Chainlink Digital Asset Insights: Q1 2024

By Daeil Cha, Product, at Chainlink Labs

Introduction

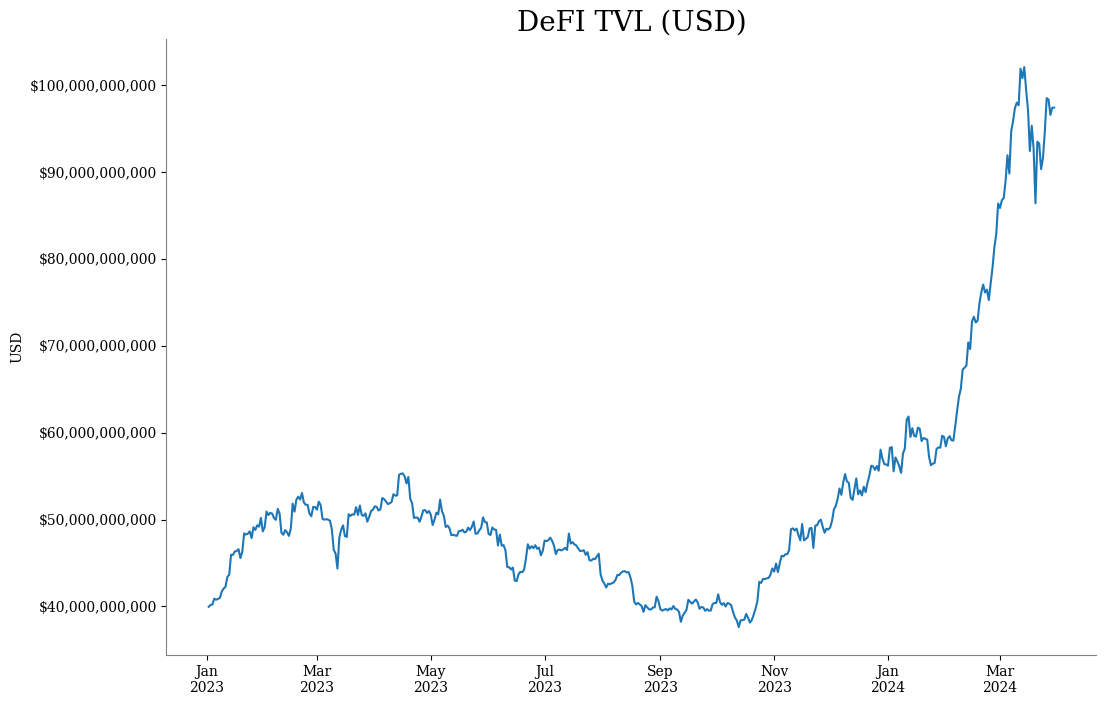

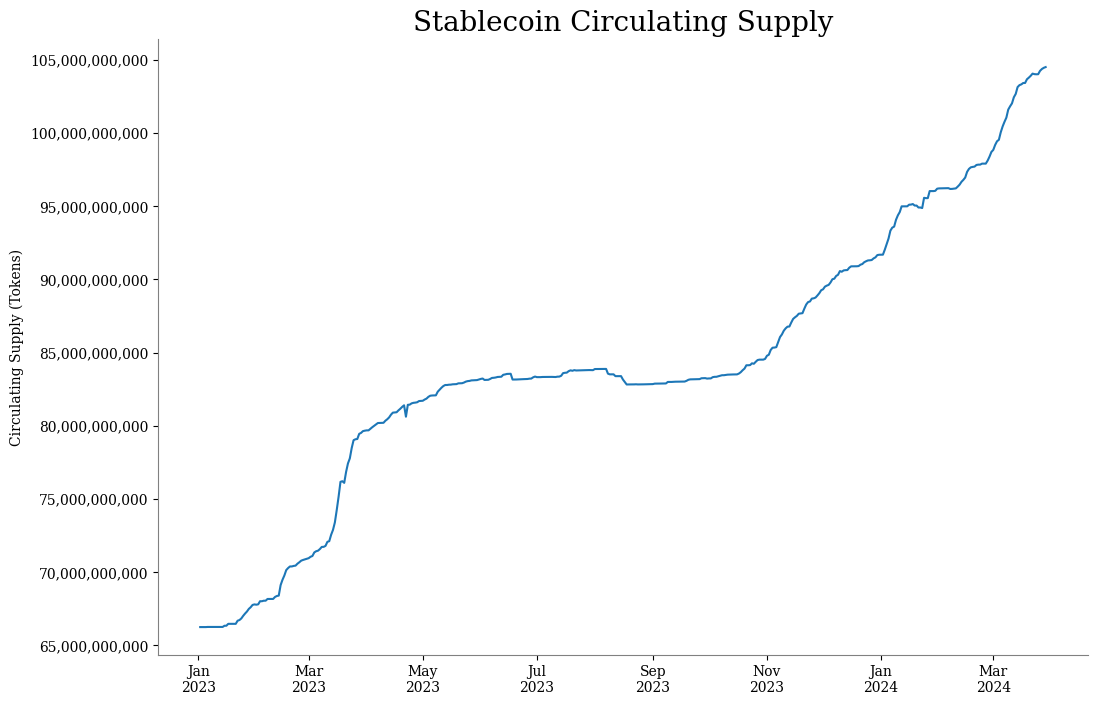

The Web3 ecosystem has recently seen a dramatic rise in activity through total value locked in decentralized finance (“DeFi”), volumes on decentralized exchanges (“DEXs”), and stablecoin activity (see the Appendix). Looking at the first quarter of the year, we examine prominent events in the space, including:

