Scaling Climate Finance With Blockchain Technology

The climate finance market has grown rapidly over the past decade, attracting a high level of interest from governments, banks, corporations, and individuals across the globe. However, it has been held back by inefficiency and a lack of transparency along with integrity and quality concerns.

That’s why major financial institutions, including the World Bank, BIS, and J.P. Morgan, are embracing blockchain technology to create more transparent, verifiable, and scalable climate finance solutions, particularly in relation to the carbon markets.

In this post, we explore climate finance, examine the market size and opportunities, address challenges and explore how the market can scale, and look at climate finance projects using blockchain technology to make a real-world impact.

What Is Climate Finance?

“Climate finance refers to local, national, or transnational financing—drawn from public, private, and alternative sources of financing—that seeks to support mitigation and adaptation actions that will address climate change.”—United Nations Framework Convention on Climate Change (UNFCCC)

Climate finance refers to funding and investment mechanisms in support of initiatives that contribute to climate change mitigation, adaptation, and resilience. These projects—whether related to capacity building, research and development, or technology transfer—typically aid or incentivize activities across renewable energy, energy efficiency, low-carbon transportation, carbon capture and storage, sustainable agriculture, and forestry. Climate finance involves action from governments, the private sector, and individuals.

Climate Finance Market Size

Current Size

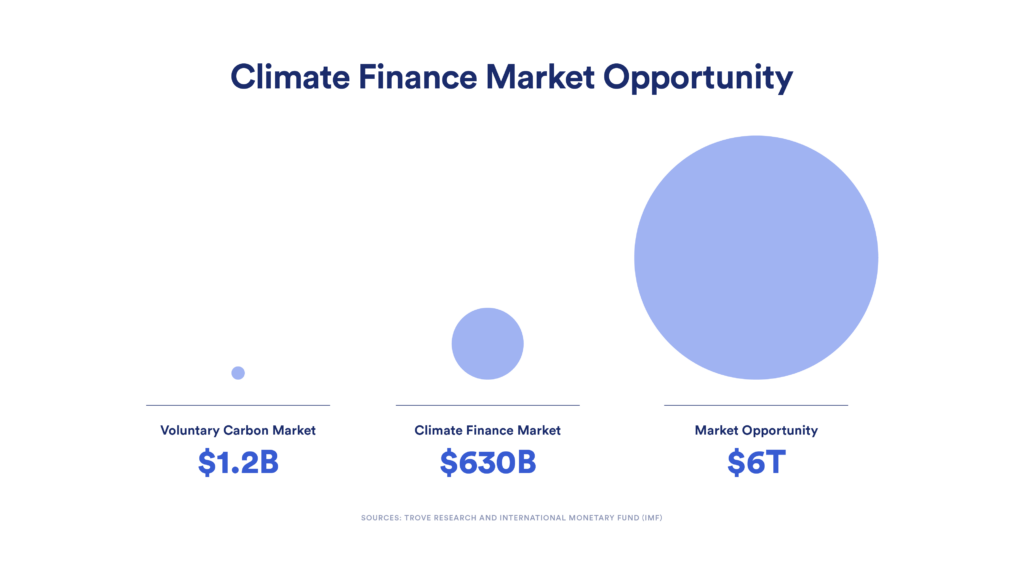

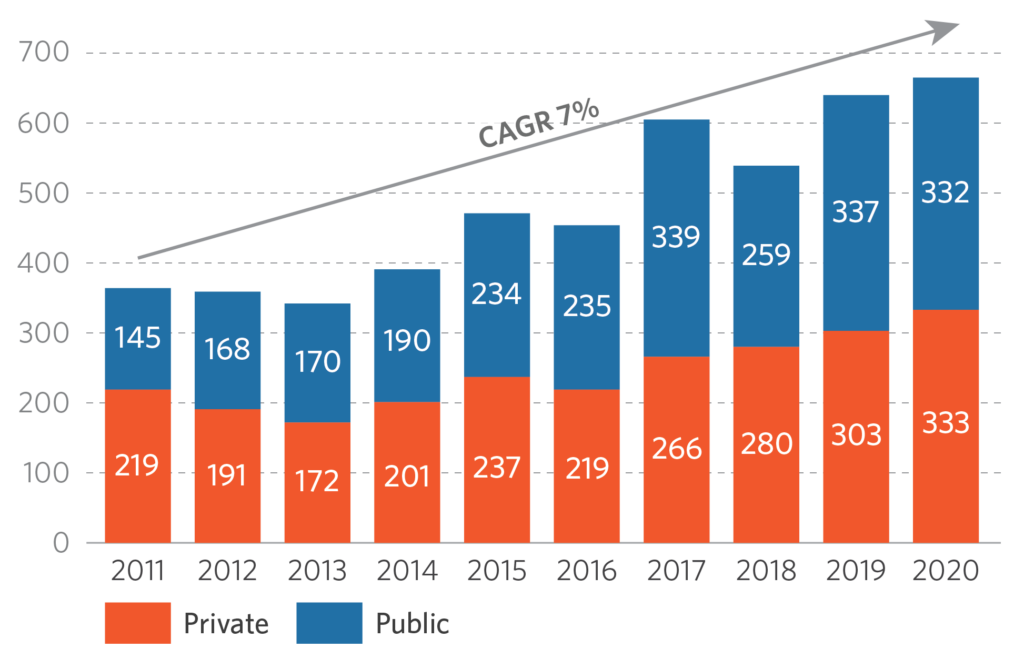

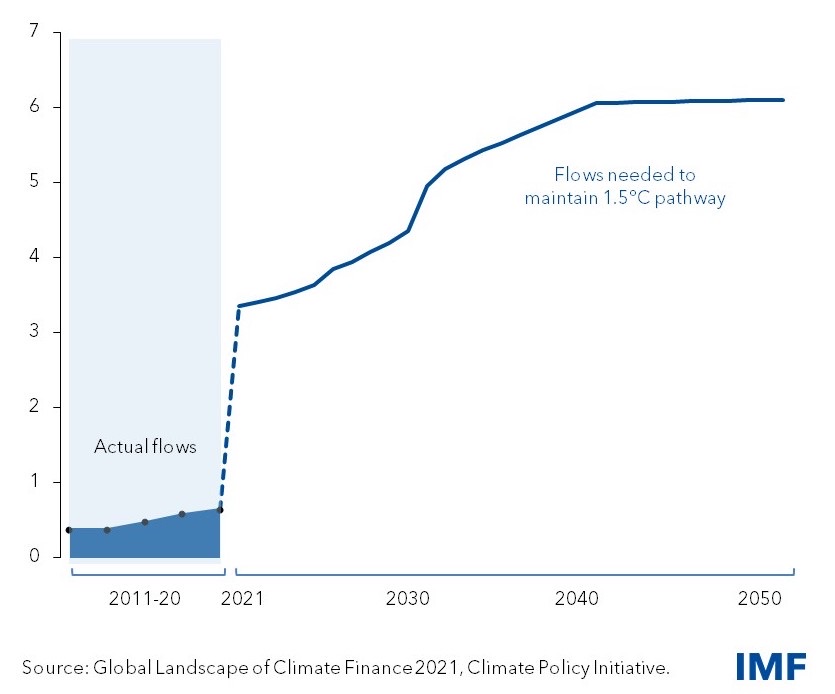

Between 2011 and 2022, a cumulative $4.8 trillion was committed to climate finance initiatives, around $480B of annual investment on average. Today’s investment level has grown to be around $630B annually; however, this is still just a fraction of the amount needed to help limit the global temperature rising to 1.5°C.

Target Size

The IMF estimates that \$3T+ of annual investment is currently required, reaching \$6T by 2050. With public budgets strained following the COVID-19 pandemic and tight borrowing conditions across emerging markets, the IMF recognizes that private finance must play a key role.

