SmartCon 2025: Key Announcements, Product Releases, Highlights, and More

Key Takeaways

- The Chainlink Runtime Environment (CRE) is now live—the all-in-one orchestration layer powering the next massive leap in the adoption of onchain finance.

- UBS has successfully completed the world’s first in-production, end-to-end tokenized fund workflow leveraging the Chainlink Digital Transfer Agent (DTA) technical standard.

- Chainlink announces Chainlink Confidential Compute, a breakthrough service that unlocks private smart contracts on any blockchain.

SmartCon 2025 brings governments, financial institutions, and leading Web3 projects together to discuss the technologies transforming markets, public services, and the global economy. The conference enables leaders across capital markets, government, and Web3 to define how global markets move onchain.

This year’s SmartCon features several monumental Chainlink announcements, speakers from large financial institutions and market infrastructures, economics updates, launches from key ecosystem partners, and much more.

Product Launches and Updates

Chainlink Runtime Environment Now Live, Unlocking the Full Capabilities of Onchain Finance

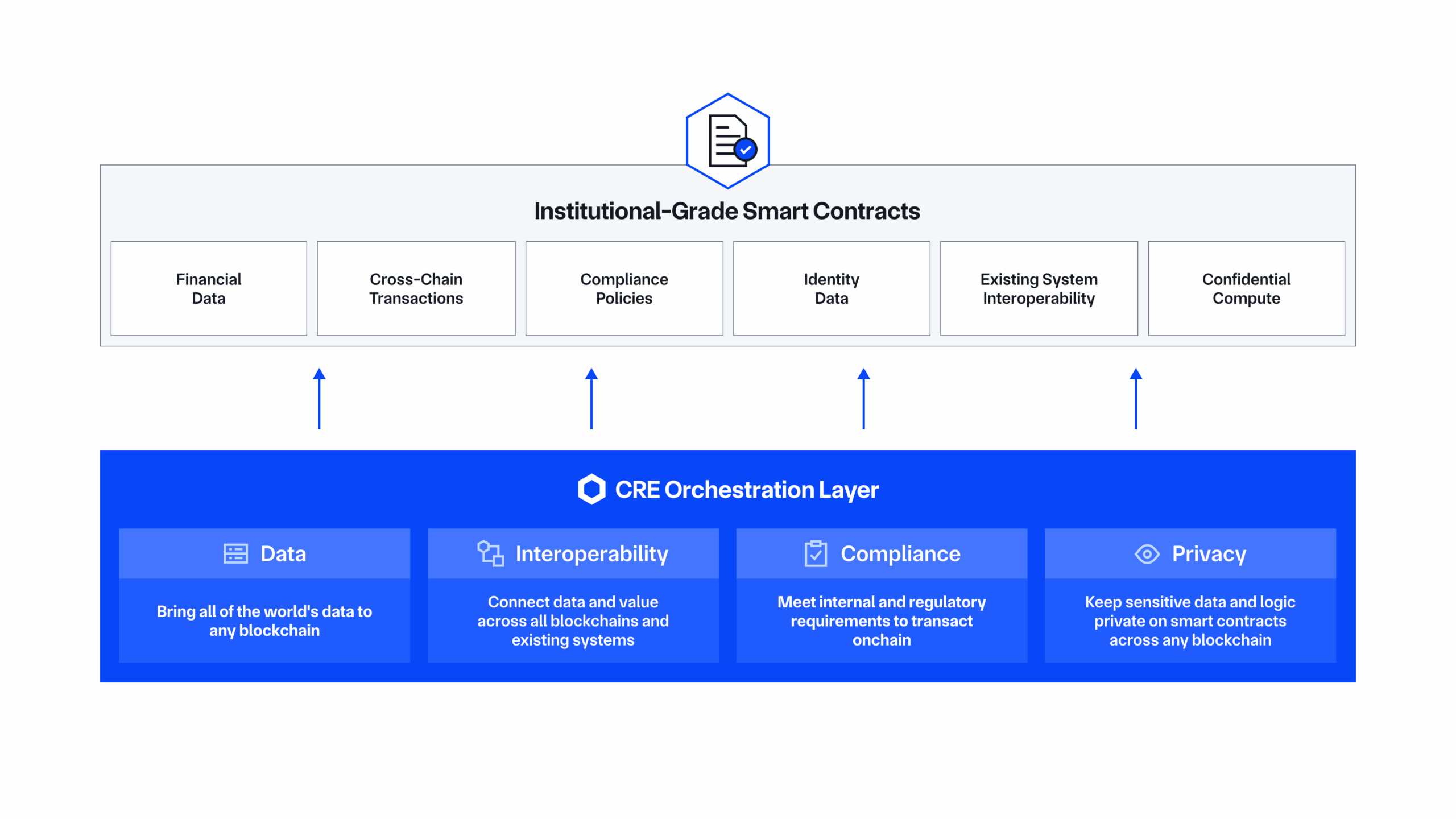

We’re excited to announce the launch of the Chainlink Runtime Environment (CRE)—the all-in-one orchestration layer powering the next massive leap in the adoption of onchain finance.

CRE provides an all-in-one orchestration layer for building end-to-end institutional-grade smart contracts. These are advanced smart contracts that are easily connected to external data, cross-chain enabled, compliance-ready, and privacy-preserving, which are able to securely interoperate across thousands of public and private blockchains, existing identity systems, and core financial infrastructure.

This is the next major technological leap needed to bring the global financial system onchain and propel our industry from a few trillion dollars in value to hundreds of trillions.

