The Evolution and Outlook for Fund Tokenization

This is a guest post from Dr. Ian Hunt, Chainlink advisor and previous Design Authority at FundAdminChain.

Mutual funds have existed for a long time – originating in Holland, where the Eendragt Maakt Magt fund (‘Unity Creates Strength’) was launched in 1774. Almost a hundred years later, in 1868, the Foreign and Colonial Government Trust was established as the first collective investment vehicle in the UK. The earliest US mutual fund (the Massachusetts Investors Trust) was established exactly 150 years after the Dutch prototype, in 1924; this was a principal-traded, open-ended fund. It established a pattern that was to be formalised in the 1940 Investment Company Act (the ’40 Act), which is still in effect today.

Tokenisation is a recent innovation in this lengthy history. The first instance of fund tokenisation in the UK was the launch by Fidelity International of a tokenised share class on FundAdminChain’s Corda ledger, in 2021. Also in 2021, Franklin Templeton launched their OnChain U.S. Government Money Fund (FOBXX). So, real tokenised funds have been around for 4 years, although the idea of fund tokenisation was in circulation for a few years prior to this.

What Fund Tokenisation Is

In its simplest form, a fund (or share class) is tokenised when the marker of title to the fund, on behalf of its investors, changes to a token. So the investor holds a token of ownership issued by the fund, rather than, for example, a share (in an investment company), a unit (in a unit trust) or a limited partner agreement (in a private fund run by a limited liability partnership). The token is represented on one or more blockchains, and held on a digital ledger which acts as the fund register.

The Specific Benefits of Fund Tokenisation

The benefits of tokenising a fund are straightforward. The digital ledger becomes the register, and transactions are settled through the movement of tokens between participants. So the maintenance of a register of ownership by the transfer agent disappears as a function, and the register becomes self-maintaining: settlement moves tokens, which transfers ownership. At all times the ledger is the definitive record of ‘who owns what’. The transfer agent’s role is simplified and reduced.

