Chainlink Digital Asset Insights: Q2 2024

By Daeil Cha, Product, at Chainlink Labs

Introduction

The first half of the year saw increased signs that financial institutions are exploring the blockchain ecosystem through initiatives like cryptocurrency ETFs and asset tokenization. While the general public is becoming more familiar with the broad benefits of blockchain, how institutions will integrate with the blockchain ecosystem is not necessarily as clear. Some key necessary elements for such integration include transparency into asset valuation, cross-chain interoperability, custody, settlement, security, and more. In this quarterly update, we discuss the benefits of tokenization and how Chainlink Proof of Reserve, Chainlink’s Daily Reference Price, and other Chainlink services can enhance the tokenization economy.

The Benefits of Asset Tokenization

Asset tokenization involves creating a digital representation (i.e., a token) of an asset, where the token represents ownership of the underlying asset and can be utilized and traded on a blockchain. Virtually any asset, whether physical or financial, can be tokenized, offering a range of potential benefits, including:

- Increased access for market participants: Asset tokenization offers digital tokens that can be easily bought, sold, and traded on blockchains. This process can also enable fractional ownership, which allows participants to purchase smaller, more affordable portions of high-value assets that would otherwise be unavailable to some users. Thus, tokenization helps democratize markets by providing access to a broader range of participants.

- 24/7 trading of assets: Tokenization enables 24/7 asset trading by leveraging blockchains, which operate continuously without the constraints of traditional market hours. This accessibility allows investors to trade tokenized assets at any time, providing greater flexibility and responsiveness to market changes. As such, this increased availability enhances liquidity and market efficiency, as transactions are no longer confined to the operating hours of traditional exchanges, allowing for a more dynamic and global trading environment.

- Increased transparency of markets: Tokenization increases market transparency by recording all transactions on an immutable blockchain ledger. This transparency allows participants to track the history and ownership of tokenized assets, helping to ensure the integrity of the market. Enhanced transparency fosters trust among participants as they can independently verify information and make more informed decisions.

How Chainlink Proof of Reserve Enhances Asset Tokenization

Tokenization effectively bridges the gap between traditional investments and digital assets. The expansion of blockchain into the realm of real-world assets (RWAs) through tokenization is a natural evolution that unlocks a multitude of opportunities. As assets become tokenized, the Chainlink platform reports and updates the necessary performance data onchain to enable the utilization of tokenized assets and support a thriving onchain finance ecosystem around them, just as Chainlink did with crypto-native assets in DeFi. By verifying the status of offchain assets and relaying that information onchain, Proof of Reserve in combination with Chainlink Cross-Chain Interoperability Protocol (“CCIP”) can help create an onchain golden record that enhances the utility and transparency of tokenized RWAs.

By representing assets digitally on a blockchain network, asset managers can benefit from a standardized, efficient, and transparent ecosystem that can not only streamline operations and reduce administrative burdens significantly but also enhance revenue generation through increased liquidity. Tokenizing funds simplifies and automates the fund management process for asset managers and investors alike, giving rise to a standard platform for order processing, ownership tracking, and data management, which can ultimately stimulate liquidity and offer a more scalable approach to make alternative investments more globally accessible.

Chainlink has already proven itself as essential blockchain infrastructure by connecting smart contracts with secure, reliable, and accurate offchain data. By providing key market data onchain, Chainlink enabled the growth of DeFi into a multi-hundred-billion dollar industry and unlocked core onchain primitives and advanced use cases. Now, Chainlink is enabling the next phase of onchain markets by providing the foundational infrastructure required to make tokenized assets composable and programmable across both traditional systems and public/private blockchains. This includes Chainlink enriching tokenized assets with crucial real-world data, enabling interoperability across blockchains and traditional systems, and ensuring dynamic synchronization so tokenized assets stay up-to-date with key data as they move across chains. The result is unlocking powerful applications that, compared to traditional finance, feature enhanced liquidity, utility, programmability, and new distribution channels that can operate globally 24/7/365.