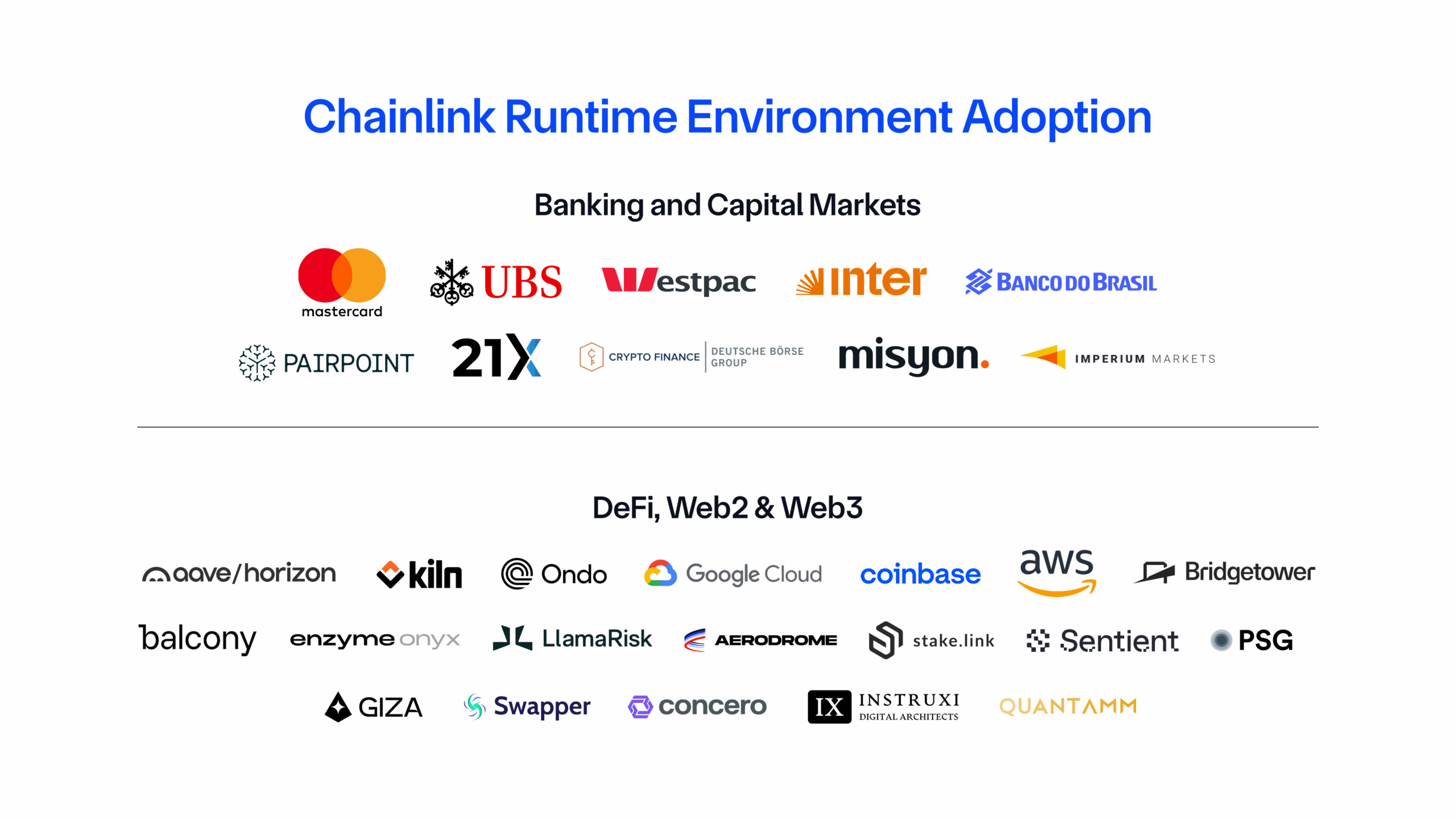

From stablecoins and tokenized real-world assets to Delivery vs. Payment (DvP) settlement and onchain data distribution, a wide variety of more advanced onchain finance use cases are already being built and deployed on CRE today by leading institutions, Web2 enterprises, and Web3 protocols, including:

- Kinexys by J.P. Morgan and Ondo used CRE to conduct a first-of-its-kind cross-chain DvP transaction between public and private blockchains.

- Swift, Euroclear, and 22 leading financial market participants are part of an industry initiative using CRE to streamline corporate actions processing.

- UBS Tokenize and DigiFT completed the first-ever redemption of a tokenized fund using the Chainlink Digital Transfer Agency (DTA) technical standard powered by CRE.

- Swift and UBS are leveraging CRE to manage tokenized fund workflows using the existing ISO 20022 messaging standard.

- Mastercard and Swapper co-developed a payments solution on CRE that enables Mastercard’s 3.5 billion credit card holders to purchase crypto assets on decentralized exchanges, such as Uniswap.

- Westpac Institutional Bank and Imperium Markets are implementing CRE in Project Acacia, a new joint initiative between the Reserve Bank of Australia and Digital Finance CRC (DFCRC), to orchestrate DvP settlement of tokenized assets.

- Banco Inter, Hong Kong Monetary Authority (HKMA), the Central Bank of Brazil (Banco Central do Brasil), Standard Chartered, and additional partners launched a blockchain-powered trade finance platform that leverages CRE to securely automate settlement of cross-border agricultural trade

- Coinbase’s x402 standard is enabling AI agents to pay for CRE workflows.

- Google Cloud and Amazon Web Services (AWS) are collaborating with Chainlink to showcase how CRE can connect to Web2 systems.

- Balcony, the leading platform for real estate tokenization backed by government-sourced data, is adopting CRE to power $240+ billion in property assets onchain.

- 21X, the first EU-regulated onchain exchange for tokenized securities, adopted CRE in production to power its exchange with verifiable post-trade data, including last traded prices and bid-ask offers, for securities listed on the 21X platform.

- Horizon, Aave Lab’s institutional initiative built on Aave infrastructure that enables tokenized assets to be used as collateral to borrow stablecoins, is adopting the Chainlink ACE, powered by CRE, to enable compliance policies that govern how regulated capital is deployed in lending markets.

- KILN, an enterprise-grade staking platform with over $16 billion under management, built an entire new DeFi product called Railnet on CRE, which empowers users to manage liquidity across omni-vaults through programmatic yield strategies.

- Crypto Finance by Deutsche Börse Group leveraged CRE to orchestrate a Proof of Reserve feed for onchain verification of assets held in custody by Crypto Finance, supporting its physically backed Ethereum and Bitcoin ETPs.

- Many more: Misyon Bank, Pairpoint (Vodafone and Sumitomo joint venture), and LlamaRisk are using CRE to orchestrate the connection of key data onchain—from price feeds and proof of reserves to telco tower usage, and risk-adjusted pricing for tokenized RWAs—while many top Web3 protocols are also integrating CRE, including BridgeTower, Enzyme Onyx, PSG Digital, Aerodrome, Stake.Link, Sentient, Giza, Concero, Instruxi, and Quantamm.

If you’re a developer, you can start building on CRE today. If you’re an institution ready to deploy, reach out to us.

If you’d like to read more about CRE, read the product announcement blog: Chainlink Runtime Environment Now Live, Unlocking the Full Capabilities of Onchain Finance.

Introducing Chainlink Confidential Compute: Unlocking Private Smart Contracts on Any Blockchain

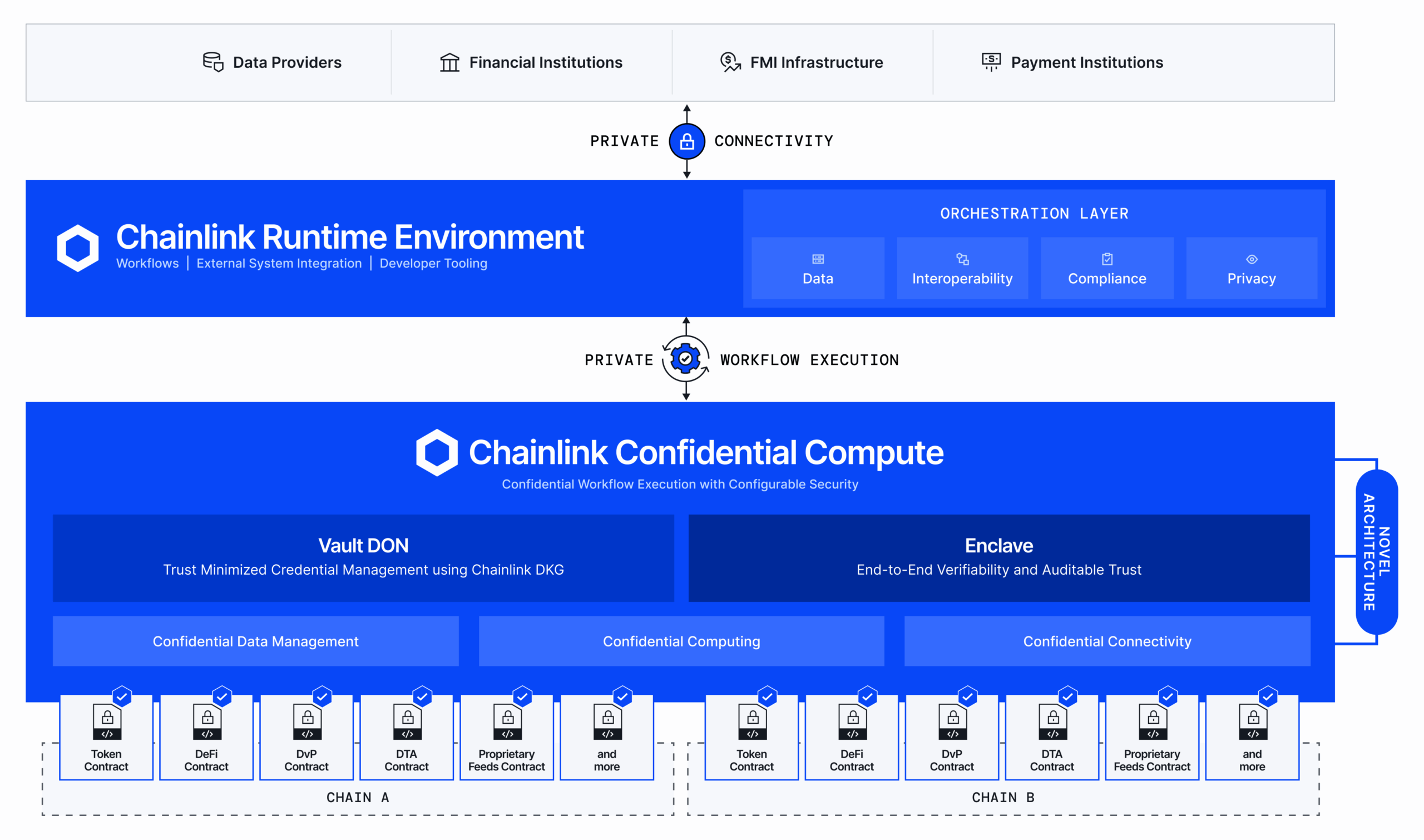

Building on years of innovation and engineering, we’re announcing Chainlink Confidential Compute, a breakthrough service that unlocks private smart contracts on any blockchain.