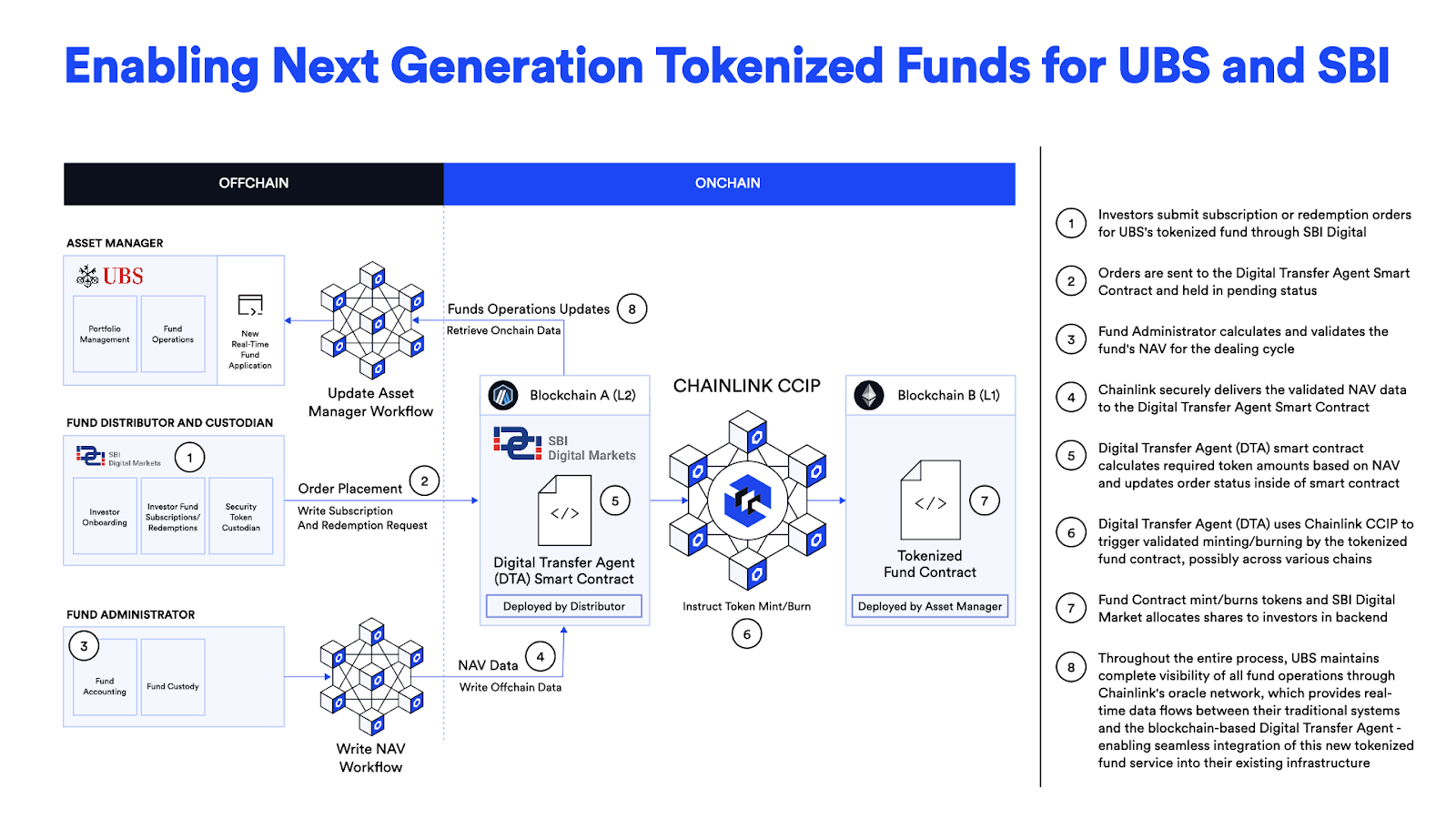

This model of an on-ledger register with automated fund servicing is already being explored in practice. As part of the Monetary Authority of Singapore’s Project Guardian, SBI Digital Markets, UBS Asset Management, and Chainlink demonstrated how the combination of Chainlink and a Digital Transfer Agent smart contract enables the creation of tokenised funds with automated fund management operations and transfer agency processes. The solution allows the fund’s share register to be maintained on one blockchain while using Chainlink’s Cross-Chain Interoperability Protocol (CCIP) to process fund lifecycle activities, such as subscriptions and redemptions, on another.

The fund tokens, like any tokens, are (at least in theory) tradeable and transferable between participants on the ledger, and so, even in a principal-traded fund (where all trades are with the fund entity) a secondary market becomes a feasible proposition. For any fund that is market-traded (whether wholly secondary-traded or hybrid with principal-trading), regular intra-day NAV publication is key. Investors and service providers need to know if the fund is trading at a discount or at a premium to the underlying. With an on-ledger fund, regular broadcasting of intra-day NAVs becomes practical and straightforward. Even for principal-traded funds, there are operational and trading benefits of regular intra-day NAV updates, even if the end-of-day NAV drives the principal-trading price.