- With the approval of eleven spot bitcoin (“BTC”) ETFs in January, Chainlink Proof of Reserve will be critical in providing transparency into the underlying assets for both ETFs and wrapped tokens.

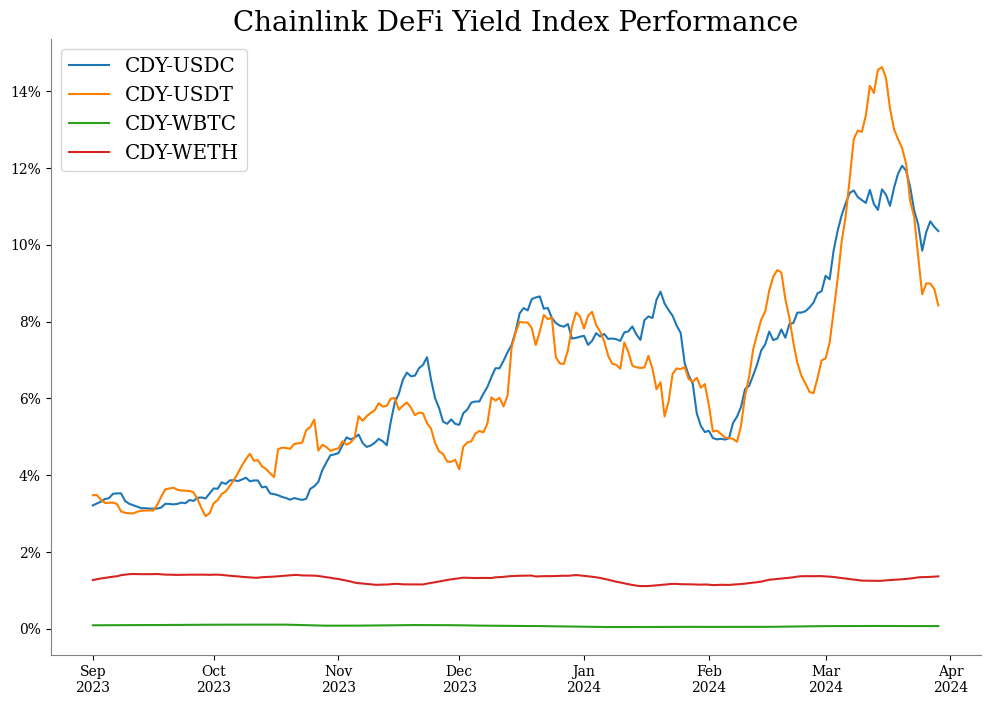

- The activity of wrapped BTC has caused higher lending yields—as measured by the Chainlink DeFi Yield (“CDY”) Index—of other tokens like USDC and USDT (see the chart below).