Expected Growth

Private markets are committing huge sums of money to finance climate initiatives.

A recent commitment from four banks amounted to \$5.5T in investment by 2030. J.P. Morgan committed \$2.5T, while Barclays, HSBC, and Citigroup each pledged \$1T. Already, J.P. Morgan has invested in a $500M southern pine plantation, which absorbs carbon from the atmosphere as the trees grow. Additionally, 450 financial institutions joined the Glasgow Financial Alliance for Net Zero to help achieve net-zero carbon emissions.

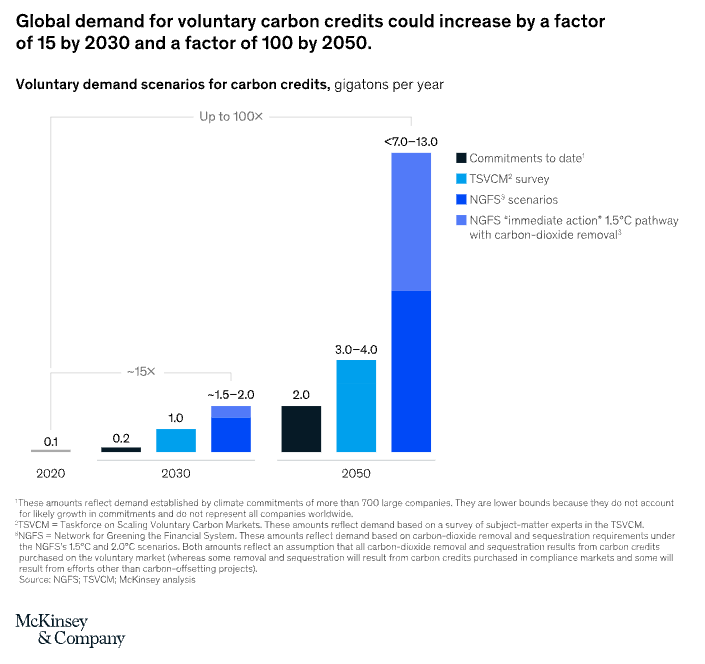

In similar efforts, private companies from across a wide range of industries, including blue chips like Sony, DHL, Lufthansa, Cemex, and Delta Airlines, are committing to emissions reductions through voluntary carbon markets. In 2022, the size of the voluntary carbon market grew 20% to $1.2B and the number of companies setting net zero targets more than doubled. According to McKinsey & Company estimates, annual global demand for carbon credits could increase by a factor of 15 by 2030 and a factor of 100 by 2030.

Challenges for Climate Finance

Project Quality and Credibility

Uncertainty around the effectiveness of carbon capture projects undermines the motivation for companies to invest. For carbon markets to gain adoption, carbon offsets need to demonstrate causal and permanent change to greenhouse gas volumes. Projects must also prove that they’re free from double counting and other detrimental behavior.

