Chainlink’s Work With Swift, Euroclear, and Major Banking and Capital Markets Institutions

The Chainlink standard enables financial institutions to develop customized, compliant, and future-proof blockchain applications and tokenized assets. Already, Chainlink has enabled tens of trillions in value and is enabling the world’s largest infrastructures and institutions to move onchain.

In this repository, you’ll find Chainlink’s major banking and capital markets announcements with some of the world’s largest financial market infrastructures and institutions.

Quick Links

- Financial Market Infrastructures

- Governments, Monetary Authorities, and Central Banks

- Asset Managers

- Institutional Banks

- Exchanges and Trading Venues

- Payment Networks

FINANCIAL MARKET INFRASTRUCTURES

Swift Completes Digital Asset Interoperability Milestone as Part of Work With Chainlink

Swift has achieved a landmark digital asset interoperability milestone, most recently concluding its interoperability trials with a tokenized bond initiative involving major European Banks including BNP Paribas Securities Services, Intesa Sanpaolo, and Société Générale (FORGE). This latest trial demonstrated how Swift can orchestrate tokenized asset transactions, specifically bonds, across blockchains and existing enterprise systems.

This milestone builds on Swift’s prior work with Chainlink and UBS Asset Management, which successfully demonstrated cross-chain settlement of tokenized assets with existing payment rails. That work, featuring 12+ major financial organizations including Citi, BNY Mellon, and BNP Paribas, contributed to the broader interoperability framework Swift is extending across its global network of 11,500+ financial institutions.

Link to the announcement.

Establishing a Unified Standard for Asset Servicing With the Chainlink Platform, Blockchains, and AI

Announced at Sibos 2025, Chainlink and 24 of the world’s largest financial institutions and market infrastructures, including Swift, DTCC, Euroclear, UBS, and Wellington Management, continued their work on corporate actions processing. Building on the foundations established in Phase 1, the second phase introduces a production-grade system that includes new data attestor and data contributor roles. These roles enable trusted institutions to validate and enrich the LLM-extracted corporate actions records, allowing data accuracy for confirmed records to reach 100%.

The Chainlink Runtime Environment (CRE) orchestrated the validation of multiple AI model outputs and transformed the confirmed results into ISO 20022-compliant messages, which were then transmitted to the Swift Network. In parallel, Chainlink Cross-Chain Interoperability Protocol (CCIP) distributed these same confirmed records across DTCC’s blockchain ecosystem and additional public and private blockchain environments, enabling simultaneous access across traditional infrastructure and blockchain-based platforms. New institutionally-designated roles for data attestors and contributors were also introduced to cryptographically attest to data accuracy and contribute to any missing data fields, creating a verifiable chain of custody across the lifecycle of each corporate action.

Throughout testing, the system achieved nearly 100% data consensus agreement among AI models across all evaluated corporate actions. The architecture also demonstrated support for multilingual processing across disclosures written in non-English languages, such as Spanish and Chinese, enabling broader global coverage across jurisdictions.

This solution unlocks an onchain golden record for corporate actions, an attested, real-time source of truth that can be accessed simultaneously by smart contracts, custodians, and post-trade systems. It also enables tokenized equities, an increasingly adopted category of tokenized assets, to reference the same confirmed records across public and private blockchains, laying the groundwork for better synchronization and increased automation across onchain markets.

By standardizing how corporate actions data is extracted, validated, and delivered, the initiative creates a shared foundation for asset servicing across both blockchain networks and traditional financial infrastructure.

Swift and Chainlink Enabling Banks To Connect To Blockchains Using Existing Swift Standards and Chainlink Infrastructure

At Sibos 2024, Chainlink Co-Founder Sergey Nazarov showcased significant new capabilities to accelerate blockchain adoption in capital markets, including the integration of Swift with blockchains. This integration enables banks to seamlessly connect to blockchains using existing Swift standards and Chainlink infrastructure, streamlining interoperability and enhancing efficiency in financial transactions.

Link to full Sibos 2024 presentation slides.

Swift and Chainlink Demonstrated a Secure and Scalable Way To Transfer Tokenized Assets Cross-Chain Using CCIP

Swift—the international bank messaging standard for 11,500+ banks—is working with Chainlink to enable financial institutions to connect to any existing public/private chain using Chainlink and their existing Swift infrastructure and messaging standards. Chainlink CCIP was used to enable the cross-chain settlement of tokenized assets across public and private blockchains. The successful initiative featured 12+ world-leading financial institutions, including Euroclear, Clearstream, ANZ, Citi, BNY Mellon, BNP Paribas, Lloyds Banking Group, and SDX.

“With the increasing number of blockchains, the task of connecting our traditional technical platforms and ensuring interoperability between blockchains presents a growing challenge that we must overcome. In this regard, the experiment demonstrated the potential to leverage the extensive connectivity already established with Swift.”—Alain Pochet, Head of Client Delivery, Securities Services at BNP Paribas

Link to the full report and panel discussion between Swift and Chainlink.

Swift, UBS Asset Management, and Chainlink: Successfully Bridge Tokenized Assets with Existing Payment Systems

As part of the Monetary Authority of Singapore (MAS) Project Guardian, Swift, UBS Asset Management, and Chainlink demonstrated the issuance and settlement of tokenized funds using traditional Swift fiat payment rails. As a result, digital asset transactions can be settled using the existing Swift fiat payment systems already used by 11,500+ financial institutions, across 200+ countries and territories.

“For digital assets to be adopted globally, they must seamlessly integrate with both existing payment systems and digital currencies. Our work with UBS Asset Management and Chainlink in MAS’ Project Guardian leverages the global Swift network to bridge digital assets with established systems. This initiative aligns with our strategy to provide our community of financial institutions with a secure and scalable way to transact across multiple digital asset classes and currencies, leveraging Swift’s existing infrastructure.”—Jonathan Ehrenfeld, Head of Strategy, Swift

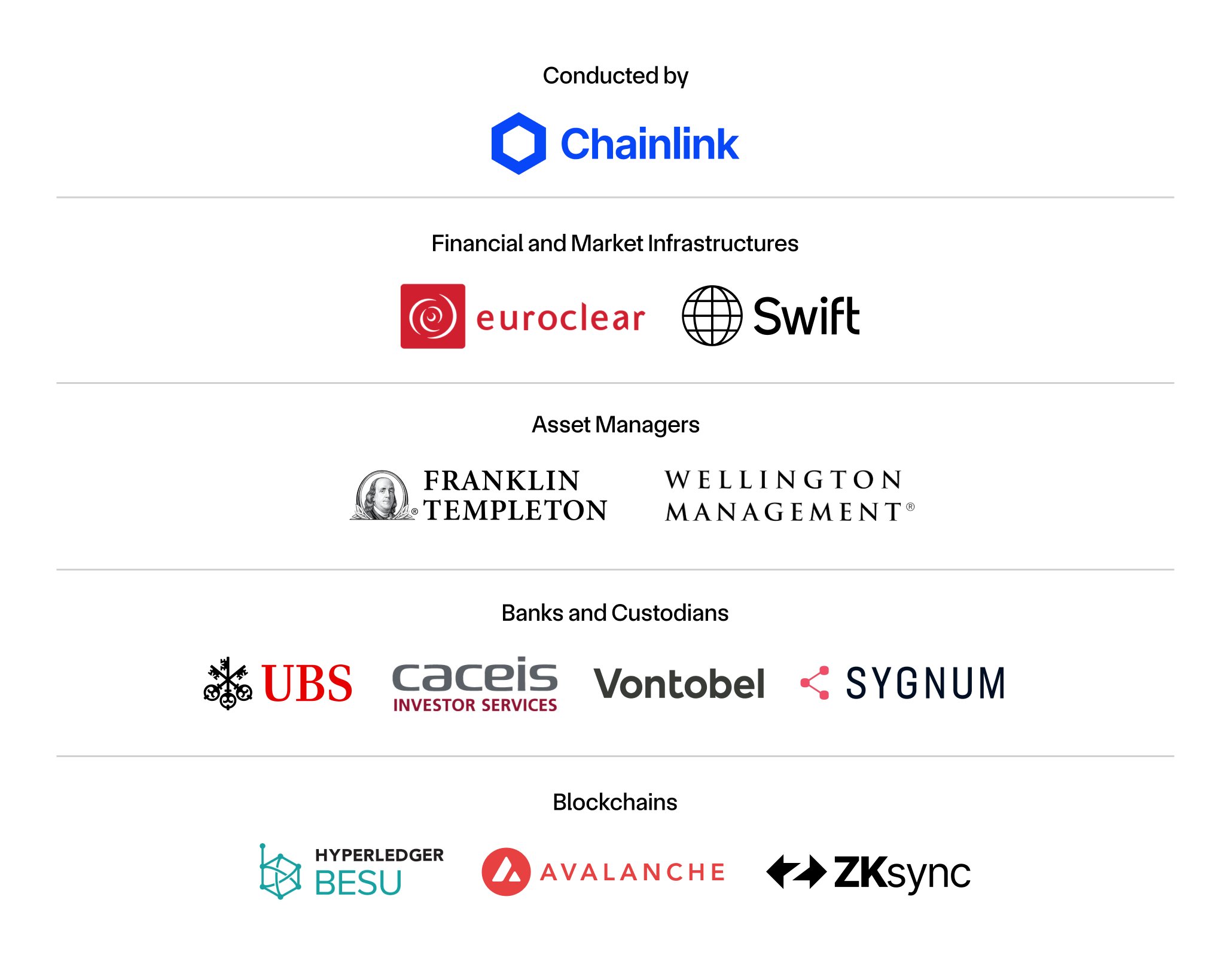

Euroclear, Swift, & 8 Major Financial Institutions: Transforming Asset Servicing With AI, Oracles, and Blockchains

Chainlink, together with leading market infrastructures, Euroclear and Swift, and some of the world’s largest financial institutions, including UBS, Franklin Templeton, Wellington Management, CACEIS, Vontobel, and Sygnum Bank, launched an industry initiative to combine advancements in AI, oracles, and blockchains to solve a long-standing problem in corporate actions—the lack of real-time standardized data in fragmented markets like Europe. This initiative is a significant industry milestone that successfully demonstrates how AI, oracles, and blockchains can be combined to convert unstructured, human-readable financial data into structured, machine-readable, easily distributable data.

