What Is an NFT?

The most widely recognized application of blockchain technology is the creation of cryptocurrency, such as Bitcoin and Ether, which enables users to transfer value peer-to-peer without a rent-seeking middleman. Programmable smart contracts expanded upon this concept by empowering anyone in the world to create their own fungible tokens, such as stablecoins, commonly used in the DeFi ecosystem. The latest evolution of this innovative model of digital value exchange are Non-Fungible Tokens (NFTs)—blockchain-based assets that represent a unique item such as a digital artwork, in-game virtual goods, rare collectibles, or any other digital/physical asset.

In contrast to fungible assets like dollars, where each unit is identical and fully interchangeable, non-fungible assets like NFTs are unique from one to another as they represent ownership of a specific asset. This ownership is validated and tracked using a public blockchain network, allowing users to verify the legitimacy of any NFT and track its provenance all the way back to its origin. NFTs therefore can be best described as a “certificate of authenticity” issued by the original creator which provides cryptographic proof that the NFT holder has ownership of the official copy of the unique asset.

NFTs provide a wide range of benefits such as allowing artists to monetize their digital artwork, enabling the creation of provably rare in-game items, supporting a new ecosystem of digital collectibles, tokenizing real-world assets to increase liquidity, and much more. In this article, we will provide context on the NFT economy, explore the various types of NFTs that exist, and explain the importance of verifiable randomness for provably rare NFTs.

Growth of the NFT Economy

NFTs were first popularized in 2017 with the launch of CryptoKitties, a decentralized application on Ethereum that allows users to breed and collect digital cats. Now with the launch of higher-performance blockchains, layer 2 solutions, and various scaling optimizations that enable high-throughput dApps, NFTs have seen a resurgence in interest from collectors and artists alike.

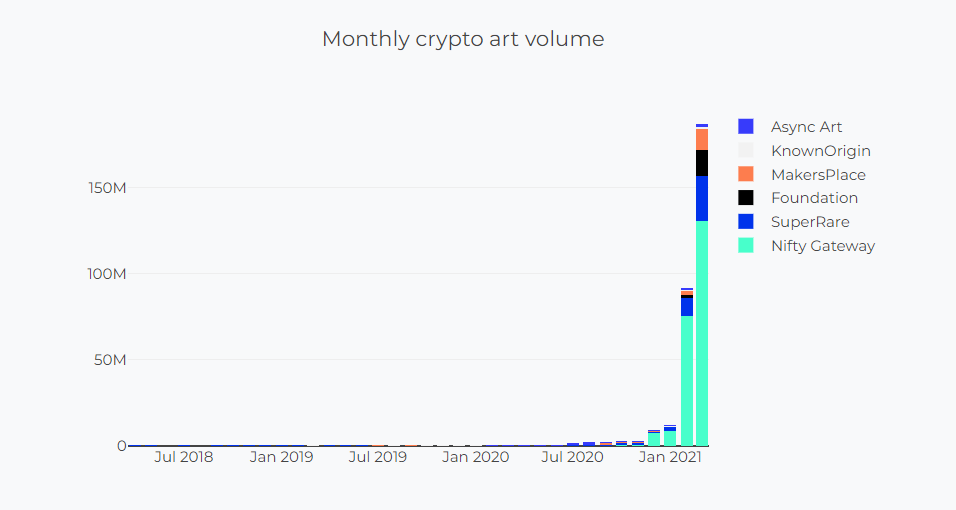

Similar to the ERC20 standard used for the creation of fungible tokens, NFTs are commonly built using the ERC721 or ERC1155 standards, which provide templates for how smart contracts and users interact with NFTs. This standardization has facilitated NFT development and spurred the creation of various marketplaces such as Rarible, OpenSea, SuperRare, and more which allow users to seamlessly distribute and acquire NFTs, further fueling the growth of the NFT ecosystem. The volume of NFTs traded on these marketplaces has rapidly accelerated, now reaching over $150M a month.

This renewed interest in NFTs has led to a Cambrian explosion of unique applications that leverage the property of non-fungibility in innovative ways, often with the goal of increasing efficiency in the transfer of asset ownership and reducing the need for intermediaries who siphon value away from creators and marketplaces. NFTs are still largely in their infancy, and we have likely yet to see even a fraction of their true potential at scale.