Lack of Urgency, Market Imperfections, and Reputational Risk

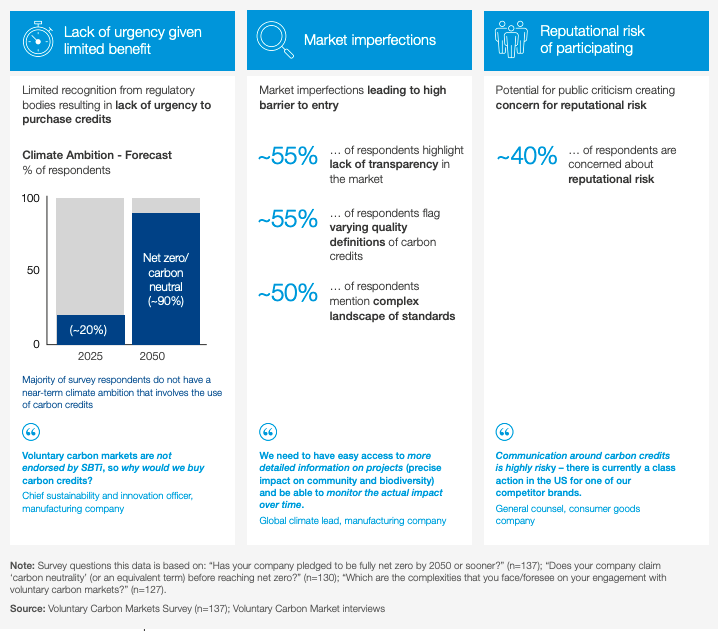

A survey conducted by the World Economic Forum and Bain and Company showed that while almost 90% were motivated to achieve net zero targets by 2050, only ~20% have the ambition of hitting the nearer-term 2025 goals. Consequently, this lack of urgency undermines their long-term aims.

More than half of those surveyed highlighted market imperfections as the reason for their inaction, highlighting the need for transparent markets where carbon offsets can be tracked to their source and verified. Additionally, around 40% of corporate workers noted reputational risk and the fear of legal action was holding them back from taking action.

Lack of Liquidity in Secondary Markets

As carbon markets are yet to gain widespread adoption, they lack the deep liquidity that would make them attractive as financial instruments, leaving suppliers with unpredictable and opaque demand. Price discovery is difficult for all participants. Over-the-counter (OTC) trading has historically hindered scale and added unnecessary costs.

Difficulty Measuring Carbon Emissions

Measuring carbon emissions can be a complex task for organizations, and their carbon footprint can vary significantly depending on the granularity and detail of the available emissions data. Carbon liabilities down supply chains are particularly challenging. Measurement can be especially difficult for banks holding or helping thousands of entities, which often lack the specific details around projects and clients they fund, such as the location, energy sources, and other factors that contribute to greenhouse gas emissions. Equally, the measurement of carbon sequestration projects has been difficult, manual, expensive, and slow. Technology looks set to dramatically change these operations.

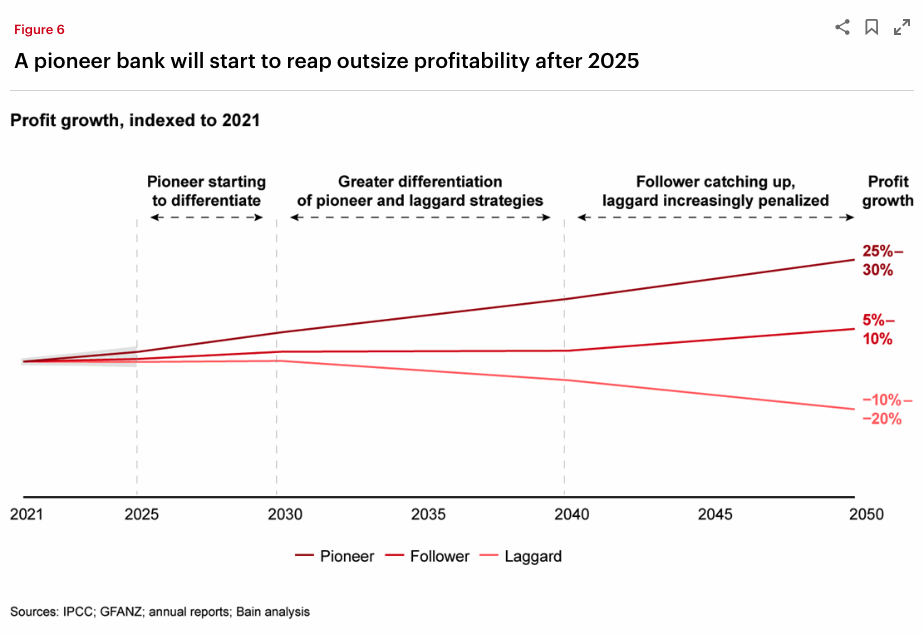

Time To Profit

According to Bain & Company projections, green financing strategies won’t outperform other assets until 2025. While they’re expected to provide far greater returns when measured over the coming decades, it may be more difficult to attract funds over the next 24 months.

