How CCIP Programmable Token Transfers Unlock Cross-Chain Innovation

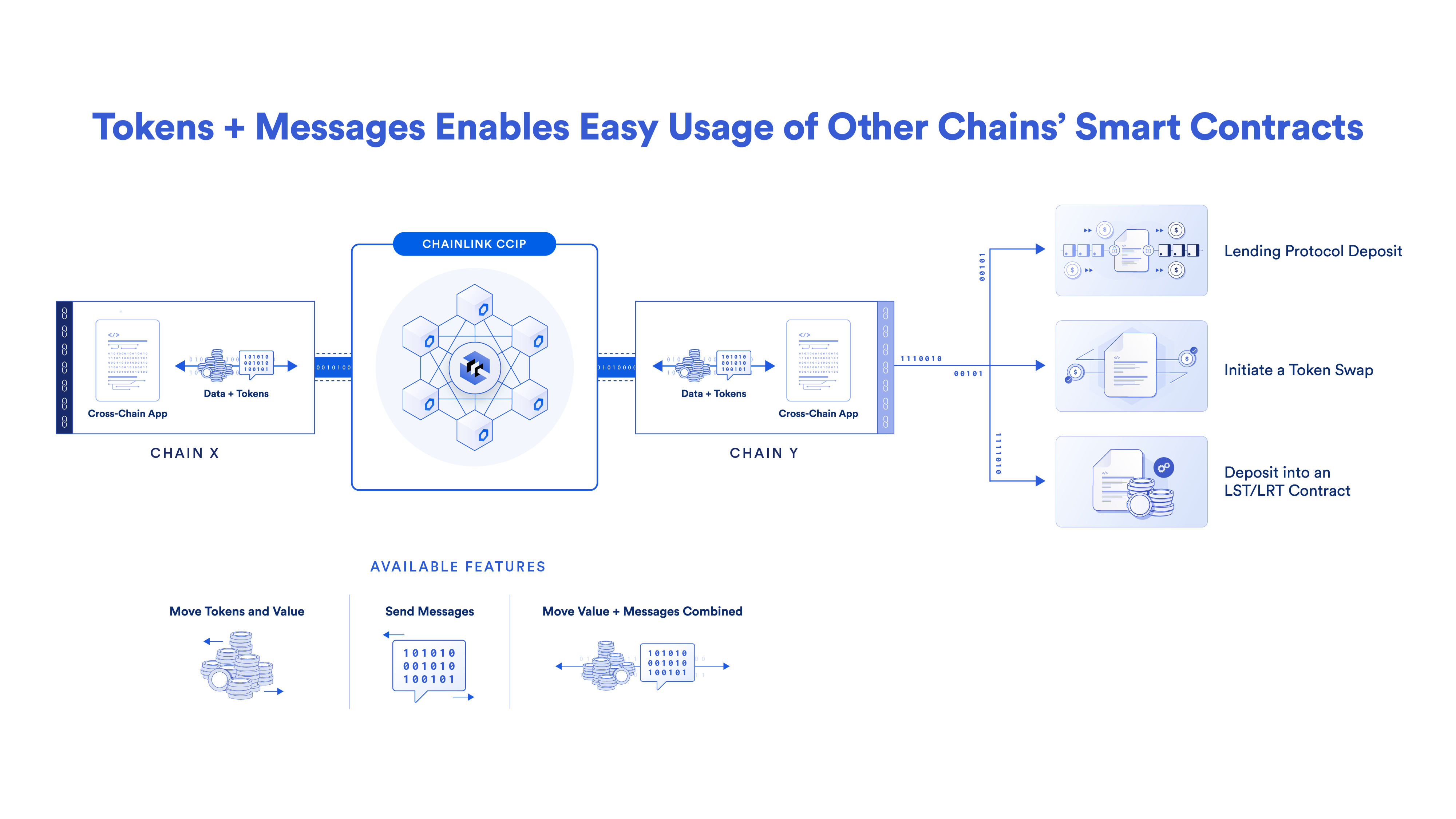

The Chainlink Cross-Chain Interoperability Protocol (CCIP) is far more than a simple token bridging solution. It’s a generalized cross-chain messaging protocol for transferring tokens (value), messages (data), or both tokens and messages simultaneously within a single cross-chain transaction—referred to as Programmable Token Transfers.

