Solving Web3’s Latency Problem to Unleash High-Speed dApps

Web3 is a breakthrough in computing that gives users control over their data, ownership of censor-resistant digital assets, and global access to exciting new applications. Underpinning these advances is the decentralized architecture of blockchain and oracle networks.

However, decentralized networks—with geographically distributed nodes that take time to reach consensus and update—introduce a latency challenge. Long delays from high-latency networks can slow down dApps and negatively impact user experience.

This latency problem is continually being addressed by advanced Web3 infrastructure such as Chainlink’s low-latency oracle solution. By mitigating the latency problem, the future of Web3 can be filled with apps that are both decentralized and high-speed.

Understanding Latency in Web3 Infrastructure

Latency in Blockchains

The speed at which a dApp can operate is ultimately limited by the underlying blockchain that it’s built on. To create fast dApps, developers need low-latency blockchains.

Blockchain latency is impacted by:

- Block time: The time period between blocks of transactions published on a blockchain is known as block time. Proof-of-work blockchains generally have variable block times that follow a Poisson distribution, while proof-of-stake networks usually have fixed block times. For example, Bitcoin produces a block approximately every 10 minutes on average, while Ethereum aims for a fixed 12-second interval. While lower block times indicate lower latency, finalization also needs to be considered.

- Finalization: Finalization is the point at which it’s highly improbable or too expensive for a published block to be removed from the chain through a block reorganization (reorg). Finalization on proof-of-work chains usually depends on probabilistic finalization, where it becomes increasingly costly to rewrite the chain with every new block added. After a certain point, the cost is considered so high, that blocks past a certain point are considered final, due to the low likelihood of a reorg occurring. In contrast, proof-of-stake chains predominantly use explicit finalization mechanisms that halt the chain and/or slash validators if a reorg is attempted.

- Throughput: Latency is indirectly impacted by throughput, the volume of transactions a network can handle. When demand for blockspace outstrips available supply, then users either have to pay much higher transaction fees or wait long periods for their transaction to be included in a block.

The demand for low-latency blockchains has resulted in a greater proliferation and adoption of proof-of-stake blockchains, scalability solutions like rollups, parallelization, and other methods of reducing block times, achieving faster finalization, and expanding throughput generally.

Oracle Latency

Oracles connect blockchains to external data and off-chain computation. Because oracles deliver information on-chain through oracle reports, their speed is limited by the latency of the blockchain the report is delivered to. There is also latency from when an oracle fetches data or computation off-chain to the time it’s delivered on-chain.

While oracles with a blockchain-agnostic design can operate at the native latency of any supported chain, specific oracle services such as delivering real-world data or communicating cross-chain can have their own latency considerations.

Latency is also impacted by whether oracle updates are pulled or pushed on-chain:

- Trigger-based oracles: Data is regularly put on-chain into a reference contract based on predefined triggers, where multiple smart contract dApps can fetch the latest or historical answer on-chain at any time. The latency is generally considered to be the time between when the data point was collected off-chain and read on-chain by a dApp; therefore higher update frequencies lead to lower latency (as data on-chain is more fresh). For price feed reference contracts, data is pushed on-chain whenever a trigger is met, such as a heartbeat (preset time since the last update) and/or a deviation threshold (percentage difference from off-chain value to latest on-chain response). This leads to more frequent updates during times of high volatility, and reduced operating costs and less frequent updates during times of low volatility. Data points that are put on-chain may not always be used by a dApp.

- Pull-based oracle: Data from an oracle network is made available off-chain and only put on-chain on-demand when needed by a user’s transaction. Because the data is made available off-chain, dApps can consume this data at lower latencies without the constraints of waiting for data to first be written on-chain at trigger-based intervals. While this can require more off-chain infrastructure and may not service every use case, pull-based oracles can result in low-latency data inputs and can be more cost-efficient as data delivered on-chain is data that is actively in-demand.

