Chainlink: The Platform for Building the Verifiable Web

In his recent SmartCon 2023 keynote, Sergey Nazarov explored how Chainlink enables the verifiable web where users can understand exactly what’s going on and remain in control of their assets at all times. This post is based on his presentation.

Manipulation in the Modern World

“When I look around, I see a few problems in society that the technology that we’re building can solve.”—Sergey Nazarov

The first thing that Chainlink can help overcome is the immense amount of manipulation going on in every aspect of society. In the financial world, people are manipulated by large institutions and smaller groups. In the world of information, very few people can rely on the news or social media. Now, with the emergence of AI, we’re unfortunately going to see even more manipulation—even amongst certain individuals who have access to extremely powerful computing systems. The world of manipulation is increasing.

The second aspect of creating a manipulation-resistant world relates to information. If you can’t access truthful information about what’s going on inside the system you’re about to join, you can’t understand what you’re signing up for.

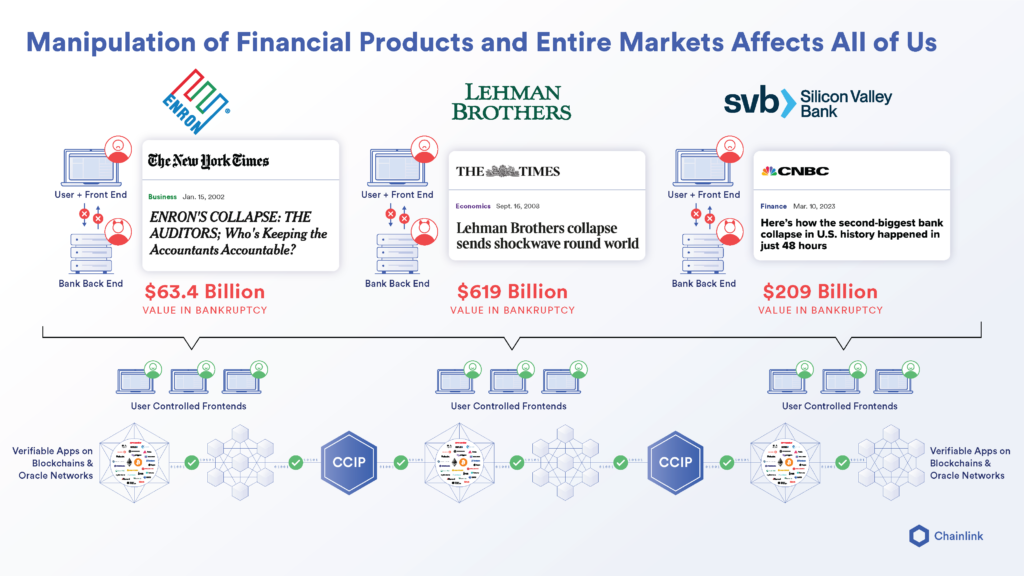

Both manipulated systems and unverifiable misinformation lead to reactive fixes. When something goes wrong in society, complaints are met with excuses, inadequate fixes are proposed, and then an even worse version of that fix is implemented…and it all happens again and again. That’s the story of the 2008 financial crisis and the recent SVB failure. That’s the story of multiple news cycles that repeatedly cover provably false information. A problem emerges, we react inadequately, and it reoccurs.

The good news is that we have the technology to solve these problems. Creating verifiable user-controlled systems empowers anyone to understand what the system is before they join and then leave the system whenever they want. This degree of user control and verifiability will become increasingly important as more and more of the world’s systems become manipulated and opaque.

A Manipulation-Resistant World Built on the Verifiable Web

“The world that I would like to live in, and where I believe most of you would like to live in, is a world where I can understand a system before I enter it and on an ongoing basis, whether it’s a financial system, an informational system, or any other system. I want verifiable proof of how it works, the deterministic guarantees of the system, and the conditions under which I can leave.”—Sergey Nazarov

At a high level, this is the world we’re building with blockchains, smart contracts, decentralized oracle networks, and trust-minimized compute. Through cryptographic truth, we’re building a verifiable web where users can make informed choices because they can know and verify exactly what the system is doing.

The verifiable web offers three key improvements:

- Know what you’re getting into because you can proactively verify everything about a system before entering into it, knowing it can’t change.

- Know what is going on by utilizing verifiable cryptographic truth to avoid misinformation and know what is actually going on in the system you’re in.

- Proactively decide on whether you should leave the system because it’s a user-controlled system that clearly defines how you can leave the system.

How The Verifiable Web Transforms Society

1. The Financial System

The financial system currently operates in a reactive mode where bad actors can manipulate information to make false promises, such as misrepresenting the value of assets. When these systems implode, it’s the users that are left paying the costs. From Enron to Lehman Brothers to SVB, these failures of centralized systems have occurred too many times.

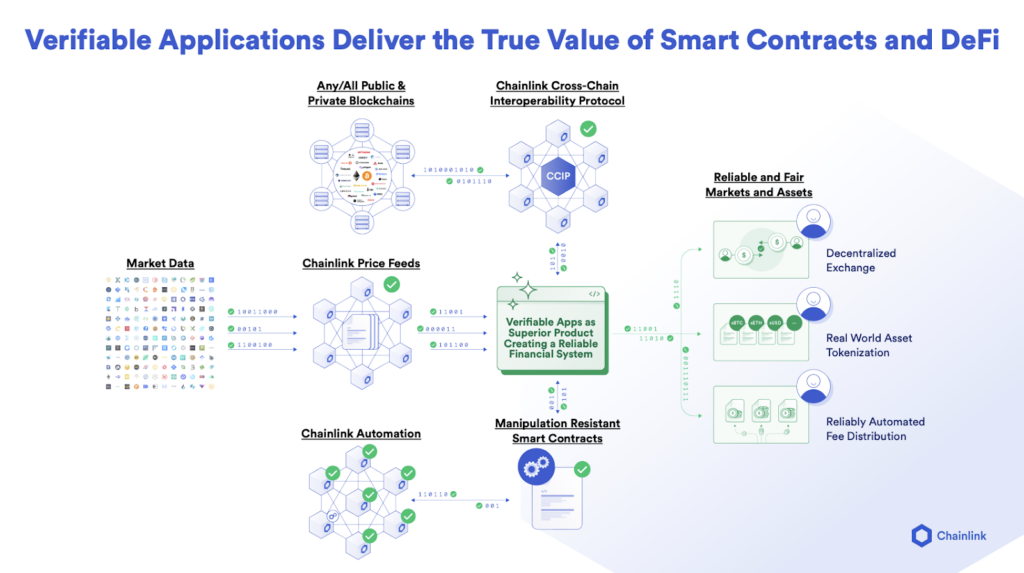

How do we get to a manipulation-resistant world? We combine blockchains, smart contracts, and decentralized oracle networks to create verifiable applications that provide cryptographically guaranteed representations about how they work. Anyone can analyze the math and code to understand how they actually work and make an informed choice about using them. Moreover, users fundamentally control the ability to join or leave a network, rather than a single frontend interface connected to a centralized database. If one frontend interface turns off access to a verifiable application, you can simply use any of the other multiple interfaces to interact with your assets.

The verifiable web solves key problems for financial markets. Everyone can understand a system before they deposit their assets, know what’s going on with their assets on an ongoing basis, and withdraw their funds at any point. Ultimately, this will increase personal accountability and help limit unfair bailouts for anyone taking excessive risks.

