Chainlink Product Update: Q2 2024

The fastest-growing trend in the blockchain industry is the tokenization of financial assets (e.g., securities, funds) and physical assets (e.g., cash, gold). Tokenized assets are a focal point of both DeFi and TradFi, with DeFi onboarding tokenized assets to increase liquidity and diversify yield, while financial institutions are adopting tokenization to bring finance into a new digital era. Chainlink is at the forefront of asset tokenization, already working with issuers like Paxos and 21Shares, as well as major financial institutions such as Swift, DTCC, ANZ, and most recently with Fidelity International and Sygnum, on how to use CCIP and other Chainlink services to unlock use cases for tokenized assets. These use cases showcase the unique power of Chainlink to provide data, compute, interoperability, and blockchain abstraction services as part of a single, secure platform offering.

In Q2, we doubled down on our commitment to unlocking tokenization at scale through various product innovations. Notable highlights include the launch of the Chainlink Digital Assets Sandbox—the first in a series of turnkey solutions designed by Chainlink Labs to accelerate digital asset innovation within financial institutions; the introduction of Chainlink-powered Net Asset Value (NAV) solutions for DTCC and Sygnum and Fidelity International; Aave’s integration of CCIP to make its GHO stablecoin cross-chain enabled, and more. These initiatives are just the beginning of our growing efforts to transform how the global financial system fundamentally operates, bringing increased transparency, security, efficiency, and control to businesses and consumers worldwide.

The following product update will examine the progress made since the Q1 2024 update and provide insight into future developments. In an upcoming YouTube video, we’ll discuss some of the Product Update highlights.

Please note that all future-facing comments are subject to change based on user feedback, shifts in consumer demand, strategic determination, and various other unforeseen challenges and opportunities. The goal of this product update is to provide insight into previous releases and current thinking based on ongoing research and development, but it is not a definitive product roadmap; it’s an attempt to balance transparency with the need to remain agile in this dynamic industry, which moves fast and is constantly evolving.

Banking and Capital Markets Solutions

Recent Deployments

- The Depository Trust & Clearing Corporation (DTCC)—the world’s largest securities clearinghouse—announced the launch of Smart NAV to showcase how the Chainlink platform could automate and streamline the dissemination of net asset value (NAV) data and enable new use cases in fund tokenization. Participating firms include American Century Investments, BNY Mellon, Edward Jones, Franklin Templeton, Invesco, JP Morgan, MFS Investment Management, Mid Atlantic Trust d/b/a American Trust Custody, State Street, and U.S. Bank. Smart NAV validates Chainlink’s abstraction layer capabilities, where DTCC systems integrate to a single CCIP endpoint, which can then relay the data to virtually any destination blockchain.

- Fidelity International and Sygnum entered into a collaboration with Chainlink Labs to bring NAV data onchain for Fidelity International’s $6.9 billion Institutional Liquidity Fund. The collaboration provides unparalleled transparency and accessibility around key asset data for Sygnum’s recently issued onchain representation of Fidelity International’s Institutional Liquidity Fund. Sygnum, a global digital asset banking group, tokenized $50 million of Matter Labs’ company treasury reserves (held in Fidelity’s International money market fund) and issued it as a token on the ZKsync blockchain (a Chainlink Scale partner).

- Launched the Chainlink Digital Assets Sandbox—a blockchain-agnostic environment for business innovation that enables financial institutions to rapidly conduct tokenization trials and collaborative PoCs using Chainlink services within days instead of months. The sandbox provides a preconfigured business environment—featuring pre-built use cases, sample application workflows, and user interfaces—that enables Product and Digital Assets teams to quickly experiment with tokenized assets with full utility, as well as internally explore or demonstrate the potential of their digital asset vision.

What’s Next

- Continue adding more use cases and workflows to the Digital Assets Sandbox and developing more turnkey environments for financial institutions to test and develop tokenized assets and other financial services use cases involving blockchain technologies and Chainlink services.

