Realizing the Onchain Cash Opportunity: ANZ and Fidelity International Use Case Enabled by Chainlink

With the increasing adoption of digital assets by leading financial institutions, the need for a cash leg to settle transactions onchain has emerged. In response, institutions are exploring various forms of digital money, including stablecoins, CBDCs, and tokenized deposits.

Already, world-leading institutions and monetary authorities, such as ANZ and the Central Bank of Brazil, are working with digital-native money to power next-gen use cases from asset transfers to trade finance. As institutions and governments worldwide increasingly accelerate their adoption of digital money, it’s critical that they implement best practices around critical onchain data, secure interoperability, user privacy, compliance, and synchronization.

In this post, we explore the key benefits that digital money unlocks, critical design requirements for digital payment infrastructure, and how Chainlink enables the secure exchange of ANZ Bank’s stablecoin with Hong Kong’s CBDC, e-HKD.

What Are The Opportunities for Institutions?

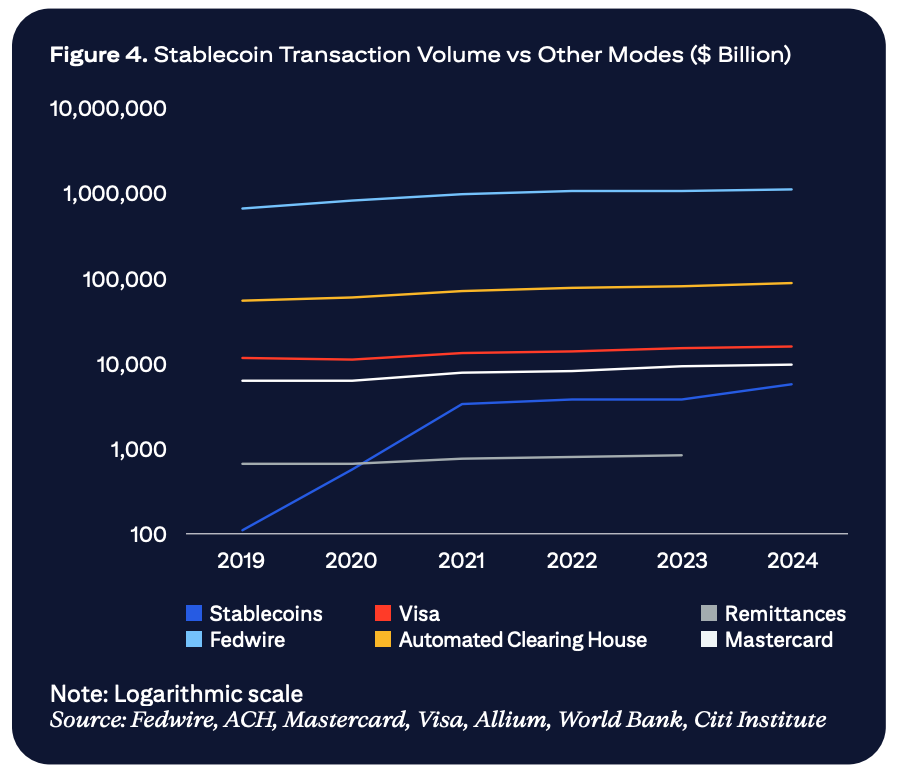

Understanding the key advantages of digital currencies and tokenized assets can position your organization to benefit significantly from their implementation. This is one of the most significant opportunities in finance, with Citi Institute estimating the market size for stablecoins could grow to $3.7 trillion by 2030.

Enhancing Transfers and Liquidity With Tokenization

Tokenization converts traditional financial assets into digital tokens that can easily move across blockchains. This flexibility enhances liquidity management and enables seamless transfers across blockchains and other trading environments, offering businesses the agility needed to optimize their capital allocation strategies efficiently and automate complex workflows.

Automating Complex Transactions Through Programmability

Smart contracts, the format in which tokenized assets are represented, support automated payments in accordance with predefined conditions, enabling complex transactions to be automated end-to-end while remaining compliant. Automating payment workflows using programmable smart contracts improves operational efficiencies, reduces manual reconciliation, and lowers processing costs.

Reducing Counterparty Risk Via Atomic Settlement

Atomic settlement ensures the simultaneous transfer of securities and currencies in real time, effectively eliminating settlement risk. For institutions engaged in cross-border flows, atomic settlement for FX transactions can significantly reduce counterparty risks that emerge due to time zone differences and limited RTGS windows. By conducting DvP and PvP exchanges onchain in near real time, institutions can greatly enhance trust while reducing the risk of default or outright fraud.

What Critical Infrastructure Is Needed To Unlock Digital Payment Rails?

“With stablecoin technology, banks have the opportunity to create better products and experiences while retaining deposits in the banking system – where users often prefer them to be secured – simply on new rails,” noted Matt Blumenfeld, Global and US Digital Assets Lead at PwC. As businesses look toward integrating digital-native money into their payment infrastructure, several critical design requirements must be considered to maximize effectiveness and security.

Compliance and Identity Verification

Meeting AML, KYC, and other regulatory requirements across borders and blockchain networks calls for a flexible, policy-driven approach—one capable of validating identity and eligibility throughout the transaction lifecycle, while supporting real-time monitoring, violation detection, and transparent audit trails.

