The Year in Chainlink 2021: 7 Pillars of Momentum

2021 has been a year of exponential growth for the Chainlink ecosystem, featuring the accelerating adoption of key services that extend the capabilities of hybrid smart contracts across the blockchain economy. Thank you to all the developers, researchers, contributors, data providers, node operators, community members, and more who have helped make 2021 such a significant success.

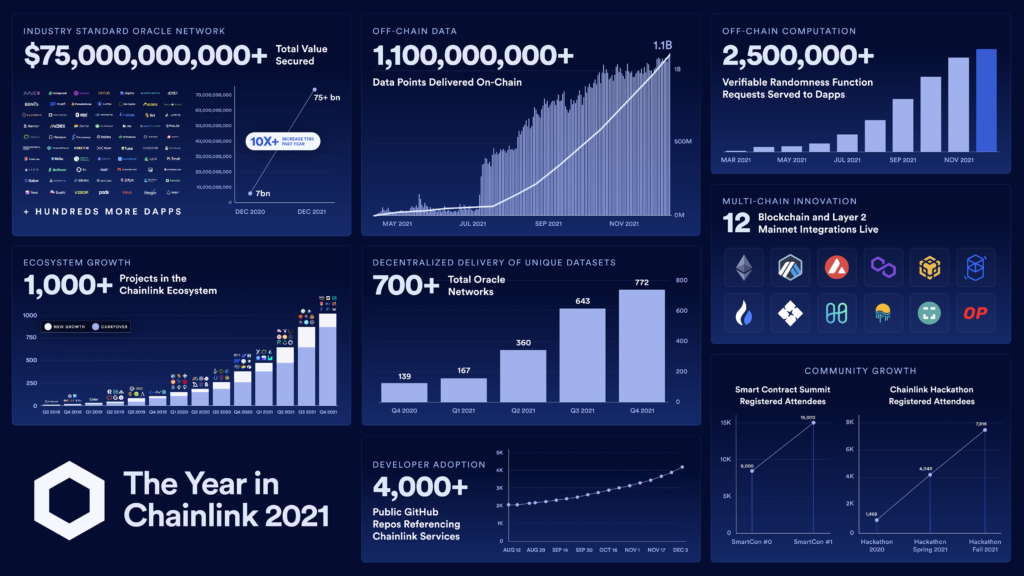

From Total Value Secured (TVS) reaching new heights and the increasing adoption of Chainlink Data Feeds to the release of new computation-based services and huge growth in the total number of integrations, we have identified seven key pillars that highlight the rapidly accelerating adoption of the Chainlink Network.

1. Chainlink Surpassed $75B Total Value Secured (TVS)

At the beginning of 2021, the Chainlink Network secured a total of $7B across the blockchain ecosystem. Twelve months later, Chainlink oracles secure over $75B in value—an order of magnitude increase in TVS. As a result, Chainlink is now the second most value-securing form of decentralized consensus across the DeFi ecosystem. This growth in TVS has been led by not only the proven security and reliability of Chainlink oracle networks but also the sheer diversity of data being made available and consumed by on-chain applications to secure user funds.

In fact, there are now over 700+ decentralized oracle networks live in production, publishing data across numerous independent blockchains. The datasets most in-demand by DeFi applications include financial market prices in the form of Price Feeds for a growing number of cryptocurrencies, stablecoins, forex pairs, commodities, and indices.

Additionally, in the past year Chainlink oracles have expanded the scope of data available on-chain to include Proof of Reserve, Proof of Supply, Ethereum gas prices, total market capitalization, Total Value Locked (TVL) in DeFi applications, sports game results, election race calls, identity data, compliance metrics, weather reports, and more. With more data available on-chain, a greater number of hybrid smart contract use cases are made possible, further accelerating the amount of value that can be secured.

2. Chainlink Ecosystem Grew to 1000+ Projects

Chainlink oracles are now powering a greater number of hybrid smart contract applications than ever before. In total, 1,000+ projects are now part of the Chainlink ecosystem, with more than half of all integrations taking place in 2021. To provide Chainlinked applications with the external inputs they require, more than one billion individual data points have been delivered on-chain to date. Each individual data point is the result of fetching, validating, and delivering information on-chain via independent and Sybil-resistant Chainlink oracles.

With this exponential increase in the number of integrations and data points delivered on-chain, Chainlink-powered applications now cover a significant proportion of TVL in numerous key DeFi verticals. According to DeFi Llama, Chainlinked applications now secure the majority of TVL across various DeFi use cases. Chainlink is also being used to secure value across a number of additional innovative DeFi use cases such as algorithmic stablecoins, decentralized exchanges, prediction markets, payment networks, insurance platforms, asset management protocols, and more.

Beyond DeFi, this year Chainlink was also increasingly used to bring unpredictability and fairness to Non-Fungible Tokens (NFTs) and on-chain gaming applications through verifiable randomness. In total, millions of NFTs have been generated or distributed using Chainlink, helping fuel the growth of the on-chain non-fungible asset economy. Furthermore, social good initiatives such as Arbol are now using Chainlink oracles to fetch weather data to settle parametric crop insurance agreements, with a total of over $1B in available risk capacity.