- Continue making progress towards the Blockchain Abstraction Layer (BAL) to empower financial institutions to leverage blockchain technology and Chainlink services for various use cases and operations without the need for direct interaction with complex blockchain primitives and infrastructure interoperability challenges.

- Enable the tokenization of physical and financial real-world assets through Proof of Reserve, NAV, Collateral Feeds, and Price Feeds.

- Develop a comprehensive certification system designed to train developers in capital markets, specifically focusing on helping ramp up banking and capital markets developers in their use and expertise with blockchain technology. These certifications will serve as a valuable resource for potential banking and capital market partners, providing them with insights and solutions for exploring and integrating Chainlink into their onchain operations.

Cross-Chain

Recent Deployments

- Aave, the largest DeFi lending market by TVL, integrated CCIP into the decentralized stablecoin GHO to enable native cross-chain transfers between Ethereum and Arbitrum. Over time, GHO will become accessible on more blockchains, as determined by the Aave community. Users can bridge GHO via CCIP today on transporter.io.

- Integrated support for the Celo and Mode blockchains into CCIP, with CCIP serving as their canonical cross-chain infrastructure. These CCIP integrations enable non-native tokens (i.e., tokens natively issued on another blockchain) to be bridged into these blockchain ecosystems, ultimately accelerating their growth. Learn more in the blog: How Blockchains Are Using Chainlink CCIP to Power Their Canonical Token Bridge.

- Integrated support for the Gnosis blockchain, expanding the blockchains supported by CCIP.

- Added 20 new tokens and three blockchains to Transporter. This includes the Celo, Gnosis, and Mode blockchains and the following tokens: GHO, BETS, BMX, Bridged mwBETH, DEXTF, DIP, DLCBTC, DPI, dsETH, hyETH, mDLP, MVI, mwBETH, REG, SDY, stTAO, TRUF, WECO, WSDM, and ZUN.

- Launched test.transporter.io for developers and end-users to send testnet transactions and demo the app without incurring mainnet gas costs.

What’s Next

- Launch CCIP v1.5 on mainnet upon completing a series of audits and testing, including the recently announced competitive Codehawks audit contest. CCIP v1.5 will enable token issuers to integrate their tokens with CCIP in an entirely self-serve manner, while also being able to take ownership of token pool contracts and customize implementation logic (e.g., rate limits). CCIP v1.5 will also make it possible for CCIP to support EVM-compatible zkRollups.

- Launch the CCIP Widget UI and SDK, a set of user-friendly frontend components featuring a customizable pre-built UI that simplifies CCIP integration. This makes it easier for developers to integrate CCIP into their dApps quickly.

- Extend the CCIP Local Simulator to all of the other Chainlink services, turning it into a generalized Chainlink Local Simulator.

- Expand CCIP to more blockchains, increase the list of supported tokens, and open up new lanes between chains.

- Add new features to Transporter, including transaction and wallet enhancements that improve the user experience.

Data

Recent Deployments

- Launched Chainlink’s low-latency Data Streams on Avalanche mainnet in collaboration with GMX. Data Streams now powers GMX V2 on both Arbitrum and Avalanche and has already helped secure $50B in trading volume for its decentralized perps markets.

- Launched Data Feeds on Starknet mainnet to give their blockchain developers access to the industry standard source of offchain data to power smart contract applications.

- DLC.Link integrated Chainlink Proof of Reserve to help secure the minting of dlcBTC—a non-custodial wrapped Bitcoin—and enhance transparency around its reserves. The protocol also integrated CCIP to enable cross-chain transfers of dlcBTC.

- Expanded Data Streams’ support to 24 different token markets, each updating in sub-second intervals and available across multiple blockchains.

- Furthered the adoption of liquid staking and liquid restaking assets and protocols with Chainlink Data Feeds by launching new Exchange Rate Feeds, establishing Chainlink as the essential composability layer for LSTfi and LRTFi.

