Chainlink Payment Abstraction Is Now Live: SVR Fee Conversion and User Fee Staking Rewards

Update: The Chainlink Reserve is a new upgrade centered on the creation of a strategic onchain reserve of LINK tokens, powered by Payment Abstraction. Read more in the blog post Introducing the Chainlink Reserve.

—

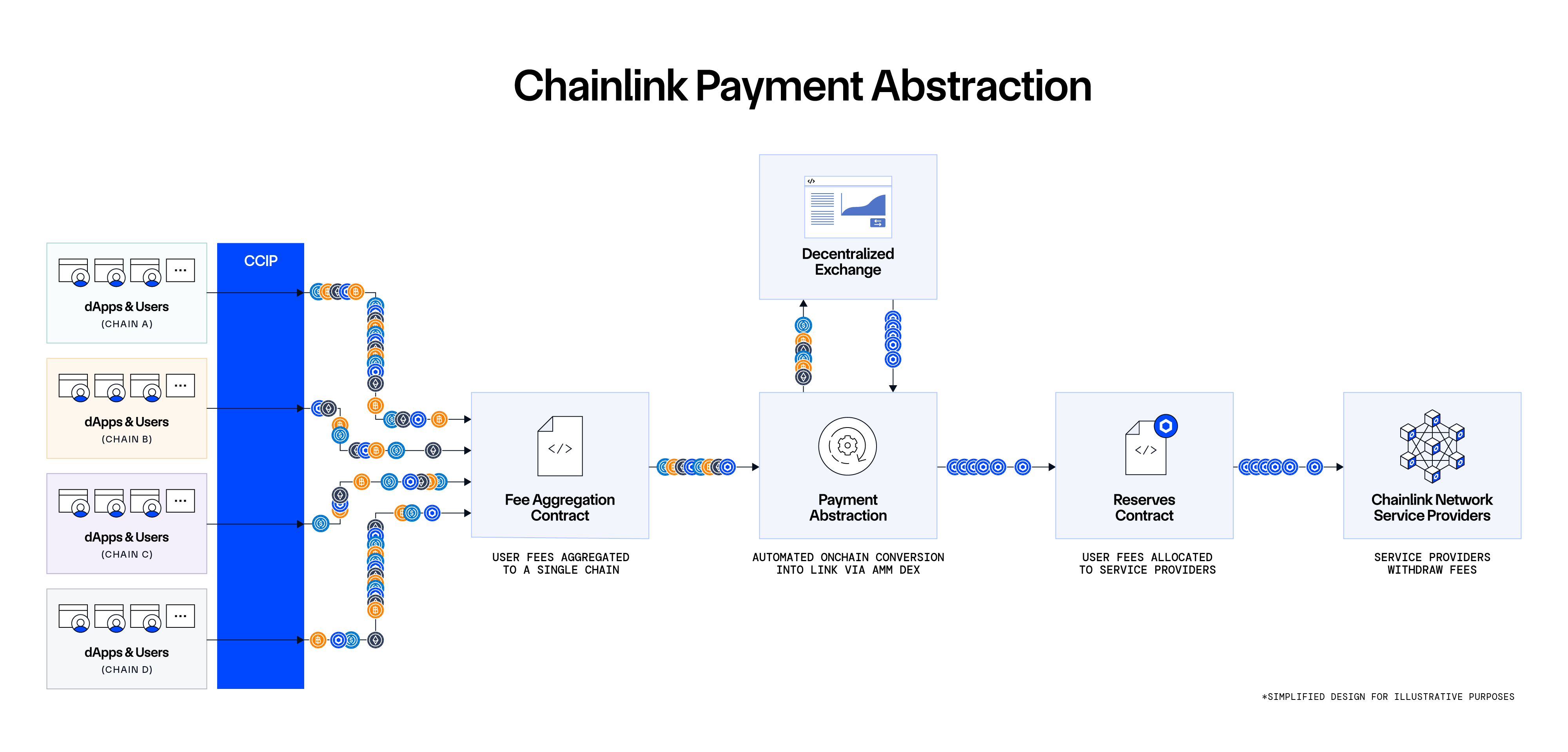

We’re excited to announce that Chainlink Payment Abstraction—a novel cross-chain-enabled payment system that significantly reduces payment friction within the Chainlink Network—is officially live on mainnet. Payment Abstraction enables users to pay for Chainlink Services in alternative assets (e.g., gas tokens and stablecoins), which are then automatically converted into LINK using a combination of Chainlink Automation, Price Feeds, CCIP, and a decentralized exchange (DEX).