In effect, CCIP Programmable Token Transfers enable smart contracts to transfer tokens cross-chain along with instructions on what the receiving smart contract should do with those tokens once they arrive on the destination chain. This revolutionary concept of wrapping value and instructions together allows tokenized value to interact automatically and dynamically once it arrives at a destination, opening up a world of new possibilities.

In decentralized finance (DeFi), CCIP Programmable Token Transfers enable the creation of cross-chain native dApps, such as a smart contract that can automatically transfer tokens cross-chain and deposit them into the highest yield lending markets. Within traditional finance (TradFi), CCIP Programmable Token Transfers enable advanced use cases, such as a cross-chain delivery-vs-payment (DvP) transaction where an institution holding stablecoins on its private blockchain can purchase a tokenized asset issued on a different private or public chain.

Importantly, CCIP Programmable Token Transfers enable institutions to interact with smart contracts and tokenized assets on other blockchain networks without needing to integrate or directly interact with that blockchain. All they need to do is send instructions to CCIP on how to interact with that chain, greatly reducing their overhead and the risks associated with point-to-point integrations with each blockchain network.

“This is the pinnacle of our achievement so far … The value and the message moving together is revolutionary.”

—Nigel Dobson, Banking Services Lead at ANZ

The following blog takes a deeper look into CCIP’s Programmable Token Transfer capability and how top DeFi protocols and major TradFi institutions are leveraging this functionality to unlock cross-chain innovation and more advanced tokenization use cases.

CCIP Supports Any Cross-Chain Transfer Involving Both Data and Value

Just as TCP/IP is a universal standard that underpins the Internet, Chainlink CCIP serves as a universal standard that underpins the Internet of Contracts. To support all the various cross-chain use cases that exist within DeFi and TradFi, CCIP allows for a variety of ways to transfer data and/or value across blockchains.

Arbitrary Messaging

CCIP’s support for Arbitrary Messaging enables developers to transfer any arbitrary data (encoded as bytes) across blockchain networks. Developers utilize CCIP’s Arbitrary Messaging to make their smart contract applications cross-chain native.

With CCIP, smart contracts on a source chain can call any arbitrary function on any arbitrary smart contract on a destination chain to trigger any arbitrary action (and receive a callback on the source chain if needed). Developers can encode multiple instructions in a single message, empowering them to orchestrate complex, multi-step, multi-chain tasks.

