Chainlink SmartCon 2024: Key Announcements, Product Releases, Highlights, and More

Chainlink SmartCon is the industry-leading conference that serves as the convergence point for TradFi and DeFi, uniting pioneering Web3 leaders and experts from the world’s largest financial institutions and market infrastructures.

This year’s SmartCon features several monumental Chainlink announcements, speakers from large financial institutions and market infrastructures, economics updates, launches from key ecosystem partners, and much more.

Chainlink Announcements and Product Updates

Chainlink Runtime Environment (CRE)

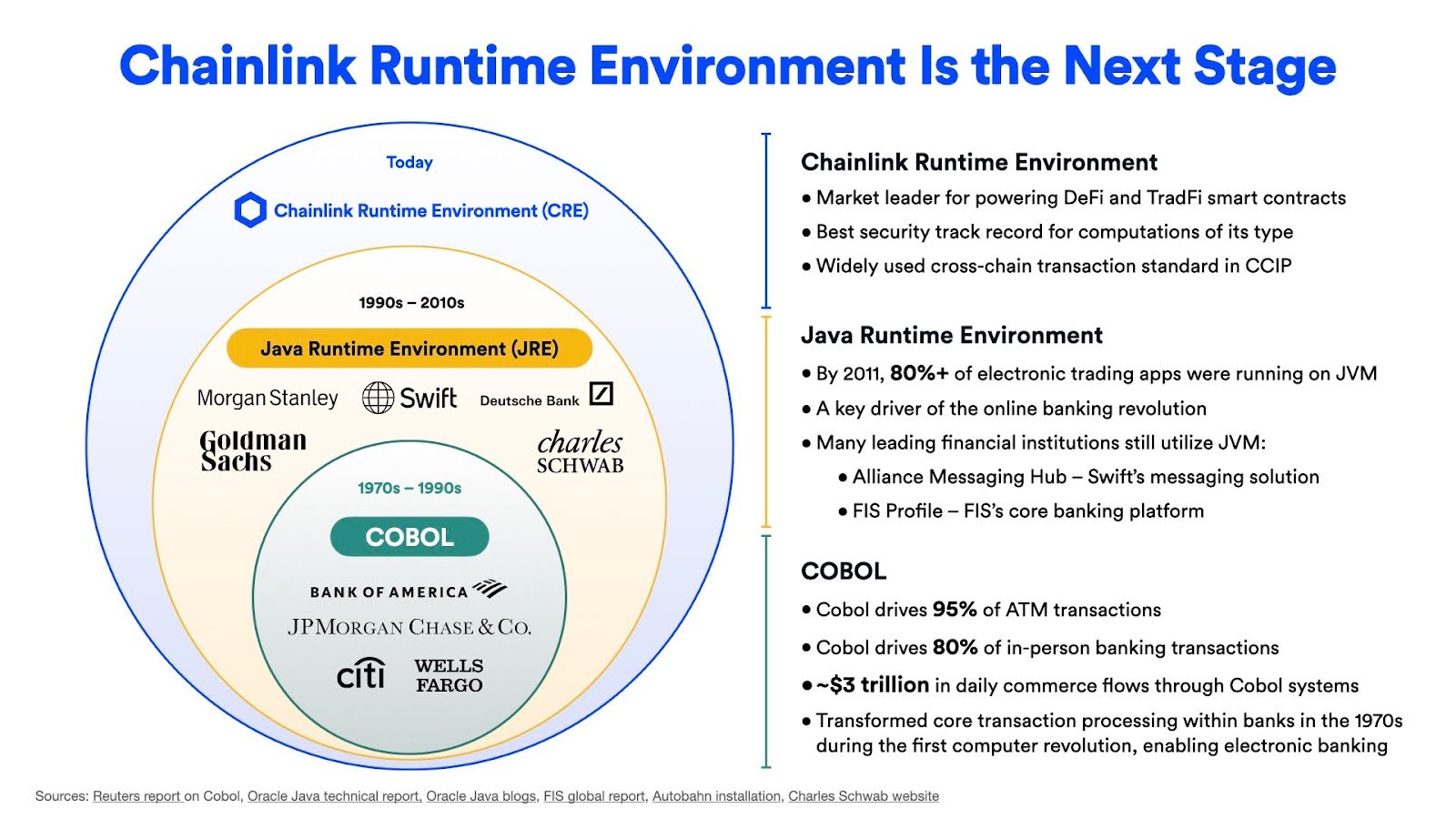

On the Main Stage at SmartCon 2024, Chainlink Co-Founder Sergey Nazarov and Chainlink Labs Chief Architect Uri Sarid announced a major upgrade to the Chainlink Platform. This upgrade is designed to scale Chainlink across thousands of blockchains, meet the growing demand from financial institutions, and empower developers to build with Chainlink faster, more easily, and with more reach and flexibility than ever before.

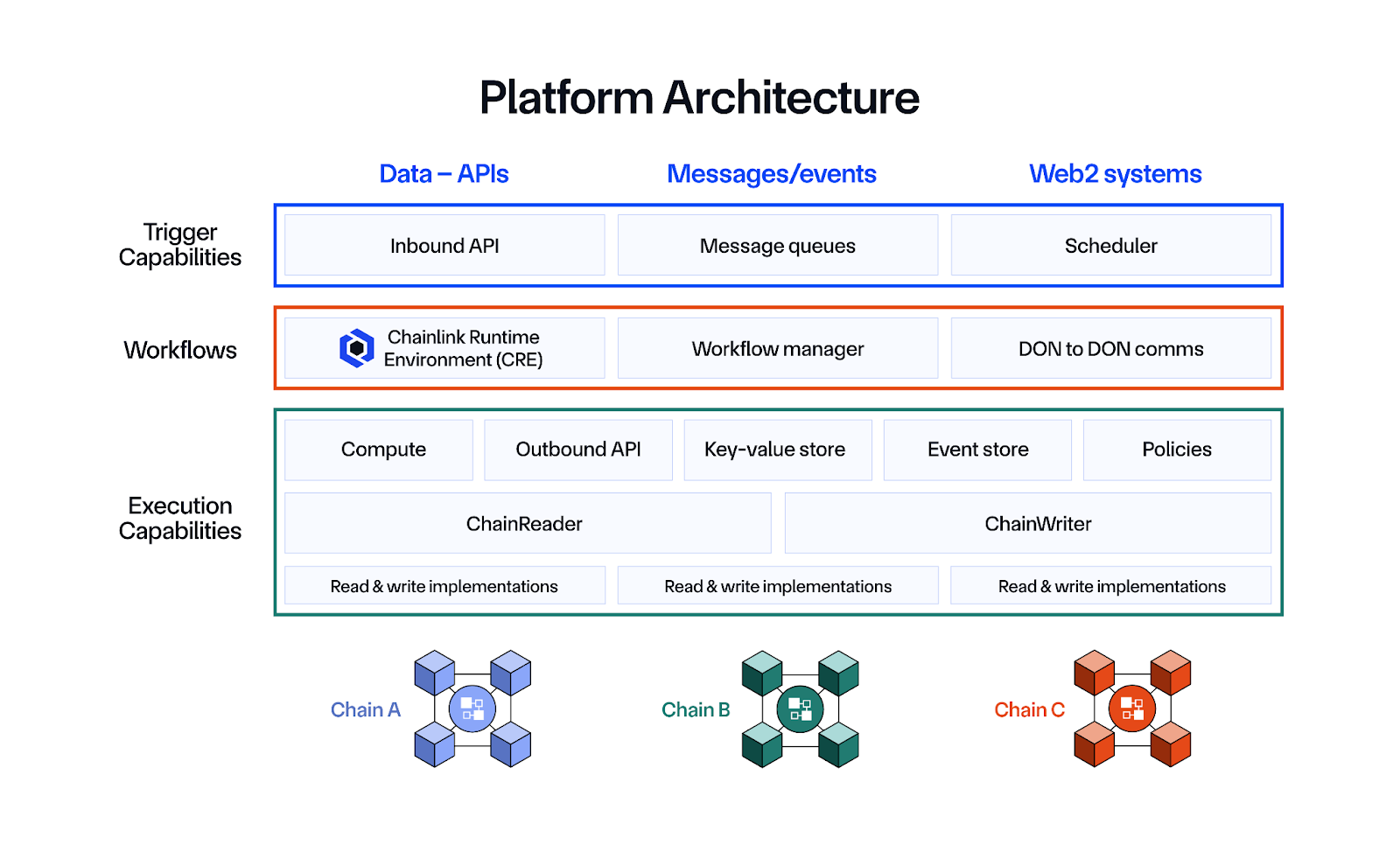

Underpinning this initiative is a deep re-architecture of the Chainlink Platform. Drawing inspiration from microservices architecture, the Chainlink node software utilized by decentralized oracle networks (DONs) is being broken down into distinct, modular capabilities (e.g., read chain, perform consensus, etc.) that are each secured by independent DONs. Developers can seamlessly combine these capabilities in any number of ways into executable workflows that run via the newly developed Chainlink Runtime Environment (CRE)—the system of DON-based capabilities, DON-to-DON communications, capability orchestration, and code execution on which workflows run with the appropriate consensus model.