Scaling Climate Finance

Purchasing carbon credits, certificates representing quantities of greenhouse gases that have been kept out of the air or removed from it, via voluntary carbon markets enables organizations to account for the emissions through retirement, that they’re unable to eliminate. Scaling the voluntary carbon market to meet incoming flows requires a number of improvements.

Infrastructure

Scalable infrastructure is necessary to support voluntary carbon markets with modern digital infrastructure, deep liquidity, and stronger risk management. Advanced data infrastructure is also required to bring transparency to the voluntary carbon market. Accurate atmospheric and satellite imagery data is essential for verifying the quality of carbon offsets using scientific methods and ensuring their long-lasting impact. Offering transparency around suppliers and end-users is also important to establish the credibility of carbon projects and enable companies to credibly prove the impact their carbon offset programs are making. Carbon ratings to provide easier investor transparency. Corporate disclosure on the project types, pricing, and transaction costs and flows around a company’s carbon offset program can also help establish credibility.

Measurement, Reporting, and Verification (MRV)

Measurement, reporting, and verification (MRV) refers to the process of measuring the amount of greenhouse gas emissions reduced by a specific mitigation activity over a period of time, such as reducing emissions from deforestation and forest degradation. This has historically been a slow, expensive manual task with reporting these findings to an accredited third party who then verifies the carbon sequestrations and issues certified carbon credits. Establishing a credible digital MRV process accepted across the financial and corporate landscape is essential for scaling the voluntary carbon market.

Why Blockchain Technology for Climate Finance?

Blockchain technology is never a panacea, but can help bring about more accurate and transparent carbon markets, automated incentive structures, and interconnected applications that help establish more impactful and verifiable climate finance initiatives. Transactions are dependent on multiple interconnected parties all benefiting from a shared system of record, greater immutability, and automation.

Tokenized Carbon Credits

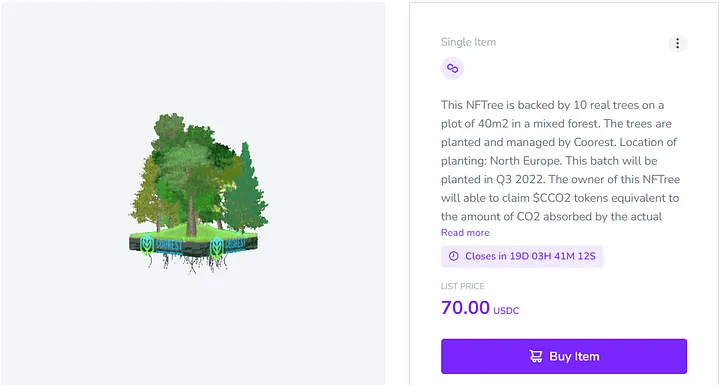

Carbon credits are typically not sold in volumes less than one metric ton of carbon sequestered. While that’s ideal for corporations buying large volumes of credits, it puts them out of reach for everyday consumers and many small businesses. Tokenization enables the creation of fractional ownership of carbon credits, allowing individuals and smaller organizations to participate in the market e.g. offsetting small credit card transactions.

For example, Coorest has created NFTrees, which are NFTs linked to real-world trees. They generate CO2 tokens—representing 1kg of absorbed carbon each—second by second according to the amount of CO2 absorbed from the real trees. Coorest utilizes satellite data from Floodlight, which is streamed to the smart contract to track how many trees are absorbing carbon, with CO2 tokens generated to reflect the carbon they absorb. This creates high-quality offsets and makes carbon tokens accessible to anyone across the globe.

Transparency, Monitoring, and Verifiability

A blockchain can be used to create an immutable record around carbon credits that’s potentially visible to all participants. This enables carbon credits to be tracked throughout their lifecycle, from creation to retirement, providing a clear and auditable trail of ownership, performance, and carbon offsetting activities.

With greater transparency and automated controls comes more accountability and a higher integrity carbon market. It also provides public insights into demand for high-quality carbon credits, which can stimulate the creation of further projects and help scale up the supply side of the voluntary carbon market.

