What Is Tokenized Real Estate?

Tokenized real estate is when a real-estate property or its cash flows are represented as a blockchain token or tokens.

In 2021, the global real-estate market was valued at ~$29 trillion dollars, making it one of the largest markets in the world. The vast majority of people around the world are connected to the real-estate market, whether as renters or owners, or as office, retail, or factory workers.

Compared to other assets, real estate is illiquid and inefficient:

- It can take weeks to months to find a counterparty.

- Sales prices fluctuate within a range.

- Real-estate transactions take weeks to close.

- Many service providers are needed to transact.

This process can be streamlined and unlocked through tokenization.

<div class="educational-divider sections-divider"></div>

What Is Tokenized Real Estate?

Tokenized real estate is when a real-estate property or its cash flows are represented as a blockchain token (or tokens) to increase liquidity, streamline processes, and enable digital ownership.

In general, the use of blockchain technology for tokenized real estate requires the use of either non-fungible tokens (NFTs) or fungible tokens, depending on the goal and what’s being tokenized. NFTs are useful when a property—or groups of properties—is being considered as a whole (i.e., one or more properties, one token). Fungible tokens are useful for fractionalizing a whole into parts (i.e., one or more properties, 100 tokens).

According to KPMG, “tokenization is ideal for owners of a single asset or a small portfolio of assets, due to the significant reduction of time and cost in offering investors the right to participate in fractional ownership and subsequent secondary trading.”

<div class="educational-divider sections-divider"></div>

How Could Tokenized Real Estate Work?

In general, tokenized real estate requires that there is a firm, trust-minimized link between the digital asset (token) and the underlying physical asset (property). Chainlink is a Web3 services platform that supports developers and entrepreneurs aiming to bridge the gap between blockchains and real-world assets (such as real estate) by providing best-in-class connectivity tools.

This section will outline different possibilities across the residential and commercial real estate markets to provide an idea as to how real estate might be tokenized.

Note: All the examples below are largely future-facing, illustrative, and have not been implemented at scale. Specifically, considerations around the verification of home ownership and any related practical issues are not addressed in these examples.

Simple Tokenized Real Estate

The simplest example of tokenized real estate is representing a single real-estate property as an NFT.

An NFT is a unique token that is verifiably different from every other token on a blockchain—making it a good fit for real estate because every property is different.

Features:

- Owning the NFT can be equivalent to owning the property.

- Transferring the NFT can mark a change in property ownership.

- The NFT can hold critical data such as past sales, address, and more.

In this theoretical example, selling a house is as simple as listing it on an NFT marketplace. A buyer can press a few buttons and, if they have the necessary funds, purchase it within minutes—a drastic shift from the weeks-long process that real-estate transactions require today. One-off instances of this form of tokenization have already taken place.

Dynamic Tokenized Real Estate

The tokenization example above can be further enhanced using dynamic NFTs (dNFTs).

Dynamic NFTs are NFTs that automatically update their data based on relevant conditions. For example, replacing the house’s roof.

Features:

- Owning the NFT can be equivalent to owning the property.

- Transferring the NFT can mark a change in property ownership.

- The NFT can hold—and automatically update—critical data.

Dynamically updating NFTs enable better information exchange between counterparties. Relevant information such as improvements, renovations, and past sales can be automatically updated in the NFT by Web3-powered startups using Chainlink Functions—a simple development tool that connects smart contracts to any API or external dataset—to provide prospective buyers with the ability to better understand the property and its changes.

Dynamic NFTs become more useful over time. For example, an NFT can hold images or videos of a particular property that showcase the state of a house at a particular point in time. As ownership changes hands multiple times, the plethora of videos/images that are continuously added to the NFT enable buyers to see the changes to a property over time—providing deeper insights for their purchasing decision.

