Scaling (Re)Staking Protocols Cross-Chain With CCIP

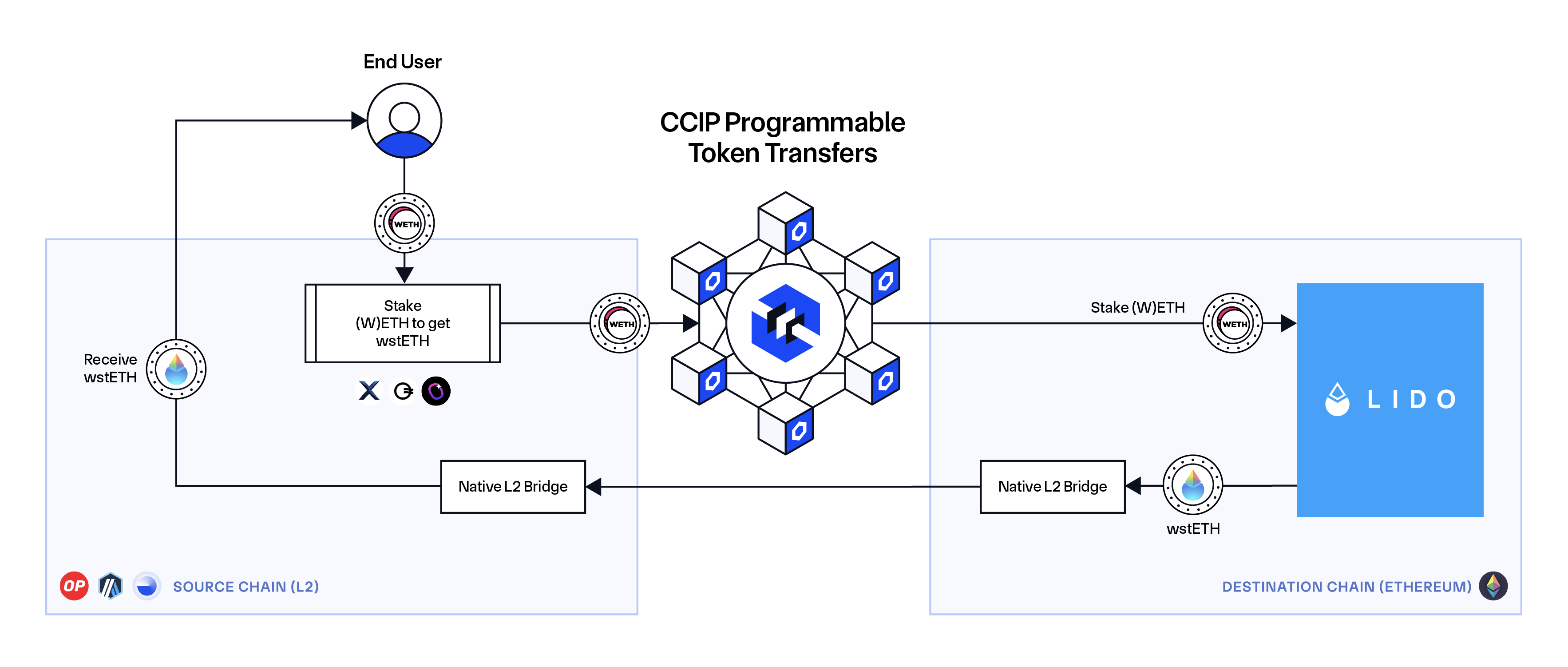

Chainlink’s Cross-Chain Interoperability Protocol is helping liquid staking and restaking protocols scale by enabling them to allow their users to stake their ETH directly from layer-2 networks—significantly expanding the accessibility of liquid staking tokens (LSTs) and liquid restaking tokens (LRTs) across the multi-chain ecosystem. This capability is uniquely enabled by CCIP’s support for Programmable Token Transfers, which enable the simultaneous transfer of tokens and data instructions cross-chain.

Lido, a leading liquid staking protocol, recently integrated CCIP to power the new Lido Direct Staking rails, which enable users to stake their ETH directly from other blockchain networks and receive wstETH, starting with support for Arbitrum, Base, and Optimism. The new Lido Direct Staking rails are being adopted by various DeFi frontends including XSwap, OpenOcean, and Interport.

In addition to Lido, a growing number of protocols are also integrating Chainlink CCIP to go cross-chain and enable the staking/restaking of ETH from layer-2 networks:

In this blog, we’ll dive into the different ways that CCIP can enable the staking of layer-1 assets from layer-2 networks and the benefits this can bring to the LST/LRT ecosystem.