As Bitcoin has risen in prominence and distribution over the past 15 years, it has emerged as a new decentralized monetary asset separate from the traditional fiat money system. Bitcoin is often used as collateral or a means of settlement across the DeFi ecosystem, and numerous Bitcoin-based financial products have been built using both onchain and offchain infrastructure. All of these applications require secure and tamper-proof price data to inform asset valuations in these products, whose growth Chainlink has helped to facilitate by providing the most decentralized and widely used BTC/USD Price Feed in the blockchain industry as a means of triggering smart contract execution or serving as a tamper-resistant circuit breaker. With the approval of spot Bitcoin ETFs, Chainlink continues to enhance the adoption of Bitcoin through industry-standard services, such as Chainlink Price Feeds, Chainlink Proof of Reserve, the Chainlink DeFi Yield Index, and more.

Enabling Bitcoin Adoption With Proof Of Reserve

On January 10, 2024, 11 spot Bitcoin ETFs were approved in the United States. The transparency of the ETFs’ underlying assets (in this case, BTC) held in custody is crucial for maintaining trust; market participants rely on the accuracy and integrity of the information provided about the assets in order to make allocation decisions, assess risk, and understand how their capital is allocated. The BTC ETFs demonstrate how Chainlink Proof of Reserve provides transparency into underlying assets, enabling the onboarding of institutional levels of capital. For instance, the ARKB ETF (issued by 21Shares and ARK Investment Management) manages about $2.7 billion of Bitcoin assets as of late March 2024, and utilizes Chainlink’s Proof of Reserve, which pulls reserve data directly from ARKB’s custodian (Coinbase Prime) and reports the data onchain (Ethereum mainnet) via Chainlink oracles. Chainlink Proof of Reserve also helps relay collateral value data in other applications besides ETFs, as evidenced by Ava Labs’ BTC.b Proof of Reserve, which secures Avalanche’s native bridge, ensuring each BTC.b is backed. In addition, Swingby’s Skybridge reads Chainlink Proof of Reserve for WBTC off-chain as a collateral check before enabling transfers of WBTC. Industry leaders use Chainlink Proof of Reserve for its unmatched security, reliability, and compatibility by 1) reducing risk with automated, truth-based verification, 2) bringing enhanced transparency to users, and 3) preventing systemic failures and contagion.

The transparency provided by Chainlink Proof of Reserve will continue to be critical as more institutions consider participating in tokenization and cryptocurrency.