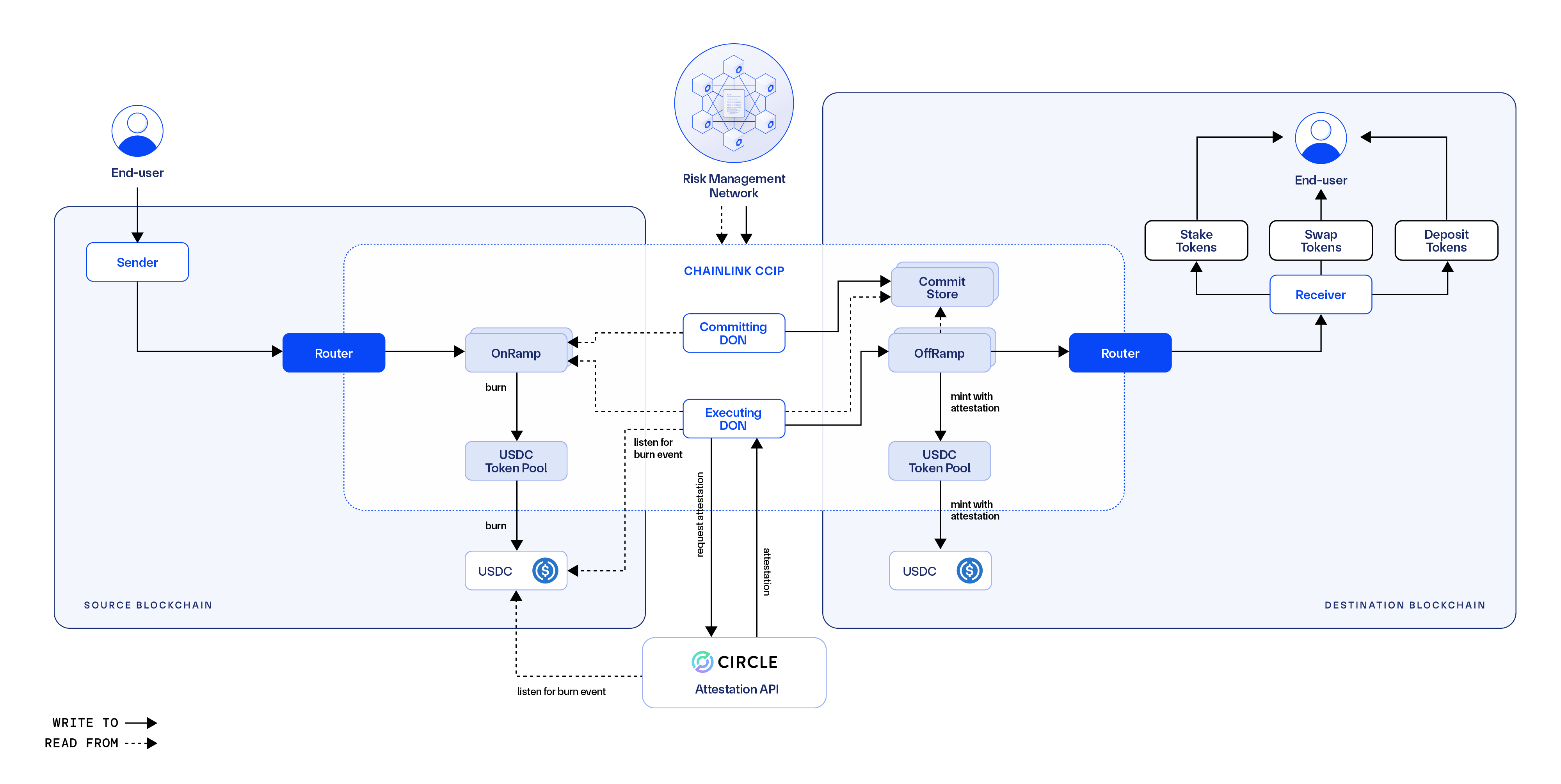

Token Transfers

CCIP Token Transfers enable the transfer of tokens between chains via highly audited and security-reviewed token pool contracts. Transactions can be initiated directly by externally owned accounts (EOAs), such as from user wallets via a bridging app like Transporter, or directly by a smart contract. Tokens can then be sent to an EOA or to a smart contract.

In order to ensure the highest level of security and a superior user experience, token issuers can use CCIP directly within their token’s smart contract to make it a native cross-chain token. As a result, any user or developer can use CCIP to transfer the official (canonical) version of that issuer’s token cross-chain. Various layer-1 blockchain and layer-2 rollups such as Wemix and Metis built upon this concept by integrating CCIP as their official cross-chain infrastructure to power their canonical token bridges. Every token transferred onto those blockchain networks via CCIP is the canonical representation of that token on that chain.

Security and user experience are our top priorities when it comes to the infrastructure securing the canonical Metis token bridge, and Chainlink CCIP’s defense-in-depth security architecture and advanced capabilities are unparalleled. We’re thrilled to be integrating Chainlink CCIP to enable Metis to securely interoperate cross-chain and help drive the network’s long-term growth and adoption.”

—Tom Ngo, Executive Lead at Metis.