Privacy shouldn’t be something we have to compromise on when making the next generation of smart contracts; we’re fixing that. We have also seen that a lack of privacy is the greatest barrier holding back large-scale institutional adoption of onchain finance.

Chainlink Confidential Compute unlocks a new class of private smart contracts that connect to real-world financial data and Web2 systems and interoperate across blockchains while keeping proprietary data, business logic, external connectivity, and computation fully confidential. This unlocks new, previously impossible onchain use cases for institutions, such as:

- Private Transactions: Enable onchain value exchange with confidentiality, concealing key transaction details so business transactions and market positions remain confidential.

- Privacy-Preserving Tokenization (RWAs): Bring new types of institutional real-world assets (RWAs) onchain, such as tokenized bonds, private credit pools, and fund allocations, without exposing investor information, deal sizes, or pricing terms.

- Confidential Data Distribution: Monetize and securely distribute your proprietary data onchain, such as benchmark indices, reference rates, and valuations, to approved subscribers only in a privacy-preserving manner, while also giving smart contracts the capacity to perform operations without revealing underlying data.

- Privacy-Preserving Cross-Chain Interoperability: Execute transactions across public and private blockchains without revealing key transaction data to Chainlink node operators or other third parties, enabling use cases like Delivery vs. Payment (DvP) settlement where tokenized assets and stablecoins/CBDCs exist on different chains.

- Privacy-Preserving Identity and Compliance: Prove compliance and verify identities using existing identity providers and APIs without revealing underlying personal or institutional data onchain or to the nodes themselves.

Chainlink Confidential Compute is powered by the Chainlink Runtime Environment (CRE), which enables the creation of workflows that execute across blockchains and existing systems while connecting to key data, automating compliance policy enforcement, and leveraging private computation. By incorporating Confidential Compute into CRE, privacy can underpin every part of the transaction lifecycle, from data inputs, API requests, and identity verification to transaction processing, cross-chain transfers, and final settlement. CRE is your all-in-one orchestration layer for executing private smart contracts end-to-end.

The Early Access version of Chainlink Confidential Compute will be available through CRE in early 2026, with General Access launching later in 2026.

Read the whitepaper to learn more and sign up for early access today.

Chainlink Automated Compliance Engine (ACE) Partner Ecosystem

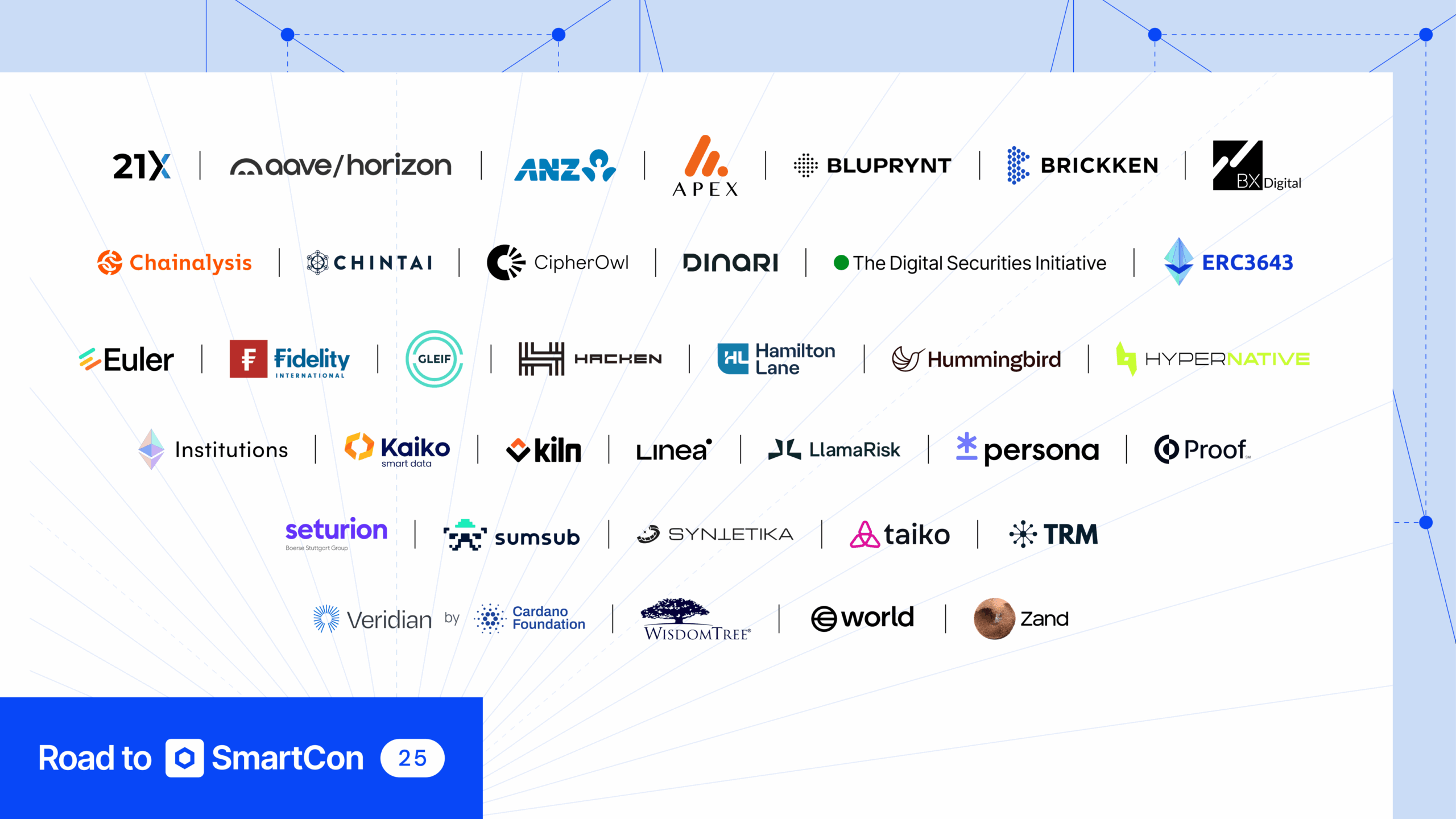

We’ve launched the Chainlink Automated Compliance Engine (ACE) partner ecosystem, featuring 20+ leading compliance providers, frameworks, and regulators powering the next generation of onchain compliance.

The Chainlink ACE partner ecosystem is a network of trusted vendors whose solutions are now natively compatible with ACE. These partners recognize ACE as the standard for onchain compliance and are integrating their data and services directly into ACE to unlock complete compliance, monitoring, and reporting solutions.

At launch, the Chainlink ACE partner ecosystem includes:

IDENTITY PROVIDERS

- GLEIF—Brings trusted global identity standards to ACE users.

- World—Connects its decentralized World ID to ACE users, allowing World’s proof-of-human protocol to be composed anonymously with data from other ACE partners.

- SumSub—Enables reusable digital identity for users to leverage within ACE through SumSub’s KYC/KYB.

- Persona—Allows ACE users to leverage reusable digital identity via Persona’s KYC/KYB verification.

- Proof—Provides cryptographically secure, verified digital identities for ACE users—both individuals & organizations—to sign and protect their transactions.

- Veridian by the Cardano Foundation—Enables ACE users to issue GLEIF’s vLEI-based credentials offchain, which are then delivered onchain in the form of CCIDs.

RISK SCORING PLATFORMS

- Chainalysis—Streams wallet and transaction risk scores directly into ACE policies for institutional-grade AML controls.

- TRM Labs—Provides real-time risk intelligence to ACE, enabling issuers and protocols to block sanctioned or high-risk activity.