Unlocking DeFi Insights With the Chainlink DeFi Yield Index

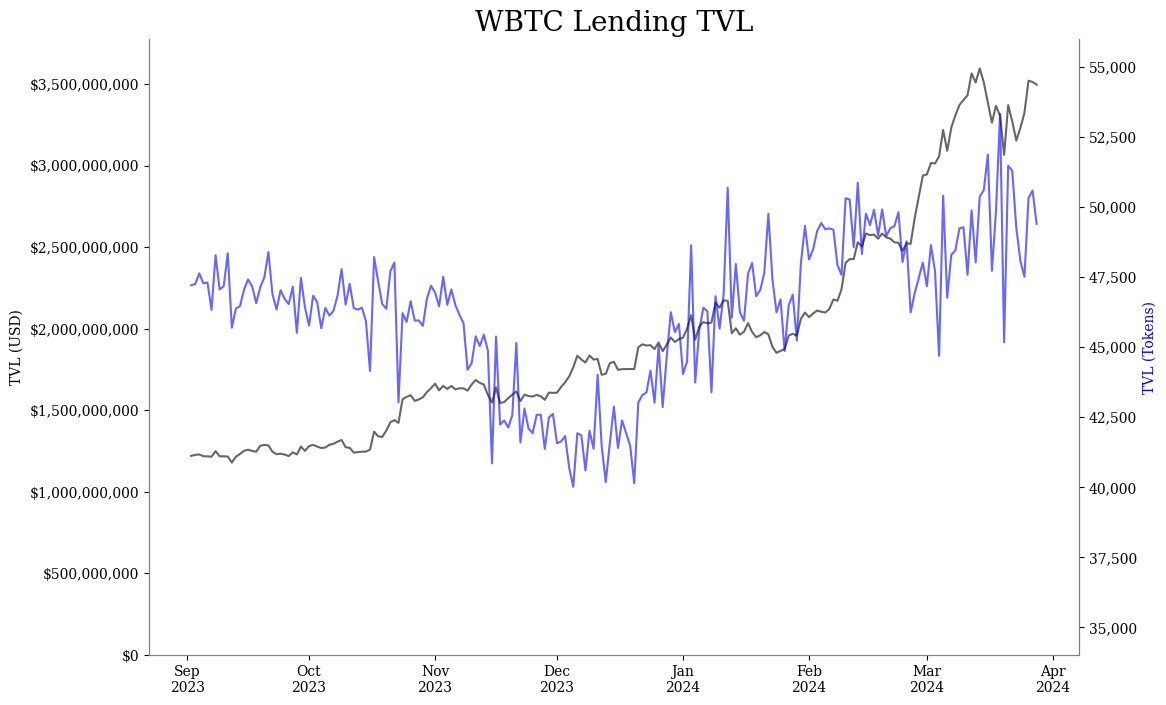

The supply of wrapped BTC (“WBTC”) in DeFi lending protocols on Ethereum increased in both token and dollar terms.

The number of WBTC tokens in major DeFi lending protocols on Ethereum—i.e., including CDY-WBTC members Aave v2, Aave v3, and Compound v2—increased from about 40,000 in December 2023 to about 50,000 in March 2024.