“The complexity of corporate actions is a relevant and appropriate use case for the convergence of AI, oracles, and blockchain technology. By leveraging AI and Chainlink oracles to interpret, standardize, and deliver high-value unstructured data, we can dramatically reduce the manual processes required, enabling significant potential operational efficiency and cost reduction while ensuring that data flows through the system with the required levels of accuracy and transparency.”—Mark Garabedian, Director, Digital Assets & Tokenization Strategy, Wellington Management

Links to the full report and Sibos panel featuring Swift, Euroclear, and Chainlink.

GLEIF and Chainlink Form Strategic Partnership to Bring Institutional-Grade Identity Solution to Blockchain Industry

The Global Legal Entity Identifier Foundation (GLEIF) and Chainlink have partnered to deliver an institutional-grade identity solution for the blockchain industry. The solution combines GLEIF’s verifiable Legal Identity Identifier (vLEI) with Chainlink’s infrastructure for Cross-Chain Identity (CCID) and Automated Compliance Engine (ACE) to enable digital asset transactions that are verifiable, compliant, and trusted across jurisdictions while preserving user privacy.

By enabling verifiable identity data to be embedded directly into onchain assets and smart contracts, GLEIF and Chainlink are empowering institutions and tokenization platforms to programmatically verify asset provenance, automatically enforce compliance policies, reliably recover control over assets if private cryptography keys are compromised, and seamlessly meet compliance requirements for regulatory frameworks across the globe.

GOVERNMENTS, MONETARY AUTHORITIES, AND CENTRAL BANKS

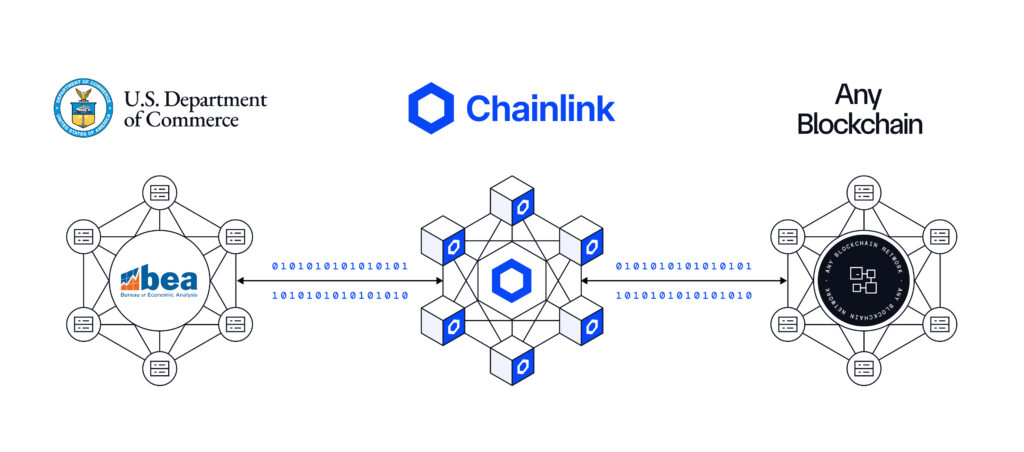

U.S. Department of Commerce Brings Key Macroeconomic Data Onchain with Chainlink

Chainlink and the United States Department of Commerce have worked together to bring key U.S. government macroeconomic data onchain for the first time. The data is sourced from the Bureau of Economic Analysis (BEA) and made available through new Chainlink Data Feeds.

The feeds deliver critical economic indicators including Real Gross Domestic Product (GDP), the Personal Consumption Expenditures (PCE) Price Index, and Real Final Sales to Private Domestic Purchasers. These datasets are updated monthly or quarterly as applicable and are initially available across ten blockchain networks: Arbitrum, Avalanche, Base, Botanix, Ethereum, Linea, Mantle, Optimism, Sonic, and ZKsync. Support for additional networks will be based on user demand.

Bringing BEA data onchain enables a wide range of use cases, such as automated trading strategies, tokenized asset issuance, real-time prediction markets, macro-driven DeFi risk management, and composable dashboards powered by immutable government data.

This development builds upon Chainlink’s accelerated work with the U.S. government in 2025, including meeting with several key officials and regulators to make policy recommendations that are advancing the growth of the blockchain industry.

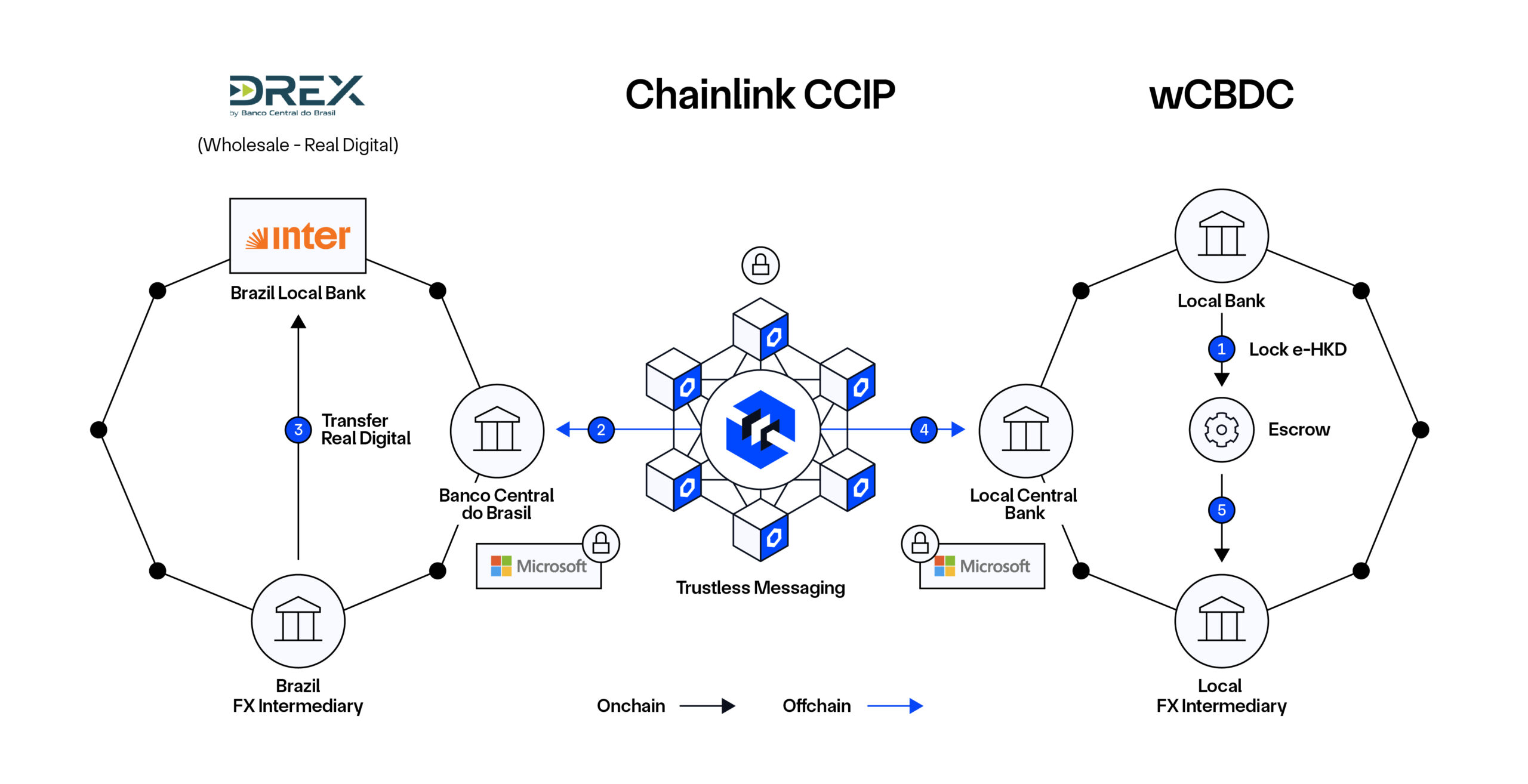

Chainlink Powers Cross-Border DvP Settlement Between the Central Bank of Brazil and Hong Kong Monetary Authority

In phase two of the Central Bank of Brazil’s (BCB) Drex project, which is focused on cross-border trade, Chainlink connected BCB with the Hong Kong Monetary Authority (HKMA) to orchestrate seamless and secure trade settlement across jurisdictions in a compliant manner. Additional participants included Banco Inter, Standard Chartered, the Global Shipping Business Network (GSBN), and 7COMm.