Unlocking The Multi-Chain Demand for LSTs/LRTs

Liquid staking has become one of the largest sectors in DeFi, with over $40 billion in TVL. Restaking, and by extension liquid restaking, have also grown at an accelerated rate, with restaking representing approximately $13.7 billion in TVL (of which $10 billion is in liquid restaking form).

Despite this growth, a key limitation facing both liquid staking and restaking protocols is the liquidity and availability of their respective LSTs / LRTs across the multi-chain ecosystem. While many such protocols have made their respective LST/LRT tokens bridgeable across a number of blockchains (in many cases via CCIP), the minting of new LST/LRT tokens is often limited to a single blockchain where the core (re)staking protocol contracts operate.

As a result, it is often difficult for holders of layer-1 assets on layer-2 networks to mint LST/LRT tokens. For example, holders of ETH on layer-2 networks looking to (re)stake their ETH must manually bridge their ETH back to Ethereum mainnet (which may take up to 7 days with optimistic rollups), stake their ETH in exchange for their LST/LRT of choice, and then manually bridge their LST/LRT back to the layer-2 network.

Chainlink CCIP and its support for Programmable Token Transfers can help compress all of these steps into a single layer-2 transaction from the user’s perspective.

How CCIP Enables Cross-Chain Connections To Liquid Staking and Restaking Protocols

