation in Capital Markets

We’re excited to launch the Chainlink Digital Assets Sandbox (DAS), designed by Chainlink Labs and powered by the Cross-Chain Interoperability Protocol (CCIP), to accelerate digital asset innovation within financial institutions.

The Chainlink DAS is the ideal solution for financial institutions that want to quickly innovate and experience the potential of generating new revenue opportunities, increasing efficiencies, improving time-to-market, and more. With the DAS alongside expert support and consultancy services provided by Chainlink Labs, financial institutions can now go from the start of their digital asset journey to having completed a successful PoC in days, not months, saving them not only time and resources but also realizing business impact much faster.

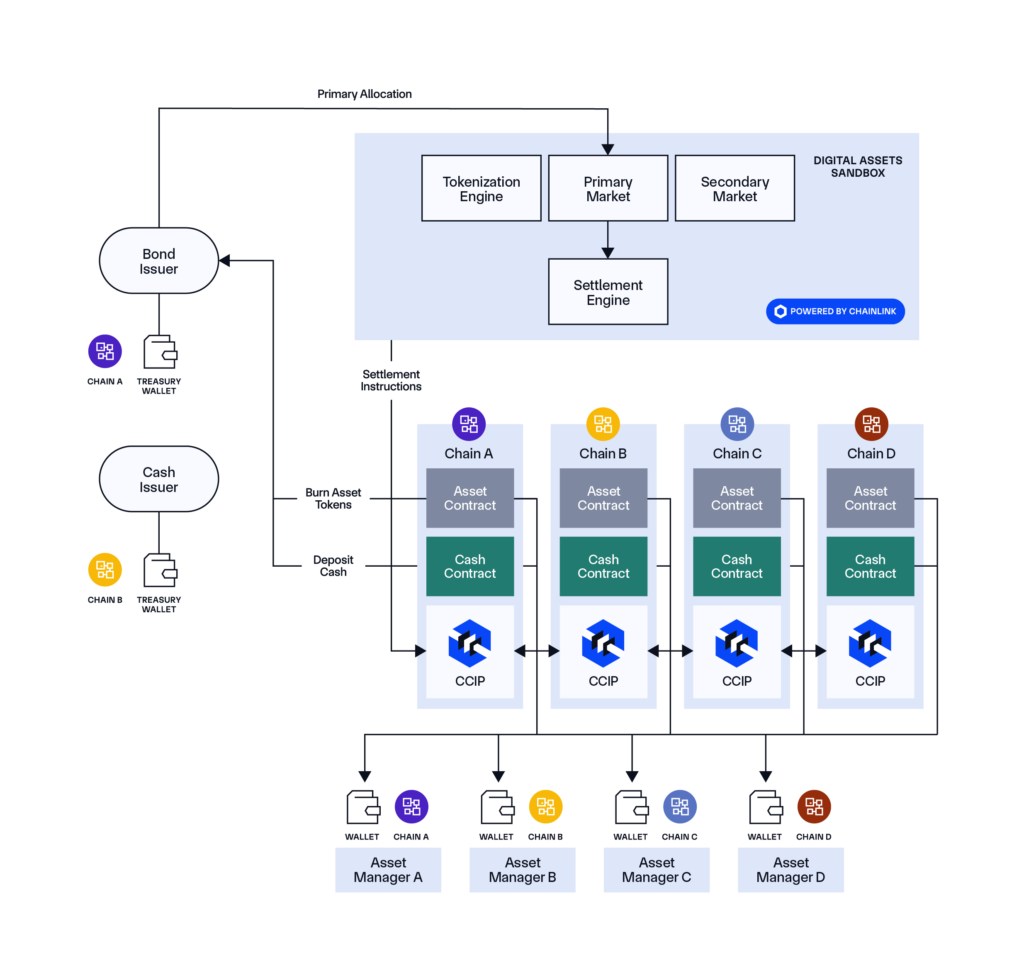

The Chainlink DAS enables institutions to access ready-to-use business workflows for digital assets. For example, institutions can use the Chainlink DAS across multiple blockchain testnets to digitize a traditional bond by converting it into digital tokens and enabling these tokens to be traded and settled on a Delivery versus Payment (DvP) basis, along with many other real-world examples involving a variety of financial instruments across their entire life cycles.

The Tokenized Asset Opportunity Is Measured in Trillions

Asset tokenization is a transformative opportunity for capital market participants, including investors, issuers, intermediaries, and infrastructures. By 2030, Northern Trust and HSBC estimate that 5-10% of all assets will be digital and a joint study from BCG and ADDX projects the tokenized asset market to reach $16 trillion or 10% of the global GDP. To learn more about the tokenized asset megatrend, check out our industry report: The Definitive Guide to Tokenized Assets.

Today, for financial institutions dealing with the complex, fragmented, and ever-evolving landscape of blockchain technologies, conducting even a basic proof of concept (PoC) can be technically challenging and expensive. PoCs involve extensive integration work and intricate processes, often stretching over periods of several months or longer. In a world where thousands of public and private blockchains exist alongside a variety of different asset classes, connecting blockchain transactions to existing legacy systems and enabling cross-chain synchronization is not a straightforward process—it requires specialized knowledge and substantial technical effort.