The Chainlink platform enabled seamless communication across the Drex platform, the Hong Kong Ensemble Network, and GSBN’s trade finance system. The Chainlink Runtime Environment (CRE) translated messages between networks, triggered electronic Bill of Lading transfers, and connected offchain systems like GSBN’s API. Chainlink CCIP provided secure cross-chain messaging, allowing key events like contract execution and credit release to stay in sync across all platforms.

This marked the first instance where a blockchain-based title registry and cross-chain payment infrastructure were connected in a single, automated workflow. Chainlink’s infrastructure enabled installment-based conditional payments using different digital currencies and tokenized reserves across jurisdictions.

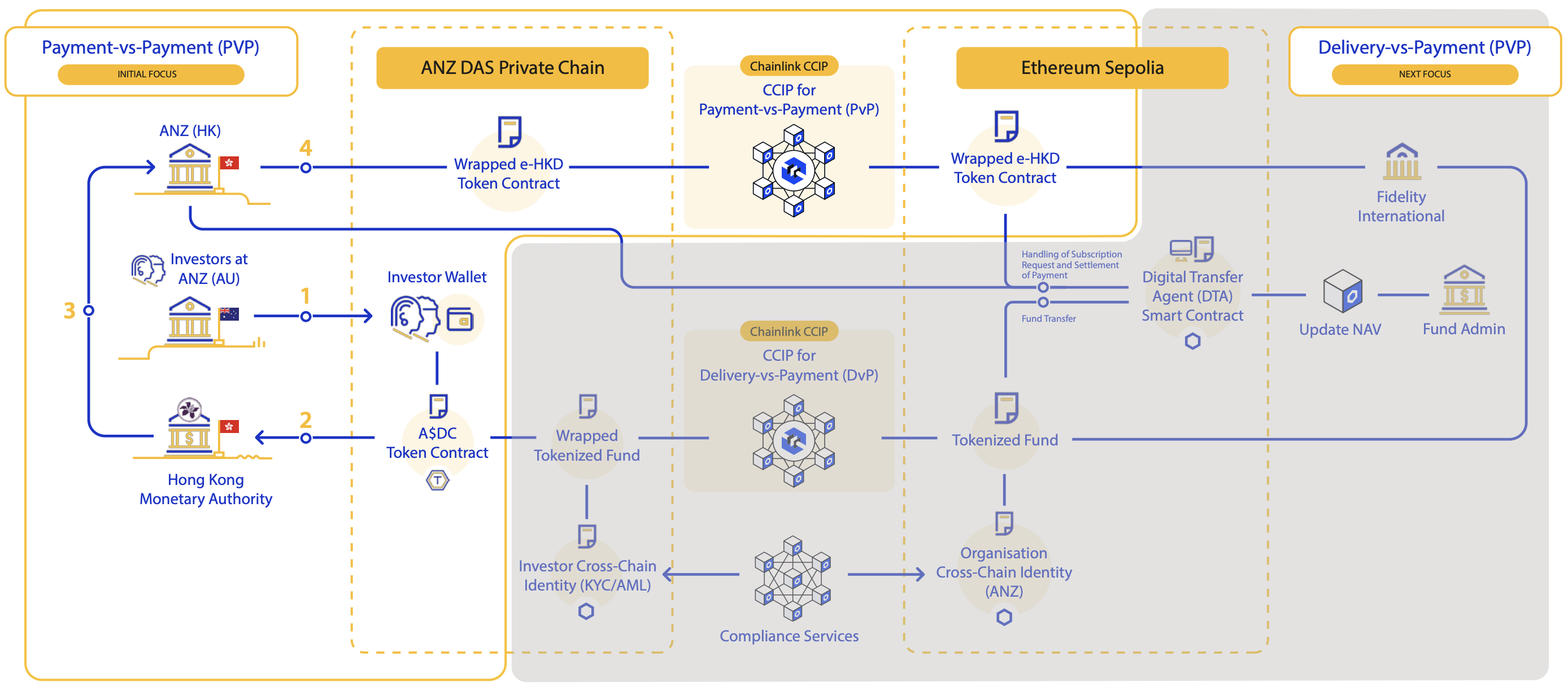

Chainlink Powers Cross-Chain Settlement of Tokenized Assets in Hong Kong Monetary Authority’s e-HKD Phase 2 Program

The Hong Kong Monetary Authority (HKMA) released a report on Phase 2 of its e-HKD program, publishing the results of multiple industry initiatives, including a key cross-chain settlement solution powered by Chainlink with ANZ, China AMC, and Fidelity International.

In the solution, ANZ, China AMC, and Fidelity International leveraged Chainlink CCIP and the Automated Compliance Engine (ACE) to meet both institutional cross-chain interoperability and compliance requirements for secure cross-chain settlement of tokenized assets.

The use case demonstrates how Australia-based investors can acquire tokenized money market fund units from Hong Kong–based asset managers using e-HKD and tokenized deposits.

The solution addresses the three biggest challenges of institutional tokenized asset transactions by unifying trusted data, cross-chain connectivity, and automated compliance into a single workflow. It provides secure, high-quality data to accurately price assets and support transfer agent operations; enables seamless value and data movement across blockchains using Chainlink CCIP; and enforces compliance by verifying onchain identity proofs against jurisdiction-specific regulatory policies through Chainlink’s Automated Compliance Engine (ACE).

By unifying these capabilities under a single standard, Chainlink enables institutional-grade tokenized asset transactions end-to-end at scale, unlocking the next generation of regulated tokenized finance.

ANZ Bank and Fidelity International Use the Chainlink Standards for Data, Connectivity, and Compliance in Cross-Chain Settlement of CBDCs, Stablecoins, and Tokenized Assets under

Hong Kong Monetary Authority’s e-HKD Program

Recently, Visa highlighted Chainlink’s work with ANZ Bank and Fidelity International under phase 2 of the Hong Kong Monetary Authority’s e-HKD program.

In the first phase of the use case, the participants demonstrated a Payment-vs-Payment (PvP) settlement workflow involving an Australian Stablecoin (A$DC) on ANZ’s DAS Chain and a wrapped Hong Kong CBDC (e-HKD) on Ethereum Sepolia—using Chainlink for cross-chain connectivity and compliance verification.

The next phase (highlighted above) demonstrates a Delivery-vs-Payment (DvP) workflow involving an Australian investor purchasing a tokenized asset in Hong Kong, leveraging Chainlink for cross-chain connectivity, compliance verification, and NAV pricing, along with Chainlink’s Digital Transfer Agent solution.

The use case highlights how, in a single platform, Chainlink overcomes the three key challenges in creating next-gen smart contracts for institutional transactions:

- Providing access to data onchain enables tokenized assets to be properly priced and supports automated onchain transfer agent operations. Chainlink is providing NAV data to enable the Digital Transfer Agent smart contract to automate updates, ensuring accurate pricing for subscriptions and redemptions of a tokenized money market fund.

- Powering cross-chain interoperability enables digital assets and data to be securely transferred across multiple public and private blockchain networks. Chainlink CCIP is powering a cross-chain PvP settlement workflow that supports atomic settlement for the cash (e-HKD CBDC and ANZ’s stablecoin) leg of the transaction.

- Bringing verifiable identity data onchain, while protecting user privacy, enables new use cases to meet the high regulatory requirements and internal policy controls of institutions. Chainlink is enabling compliance by allowing ANZ’s offchain identity registry to be verified onchain and create reusable credentials, ensuring transactions adhere to required regulatory standards across Hong Kong and Australia.

Combining these capabilities, the Chainlink platform is enabling Fidelity International and ANZ to validate how secure, privacy-preserving, and compliance-ready infrastructure streamlines tokenized fund operations at scale.

Banco Central do Brasil: Brazil’s Central Bank Is Using Chainlink To Build a CBDC Project for Trade Finance Alongside Microsoft

The Central Bank of Brazil (BCB) selected Banco Inter alongside Chainlink, Microsoft Brazil, and 7COMm to build a trade finance solution for the second phase of Brazil’s Drex CBDC project. It leverages the Chainlink standard and blockchain technology to automate supply chain management and improve trade finance processes.