Fractionalized Real Estate

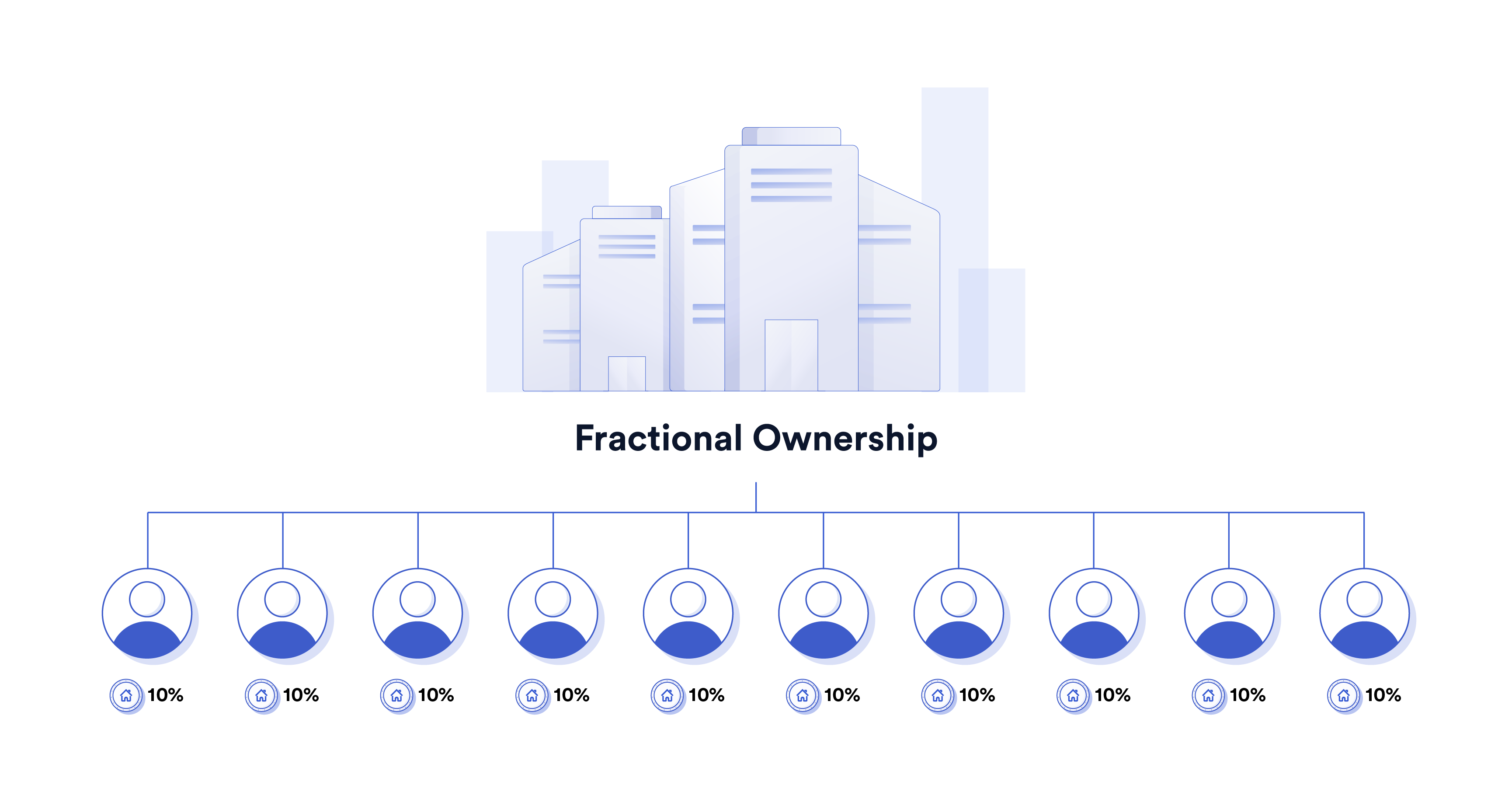

A compelling use case for real-estate tokenization is fractionalization, or enabling fractional ownership of a property. This approach uses fungible tokens.

Fungible tokens are indistinguishable from each other. An existing example of a fungible asset is stocks—one stock is always equivalent to another.

Features:

- Individual tokens can represent a specific percentage of ownership over the property.

- Owning all fungible tokens can be equivalent to owning the property.

Fractional ownership over real estate unlocks access to the real-estate market in a completely novel manner. With the right design, fractionalized real-estate tokens could allow savvy investors to build custom-made portfolios of different real-estate assets, prospective homebuyers to make incremental steps to live in—and own—their desired home, and companies to create tailored real-estate products. For example, Blocksquare is a Slovenia-based company that aims to help businesses fractionalize properties through a token-related solution built on Ethereum and IPFS.