The result of this upgrade is developers being able to build substantially quicker, connect their apps seamlessly across all chains connected to the Chainlink Platform, and create more powerful applications, including purpose-built financial apps that interact with capital markets infrastructure, incorporate custom compliance policies, and handle sensitive information in a privacy-preserving manner.

While developers will continue to write core application logic as onchain smart contracts, CRE enables them to deploy code directly on the Chainlink Platform for building and composing capabilities, removing the need to add Chainlink-specific code to their onchain contracts. This allows developers to leverage Chainlink’s capabilities regardless of which blockchains their application is deployed to, leading to unified applications secured end-to-end by consensus computing. The Chainlink Runtime Environment is currently in an early access phase.

CCIP v1.5: Cross-Chain Token (CCT) Standard, Self-Serve Onboarding, and More

We’re excited to introduce the CCIP v1.5 upgrade—a set of upgrades and improvements to the Chainlink Cross-Chain Interoperability Protocol (CCIP), focused on massively scaling the number of tokens integrated with CCIP and making the protocol easier than ever for developers to use. The CCIP v1.5 upgrade is now live across all supported blockchain testnets and will soon launch on blockchain mainnets.

CCIP v1.5 introduces the Cross-Chain Token (CCT) standard, which enables token developers to integrate new and existing tokens with CCIP in a self-serve manner in minutes. CCTs support self-serve deployments, full control and ownership for developers, enhanced programmability, and zero-slippage transfers—all backed by CCIP’s industry-standard defense-in-depth security.

Notably, CCTs are token logic agnostic, meaning token developers can deploy pre-audited token pool contracts to turn any ERC20-compatible token into a CCT or deploy their own custom token pool contracts for bespoke token use cases. CCTs do not require token developers to inherit any CCIP-specific code within their token’s smart contract.

Furthermore, CCIP v1.5 introduces a new Token Developer Attestation feature that enables token developers to participate in an optional layer of verification for their CCTs by attesting to token burn or lock events on source chains before CCIP can mint or unlock tokens on destination chains. This feature was widely requested by developers of tokenized assets as a way to support their security model and assist with their compliance needs. The Token Developer Attestation feature is currently available in private beta.

Once live across blockchain mainnets, token developers will also have access to the CCIP Token Manager—an intuitive front-end web interface for the deployment of new and management of existing CCTs by their developers, including no-code guided deployments and configuration tools. The CCIP v1.5 upgrade also features a number of key developer experience improvements, including the new CCIP SDK, improvements to the CCIP Explorer, and additional security and privacy capabilities to further strengthen CCIP’s position as the most secure cross-chain infrastructure for Web3 and capital markets.

Chainlink Platform Privacy Suite

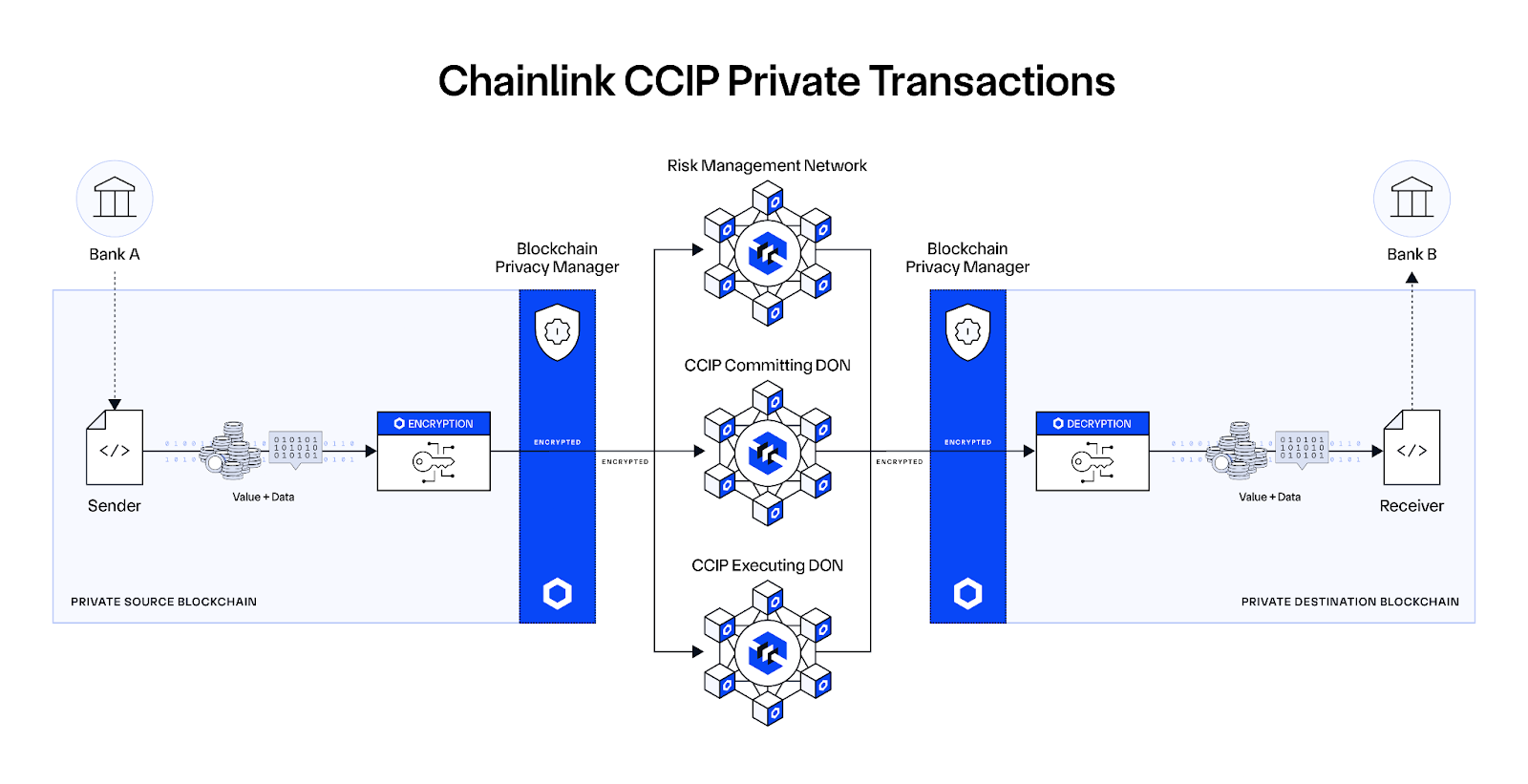

Chainlink recently launched new blockchain privacy tools, namely the Blockchain Privacy Manager and CCIP Private Transactions. These privacy tools enable financial institutions to maintain data confidentiality, data integrity, and can support compliance obligations when transacting across the multi-chain economy.

The Blockchain Privacy Manager allows institutions to integrate their private blockchain networks with existing systems, such as traditional enterprise backends, while limiting onchain data exposure. This feature enables private chains to be integrated with the public Chainlink Platform without exposing sensitive private chain data to third parties. Using the Blockchain Privacy Manager, CCIP Private Transactions leverages a novel onchain encryption/decryption protocol to enable institutions to transact across multiple private blockchains using the public CCIP network while keeping the transaction details fully confidential.

You can read more about these new privacy-preserving capabilities in the full product announcement blog: Introducing the Chainlink Platform Privacy Suite. If your organization is interested in adopting the Blockchain Privacy Manager and/or CCIP Private Transactions, reach out to an expert below.