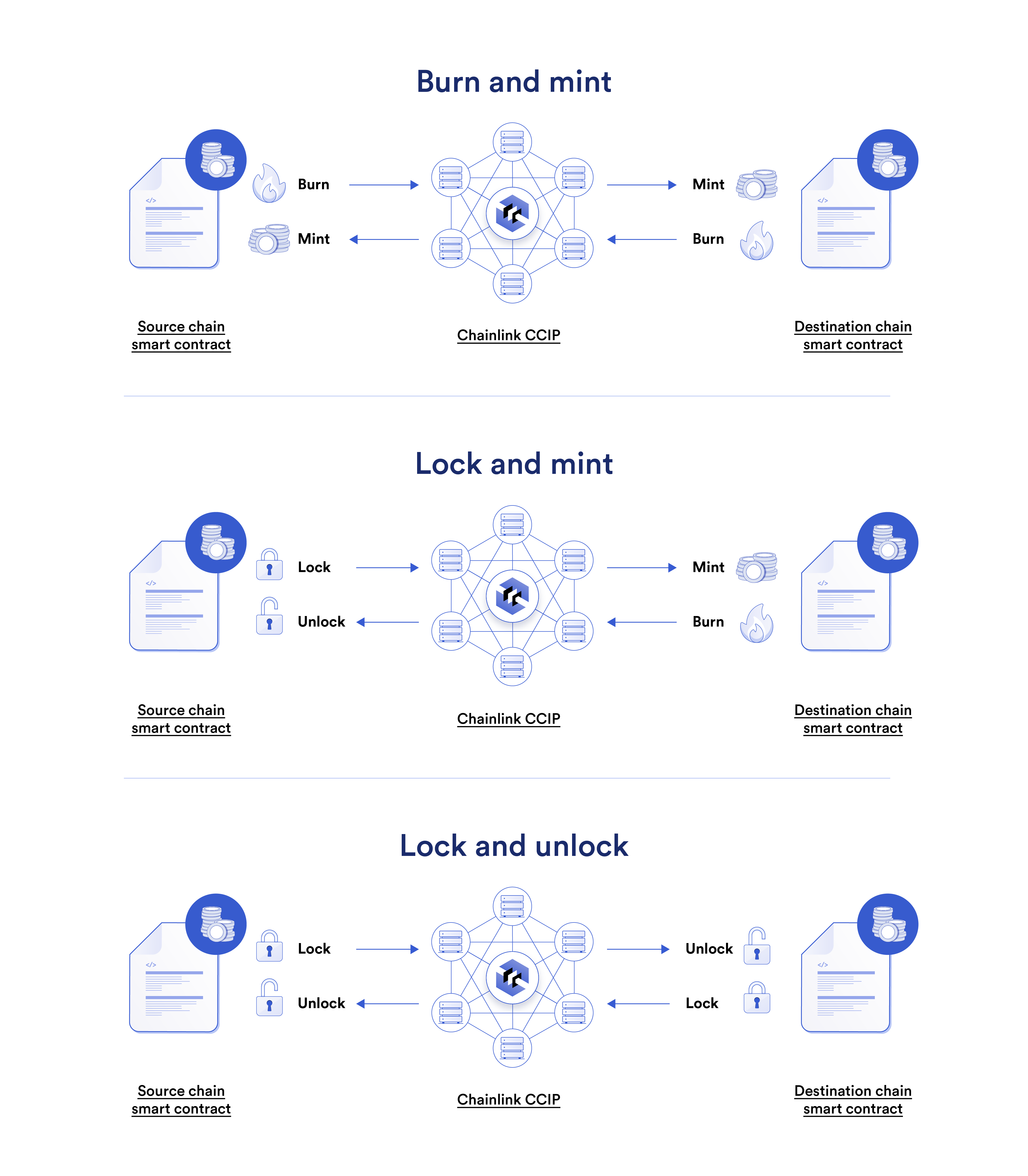

There are three primary ways developers can integrate CCIP for token transfers:

- Burn and mint—Tokens are burned on a source chain, and an equivalent amount is minted on a destination chain. This enables the creation of cross-chain native tokens with a dynamic, unified supply across chains. CCIP supports Circle’s USDC via the burn and mint token transfer method.

- Lock and mint—Tokens are locked on the chain they were natively issued on, and fully collateralized “wrapped” tokens are minted on destination chains. These wrapped tokens can be transferred across other non-native destination chains via burn and mint or be burned to unlock tokens back on the original issuing source chain. Truflation’s TRUF token utilizes lock and mint for its token transfers on CCIP.

- Lock and unlock—Tokens are locked on a source blockchain, and an equivalent amount of tokens are released on the destination blockchain. This enables the support of tokens without a burn/mint function or tokens that would introduce challenges if wrapped, such as native blockchain gas tokens. CCIP supports native ETH transfers via the lock and unlock token transfer method.

