Volatility Oracles: Unlocking New DeFi Risk Management Strategies and Derivatives Markets

Chainlink Price Feeds have served as a foundational building block for the DeFi ecosystem, providing accurate, tamper-proof, and aggregated price reference data for an expanding number of cryptocurrencies, commodities, and fiat currencies. The availability of high-quality price data has played a significant role in DeFi’s growth to over $170B in Total Value Locked at its peak, while protecting users from data manipulation-related exploits.

However, the demand for a secure source of external data from DeFi applications extends beyond price data to encapsulate various other key metrics that can serve as crucial inputs for the creation of more sophisticated financial products and automated risk management strategies. To meet the market demand from users for new unique data points, we continuously engage in research and development around new product innovations that make these data points available to developers.

For instance, Chainlink Liquidity Indicators are now live in beta testing to support risk management with DeFi derivatives using Chainlink low-latency oracles. These feeds can enable derivatives markets to mitigate the risk of excessively large positions being taken on illiquid assets and for lending markets to adjust parameters such as LTV ratios based on prevailing liquidity conditions.

To further support developers in the DeFi ecosystem, the Chainlink Network is introducing support for realized and implied volatility oracles. This represents another powerful tool in the DeFi developers’ toolbox, which can enable a new wave of on-chain risk management strategies and unique derivatives markets to be built.

In this blog, we’ll explore the role that realized and implied volatility data plays in financial markets and how developers can get started today and begin testing with Chainlink Realized Volatility Data Feeds and leverage Chainlink Functions for implied volatility.