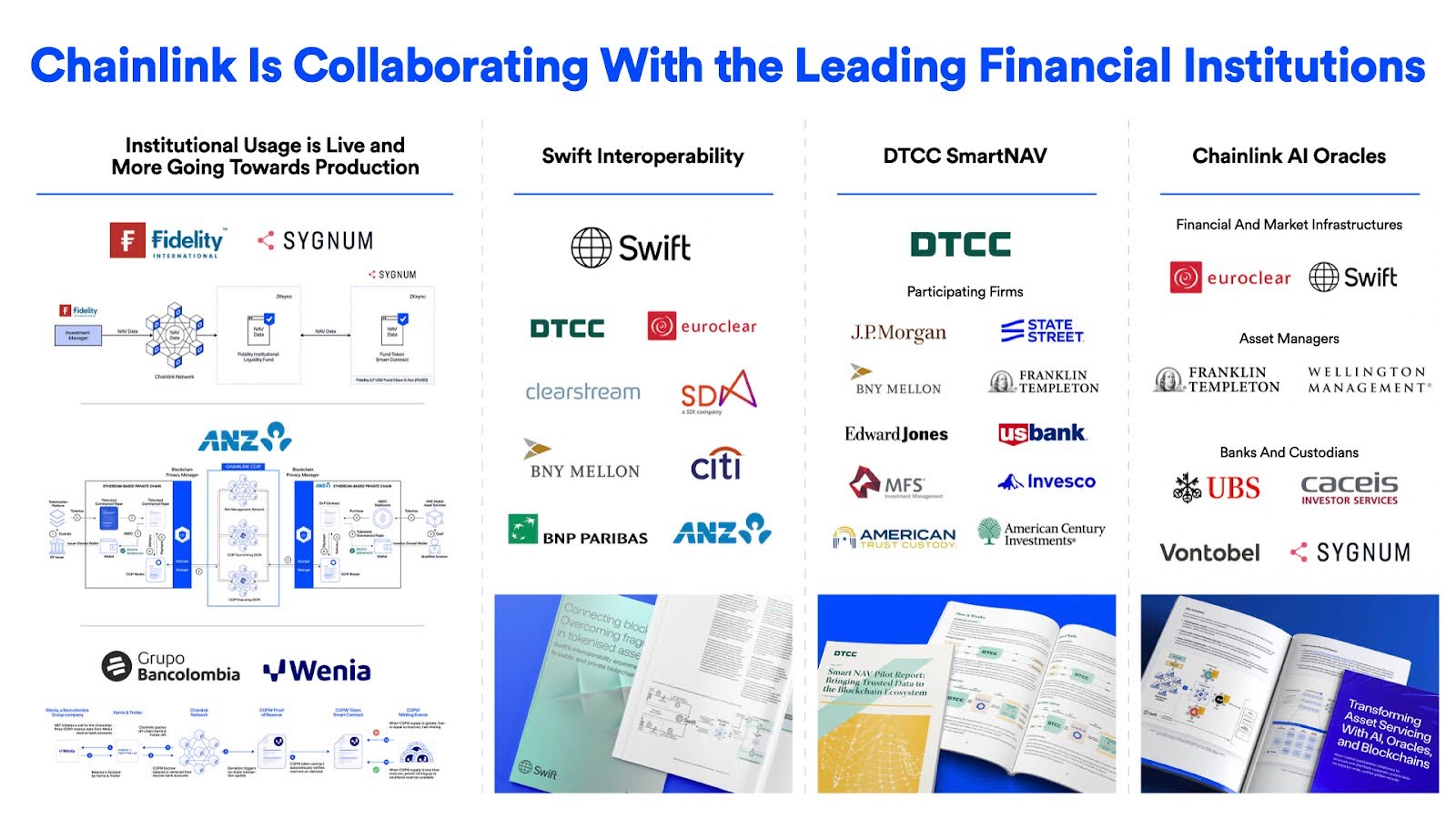

Australia and New Zealand Banking Group (ANZ)—a leading Australian bank with over $1T in AUM—will be among the first financial institutions to demonstrate the capability for cross-chain settlement of tokenized real-world assets (RWAs) under the Monetary Authority of Singapore (MAS) Project Guardian initiative.

“Chainlink’s new cross-chain privacy capabilities have the potential to further accelerate institutional blockchain adoption by enabling end-to-end privacy between blockchain networks.”—Nigel Dobson, Banking Services Lead at ANZ

At SmartCon, several keynotes and panels focused on blockchain privacy and the Chainlink Platform’s new privacy-preserving capabilities. During the Chainlink Product Keynote, Anurag Soin from ANZ Bank highlighted how CCIP can enhance transaction privacy for institutions. Additionally, the panel Privacy and Data Protection in an Interconnected World of Digital Assets brought together industry experts to explore the challenges and opportunities of safeguarding sensitive data while navigating the digital asset space.

Chainlink DECO Sandbox Now Available

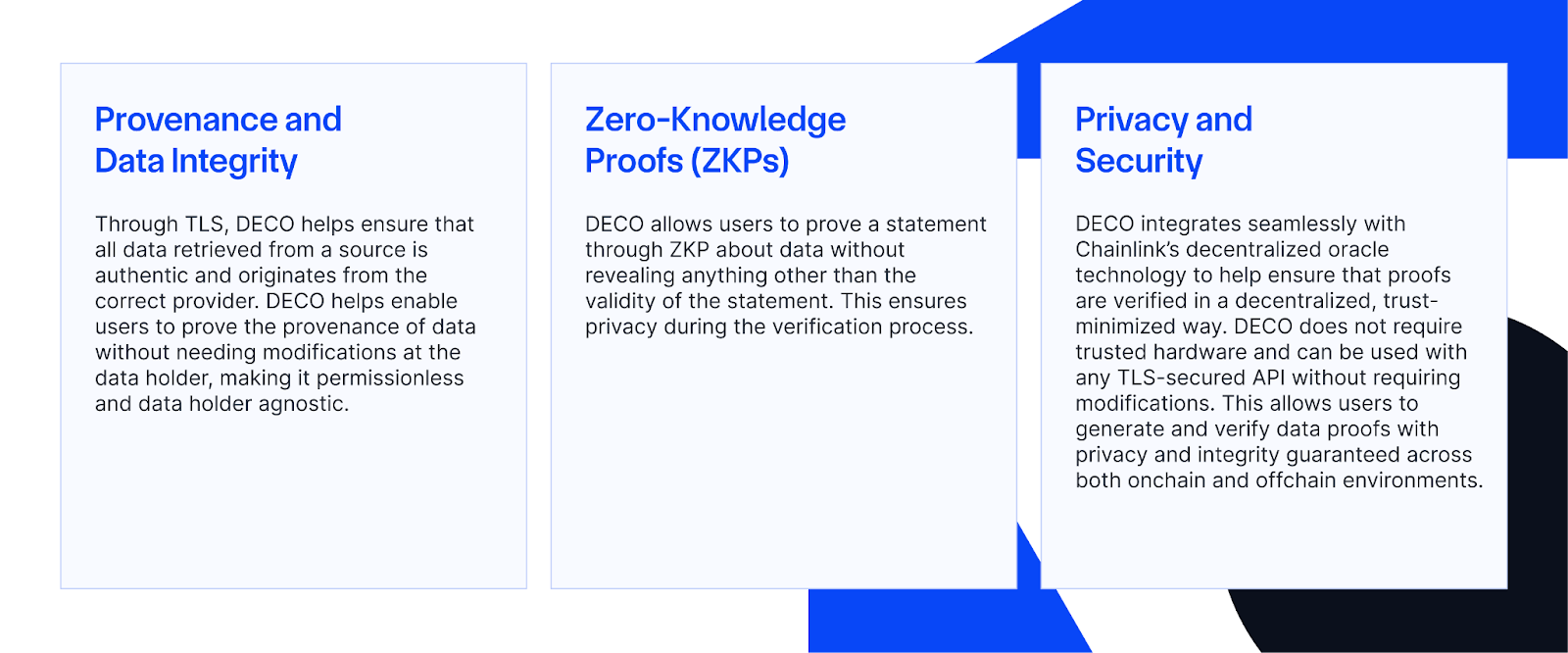

The Chainlink DECO Sandbox has been opened to the public during SmartCon, providing access to DECO, the foundational zkTLS-oracle technology for authenticating and verifying web data in a privacy-preserving manner.

DECO Sandbox enables financial institutions and enterprises to quickly explore how to streamline user onboarding while maintaining data privacy and ensuring data provenance. Furthermore, Web3 developers can experiment with novel use cases, such as utilizing decentralized identity and Proof of Funds to allow institutional investors to participate in the DeFi economy via their offchain identities and credit histories, for example.

Chainlink DECO Sandbox offers developers pre-configured use cases that showcase DECO’s capabilities and serve as frameworks for running their own experiments and configuring their own proofs. Developers can test scenarios such as conducting a client’s identity check without revealing their personal details, verifying a customer has sufficient funds across multiple bank accounts with data provenance from the account service providers, and conducting auditable sanctions screening with tamper-proof, time-stamped attestations of those checks.

DECO’s technology is unique in that it requires no modifications at the data source and can be easily integrated into existing workflows and legacy tech stacks. DECO supports multiple methods of generating attestations about offchain data that can be consumed both onchain and offchain in a privacy-preserving manner.

Start exploring DECO Sandbox today to discover how privacy-preserving data verification can transform your operational efficiency and unlock new use cases in onchain finance and beyond.

