Building High-Integrity DeFi Markets

The verifiable web gives builders the power to enshrine truth and transparency as fundamental tenets of digital interactions. Instead of paper promises from third parties who can abuse their privileged position to influence outcomes to their own benefit, builders can leverage cryptographic guarantees and decentralized consensus to provide their users with provably fair financial services and high-integrity markets. This is the value proposition of Web3, and it represents a massive opportunity for builders who want to reshape society for the better.

Unfortunately, the realization of a verifiable web is still not guaranteed, as many infrastructure providers hold conflicts of interest. The onus is on market participants and developers to overcome these obstacles and adopt credibly neutral infrastructure that is inherently designed to be conflict-of-interest-free and incentive-aligned to the benefit of all participants. A failure to prioritize credibly neutral infrastructure will leave DeFi vulnerable to the same bias, censorship, and manipulation currently present across traditional markets.

With Chainlink’s credibly neutral infrastructure for data, computation, and interoperability, we can create a DeFi ecosystem where users can be verifiably protected from unfair market manipulation and exploitation. This is why leading protocols are integrating Chainlink Data Streams as data infrastructure that helps ensure the fair execution of user trades.

The Consequences of Conflicts of Interest

Conflicts of interest have existed in financial markets since their inception. Centralized financial systems are inherently flawed because users must trust that facilitating third parties will act in their best interest—even when they are not incentivized to do so.

From their privileged positions, centralized parties can exploit the market and its participants. Guilty pleas and heavy fines are seen by some as simply the cost of doing business. As long as this behavior is incentivized, it will continue unabated.

DeFi promises a fair and transparent alternative backed by cryptographic guarantees and incentives mutually aligned between all participants. However, without credibly neutral infrastructure that enables market structures to be free from conflicts of interest, DeFi users—from traders and liquidity providers to lenders and borrowers—will remain vulnerable to increasingly sophisticated value extraction techniques.

In fact, DeFi is beginning to see the emergence of value extraction schemes from some of the financial establishment’s sophisticated players as they attempt to co-opt DeFi’s narrative, infrastructure, and communities. These “wolves in sheep’s clothing” attacks include:

- Information asymmetry systematically extracts value from retail participants as privileged entities use advanced MEV techniques, provide pricing data to the markets on which they trade, or utilize in-house keeper networks to manipulate or prematurely reveal pricing information to third parties.

- Backdoor dealings and opaque market-making agreements allow entities to steal or utilize user funds without their knowledge/consent, and to quietly prop up fundamentally unstable products under the guise of natural market forces (e.g. FTX and Terra).

Chainlink Is Designing Credibly Neutral Infrastructure for a Conflict-of-Interest-Free DeFi Ecosystem

With the Chainlink Network’s credibly neutral infrastructure, DeFi has an opportunity to redesign financial markets to be conflict-of-interest-free, aligning the incentives of all participants to help ensure high-integrity markets.

Credibly neutral infrastructure provides DeFi users with a level playing field by eliminating frontrunning, conflicts of interest, and market manipulation risks while maintaining the highest degrees of security, reliability, and accuracy, even during periods of extreme volatility or congestion.

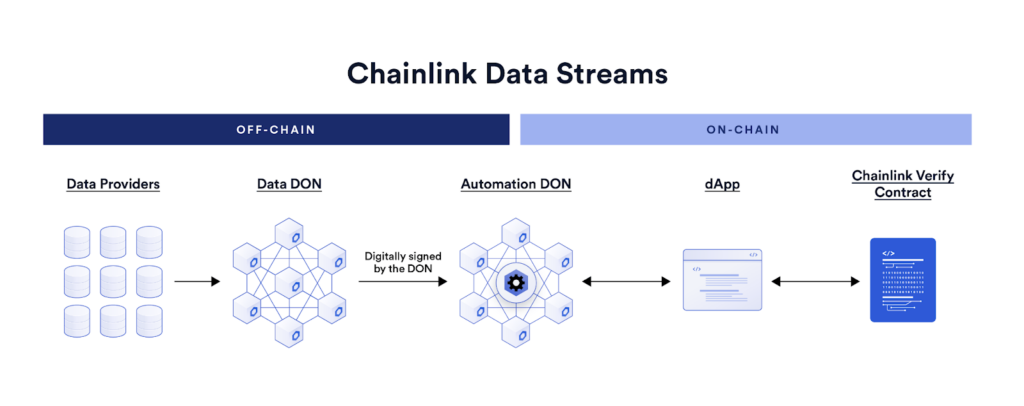

Chainlink Data Streams, consisting of a new low-latency oracle architecture combined with Chainlink Automation, is purpose-built to remove misaligned incentives and provide DeFi applications with the infrastructure they require for fair transaction execution.