Chainlink Proof of Reserve enables custodian and auditor attestations by creating an onchain source of truth for accurate and transparent asset collateralization. By enabling onchain verification through a network of qualified custodians and top auditors, Chainlink Proof of Reserve provides:

- Secure and high-quality reserve data sources that provide a transparent and real-time review mechanism for verifying the collateralization of digital assets.

- Automated onchain verification, which can be deployed for automated onchain audits that give users a superior guarantee of an asset’s underlying collateralization.

- Enhanced transparency through open onchain monitoring by anyone in near real-time, allowing investors to verify asset collateralization independently and generate a higher degree of transparency for the crypto ecosystem around asset collateralization.

One example of this use case is the gold-backed token PAXG, where Chainlink Proof of Reserve helps ensure the token is fully backed by offchain gold reserves. For more security and transparency into the stablecoin’s minting process, PAXG has also integrated Proof of Reserve’s Secure Mint feature to help prevent the minting of tokens without adequate backing, protecting the stablecoin against infinite mint attacks.

Another example of this use case, which we discussed in our last quarterly review, is Bitcoin ETF issuers utilizing Chainlink Proof of Reserve to provide transparency into their assets, helping to enable the onboarding of more institutions into the ETF ecosystem. The ARKB ETF (issued by 21Shares and ARK Investment Management) uses Chainlink Proof of Reserve, which pulls reserve data directly from ARKB’s custodian (Coinbase Prime) and reports the data onchain (Ethereum mainnet) via Chainlink decentralized oracle networks.

An additional potential use case for Chainlink Proof of Reserve is onchain credit ratings, which reflect risk analytics firms’ views on a company’s creditworthiness with respect to, for example, a bond issued by that company. Credit ratings are not only descriptive; they can also have a direct impact on companies if their ratings are downgraded (by, for example, increasing borrowing costs or triggering a debt covenant). As such, credit ratings are useful for market participants who wish to price assets and manage portfolio allocation and risk. Currently, there is no robust credit rating framework for onchain assets, which limits institutional confidence in investing in these assets and hampers their ability to build programmatic logic into allocation and risk management decisions. Reporting ratings onchain (i.e. AAA or AA ratings for particular tokenized assets) will help enable programmatic risk management and capital allocation. For example, if the credit rating of a collateral backing of an asset is downgraded, programmatic logic can automatically rebalance a portfolio to utilize less of that asset. A future state of a fully robust and global onchain financial ecosystem is dependent upon a trusted and accessible asset credit rating framework.