CCIP Connections to Liquid (Re)Staking Protocols

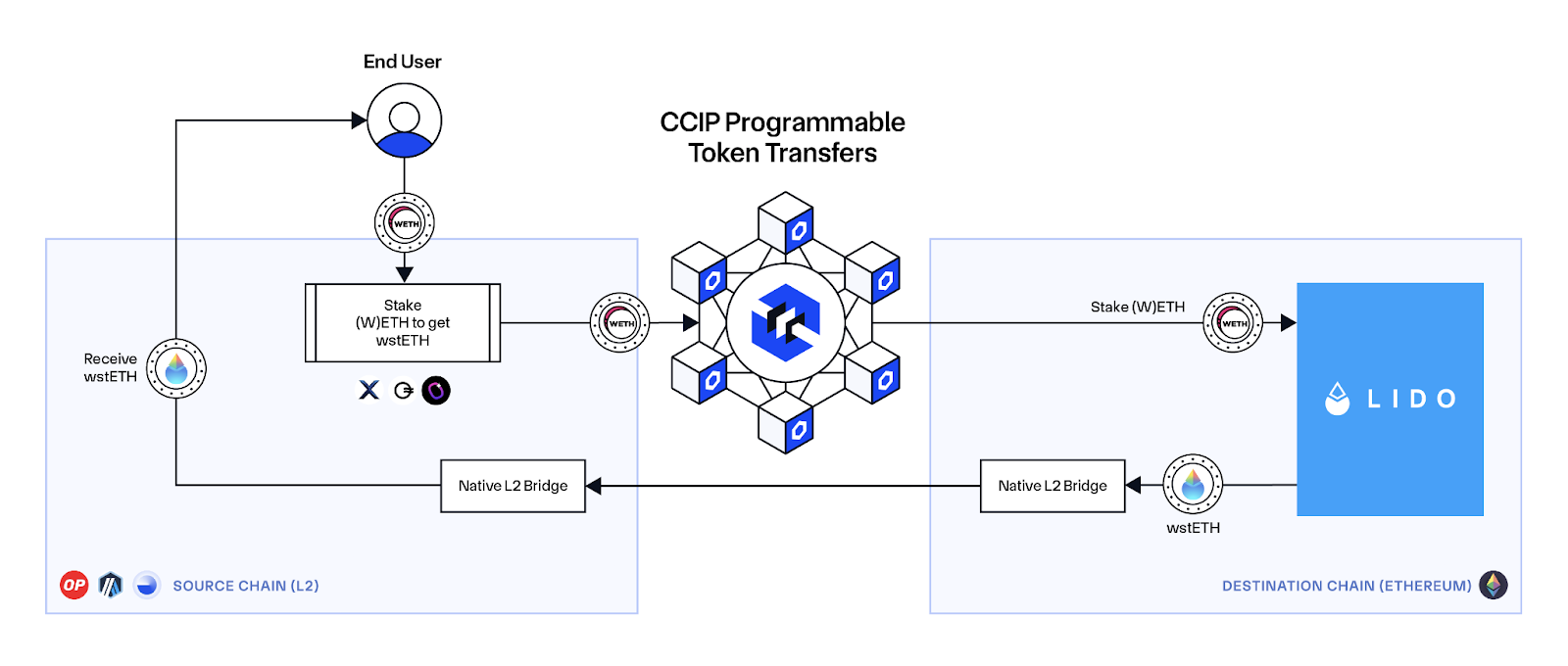

Chainlink’s Cross-Chain Interoperability Protocol is helping liquid staking and restaking protocols scale by enabling them to allow their users to stake their ETH directly from layer-2 networks—significantly expanding the accessibility of LSTs and LRTs across the multi-chain ecosystem. This capability is enabled by CCIP’s support for Programmable Token Transfers, which enable the simultaneous transfer of tokens and data instructions cross-chain.

Lido, a leading liquid staking protocol, recently integrated CCIP to power the new Lido Direct Staking rails, which enables users to stake their ETH directly from other blockchain networks and receive wstETH, starting with support for Arbitrum, Base, and Optimism. The new Lido Direct Staking rails are being adopted by various DeFi frontends including XSwap, OpenOcean, and Interport.

In addition to Lido, a growing number of protocols are also integrating Chainlink CCIP to go cross-chain and enable the staking/restaking of ETH from layer-2 networks:

For more information on how CCIP is helping (re)staking protocols scale, read the full announcement blog: Scaling (Re)Staking Protocols Cross-Chain With CCIP.

If you are a DeFi protocol or traditional financial institution and want to explore how CCIP Programmable Token Transfers can unlock your cross-chain and tokenization use cases, reach out to our team of experts. If you are a developer and want to get started with CCIP Programmable Token Transfers, check out the Chainlink documentation for more technical resources.

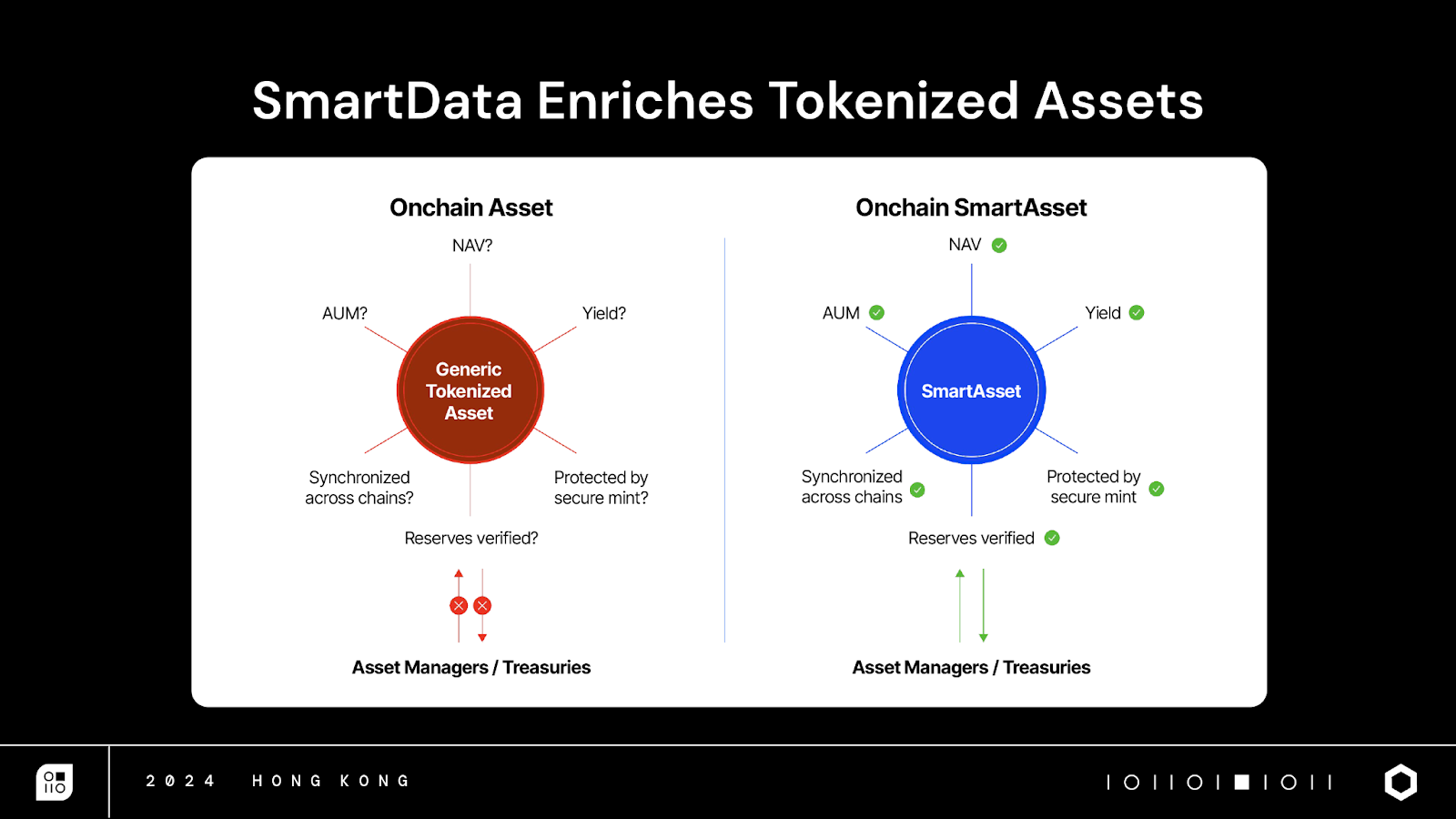

Chainlink Launches SmartData

Tokenized assets need more than just the price data and asset transparency that Chainlink provides today. To transform static onchain representations of real-world assets into dynamic smart assets, we need TradFi-grade asset servicing infrastructure that delivers high-quality data in a secure, scalable, and reliable manner.

“The next generation of assets needs smarter services, new types of data, and scalable infrastructure in order to hit the escape velocity that’s needed for hyper-growth.”—Rui Zhang