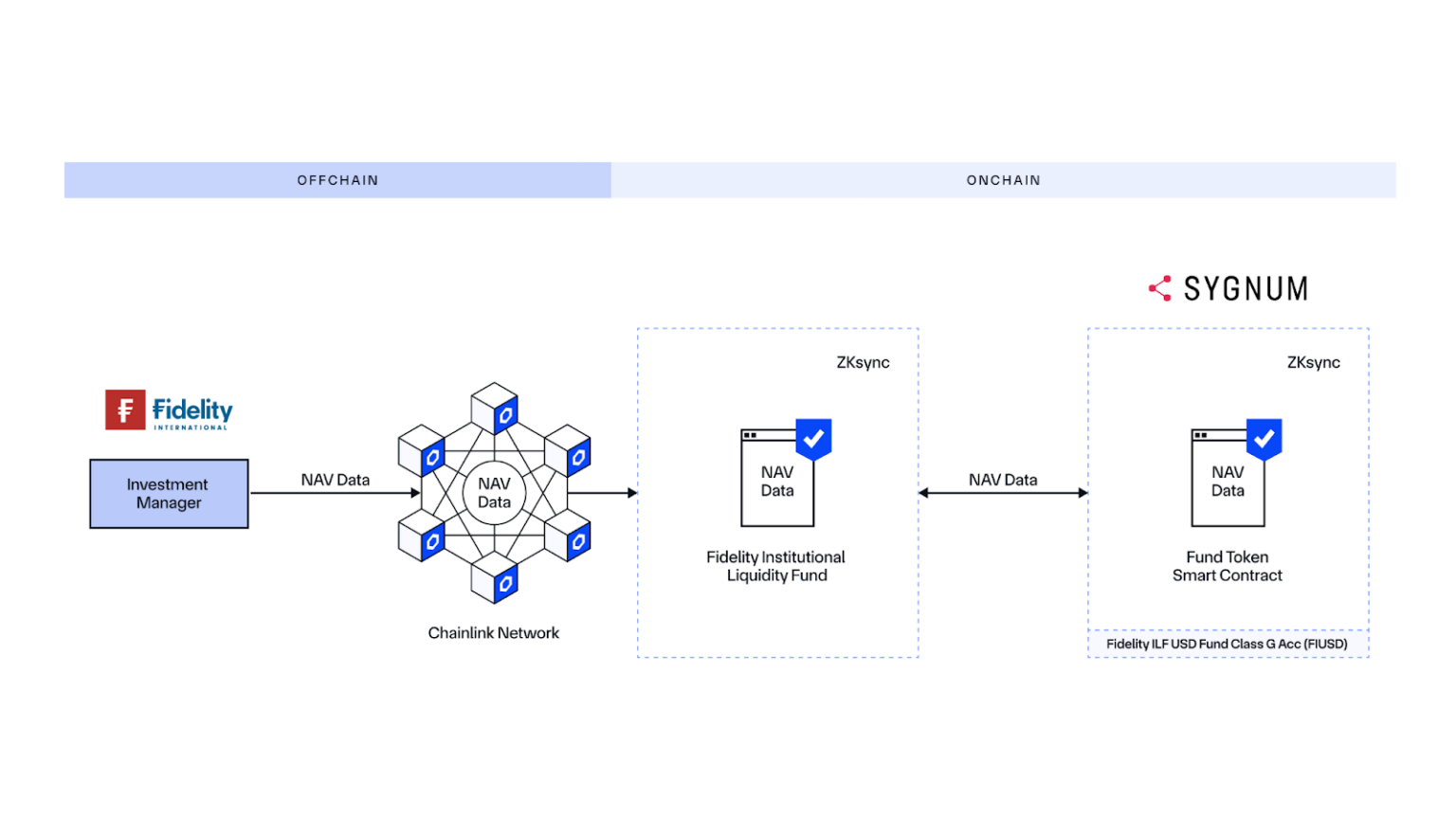

A recent collaboration between Sygnum Bank, Fidelity International, and Chainlink demonstrated how NAV data can be published and maintained onchain in real time. As part of Sygnum’s issuance of an onchain representation of Fidelity International’s $6.9 billion Institutional Liquidity Fund, a LVNAV money-market fund that must maintain price stability through precise daily NAV calculation, Chainlink was used to deliver NAV updates on a public blockchain in an automated and secure manner.

Management of cash in conventional mutual funds is often complex, and it is not uncommon for trades to be funded post-event; this leads to a high workload in chasing and reconciling the cash associated with orders from the investors, as well as to a capital requirement for the fund. Settlement involves the coordination of register updates on the asset side with transfers across conventional rails on the cash side. There is therefore settlement risk, as the two sides of settlement are managed in two different environments, and timing is hard to align.

Mutual fund settlement is often managed in extended cycles: T+4 settlement is not uncommon. While tokenisation of funds does not of itself deliver instant settlement, it certainly makes the acceleration of settlement easier.

Deploying digital cash on-ledger enables the complexity of cash management to be reduced, and settlement to be derisked. If settlement is achieved against digital cash in some form, then further benefits accrue: atomic settlement is the simultaneous, locked transfer of the cash and asset sides of a trade within the same environment. Atomic settlement in digital cash eliminates timing issues and reduces settlement risk material: it is a major tokenisation benefit, and a key part of current initiatives in the space.