2. Developing Economies

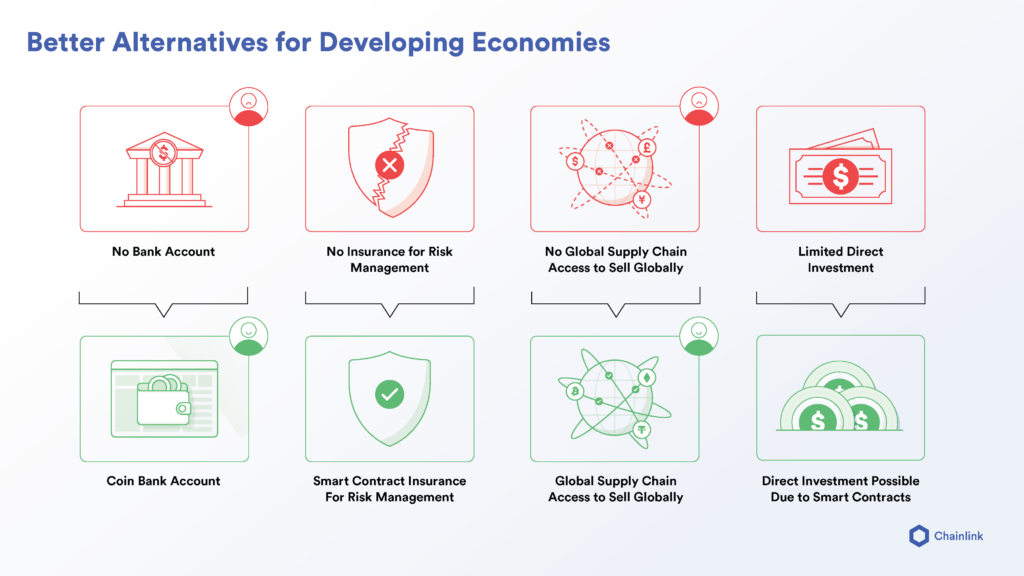

Developing economies often don’t have the frameworks and systems necessary to support a banking system, insurance, global supply chains, and direct capital investments.

This matters because they’re the key ingredients to a better economic future and billions of people don’t have access to them. To thrive, they need to be able to save money that’s stable and in their control, protect their livelihood against adverse events, participate in the global marketplace, and finance growth.

The verifiable web can provide these people with a parallel system of contracts that provide access to stablecoins, parametric insurance, a public global marketplace, and alternative funding sources. This is all possible with access to the Internet and a Web3 wallet.

Similar to how emerging economies skipped libraries and landlines and gained access to the world’s information and communications via mobile phones and Internet access, an Internet of contracts on the verifiable web can provide the benefits that a framework provides, without waiting for it to be built. This will create real economic growth and prosperity across emerging markets.

3. Information Transfer

We are in a world where the majority of the public don’t trust the news or social media. With information increasingly being manipulated to serve economic or political goals, individuals are unable to make informed decisions. This problem is only going to get worse as even people with limited resources will be able to disseminate false information at a greater scale using AI.

Verifying information and proving provenance with cryptographic signatures can help establish ground truths for society that are widely accepted. This will help previously divided groups find common ground and protect against AI-generated misinformation.

The Next Standard for Truth

Various forms of truth have underpinned core societal functions and technical systems. Now, cryptographic truth provides a major leap forward.

Initially, many things in society were determined by stories, which were turned into myths, then religions. When civilization gained the ability to precisely and repeatedly measure things, scientific truth emerged. The Gutenberg printing press enabled widely held truths to be transcribed and shared across the globe, although production had limits. Digital truth changes that dynamic as anyone can share information with the world at virtually no cost. As we’ve all seen, they are often either purposefully misleading or provably false.

Cryptographic truth differs from digital truth because it enables you to verify the authenticity of the information. While cryptographic truth may not answer every single question, verified information immune to manipulation provides society with a solid foundation.

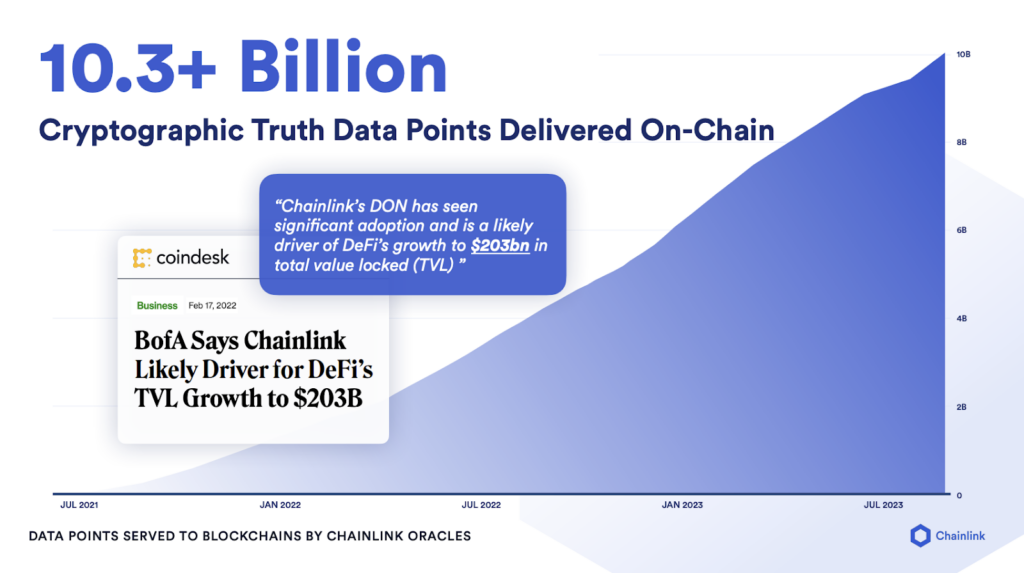

Chainlink Has Provided the Most Cryptographic Truth In History

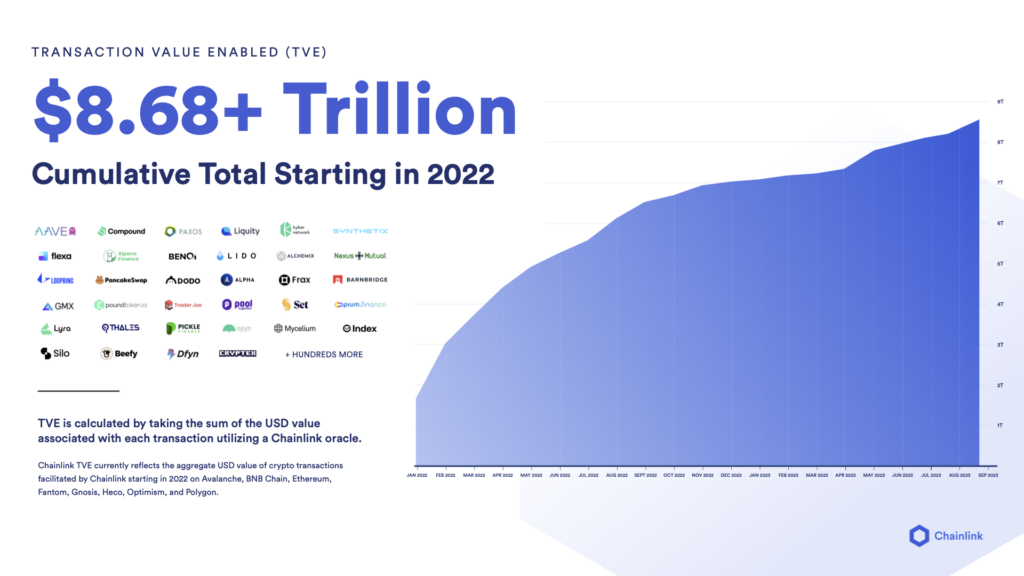

With 10.3B+ data points delivered onchain, the Chainlink Network has delivered the most cryptographic truth. This has predominantly come in the form of market data that can’t be manipulated, as there was immense demand from DeFi. Additionally, we have generated many other forms of cryptographic truth, including proof of reserves, identity and weather data, and more. Cryptographic truth is clearly of incredibly high value to people, having generated over $8.6T in transaction value in less than two years.