- Hypernative—Provides real-time risk intelligence to ACE, enabling issuers and protocols to block high-risk activity.

- CipherOwl—Delivers risk scores into ACE to power agile, customizable compliance rules.

- Llamarisk—Audits ACE-enabled tokens to provide independent risk scores and assessments.

MONITORING & REPORTING

- Bluprynt—Designs, runs, and manages compliance policies directly on ACE for institutions, while also fulfilling regulatory reporting obligations via automated disclosures and regular or on-demand compliance reports.

- Hacken—Builds real-time security monitoring and alerting on top of ACE to detect threats and abnormal behavior.

- Kaiko—Delivers market data and analytics leveraging ACE transaction data logs.

- Hummingbird—Offers a case management and automated SAR reporting solution on top of ACE.

TOKENIZATION PLATFORMS

- Apex Group—Enforces end-to-end compliance across its tokenization infrastructure.

- Chintai—Uses ACE to define investor and transaction eligibility requirements for Chintai assets in public blockchain environments.

BLOCKCHAINS & LAYER-2 NETWORKS

- Ethereum for Institutions—Co-designs and drives institutional adoption of ACE.

- Linea—Establishes ACE as the standard for compliance in the Linea ecosystem.

- Taiko—Leverages ACE for tokenization use cases within the Taiko ecosystem.

INDUSTRY FRAMEWORKS

- ERC-3643—Unlocks compatibility with the ERC-3643 token standard with ACE’s offchain policy.

- ERC-7943—Co-authored by Build member Brickken, the ERC-7943 token standard uses ACE to power compliance and interoperability.

- Digital Securities Initiative (DSI)—Recognizes ACE as a trusted compliance standard, and is collaborating with Chainlink Labs to make ACE compatible with DSI’s regulatory frameworks.

As the industry standard for onchain compliance, ACE is already being adopted by leading institutions and DeFi protocols to power compliant tokenized finance use cases, including:

- Fidelity International—Manage identity and transaction eligibility requirements in private-public blockchain PvP & DvP workflows for tokenized money market fund subscriptions.

- WisdomTree—Unlock reusable identity and enable users to securely exchange identity data onchain.

- ANZ Bank—Manage identity and transaction eligibility requirements in private-public blockchain Payment-vs-Payment (PvP) & Delivery-vs-Payment (DvP) workflows for tokenized money market fund subscriptions.

- Aave Horizon—Protect stablecoin pools on Aave Horizon, making sure assets are coming from legitimate sources.

- Zand Bank—Create identities and credentials, attach policies to contract methods, and evaluate such impact to its control framework.

- 21X—Power compliance capabilities for the EU’s first regulated exchange for the trading and settlement of tokenized securities.

- Kiln—Verify the identity of depositors into Kiln institutional vaults.

- Euler—Support stablecoin pools by ensuring that assets are coming from verified sources.

- Syntetika—Manage identity eligibility requirements of users on its platform.

In addition, Dinari is also planning to integrate ACE to power onchain compliance.

Banking and Capital Markets Announcements

UBS Successfully Completes the World’s First In-Production, End-to-End Tokenized Fund Workflow Leveraging the Chainlink Digital Transfer Agent (DTA) Technical Standard

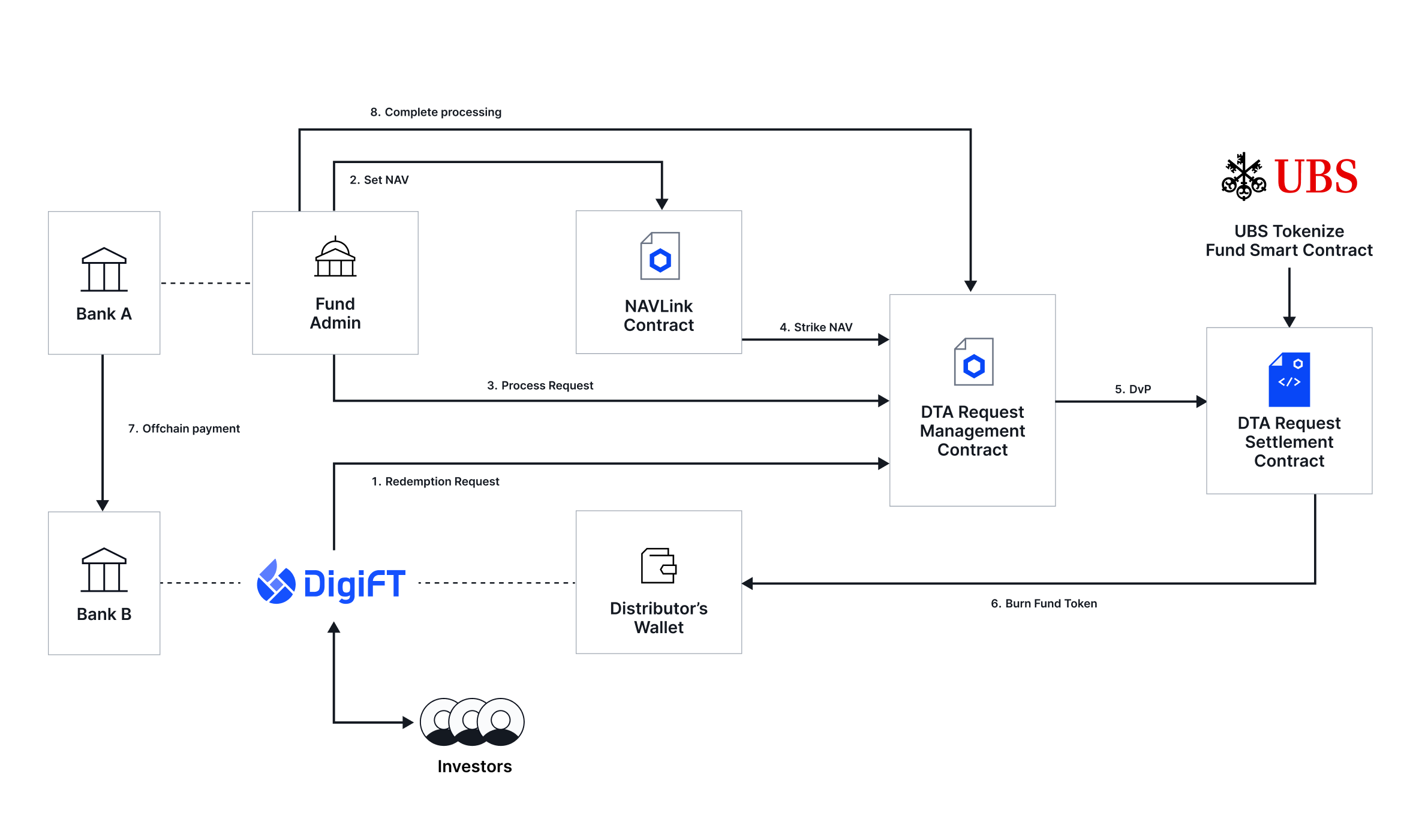

UBS has successfully completed the world’s first in-production, end-to-end tokenized fund workflow leveraging the Chainlink Digital Transfer Agent (DTA) technical standard.

UBS—one of the world’s largest private banks with over $6 trillion in AUM—worked with its in-house tokenization unit UBS Tokenize and DigiFT to showcase a live, in-production tokenized fund transaction that leverages the Chainlink DTA technical standard to complete the first-ever subscription and redemption request of a tokenized fund.

This development marks a major achievement that builds upon prior work between UBS and Chainlink within the Monetary Authority of Singapore’s Project Guardian initiative and proves how fund operations can be seamlessly automated onchain for increased efficiency and utility gains. In this live transaction, DigiFT functioned as the onchain fund distributor and leveraged the DTA standard to successfully request and process a subscription and redemption order.

The DTA technical standard leverages key Chainlink platform capabilities, including:

- Chainlink Runtime Environment (CRE) for orchestration across onchain environments and existing in-house systems used by financial institutions.

- Cross-Chain Interoperability Protocol (CCIP) for interoperability across any public or private chain.

- Automated Compliance Engine (ACE) for programmable compliance.

- NAVLink for robust pricing inputs required for fund subscriptions and redemptions.