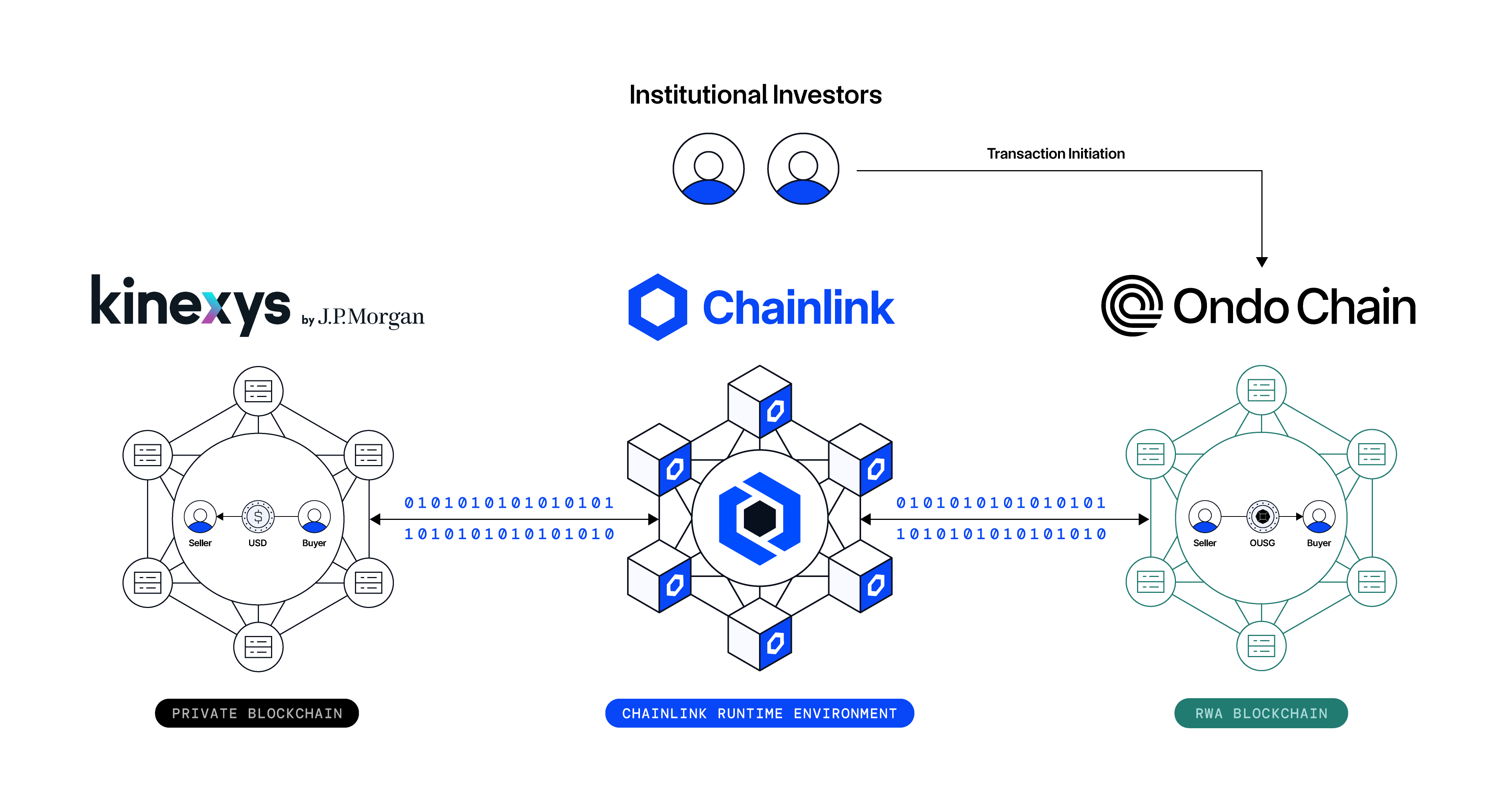

A recent initiative shows how that next step can look in practice. Kinexys by J.P. Morgan, Ondo Finance, and Chainlink recently executed an atomic Delivery-versus-Payment transaction in which units of Ondo’s tokenised Short-Term U.S. Treasuries Fund and a payment token on Kinexys Digital Payments were exchanged in a single, coordinated workflow powered by the Chainlink Runtime Environment (CRE). Both the asset leg and the digital-cash leg were locked and released together, eliminating timing gaps and reducing settlement risk. Although this involved a treasury-fund vehicle rather than a conventional mutual fund, it demonstrates the same cash-and-asset synchronisation that tokenised mutual funds will be able to adopt as digital cash becomes more widely available.

Benefits Beyond Fund-Specifics

In addition to these benefits which are specific to collective vehicles, tokenisation of funds delivers a set of generic benefits: these are the benefits which accrue whenever blockchains, distributed ledger technology and digital tokens are implemented.

Security and resilience: The blockchain brings a material enhancement to security and resilience, through strong cryptographic security and a definitive, complete, immutable history of transactions and positions. This enables the purchaser of an asset to be confident that the seller has good title to that asset, and the seller to know that the buyer’s digital cash is good for the trade.