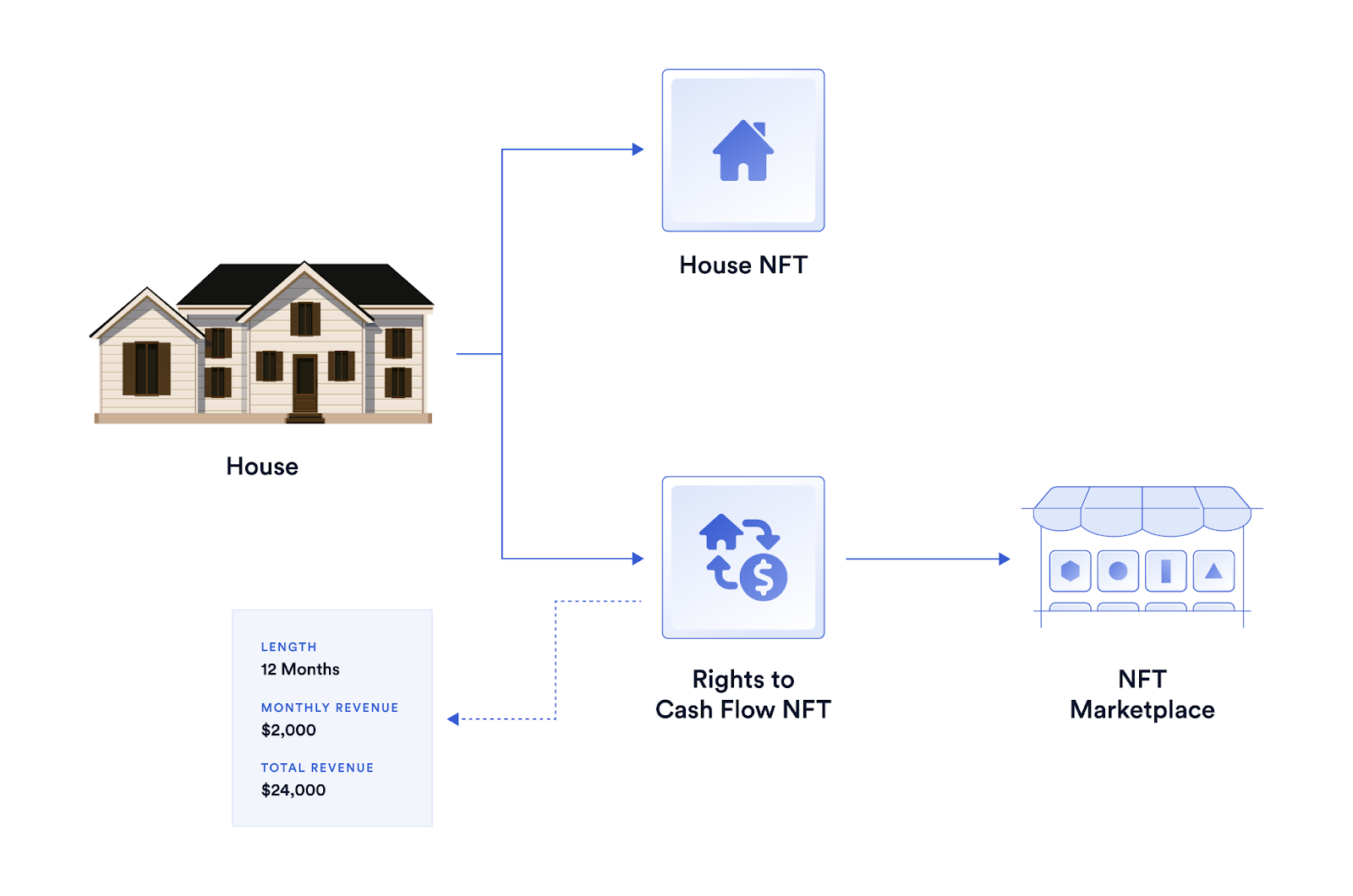

Tokenized Real Estate Cash Flows

With blockchain-based tokens, it’s possible to separately tokenize ownership of a particular property from the cash flows that the property generates—unlocking liquidity for property owners.

Tokenized cash flows can unlock the ability to sell the rights to future rental income for a lump sum.

Features:

- Separation of property ownership and rights to cash flow.