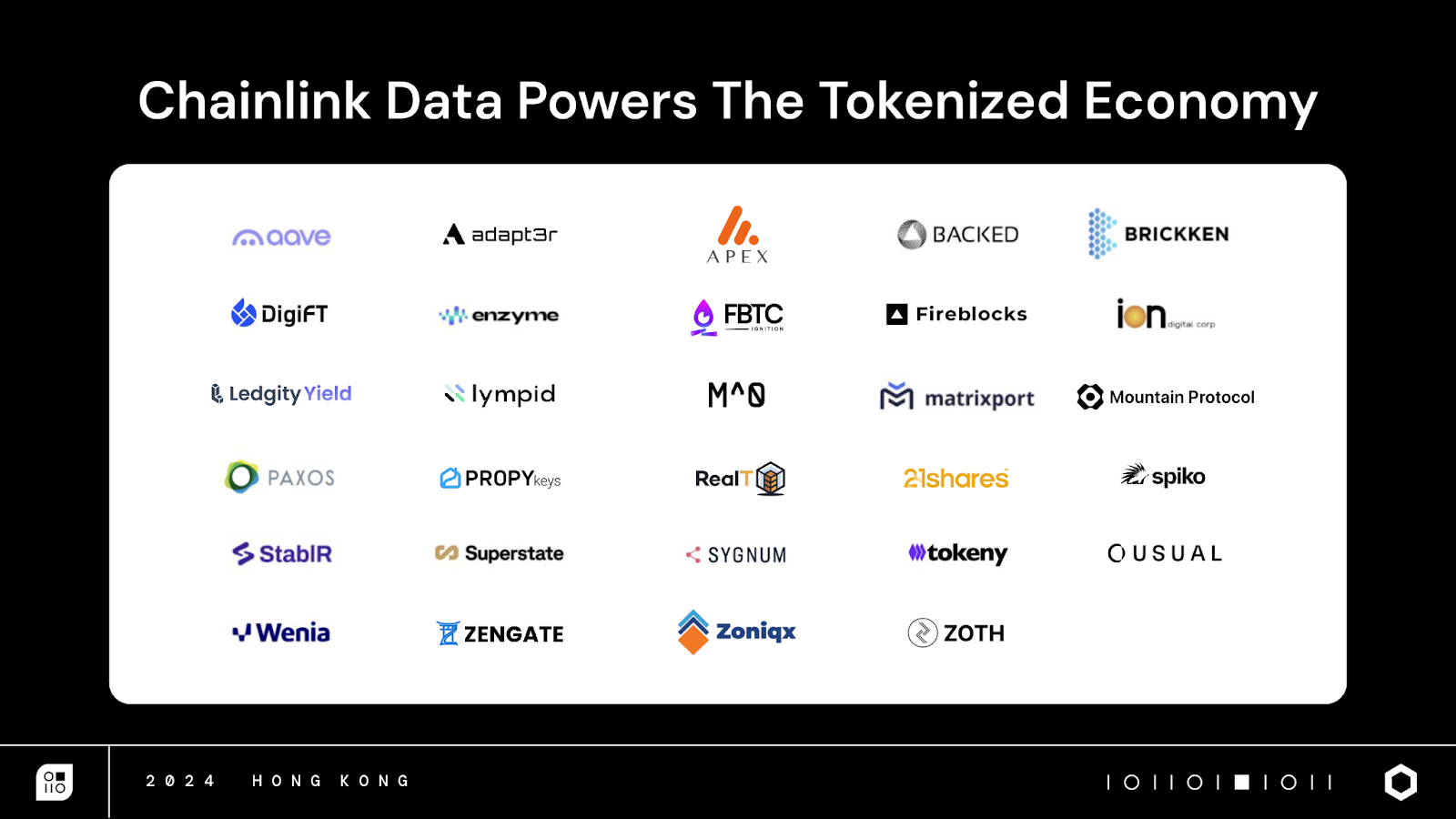

At SmartCon, Chainlink launched the new standard for tokenized asset servicing: SmartData. SmartData is Chainlink’s new suite of data asset services for tokenized real-world assets, which embody Chainlink’s vision to be the essential infrastructure connecting TradFi and DeFi. With SmartData, tokenized assets will have access to real-time asset servicing data that is delivered directly from the canonical source to onchain environments.

Chainlink’s current data integrations include reserves verification data through Proof of Reserve, as well as assets under management (AUM), net asset value (NAV), and other collateral information. We’re also rapidly expanding our asset data coverage to meet expanded tokenized asset needs.

SmartData maintains a golden record of the critical data you need to anchor your tokenized assets, making them smarter to use and safer to manage. We’re already partnering with leading asset managers and token issuers across a wide range of real-world asset classes around integrating with SmartData.

Chainlink Keynotes

Sergey Nazarov: Chainlink Unveils Historic Upgrade to Power All Finance Onchain

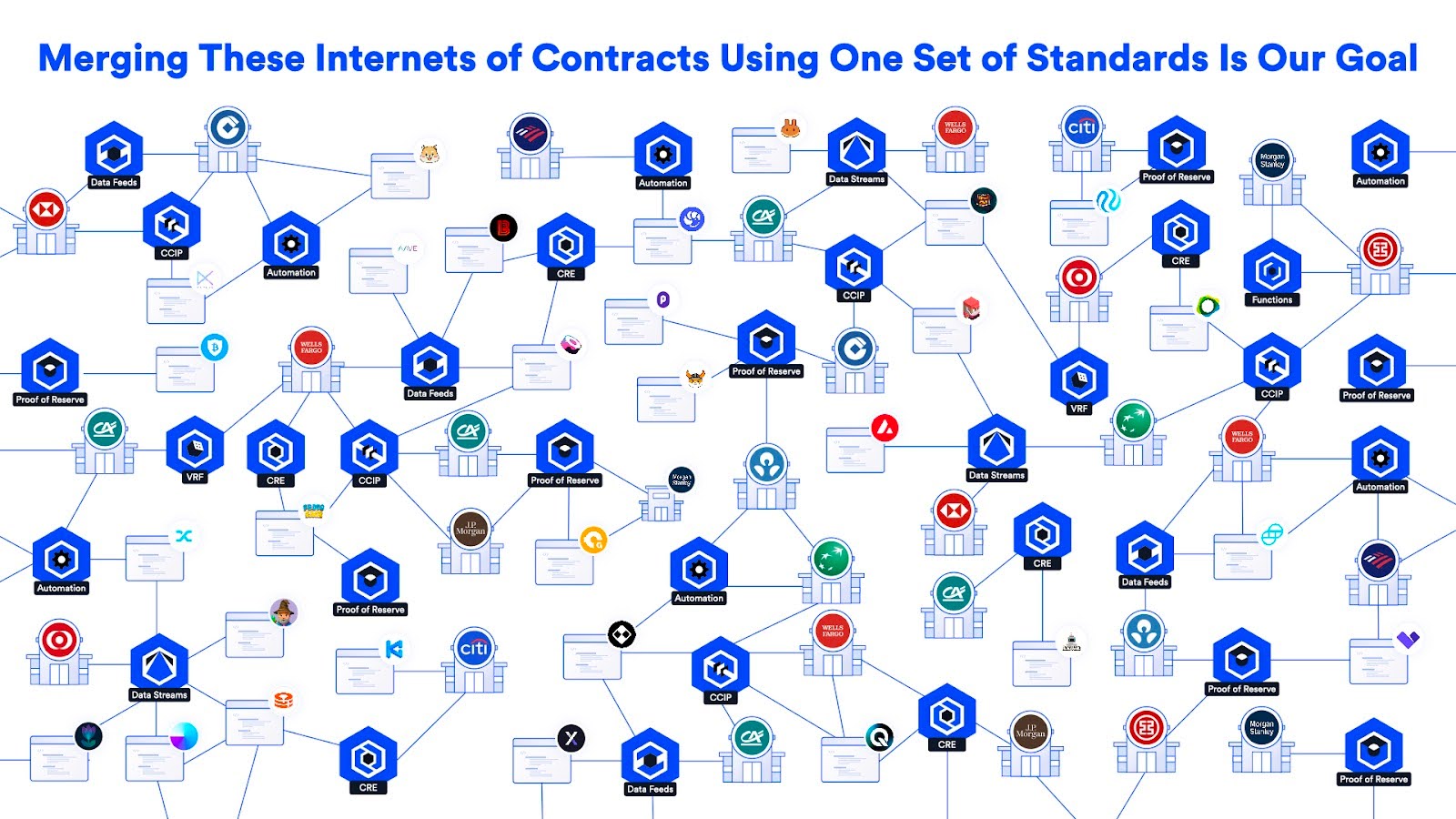

On the Main Stage, Sergey Nazarov delivered this year’s biggest SmartCon keynote. He explained how Chainlink is becoming the global standard for onchain finance, bringing together the worlds of DeFi and traditional finance into a single Internet of Contracts, which is set to create an economic boom from the merger.

From working with Swift, the international bank messaging standard for 11K+ banks, to Lido, a leading liquid staking solution in DeFi, Chainlink’s infrastructure is being adopted by major players across both industries.

Now, a new upgrade is set to rapidly increase the rate of adoption: The Chainlink Runtime Environment (CRE). Along with CCIP, the CRE makes it easier than ever for financial institutions and DeFi developers to build advanced, cross-chain, blockchain-based applications from a single environment.

“Just like COBOL coordinated the very first databases into the first core banking transactions, and JRE converted modern database technologies and the Internet into the first online banking transactions, the Chainlink Runtime Environment (CRE) is built to coordinate the different blockchain technologies, oracle networks, and smart contracts into a single unified application.”—Sergey Nazarov

Chainlink Product Keynote: Building the Foundation for Onchain Finance

“Tokenization is the catalyst that’s going to take our industry into the mainstream.”—Ghando

In a massive product update at Chainlink SmartCon 2024, Chainlink Labs team members and Chainlink ecosystem participants went more in-depth into the multitude of key product releases for the Chainlink ecosystem discussed above, such as the Chainlink Runtime Environment, CCIP v1.5, DECO Sandbox, SmartData, and more.

Johann Eid: Unifying Standards to Scale

Chainlink Labs Chief Business Officer Johann Eid dives into why our industry has already reached mass adoption—the question is not when we get to mass adoption, but how we can sustain the current rate of growth. Johann highlights Chainlink’s pivotal role in the development of DeFi and tokenization, and how it’s the only platform that aims to unify all the puzzle pieces of the current onchain economy into a single standard.

“This next cycle won’t be like the others. This next cycle will last. This next cycle is where the whole world starts running on blockchain and keeps running on it for the next 100 years.”—Johann Eid

Lorenz Breidenbach: Research Innovations Underpinning the CRE

Chainlink Labs’ Head of Research Lorenz Breidenbach discusses the cutting-edge computing innovations behind the newly introduced Chainlink Runtime Environment (CRE) and the Chainlink DECO Sandbox.