The Growing Adoption of Chainlink Proof of Reserve

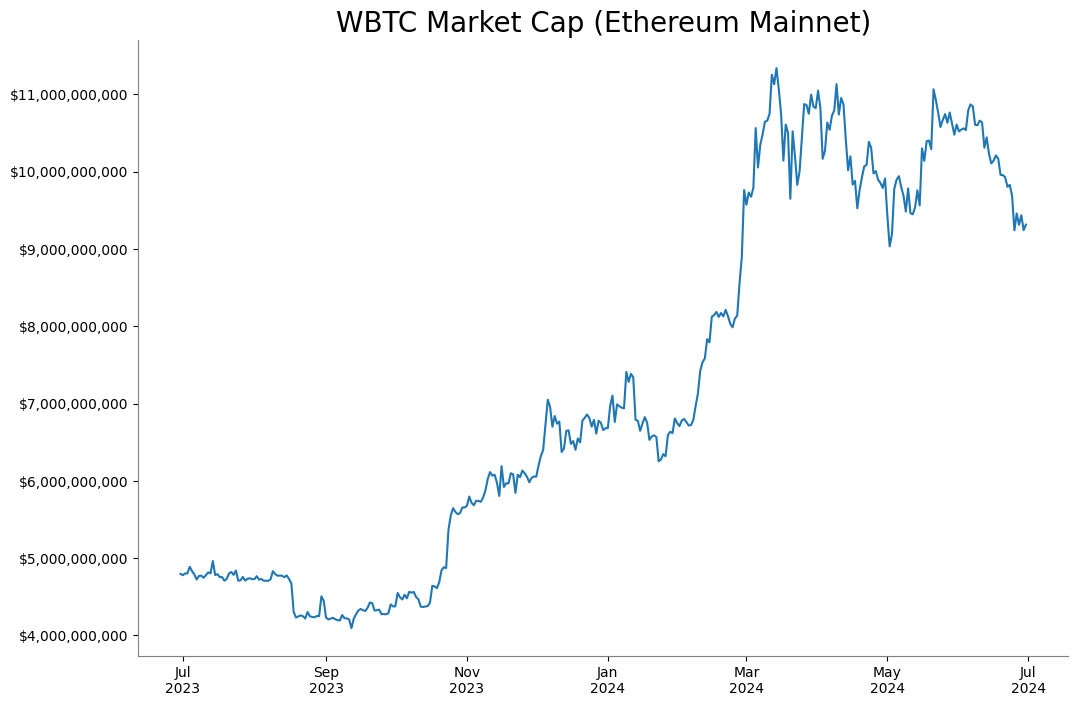

Tokenization’s benefits for asset issuers often depend on the resulting token being actively traded and utilized, which requires user trust. Since tokenized assets and bridged assets are similar in that they are representations of an underlying asset, it is natural to demonstrate how Chainlink Proof of Reserve can help facilitate tokenization through its proven success in providing enhanced transparency into bridged assets (both traditional and digital native). One of the most prominent examples of Chainlink Proof of Reserve’s value proposition is wrapped Bitcoin (WBTC) on Ethereum mainnet, with a market cap north of $9 billion as of Q2 2024. BitGo—the issuer of WBTC—integrated Chainlink Proof of Reserve to prove the collateralization of WBTC onchain to both DeFi protocols and users.

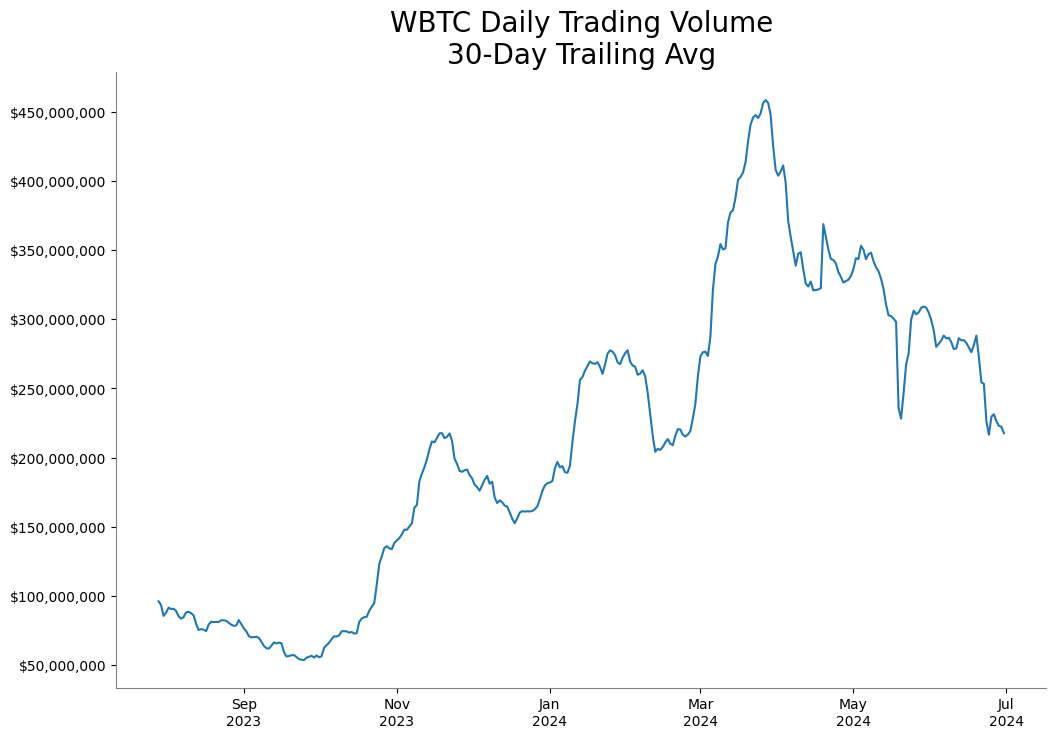

We can also see the daily trading volumes for WBTC have doubled in the same period:

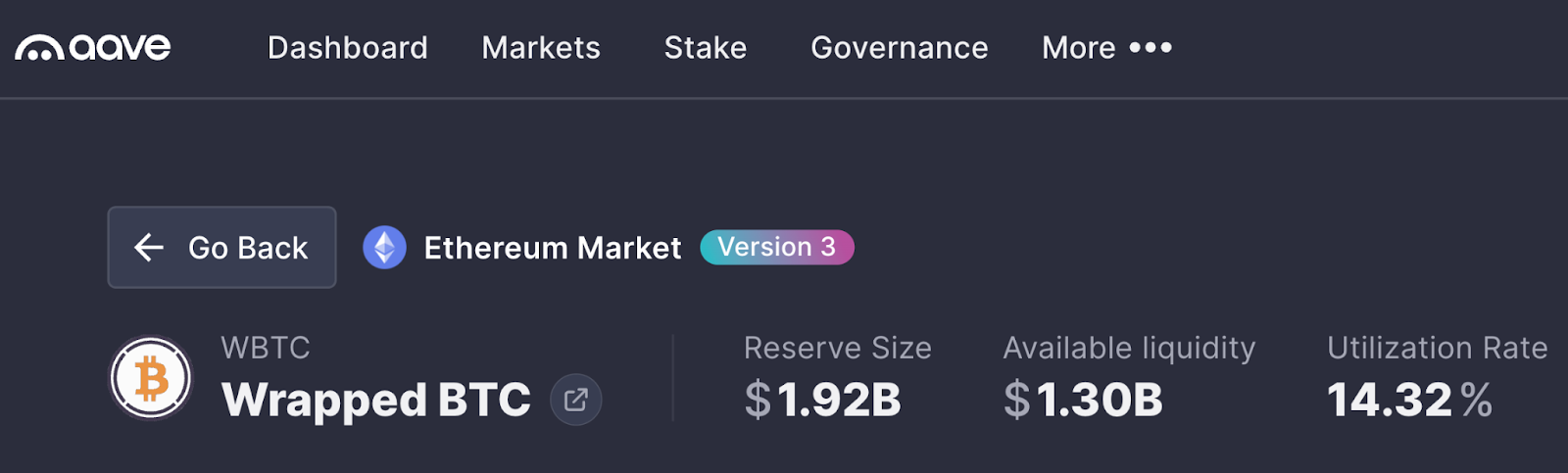

WBTC is also listed as collateral on the major lending platforms on Ethereum mainnet, including on Aave v3 (with $1.92 billion deposited):