What’s Next

- Continue work with the lending community on developing a hybrid exchange rate oracle for pricing LSTs, which optimizes for security and scalability.

- Rapidly expand the number of markets supported by Data Streams, including real-world assets and assets that trade primarily on DEXs.

- Expand Data Streams to additional blockchains and continue to onboard more protocols on mainnet, with a focus on economically sustainable revenue share agreements.

Compute

Recent Deployments

- Launched Chainlink Functions on Base mainnet and testnet. Base developers can now leverage Chainlink Functions within their applications for on-demand data and computing.

- Launched Chainlink VRF v2.5, the next iteration of the most widely adopted onchain random number generator (RNG) in Web3 across all supported networks. VRF v2.5 includes low-friction billing, more predictable pricing, and seamless upgradability

- Launched Chainlink Automation on Gnosis mainnet and testnet.

- Performed technical upgrades on Automation’s UX, enabling fine-grained control over spending during peak gas spikes.

- Improved the Functions UX by enabling more compute time, more memory, and larger callback gas available on request.

- Surpassed 1,750,000 upkeeps performed by Chainlink Automation.

- Integrated Chainlink Automation, Functions, and VRF on the Polygon Amoy testnet.

What’s Next

- Enhance the Automation user experience with simplified billing and gas controls, as well as expand its reach to more chains.

- Expand VRF and Functions to additional Layer-2 networks.

- Extend the compute vision of Functions by progressively enabling more direct customizability for the user, adding more developer frameworks (e.g., Foundry), and adding external libraries and QuickStarts.