Asset Volatility Data in Financial Markets and DeFi

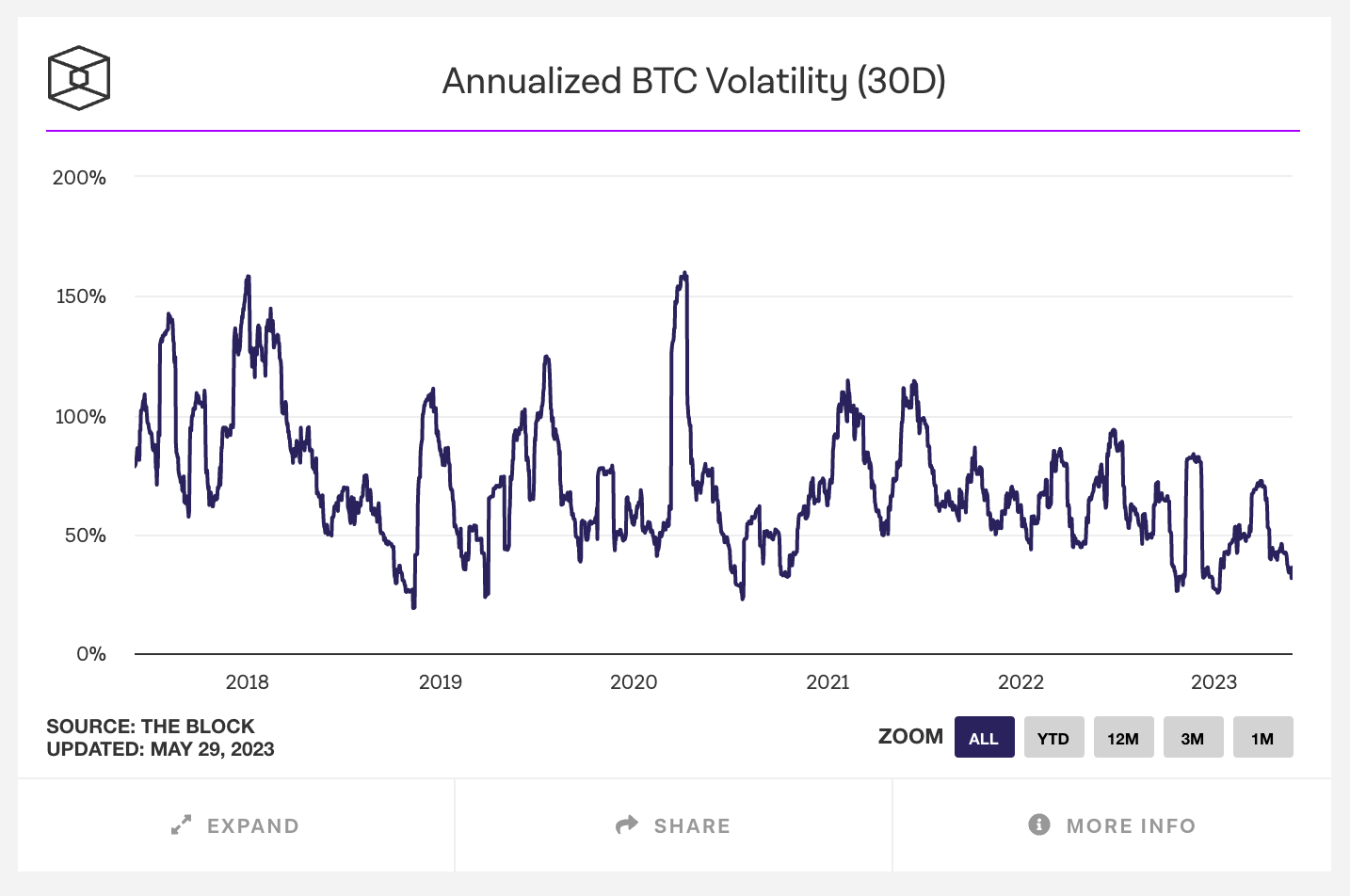

In finance, volatility refers to both the frequency and magnitude of an asset’s change in price, both up and down, over a defined period of time. Notably, volatility doesn’t measure the direction of price changes, but rather their variation. While two different assets may have the same returns, an asset with greater volatility has larger swings in price and is often perceived as more risky.

Volatility can be further broken down into two different types of asset volatility measurement: realized and implied.

Realized Volatility (RV)

Realized volatility (also known as historical volatility) measures how much an asset has changed in price in the past over a specific time interval. Prices are measured at regular intervals such that the larger the changes in price over time, the higher the realized volatility. Realized volatility is used within a variety of financial derivatives instruments, such as volatility futures and volatility options, allowing market participants to speculate on or hedge against a specific market’s volatility.

Additionally, realized volatility is useful for determining the “normal” ranges for asset price movements, so that when prices move outside of those ranges, parameters used for financial products can be adjusted to reduce risk exposure. Furthermore, because realized volatility data can be used to measure the market riskiness of an asset, it can also be used to adjust leverage, lending utilization rates, and collateral coverage ratios, as well as rebalance asset allocation for portfolio holdings as a means to meet risk targets.

Implied Volatility (IV)