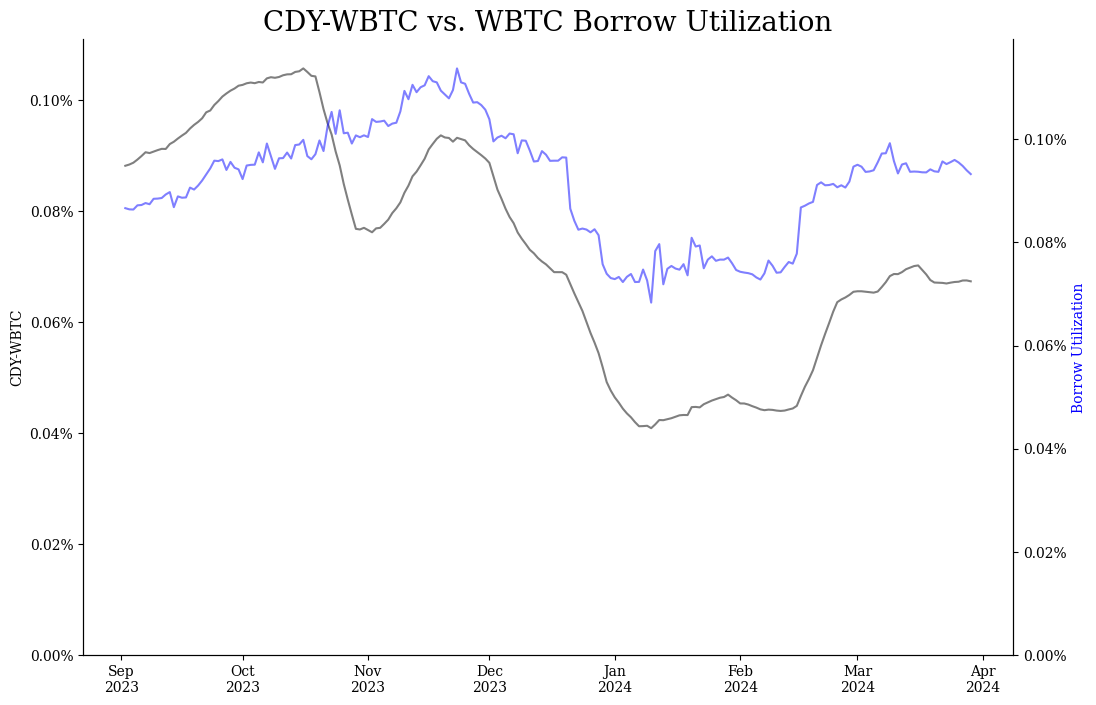

The increased supply of WBTC on DeFi lending does not necessarily change its yield profile since lending yields are based on borrow utilization (WBTC borrowed relative to WBTC supplied), and its borrow utilization was already at low levels on the major lending protocols.

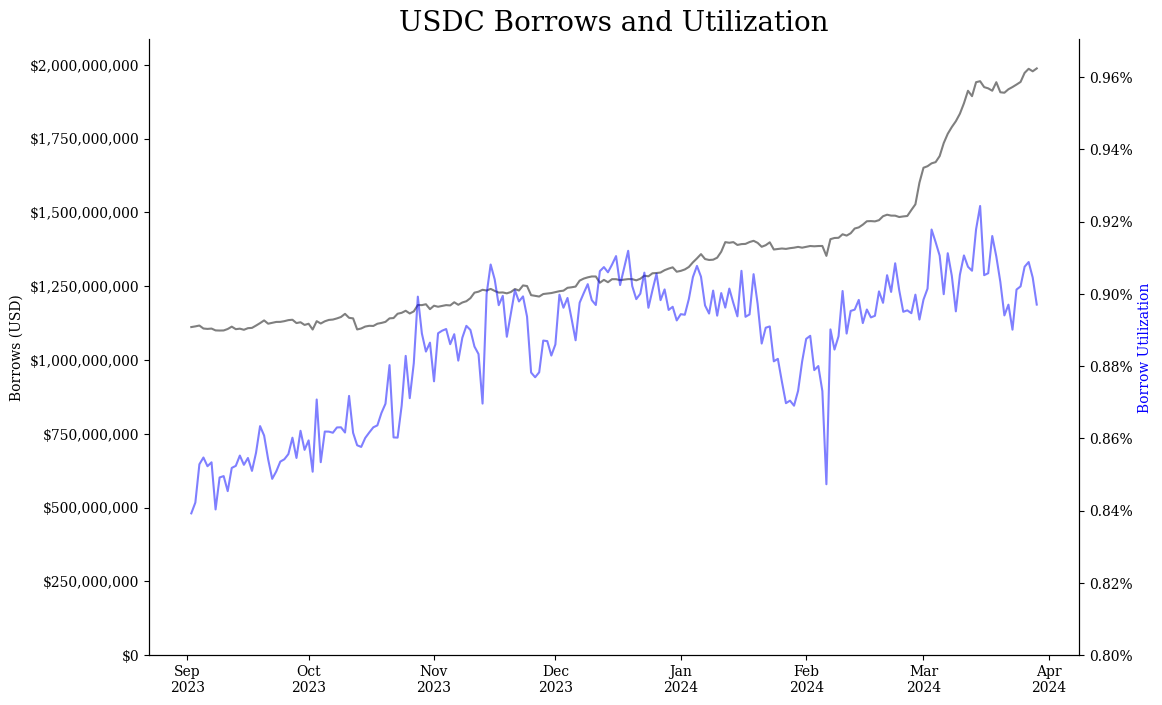

That said, when users deposit more of a low-yielding collateral token on a lending protocol, it suggests they intend to borrow more of another token—indeed, this is observed across major lending protocols. The chart below shows the borrow levels of USDC (left axis) and its borrow utilization (right axis) on major lending protocols.