3. Chainlink Serviced 2.5M+ Requests for Secure Off-Chain Computation

As described in the Chainlink 2.0 whitepaper, the role of Decentralized Oracle Networks (DONs) is rapidly evolving beyond data delivery to also providing access to secure off-chain computation, further extending and enhancing the capabilities of smart contract applications. In 2021, multiple Chainlink services launched to provide various blockchains with secure and trust-minimized off-chain computation to realize this vision.

Chainlink VRF was first released on Ethereum in late 2020 to provide smart contracts access to a secure source of on-chain randomness, commonly required by NFTs and on-chain gaming applications to enable unpredictability and fairness to enhance users’ experiences. In 2021, Chainlink VRF expanded support for additional blockchains including Binance Smart Chain (BSC) and Polygon, supporting the multi-chain ecosystem. Usage of Chainlink VRF has risen exponentially, with a total of over 2.5M requests for verifiable randomness successfully received and fulfilled on-chain. As a result, Chainlink VRF has become the category-defining solution for secure on-chain RNG.

To further expand support for off-chain computation, Chainlink Automation was released in 2021 to provide developers with a decentralized transaction execution solution, enabling them to outsource and simplify DevOp tasks in a highly reliable and cost-efficient manner. Initially launched on Ethereum and later expanded to Polygon and BSC, Chainlink Automation actively triggers a multitude of key contract functions such as the liquidation of undercollateralized loans, the rebasing of elastic supply tokens, the harvesting of yield, and more.

2021 also saw Chainlink Price Feeds upgraded to the Off-Chain Reporting (OCR) protocol, enabling oracle nodes to aggregate real-world data off-chain and deliver the validated oracle report on-chain within a single transaction. The costs of on-chain Price Feed updates were reduced by up to 90%, enabling 10 times more real-world data to be delivered on-chain. This upgrade also further boosted the decentralization of Chainlink Price Feeds, increasing the tamper-resistance and reliability of on-chain updates.

4. Chainlink Integrations Across Blockchains and Layer 2s Propelled the Multi-Chain Ecosystem

As a blockchain-agnostic protocol, the Chainlink Network is continually expanding support for additional blockchain environments, supported by the Chainlink Community Grants Program. In 2021, Chainlink services launched on a number of leading layer-1 blockchains and layer-2 scaling solutions including Arbitrum, Avalanche, Binance Smart Chain, Ethereum, Fantom, Harmony, Heco, Moonriver, Optimism, Polygon, Starkware, and xDai. Given that the vast majority of smart contract use cases require oracles, the deployment of Chainlink services onto a new blockchain environment provides developers in that on-chain ecosystem with the critical infrastructure they require to launch into production.

One example of this dynamic was the launch of Chainlink Price Feeds on the Avalanche blockchain. With a secure source of market data available on Avalanche, development teams including Aave, Benqi, Everest, Maximus Farm, Teddy Cash, Trader Joe, Vee Finance, and xDollar were able to deploy their applications into production and enable an array of use cases such as lending markets, options, yield farming, and stablecoins. Chainlink oracles helped accelerate Avalanche’s growth, with the chain’s TVL increasing over 88-fold in the five months after integration.

Furthermore, the integration of Chainlink oracles onto other blockchain networks similarly led to a growth in the number of DeFi applications within each on-chain ecosystem. On the Fantom network, projects including Ftm Bet, Ola Finance, SCREAM, SpiritSwap, Syfinance, and more have integrated Chainlink, resulting in rapid ecosystem growth. With Chainlink Price Feeds live on the Solana Devnet, projects such as Marinade Finance, Nextverse, Phantasia, Saber, Seeded, Synthetify, and Tulip Protocol are also actively integrating Chainlink to increase the security and reliability of their protocols, resulting in a superior user experience.

5. Open-Source Developers Leveraged Chainlink to Compose Innovative Smart Contract Use Cases

In order to support the smart contract developer ecosystem, Chainlink hosted several ecosystem-wide events, providing developers the opportunity to build the next generation of smart contract applications alongside a community of builders, creators, artists, and industry-leading mentors. The Spring 2021 Chainlink Hackathon, spanning from March to April, featured over 4,000+ signups, 140+ project submissions, and participants from over 170+ countries. Through the Community Grants Program and sponsors, over $130,000 in prizes was awarded to recognize the top projects building hybrid smart contracts. Awards spanned various smart contract verticals including DeFi, NFT and gaming, social impact, GovTech, and more.

In August, 15,000+ attendees from 140+ countries around the globe came together at Smart Contract Summit #1. From developer speed runs to cutting-edge research into fair transaction ordering, SmartCon #1 offered a snapshot of the massive wave of innovation happening in the blockchain industry, with over 200+ top founders, researchers, and developers exploring the key smart contract innovations and collaborations across the ecosystem.