“Banco Inter sees Phase 2 of the DREX CBDC project as an exciting moment for Brazil. We see collaborating in this project with technology leaders like Microsoft and Chainlink Labs as a transformative opportunity to expand market reach and improve the health of the Brazilian market.”—Bruno Grossi, Head of Emerging Technologies, at Banco Inter

Monetary Authority of Singapore (MAS) Project Guardian: SBI Digital Markets, UBS Asset Management, and Chainlink: Enabling Next Generation Tokenized Funds

As part of the Monetary Authority of Singapore (MAS) Project Guardian, SBI Digital Markets, UBS Asset Management, and Chainlink successfully demonstrated how the combination of Chainlink and a Digital Transfer Agent (DTA) smart contract enables the creation of tokenized funds with automated fund management operations and transfer agency processes. The solution enables tokenized funds to maintain their share register on one blockchain while using Chainlink CCIP for the processing of intensive fund lifecycle activities like subscriptions and redemptions on another blockchain.

“This architecture creates a foundation for our own onchain financial products and services to meet immediate user demand for tokenization and tokenized funds in particular. This new way of launching fund structures and administering them via smart contracts empowers both fund managers and their service providers to deliver new onchain financial products and lower operational costs to investors, both things they are actively looking for.”—Winston Quek CEO at SBI Digital Markets

Links to the announcement and Singapore FinTech Festival panel (slides).

Monetary Authority of Singapore (MAS) Project Guardian: ANZ, ADDX, and Chainlink Introduce Privacy-Enabled Cross-Chain, Cross-Border Connectivity for Tokenized Commercial Paper

Under the Monetary Authority of Singapore (MAS) Project Guardian, ANZ, ADDX, and Chainlink partnered on a use case supporting the entire lifecycle of tokenized commercial paper. The use case leverages ADDX’s investment platform, ANZ’s Digital Asset Services, and CCIP Private Transactions—a privacy-preserving capability powered by the Chainlink Blockchain Privacy Manager—to expand access to tokenized assets across borders while helping users meet confidentiality requirements.

“This use case is a continuation of our work to explore and enhance the interoperability of digital assets. While we see significant potential for blockchain technologies to streamline the entire asset lifecycle, transaction confidentiality, and meeting compliance obligations remain paramount. We look forward to exploring the privacy-preserving capabilities of Chainlink CCIP to support our customers with end-to-end private transactions.”—Richard Schroder, Head of Digital Asset Services at ANZ

Westpac Institutional Bank and Imperium Markets are Integrating Chainlink in the Reserve Bank of Australia’s Project Acacia

Westpac Institutional Bank and Imperium Markets are integrating Chainlink in Project Acacia, a new joint initiative between the Reserve Bank of Australia and Digital Finance CRC.

The Chainlink Runtime Environment (CRE) is orchestrating secure, seamless, and compliant Delivery vs. Payment (DvP) settlement of tokenized assets across blockchain markets and the existing PayTo Australia domestic payments system. This capability is key to accelerating the adoption of digital assets and bringing institutional capital onchain.

The Australian central bank has estimated that tokenization can save asset issuers in Australian markets up to AUD $12+ billion annually, while Westpac highlighted that the project is a key step to understanding how digital money can support “innovations in wholesale markets by providing risk-free settlement assets, backed by a resilient architecture and an appropriate regulatory environment.”

By connecting offchain payment capabilities and tokenized assets for secure DvP settlement, Westpac, Chainlink, and Imperium Markets are unlocking innovative use cases and scaling the institutional adoption of tokenized assets.

Chainlink and Apex Group Create Institutional-Grade Stablecoin Infrastructure Solution to Power the Bermuda Monetary Authority’s Embedded Supervision Initiative

Chainlink and Apex Group have successfully created an institutional-grade stablecoin infrastructure solution supporting the Bermuda Monetary Authority’s embedded supervision initiative.

Conducted in collaboration with the Bermuda Monetary Authority as part of its Innovation Hub, the solution enables a unified, compliance-forward, institutional-grade stablecoin framework powered by the Chainlink Cross-Chain Interoperability Protocol (CCIP), Automated Compliance Engine (ACE), and Proof of Reserve.

The Bermuda Monetary Authority (BMA) serves as the regulator for Bermuda’s financial services sector, responsible for issuing the Bermudian dollar and overseeing institutions such as banks and insurers. As of 2023, Bermuda hosted over 1,200 registered insurers that collectively underwrote more than $277 billion in gross premiums. In 2022, the banking sector reported its consolidated assets as $26 billion.

In the solution, Chainlink serves as the official infrastructure provider, enabling regulated asset issuers to operate through a full-stack oracle platform. CCIP powers cross-chain token transfers using the Cross-Chain Token (CCT) standard, enabling zero-slippage interoperability across public and private blockchains. ACE enforces jurisdiction-specific regulatory and operational policies directly onchain. Chainlink Proof of Reserve posts real-time reserve data onchain, providing ongoing transparency into the collateral backing the stablecoin. Secure Mint ensures supply is only issued when properly collateralized, helping prevent infinite mint attacks.

The solution also brings together several Chainlink ecosystem participants. Apex, a global services provider with $3.5 trillion in assets, provides reserve custody, management, and tokenization infrastructure. bluprynt, a trusted identity issuer backed by Robinhood, links verified entities to mint authority wallets. Hacken, a blockchain security and compliance platform with more than $430 billion in verified assets, delivers real-time compliance and risk dashboards for enhanced onchain visibility.

ASSET MANAGERS

Chainlink Introduces the Digital Transfer Agent Technical Standard, Advances Tokenized Fund Workflows With Swift Messaging in Partnership With UBS

Chainlink announced a landmark technical solution enabling financial institutions worldwide to manage digital asset workflows directly from their existing systems using Swift messaging and the CRE. With Swift messages and the CRE, banks and institutions can seamlessly access blockchains through the same Swift infrastructure they have relied upon for decades. This shows how institutions can access blockchains without needing to upgrade to new infrastructure, replace their existing processes, or integrate new identity and key management solutions.

A first use case involved a technical and operational pilot with UBS Tokenize, the in-house tokenization unit of UBS. Subscriptions and redemptions for a tokenized fund smart contract from UBS were triggered using ISO 20022 messages through CRE and Swift infrastructure. CRE received the Swift messages, which then triggered subscription and redemption workflows in the Chainlink Digital Transfer Agent (DTA) technical standard.

This new plug-and-play solution is set to be a critical unlock for the $100+ trillion global fund industry. Institutions can leverage the speed, efficiency, composability, and risk management benefits of blockchain technology that are only fully realized when tokenized fund workflows are fully onchain.

UBS Completes First In-Production End-to-End Tokenized Fund Workflow Powered by the Chainlink Digital Transfer Agent (DTA) Technical Standard

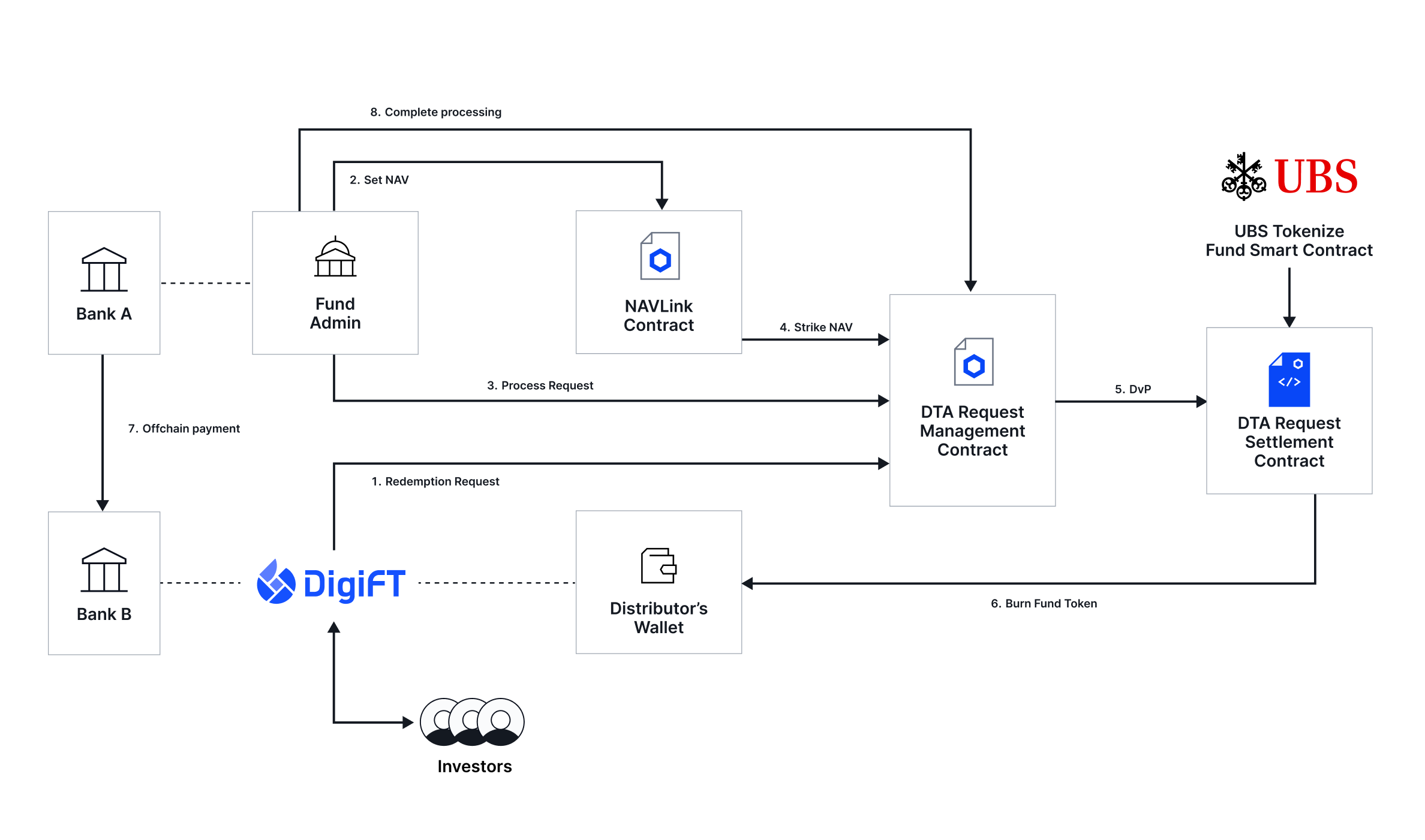

As one of the largest private banks globally with over $6 trillion in assets under management, UBS worked with its in-house tokenization unit, UBS Tokenize, and DigiFT to complete a live tokenized fund transaction that used the Chainlink DTA standard to process the first-ever onchain subscription and redemption request for a tokenized fund.