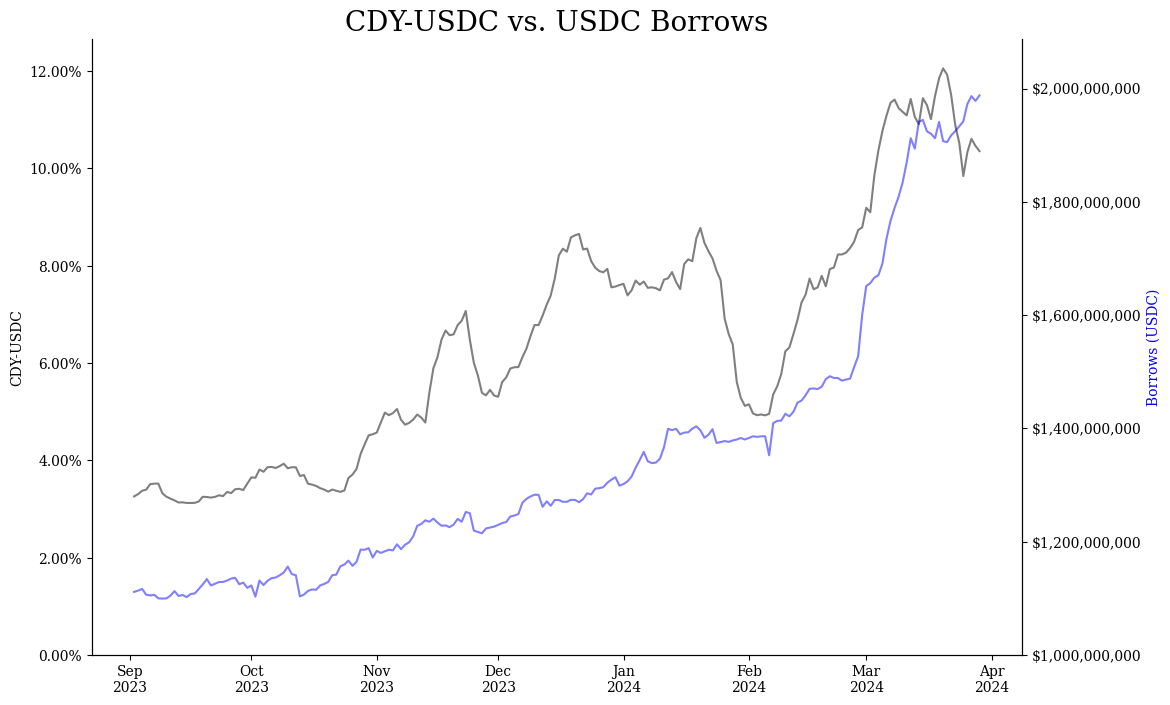

Higher borrow utilization implies higher rates (both lending and borrowing rates), which have trended higher across the markets as USDC borrows on major lending protocols have increased (see the figure below).

Note that raw lending yields on individual protocols are choppy on a daily basis; not only does the CDY-USDC index smooth out these yield figures, but it also aggregates lending yields for USDC across the vast majority of the DeFi lending space. The takeaway is that increased levels of supplied WBTC can significantly impact the lending yields of other tokens, a dynamic that is easily observed through the Chainlink DeFi Yield (“CDY”) Indices, which capture the lending yields of major tokens in DeFi: USDC, USDT, WBTC, and WETH. These indices track the yields of lending protocols secured by Chainlink oracles, with the goal of providing users a comprehensive view of prevailing market yields. This will enable users to compare rates between traditional banking and DeFi markets, assess relative token yields, and identify yield trends and opportunities that would otherwise not be transparent to them. As the DeFi lending space is considerably dynamic with various protocols on different chains, the CDY Index streamlines the process of market analysis, offering users a simplified yet insightful overview that facilitates timely decision-making.