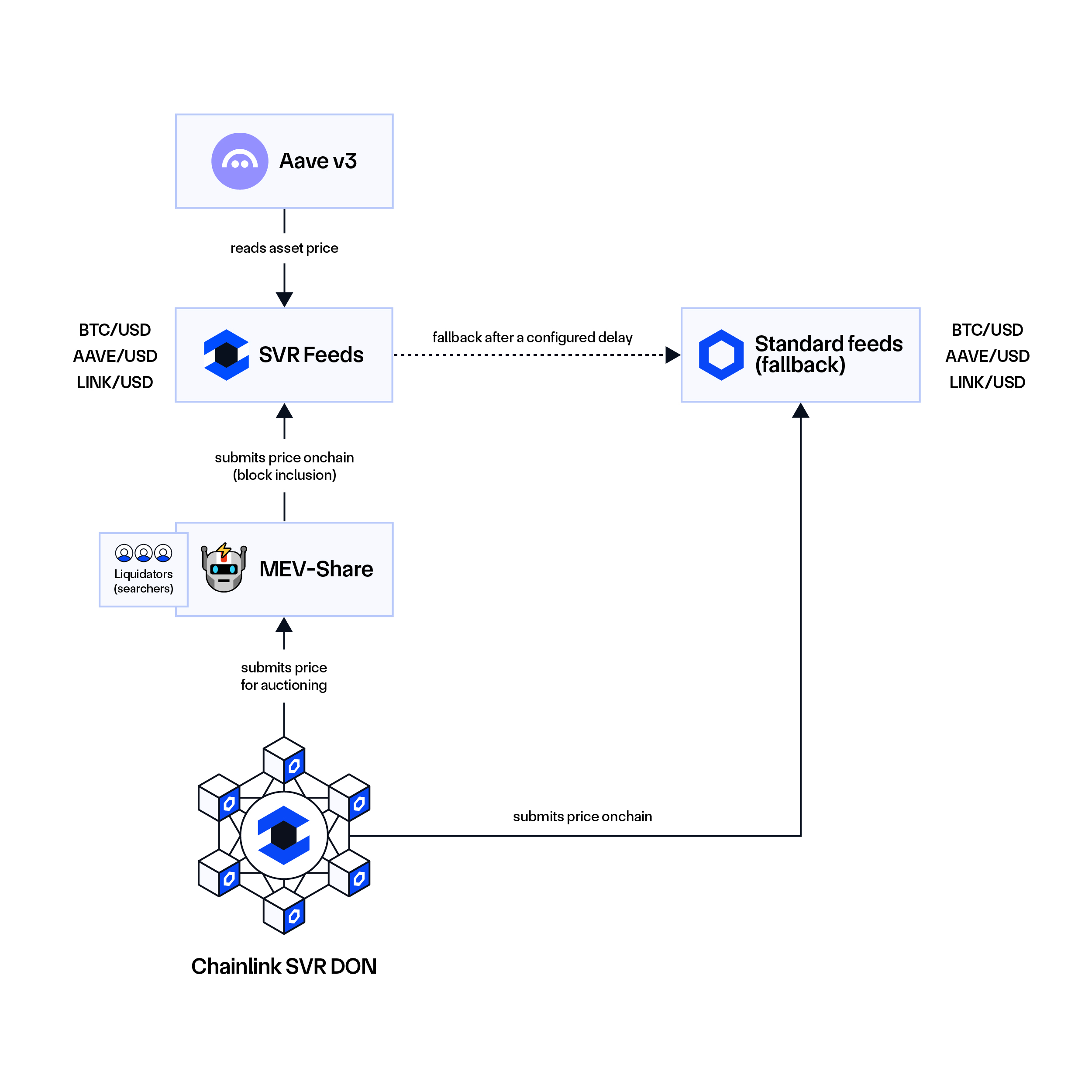

Payment Abstraction has been deployed into production with an initial focus on converting network fees generated by Chainlink Smart Value Recapture (SVR)—an oracle solution that enables DeFi applications to recapture the non-toxic Maximal Extractable Value (MEV) generated from their use of Chainlink Data Feeds. Recaptured MEV fees are split between the integrating DeFi applications and the Chainlink Network. Chainlink SVR recently launched with Aave as its first user, including an initial 6-month discounted fee split of 65% to the Aave community and 35% to the Chainlink ecosystem.