- The rights to cash flows can be represented as an NFT.

- Automatic redirection of cash flow to the NFT owner.

In this model, property owners can separate property and cash flow ownership. The rights to the cash flow (often a monthly rental income) can then be sold as a whole to another party over a specific time length. Tokenized cash flows of real-estate properties can provide additional optionality to property owners and reduce the cost of capital for real-estate ownership.

This process can also be automated in a decentralized manner using the Chainlink Web3 services platform. For example, LaProp—a Colombia-based real-estate startup pioneering fractionalized real estate—integrated Chainlink Automation to help automate rental payments to token owners.

Tokenized Real Estate Baskets

It’s also possible to create a tokenized representation of a basket of real-estate properties and their cash flows.

Features:

- Fungible tokens can collectively represent all properties and cash flows.

- Automated cash can flow back to token owners.

The key benefit of using tokens to tokenize large baskets of real estate is the ability to provide trust-minimized guarantees and automatically act based on verifiable data. Ownership of the property and the cash flows on-chain can enable higher verifiability of the underlying collateral (the properties and their cash flows), automatic payouts, and increased transparency into asset health.

<div class="educational-divider sections-divider"></div>

Benefits of Tokenized Real Estate

There are many benefits to tokenizing real-estate assets, whether individual properties or multiple, whether whole or fractional.

Increased Liquidity

Ultimately, tokenization aims to remove the current barriers to real-estate transactions by optimizing processes, removing unnecessary third parties, and lowering the price barriers to entry. When assets become easier to transact (and cheaper), there can be an increase in liquidity—more buyers and sellers can participate in the market and make transactions. According to Ernst & Young (EY), “The tokenization of real estate assets can play a significant role in the real estate industry. The notary visit, the considerable transaction costs or the land transfer tax become technically obsolete through the use of tokenization.”

Better Price Discovery

Fractionalized real-estate tokens can help the larger market discover the fair-market prices of different real-estate assets. Today, real-estate experts use a variety of data points to come up with a fair price for any property, and estimates from different experts can vary. Similarly, when sellers list their property for sale, offers can come in a wide range. But if individual properties were fractionalized, the price discovery on a fraction of the house can provide better insight into the fair market value of the entire property.

Lower Costs

Past fractionalization, tokenized real estate does not impact the direct cost of real estate itself. But it can streamline the processes and approvals surrounding real-estate transactions. Tokens are facilitated through smart contracts, which can specify the terms of transfer and automatically execute approved transactions—enabling low-cost and trusted coordination between mortgage lenders, notaries, escrow companies, and more.

Reduced Fraud

Real-estate fraud occurs in various ways. Information about a property can be manipulated to provide buyers with false information about key metrics like square footage. Buyers can be lured into making fraudulent purchases like fake house deeds. Blockchains, smart contracts, and decentralized oracle networks like Chainlink can provide better trust-minimization, improved authentication, and verifiable data that reduces information asymmetry—which is often the root cause of successful fraud attempts.

[…] blockchain technology has significant potential to drive transparency, efficiency, and cost savings for CRE owners by removing many of the existing inefficiencies in key processes. —Deloitte, Blockchain in commercial real estate, 2022.

<div class="educational-divider sections-divider"></div>

Technical Challenges of Real-Estate Tokenization

The reality is that widespread adoption of tokenized real estate is still some way off, and there are many challenges that need to be overcome to make it a reality. While there have been a few attempts at tokenized real estate thus far, none have yet been able to create a scalable solution that solves the problems and limitations of the real-estate market today.