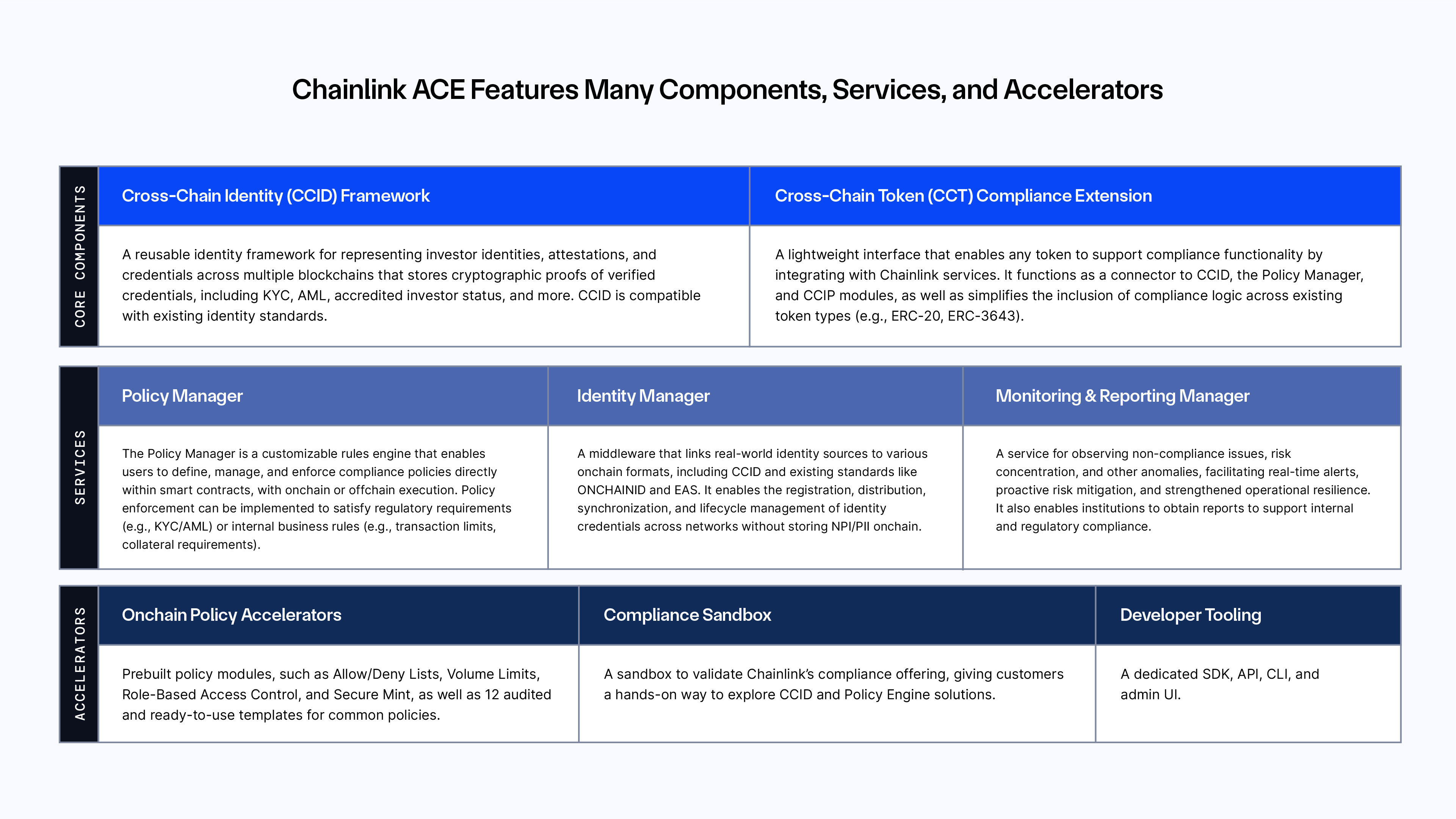

Policy enforcement and compliance: Smart contracts allow compliance requirements to be embedded directly within the digital asset’s logic. One recent development in this area is the introduction of Chainlink’s Automated Compliance Engine (ACE) which enables institutions to define, manage, and enforce compliance policies in real time across public and private blockchains. These may include jurisdictional restrictions, investor eligibility, transaction limits, or fund-specific rules. In the context of tokenised funds, this simplifies regulatory implementation, reduces the reliance on off-ledger compliance infrastructure, and enables funds to be structured, distributed, and managed within a secure, rules-based onchain environment.

Verifiable identity: A further enhancement to integrity comes through the definitive identification of participants in the ecosystem. On-ledger management of assets and trades enables a clean integration with digital identity sources, and consequently strengthens trust in their counterparties for all participants.

Chainlink’s Cross-Chain Identity (CCID) framework allows verified credentials, such as KYC status, AML checks, and investor classification, to be represented onchain as cryptographic proofs. These proofs preserve privacy by keeping personally identifiable information off-ledger, while still enabling the secure exchange of verified identity data across multiple blockchains.

