Introducing The Chainlink DeFi Yield Index (CDY Index)

Decentralized finance (DeFi) lending has become a premier smart contract use case, with ~$47B in total value locked across hundreds of DeFi lending protocols as of January 2025. As DeFi becomes more robust and increased activity results in more attractive yields, traditional financial institutions need to evaluate onchain investment opportunities. However, in order to do so effectively, they require a clear and reliable window into the opportunities presented by the DeFi ecosystem.

We’re excited to introduce the Chainlink DeFi Yield Index (CDY Index)—a new data product that uses the Chainlink standard to aggregate market-wide DeFi lending rates. Leveraging Space and Time’s blockchain indexer and database technology to prepare real-time chain activity for the calculation process, the CDY Index is designed with a focus on accuracy, robustness, and market representativeness. This enhances the discoverability of onchain lending opportunities and improves capital efficiency and liquidity.

Access the Chainlink DeFi Yield Index fact sheet here.

The Necessity of a DeFi Yield Index

DeFi protocols heavily rely on asset pricing information: If a user wants to borrow or lend assets, the protocol must first accurately determine the value of the debt and collateral. Chainlink Price Feeds play a critical role in DeFi lending as protocols rely on accurate prices to value collateral, liquidate loans, calculate interest rates, and manage risk and capital efficiency.

The intense focus on data quality and oracle infrastructure security has led to Chainlink Price Feeds becoming the most time-tested and widely used price oracle solution across the DeFi economy, making it the standard for onchain data. Nearly all major lending protocols, including Aave and Compound, use Chainlink Price Feeds to support their functionality.

While traditional finance has established indexes that reflect macroeconomic activity, DeFi has yet to create such aggregated data sources. DeFi does not have a definitive base rate directly analogous to the federal funds rate in traditional markets, as one rate in DeFi does not unilaterally impact all other rates. In addition, it’s difficult to aggregate DeFi yields since protocols constantly evolve and the categories of protocols are diverse, making strategies that offer yield (and the determining factors of these yields) vary widely.

Constructing a DeFi yield index requires knowledge of what drives rates on protocols and expertise in accurately aggregating rates in a way that is representative of the lending market. With a proven history of security and reliability in any market and network environment, Chainlink is substantially qualified to construct an aggregate market-wide DeFi lending yield index because the Chainlink standard is deeply embedded in DeFi, and Chainlink’s decentralized data aggregation methodologies have proven to be accurate and robust.

The Chainlink DeFi Yield Index (CDY Index)

The Chainlink DeFi Yield Index is designed to aggregate DeFi lending yields using Chainlink decentralized oracle networks. By promoting the discoverability of onchain yield opportunities on lending protocols, the CDY Index is intended to enhance capital efficiency in DeFi lending.

The CDY Index integrates robust principles of responsibility segregation, with Chainlink serving as the Index Administrator and Space and Time as the Calculation Agent, to deliver a fair, accurate, and transparent index product.

“Chainlink has established itself as the standard for verifiable data across DeFi and the emerging onchain finance ecosystem, and Space and Time provides a transformative database solution that unlocks advanced Web3 use cases,” said Scott Dykstra, Co-Founder of Space and Time. “We’re excited to provide the indexing and database infrastructure to support the calculations for Chainlink DeFi Yield Indexes and enable financial institutions to capture more opportunities in the public blockchain ecosystem.”

The Chainlink DeFi Yield Index offers enhanced opportunities for a variety of market participants:

- Capital markets institutions can discover yield opportunities they had previously not considered. The CDY Index gives traditional financial institutions a window into DeFi and helps them evaluate new ways to earn yield, manage risk, create new investment products, and deploy capital more efficiently.

- DeFi protocols get a trusted index to increase market transparency and generate new investment solutions to enhance yield opportunities for DeFi and stablecoin users.

- Users and the ecosystem of DeFi lending protocols can benefit from the CDY Index as it brings transparency and liquidity to the market. The new inflows lead to deeper liquidity pools, reducing slippage and providing users with better access to loans or the ability to exit positions more efficiently. These benefits can attract more borrowers, leading to higher protocol revenues and potentially higher yields for liquidity providers.