Together, Chainlink’s low-latency oracle architecture and Chainlink Automation enable DeFi applications to provide a fairer experience for their users:

- Conflict-of-interest-free data where Chainlink service providers (e.g., node operators, data sources) are not financially incentivized to exploit privileged knowledge of user transactions). This protects traders and liquidity providers from malicious price manipulation and information arbitrage.

- Low-latency updates and “commit-and-reveal” architecture with sub-second data delivery, transaction privacy tools to help mitigate frontrunning, and onchain cryptographic guarantees of posted data to ensure its veracity.

- Credibly neutral execution of user transactions via Chainlink Automation prevents adverse selection, a situation where the price retrieval mechanism used by a dApp is able to select a favorable price at which to settle a trade or view the price in the latest price report prior to submitting a trade. Chainlink’s decentralized network of world-class node operators is incentivized to correctly execute user transactions and remains completely independent of the dApp, meaning the dApp’s developers can’t frontrun traders on their own platform.

A truly equitable DeFi ecosystem is imperative for the next wave of adoption and innovation. Users do not want to participate in exploitative markets and will ultimately demand that dApps utilize credibly neutral infrastructure, fostering a self-reinforcing cycle that boosts confidence, adoption, and liquidity within the DeFi industry.

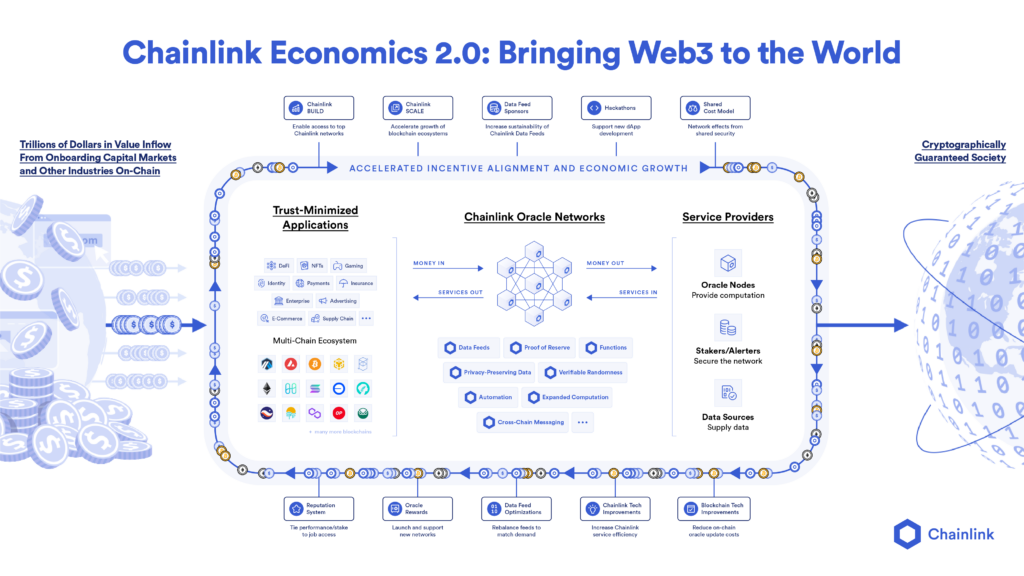

The Importance of Incentive Alignment

Aligning the incentives of infrastructure and service providers with those of end-users is critical for enabling the best outcomes for users over the long term and supporting the sustainability of blockchains, oracle networks, and dApps. This is why Chainlink Economics 2.0 initiatives, such as Chainlink Build and Chainlink Scale, along with Chainlink Staking, play a crucial role in driving the next generation of sustainable, secure, and fair DeFi protocols. Through cryptoeconomic security that eliminates conflicts of interest, data providers and node operators are incentivized to reliably provide users with accurate and timely data.

Next Steps Toward Building a Fairer Future for DeFi

Fulfilling the promise of the verifiable web—fairer, transparent, and more accessible markets and services thanks to built-in protections against malicious actors and unfair value extraction—requires credibly neutral infrastructure that guarantees fair execution and proper incentive alignment between market participants.

From its inception, the Chainlink Network has been built to be secure, reliable, and credibly neutral so that a fairer DeFi ecosystem can be created—one in which users have verifiable safeguards in place that protect them from exploits, market manipulation, and frontrunning. In fact, this is the only way in which DeFi can succeed and stand out compared to traditional markets.

One way DeFi protocols can prove to their users that they are credibly neutral is by integrating Chainlink Data Streams as their data oracle and settlement automation infrastructure solution.

If you want to explore using Data Stream in your dApp, reach out here. You can also learn more by reading the announcement blog and visiting the developer documentation.