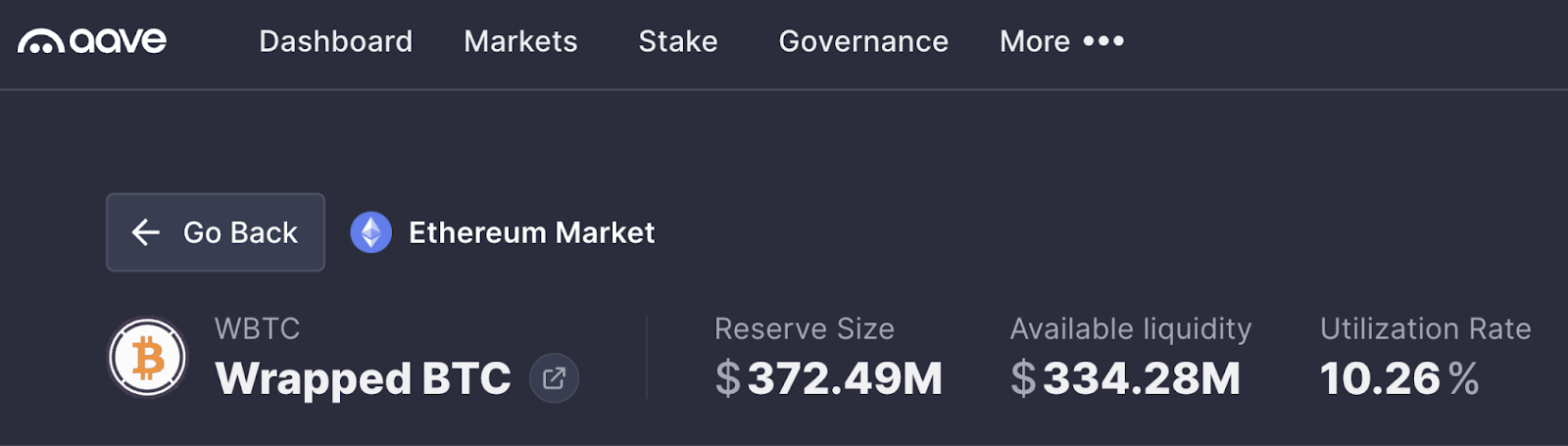

And on Aave v2 on Ethereum (with $372 million deposited):

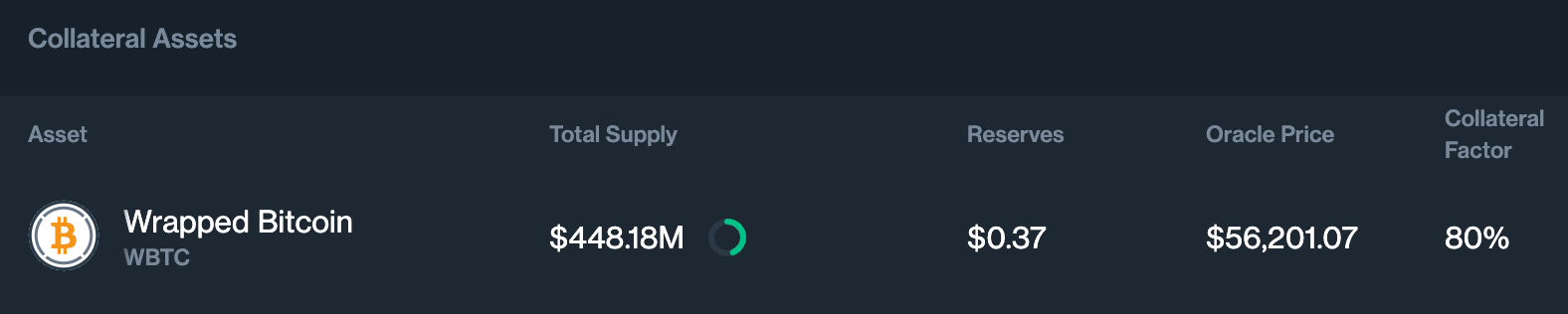

And on Compound v3 for the USDC market on Ethereum (with $448 million deposited):