Chainlink is a generalized protocol that can be configured to meet the latency and use case requirements of any application, with the ability to push data on-chain or respond to off-chain pull requests as desired by users.

Latency in Data Providers

Data providers support oracles with data on capital markets, decentralized finance, sports/esports, news, and more. Leading data providers such as CoinGecko, Kaiko, and Tiingo use data aggregation methodologies to generate refined, high-quality data sets. While this ensures broad market coverage and tamper-resistance, aggregation processes can also introduce a limited amount of latency depending on the situation and market.

Data aggregation methods are absolutely critical for oracle networks. While an oracle network could slightly reduce latency by using raw data sources that have not undergone data aggregation, this would expose them—and the dApps relying on their data—to market anomalies that result in inaccurate price data, such as flash crashes, dislocations, and even oracle manipulation.

The future of Web3 is oracle networks that still generate low-latency updates while delivering high-quality and tamper-resistant data. For example, Chainlink oracles already source data from a number of providers that have refined their approach to data aggregation and are thus able to provide data with sub-second update frequencies and response times to ensure dApps have access to fresh and accurate data, which is especially important for low latency oracles.

The Advantages of Low Latency for Unlocking New Web3 Applications

Low-latency blockchain and oracle infrastructure unlocks high-speed Web3 applications without sacrificing the security and decentralization guarantees of blockchain technology.

Better UX

Users have grown accustomed to low-latency Web2 applications and web pages that load almost instantly. Waiting 10 seconds for information to be refreshed, let alone 10 minutes, is too long for many of today’s users. With low-latency infrastructure, Web3 can feel as fast and responsive as Web2 while also providing the security, reliability, and decentralization guarantees of Web3.

Fast Settlement

Traditional finance typically has a two-day settlement (T+2) process for trades. Web3 already has a much faster settlement process (on the order of minutes to seconds) and low-latency solutions will cut settlement times for digital assets even further. This will increase capital efficiency and reduce both counterparty and systemic risks.

Lower-Slippage Trades

The longer the time that passes between when a price is quoted on exchanges or derivative platforms and when the order is filled, the higher the slippage can be as the spot price has more time to move from the quoted price. Low-latency solutions in Web3 can reduce this time delta and therefore the slippage that traders experience, allowing DeFi platforms to compete for flow.

Low-Latency Chainlink Oracles for the Next Generation of High-Speed dApps

Providing a low-latency oracle solution for the DeFi space can help Web3 capture a huge amount of value. The global derivatives market represents over $1 quadrillion in value and Web3 platforms have an exciting opportunity to improve upon current solutions available in traditional finance. While there are some successful Web3 derivative protocols, latency challenges make them uniquely sensitive to frontrunning. Low latency oracles will help mitigate frontrunning and enable Web3 derivative protocols to flourish.