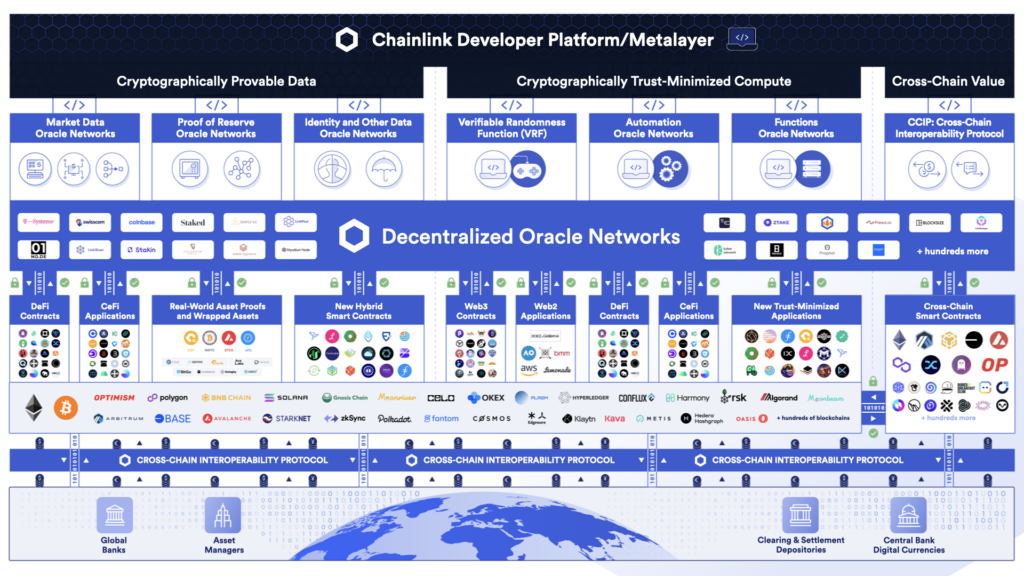

Beyond Cryptographic Truth: Cryptographically Guaranteed Compute and Connectivity

Cryptographic truth alone isn’t sufficient to build a verifiable application that has deterministic outcomes and enables users to leave at any time. That’s why we developed the ability to provide verifiable, cryptographically guaranteed compute and connectivity. Together, the Chainlink platform has the three key building blocks needed to build a verifiable application onchain: data, compute, and connectivity.

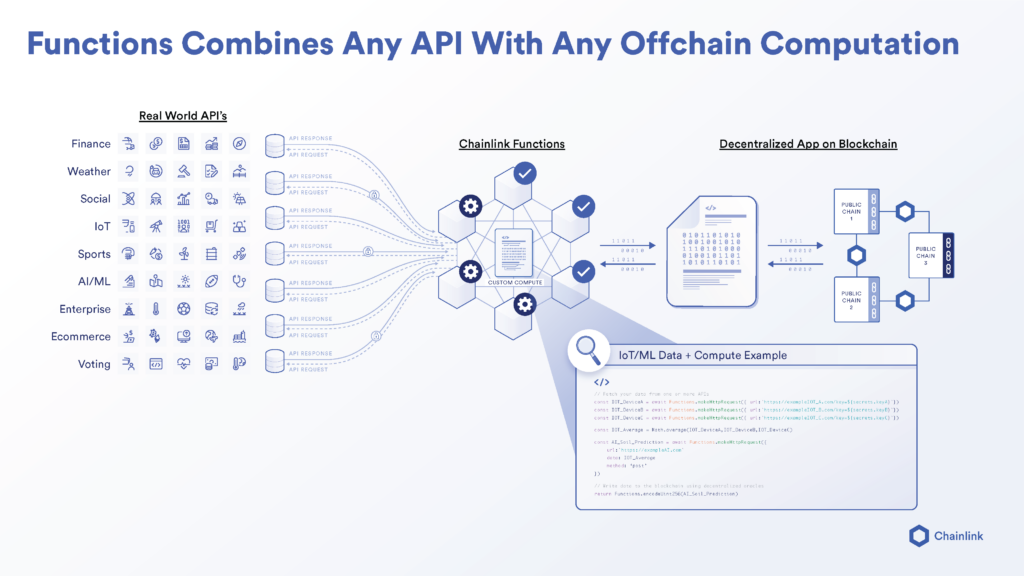

Access Any Offchain Data and Compute With Chainlink Functions

We’ve recently launched the most advanced version of Chainlink Functions so far, featuring a combination of data and computation. Chainlink Functions enables you to make a request to any API that you define, and then input your own arbitrary computation into the same decentralized oracle network (DON). This level of flexibility is new to oracle networks, and people need to be careful about using it in a secure way.

This more flexible, self-service, and expansive way of providing Web3 services reflects where the platform is heading more generally. We’re now in a world where the Chainlink platform securely provides both cryptographically verified data and trust-minimized compute across random numbers, automation to trigger smart contracts, and external information.

Securely Interact Cross-Chain via Chainlink CCIP

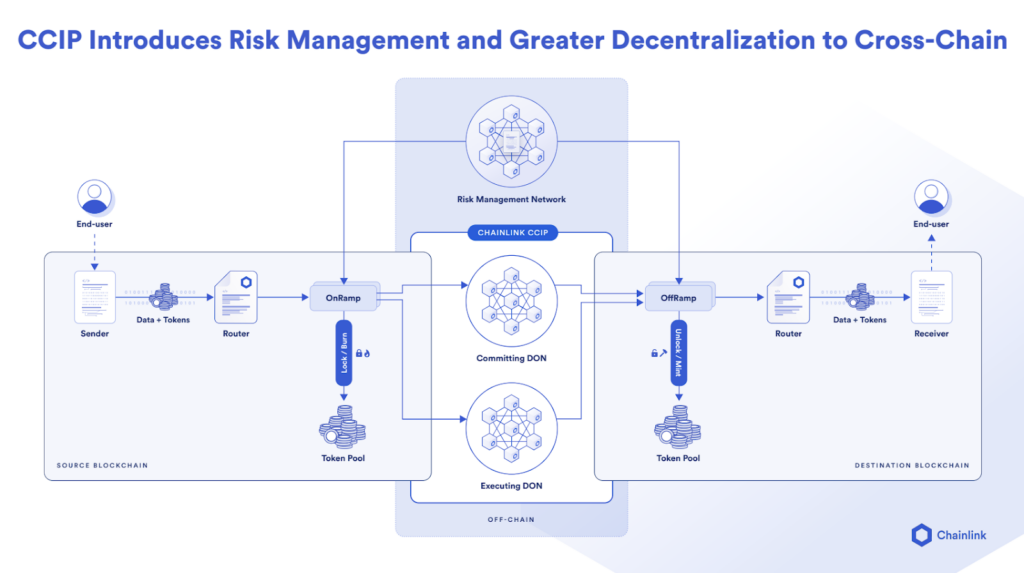

Cross-chain connectivity is a monumental problem because it’s critical for the Internet of contracts. It’s not just creating a set of networking connections between different nodes or different systems, it’s creating a set of connections that can secure trillions and eventually hundreds of trillions of dollars in value cross-chain. By connecting all of the different blockchains and smart contracts in an efficient, secure, decentralized, and verifiable way, it unlocks the verifiable web.