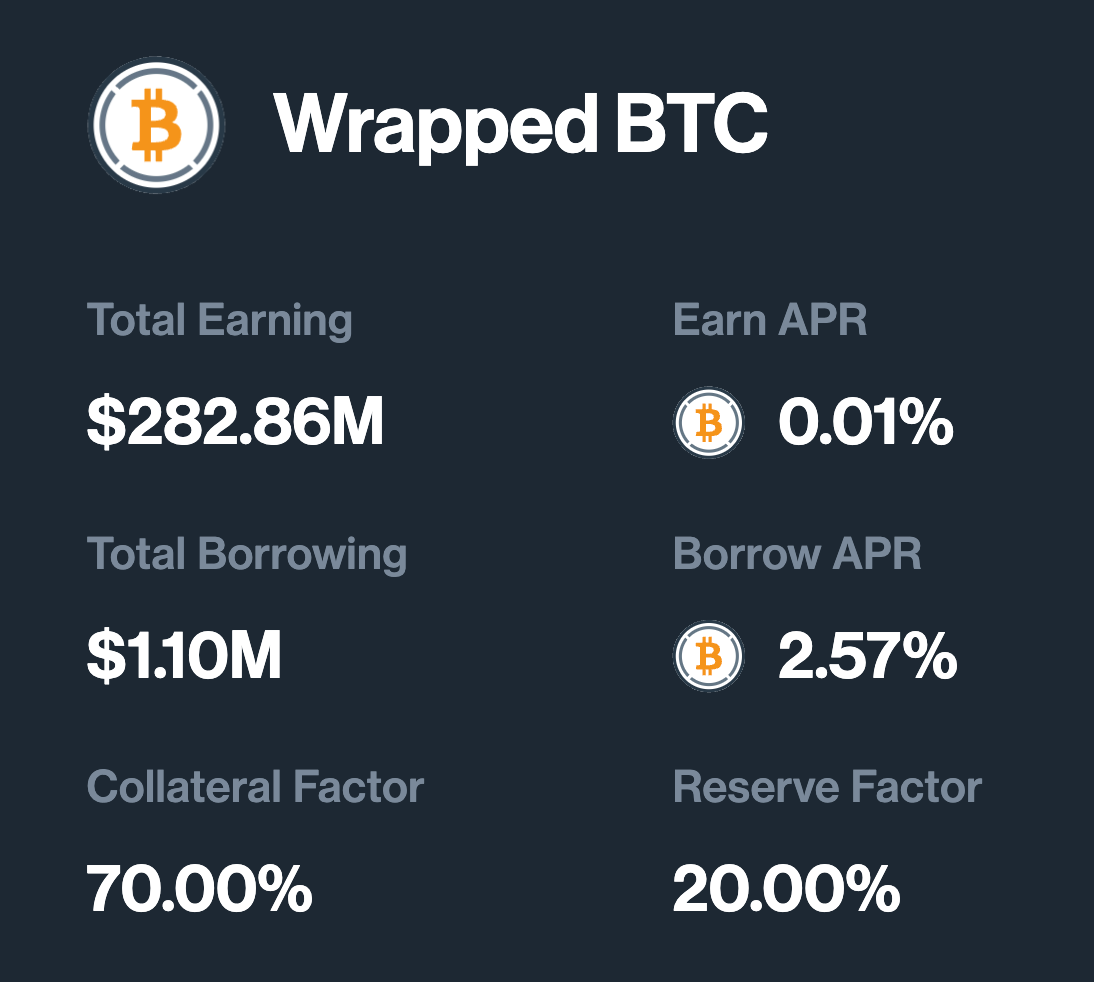

And finally on Compound v2 on Ethereum (with $283 million deposited):

Across these lending platforms, WBTC can be utilized as collateral with a loan-to-value ratio that ranges from 70-80%; this implies the lending protocols consider WBTC a relatively safe collateral asset (the maximum loan-to-values typically seen in DeFi are 90%+, for stablecoins).