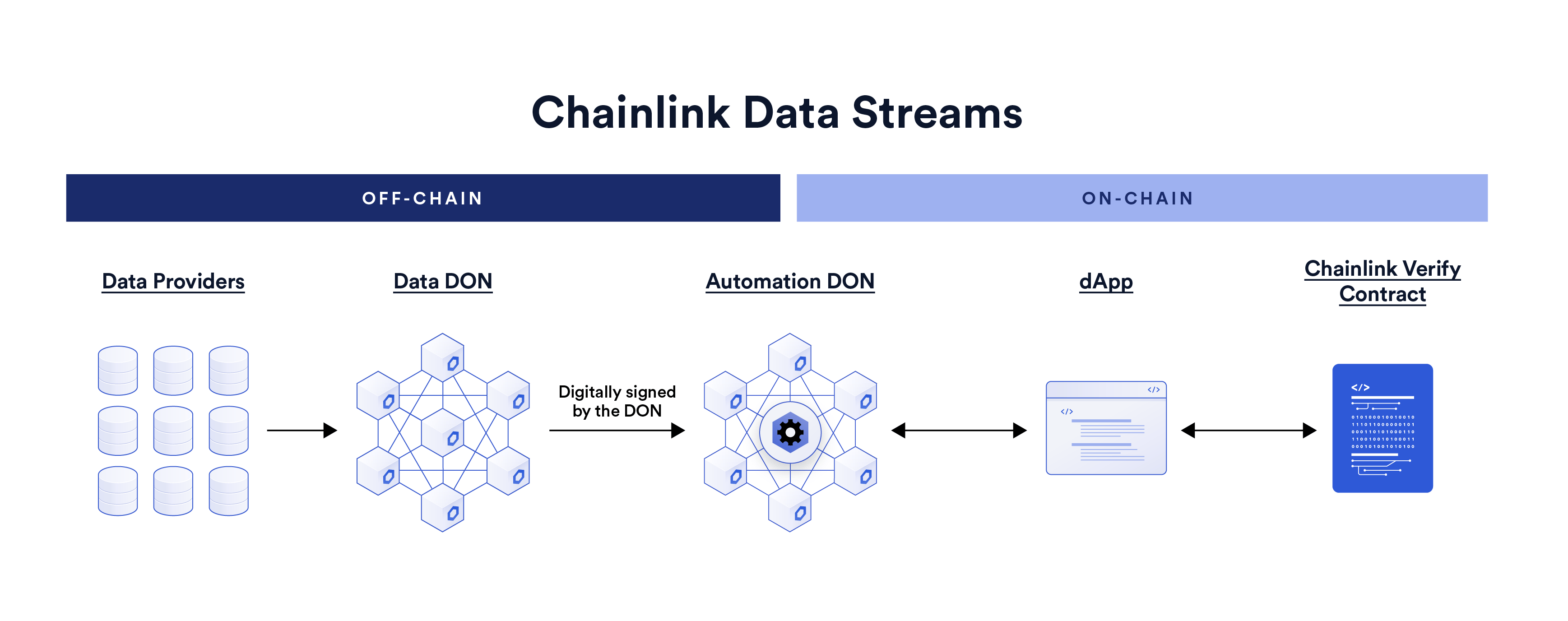

Chainlink’s low-latency oracle solution is a pull-based oracle solution under development that aims to enable high-speed DeFi applications such as derivatives. By delivering high-frequency pricing data to the dApp off-chain while still enabling on-chain verification via cryptographic signatures from a decentralized oracle network, Chainlink can meet the unique requirements of Web3 derivatives platforms.

This pull-based, low-latency oracle aims to provide the following benefits:

- Low latency: dApps can settle transactions much faster. Because oracle updates are generated per block off-chain, with users able to retrieve oracle reports and atomically validate them with an on-chain transaction, latency is reduced by multiple orders of magnitude.

- Frontrunning mitigation: The design keeps prices private until transactions are settled, which shields pricing data from potential arbitrageurs and helps mitigate frontrunning.

- Gas efficiency: The pull-based design means that data is only published on-chain when it’s being used by a dApp, making it highly economically efficient in terms of operating costs.

Critically, Chainlink’s low-latency oracle solutions will be secured by the same highly reliable, decentralized network of nodes responsible for helping securely enable over $12T in transaction value as of the date of this post. Beyond DeFi, Chainlink’s low-latency oracle solution can be expanded in scope to power any dApp that requires low-latency oracle data.

Conclusion

In the early days of blockchain technology, the industry prioritized decentralization and censorship resistance over raw speed. Thanks to exciting innovations and cutting-edge infrastructure, it’s now possible to build applications that are fast while also retaining the benefits of decentralization. Low-latency blockchains and oracles give developers the necessary infrastructure to build high-speed Web3 applications that can outcompete their Web2 counterparts by providing the same level of responsiveness but with added decentralization guarantees that give users ownership of digital assets and control over their data. Ultimately this unlocks an exciting new generation of high-performance applications that drive the space forward.

To learn more about Chainlink, subscribe to the Chainlink newsletter and follow the official Chainlink Twitter to keep up with the latest Chainlink news and announcements.