The Chainlink Network portion of fees collected from SVR services not yet secured by Chainlink Staking will initially be used to help cover the existing oracle rewards paid to node operators, supporting the network’s economic sustainability—a long-time goal of Chainlink Economics.

We plan for Chainlink Network fees generated by SVR services to transition to being sent to LINK Stakers—including both node operator and community stakers—once Chainlink Staking secures the node set powering an SVR service. We expect to launch additional SVR services and integrate Chainlink Staking into more SVR services in the near future. More information about the use of Chainlink SVR fees with Chainlink Staking is covered later in this blog.

We’re also excited to share that the first phase of the Chainlink Build claims mechanism is code-complete and expected to launch this year. This mechanism will make Build tokens claimable by Chainlink ecosystem participants, including Stakers. More information will be provided as the launch approaches.

In parallel to the launch of Payment Abstraction, existing node operator oracle rewards are planned to be consolidated within the Chainlink Network from 40+ chains to a single blockchain, starting with CCIP. This is an additional step to support the efficiency of the Chainlink Network by leveraging onchain infrastructure introduced by Payment Abstraction.

The following blog will dive further into the architecture behind Chainlink Payment Abstraction, explore its first use case with Chainlink SVR, the use of SVR fees, and outline the goal of consolidating node rewards.

Improving Chainlink Services With Payment Abstraction

Chainlink Payment Abstraction is designed to reduce payment friction and simplify the payment experience for users interacting with Chainlink services. Through a combination of onchain smart contracts, Chainlink services, and a decentralized exchange, the process of paying Chainlink Network service providers (e.g., nodes and stakers) in LINK is frictionless and automated.

Payment Abstraction enables users to pay for Chainlink services with the assets they already have (e.g., gas tokens, stablecoins, etc) while maximizing the Chainlink Network’s cryptoeconomic security and sustainability by leveraging LINK as a singular Universal Gas Token for service payments and staking.

Chainlink Payment Abstraction was inspired by direct feedback from protocol users and various abstraction-related technologies in the blockchain ecosystem such as Account Abstraction and Paymasters. We expect to continue taking learnings from ecosystem-wide developments to further enhance the payment experience of Chainlink services in the future.

The Payment Conversion Process

The initial version of Payment Abstraction currently live on mainnet involves four key steps to convert user fees into LINK:

1). Users pay for Chainlink services using Payment Abstraction with various tokens across different blockchains (service chains) supported by the Chainlink Network.

Tokens supported by Payment Abstraction are allowlisted for both security purposes (e.g., to block malicious tokens) and to ensure there is sufficient onchain liquidity for conversion into LINK. The first alternative asset supported is ETH (and its ERC20 wrapped version WETH), which has predictable onchain liquidity against LINK. Support for additional tokens is planned to be incorporated over time, such as additional blockchain-native gas tokens and stablecoins.