“This transaction represents a key milestone in how smart contract-based technologies and technical standards enhance fund operations and the investor experience. As the industry continues to embrace tokenized finance, this achievement illustrates how these innovations drive greater operational efficiencies and new possibilities for product composability. Through our UBS Tokenize initiative, we are committed to fostering innovation and applying our deep expertise to support the development of digital strategies and products that meet our clients’ evolving needs.”—Mike Dargan, Group Chief Operations and Technology Officer, UBS

FTSE Russell Collaborates With Chainlink To Publish Its World-Leading Global Indices Onchain for the First Time via DataLink

FTSE Russell, a leading global index provider with $18+ trillion in AUM benchmarked, has collaborated with Chainlink to publish its world-leading global indices onchain for the first time via DataLink.

With this integration, the Russell 1000 Index, Russell 2000 Index, Russell 3000 Index, FTSE 100 Index, WMR FX benchmarks, FTSE DAR Digital Asset Prices, and the FTSE Digital Asset Index will be available on 40+ blockchains via DataLink, an institutional-grade data publishing service powered by Chainlink.

FTSE Russell indexes are globally adopted, covering 98% of the investible market worldwide:

- Russell 1000 Index—A U.S. equity index composed of ~1K of the largest publicly traded U.S. companies, representing the large-cap segment of the U.S. equity market, with an average market cap of $1.2T+.

- Russell 2000 Index—Tracks approximately 2K small-cap U.S. equities and is often regarded as the leading benchmark for U.S. small-cap equity performance.

- Russell 3000 Index—Includes ~3K U.S. stocks and represents ~98% of the investable U.S. equity market. It serves as the broad benchmark for U.S. equities, covering both large and small-cap segments.

- FTSE 100 Index—Tracks the 100 largest companies listed on the London Stock Exchange by market cap. The index serves as the primary performance indicator for United Kingdom blue-chip equities.

- WMR FX benchmarks—Provides globally recognized FX benchmark rates used by institutions for currency valuation, trading, and index construction.

- FTSE DAR Digital Asset Prices—Delivers independently calculated digital asset prices sourced from vetted exchanges to meet institutional data standards.

- FTSE Digital Asset—Provides institutional-grade benchmarks for the digital asset market. It covers the top ~95% of eligible digital assets and is rebalanced quarterly.

DataLink leverages Chainlink’s proven infrastructure to enable institutions to seamlessly distribute and commercialize their data onchain, while retaining full control and eliminating the need to build and maintain dedicated infrastructure.

By bringing FTSE Russell benchmarks onchain, DataLink accelerates institutional adoption of digital assets by providing financial institutions access to the same trusted data they already rely on today to support their financial services.

Tradeweb Collaborates With Chainlink To Bring U.S. Treasury Benchmark Data Onchain via DataLink

Tradeweb has collaborated with Chainlink to publish its U.S. Treasury data onchain for the first time via DataLink.

As one of the world’s leading electronic marketplaces used by institutional investors, Tradeweb offers over 50 products in more than 85 countries across the globe, with an average daily volume of $2.4 trillion. More than 3,000 clients connect to Tradeweb to form a global network of the world’s largest banks, asset managers, hedge funds, insurance companies, wealth managers, and retail clients.

DataLink is now making Tradeweb’s FTSE U.S. Treasury Benchmark Closing Prices available to 2,000+ onchain applications across 60+ public and private blockchains in the Chainlink ecosystem, driving a new wave of tokenization by established institutions and onchain innovators alike.

“Tokenization represents one of the fastest-growing opportunities in our markets today, and our collaboration with Chainlink is a significant step forward in modernizing traditional financial markets through blockchain applications. By making our Tradeweb FTSE U.S. Treasury Benchmark Closing Prices available onchain, we aim to unlock new opportunities for innovation and 24/7 access across the global financial ecosystem.” — Chris Bruner, Chief Product Officer at Tradeweb

WisdomTree Collaborates With Chainlink To Bring NAV Data Onchain for the CRDT Tokenized Private Credit Fund

WisdomTree, a global asset manager with $130+ billion AUM, and Chainlink are collaborating to bring institutional-grade NAV data onchain to power subscriptions and redemptions for its CRDT tokenized fund on Ethereum.

The WisdomTree Private Credit and Alternative Income Digital Fund (CRDT) is a tokenized private credit fund that provides exposure to a diversified portfolio of liquid private credit and alternative income instruments, tracking the Gapstow Liquid Alternative Credit Index (GLACI).

By bringing the CRDT fund’s NAV data onchain via the Chainlink data standard, WisdomTree can enable subscriptions and redemptions through its Prime and Connect platforms, while ensuring that the fund maintains institutional-grade transparency, auditability, and interoperability with the broader digital asset ecosystem.

With verified NAV data available on Ethereum via Chainlink, DeFi protocols and institutional platforms can also now reference CRDT’s valuation in smart contracts, unlocking new use cases across lending, yield aggregation, and automated portfolio management.

“I’m excited to see WisdomTree go live with Chainlink in production for its tokenized private credit fund, which proves how industry-standard onchain data infrastructure is now powering core institutional tokenized fund workflows. When a leading global asset manager and financial innovator such as WisdomTree integrates Chainlink’s platform, it sends a clear signal that institutional-grade decentralized data infrastructure has become the foundation of the new global financial system.” — Sergey Nazarov, Co-Founder of Chainlink

S&P Dow Jones Indices and Dinari Partner With Chainlink and Selected It As the Official Oracle Provider for the S&P Digital Markets 50 Index

S&P Dow Jones Indices and Dinari have selected Chainlink as the official oracle provider for the S&P Digital Markets 50 Index to power official index values and live token prices for its multi-asset index.

The integration on Avalanche includes Chainlink Price Feeds and SmartData—including Proof of Reserve, NAVLink, and SmartAUM—with plans to integrate Data Feeds and the Automated Compliance Engine (ACE).

The S&P Digital Markets 50 Index is the first tokenized benchmark combining U.S. equities and digital assets. Chainlink will deliver critical pricing data and official index values to DeFi platforms supporting the S&P Digital Markets 50.

SBI Digital Markets Adopts Chainlink as Exclusive Infrastructure Provider To Power Its Digital Assets Platform

SBI Digital Markets (SBIDM)—the digital asset arm of Japan’s leading conglomerate SBI Group with ¥10+ trillion AUM—is adopting Chainlink as its exclusive infrastructure solution to power its digital assets platform.

Through this strategic partnership, SBIDM is integrating Chainlink CCIP as its exclusive interoperability solution, enabling its expanding pipeline of tokenized assets to be transferred securely across public and private chains and further bridge the worlds of TradFi and DeFi. By leveraging CCIP Private Transactions, SBIDM prevents third parties from accessing private data, including amounts, counterparty details, and more.

Powered by Chainlink, SBIDM is evolving from a tokenized asset issuance and distribution platform into a comprehensive digital asset hub that offers the full end-to-end lifecycle its customers require, including the compliant issuance, purchase, settlement, and secondary trading with tokenized cash across jurisdictions.

Chainlink Powering Cross-Border DvP Settlement Between the Central Bank of Brazil and Hong Kong Monetary Authority Alongside Banco Inter, Standard Chartered, GSBN, & 7COMm in the Drex Program

Chainlink is powering cross-border DvP settlement between the Central Bank of Brazil and Hong Kong Monetary Authority alongside Banco Inter, Standard Chartered, GSBN, & 7COMm in the Drex program.

In phase two of the Central Bank of Brazil’s (BCB) Drex project, which is focused on cross-border trade, Chainlink connected BCB with the Hong Kong Monetary Authority (HKMA) to orchestrate seamless and secure trade settlement across jurisdictions in a compliant manner.

In addition to BCB, HKMA, and Chainlink, there were multiple leading organizations involved in this workflow:

- Standard Chartered—Global bank with over $800 billion in total assets.

- Banco Inter—The Brazilian financial super-app serving over 40 million users.

- Global Shipping Business Network—The consortium empowering digital trade with its data infrastructure and ecosystem partners.

- 7COMm—Technology provider serving the largest financial institutions in Brazil.