For example, a 2023 study on distributed ledger technology (DLT) from the International Securities Services Association (ISSA) found that 28% of financial institutions report challenges with internal prioritization of resources, while 33% struggle with integrating DLT into legacy IT systems and across multiple blockchain networks. Furthermore, Deloitte reports that the technical skills gap is a major hurdle, with companies struggling to find the necessary talent to develop and implement blockchain solutions, which leads to additional constraints. All of these factors are limiting an institution’s ability to quickly get started to innovate, build new PoCs, and take advantage of the enormous opportunity tokenization presents.

With the launch of DAS, Chainlink is solving these key problems by improving the speed, reducing the cost, and decreasing the complexity of bringing new digital asset use cases to market.

The Chainlink Digital Assets Sandbox

The initial version of the Chainlink DAS is focused on tokenized bond workflows. Chainlink DAS enables financial institutions to easily conduct onchain trials around end-to-end tokenized asset workflows by providing a preconfigured, customizable, cross-chain, and secure business environment—featuring pre-built use cases, sample application workflows, and user interfaces. Users can launch and evaluate PoCs individually or together with other institutions in a collaborative digital asset environment, and leverage consultancy services from the Chainlink Labs team to define a digital asset adoption roadmap based on proven, scalable, and future-proof blockchain technologies.

As part of the Chainlink DAS institutions can access:

- A preconfigured environment, to be integrated with major private and public blockchains with secure interoperability between chains powered by CCIP.

- Pre-built workflows and use cases, with tokenized bonds as the initial supported asset, and the workflows that cover its full life cycle, from issuance to asset servicing and corporate actions. Upcoming releases are expected to support more financial instruments and workflows, like fund tokenization and distribution, and cross-border payments.

- Multiple deployment models, ranging from a private, dedicated environment for a single institution to a shared environment alongside numerous other participants.

- Expert support and consultancy services, provided by the Chainlink Labs team, which has the deep industry expertise and experience needed to assist both business and technical organizations.

- Customization, across chains and workflows to adapt them to users’ specific business needs.

With this easy-to-use turnkey solution, financial institutions can now test and validate business use cases within days, rather than months. Powered by CCIP, financial institutions can transfer data and assets across any public or private blockchain in a single atomic transaction, as well as transact across the multichain ecosystem from their existing infrastructure through a single point of integration. As a result, institutions can experience the full potential of cross-chain digital assets to better understand and demonstrate the potential of digital assets across PoCs, collaborative trials, and service providers.

End-To-End Tokenized Bond Workflow Examples

Out of the box the Chainlink DAS includes tokenized bonds workflows across the entire asset lifecycle, starting with the issuance, online auction and primary market allocation on an atomic DvP basis, secondary markets with central limit order books (CLOB), OTC trading, secure settlement, and custody and asset servicing with both coupon and maturity payments. Future versions are expected to feature additional modules, expanding support for various financial instruments and use cases, including fund tokenization and cross-border payments.

Let’s take a look at an example workflow for tokenized bonds:

Online Auction and Primary Market Allocation for Tokenized Bonds With Atomic DvP Settlement

The process begins with two options: uploading an allocation file or launching an auction. In the first option, the workflow starts with the upload of the allocation file provided by the book-runner or issuer, which then triggers the distribution and settlement process. In the second option, the workflow starts with setting up the auction details, including start and end dates/times, offer size, minimum and maximum prices, etc., followed by launching the auction and monitoring bids received. After analyzing volume and imbalance at each price and reviewing the details of each individual bid, the final price is decided and the auction is executed. In both scenarios, the process culminates in atomic DvP settlement transactions powered by CCIP. Bond tokens are delivered to the non-custodial wallets of asset managers on their respective networks, while the issuer receives payments in their non-custodial wallet on their chosen network.

This workflow enables users to fully leverage the utility of tokenized assets powered by CCIP, transforming assets from single-chain to any-chain assets. By enabling atomic DvP settlement, Chainlink DAS and CCIP enable seamless movement and execution of instructions across blockchain boundaries, enhancing the efficiency and security of transactions, and removing counterparty risk.

Powered by Chainlink’s Enterprise-Grade Platform

The enterprise-grade sandbox is underpinned by Chainlink’s industry-standard platform, which is the only platform capable of addressing the data, liquidity, and synchronization challenges for capital markets. Chainlink has enabled over $12 trillion in onchain transaction value and is pioneering the future of global markets onchain via collaborations with Swift, ANZ Bank, Sygnum and Fidelity International, and more. Sandbox users will also receive the support and consultancy services of Chainlink Labs, the organization behind many cutting-edge innovations that have facilitated the growth of the onchain economy.

Simplifying this process and reducing development time from months or several quarters to days is just the first step. Chainlink Labs, the primary contributing developer of Chainlink, can help evolve the next stages of product roadmaps, and expertly guide institutions across all phases of the adoption process, including exploration, testing, development, and production.

If you want to explore how your digital assets strategy can benefit from Chainlink’s industry-standard platform and the new Digital Assets Sandbox, reach out to one of our experts.

Disclaimer: This post is for informational purposes only and contains statements about the future, including anticipated product features, development, and timelines for the rollout of these features. These statements are only predictions and reflect current beliefs and expectations with respect to future events; they are based on assumptions and are subject to risk, uncertainties, and changes at any time. There can be no assurance that actual results will not differ materially from those expressed in these statements, although we believe them to be based on reasonable assumptions. All statements are valid only as of the date first posted. These statements may not reflect future developments due to user feedback or later events, and we may not update this post in response.