“Chainlink today runs 1,999 production DON instances, each running our OCR consensus protocol—nobody else has achieved a comparable degree of parallelism.”—Lorenz Breidenbach

Rahul Shah: Chainlink CCIP’s Latest Tools and Innovations

Rahul Shah, Product Director at Chainlink Labs, describes the recent v1.5 upgrades to CCIP and gives a preview into the future of the industry-standard cross-chain protocol.

“The space has grown to thousands of chains, split between public chains and private chains. The goal for CCIP has been—and continues to be—to be the secure standard to connect all of those chains.”—Rahul Shah

Raoul Schipper: How Chainlink Data Streams Is Enabling DeFi Innovation at Scale

Raoul Schipper, Strategic Accounts & Solutions at Chainlink Labs, dives into how Data Streams is scaling support to new chains and adding new functionalities in order to expand access to high-frequency market data across the multi-chain DeFi economy.

“We’re going to move from ‘critical infrastructure for high-throughput DeFi’ to ‘critical infrastructure for the future of onchain finance’.”—Raoul Schipper

Industry Panels

Modernizing Corporate Actions for Today’s Asset Manager

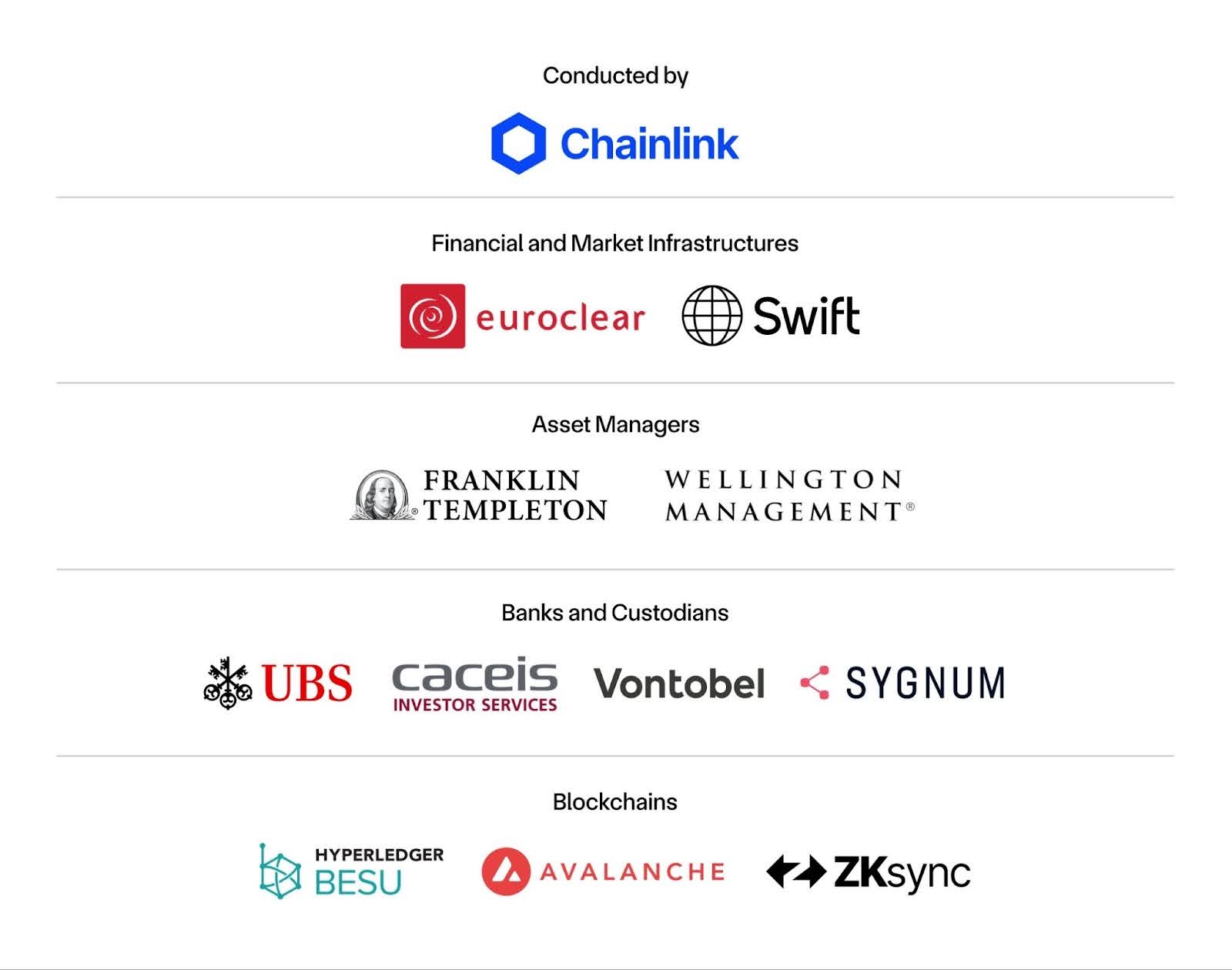

Leaders from Chainlink, Euroclear, Franklin Templeton, and Swift explored how blockchain technology can transform corporate actions data into efficient and usable information. They discuss how key technologies like blockchain and AI can drastically cut costs by streamlining corporate actions processes, helping minimize errors, enhance trust, and improve coordination among stakeholders.

“The way that Chainlink has taken unstructured data, structured it, and then put it in code so it can be used by everyone synchronously will now enable us to break out of this limitation of only being able to offer money market funds.”—Andrew Crawford, Franklin Templeton

The panel highlighted the recently announced industry-wide initiative between Chainlink, leading financial and market infrastructures Euroclear and Swift, and some of the world’s largest financial institutions, including UBS, Franklin Templeton, Wellington Management, CACEIS, Vontobel, and Sygnum Bank.

The initiative aims to address today’s inefficient corporate action processes, which cost regional investor, broker, and custodian businesses approximately $3-5 million each annually, with 75% of firms manually re-validating custodian and exchange data. The initiative successfully demonstrated how LLMs can be used in combination with Chainlink to gather unstructured corporate action events data and distribute a structured data output in near real-time across three blockchain networks. With its novel approach of creating an interoperable, onchain golden record, the initiative marks a significant architecture milestone in the ongoing journey to transform the management and dissemination of corporate actions data.

Read the full report.

Bridging Worlds: DeFi Meets TradFi

Industry leaders explored the convergence of DeFi and TradFi. They discussed how blockchain technologies are reshaping the financial landscape and how collaborations between established financial institutions and DeFi builders are unlocking exciting innovations.

“The term DeFi will disappear, and TradFi will disappear, and we’ll just have Fi.”—Emilio Frangella, Aave Labs

BTCFi: Tapping Into a Trillion-Dollar Opportunity

DeFi on Bitcoin is becoming a reality. This panel dives into how BTCFi is bringing a new wave of functionality to the Bitcoin blockchain and how protocols are unlocking Bitcoin liquidity and providing more value to BTC holders.

“Imagine we can unlock $1.5 trillion in Bitcoin and make this value flow into DeFi.”—Johann Eid, Chainlink Labs

The Future of Asset Management

The buy side and asset management sectors are key to the adoption of tokenized assets. On this panel, leaders from HSBC, Fidelity International, Franklin Templeton, UBS, and Chainlink Labs discussed the market forces driving the adoption of blockchain and tokenized assets.

“I do believe that this interoperability will come. Because you want to use [assets] in multi-markets—why should you restrict yourself to only one market? I think we are just at the beginning of this journey.”—Edgar Gehringer, HSBC Global Asset Management

Bringing the World Onchain: The Importance of Interoperability

Panelists from Aave Labs, HSBC, SBI Digital Markets, and Chainlink Labs discuss the inevitable convergence of TradFi and DeFi, the explosion of new public and private blockchains, and the key role that interoperability plays in the merging of all these different onchain environments and existing systems into a single unified Internet of Contracts.

Sergey Nazarov: “Do you see TradFi becoming a user of DeFi at some point?”

Benjamin Chodroff: “Absolutely.”

The Future of Financial Market Infrastructure

Leaders AsiaNext, Euroclear, SBI Digital Markets, and Chainlink discussed key trends driving the replatforming of global finance. The panelists talked about the macro drivers behind the adoption of decentralized technologies in financial markets, highlighting the impact of initiatives like MAS’s Project Guardian and BIS’s Project Agorá in helping to drive this transition. They also explored the development of infrastructure supporting tokenized asset adoption and shared their outlook on what’s needed in the coming months to further accelerate adoption.