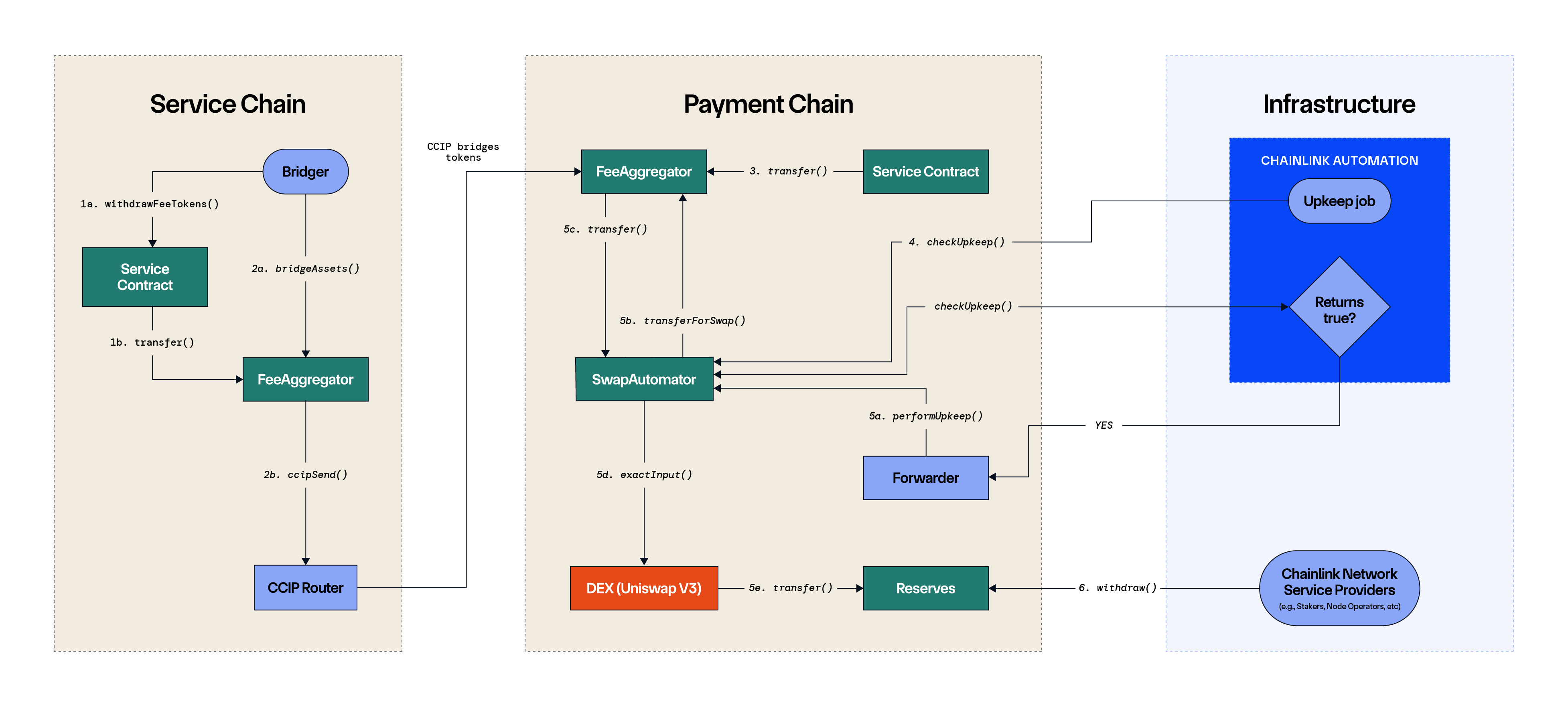

2). Consolidate fee tokens from users onto a single blockchain network (payment chain) using Chainlink CCIP.

Fee tokens from various service chains are automatically consolidated in regular intervals onto a single payment chain via CCIP. The Ethereum blockchain is used as the payment chain to minimize costs, providing an optimal balance between a multitude of factors such as gas fees and depth of onchain liquidity. Consolidating fees to a single chain streamlines the final payment of converted LINK. For example, core infrastructure such as Chainlink Staking currently operates on Ethereum mainnet.

3). Convert fee tokens into LINK using Chainlink Automation, Price Feeds, and a decentralized exchange (DEX).

On a periodic basis, the pool of fee tokens consolidated on the payment chain are converted to LINK using Chainlink Automation and an onchain DEX. The initial DEX used by Payment Abstraction is Uniswap V3, given its liquidity profile for supported tokens and the fact that it can be permissionlessly integrated by other smart contracts while minimizing centralized points of control. In the future, additional DEX services could be integrated to enhance MEV protection and support features such as smart order routing.

Chainlink Price Feeds are used as the official source of truth on the pricing of supported tokens. This ensures token prices are accurate and conversion transactions can be automatically reverted in situations where the pool price deviates too far from the market wide price of an asset. Chainlink Automation is used to automate conversions and batching without the need for manual interactions.

4). Send converted LINK tokens into a dedicated smart contract for withdrawal by Chainlink Network service providers.

After being converted to LINK, fees are automatically deposited into a Reserves contract, where allocations are earmarked to Chainlink Network service providers and become available for withdrawal. Payment Abstraction will initially be used for Chainlink SVR, but is planned to expand to additional Chainlink services in the future. More information about the use of SVR fees are described later in this blog.

Technical Implementation

Payment Abstraction accomplishes the four-step conversion process through the introduction of multiple smart contracts, including:

- FeeAggregator.sol: A smart contract on the service chains where fee payments are collected and on the payment chain (Ethereum) where fees are accumulated after bridging. This contract is capable of both bridging and receiving fee tokens on a configuration basis.

- SwapAutomater.sol: A smart contract on the payment chain (Ethereum) in the form of a Chainlink Automation Upkeep that triggers conversion through a decentralized exchange (Uniswap), with protections in place for slippage tolerable on the Uniswap V3 routes.

- Reserves.sol: A smart contract on the payment chain (Ethereum) that receives LINK that was converted from fee tokens. Earmarks are set to specify how much LINK Chainlink Network service providers can withdraw.