We focused on verifiability and decentralization for CCIP because the security model works. Many of the people who have tried to solve this interoperability problem don’t generate the amount of security via decentralization that we think is needed, which actually was what happened with data oracles before Chainlink was utilized to transmit data to DeFi. Either there were centralized solutions or protocols that tried to appear decentralized but were actually distributed—creating massive risks and issues that prevented DeFi from taking off. That situation is similar to where bridges are today, and, once again, this is a problem that Chainlink can help solve.

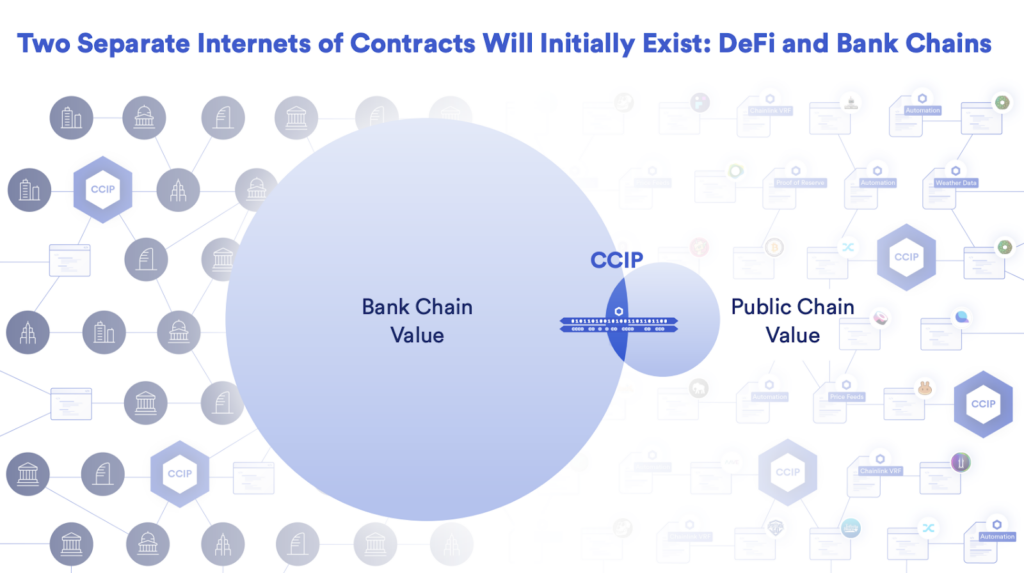

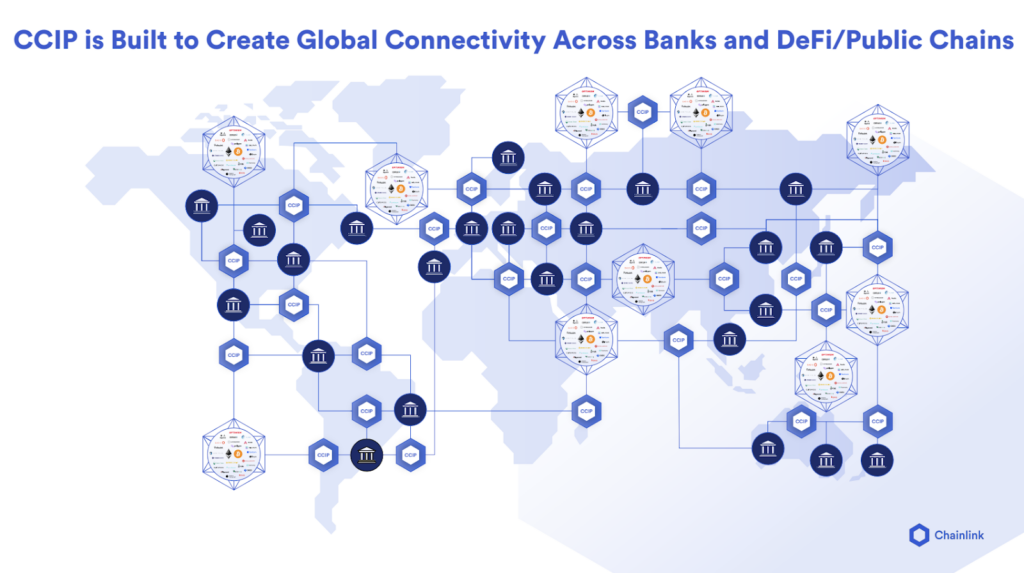

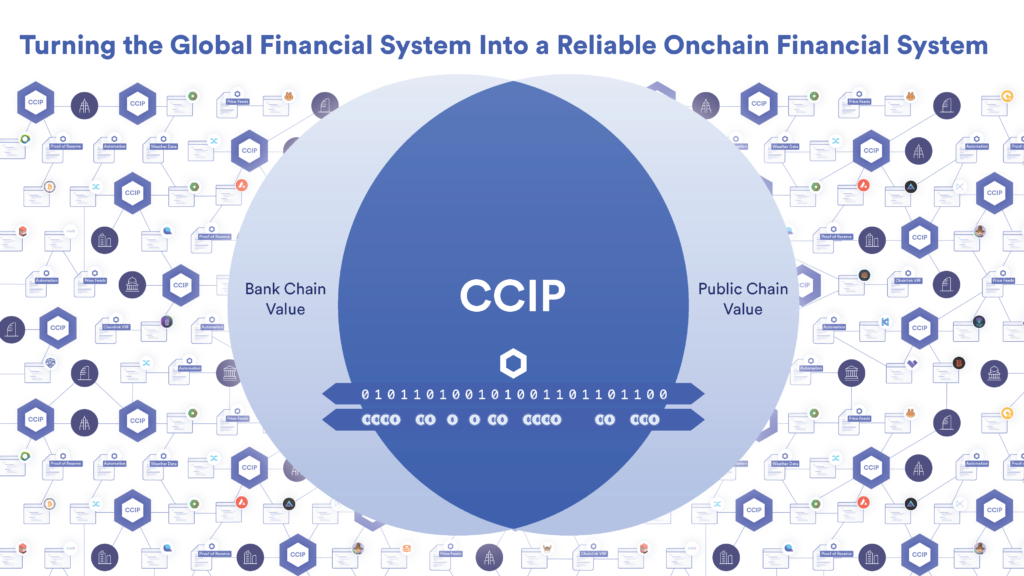

The ability to have reliable cross-chain value transfer and communications will create two fundamentally different worlds that will eventually combine. The first world is the public blockchain world, where CCIP is already live in production. Many people are adopting it, using it to both transfer value and send information, as well as combining value with the information to efficiently trigger smart contracts. The second world where CCIP is being adopted is in capital markets, where banks and asset managers hold hundreds of trillions of dollars in value.