“I don’t think a single global blockchain is the correct answer for regulated financial markets. I think the development of one or multiple networks—almost like a Swift network—that are interoperable is what’s key to driving this forward.”—Tom Menner, SBI Digital Markets

Developer Announcements

Chainlink Certifications

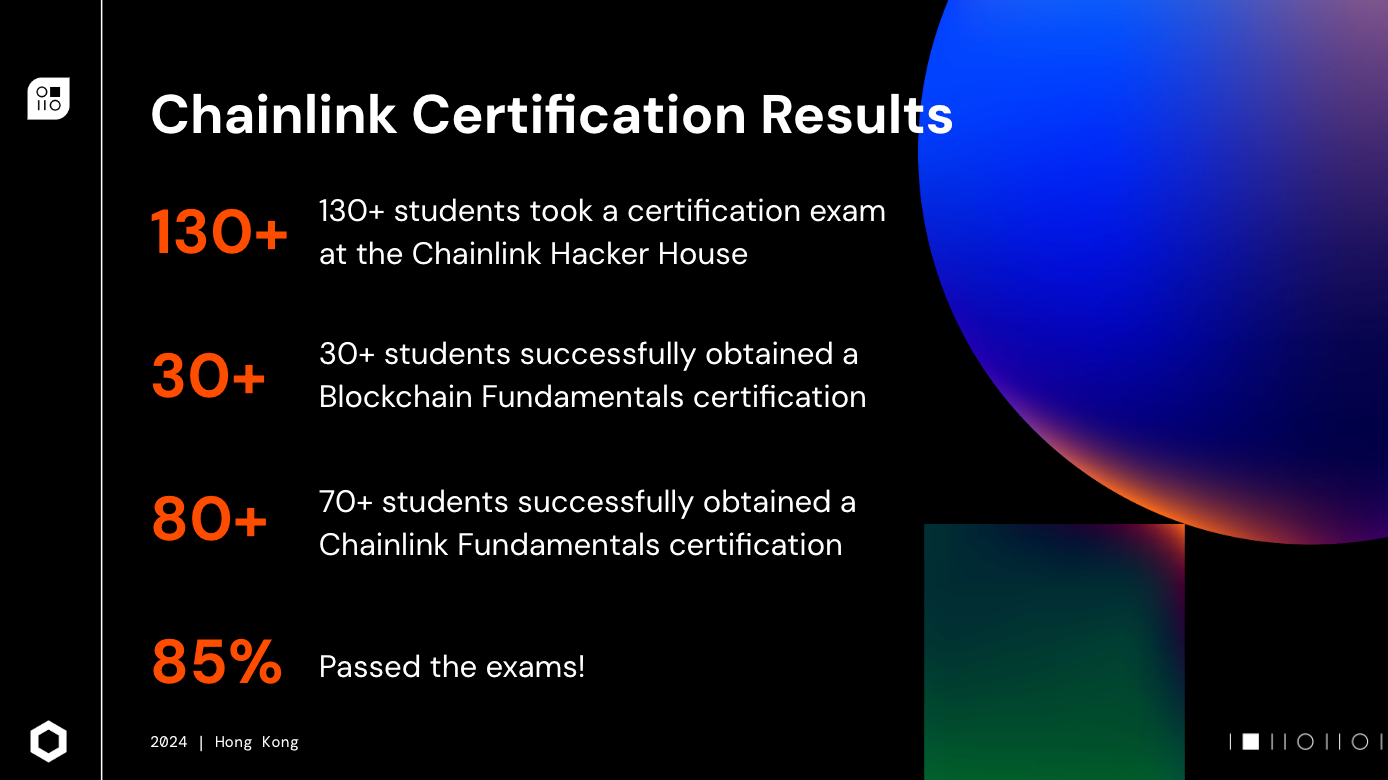

Chainlink Certifications is a new program officially launched at the SmartCon Hacker House. It offers both technical and non-technical learners the chance to gain essential blockchain, tokenization, and Chainlink skills.

The program includes courses like “Blockchain Fundamentals” and “Chainlink Fundamentals,” designed for newcomers, onchain enthusiasts, and those looking to enhance their blockchain expertise, whether they have a technical background or not. Developed by industry experts, the training is hands-on, interactive, and self-paced. Best of all, participants earn a credential to showcase their skills—and it’s completely free.

Over 130 students took a certification exam at the Hacker House, with 85% of them passing.

Home.chain.link

Home.chain.link is a new page designed to simplify and unify the developer experience. With this single page, developers can now view all of their requests across Automation, Functions, and VRF, as well as across all networks—eliminating the need to switch between different product- and network-specific pages.

For example, instead of toggling between automation.chain.link and vrf.chain.link for specific requests, developers can simply connect their wallet to home.chain.link and see all their requests in one place. This streamlined interface offers a more efficient solution for managing tasks across multiple Chainlink services and blockchains.

Chainlink Explore

Chainlink Explore product demos are now live. Discover how Chainlink powers the future of onchain finance through interactive demos on RWA tokenization, fund tokenization, DeFi derivatives, and much more.

Choose your adventure today: explorechainlink.com

Economics

Payment Abstraction

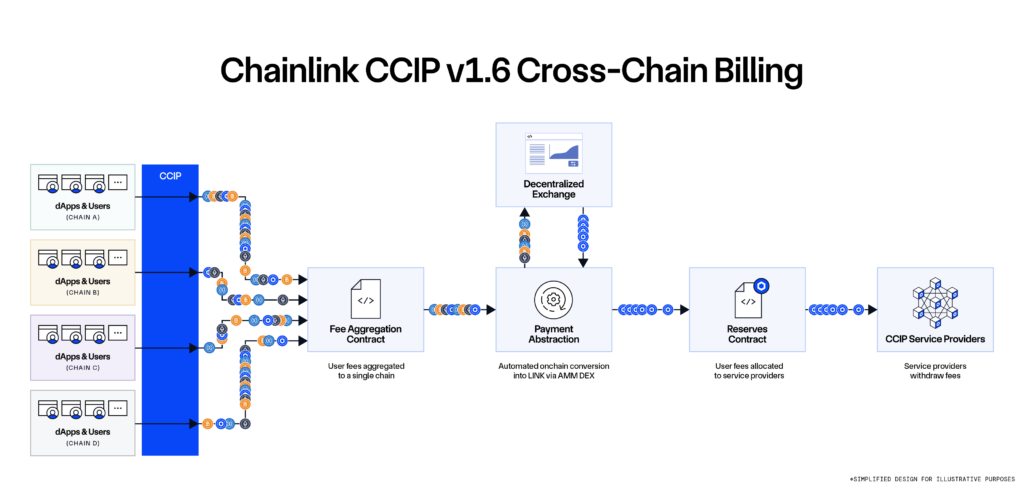

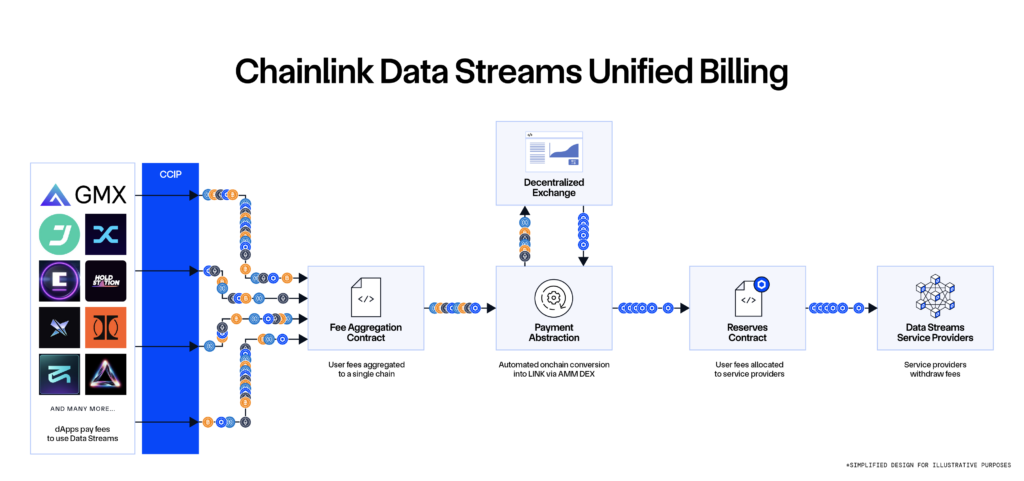

At SmartCon, Chainlink product deep dive presentations by Chainlink Labs’ Rahul Shah (Product Director) and Raoul Schipper (Strategic Accounts & Solutions) highlighted future developments including the integration of Payment Abstraction in Chainlink services, including CCIP and Data Streams.

Payment Abstraction is a system of onchain smart contracts that aim to reduce payment friction and simplify billing for users and developers interacting with Chainlink services. The system is designed to (1) accept fees in various tokens across multiple blockchain networks, (2) consolidate fee tokens onto a single blockchain network via Chainlink CCIP, (3) convert fee tokens into LINK via Chainlink Automation, Price Feeds, and existing Automated Market Maker (AMM) Decentralized Exchange (DEX) contracts, and (4) pass converted LINK into a dedicated contract for withdrawal by Chainlink Network service providers.

The source code for Payment Abstraction is available on GitHub and will be undergoing a public competitive audit on the Code4rena platform on December 6, featuring a $100K prize pool.

Build Program Update

We know the community has been eagerly awaiting the next stage of the Chainlink Build program, the point at which projects can make their native tokens claimable by participants in the Chainlink ecosystem, including stakers. While communications have been limited, this does not mean questions about the program’s development have gone unheard.

The primary goal of the Build program is to accelerate the growth of early-stage and established projects in the Chainlink ecosystem and provide enhanced access to Chainlink services, in exchange for projects committing a percentage of their native token supply to the program. Making such tokens available to ecosystem participants requires a mechanism that is sustainable for all participants, legally compliant, and accessible to as many community members as possible.