Blockchain oracles, a Web3 technology that brings real-world data and computation to blockchains, can use IoT, satellite, and remote sensing data to measure the carbon sequestration in a particular geographic region to verify a project’s stated CO2 offset before issuing a carbon credit and monitor it over its lifetime. Oracles can also make data from third-party rating agencies, professional auditors, and regulators available on-chain.

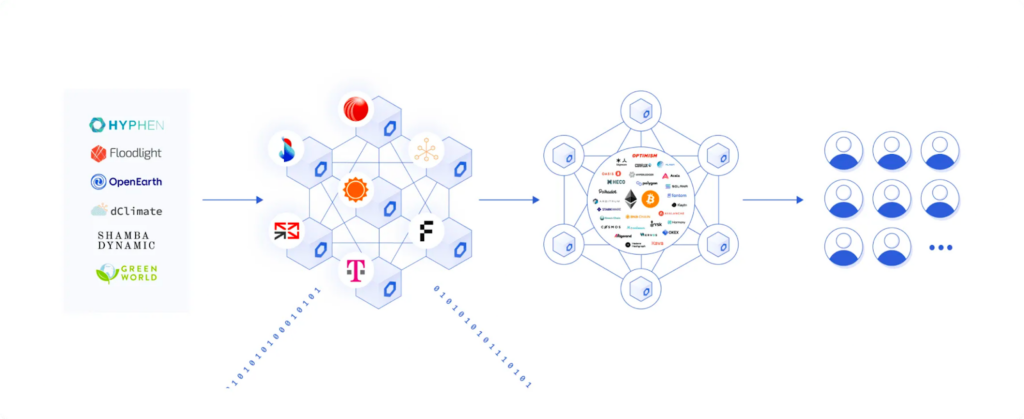

Together, on-chain transparency and active monitoring enable verifiable carbon credits that mitigate the risk of greenwashing. For example, Hyphen is using Chainlink oracles to deliver verified greenhouse gas data in near real-time on-chain to reduce the data gap that exists between reported claims and the reality of what is happening in the atmosphere.

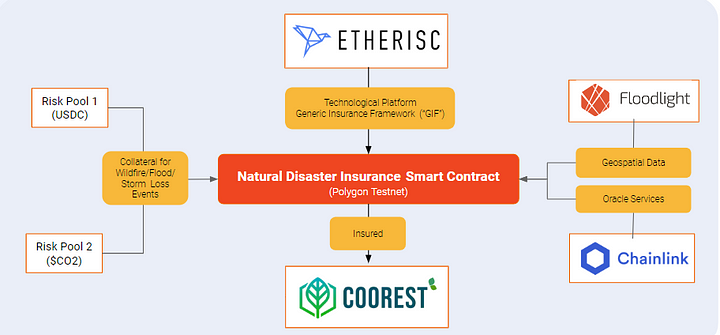

Parametric Insurance

Parametric insurance applications combine blockchain technology and real-world data to automate claims processing and lower operating costs. Using geospatial climate data that can detect and verify whether a forest has been impacted by a wildfire, flood, or storm, anyone can efficiently access insurance that mitigates the financial risk of reforestation projects. This innovative insurance model expedites claims processing and payouts, increases transparency, and can reduce the cost of premiums for policyholders. In the carbon market today, the project developer typically self insures the project, with 15-20% extra collateral included. Reducing this with an efficient insurance program can generate more direct capital in project sales.

For example, in collaboration with Chainlink Floodlight, and Coorest, Etherisc is developing an on-chain carbon offsets insurance product that better protects reforestation projects and carbon credit holders against the financial risk of wildfires, floods, and storms.

Operational Efficiency

Blockchains increase the operational efficiency of the voluntary carbon market by providing a secure and transparent platform for tracking carbon offsets, streamlining the verification process and compliance checks, reducing transaction costs, and automating repetitive processes with self-executing applications. Open infrastructure also makes it easier for developers to create innovative new solutions that further enhance market efficiency and functionality.