Ultimately, the first world of public DeFi can move quickly, innovate, and build exciting new applications, which CCIP can connect to the second world of capital markets that hold vast amounts of value. Web3 will get access to trillions in value, and capital markets will deepen liquidity. That’s the world we’re moving toward, and it will have an immensely powerful effect of creating the world’s largest liquidity layer and an Internet of contracts.

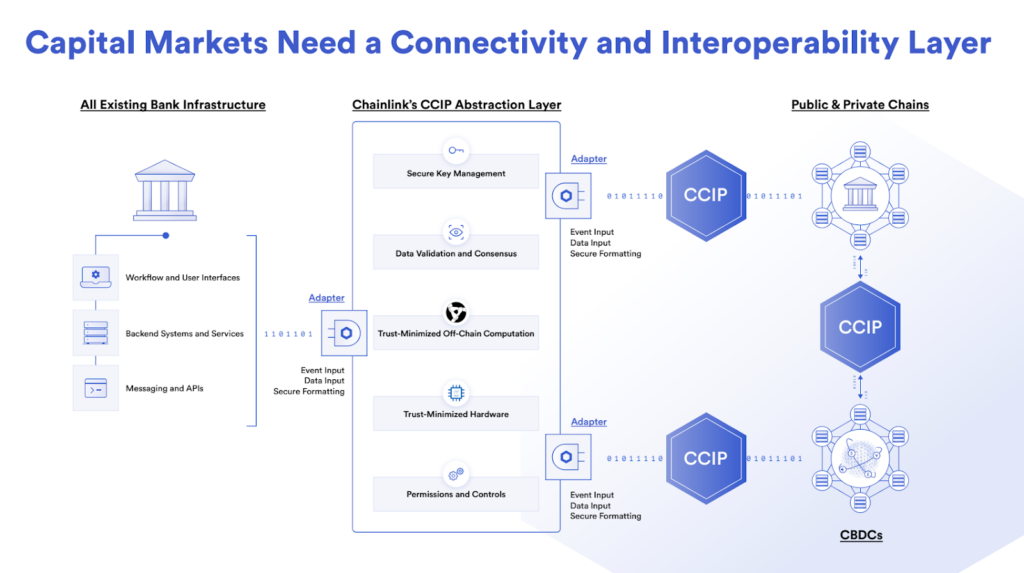

Why Capital Markets Need CCIP

Chainlink CCIP helps capital markets address three fundamental problems in the near term.

1. Connecting to Blockchains

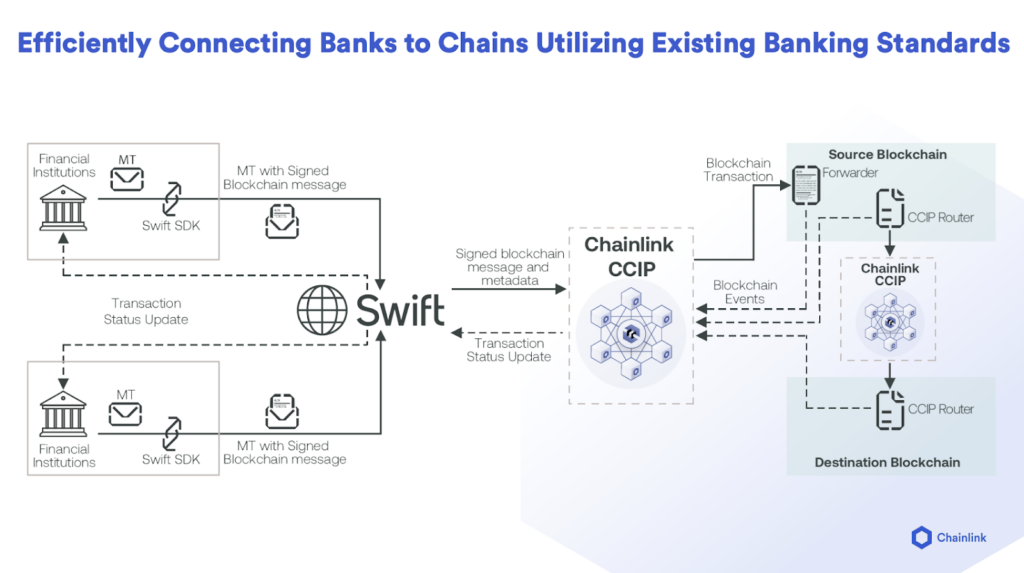

Capital markets require blockchain interoperability. How do you connect bank systems that are 30, 40, or 50 years old to blockchains without having to reinvent everything? Moreover, for anyone securing hundreds of billions in a system, switching over to a new system can be a risk. Using CCIP, financial institutions can easily and securely connect their existing systems to blockchains, eliminating the need to rebuild or replace their existing infrastructure.

Connecting with existing systems also provides benefits for CCIP. By integrating with existing infrastructure such as Swift, we do not need to get a private key in the hands of the people running banks. They have already been using private key signing devices for years through Swift, and their current private key signing device can be used to sign transactions that send value into the blockchain ecosystem.

By enabling existing systems to securely and efficiently interact with blockchains, rather than replacing those systems, you’ll get the world working on blockchains much faster.

2. Connecting Hundreds of Chains Per Bank

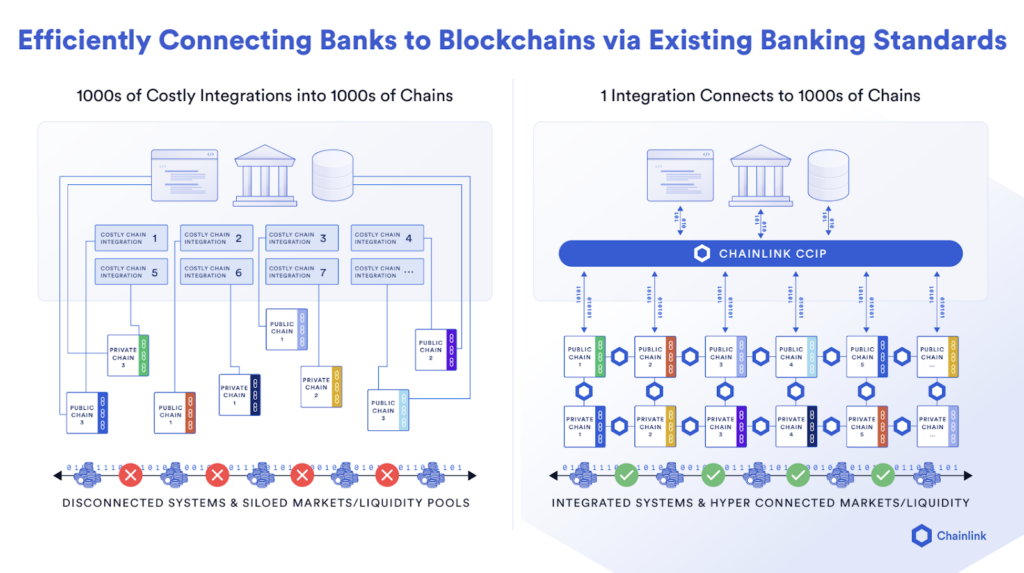

While banks previously envisioned having their own global chain that everyone would use, they now recognize that each bank will have hundreds of chains to cater to varying asset classes and geographies. With assets and buyers split across various chains, liquidity will be fragmented across digital islands.