The Payment Abstraction codebase underwent multiple private independent security audits from Sigma Prime and Trail of Bits, as well as a public competitive audit on the Code4Rena platform that featured a $100K prize pool where no critical or high severity issues were found. The source code for Payment Abstraction is available on GitHub and additional documentation used in the Code4Rena contest can be found here.

First Use Case of Payment Abstraction: Chainlink SVR Fees

The first use of Payment Abstraction is the conversion of the Chainlink Network portion of fees generated by Chainlink SVR. Aave recently integrated SVR into its Aave V3 deployment on Ethereum Mainnet, starting with the tBTC, LBTC, AAVE, and LINK markets through the SVR services for the AAVE/USD, BTC/USD, and LINK/USD.

Aave’s usage of Chainlink SVR includes an initial 6-month discounted fee split of 65% to the Aave community and 35% to the Chainlink ecosystem. Aave’s portion of SVR fees are sent to the Aave DAO periodically in the same asset the fees were collected in. On a periodic basis, the Chainlink Network portion of SVR fees is sent into the Payment Abstraction system to be converted to LINK.

Given that liquidations most commonly occur during times of high market volatility, with a few liquidations compromising the vast majority of liquidation MEV, it’s difficult to project precisely how much in fees will be generated via SVR. Historically, tens of millions of dollars worth of liquidation MEV have leaked to third parties.

Use of Chainlink SVR Fees and Chainlink Staking

As mentioned previously, the Chainlink Network portion of fees from SVR services will initially be used to help cover the existing oracle rewards paid to node operators, before transitioning to being sent to LINK Stakers—including both node operator and community stakers—once Chainlink Staking secures the node set powering an SVR service.

The Chainlink SVR services used by Aave will consist of the same Chainlink node set used to power standard Data Feeds. Therefore, when Chainlink Staking is used to help secure the node set powering a standard Data Feed (e.g., ETH/USD), Staking will also secure the same node set powering the corresponding SVR service (e.g., ETH/USD SVR).

When fees are made available to stakers, we expect that 50% will go toward making the existing Staking Reward rate more sustainable, while the other 50% will serve as an additional fee reward for LINK Stakers that is split 50/50 between node operator and community stakers.

The use of SVR fees may change over time based on the security needs of the network and various considerations around Chainlink Network’s service providers, developer teams that utilize the SVR Data Feeds, the needs of asset issuers, and other key groups.

For the current version of Chainlink Staking, Stakers will not need to take any further action, as fees will be made available in the same manner current staking rewards are today.

Fees earmarked for stakers may periodically move from the Reserves contract to an intermediary contract address before becoming available in the Chainlink Staking rewards contract. We expect to provide additional information about when and how Chainlink SVR fees will be made available to LINK Stakers in the future.

Simplifying Node Operator Rewards

To simplify the reward process for Chainlink node operators, a portion of the onchain infrastructure introduced by Payment Abstraction is planned to be used to consolidate existing node operator oracle rewards across 40+ blockchains onto a single blockchain network (Ethereum), which is expected to start with rewards for CCIP node operators.

LINK rewards for Chainlink node operators typically accrue across multiple blockchains. This means if a node operator participates in decentralized oracle networks (DONs) across 40 blockchain networks, then the node operator may accrue oracle rewards on up to 40 distinct blockchain networks. This can result in up to 40 different onchain claim transactions for node operators.

By using the Reserves contract on Ethereum mainnet introduced by Payment Abstraction, node operators can accrue oracle rewards on a single blockchain (Ethereum) for their participation in DONs across the multi-chain economy, starting with CCIP. This adjustment in the rewards accrual process for node operators is designed to create time and cost savings for service providers in the Chainlink Network.

Accelerating The Sustainability of Oracle Networks

The launch of Chainlink Payment Abstraction, ongoing conversion of Chainlink SVR fees into LINK, and the enablement of user fee rewards for LINK stakers, represents another major milestone in the history of Chainlink economics. Payment Abstraction supports the long standing goal of creating sustainable oracle economics and LINK as the Chainlink Network’s native payment and staking token.

—

Disclaimer: This post is for informational purposes only and contains statements about the future, including anticipated product features, development, and timelines for the rollout of these features. These statements are only predictions and reflect current beliefs and expectations with respect to future events; they are based on assumptions and are subject to risk, uncertainties, and changes at any time. There can be no assurance that actual results will not differ materially from those expressed in these statements, although we believe them to be based on reasonable assumptions. All statements are valid only as of the date first posted. These statements may not reflect future developments due to user feedback or later events and we may not update this post in response. Please review the Chainlink Terms of Service, which provides important information and disclosures.