This achievement builds on prior work between UBS and Chainlink under the Monetary Authority of Singapore’s Project Guardian initiative and proves how fund operations can be seamlessly automated onchain. In this live transaction, DigiFT functioned as the onchain fund distributor and leveraged the DTA standard to successfully request and process a subscription and redemption order.

The DTA-powered workflow supports every stage of the fund lifecycle, including order taking, execution, settlement, and data synchronization across onchain and offchain systems.

The DTA standard leverages key Chainlink platform capabilities. Chainlink Runtime Environment (CRE) orchestrates actions across blockchain and traditional environments. Chainlink CCIP enables secure interoperability between public and private chains. Chainlink Automated Compliance Engine (ACE) provides programmable, jurisdiction-aware compliance. NAVLink delivers the reliable NAV pricing data needed to process fund transactions accurately.

“This transaction represents a key milestone in how smart contract-based technologies and technical standards enhance fund operations and the investor experience. As the industry continues to embrace tokenized finance, this achievement illustrates how these innovations drive greater operational efficiencies and new possibilities for product composability. Through our UBS Tokenize initiative, we are committed to fostering innovation and applying our deep expertise to support the development of digital strategies and products that meet our clients’ evolving needs.”—Mike Dargan, Group Chief Operations and Technology Officer at UBS

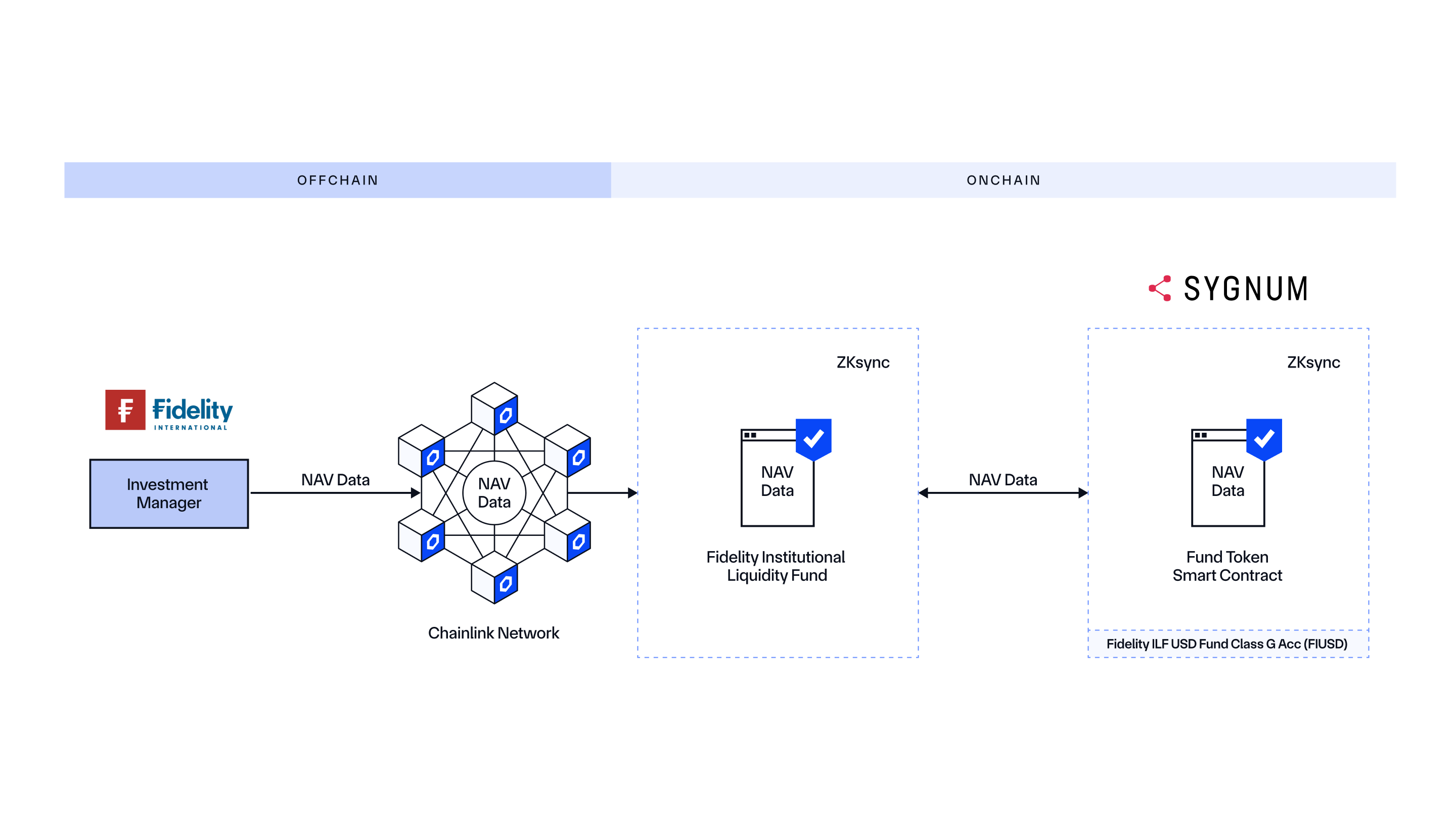

Sygnum and Fidelity International Partner With Chainlink To Provide Fund NAV Data Onchain

Chainlink, Fidelity International, and Sygnum partnered to bring Net Asset Value (NAV) data onchain to enable the tokenization of Fidelity International’s $6.9 billion Institutional Liquidity Fund on the zkSync public blockchain. With Chainlink, NAV data is accurately reported and synchronized onchain in an automated and secure manner, providing real-time transparency and built-in access to historical data for Sygnum, its clients, and broader market participants.

WisdomTree Publishes NAV Data Onchain for Tokenized Private Credit Fund Powered by Chainlink

WisdomTree, a global asset manager with over $130 billion in assets under management, is using Chainlink to bring institutional-grade NAV data onchain for its CRDT tokenized private credit fund on Ethereum.

The WisdomTree Private Credit and Alternative Income Digital Fund (CRDT) offers exposure to a diversified portfolio of liquid private credit and alternative income instruments, tracking the Gapstow Liquid Alternative Credit Index (GLACI).

By bringing CRDT’s NAV data onchain via the Chainlink data standard, WisdomTree enables automated subscriptions and redemptions through its Prime and Connect platforms while ensuring institutional-grade transparency, auditability, and interoperability with the broader digital asset ecosystem.

With verified NAV data available on Ethereum via Chainlink, DeFi protocols and institutional platforms can also now reference CRDT’s valuation in smart contracts, unlocking new use cases across lending, yield aggregation, and automated portfolio management.

INSTITUTIONAL BANKS

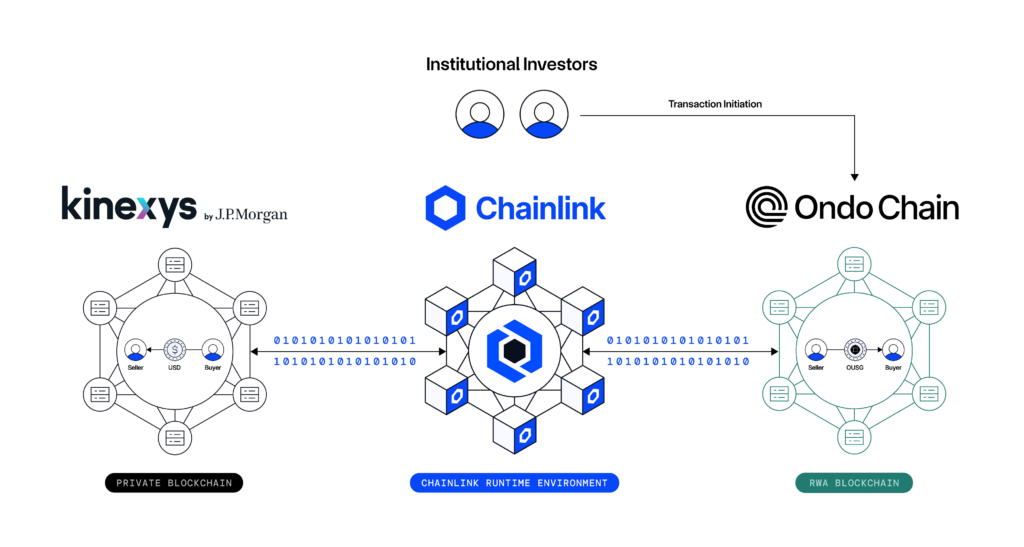

Chainlink, Kinexys by J.P. Morgan, and Ondo Finance Team Up to Bring Bank Payment Rails to Tokenized Asset Markets

Chainlink, the standard for onchain finance, Kinexys by J.P. Morgan, the financial services firm’s blockchain business unit, and Ondo Finance, the leading name in real-world asset tokenization, successfully executed a cross-chain Delivery versus Payment (DvP) transaction between Kinexys Digital Payments’ permissioned blockchain network and Ondo Chain testnet, with the Chainlink Runtime Environment (CRE) orchestrating end-to-end settlement.