How will they connect with each other and to various chains from other banks? Creating thousands of costly connections between each bank is unnecessary. Instead, CCIP can serve as the universal standard that connects all bank chains, enabling liquidity to flow seamlessly between them.

Similar to email, where anyone with an email address can send anyone else with an address a message, any bank connected to CCIP will be able to transfer tokens and send messages to any other bank also connected to CCIP. This enables banks to launch new chains and rapidly create deep markets around assets that would otherwise have low liquidity.

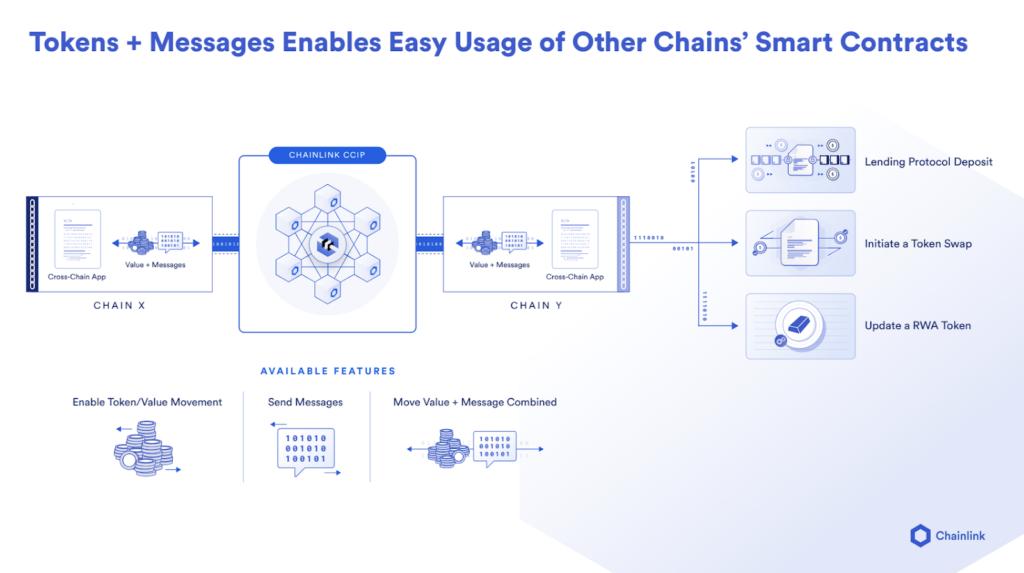

3. Combining Value With Instructions

Today, if you want to buy an asset on a different chain, you must make multiple transactions, swap various assets, use a bridge back and forth, and more. Instead of multiple steps and transactions, CCIP makes it possible to condense multiple steps into a single transaction. All the user has to do is send an instruction to CCIP from their home chain, and it will securely make all necessary transfers and swaps. This capability not only transforms Web3, but global financial markets as well.

This capability works by combining the value and instructions together, which differs from how the global financial system works today, where value and information move separately. You can send an asset to a different chain and tell it what to do when it gets there, along with enabling atomic settlement and many other benefits that will transform financial market workflows.

Only Chainlink Can Unlock the Benefits of Real-World Assets

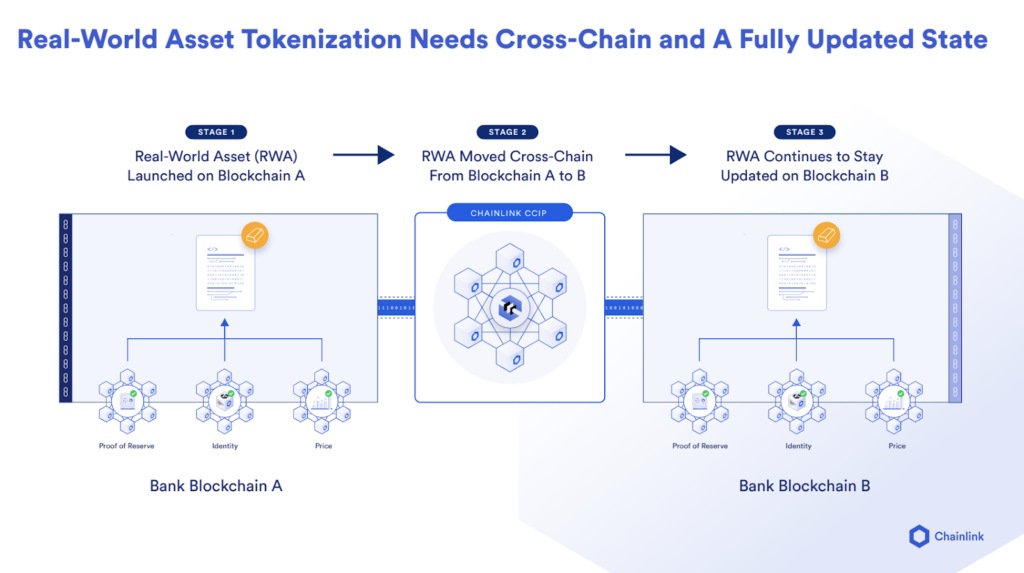

Remaining connected to real-world information regardless of which chain it lands on makes tokenized assets a superior format. Chainlink solves three key problems that unlock the potential of real-world assets:

- Injecting information—Chainlink can provide the necessary information, such as proof of reserves, identity data, real-time prices, and settlement requirements, that banks and their customers require to buy/sell tokenized assets.

- Enhancing liquidity—Accessing the massive liquidity layer of the blockchain economy via CCIP enables thriving markets around various real-world assets.

- Updating assets cross-chain—Tokenized real-world assets need to be updated with proof of reserves, price, and other data even as they move across various chains, which only Chainlink can provide as it has both the necessary data and cross-chain connectivity.

Solving these problems is critical, as without real-time updates across various chains, tokenized real-world assets would lose their fidelity and liquidity advantages.

A New Stage in Blockchain Adoption by Banks

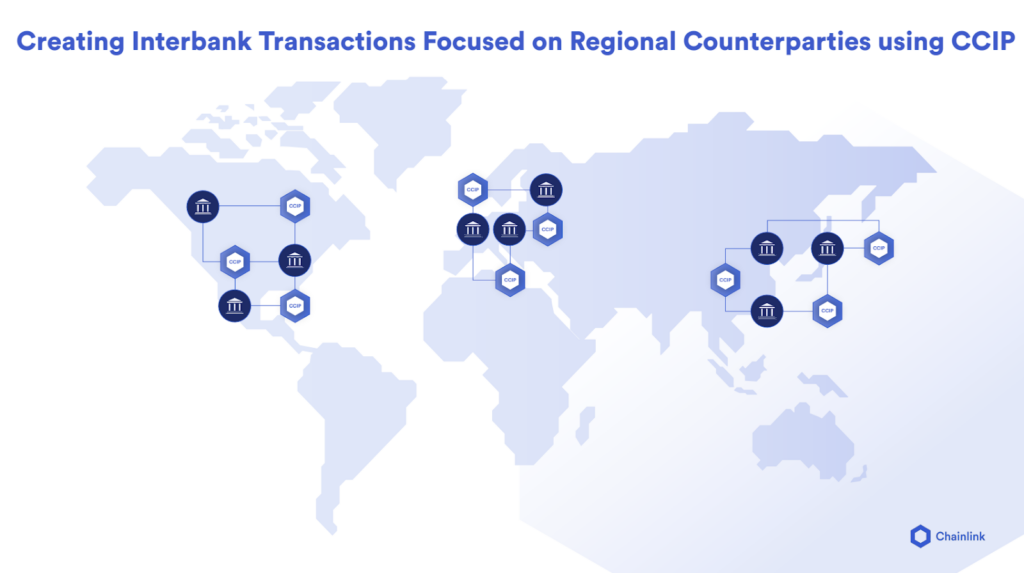

Although blockchain use by capital markets is developing at a slow to moderate pace, this is an improvement. There are now dedicated digital asset teams led by senior managing directors that have key decision-making power within their organizations. We’re now seeing them eager to perform blockchain transactions regionally.