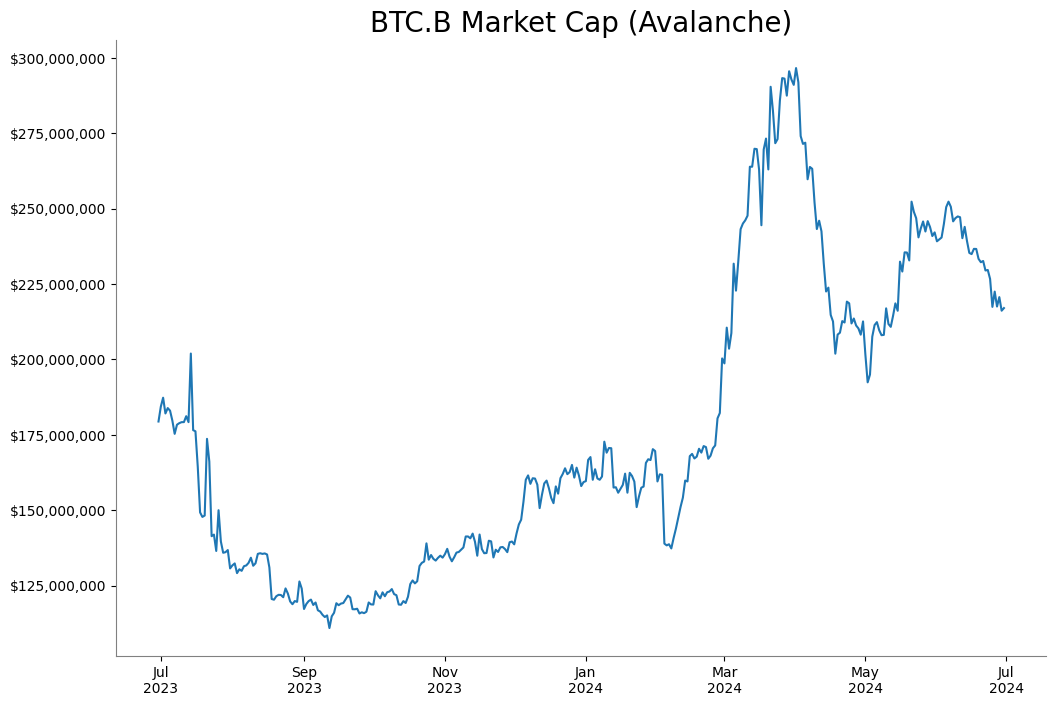

BTC.B on Avalanche also utilizes Chainlink Proof of Reserve, and its market cap is over $200 million as of Q2 2024.

Industry leaders use Chainlink Proof of Reserve for its unmatched security, reliability, and compatibility by 1) reducing risk with automated, truth-based verification, 2) bringing enhanced transparency to users, and 3) preventing systemic failures and contagion. We believe the transparency provided by Chainlink Proof of Reserve will continue to be critical as more institutions consider participating in tokenization and cryptocurrency.

Chainlink’s Daily Reference Price

In traditional financial markets, a reference price is a benchmark price used as the basis for the valuation and trading of financial instruments. It serves as a standard for pricing assets and can be derived from sources that are generally accepted to be representative of the market and resistant to manipulation. The lack of a reference price would have far-reaching implications, including challenges in price discovery (where participants cannot determine fair value for an asset), increased volatility, reduced liquidity, wider bid-ask spreads, and challenges in portfolio management. Derivatives and structured products would also face difficulties in valuation and liquidity. Public equity markets use daily closing price or volume-weighted average price as a reference price, while bond markets use yield curves or credit spreads.

Chainlink now offers a Daily Reference Price for its Data Feeds, which provide a secure, reliable, and decentralized source of data to power blockchain activities underpinning use cases like asset tokenization and other blockchain-enabled financial instruments and applications. Chainlink Data Feeds can be configured to provide generalized data about any event, outcome, or asset type, including cryptocurrencies and securities. The schedule for Chainlink’s Daily Reference Prices are:

- 4PM SGT Singapore/Hong Kong

- 4PM GMT London

- 4PM ET New York

The Daily Reference Prices are available to users of Chainlink Data Feeds and Proof of Reserve for in-scope assets. They can be accessed as a downloadable historical time series from the individual feeds pages at https://data.chain.link/feeds.

With Chainlink’s Daily Reference Prices, market participants can more easily execute the following functions:

- Discovery of fair and transparent market values of assets.

- Net asset value calculation for funds that hold digital assets.

- Order execution to optimize market impact.

- Derivatives pricing.

- Index construction and performance tracking.

- Risk management and hedging.

Reach Out to Our Team of Experts

To find out how your organization can benefit from using the Chainlink platform, reach out to our team of experts.

This post is for informational purposes only and contains statements about the future. There can be no assurance that actual results will not differ materially from those expressed in these statements, although we believe them to be based on reasonable assumptions. Interactions with blockchain networks create risks, including risks caused by user input errors. All statements are valid only as of the date first posted. These statements may not reflect future developments due to user feedback or later events and we may not update this post in response.