The transaction involved the exchange of Ondo Chain’s Short-Term U.S. Government Treasuries Fund (OUSG) as the asset leg with Kinexys Digital Payments serving as the payment leg. The DvP solution that orchestrated the movement of asset and payment was powered end-to-end by the Chainlink Runtime Environment (CRE)—a secure offchain computing environment for coordinating activity across blockchains and existing systems, which leveraged an integration with Kinexys Digital Payments’ synchronized settlement workflow. CRE facilitated a seamless settlement between Kinexys Digital Payments and Ondo Chain’s testnet environment, while preserving institutional-grade security, compliance, and scalability standards.

“The demonstrated cross-chain solution is a testament to what can be achieved by strong collaboration across diverse segments of the Web3 ecosystem, and we are pleased to have worked with Ondo and Chainlink to bring this to life as the first transaction on Ondo Chain testnet,”—Nelli Zaltsman, Head of Platform Settlement Solutions, Kinexys Digital Payments at Kinexys by J.P. Morgan.

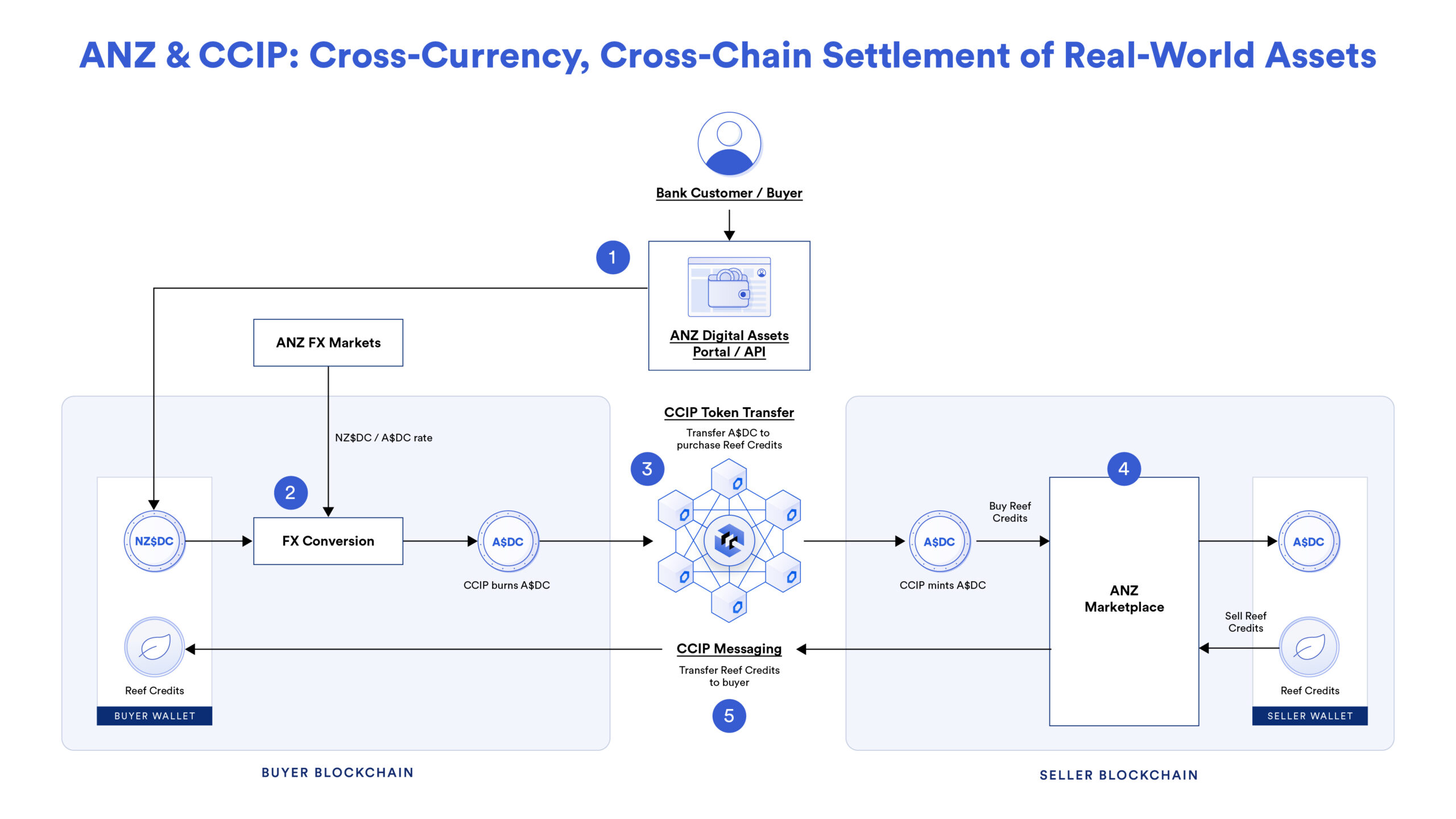

ANZ Bank: Cross-Chain Settlement of Tokenized Assets Using CCIP

ANZ Bank demonstrated an advanced Delivery vs Payment use case leveraging Chainlink CCIP and multiple blockchains. ANZ issued two stablecoins backed by the Australian dollar and the New Zealand dollar. Using CCIP, ANZ was able to demonstrate a cross-border, cross-currency, and cross-chain purchase of a tokenized asset using ANZ stablecoins.

Links to the case study and ANZ Bank discussing the solution at SmartCon 2023.

SBI Digital Markets Adopts Chainlink as Exclusive Infrastructure Solution to Power Its Digital Assets Platform

SBI Digital Markets (SBIDM)—the digital asset arm of Japan’s SBI Group, which oversees more than ¥10 trillion in assets—is adopting Chainlink as its exclusive infrastructure solution to power its end-to-end digital assets platform.

Through this strategic partnership, SBIDM is integrating Chainlink CCIP as its exclusive interoperability solution, enabling its expanding pipeline of tokenized assets to be transferred securely across public and private chains. By leveraging CCIP Private Transactions, SBIDM prevents third parties from accessing private data, including amounts, counterparty details, and more.

Powered by Chainlink, SBIDM is evolving from a tokenized asset issuance and distribution platform into a comprehensive digital asset hub that offers the full end-to-end lifecycle its customers require, including the compliant issuance, purchase, settlement, and secondary trading with tokenized cash across jurisdictions.

Together, Chainlink and SBIDM are accelerating the expansion of onchain finance across Asia and Europe.

SBI Group and Chainlink Announce Strategic Partnership To Accelerate Institutional Digital Asset Adoption In Key Global Markets

SBI Group (SBI), one of Japan’s largest financial conglomerates with the USD equivalent of over $200 billion in total assets, and Chainlink, announced a strategic partnership focused on accelerating blockchain and digital asset adoption across global markets. This strategic partnership combines SBI’s deep market expertise with Chainlink’s secure and reliable infrastructure for data and interoperability.

SBI and Chainlink’s strategic partnership focuses on a number of key use cases for financial institutions in Japan and the APAC region. This includes enabling cross-chain tokenized real-world assets, such as real estate and bonds, utilising Chainlink’s Cross-Chain Interoperability Protocol (CCIP). CCIP and Chainlink SmartData will also be leveraged to bring net asset value (NAV) data onchain for tokenized funds, which helps to unlock liquidity and improve operational efficiency. The partnership will also focus on facilitating payment versus payment (PvP) for FX and cross-border transactions using Chainlink CCIP, whilst also leveraging Chainlink Proof of Reserve to provide transparent onchain verifications of the reserves backing stablecoins.