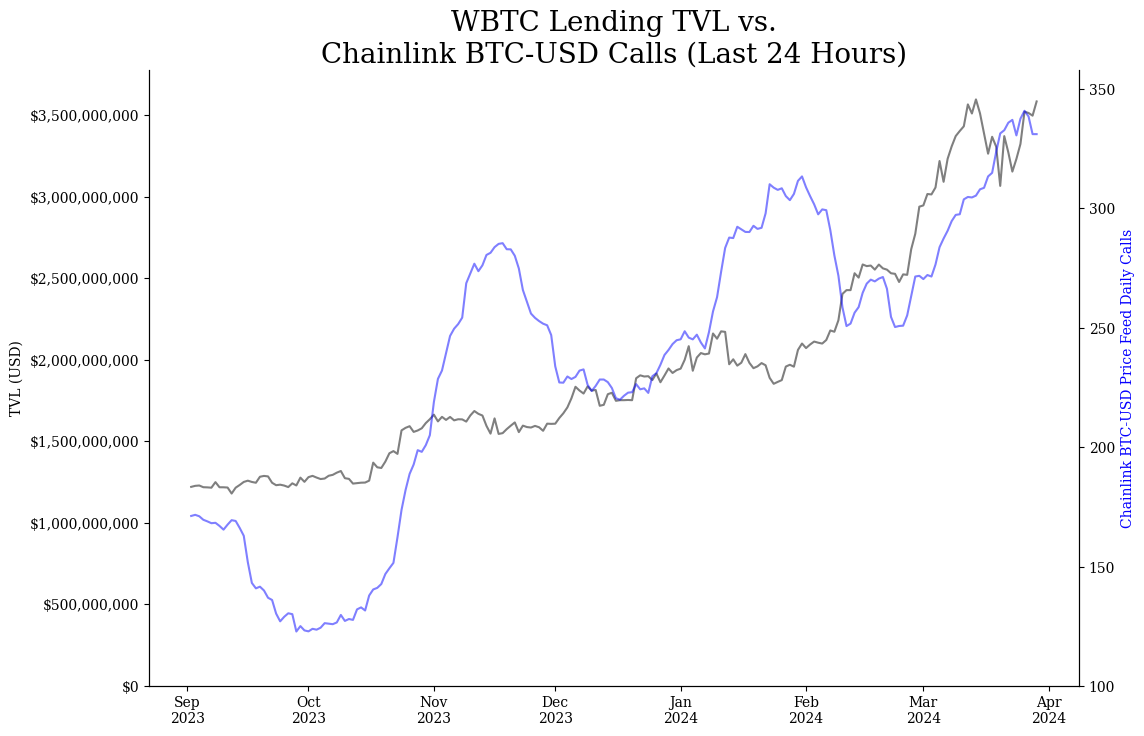

Chainlink Continues to Unlock DeFi

The Chainlink platform enables assets like Bitcoin to be onboarded across chains through its industry-standard Price Feeds and Proof of Reserve services. Chainlink’s WBTC Proof of Reserve feed (active on Ethereum since 2021) provides users with transparency of the assets underlying wrapped BTC, which will be critical as more assets are moved across chains, while Chainlink Price Feeds continue to underpin DeFi (Chainlink’s BTC/USD Price Feed on Ethereum has been active since 2020). Users’ daily calls to Chainlink’s BTC/USD Price Feed on Ethereum have markedly increased since September 1, 2023, as WBTC activity picked up.

Note: Price Feed calls visualized here are a 30-day moving average of the count of calls in the last 24 hours on Ethereum.

In addition, the Chainlink Build program includes protocols that help increase the adoption of Bitcoin in the EVM ecosystem and thus Bitcoin DeFi services. For instance, Merlin Protocol has adapted assets like BRC-20 (tokens issued on the Bitcoin network), Bitcoin, and Bitcoin hash power to the EVM ecosystem.

Reach out to Our Team of Experts

To find out how your organization can benefit from using the Chainlink platform, reach out to our team of experts.

Appendix