Chainlink powers the DvP solution end-to-end and enables conditional, installment-based payments for goods via different digital currencies and tokenized reserves:

- Chainlink Runtime Environment (CRE) established interoperability channels between the Drex platform and the Hong Kong Ensemble Network (led by the HKMA), and between the DLT-based Trade Finance Platform (TFP) on Besu and GSBN. This enabled CRE to seamlessly transfer payment instructions between Drex, Banco Inter, and HKMA—translating messages into the correct format when needed (e.g., ISO 20022 for HKMA)—and to call the GSBN API to trigger eBL (electronic Bill of Lading) transfers.

- Chainlink CCIP enabled secure communication between the Drex platform and TFP, ensuring events such as contract execution or credit release to be automatically synchronized between different networks.

This solution marks the first time a blockchain-based title registry and cross-chain payment infrastructure were connected via a single, automated workflow, setting a new standard for global trade settlement.

“By implementing Chainlink as the standard for connecting the Central Bank of Brazil, the Hong Kong Monetary Authority, and existing trade finance platforms, we’re building a more connected financial ecosystem that will underpin the future of global trade.”—Bruno Grossi, Head of Emerging Technologies at Banco Inter

Chainlink and Apex Group Advance Institutional-Grade Stablecoin Infrastructure in Support of the Bermuda Monetary Authority’s Embedded Supervision Initiative

Chainlink and Apex Group have successfully created an institutional-grade stablecoin infrastructure solution supporting the Bermuda Monetary Authority’s embedded supervision initiative.

Conducted in collaboration with the Bermuda Monetary Authority as part of its Innovation Hub, the solution enables a unified, compliance-forward, institutional-grade stablecoin framework powered by Chainlink CCIP, Automated Compliance Engine (ACE), and Proof of Reserve.

The Bermuda Monetary Authority (BMA) serves as the regulator for Bermuda’s financial services sector, responsible for issuing the Bermudian dollar and overseeing institutions such as banks and insurers. As of 2023, Bermuda hosted over 1,200 registered insurers that collectively underwrote more than \$277 billion in gross premiums. In 2022, the banking sector reported its consolidated assets as $26 billion.

In the solution, Chainlink serves as the official, trusted infrastructure enabling regulated asset issuers, through its full-stack oracle platform:

- Enabling seamless cross-chain interoperability with zero-slippage transfers through the Cross-Chain Token (CCT) standard powered by CCIP.

- Using ACE to enforce Bermuda-specific regulatory and operational policies directly onchain.

- Posting real-time reserve data onchain via Proof of Reserve, providing continuous visibility into the stablecoin’s underlying collateral.

- Securing onchain issuance via Secure Mint to mitigate against infinite mint attacks by validating reserves before new supply is minted.

The solution also brings together key Chainlink ecosystem members:

- Apex, the leading global services provider with $3.5 trillion in assets, for stablecoin asset servicing, including custody of underlying assets, reserve management, and tokenization.

- Bluprynt, a trusted identity issuer backed by Robinhood, for linking verified entities to their mint authority wallets.

- Hacken, a blockchain security and compliance protocol with $430+ billion in assets verified across proof of reserve audits, for onchain visibility and intelligence through real-time security and compliance dashboards.

DeFi and Tokenization Announcements

Lido Is Upgrading to Chainlink CCIP as Official Cross-Chain Infrastructure for wstETH Across All Chains

Lido, the leading liquid staking protocol and one of the largest DeFi protocols with $33+ billion TVL, is upgrading to Chainlink CCIP as the official cross-chain infrastructure for wstETH, across all chains.

With this upgrade, all cross-chain transfers of Lido’s Wrapped Staked Ether (wstETH), the largest liquid staking token in the industry, will be secured by Chainlink CCIP by leveraging the Cross-Chain Token (CCT) standard.

Work is ongoing to upgrade wstETH across all 16 existing chains the token is currently deployed on. In addition, early expansions are already happening across Plasma, Monad, Ink, 0G, and Ronin Network via CCIP.

This upgrade builds on Lido’s existing use of the Chainlink platform, including secure Data Feeds that facilitate the adoption of stETH/wstETH across DeFi and CCIP-powered Direct Staking rails that enables users to stake ETH directly from other networks and receive wstETH.

“For stakers, the ability to move assets quickly across the ecosystem is essential for seizing opportunities, rebalancing liquidity, and managing their staked ETH efficiently. By adopting Chainlink CCIP as the official cross-chain standard for wstETH, we’re giving users and builders a standardized, secure way to move wstETH across chains. The Cross-Chain Token standard keeps ownership with the Lido community while adding the programmatic safeguards needed as wstETH scales to more networks.” — Jakov Buratovic, Master of DeFi at Lido

Aave Horizon Is Adopting Chainlink’s Automated Compliance Engine (ACE)

Aave Horizon, the institutional lending and borrowing market for tokenized assets from Aave, is adopting Chainlink ACE. ACE serves as a modular compliance layer that verifies policy and identity data at the transaction level, allowing Horizon to enforce issuer and regulatory standards onchain.

With Chainlink ACE, Horizon is able to support secure and compliant-focused tokenized asset markets, creating new opportunities for regulated institutions to participate in DeFi.

Chainalysis and Chainlink Enter Into a Strategic Partnership To Power Advanced Cross-Chain Compliance Workflows

Leading onchain intelligence and compliance platform Chainalysis has entered into a strategic partnership with Chainlink to power advanced cross-chain compliance workflows using Chainlink’s Automated Compliance Engine (ACE).

This will enable users to leverage Chainalysis KYT risk intelligence directly in onchain workflows and apply uniform compliance policies across chains. Instead of manual reviews and chain-specific integrations, builders can define KYT-driven conditions for transactions, reducing operational overhead while improving speed, transparency, and oversight.

x402 by Coinbase Is the First AI Payments Partner for the Chainlink Runtime Environment (CRE)

x402 is a protocol launched by Coinbase that enables APIs, apps, and AI agents to transact seamlessly over HTTP. x402 is now the first AI payments partner for the Chainlink Runtime Environment (CRE).

Through this partnership, AI agents can discover, trigger, and pay for CRE workflows leveraging x402’s programmable payments layer, unlocking:

- Programmatic payouts from proprietary data—Chainlink ensures data authenticity, CRE enables execution, and x402 orchestrates payments between agents and providers.

- Monetizing CRE workflows—Builders can publish public or private workflows that anyone, including agents, can pay to use.

- An onchain, native protocol stack for agentic workflows—AI agents discover CRE workflows, verify results with Chainlink, pay autonomously using x402, and settle real-world outcomes onchain.

This marks a major shift from manual transactions to economically expressive AI that can participate directly in the onchain economy.

Erik Reppel, coauthor of the x402 whitepaper and Head of Eng at CDP, said:

“Seeing industry leaders like Chainlink team up with x402 reinforces what we’ve long believed: onchain payments will power the future of AI. We’re excited to see what developers build with CRE and x402, creating new seamless, secure ways to transact onchain.”

GSR and Chainlink Form Strategic Partnership to Launch Stablecoin Enablement Program Powering the Next Wave of Stablecoin Innovation

GSR, a global crypto trading firm and liquidity provider, and Chainlink have partnered and launched a stablecoin enablement program powering the next generation of institutional-grade stablecoins.

The program provides stablecoin issuers with access to Chainlink’s industry-standard oracle platform, including its data, interoperability, privacy, and compliance standards, alongside GSR’s capital markets expertise, liquidity provisioning, and go-to-market support.

Together, Chainlink and GSR are enabling stablecoin protocols to meet the growing demand for trusted, cross-chain stablecoins that are designed for institutional usage, built-in compliance, and real-world utility.

Builders looking to bring secure, scalable stablecoins to market can already apply to the program: Apply here.

Lighter Adopts Chainlink Data Streams as Official Oracle Solution to Power RWA Perp Markets

Lighter, a leading perp DEX and Ethereum-based zk rollup, has adopted Chainlink Data Streams as its official oracle solution powering its RWA markets.

With Chainlink, Lighter gains access to high-fidelity pricing data for RWA markets, including commodities, equities, and forex. This pricing data powers critical protocol operations, such as triggering liquidations, calculating margin consumption, and triggering conditional/limit orders.

