The Chainlink Platform: A Single Secure Gateway for Stablecoin Issuers

Chainlink provides all of the key capabilities that stablecoins require in a single platform, making it easy for issuers to launch and grow stablecoins without introducing multiple dependencies. This enables banks and other stablecoin issuers to seamlessly and securely launch new stablecoins, which can expand their market and increases access to their services. All of this is possible while maintaining the high security standards that the finance industry demands.

In this post, we explore how world-leading financial institutions, stablecoin issuers, and standards bodies are working with Chainlink and the unique capabilities unlocked by the Chainlink platform.

World-Leading Banks, Infrastructure Providers, and Stablecoin Issuers Choose Chainlink

Chainlink is collaborating with some of the world’s largest financial institutions, including:

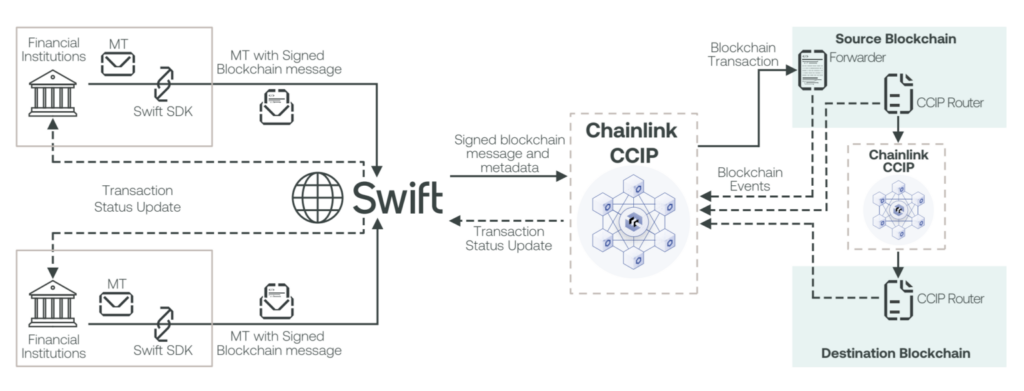

- Swift—Swift, the standard messaging network connecting 11K+ banks, collaborated with Chainlink and over 10 leading institutions—including Euroclear, Clearstream, BNP Paribas, BNY Mellon, and Citi—to successfully demonstrate a secure and scalable way to connect multiple blockchains.

- DTCC—The Depository Trust & Clearing Corporation (DTCC) is the world’s largest securities settlement system, processing $2+ quadrillion annually. It is actively working with Chainlink to bring capital markets onchain.

- ANZ Bank—Australia and New Zealand Banking Group Limited (ANZ), a leading Australian bank with \$1T+ in AUM, utilized Chainlink CCIP to demonstrate a cross-currency, cross-chain purchase of tokenized assets. They have also issued two stablecoins, A\$DC and NZ$DC, which are backed by the Australian dollar and New Zealand dollar respectively.

- Vodafone—Vodafone is exploring using CCIP to help power its global trade, Economy of Things platform.

Chainlink is also used by top Web3 teams, including Compound, GMX, Maker, and Synthetix, and has enabled over $9T in transaction value. Aave, Circle, Paxos, StablR, Raft, TrueUSD, and many more utilize the Chainlink platform to help power their stablecoins.

Seven Key Stablecoin Capabilities Unlocked By Chainlink

1. Bootstrap Liquidity

Many leading DeFi protocols will only accept a stablecoin if there is a Chainlink Price Feed (or Chainlink Data Stream) to deliver accurate, reliable, and tamper-proof price data regarding it onchain. Without Chainlink’s battle-tested service, their applications (and the funds held within them) would be vulnerable to market manipulation attacks and other exploits. Therefore, Chainlink Data Feeds is a prerequisite prior to DeFi protocols making stablecoins available in their dApps and thus broadly available throughout the onchain economy.

2. Unlock Programmability

Chainlink Data Feeds and Chainlink Functions can enrich stablecoins with real-world information, such as available yields, real-time prices, and ownership records. Chainlink Automation can then dynamically trigger preset stablecoin smart contract updates based on that offchain data—effectively making stablecoins a secure, programmable container of value and information. This increased utility ultimately translates to an increased demand for enriched stablecoins.