Chainlink DeFi Yield Indexes are initially calculated for the largest, most liquid crypto markets, including:

- USDC

- USDT

- Wrapped BTC (WBTC)

- Wrapped ETH (WETH)

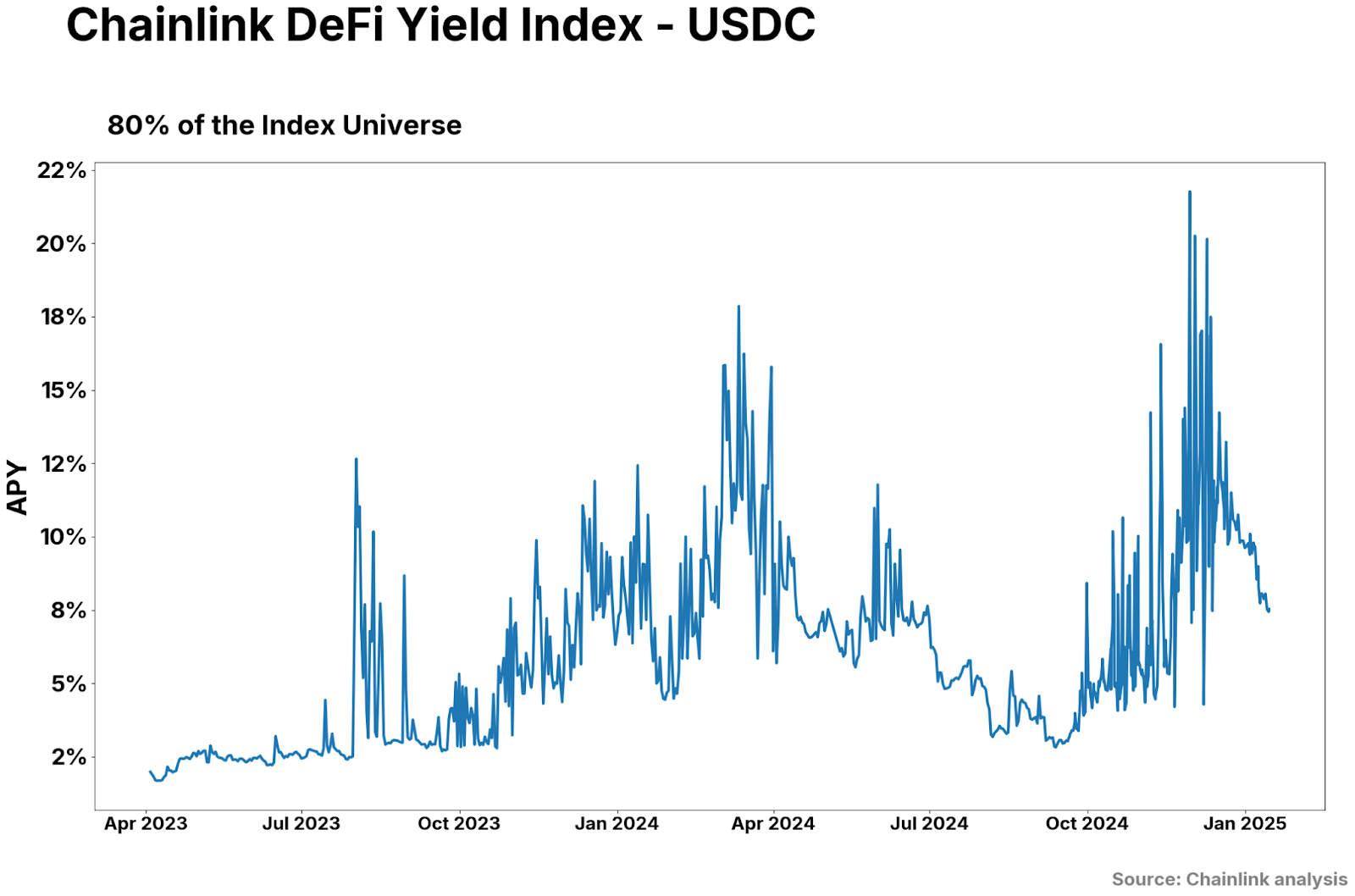

Below is an example of the CDY Index calculated for USDC lending rates.

If you’d like to read more about the methodology behind the CDY Index calculation, read the full research report.

Reach Out to Our Team

The CDY Index represents a pivotal point in DeFi lending, offering financial institutions and DeFi market participants access to an index that tracks and aggregates lending yields across DeFi markets in a robust and accurate manner—underpinned by the Chainlink standard’s time-tested, credibly neutral infrastructure.

To find out how your organization can benefit from the Chainlink DeFi Yield Index, reach out to our team.

Looking to understand the tokenization opportunity? This industry report provides a comprehensive overview of the growing tokenization market, with contributions from BCG, 21Shares, Paxos, Backed, and Chainlink. Access now.

This post is for informational purposes only and contains statements about the future. There can be no assurance that actual results will not differ materially from those expressed in these statements, although we believe them to be based on reasonable assumptions. Interactions with blockchain networks create risks, including risks caused by user input errors. All statements are valid only as of the date first posted. These statements may not reflect future developments due to user feedback or later events and we may not update this post in response.