Given that institutions are still in the process of clearly establishing regulatory frameworks and participating in ongoing pilot regimes for tokenization, U.S., European, and Asian banks are all looking to transact with other banks in their local regions. Notably, CCIP is being built more and more with these requirements in mind.

Looking at the big picture, banks coding blockchain transactions with other banks cross-chain is something that hasn’t been seen before. This is a completely new stage in the adoption of onchain finance.

“This is not the same movie as before.”—Sergey Nazarov

Creating the Bank Chain Internet of Contracts

We’re in the early stages of adoption, and that’s exactly the right time to create a universal interoperability standard that will power both the public blockchain Internet of contracts and power the bank chain Internet of contracts.

Chainlink has experience successfully creating standards, being the data, compute, and proof of reserve standard for DeFi, among others. The interoperability standard for the Internet of contracts presents a massive opportunity for the Chainlink Network.

Expanding CCIP as the Standard Across All Banks

The next stage of creating a universal standard is onboarding more banks, asset managers, and other financial players. That increases value liquidity in the system, which attracts even more users, and adoption of the standard continues to grow.

CCIP: The Universal Interoperability Standard

As a standard for both bank chains and public blockchains, CCIP will then be able to connect these separate ecosystems to create an interconnected onchain financial system where value can flow back and forth between banks and Web3. This is a massive step forward for the Internet.

Right now on the Internet, you don’t know which backend database a website or application is using. Frankly, it’s not important to most users whether the backend runs on AWS, Azure, or any other platform, as long as it’s working correctly. Similarly, the blockchain network underpinning their application won’t be important to most users as long as it operates as expected.

What’s important now is creating a universal standard for the Internet of contracts that enables value to move securely across various blockchain networks, similar to how TCP/IP enabled disparate systems to connect and transfer information. That’s the vision for CCIP and will complete the final piece of the Chainlink developer platform puzzle.

The Chainlink Metalayer

Developers can access 90%+ of what they need to build a verifiable application through the Chainlink platform. They can select the blockchain they want to build on and then get the data, compute, and connectivity to the users and the value needed for their application through Chainlink. Builders can stay in the Chainlink Network even as they expand their app across multiple chains.

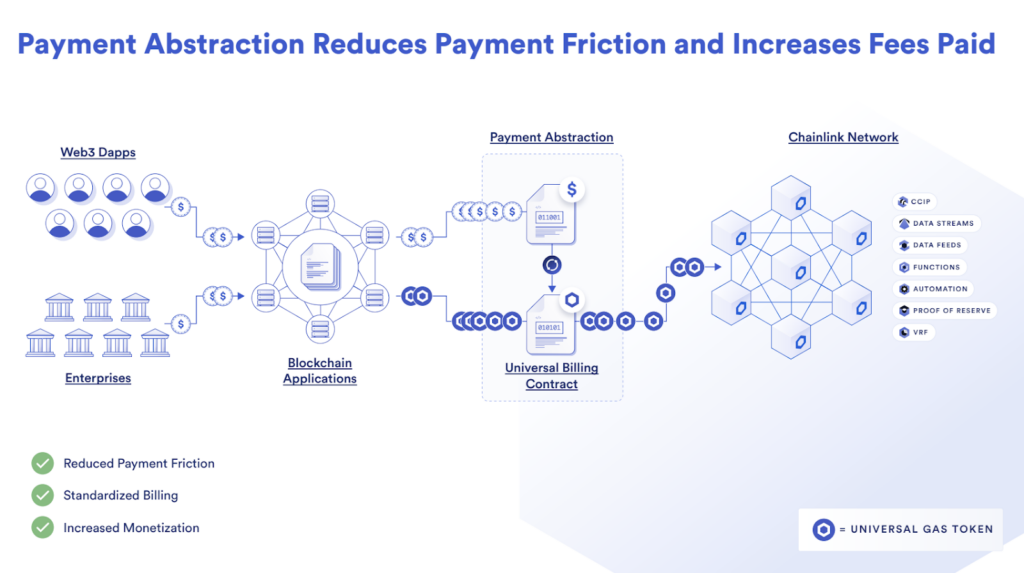

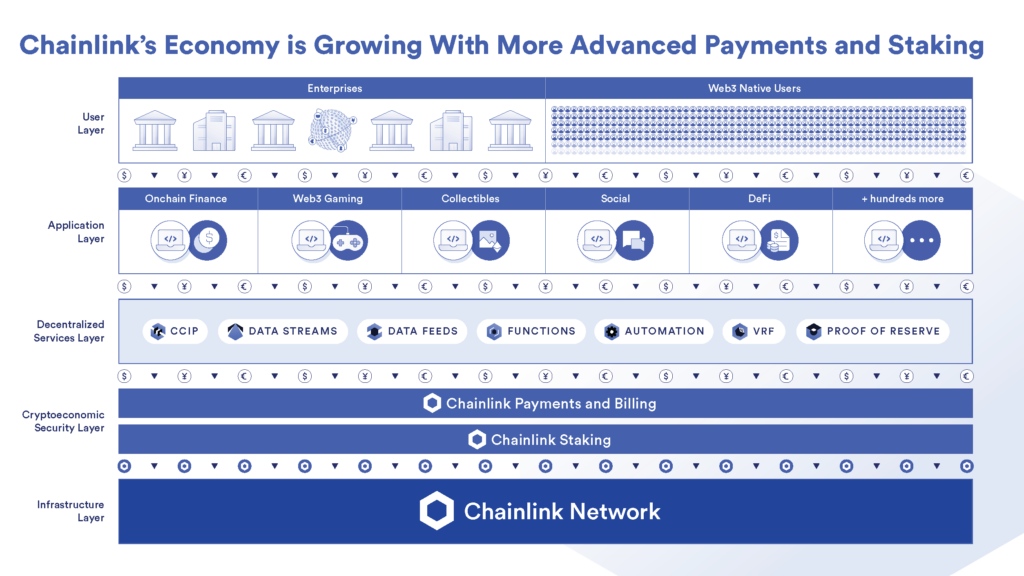

The Payment Abstraction Layer: Reducing Payment Friction

The next thing to solve is making sure all users of the Chainlink platform can efficiently interact with the system and pay value into it to gain access to additional oracle networks, as well as have more stakers join the network to strengthen the system’s security. This is why we’re working on a payment abstraction layer, which will abstract away the complexity of paying for Chainlink oracle networks, while allowing oracle networks to get paid in LINK.

The payment abstraction layer is something that not many projects in our industry can build because you need to know the value of the token you’re getting paid in order to receive it. That requires price oracles, which Chainlink is the industry leader in. This mechanism is the right way for payments to work for many infrastructures and applications in our industry, and the payment abstraction layer may at some point in the future become its own separate Chainlink service, where data oracles are used to assign value to whatever tokens users want to pay with.