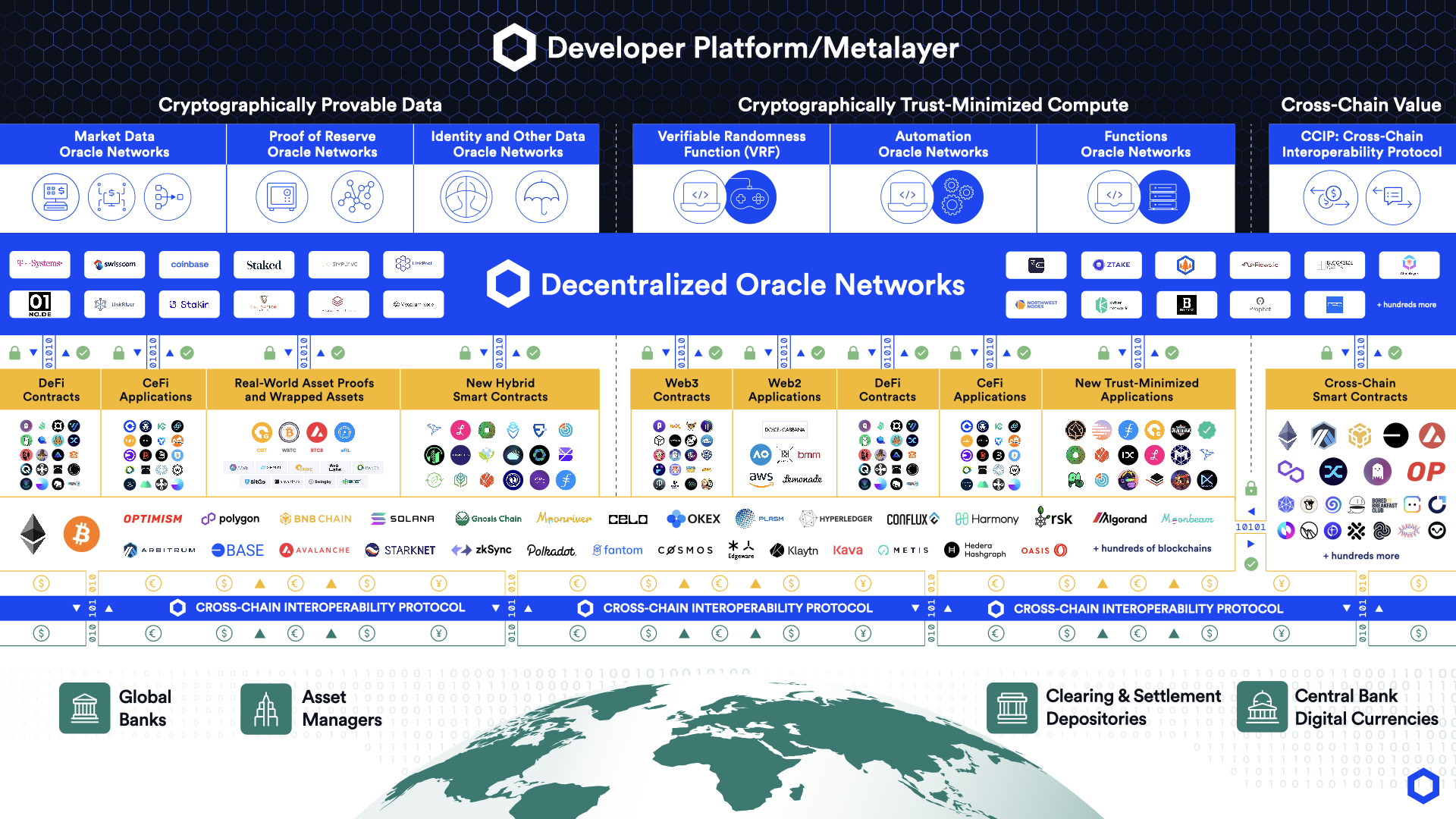

Chainlink Platform

We have been accelerating our work around re-inventing the foundation and technology underpinning the Chainlink platform, with the goal of meeting the rapidly evolving needs of developers in the capital markets, tokenization, and DeFi. Key focus areas for the Chainlink Platform include:

- Chainlink Everywhere: Enable Chainlink service to be readily available across not just tens but hundreds of blockchains and app chains.

- Developers First: Empower developers to build custom workflows utilizing all of the Chainlink infrastructure capabilities in a flexible and self-serve manner.

- Efficiency Gains: Make Chainlink Decentralized Oracle Networks (DONs) more efficient, sustainable, and faster in supporting new product releases.

Developer Community

Recent Highlights

- Launched Faucets 2.0 at EthCC, a new and improved user interface that makes it faster and easier to get testnet funds as well as more types of testnet funds.

- Completed the Chainlink Block Magic Hackathon, which saw nearly 400 submissions across various use cases such as finance, gaming, consumer apps, cross-chain, and AI. Notably, the Block Magic Hackathon doubled its participation in China compared to the last hackathon.

- Executed a 10-day Chainlink Bootcamp in English, Spanish, Portuguese, Chinese, and Turkish. Developers can now access these bootcamp on demand via the hyperlinks.

- Participated in various Web3 events and developer conferences, including ETHGlobal Sydney, ETHBelgrade, GMVietnam, ETHDubai, and ETHBerlin.

- As part of our Web2 strategy, we participated in React Summit and JS Nation in Amsterdam, where we gave talks and held a workshop to help Web2 developers learn how to build in Web3.

- CCIP was the most used cross-chain protocol on testnets in Q2 across the blockchain ecosystem, with active CCIP developers peaking at over 1,200+ in May.

What’s Next

- Complete the native Chinese blockchain developer course mentioned in the Q1 Product Update.

- Continue educating non-crypto developers about Chainlink and blockchain by attending non-crypto tech events, conferences, hackathons, and workshops. Some of our upcoming developer activations include hosting the first-ever CCIP Bootcamp in English and Mandarin, as well as a Tokenization Bootcamp and Chainlink Bootcamp.

To learn more about Chainlink, visit chain.link, subscribe to the Chainlink newsletter, and follow Chainlink on Twitter, YouTube, and Reddit.