The Fall 2021 Chainlink Hackathon, spanning from October to November, built on the success of the spring hackathon, with over 7,500+ signups, 280+ project submissions, and support from a wide range of industry-leading judges and mentors. Over $600k in prizes from the Community Grants Program and sponsors was awarded to developers building innovative hybrid smart contract applications. Sponsors included leading projects and enterprises such as Aurora, Avalanche, ConsenSys, EY, Filecoin, Google Cloud, Harmony, Moralis, Polygon, Solana, Sushi, UNICEF, and more.

In addition to hackathon events, development progress in the SmartContract GitHub rapidly increased with over 3,300+ public pull requests from over 180+ contributors from the open-source community in 2021. With multiple independent development teams contributing to the ecosystem, including Chainlink Labs, LinkPool, LinkRiver, Oracle Reputation, Fiews, and more, significant development progress has been made on the core Chainlink client, external adapters, decentralized services, and supporting architecture. In addition, over 4,000 third-party GitHub repositories now reference Chainlink oracles in total.

6. Global Enterprises Began Using Chainlink as Their Gateway to the Blockchain Economy

The Chainlink ecosystem consists of a wide range of participants, including developers, contributors, users, data providers, node operators, infrastructure providers, community members, and more. In 2021, a number of leading enterprises joined the Chainlink ecosystem by supporting and/or launching oracle node infrastructure to further the growth of the hybrid smart contract economy across the multi-chain ecosystem. Some of these enterprise integrations and collaborations included:

- The Associated Press, one of the largest news organizations in the world, announced it would bring its trusted economic, sports, and race call datasets to leading blockchains by launching a Chainlink oracle node. By cryptographically signing its data, developers can independently verify the authenticity of the data as coming directly from AP and enable entirely new innovative smart contract use cases.

- AccuWeather, a leading global weather and media company, launched a Chainlink oracle node to make its premium weather data available to smart contract applications across various blockchains. As a result, AccuWeather was able to extend the reach of its premium weather data into emerging markets and support the next generation of weather-related smart contract applications.

- Amazon Web Services collaborated with Chainlink to launch the AWS Chainlink Quickstart, a one-click workflow for enterprises, data providers, and DevOps teams to easily deploy a Chainlink oracle on AWS and sell real-world data across multiple blockchain networks. This lowered the barrier to entry for launching a secure Chainlink oracle, allowing for even more data to be brought on-chain.

- Google Cloud Platform demonstrated how premium weather data from the National Oceanic and Atmospheric Administration (NOAA) hosted on Google Cloud could be delivered on-chain to be consumed by smart contract applications through a newly deployed Chainlink oracle. This enables the creation of smart contract crop insurance agreements that automatically settle using high-quality weather data.

- Swisscom, a leading telecommunications provider in Switzerland, joined the Chainlink Network as a node operator and began providing DeFi applications with access to premium financial market data. The addition of enterprises like Swisscom as node operators directly increases both the security and the decentralization of Chainlink services.

7. Cross-Chain Interoperability Is Set to Unlock Massive Global Value Across DeFi and Traditional Finance

As the smart contract economy evolves, the Chainlink Network will continue to expand and provide developers with the secure oracle infrastructure they require to power increasingly advanced decentralized applications. The growth and adoption of smart contracts is expanding outside of single blockchains, instead taking place across an ecosystem of numerous independent blockchains—generating demand for inter-chain solutions.

To accommodate this demand, the Cross-Chain Interoperability Protocol (CCIP), a global open-source standard for secure cross-chain communication, is being actively developed to serve the multi-chain ecosystem. CCIP will provide smart contract developers with generalized, compute-enabled infrastructure for transferring data and commands across public and private blockchains.

The vast and growing array of services within the Chainlink ecosystem, encompassing Price Feeds, Verifiable Random Function, Automation, CCIP, and more serves towards reaching the overarching goal of creating a world powered by truth—a systemic shift away from the existing status quo of “just trust us” paper promises that plague traditional centralized contractual agreements. In a 2021 report, the World Economic Forum estimated that blockchain technology could disrupt $866T+ in traditional markets, presenting a significant opportunity.

To help achieve this goal, a multitude of industry leaders have been onboarded as Chainlink advisors, including Eric Schmidt, former Google CEO and executive chairman; Jeff Weiner, former LinkedIn CEO and current executive chairman; Lynda Smith, former Twilio CMO; and Balaji Srinivasan, former Coinbase CTO and general partner at Andreessen Horowitz.

In summary, the past year has been a period of exponential growth for the Chainlink ecosystem. From surpassing $75B+ TVS and reaching 1,000+ projects in the ecosystem to the launch of additional services and the growth of enterprise adoption, progress has accelerated rapidly. We look forward to continuing to provide developers with the off-chain infrastructure they require to power innovative decentralized applications and achieving even more in 2022.

Start building with Chainlink today by visiting the developer documentation, joining the technical discussion on Discord, and/or reaching out to an expert.

To learn more about Chainlink, visit the Chainlink website and follow the official Chainlink Twitter to keep up with the latest Chainlink news and announcements.