The payment abstraction layer is important because it reduces the friction of users paying to get access to decentralized oracle networks. Users should be able to pay with a credit card, a bank account, a native blockchain token, a stablecoin, or their own protocol token, while the payment abstraction layer turns it into LINK.

Build Program Grows To 70+ Projects

Build is an example of other ways projects are able to pay for Chainlink services. The program has grown to over 70 projects and is a great way for smaller teams to access high-security Chainlink oracle networks by allocating a portion of their token supply. We’re proud of our work that contributed to the success of various DeFi protocols and Build will help give other early-stage projects an opportunity to create next-gen applications.

Chainlink Staking Is Expanding With v0.2

The staking system is expanding to include more participants and further strengthen the cryptoeconomic security of the Chainlink Network. At SmartCon, we launched the Early Access Eligibility App for Staking v0.2. The v0.2 update is currently undergoing various security reviews and is expected to come out this year. We take security extremely seriously and the update will help increase the security of the protocol by including more members of the community as part of the staking system.

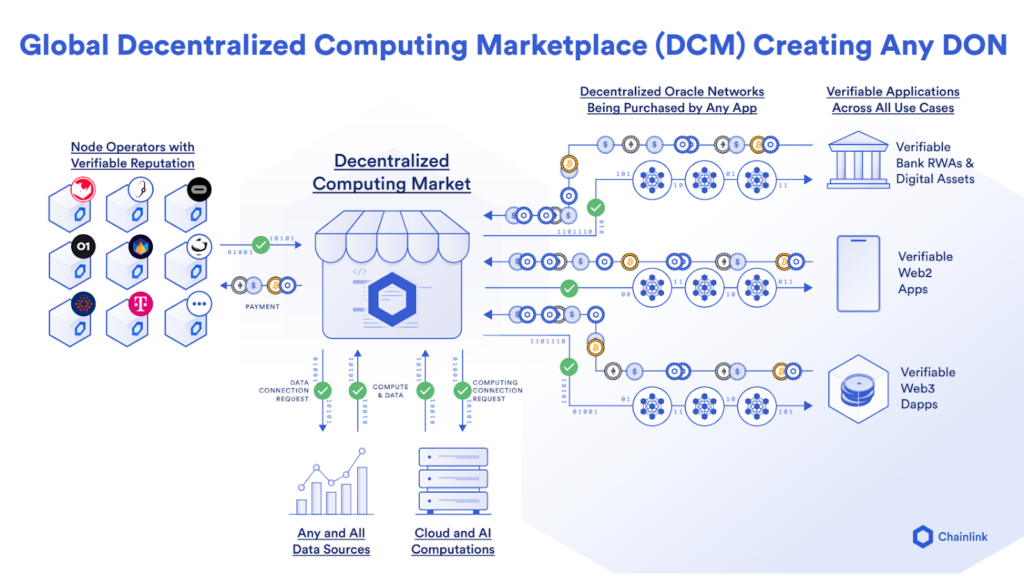

Decentralized Computing Marketplace: Matching Budgets to Security

A longer-term goal is to launch a Decentralized Computing Marketplace (DCM) that makes it easy for users to define their security budget and have the onchain marketplace provide the data, compute, and security it can afford.

One of the problems right now is the inability of users without a sufficiently large budget to afford the high levels of security provided by the Chainlink Network. The DCM will not only make it easy for users to pay for services, it will enable anybody with any budget to define any set of configurations for an oracle network and receive services from a highly automated system that meets their defined standard of security and reliability. In this way, Chainlink can meet everybody’s security and budget requirements. We’ve consistently seen that as applications scale and secure more value, they increase their security budgets to pay for additional nodes and security features, and the DCM will make this process even more efficient.

Overall, the DCM enables users to access the security that meets their budget and automate it in an efficient way, and can seamlessly scale as they grow.

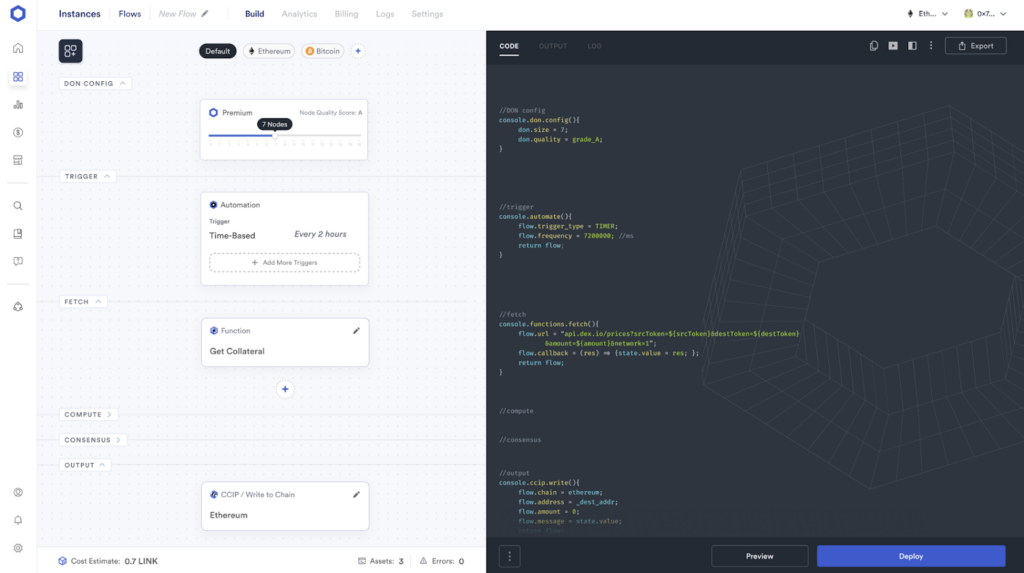

A Single Platform For Building Verifiable Applications

One of the great benefits of having all the data, all the compute, and all the cross-chain connectivity in a single platform is you can create one environment where people can compose all those capabilities. Developers can configure how many nodes they want in a DON, the triggers under which the DON acts, where the data is fetched from and what to do with that data, and how that data flows onto a specific chain.

Conclusion

Chainlink has among the largest aggregation of demand for Web3 services, whether they’re data, compute, or cross-chain related. That’s important because in markets, supply generally follows demand. Once you have developers that utilize the Decentralized Computing Marketplace on the backend to create hundreds or thousands of oracle networks to power their verifiable applications, this demand brings all the best nodes, data sources, and compute platforms,

The Chainlink system is among the largest aggregation of Web3 developers in one place and attracts world-class nodes and continually adds more data and compute capabilities. This will accelerate us toward the verifiable web, where users know what’s going on in the system and retain the ability to leave at any time.

While this industry will evolve very quickly, right now we’re working on the payment abstraction layer to create a universal gas token and payments layer, an improved staking system, and a Decentralized Computing Marketplace with a single unified developer experience that empowers builders to compose advanced, verifiable applications.

“I’m really very grateful to all the people who I’ve been working with for many years, both in the community and Chainlink Labs, everyone from the node operators to the developers to the users that give us feedback to the data sources to everybody in the community who contributes to the success and growth of Chainlink…

There aren’t that many things in life that you could work on that are really worth it, and the more that I look at what we’re building, this single Internet of contracts, the verifiable web, and all of these new ways for the world to work, the more convinced I am that it is worth it and for those of you that feel the same way and push yourselves to the limit and do whatever you can to help make us successful.”—Sergey Nazarov