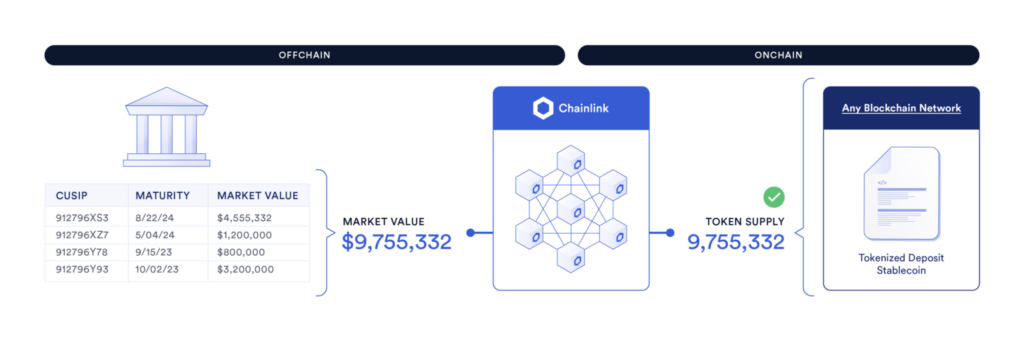

3. Establish User Confidence

Chainlink Proof of Reserve verifies valuations of the collateral backing stablecoins and publishes this information onchain. By providing end-users with additional guarantees about the reserves of your stablecoin, you can give them increased confidence in its collateralization, making them more likely to use it over other stablecoins.

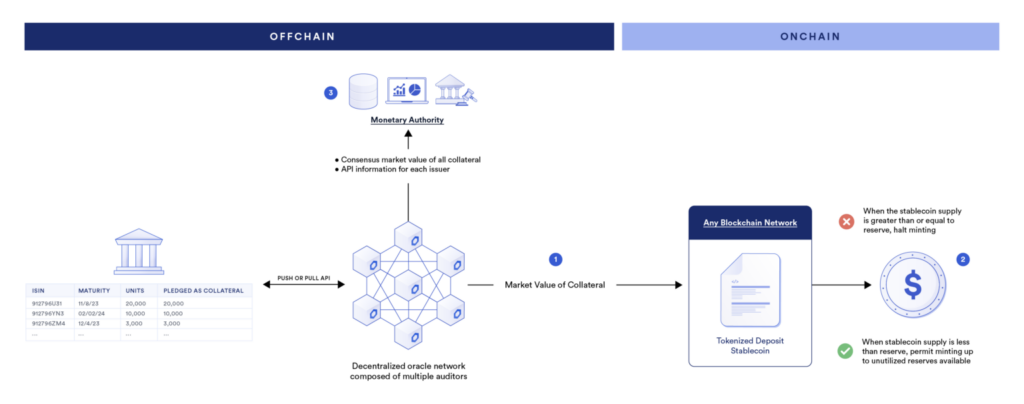

4. Prevent Malicious Minting

A circuit breaker halts or pauses certain activity in the event of unforeseen or unusual circumstances. Proof of Reserve can be used to trigger a circuit breaker that automatically prevents the stablecoin issuer solution from minting additional stablecoins when unusual activity is detected, such as collateral value falling below a given threshold. Additionally, other onchain applications can use these same Proof of Reserve feeds to create circuit breakers for their own protocol, which helps prevent malicious minting and mitigates the risk of accepting the stablecoin, ultimately leading to an increase in demand for the stablecoin as collateral.

5. Unleash Unified Cross-Chain Liquidity

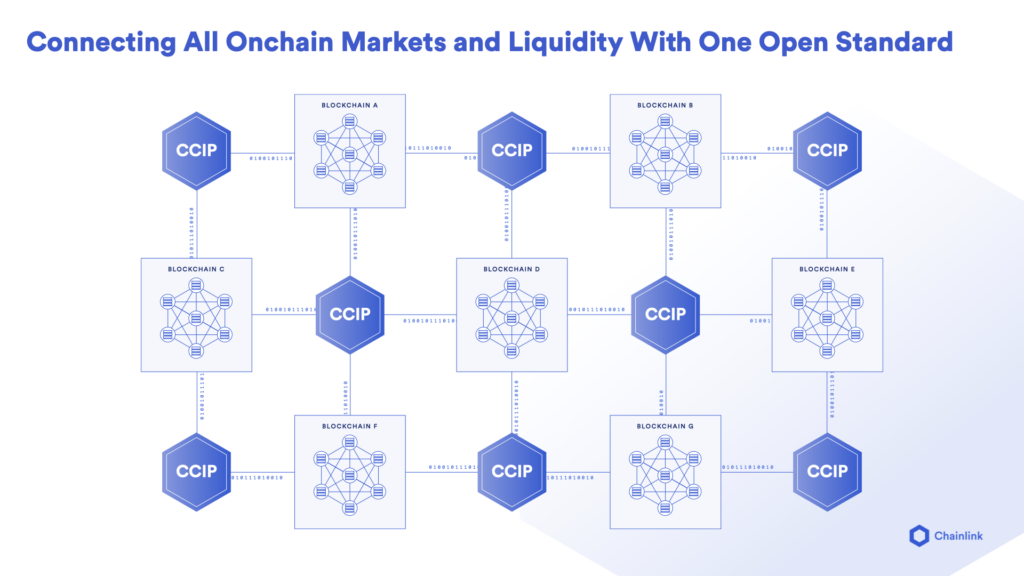

Banks, asset managers, and Web3 protocols are increasingly recognizing that liquidity will be fragmented across hundreds and potentially thousands of different blockchain networks. As the secure blockchain interoperability standard, Chainlink Cross-Chain Interoperability Protocol (CCIP) will be able to effectively unify liquidity across the global market by enabling the secure transfer of stablecoins between blockchains so that stablecoins can seamlessly move with demand and liquidity across the onchain economy. Backed by the Risk Management Network, a separate, independent network that continually monitors and validates the behavior of the primary CCIP network, CCIP is the only cross-chain solution to achieve the fifth and highest level of cross-chain security.