In support of companies establishing relevant internal carbon prices and allowing for more impactful voluntary carbon markets, OpenEarth Foundation is building an open-source carbon pricing tool that accounts for policy scenarios, various economic variables, and energy projections in order to incorporate the social costs of carbon into carbon pricing. This helps parties establish a price of carbon in their accounting. Similarly, dClimate is bringing institutional-grade climate data on-chain to provide governments, companies, and other applications with the information necessary to create better climate risk tools, like dMRV for the carbon market.

Financial Institutions’ Blockchain Initiatives for Voluntary Carbon Markets

Banks across the globe are committing trillions of dollars toward climate investments, and they’re targeting their corporate and municipal clients in particular. With innovative blockchain-based solutions, they’re building exciting new fixed income platforms, leveraging the latest technologies, and ultimately revolutionizing carbon trading. Let’s take a look at some of the latest innovations.

Digital Green Bonds

Green bonds are debt instruments that raise funds for green initiatives, including decarbonization investments. To date, non digital green bonds have suffered from a lack of transparency and rigor in use of funds. By issuing green bonds on a blockchain, they become easily auditable by all parties, their financial performance and environmental impact can be seamlessly tracked across their lifetimes, and they can be used as collateral across the DeFi ecosystem and by permissioned networks. Similarly, as we have seen with Project Genesis in Asia, the bond can be backed by future mitigation outcome interests, i.e. commitment to deliver a certain number of carbon credits, all potentially managed on-chain.

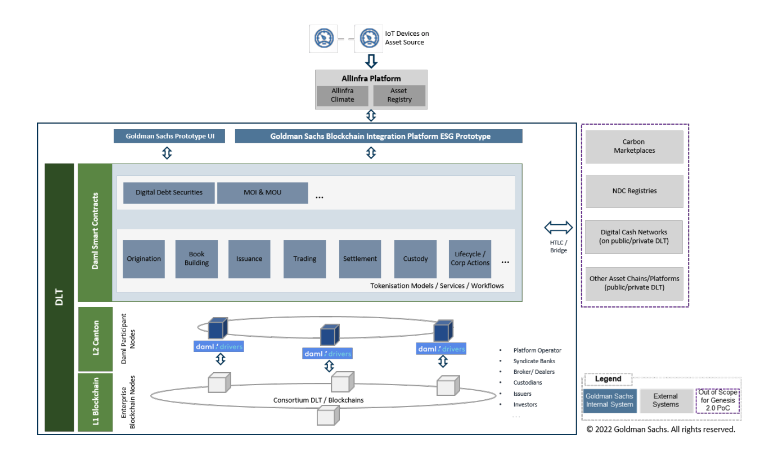

Project Genesis by Bank of International Settlements

Project Genesis 2.0 is an initiative by the Bank of International Settlements (BIS) in collaboration with the Hong Kong Monetary Authority, UN Climate Change Global Innovation Hub, Goldman Sachs, Digital Asset, and others. The project builds on Project Genesis 1.0’s successful proof of concept, which tokenized retail green bonds on both a public and a permissioned blockchain.

Project Genesis 2.0 uses a blockchain, smart contracts, and internet-of-things (IoT) devices to digitally track, deliver, and transfer mitigation outcome interests (MOIs)—future contracts with a commitment to deliver, at maturity, verified carbon credits—appended to the green bond.

The bond effectively addresses issues around greenwashing by verifying carbon credits in line with the Paris Agreement, stimulates new projects by distributing funds at the outset of an initiative, lowers funding costs for green projects, and ensures that the bond serves the 1.5 °C climate goal.

Lending and Borrowing

Companies like Kumo and Neutral Protocol have recognized the value of being able to borrow and lend against these assets. In the same way Chainlink supports the crypto borrowing market with on-chain prices feeding smart contracts, Chainlink is looking to do similar in this digital asset class.