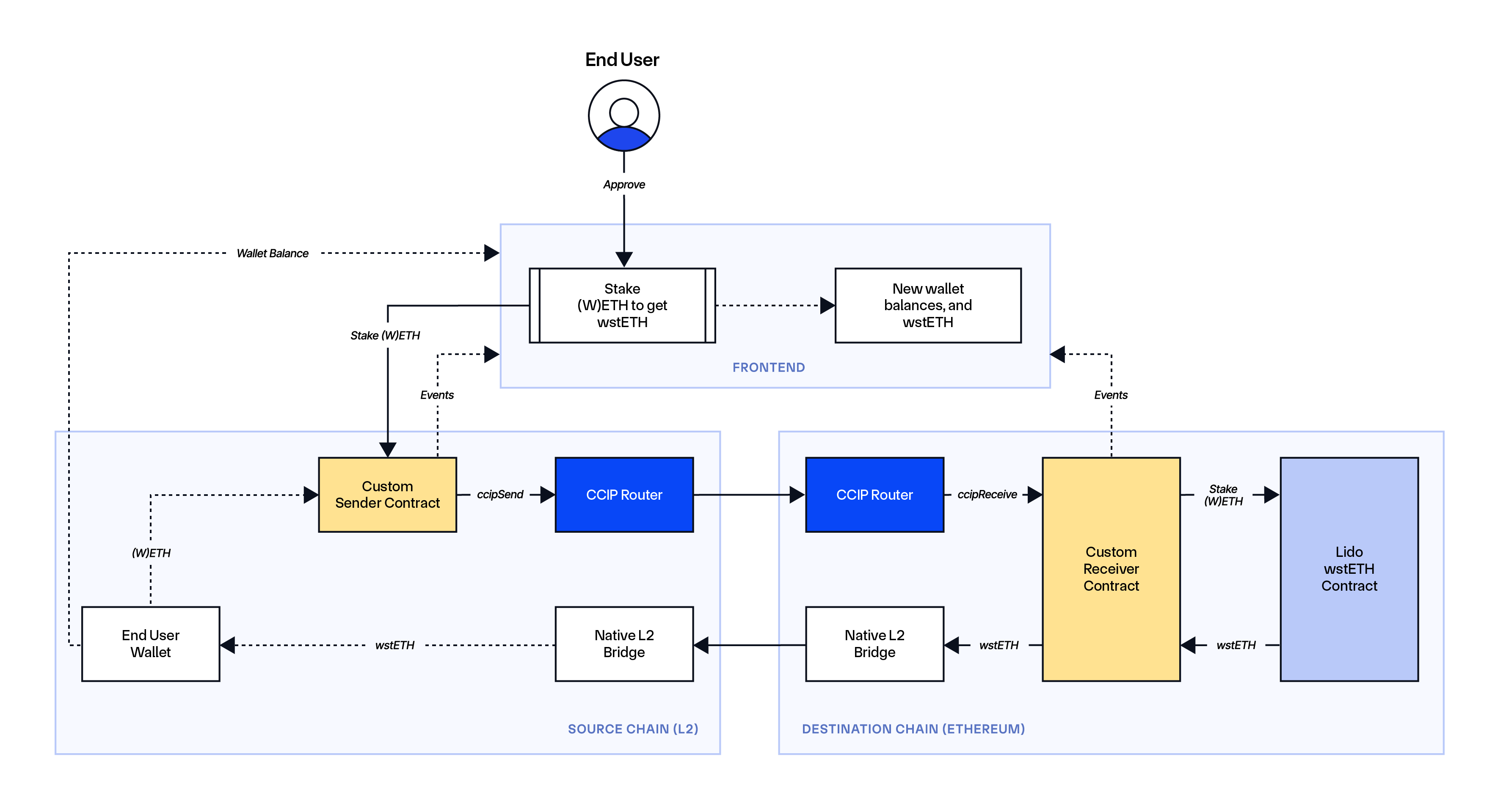

CCIP Programmable Token Transfers enable smart contracts to transfer tokens cross-chain along with data instructions on what the receiving smart contract should do with those tokens once they arrive on the destination chain. This programmability is key to enabling complex cross-chain interactions, such as cross-chain staking, as it enables users on one blockchain to interact with and benefit from smart contracts on another blockchain—without ever leaving their preferred blockchain environment.

A staking protocol’s use of CCIP to enable (re)staking from layer-2 networks can be accomplished in multiple different ways, depending on the speed and cost preferences of the (re)staking protocol and its users.

Direct Approach

How it works on Ethereum: In the direct approach, an end-user initiates a staking interaction on a layer-2 network, and then their ETH, along with data instructions on what to do with the tokens, are sent to Ethereum via CCIP. A receiving smart contract on Ethereum receives the ETH, stakes it into a liquid (re)staking protocol, and the newly minted LSTs/LRTs representing that staked position are then bridged back to the user’s wallet address on the layer-2.

Benefits/Challenges: This approach is highly cost-effective for (re)staking protocols to support as it involves no liquidity management operations, but users must wait until all cross-chain transactions involved in the process have been completed in order to receive their LST/LRT tokens on the layer-2 network (users receive their LST/LRT in a separate transaction later in time asynchronously).

Examples:

- Lido’s Direct Staking rails use CCIP to support the direct staking method of staking ETH for wstETH from layer-2 networks, in addition to the liquidity pool approach.

- EigenPie is integrating CCIP to enable its users to restake ETH for egETH from layer-2 networks.

- StakeStone is integrating CCIP to enable its users to stake ETH for STONE from layer-2 networks.