CCIP also supports Programmable Token Transfers, which enable stablecoins and instructions (tokens and messages) to be sent to a receiving cross-chain smart contract in a single transaction. This unlocks a wide range of advanced use cases for DeFi and capital markets.

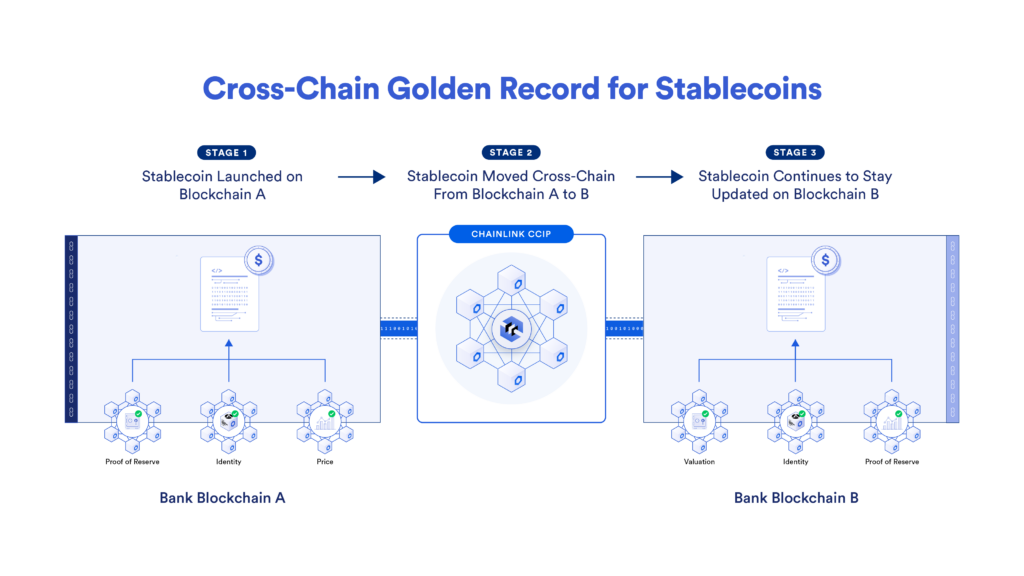

6. Preserve the Golden Record

Maintaining a golden record in the multi-chain economy requires not only offchain data on the initial chain and cross-chain connectivity, but continued access to real-world information regardless of which chain the stablecoin is transferred to. Chainlink can solve this problem because it provides complementary data and cross-chain services while maintaining the high-security guarantees required by banks and other institutions. CCIP gives stablecoin issuers and holders the assurance that a stablecoin’s golden onchain record will continue to be updated.

7. Build for a Changeable Future

The onchain economy is continuously evolving, with new networks launching frequently. With a single CCIP integration, underpinned by Chainlink’s blockchain-agnostic platform, stablecoin issuers can seamlessly reach many chains using their existing backend infrastructure. This safeguards against vendor lock-in and obsolescence and enables issuers to mint stablecoins on new chains quickly and easily as they emerge.

A Single, Secure Gateway For Stablecoin Issuers

The Chainlink platform is the onchain entry point for stablecoin issuers, providing them with the services needed to make their stablecoins programmable and overcome the key challenges of adoption, such as attracting liquidity and remaining compliant across various regulatory environments. Critically, Chainlink enables these capabilities, and many more, while maintaining the high level of security required by financial markets. These are just a few of the reasons that Stablecoin Standard, the industry body for stablecoin issuers, is collaborating with Chainlink Labs. A core component of this alliance will be to collaborate with industry leaders and to provide guidance and best practices for stablecoins and stablecoin issuers.

“Chainlink Labs will help us support stablecoin adoption and ensure best practices for stablecoin issuers around the globe.”—Christian Walker, Co-Founder, Stablecoin Standard

If you’d like to explore a stablecoin implementation, reach out to one of our experts. To learn more about how Chainlink can also support the tokenization of other real-world assets, check out How Chainlink Unlocks the Full Capabilities of Tokenization for Capital Markets.

Looking to understand the tokenization opportunity? This industry report provides a comprehensive overview of the growing tokenization market, with contributions from BCG, 21Shares, Paxos, Backed, and Chainlink. Access now.