Developer Announcements

London Stock Exchange Group Wins GLEIF vLEI Hackathon at SmartCon, Sponsored by Swift and Chainlink

Congratulations to London Stock Exchange Group for winning the GLEIF vLEI Hackathon at SmartCon, and to Clearstream for securing the runner-up spot.

Sponsored by Swift and Chainlink, the hackathon was held during SmartCon’s exclusive forum on Digital Organizational Identity and drew 110 submissions from top financial institutions and market infrastructures worldwide.

This announcement follows the recent strategic partnership between GLEIF and Chainlink to deliver an institutional-grade identity solution for the blockchain industry—one that combines GLEIF’s verifiable Legal Entity Identifier (vLEI) with Chainlink’s Cross-Chain Identity (CCID) and Automated Compliance Engine (ACE).

Keynotes

Sergey Nazarov Keynote: Creating a Cryptographically-Guaranteed Financial System

In his keynote, Chainlink Co-Founder Sergey Nazarov announced the launch of the Chainlink Runtime Environment and introduced Chainlink Confidential Compute, both enabling a new generation of infrastructure that enables institutions to build secure, compliant, and privacy-preserving onchain applications, further expanding the capabilities of the Chainlink platform which already secures the majority of DeFi and is trusted by leading financial institutions globally.

“At the end of the day, Chainlink is really the only system that can bring DeFi and TradFi together.” — Sergey Nazarov, Co-Founder, Chainlink

Chainlink Product Keynote: Solving Hard Problems Defines Our Future | Apurva Joshi

Apurva Joshi, Chief Product Officer at Chainlink Labs, delivers a keynote speech exploring how Chainlink is solving foundational problems across data, interoperability, compliance, and privacy.

Swift CIO Keynote: Why Global Finance Is Moving From Trust to Truth | Thomas Zschach

Swift Chief Innovation Officer Thomas Zschach delivers a keynote presentation on the evolution of global financial infrastructure, including the growing importance of provable security and end-to-end verification for tokenized assets, and highlights the key role Chainlink plays in enabling this shift.

Industry Panels

Unlocking U.S. Crypto Innovation | White House’s Patrick Witt & Sergey Nazarov

White House Digital Assets Council Executive Director Patrick Witt joins Chainlink Co-Founder Sergey Nazarov to discuss U.S. stablecoin leadership, market structure reform, and how the current administration is working to ensure crypto innovation thrives in America.

What’s Next for DeFi | Aave, Chainlink, Altcoin Daily

Aave Founder Stani Kulechov, Altcoin Daily Host Aaron Arnold, and Chainlink Co-Founder Sergey Nazarov discuss how DeFi has evolved into resilient financial infrastructure and how Aave and Chainlink are powering the next wave of institutional adoption of DeFi.

Economics

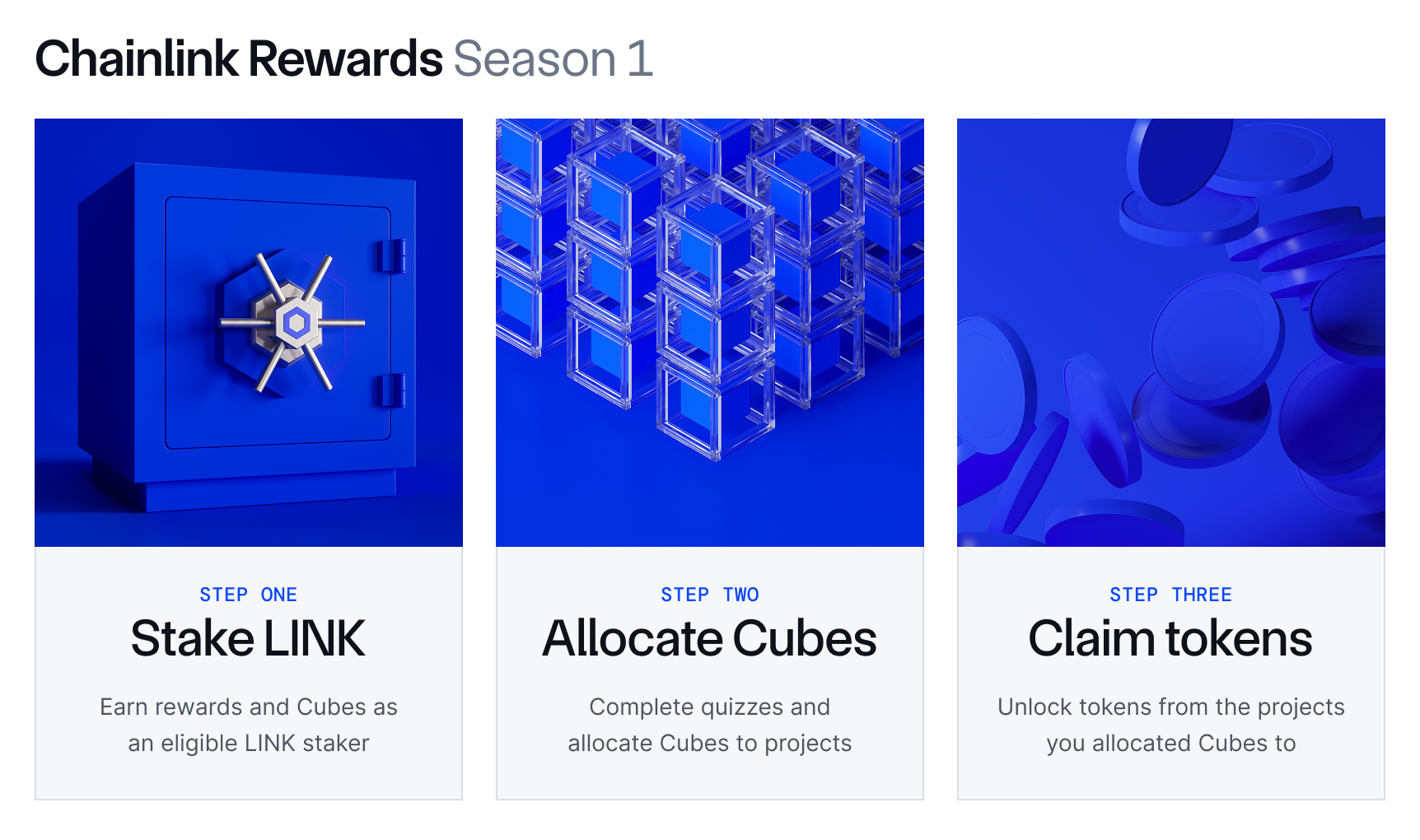

Introducing Chainlink Rewards Season 1

We’re excited to introduce Chainlink Rewards Season 1—the next evolution of the community engagement and rewards program that enables Chainlink Build projects to make their native tokens claimable by Chainlink ecosystem participants, including eligible LINK stakers.

Building on the success of Chainlink Rewards Season Genesis, where Space and Time made 100M SXT tokens available to eligible LINK stakers, Season 1 features nine Build projects and introduces a more advanced engagement and claiming mechanism. Season 1 will start on November 11, 2025 and features the following Build projects: Dolomite, Space and Time, XSwap, Brickken, Folks Finance, Mind Network, Suku, Truf Network by Truflation, and bitsCrunch.

Season 1 is designed to give eligible LINK stakers a more interactive, choice-driven experience while strengthening their engagement and connection with Build projects. The new claims mechanism for Chainlink Rewards Season 1 involves three key steps:

- Stake LINK, Earn Cubes — Cubes are a non-transferable, non-monetary unit of account, similar to credit card points or airline miles, that can be redeemed for token rewards. In Season 1, eligible LINK stakers will receive an amount of Cubes related to their historical participation in Chainlink Staking v0.1 and v0.2 (amount of LINK staked and time staked). A snapshot determining Season 1 Cube balances was taken November 3, 2025.

- Allocate Cubes — Starting on November 11, 2025, eligible LINK stakers can visit rewards.chain.link to view their Cubes balance and begin allocating Cubes to projects. Allocating Cubes determines which Build project tokens a participant can claim. Participants may allocate in any fashion (all to one project, spread across many, equal-weighted, etc.) and can adjust allocations any time until December 9, 2025, when a final snapshot of Cubes allocations is taken. Allocations take place offchain and incur no transaction fees. Cubes expire after the final allocation snapshot.