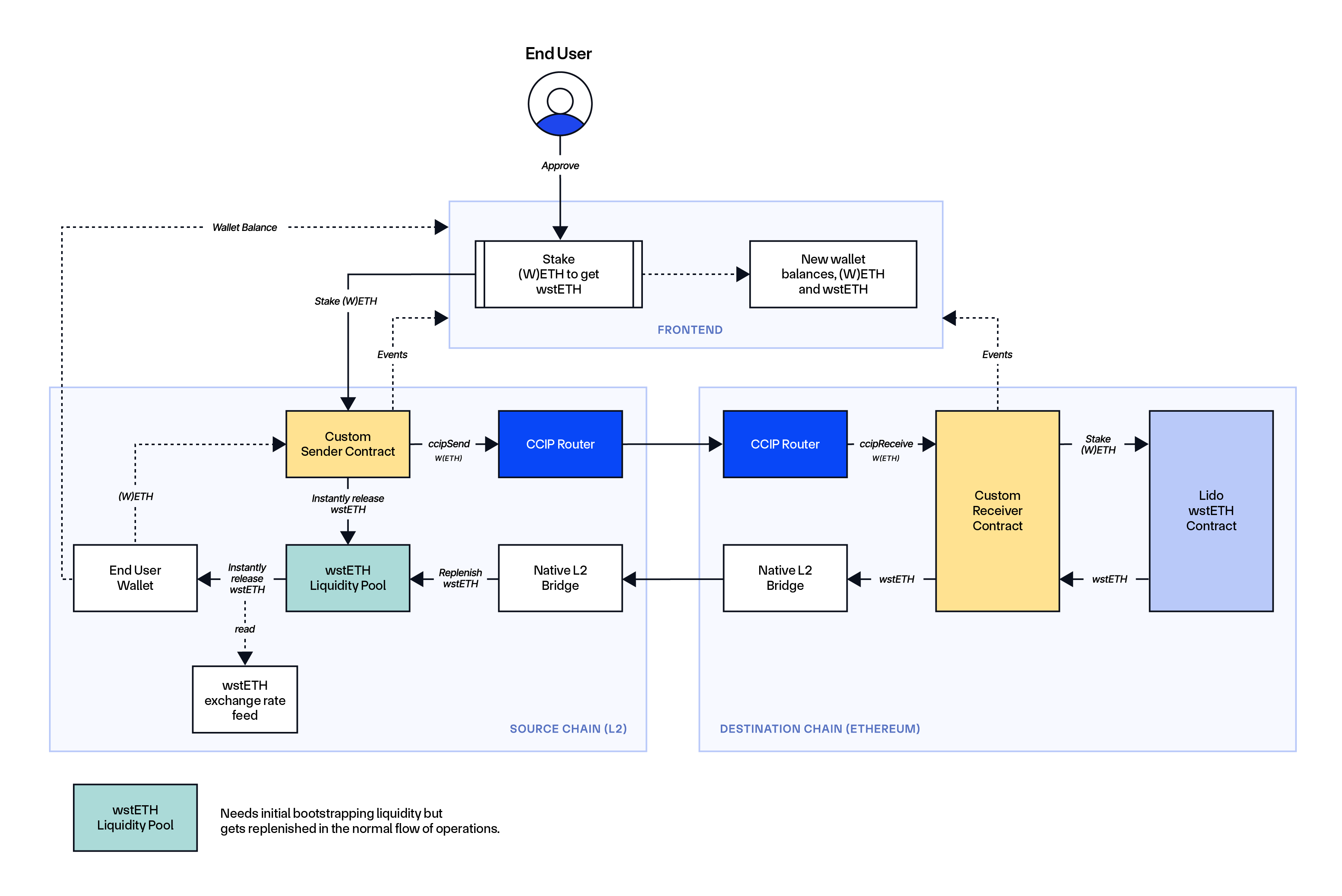

Liquidity Pool Approach

How it works on Ethereum: In the liquidity pool approach, an end-user initiates a staking interaction on a layer-2 network and immediately receives an LST/LRT from the (re)staking protocol’s liquidity pool. This is achieved by using an exchange rate data feed to report the (re)staking protocol’s internal exchange rate for the LST/LRT on that L2 or by using CCIP to bridge the exchange rate data. Once the ETH deposited by the user into the (re)staking protocol’s liquidity pool is sent to Ethereum via CCIP along with the instructions for the receiving smart contract to (re)stake, the newly minted LST/LRT is then bridged back to layer 2 to replenish the liquidity pool.

Chainlink Automation can be used to enable transaction batching, where after a certain amount of ETH is collected in the liquidity pool (or a certain amount of time has passed), CCIP is triggered to transfer a batch of ETH to Ethereum where a receiving smart contract can (re)stake that ETH into an LST/LRT format and bridged back to the layer-2 to replenish the liquidity pool, reducing the liquidity management costs for the (re)staking protocol.

Benefits/Challenges: This method enables users to instantly receive LSTs / LRTs within the same atomic transaction they initiate a staking interaction, but requires (re)staking protocols to bootstrap a liquidity pool—which can become self-sustaining through the replenishing process. For this approach, the (re)staking protocol must manage liquidity for its LST/LRT on the layer-2 networks where the feature is made available. If a user attempts to stake a large amount of ETH, there needs to be enough available liquidity in the pool or otherwise provide a fallback to the direct approach of using CCIP to stake from layer-2 networks.

Examples:

- Lido’s Direct Staking rails use CCIP to support the liquidity pool method of staking ETH for wstETH from layer-2 networks, in addition to supporting the direct approach.

- Frax is integrating CCIP to enable its users to stake ETH for sfrxETH from layer-2 networks. If liquidity in the layer-2 liquidity pool is insufficient to cover a staking transaction, Frax will also support the direct staking approach with CCIP.