“Chainlink is a natural partner for SBI complementing our financial footprint with their market leading interoperability and reliability onchain. With our combined strengths, we are delighted to be working together on developing groundbreaking, secure, compliance-focused solutions, including powering compliant cross-border transactions using stablecoins, that accelerate the widespread adoption of digital assets in Japan and the region.”— Yoshitaka Kitao, Representative Director, Chairman, President & CEO of SBI Holdings

Emirates NBD: The ~$260B AUM Banking Group in the MENAT Region Welcomes Chainlink to Digital Asset Lab

Following the signing of a Memorandum of Understanding at Abu Dhabi Finance Week, Emirates NBD welcomed Chainlink as a new council member alongside other founding members including PwC, Fireblocks, R3, and Chainalysis. The Digital Asset Lab was launched in May 2023 at the Dubai FinTech Summit, to accelerate digital asset and financial services innovation in the UAE. Chainlink’s membership will play a key role in advancing the Digital Asset Lab’s mission to create innovative solutions in digital finance.

“We are proud to partner with Chainlink and welcome them to Emirates NBD’s Digital Asset Lab as a council member. As a key platform for our innovation strategy, the Digital Asset Lab enables us to pioneer next-generation solutions for our customers. With Chainlink Labs’ expertise in onchain finance, we are confident this partnership will drive new advancements in tokenisation and digital asset management, reinforcing Emirates NBD’s position as a regional leader in financial innovation.”—Miguel Rio Tinto, Group Chief Digital and Information Officer at Emirates NBD

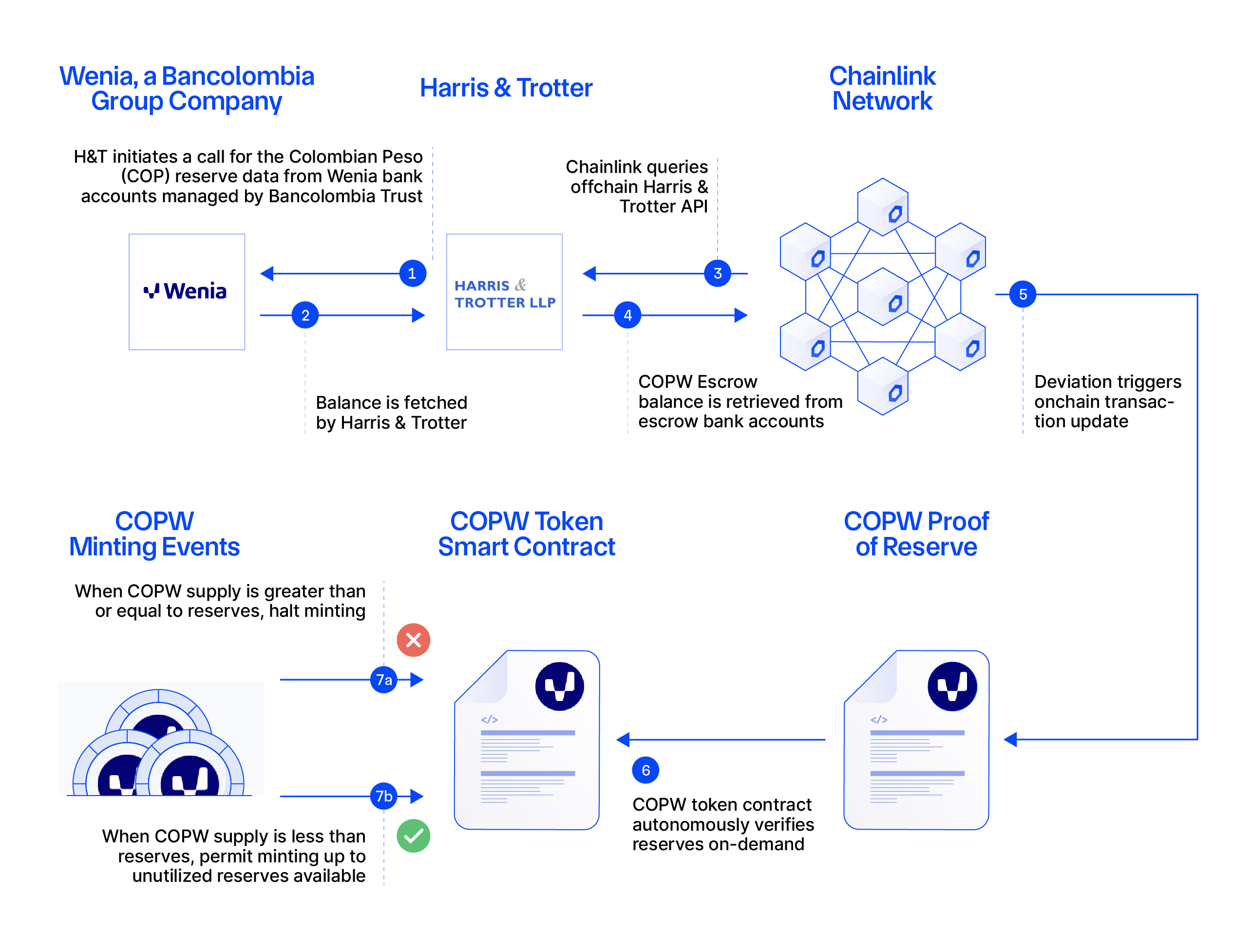

Bancolombia Group’s Wenia Taps Chainlink To Increase Transparency of Its Stablecoin

Wenia—the digital asset company from the Bancolombia Group, one of the largest financial conglomerates in Latin America—is using Chainlink Proof of Reserve to bring end-to-end transparency to the Colombian Peso reserves backing its COPW stablecoin. Proof of Reserve is integrated directly into the stablecoin’s minting function, helping to protect users against the risk of infinite mint attacks where additional COPW is issued without sufficient available reserves.

EXCHANGES AND TRADING VENUES

Coinbase Selects Chainlink CCIP as Its Exclusive Interoperability Provider for All Coinbase Wrapped Assets

Coinbase has selected Chainlink CCIP as the exclusive cross-chain infrastructure for all Coinbase Wrapped Assets, including cbETH, cbBTC, cbDOGE, cbLTC, cbADA, and cbXRP. With a combined market cap of ~$7B, these assets will use CCIP to expand across blockchain ecosystems in a highly secure, reliable, and compliant manner. The integration further establishes CCIP as the preferred interoperability solution for leading exchanges and financial institutions.

“We chose Chainlink because they are an industry leader for cross-chain connectivity. Their infrastructure provides a reliable means to expand Coinbase Wrapped Asset offerings.”— Josh Leavitt, Senior Director, Product Management at Coinbase.

FTSE Russell Publishes Global Indices Onchain for the First Time with Chainlink DataLink

FTSE Russell, a leading global index provider with over $18 trillion in assets benchmarked, is now publishing its world-leading indices onchain via DataLink—an institutional-grade data publishing service powered by Chainlink. This integration brings trusted benchmarks like the Russell 1000, Russell 2000, Russell 3000, FTSE 100, WMR FX benchmarks, FTSE DAR Digital Asset Prices, and the FTSE Digital Asset Index to more than 40 public and private blockchains.

By leveraging Chainlink’s industry-standard oracle platform, FTSE Russell is able to seamlessly deliver high-quality, institutionally adopted benchmarks onchain without the need to build or maintain custom infrastructure. DataLink provides the foundation for new onchain markets and financial products to be built on the same trusted data that underpins traditional finance.

Bringing these indices onchain accelerates the adoption of digital assets by enabling financial institutions to access the same data they already rely on today, while also unlocking new possibilities for real-time transparency, automated asset creation, and DeFi integration.

S&P Global Ratings and Chainlink Partnership Brings S&P’s Stablecoin Stability Assessments Onchain

S&P Global Ratings, the world’s leading provider of credit ratings, benchmarks, and analytics, in partnership with Chainlink, launched an initiative to publish S&P Global Ratings’ Stablecoin Stability Assessments (SSAs) onchain via DataLink—an institutional-grade data publishing service powered by the Chainlink data standard.

This partnership marks a major milestone in bridging traditional financial risk analysis with DeFi, making S&P Global Ratings’ independent and data-driven stablecoin assessments directly accessible to DeFi protocols and smart contracts for the first time. This data provides institutions and DeFi protocols with critical information to evaluate a stablecoin’s ability to maintain a stable value relative to its pegged fiat currency, enhancing risk management operations.

“The launch of SSAs onchain through Chainlink underscores our commitment to meeting our clients where they are. By making our SSAs available on-chain through Chainlink’s proven oracle infrastructure, we’re enabling market participants to access our assessments seamlessly using their existing DeFi infrastructure, enhancing transparency and informed decision-making across the DeFi landscape.”—Chuck Mounts, Chief DeFi Officer, S&P Global

Chainlink and Intercontinental Exchange (ICE) Partner To Bring High-Quality Forex and Precious Metals Data Onchain

Intercontinental Exchange (ICE) and Chainlink are now bringing high-quality forex and precious metals data onchain. FX and precious metals rates from ICE’s consolidated feed are now available to 2,000+ applications, leading banks, asset managers, and infrastructures in the Chainlink ecosystem.

ICE is a global financial powerhouse that operates markets, clearing houses, and data services critical to the functioning of the world’s economy, such as the New York Stock Exchange. Its FX rates and precious metals prices are relied on by world-leading banks, asset managers, and other institutions.

The inclusion of ICE’s consolidated feeds, as one of multiple high-quality data providers supporting Chainlink Data Streams, further enhances Chainlink’s data standard. Supplying DeFi applications with access to tamper-resistant data enables an onchain experience that meets the rigorous requirements of traditional capital markets and unlocks a new class of institutional-grade applications.