- Claim Tokens — On December 16, 2025, tokens begin unlocking and become claimable over time, with unlocks occurring linearly over a 90-day period. The number of tokens a participant can claim from a Build project is proportional to their share of the total Cubes allocated to that project. For example, if your allocation equals 1% of all the Cubes allocated to a project, you can claim 1% of the tokens that project made available in Season 1. Participants can also trigger an optional Early Unlock to claim a portion of their still-locked tokens early while forfeiting the rest. Forfeited tokens are redistributed to a Loyalty Pool, which become claimable by participants who did not Early Unlock at the end of the unlock period.

In Season 1, eligible LINK stakers are empowered to research and learn about Build projects and the solutions they are bringing to market before choosing how to allocate their Cubes. In addition to completing project quizzes, the self-directed process of allocating Cubes means participants can select projects that interest them personally, strengthening the alignment between Build projects and the Chainlink community.

For more information on Chainlink Rewards Season 1, read the announcement blog: Introducing Chainlink Rewards Season 1.

Ecosystem Moments at SmartCon

- Cap, a stablecoin protocol, adopted Chainlink SmartData to deliver AUM data onchain for its cUSD stablecoin. Through the Chainlink data standard, Cap is enabling new DeFi integrations powered by verifiable data.

- Cryptex.Finance unveiled CRYPTEX 40, a first-of-its-kind, onchain benchmark designed to represent the performance of 40 leading digital assets by market capitalization. Chainlink Data Feeds will verify each component’s value, ensuring the NAV calculation of the index is publicly verifiable and tamper-resistant.

- Denaria launched a perpetual DEX and integrated Chainlink Data Streams to enhance the efficiency of its markets on Linea.

- Dexe Protocol launched its token on Base and upgraded to the Cross-Chain Token (CCT) standard to advance its multi-chain expansion and strengthen connectivity across DeFi.

- Ebisu integrated Chainlink Price Feeds to power its stablecoin credit markets on Ethereum and Plasma.

- Falcon Finance launched a new yield-bearing synthetic dollar protocol leveraging Chainlink Price Feeds to support secure and scalable markets around its stablecoins USDf and sUSDf.

- Mamo, a personal finance AI agent, integrated Chainlink Price Feeds on Base to gain access to high-quality market data to power secure and efficient markets around its token MAMO.

- OpenEden, a leading RWA tokenization platform, integrated Chainlink CCIP and Proof of Reserve to power its regulated, yield-bearing stablecoin backed by U.S. Treasuries.

- Planet IX announced the migration of IXT to AIX from Polygon to Base, and the migration of its full game with millions of NFTs powered by Chainlink CCIP.

- Reservoir, a decentralized stablecoin protocol, adopted Chainlink Data Streams and DataLink to power its yield-bearing stablecoin wsrUSD on BNB Chain, Plasma, and Solana. wsrUSD was also launched as collateral on Lista DAO, leveraging Chainlink’s highly secure market data.

- Solv Protocol is enhancing their use of Chainlink CCIP for cross-chain SolvBTC transfers by incorporating Symbiotic for additional cryptoeconomic guarantees. Symbiotic vaults will back a Symbiotic-powered network designed to monitor and flag potential anomalies during cross-chain transfers.

- XSwap launched its Token Creation Platform (TCP) built on Chainlink CCIP. TCP transforms token creation into a seamless, secure experience, and enables anyone to create cross-chain tokens in just a couple of seconds.

Road to SmartCon

- Aave Horizon (ACE)

- Airlinez (Data Streams)

- AllUnity (CCIP)

- ApeX Exchange (Data Streams)

- ARC (ACE, CCIP, Date Feeds, Data Streams, Scale)

- Balcony (CRE)

- Bean (Data Streams)

- Banco Inter (CRE)

- BNB Chain (Price Feeds)

- Capricorn (Price Feeds)

- Chainalysis (ACE)

- CovenantFi (Data Streams, Data Feeds)

- Curvance (Price Feeds)

- Drake Exchange (Data Feeds

- Dinari (Price Feeds, SmartData)

- Ebisu (CCIP, Price Feeds)

- Eliza Labs (CCIP)

- Enclabs (Price Feeds)

- EntravelX (Build)

- Euler Labs (Data Feeds)

- FairsquareLab (CCIP)

- Folks Finance (CCIP)

- FTSE Russell (DataLink)

- GSR (CCIP, DataLink, Data Streams)

- Hong Kong Monetary Authority (ACE, CCIP)

- Interport Finance (CCIP)

- Inverse Finance (CCIP, Price Feeds)

- Jovay (CCIP, DataLink, Data Streams)

- KernelDAO (CCIP, Price Feeds, Proof of Reserve)

- Kiln Finance (ACE, CRE)

- KingnetAI (CCIP)

- Kyan (Data Streams)

- Lendefi DAO (CCIP, Price Feeds)

- Lido (CCIP)

- Lighter (Data Streams)

- Lista DAO (Price Feeds)

- LitFinancial (CCIP, SmartData)

- LlamaGuard (CRE)

- Lombard (CCIP)

- Mamo (Price Feeds)

- Memento (CCIP)

- MegaETH (Data Streams)

- Morpheus AI (Price Feeds)

- Monad (CCIP, Data Streams, Price Feeds)

- MYX Finance (DataLink, Data Streams)

- Neverland (Price Feeds)

- Nitro Finance (Price Feeds)

- Ondo (Price Feeds)

- Orma Labs (CCIP)

- PAAL (CCIP)

- Pairpoint (CRE)

- Perpl (Data Streams, DataLink)

- Pharos (CCIP, DataLink, Data Streams)

- Pleasing Golden (Data Streams)

- Reservoir (DataLink, Data Streams)

- Re.xyz (Proof of Reserve)

- SBI Digital Markets (CCIP)

- Sherpa (CCIP)

- Solv (CCIP)

- Spiko (CCIP)

- Stabull (CCIP)

- STBL (CCIP, Price Feeds)

- Stellar (CCIP, Data Streams, Data Feeds, Scale)

- Streamex (CCIP, Price Feeds, Proof of Reserve)

- Sumer (CCIP, Price Feeds)

- Symbiotic (CCIP)

- S&P Global Ratings (DataLink)

- Tadle (CCIP)

- Tea-REX (DataLink, Data Streams)

- THENA (CCIP)

- TON (CCIP, Data Streams)

- TownSquare (CCIP, Price Feeds)

- Tradeweb (DataLink)

- Treehouse Finance (CCIP, Price Feeds)

- Turtle Club (CCIP)

- UBS (ACE, CCIP, CRE)

- Unitas (CCIP, Data Streams, Proof of Reserve)

- Uranium Digital (Proof of Reserve)

- USD.AI (Price Feeds)

- Validation Cloud (CCIP)

- Virtune (Proof of Reserve)

- WisdomTree (DataLink)

- World Liberty Financial (CCIP)

- X Layer (CCIP, Data Streams, Scale)

- xStocks (CCIP, Proof of Reserve)

- Xtreamly (Build, Price Feeds)

Industry News

- UBS executes live digital transfer agent transaction for uMint MMF. Ledger Insights.

- Chainlink Collaborates With FTSE Russell To Publish Global Indices Onchain for the First Time Via DataLink. FF News.

- UBS executes live tokenized fund transaction leveraging Chainlink DTA technical standard. FX News.

- Chainlink Introduces CRE to Fast-Track Institutional Tokenization. CoinDesk.

- UBS, Chainlink Execute First Onchain Tokenized Fund Redemption in $100T Market. CoinDesk.

- Chainlink Powers First Brazil-Hong Kong CBDC Settlement. CoinMarketCap.

- FTSE Russell Takes First Step Toward On-Chain Benchmark Data With Chainlink. Decrypt.

- Chainlink Powers UBS to Complete the First Live Tokenized Fund Transaction. Blockonomi.

- Tradeweb partners with Chainlink to publish US Treasury benchmark data on-chain. Crypto Briefing.

- Tokenized Fund Redemption: UBS Achieves a Pioneering Breakthrough with Chainlink DTA. Cryptorank.