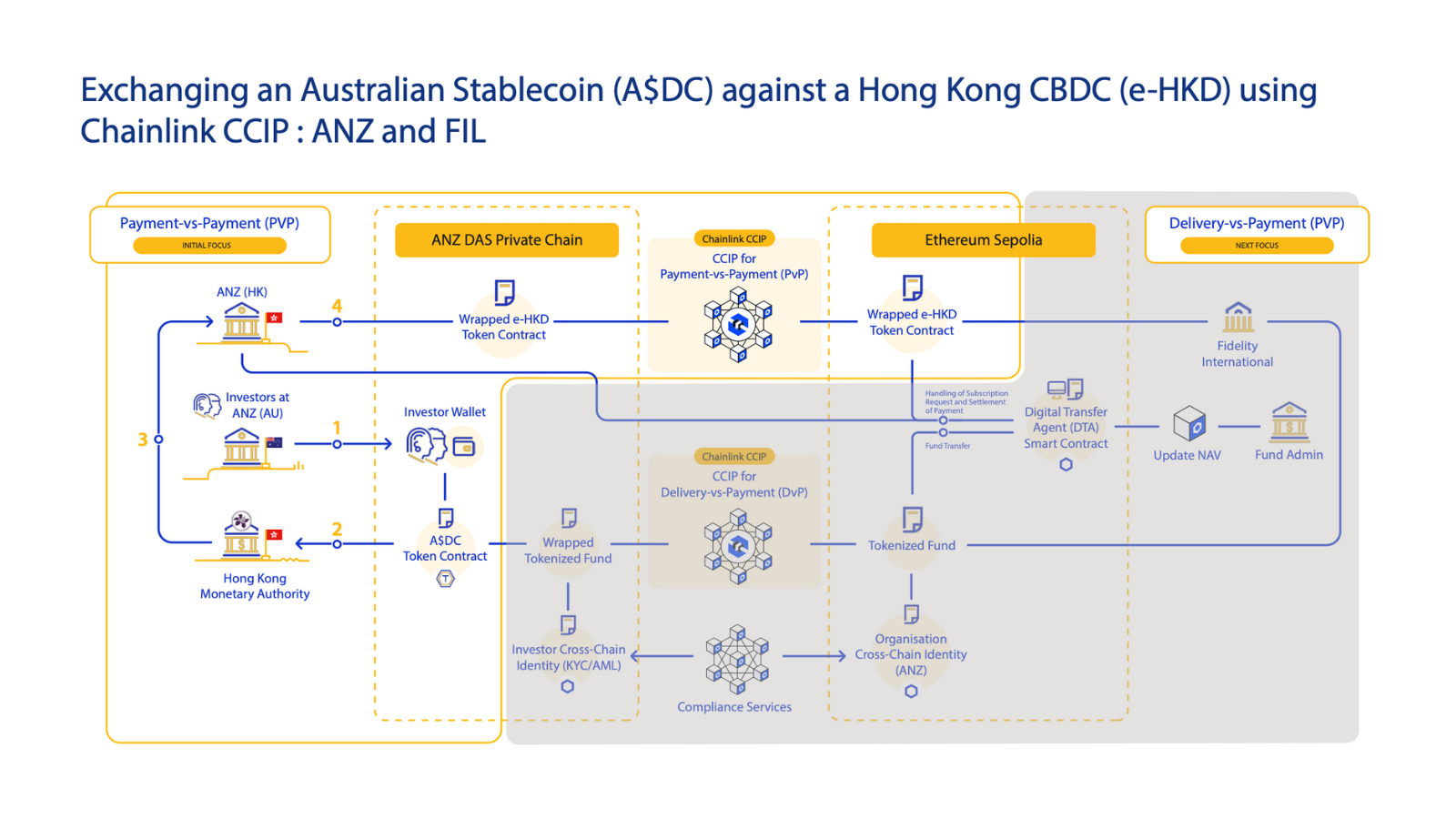

In a recent report Visa highlighted how, under the Hong Kong Monetary Authority’s e-HKD+ program, Fidelity International and ANZ used Chainlink ACE and CCID, among other Chainlink solutions, to verify investor identity onchain and complete the purchase of a tokenised fund using a cross-border CBDC and stablecoin transaction.

Unified recordkeeping: The distributed ledger brings real-time data-sharing and data-alignment, which makes reconciliations and asynchronous messaging redundant. This latter benefit is particularly significant for funds, where the conventional order process is heavily dependent on messaging services such as Calastone and EMX. Data-sharing across a distributed ledger makes these services unnecessary, and consequently eliminates their costs from the value-chain.

Embedded asset logic: Tokens, unlike shares and title deeds, can carry processible, digital data, and are programmable through smart contracts. They can therefore implement processes independently of off-ledger business systems. The full benefit of self-executing tokens will be delivered in the future through executable entitlements, rather than tokens representing static ownership. However, the programmability of tokens on a blockchain does enable, for example, compliance rules and restrictions to be encoded, and enables those rules to be self-enforced—as referenced above.

What Will Drive Industry Adoption?

For fund tokenisation to take off, there needs to be a compelling case for funds and managers to invest in the change, and to support a new form of fund ownership. Inevitably there are costs of change and operation, which are set against the benefits outlined above. The market also prices in some technical risk.

In the summer of 2024, a task force set up by the UK Treasury set out a baseline definition of a tokenised fund for the UK market. The task force included senior industry representation, alongside delegates from government, the regulator (FCA) and the Investment Association. Despite this strong sponsorship, the baseline defined was restrictive: it proscribed holdings in underlying digital assets and settlement in digital cash, and essentially just exchanged tokens for shares within an unchanged fund operating model. There has been little take up since, primarily because the industry cannot see a clear business case for tokenised finds in this form.

Without digital cash, atomic settlement and on-ledger cash management, it is hard for a sound business case to be constructed. So a credible form of digital cash is essential if the full benefits of tokenisation are to be realised across fund types.