“With content from over 300 global exchanges and marketplaces, the ICE Consolidated Feed offers trusted, structured multi-asset class data to banks, asset managers and ISVs located around the world. We’re happy to work with Chainlink to securely and reliably provide data for onchain markets, which is an important step in growing the global blockchain economy.”—Maurisa Baumann, Global Data Delivery Platforms, ICE VP

Increasing the reliability of onchain markets by connecting ICE’s data to the Chainlink data standard marks a significant milestone on the pathway towards the mainstream adoption of onchain finance.

Tradeweb Publishes U.S. Treasury Benchmark Data Onchain for the First Time Via DataLink

Tradeweb is now publishing its FTSE U.S. Treasury Benchmark Closing Prices onchain for the first time using Chainlink DataLink, bringing real-world financial data from one of the world’s largest electronic marketplaces into the onchain economy.

Tradeweb offers over 50 products in more than 85 countries across the globe, with an average daily volume of $2.4 trillion. More than 3,000 clients connect to Tradeweb to form a global network of the world’s largest banks, asset managers, hedge funds, insurance companies, wealth managers, and retail clients.

DataLink is now making Tradeweb’s FTSE U.S. Treasury Benchmark Closing Prices available to 2,000+ onchain applications across 60+ public & private blockchains in the Chainlink ecosystem, driving a new wave of tokenization by established institutions and onchain innovators alike.

“Tokenization represents one of the fastest-growing opportunities in our markets today, and our collaboration with Chainlink is a significant step forward in modernizing traditional financial markets through blockchain applications. By making our Tradeweb FTSE U.S. Treasury Benchmark Closing Prices available onchain, we aim to unlock new opportunities for innovation and 24/7 access across the global financial ecosystem.”—Chris Bruner, Chief Product Officer at Tradeweb

As an institutional-grade data publishing service, DataLink leverages Chainlink infrastructure to enable providers to seamlessly distribute and commercialize their data onchain, while retaining full control and eliminating the need to build and maintain blockchain infrastructure.

Ultimately, DataLink brings foundational institutional use cases to the blockchain economy while enabling onchain applications to launch new assets and markets faster.

Deutsche Börse Group Forms Strategic Partnership With Chainlink To Publish Market Data Onchain Via DataLink

Deutsche Börse Group’s Market Data + Services, a business unit of Deutsche Börse Group, has formed a strategic partnership with Chainlink to bring its multi-asset class market data to blockchains for the first time. Real-time data from the largest exchanges in Europe, Deutsche Börse Group’s Eurex, Xetra, 360T, and Tradegate—trading venues covering equities, derivatives, forex instruments, and more—are being made available across blockchains via DataLink, a new institutional-grade data publishing service powered by Chainlink.

With DataLink, more than 2,400+ DeFi protocols across 40+ public and private blockchains in the Chainlink ecosystem can access data from Deutsche Börse Group, unlocking new opportunities for financial products and services backed by the high-quality data powering traditional finance.

“Partnering with Chainlink to publish Deutsche Börse Group’s trusted market data onchain for the first time marks a major milestone in connecting traditional and blockchain-based financial markets. By making data from Xetra, Eurex, 360T, and Tradegate accessible onchain through the Chainlink data standard, we are empowering global financial institutions to build the next generation of regulated financial products on the same high-quality data that underpins today’s markets.”—Dr. Alireza Dorfard, Managing Director, Head of Market Data + Services at Deutsche Börse Group.

S&P Dow Jones Indices and Dinari Select Chainlink As Official Oracle Provider to Power the S&P Digital Markets 50 Index

S&P Dow Jones Indices and Dinari have selected Chainlink as the official oracle provider for the S&P Digital Markets 50 Index to power official index values and live token prices for its multi-asset benchmark.

The index is the first tokenized benchmark that combines U.S. equities and digital assets, creating a new category of investable products that bridge traditional and blockchain-based markets. Chainlink will deliver real-time pricing data and verified index values to DeFi platforms that support the S&P Digital Markets 50, enabling broader access to institutional-grade index exposure through tokenized assets.

The integration on Avalanche includes Chainlink Price Feeds and SmartData, encompassing services such as Proof of Reserve, NAVLink, and SmartAUM, with plans to incorporate additional Chainlink capabilities like Data Feeds and the Automated Compliance Engine (ACE).

BX Digital and BX Swiss, Part of Boerse Stuttgart Group, Partner With Chainlink To Bring Pricing Data Onchain

BX Digital and BX Swiss partnered with Chainlink to bring critical pricing data for Swiss-based equities onchain. BX Digital is a sister company of the Swiss exchange BX Swiss—both are part of Boerse Stuttgart Group, one of the largest exchange groups in Europe. By leveraging the Chainlink standard, BX Digital ensures securities market data price is accurately reported onchain in a manner that is decentralized, verifiable, and secure. This will allow both issuers and investors to rely on the accuracy and integrity of the data, increasing the efficiency and security of digital asset trading.

“We believe that the Chainlink standard for verifiable data plays a crucial role in accelerating both the pace and security of asset tokenization, secondary market trading, and settlement.”—Andreas Ruflin, Chief Digital Officer at BX Digital

PAYMENT NETWORKS

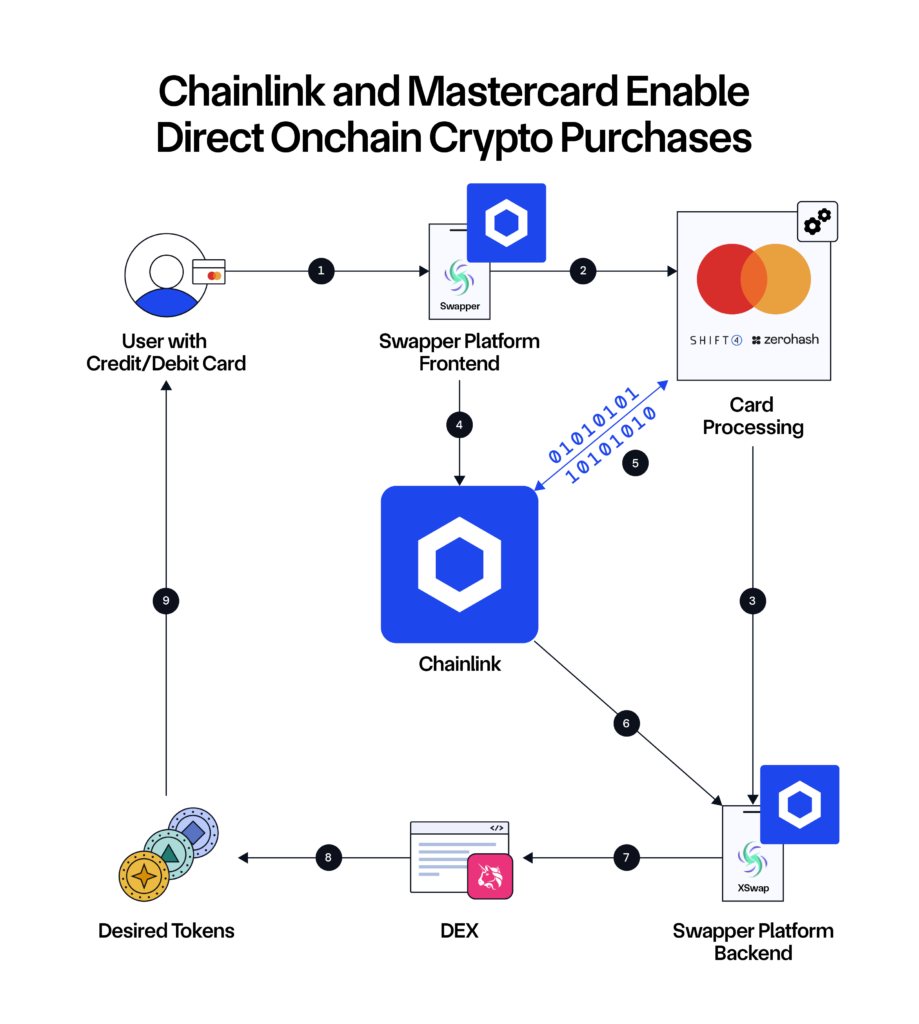

Mastercard and Chainlink Partner to Enable Over 3 Billion Cardholders to Purchase Crypto Directly Onchain

Mastercard and Chainlink have partnered to allow over 3 billion payment cardholders to purchase crypto assets directly onchain via the new Chainlink-powered Swapper app, creating a unified, compliant, and intuitive user experience that brings crypto access to mainstream payment cardholders.

Mastercard’s global payments technology and Chainlink’s secure interoperability infrastructure remove barriers that have historically kept mainstream users away from crypto, marking a major step forward in secure, compliant, and reliable access to the onchain economy for the large traditional cardholder user base.

“In coming together with Chainlink, we’re unlocking a secure and innovative way to revolutionize onchain commerce and drive the broader adoption of crypto assets.”—Raj Dhamodharan, Executive Vice President, Blockchain & Digital Assets at Mastercard