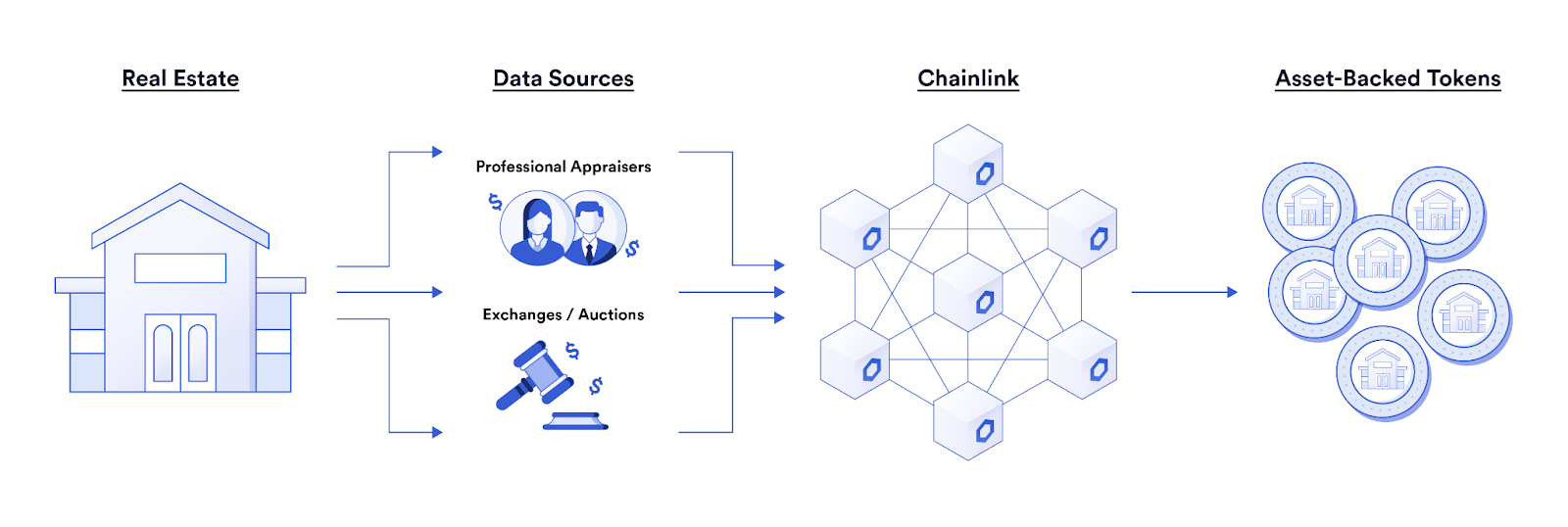

Data Authentication and Verification

Whether it’s data on property improvements and renovations, data on property ownership, or other forms of mission-critical data needed for digital real-estate transactions, there needs to be a certain degree of certainty that the data provided is true, reliable, and valid.

Data is the bedrock of decision-making for real estate because it contextualizes the property. What is the average rental price for a property? How much foot traffic does a property have? When was it built? What renovations have been made? What state is the infrastructure in? Is there any history behind the property that might impact its value?

This is the role of Chainlink in the growing movement toward real-world asset tokenization. Onboarding high-quality real-estate data providers such as ProspectNow and SmartZip to bring premium real-estate data to blockchains serves as an important step for kickstarting a future tokenized real estate market.

Wallet Recovery

Imagine that your house deed is an NFT that’s stored in your digital wallet. You—and only you—know the password. However, that also means that if you lose or forget the password, thereby losing access to the wallet and the house deed NFT, you lose the house.

This is one challenge for reconciling the physical and digital link between tokens and the underlying property: Figuring out who has the ultimate ability to decide which entity or person owns a property in case of mistakes or fraud. It wouldn’t make much sense if losing a token means losing the ownership of a house. Rather, a likely solution is that a centralized entity—such as a government—could help recover and authorize a new, reissued NFT as a replacement for your house deed. This is similar to what happens today if you lose a physical house deed.

Implementation at Scale

Tokenized real estate has immense potential to unlock liquidity and streamline operations for buyers and sellers, but there are a plethora of open questions on how tokenization can work on a global scale, or even on a country-wide scale.

Making a fundamental change to the backend architecture and processes of a $29T market is difficult. Any successful implementation of real-estate tokenization at scale will require open standards, an immense number of tests and pilots, and the coordinated efforts of Web3 projects, governments, and businesses alike.

<div class="educational-divider sections-divider"></div>

Conclusion

Real-world asset tokenization is an exciting opportunity for Web3 technology to make markets more efficient, open, and transparent. Today, there’s already a wide range of assets being tokenized on-chain, from digital dollars to collateralized gold tokens. But given the size, scale, and importance of the real-estate market, there’s likely still a long way to go until tokenized real estate is implemented at scale.

Disclaimer: This post is for informational purposes only and contains illustrative examples of what may be possible surrounding the use of tokenized real estate in the future. Notably, many practical considerations surrounding the future use of tokenized real estate fall outside the scope of this post.