Secure Interoperability

There are already thousands of blockchains and many more will emerge as the demand for onchain assets continues to grow. To prevent fragmented markets where tokenized assets are isolated across a single chain, it’s critical that assets can be securely transferred cross-chain to where demand is highest. Chainlink has built the largest ecosystem in the blockchain industry and is the blockchain interoperability standard within capital markets.

Cross-chain transfers are one of the most vulnerable points in an asset’s lifecycle. More than $2.8 billion has been lost to cross-chain exploits, making strong cross-chain security a critical requirement for any institution entering the tokenization space.

Privacy-Preserving Capabilities

While public blockchains introduce a new level of transparency—allowing market participants and regulators to independently verify transactions and assess market integrity—data stored on them is exposed publicly. The reputational impact of data breaches would be immense for any bank or asset manager, not to mention that direct costs can easily surpass $375 million.

To realize the full benefits of blockchains, institutions must leverage infrastructure that enables them to keep certain transaction data private and protect the privacy of their clients, all the while complying with regulatory requirements when transacting onchain.

Realizing the Onchain Cash Opportunity: ANZ and Fidelity International Use Case Enabled by Chainlink

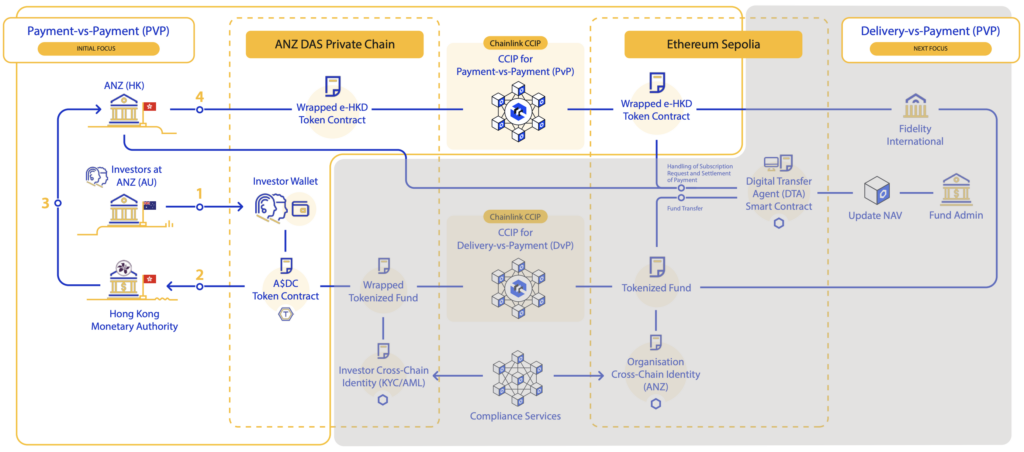

A recent report from Visa highlights payments innovations that are part of the Hong Kong Monetary Authority (HKMA) e-HKD+ Pilot Programme Background, including how Chainlink Cross-Chain Interoperability Protocol (CCIP) enables the simulated secure exchange of ANZ Bank’s A$DC stablecoin with Hong Kong’s e-HKD CBDC to facilitate the purchase of Fidelity International’s simulated tokenized fund. The use case utilizes Chainlink’s Digital Transfer Agent (DTA) offering, which streamlines multichain fund operations through smart contracts.

By leveraging Chainlink’s CCIP and DTA solution, Fidelity International and ANZ demonstrate how secure, privacy-preserving, and compliance-ready infrastructure can streamline tokenized fund operations at scale. The solution will initially focus on the PvP transaction flow for the digital currency swap. The use case is already underway, with final results expected in the coming months.

“As this technology progresses and becomes further integrated into market infrastructure, scaling adoption would lead to new distribution channels, investment opportunities and operational advantages.”—Emma Pecenicic, Fidelity International

The key challenges this use case looks to solve are enabling secure and seamless PvP flows for foreign exchange transactions and using the DTA model to execute secure and compliance-focused transactions for tokenized subscriptions and redemptions across different chains, token standards, and jurisdictions—all while preserving user privacy and automating compliance.

“We’re excited to be working with Chainlink to enable the simulated seamless exchange of our Australian dollar stablecoin (A$DC) with Hong Kong’s e-HKD CBDC across blockchains and borders. We are testing the Chainlink interoperability standard to abstract away the complexities of onchain transactions via Programmable Token Transfers and by fostering collaboration across the multi-chain ecosystem, we aim to spur the growth of the digital asset space.”—Richard Schroder, Head of Digital Asset Services at ANZ

Next Steps

In the next stage of the use case, ANZ, Fidelity International, and Chainlink will extend the PvP workflow to complete the transaction lifecycle, enabling an end-to-end process for tokenized fund subscriptions and redemptions. This will demonstrate how secure interoperability can help reduce counterparty risk, highlight the potential for 24/7 onchain markets, and verify that policy controls can be maintained in a blockchain environment without sacrificing users’ privacy. With a proven cash leg for settling digital asset transactions onchain, the industry moves closer to an always-on financial system where liquidity, compliance, and privacy are the default.