Exploring the Different Types of NFTs

Just as different cryptocurrencies and decentralized applications are created to serve a multitude of distinct use cases, NFTs provide a flexible framework for tracking ownership of a wide array of digital and physical assets using a blockchain network. The number of use cases for NFTs is only expanding. Below are a few common applications that have emerged across the ecosystem.

Digital artworks

One of the most recognized use cases of NFTs is the ability for artists to tokenize ownership of their digital artworks, significantly increasing their ability to monetize their craft. Online art marketplaces today are often centralized, opaque, and value-extracting, requiring creators to pay significant fees to list their work while trusting that their work will be discovered and distributed in a fair manner. With NFTs, artists can seamlessly sell their digital artwork and also receive revenue from all secondary sales of the NFT, providing long-term economic benefits.

An example of NFT art that recently made headlines is the artist Beeple’s digital artwork “Everydays: The First 5000 Days”, a collage of 5,000 images that took 13 years to create and which was recently tokenized as an NFT, selling for over $69M. Using the popular ERC721 token standard, Beeple was able to directly monetize his digital artwork and cryptographically prove ownership of the official copy. Thousands of other digital artworks have been tokenized in a similar manner, empowering the artist community worldwide.

In-game items

NFTs are a foundational component of blockchain-based video games as they allow unique in-game items to be tokenized, tracked, and transferred in a non-custodial manner. With traditional online video games, centralized publishers have complete control over the distribution, ownership, and attributes of in-game items that often determine the value of certain characters and the outcomes of games. If the publisher shuts down, then users lose access to all of the game items they may have spent hours acquiring.

NFTs not only ensure users have complete control over their game items, but they also enable entirely new gaming possibilities. This includes the creation of an interoperable metaverse, where the items from one game can be used and traded in another, as well as enabling a play-to-earn model, where users can monetize their time and effort from gaming by acquiring NFTs and selling them to others.

One popular blockchain-based video game leveraging NFTs is Axie Infinity, a Pokemon-inspired universe with provably unique fantasy creatures called “Axies.” Each in-game Axie is programmatically tied to an NFT which contains metadata regarding the creature’s attributes, appearance, and ownership. Through verifiable randomness provided by Chainlink VRF, which we explore further below, certain Axies such as a Quad Mystic can be made provably rare and therefore become more attractive to other players in the Axie universe.

Collectibles

Similar to the collection of physical trading cards or mail stamps, digital collectibles allow collectors to store digital objects they deem valuable and signal their support for a specific company, brand, game, or other entity. Unlike physical collectibles that can be slow to transport and expensive to maintain, NFTs have no such restraints as they are entirely digital, transferrable in seconds, and never degrade in quality.

Some of the most recognized NFT-based digital collectibles are CryptoPunks, a collection of 10,000 unique 8bit-style characters which were algorithmically generated so no two characters are exactly alike. CryptoPunks were some of the first NFTs ever created and were given away for free. They continue to attract users who want to own an original piece of NFT history.

Tokenized assets

NFTs can represent ownership of digital assets, as well as a wide array of off-chain assets such as real estate, government documents, certifications, diplomas, and more. The tokenization of real-world assets significantly increases the efficiency of transferring ownership and provides a single source of truth that verifies the legitimacy of a person’s credentials and assets.

While it is still early stages, real-world asset NFTs enable a number of new possibilities such as revenue-generating real-estate tokens backed by rent from tenants, the issuance of digital credentials without the need of a physical document counterpart, and the digitization of records—from educational records to intellectual property agreements—to facilitate information transparency and on-chain automation of transactions.

These diverse NFT use cases showcase how users can leverage blockchain technology to prove their ownership of unique assets which can be verified by anyone. As the world continues to transition to the digital domain, it is critical that the creation of NFTs is fully verifiable end-to-end, including not only the token’s ownership, but also the attributes and distribution mechanism of the NFT.

The Importance of Verifiable Randomness for NFTs

While NFTs such as 1-of-1 digital artworks can have all of their properties predetermined before deployment on-chain, there are a number of NFT designs that require a random number generator (RNG) to introduce additional rarity. This can include the randomized selection of attributes, such as the power level of an in-game item, as well as ensuring an equally fair distribution for all participants, such as a lottery featuring NFT rewards.