Decentralized Meta Registry Data Layer—Climate Action Data Trust (CAD Trust) by The World Bank & IETA

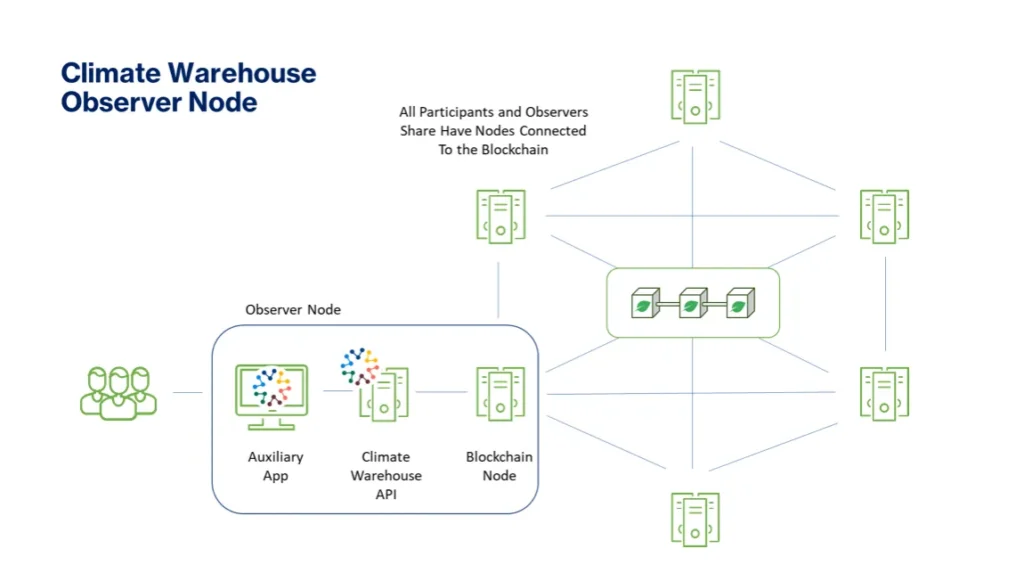

The Climate Action Data Trust is a decentralized platform that aggregates and harmonizes all major carbon registry data to enhance transparent accounting in line with the Paris Agreement. The meta-registry is developed by the World Bank’s Climate Warehouse project, the International Emissions Trading Association (IETA), Singapore Government, Google, and others.

The Climate Warehouse program of the World Bank supports the entire ecosystem to develop digital solutions in the international carbon markets. Enabling the industry to build on top of the Climate Action Data Trust (CADT) across multiple blockchains will enhance the transparency and integrity required to scale the financing through this market. To this end, the Climate Warehouse program has a collaboration with Chainlink Labs to prototype and pilot interoperability mechanisms to catalyze adoption and enable the scale-up of market infrastructure.

Carbon Trading Platforms

Carbonplace, founded by a group of nine banks including UBS, BNP Paribas, and Standard Chartered, has been building a carbon exchange that’s set to go live later this year. The credits will be available to the bank’s corporate clients, with the settlement and clearing managed on-chain. As you might expect from a bank-born project, there is a strong focus on AML and KYC requirements to minimize risk. Recently, decentralized carbon credit marketplace Thallo announced it’s bringing carbon certificates to a public blockchain, as has Senken and Air Carbon Exchange. Notably, Thallo is integrating Chainlink Proof of Reserve to automatically verify and monitor tokenized carbon credits from selected registry partners.

Conclusion

There’s a multi-trillion-dollar opportunity for climate finance, specifically in voluntary carbon markets, the world’s leading financial institutions are leveraging blockchain technology to improve integrity, reduce inefficiencies, and build innovative new solutions, as well as investing trillions to help their clients offset. Immutable, permissionless ledgers are critical for increasing the transparency and verifiability around tokenized carbon credits, helping mitigate greenwashing, double counting, and other factors that have held the climate finance industry back.

Learn more about climate markets. If you’re ready to explore how your organization can help scale climate finance with blockchain technology, talk to an expert.