While we’re tracking a number of positive legal developments, especially with the increased interest in creating regulatory clarity for crypto globally, progress has moved at a slower pace than anticipated and there has not yet been sufficient progress on the legal clarity required for a Build claims mechanism to be deployed. We are disappointed by this situation, as the development of the Build claims mechanism has progressed as expected and has been near code-complete for months. As the legal clarity around digital assets continues to improve, we will reevaluate the launch timing in order to maximize the program’s success.

In the meantime, the existing Build project community will continue to be supported and new participants will be onboarded to the program to accelerate the growth of projects in the Chainlink ecosystem.

Community

We’re grateful to the Chainlink community for being the heart of SmartCon and helping make the event a resounding success. With 1K+ in-person attendees, 1.8K+ virtual registrations, and 30+ participating sponsors, the community’s strong presence was unmistakable. Alongside the main conference, 50+ side events provided additional opportunities for networking and collaboration, reflecting the growing momentum within the Chainlink ecosystem.

Ecosystem Moments at SmartCon

SmartCon Ecosystem Moments highlights key technological developments, accomplishments, and updates from select ecosystem partners at the conference. At the main event, 22 key ecosystem projects launched major products that are set to shape the future of our industry.

- Botanix Labs announced the launch of their new testnet, showcasing how Spiderchain brings the Ethereum Virtual Machine (EVM) to Bitcoin, enabling secure and scalable decentralized applications on the Bitcoin network. This marks a significant step in advancing Bitcoin’s capabilities, providing developers with a powerful platform to build decentralized applications on Bitcoin.

- Concero announced Concero V2, expanding the reach of its interoperability protocol to any chain while utilizing Chainlink Automation, Functions, and CCIP. By leveraging Concero’s infrastructure that will be deployed with Symbiotic, Concero is able to extend the reach of Chainlink Functions beyond the currently supported chains.

- Cryptex Finance is integrating Chainlink Data Streams to create TCAP 30, a Total Market Cap Index of the top 30 crypto projects. The index aims to capture approximately 90% of the total crypto market cap, powered by low-latency market data from Data Streams. Similarly to the MEEM Index, data is further aggregated to derive an index value for each component.

- dlcBTC, a decentralized wrapped bitcoin secured by Bitcoin, is a theft-proof bridge leveraging Discreet Log Contracts and Chainlink CCIP. Users can now utilize their Bitcoin with dlcBTC by swapping native BTC on Garden Finance atomic swaps, using dlcBTC as collateral on CurveLend to get crvUSD, and participating in permissionless DeFi.

- HBAR Foundation joined Chainlink Scale, with Chainlink Data Feeds now live on Hedera Testnet and Chainlink CCIP being integrated on Hedera. This expands the longstanding collaboration between Chainlink and Hedera via the Hedera Governing Council.

- Instruxi announced the launch of its Mesh ID, powered by Chainlink, CLEAR, and Space and Time. The solution uses Chainlink Functions to access real-world data via APIs and Chainlink Automation for scalable, decentralized, and cost-efficient operations.

- JOJO Exchange upgraded to Chainlink Data Streams to support a seamless and ultra-fast DeFi user experience and help ensure unparalleled reliability and security for liquidations on its AI-driven decentralized exchange.

- KiloEx launched Hybrid Vault which allows the staking of various asset types, a Telegram Minibot, and a multi-tiered affiliate program. KiloEx also launched on Base, with an Arbitrum deployment coming soon.

- Lendvest announced a new feature that enables it to verifiably calculate DeFi rates offchain, allowing for precise tracking of rates from platforms like Aave. These offchain calculations are then used to update Lendvest’s rates, ensuring game-theory-optimized rates for term loans.

- Lido integrated Chainlink CCIP to allow users to stake their ETH directly from layer-2 networks. Powered by CCIP’s Programmable Token Transfers, this new capability is initially available on Arbitrum, Base, and Optimism. Users can stake ETH from these networks and receive wstETH in return.

- Lombard is integrating CCIP, Price Feeds, and Proof of Reserve to set the industry standard for Bitcoin in DeFi and enable a secure LBTC ecosystem. Lombard will be enhancing its security with an appchain—the Lombard Ledger—and expanding its Security Consortium with a validator network expansion.

- Matrixdock announced the launch of its gold-backed token, XAUm. This marks a significant milestone in Matrixdock’s product diversification and paves the way for Matrixdock’s future tokenization of precious metals.

- Mind Network launched its FHE validation SDK that creates a shared private state for AI validators.

- QuantAMM launched the QuantAMM simulator app for liquidity managers, unveiled the initial QuantAMM product range and strategies.

- Solv launched its Staking Abstraction Layer (SAL), aiming to bring BTC staking to mass adoption, with BNB Chain, Ceffu, and Chainlink as launch partners.

- Storm Trade integrated Chainlink as its oracle partner, which will significantly enhance the reliability and speed of its platform’s data feeds, providing accurate market information to traders. Storm Trade’s integration of Chainlink will not only strengthen its existing capabilities but also enable it to expand to new markets, including forex and commodities.

- Space and Time launched the testnet of its blockchain, SXT Chain. SXT Chain will leverage the Chainlink Network to provide developers with a more familiar and lower-cost way to ZK-verify query results compared to EVM-based verification on Ethereum. SXT Chain will be natively integrated with Chainlink Functions, so developers can deliver ZK-proven query results directly to their smart contracts.

- Theoriq launched its public testnet, introducing a decentralized ecosystem for multi-agent collaboration. This launch aims to give the community a chance to co-create the future of AI by interacting with advanced AI agent collectives, providing feedback, and engaging with the development of the protocol.

- Truflation launched Index.fun, a platform enabling users to create, launch, and trade custom indexes based on verified onchain data. Built on Truflation’s Truf Network, this platform bridges the gap between traditional finance and DeFi, offering a permissionless environment for the creation of advanced financial products while maintaining data integrity and reducing fraud risks.

- Zaros integrated Chainlink Data Streams on Arbitrum to power its perpetual DEX. Data Streams’ sub-second delivery of market data enhances Zaros’ trading experience while maintaining a high level of security.

- zkLend will launch its STRK staking product and liquid staking tokens (LST) on Starknet in November 2024. This launch supports Starknet’s decentralization goals while enabling stakers to leverage LSTs within the DeFi ecosystems on both Starknet and Ethereum. zkLend will use Chainlink Price Feeds on both chains at launch and plans to integrate Chainlink Proof of Reserve on Ethereum.

- XSwap is a launch partner for Lido’s new Direct Staking feature that enables users to stake their ETH directly from layer-2 networks. XSwap is also launching a new service that aims to allow users to access tokenized real-world assets (RWAs) across any blockchain.

Ecosystem Announcements on the #RoadToSmartCon

This month, 40+ teams announced Chainlink integrations on the #RoadToSmartCon. Check out all the teams who participated:

- Adapt3r Digital (CCIP, Data Feeds, Proof of Reserve)

- Apex Group (CCIP, Data Feeds, Proof of Reserve)

- Bedrock (CCIP, Data Feeds, Proof of Reserve)

- Bitlayer (CCIP)

- Botanix Labs (CCIP, Data Feeds, Scale)

- B² Network (CCIP)

- Davos (Data Feeds)

- DigiFT (CCIP, Proof of Reserve)

- ether.fi (Proof of Reserve)

- Gains Network (CCIP)

- GMX-Solana (Data Streams)

- HBAR Foundation & Hedera (CCIP, Data Feeds, Scale)

- Holdstation (Data Streams)

- Index Coop (CCIP)

- Ignition (Data Feeds, Proof of Reserve)

- Instruxi.io, CLEAR, Space and Time (Automation, Functions)

- JOJO Exchange (Data Streams)

- KiloEx (Data Streams)

- Lendvest (Functions)

- Lido (CCIP)

- Linea (CCIP)

- Lista DAO (Price Feeds)

- Lombard (CCIP, Price Feeds, Proof of Reserve)

- Lorenzo (CCIP, Price Feeds, Proof of Reserve)

- M^0 (Proof of Reserve)

- Mountain Protocol (CCIP)

- opBNB (Data Streams)

- PredatorAiBot (CCIP)

- PumpBTC (CCIP, Price Feeds, Proof of Reserve)

- RAAC (Build, Data Feeds)

- Ronin (CCIP)

- Scroll (CCIP)

- Solana (Data Streams)

- Soneium (CCIP, Data Streams, Functions, VRF)

- Space and Time (Functions)

- Spiko (NAV Feed)

- Synfutures (Price Feeds)

- Tokeny (CCIP, NAV Feed)

- TRON (Data Feeds, Scale)

- Usual Labs (CCIP, Proof of Reserve)

- Web3Shield (Build, CCIP)

- Winnables.com (CCIP, VRF)

- XYRO (Data Streams)

Industry News

- Big Financial Institutions Solve A $3.1 Trillion Problem With AI And Blockchain. Forbes.

- Space and Time Launches SXT Chain Testnet at Chainlink SmartCon. Decrypt.

- Chainlink Unveils ‘Chainlink Runtime Environment,’ Aiming for Better Blockchain Workflows. CoinDesk.

- Chainlink Data Streams Now Live on BNB Chain’s Layer-2. Bitcoin.com.

- Chainlink makes a case for blockchain-driven finance at its first Hong Kong event. South China Morning Post.