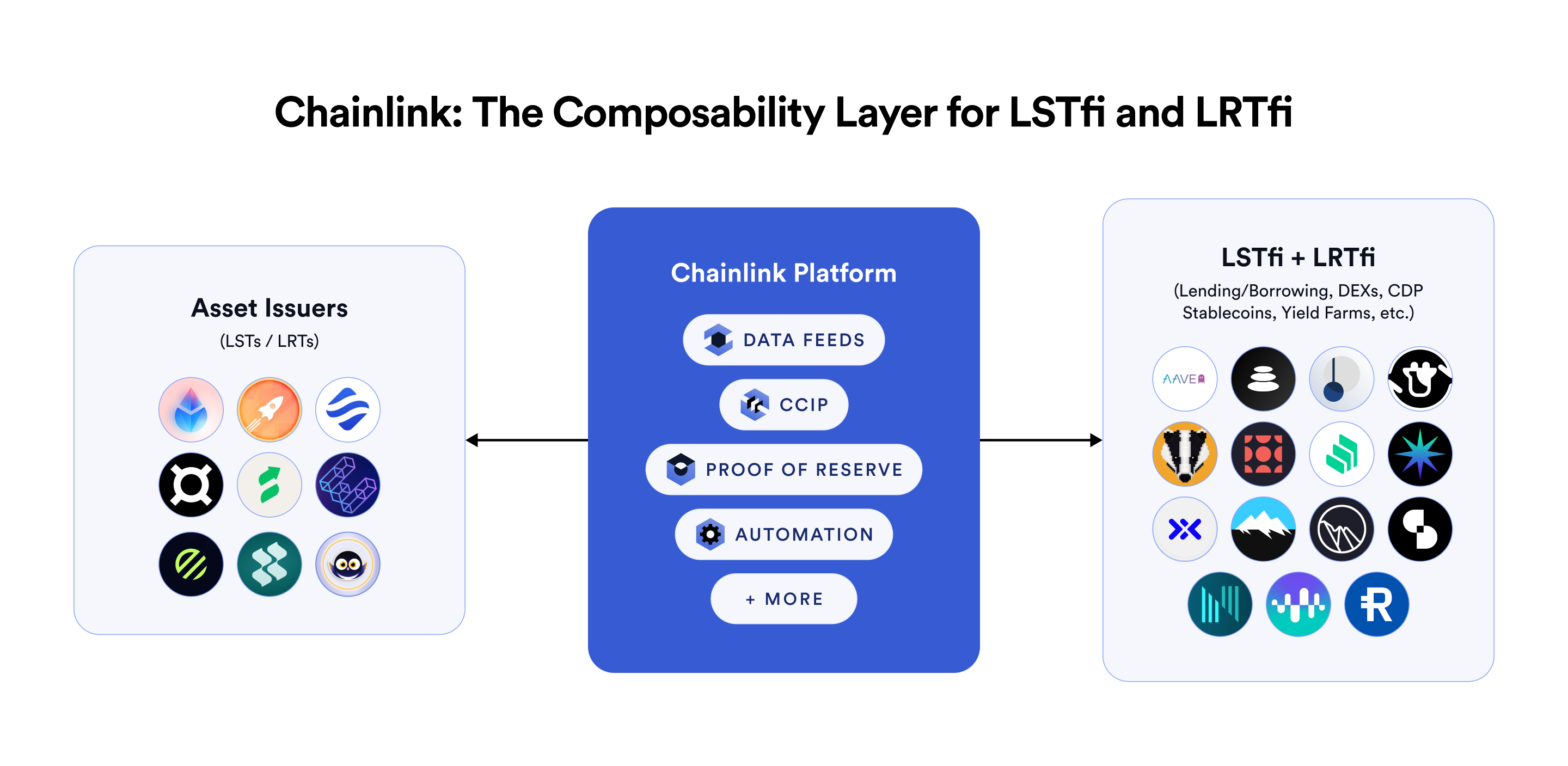

The Chainlink Platform For Liquid Staking and Restaking Protocols

CCIP offers developers flexibility to power all variations of cross-chain (re)staking for LST/LRT protocols. Notably, these capabilities are powered by the Chainlink platform, which enables advanced functionality through the combination of industry-standard services, and with little-to-no additional trust assumptions when using multiple services:

- CCIP unlocks programmable token transfers that enable value and messages to be sent within a single transaction.

- Data Feeds relay the internal redemption rates for LSTs/LRTs across chains.

- Proof of Reserve verifies the reserves backing LSTs/LRTs.

- Automation supports reliable liquidity pool rebalancing operations.

You can read more about Chainlink’s support for the staking and restaking ecosystems in How the Chainlink Platform Unlocks LST and LRT Adoption in DeFi. For a deeper technical dive, check out CCIP Masterclass: Cross-Chain Staking Edition.

If you are a DeFi protocol or traditional financial institution and want to explore how CCIP Programmable Token Transfers can unlock your cross-chain and tokenization use cases, reach out to our team of experts. If you are a developer and want to get started with CCIP Programmable Token Transfers, check out the Chainlink documentation for more technical resources.

Disclaimer: This post is for informational purposes only and contains statements about the future, including anticipated product features, development, and timelines for the rollout of these features. These statements are only predictions and reflect current beliefs and expectations with respect to future events; they are based on assumptions and are subject to risk, uncertainties, and changes at any time. There can be no assurance that actual results will not differ materially from those expressed in these statements, although we believe them to be based on reasonable assumptions. All statements are valid only as of the date first posted. These statements may not reflect future developments due to user feedback or later events and we may not update this post in response. Please review the Chainlink Terms of Service, which provides important information and disclosures.