The Current Focus – Tokenised Money Market Funds

The real focus of current interest in tokenised funds is in the money-market / treasury space. This interest is driven more by the specific potential benefits of tokenised funds in collateral management than by the inherent benefits of tokenisation outlined above.

If money-market funds are managed within appropriate quality boundaries, then they are potentially eligible as ‘high quality liquid assets’ which could be posted under collateral agreements. Currently, the shares in conventional money-market-funds are locked up in a transfer agent’s register, and can’t be transferred except through a principal trade with the fund entity. This makes it impossible to transfer the fund shares as collateral without a full change of ownership, and a settlement through the transfer agent.

Benefits Specific to Tokenised Money Funds

Tokenising a money-market fund creates mobility, as the token can be transferred on-chain, therefore liberating the fund units from the transfer agent’s register, and enabling them (if they are eligible) to be used as collateral and transferred instantly. This is the key to current interest in tokenised money funds.

While mobility is the primary upside, there is also a potential benefit of tokenisation to the managers of money-market funds. Currently, many market participants shelter cash in money-market funds, but routinely withdraw it to post as cash collateral. When the collateral is returned, then the cash is reinvested in the fund. This creates a high level of subscriptions and redemptions to / from the fund. It also reduces the average scale of cash invested in the funds, and make the AUM volatile. So the current model is operationally demanding, while reducing the potential revenues to the fund and fund manager.

If the money-market fund itself can be used as collateral, then the volume of subscriptions and redemptions will reduce, the fund will become more stable, and its average AUM will increase. All of these are material benefits to the fund and to its manager. Ultimately, this benefit should find its way to investors, through enhanced performance and reduced costs.

Leading Examples of Tokenised Money Funds

There are high-profile, substantial and well-regarded money-market funds now available in the market in tokenised form. The three leading examples are:

- BlackRock’s USD Institutional Digital Liquidity Fund (BUIDL)

- Franklin Templeton’s OnChain U.S. Government Money Fund (FOBXX / BENJI)

- Hashnote’s USD Yield Coin (USYC)

BUIDL was launched in March 2024 and grew very rapidly. It now has AUM of nearly 3 billion USD and has over 40% of the total market in US tokenised money funds. BUIDL is available on multiple prominent blockchains.

Franklin’s FOBXX was launched earlier than BUIDL, in April 2021. Its current AUM is in the region of 700 million USD. Initially FOBXX was issued only on Stellar, but, similarly to BUIDL, is now supported on multiple popular chains.

Hashnote’s USYC (recently acquired by Circle) is a treasury-backed coin, rather than strictly a fund as such, but has strong similarities to a money fund, and delivers yield. USYC was launched on Digital Asset’s Canton network in October 2024, but has extended to 3 other networks. It currently has an AUM of over 300 million USD.

The Future for Tokenised Funds

There is near-universal agreement that an acceptable form of digital cash is essential to the ability of funds and fund managers to frame a compelling business case, and therefore to the progress of fund tokenisation itself.

Beyond digital cash, the accommodation of digital assets within tokenised funds is a natural progression which would further enhance the business case for tokenisation, and create appeal to a growing investor-base that is comfortable in a Web3 environment.

Fund tokens have the potential to be used to create secondary liquidity in funds that to date have been purely principal-traded. However, legal, regulatory and market hurdles need to be overcome if this is to progress. There needs to be an approved market mechanism, and venues in which such trading could take place. This could conceivably be delivered by existing digital venues such as Coinbase, Kraken and Archax, or there could be new entrants.

A major potential evolution is from fund tokens that simply represent ownership to tokens that represent self-executing entitlements. This would fully automate settlements and distributions, effectively eliminating asset-servicing in the context of funds. The currently large number of intermediaries and roles dictated by fund regulation could reduce substantially, reducing the cost of funds to the investor, and reducing the complexity of fund operations to the fund entity.

Once we have self-executing tokens of entitlement, then bespoking of funds, and of the yield and flows that they deliver, becomes a practical proposition: in the future, the fund may become less of a collective vehicle, and more of a personalised construct, embedded in the management of wealth at the individual level.