Programmable Token Transfers

Programmable Token Transfers combine Token Transfers with Arbitrary Messaging. This enables developers to transfer both tokens (value) and instructions (data) about what to do with those tokens cross-chain within a single transaction. Importantly, Programmable Token Transfers are built natively into CCIP to give users the best possible security, reliability, UX (e.g., composability), and risk management.

CCIP Programmable Token Transfers in TradFi

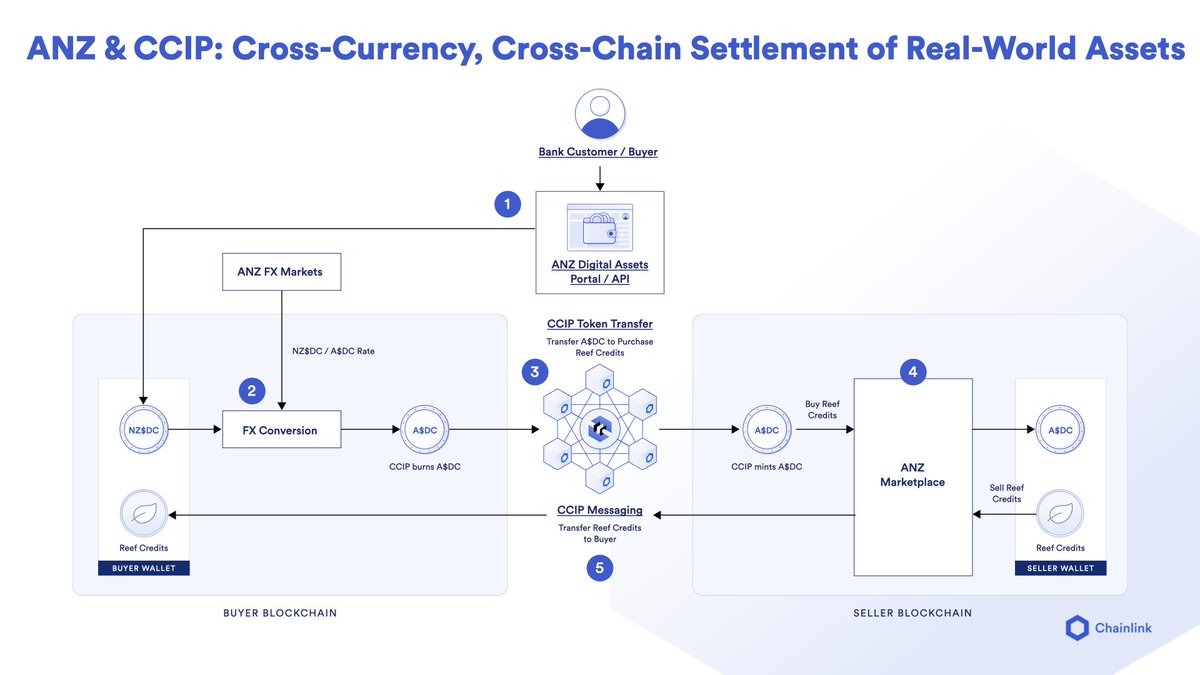

CCIP Programmable Token Transfers are critical to enabling cross-chain Delivery vs. Payment (DvP) transactions. DvP in traditional finance refers to the requirement that the delivery of assets (e.g., securities) and the payment for those assets happen simultaneously (i.e., atomic settlement). DvP is an important feature in reducing the risk that a counterparty won’t deliver on its leg of the transaction despite the other leg being fulfilled.

The Australia and New Zealand Banking Group Limited (ANZ) demonstrated how CCIP Programmable Token Transfers can enable a cross-border, cross-chain, cross-currency DvP transaction. In a single cross-chain transaction, a stablecoin backed by a local currency (NZ\$DC) was converted to another stablecoin in a different national currency (A\$DC), transferred from the buyer’s source chain to the seller’s destination chain along with the instruction to purchase a tokenized asset (e.g., reef credits), which was subsequently sent back to the customer’s wallet on the source chain.

At the SmartCon 2023 conference, Anurag Soin, Director of Digital Asset Services at ANZ Bank, discussed how ANZ used CCIP to enable this cross-chain use case.