However, if this source of randomness can be manipulated, then malicious actors can exploit the RNG mechanism to their advantage, such as minting themselves NFTs with the rarest traits or directing lottery rewards to an address under their control. This has a significant implication for the value of the NFT as users cannot verify if its attributes or distribution was actually random or falsified using manipulated RNG values.

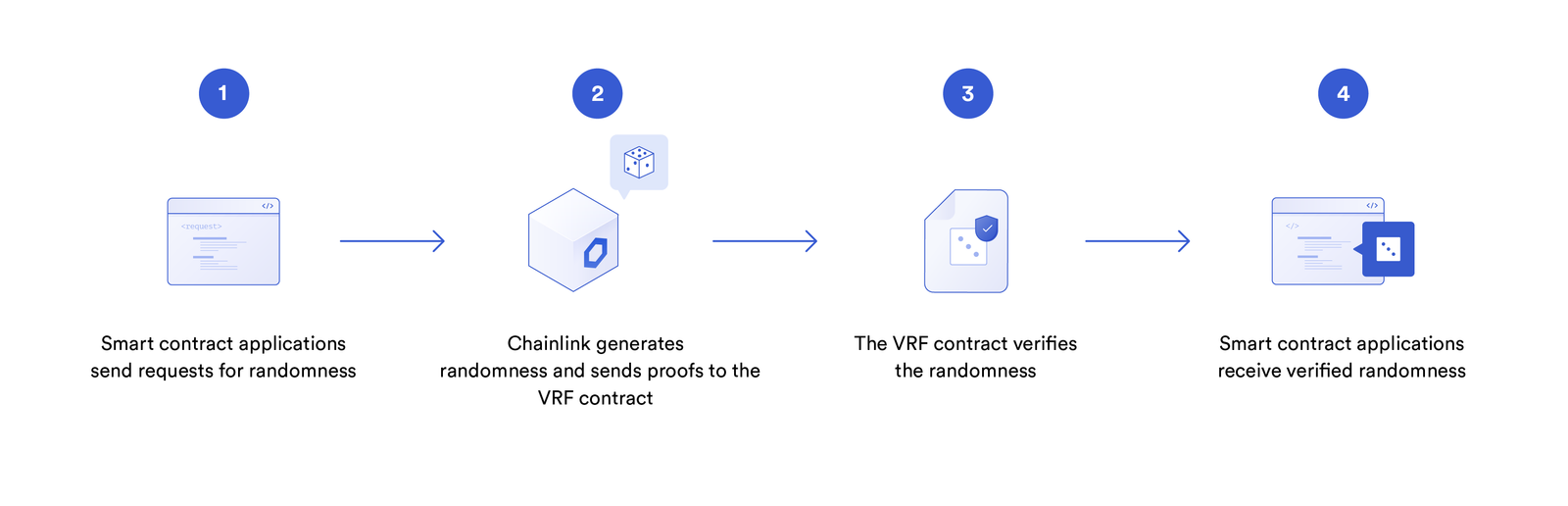

Chainlink VRF provides a solution to the problem through a Verifiable Random Function, which provides smart contracts and NFTs access to a secure source of randomness backed by a cryptographic proof. This cryptographic proof is validated on-chain before delivery to the consuming NFT contract, guaranteeing only truly random values are consumed. Chainlink VRF’s strong security properties ensure neither the oracle, users, or developers can manipulate the randomness generation, enabling NFTs that are assigned provably rare attributes and distributed in a verifiably fair manner.

Chainlink VRF is already being used in-production to power a wide array of NFT applications across a number of different blockchain networks. Aavegotchi, a blockchain-based crypto collectible game has called Chainlink VRF over 10,000 times on the Polygon Network to mint provably rare Aavegotchis with randomized traits. EtherCards, a framework for minting NFT art, uses Chainlink VRF to secure both the attributes and distribution of artist-created NFTs to users. With a verifiable source of randomness, these blockchain-based applications provide users a strong, cryptographically-backed assurance that their NFT is provably rare.

In addition to accessing verifiable randomness, developers can leverage Chainlink oracles to enable the creation of dynamic NFTs which evolve according to inputs derived from real-world data. Stay tuned for our next education series article where we explore the topic of next-generation dynamic NFTs in-depth.

If you’re a developer and want to connect your smart contract to existing data and infrastructure outside the underlying blockchain, visit the Chainlink developer documentation or talk to an expert for a more in-depth integration.