To learn more, check out the case study Cross-Chain Settlement of Tokenized Assets Using CCIP written in collaboration with ANZ and the Sibos panel discussion between Chainlink Co-Founder Sergey Nazarov and ANZ’s Banking Services Lead Nigel Dobson.

CCIP Programmable Token Transfers in DeFi

Cross-Chain Swaps

CCIP Programmable Token Transfers enable cross-chain swap use cases, where any token can be effectively bridged over CCIP by connecting to liquidity pools / DEXs on the source and destination chains.

For example, a cross-chain swap app built on CCIP enables users holding Token A on Arbitrum to be swapped for Token B on Optimism by first swapping Token A on Arbitrum for USDC, bridging the USDC to Optimism along with data about the swap, and then automatically swapping the USDC to Token B and sending it to the user’s wallet. This is why CCIP’s support for native USDC is so powerful; it doesn’t just support the cross-chain transfer of native USDC via burn and mint, but also the simultaneous transmission of data on what to do with the USDC once it arrives on the destination chain—a unique feature of CCIP Programmable Token Transfers.

XSwap is a cross-chain swaps protocol and BUILD participant that uses CCIP for Programmable Token Transfers to enable cross-chain swaps between blockchain networks. USDC is used as the liquidity token for XSwap. Since its launch, XSwap users have initiated over $130M in CCIP Programmable Token Transfers.

Other users of CCIP Programmable Token Transfers include Transporter, ChainSwap, WEMIX PLAY, Amino Rewards, and more.

Cross-Chain Staking and Restaking

CCIP Programmable Token Transfers unlock innovation for a one-step connection to cross-chain staking and restaking. End-users can stake/restake assets directly from a layer-2 network, where CCIP is used as a one-step connection to transfer the native assets back to the layer-1 blockchain chain along with instructions to (re)stake the asset in a specified (re)staking protocol. This reduces gas costs for users and provides them the convenience to (re)stake from any chain.

For example, Lido, a leading liquid staking protocol, integrated CCIP to power the new Lido Direct Staking rails, which enables a one-step connection for users to stake their ETH directly from other blockchain networks and receive wstETH, with initial support for Arbitrum, Base, and Optimism. This capability is uniquely enabled by Programmable Token Transfers, which allow for the simultaneous transfer of tokens and data instructions cross-chain.

Alongside Lido, a growing number of protocols are also integrating Chainlink CCIP to go cross-chain and enable one-step connections to the staking/restaking of ETH from layer-2 networks:

To learn more about the different ways CCIP can enable a one-step connection to the staking of layer-1 assets from layer-2 networks, read Scaling (Re)Staking Protocols Cross-Chain With CCIP. You can read more about Chainlink’s support for staking and restaking in the blog: How The Chainlink Platform Unlocks LST and LRT Adoption in DeFi. Learn how to implement Chainlink CCIP Programmable Token Transfers in the CCIP Masterclass: Cross-Chain Staking Edition for a more technical deep dive.

CCIP Programmable Token Transfers Support The Scalability of Onchain Finance

As banks continue to launch their own blockchains and DLT networks to issue tokenized assets, the need for a blockchain interoperability standard that can enable cross-chain DvP will only grow. Similarly, the more DeFi grows and its activities move to inexpensive layer-2 networks, the ability to interact cross-chain and periodically move assets back to layer-1 blockchains for specific actions will also grow. CCIP provides the universal interoperability standard that not only allows tokens and messaging to seamlessly move cross-chain but for value and data to be combined to realize advanced use cases, greater cost efficiency, and superior user experiences. This is a critical feature to realizing onchain finance at scale.

If you are a DeFi protocol or traditional financial institution and want to explore how CCIP Programmable Token Transfers can unlock your cross-chain and tokenization use cases, reach out to our team of experts. If you are a developer and want to get started with CCIP Programmable Token Transfers, check out the Chainlink documentation for more technical resources.

Disclaimer: This post is for informational purposes only and contains statements about the future. There can be no assurance that actual results will not differ materially from those expressed in these statements, although we believe them to be based on reasonable assumptions. Interactions with blockchain networks create risks, including risks caused by user input errors. All statements are valid only as of the date first posted. These statements may not reflect future developments due to user feedback or later events and we may not update this post in response.