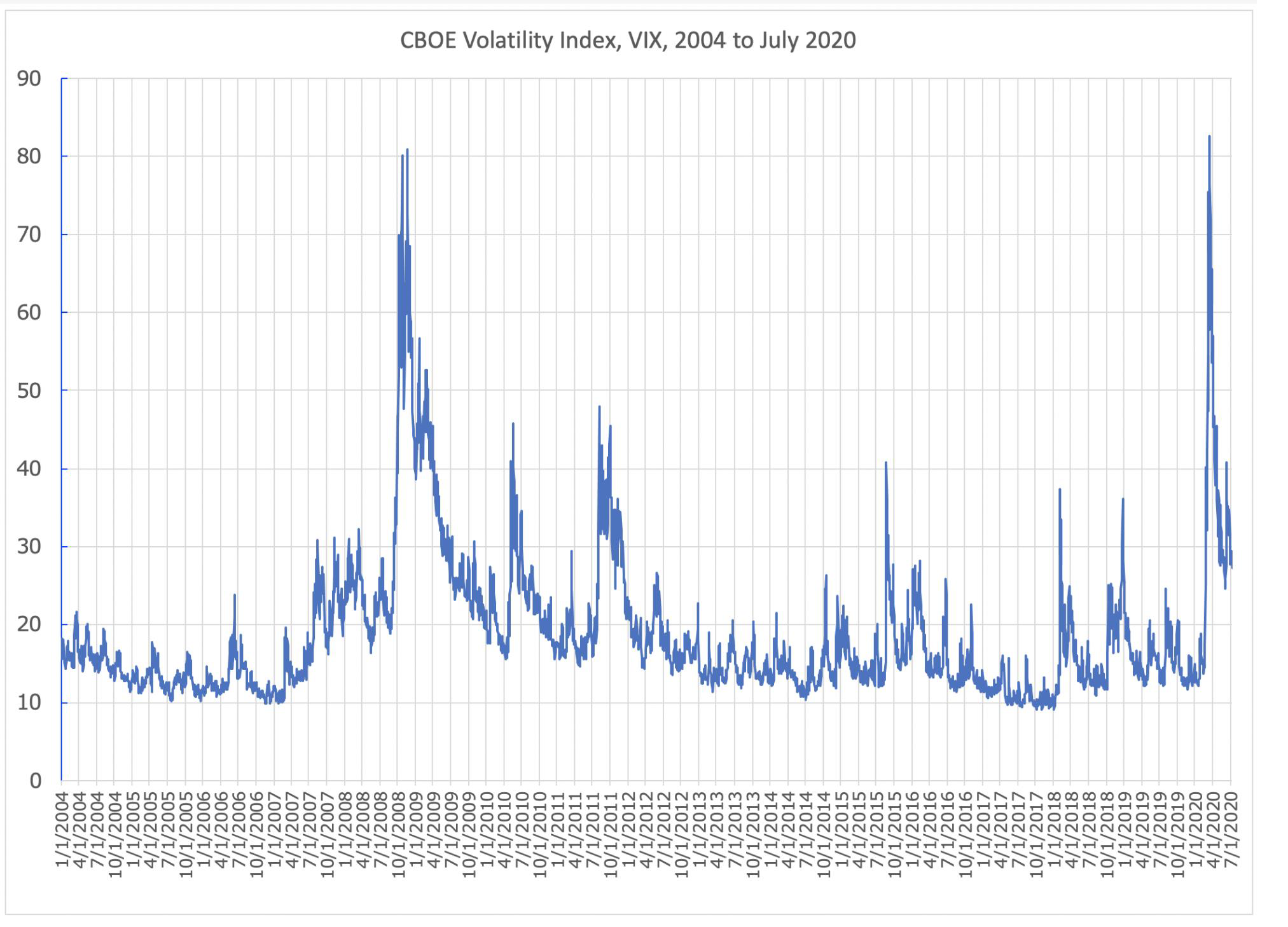

While realized volatility measures volatility that measurably happened in the past, implied volatility is a prediction of what the market expects to happen in the future. Notably, implied volatility is not a prediction of what direction an asset’s price is predicted to change. Rather, a high implied volatility is a prediction that there will be a large swing in an asset’s price, either up or down, while low implied volatility is a prediction that an asset’s price is unlikely to make large movements, up or down, and instead remain relatively stable.

Implied volatility is a metric used by market participants to estimate future fluctuations and is often used to price options contracts, where high implied volatility results in options with higher premiums.

Asset volatility data, both realized and implied, is a key component of any robust financial market. It not only enables appropriate pricing and risk management strategies, but also facilitates the creation of options and markets for institutions to hedge risk exposures. Making volatility data available on-chain via oracles for use within the DeFi ecosystem would enable dApps to introduce new products and incorporate advanced risk management strategies, pushing forward the utility and maturity of the DeFi ecosystem as whole.

Chainlink’s Approach to Asset Volatility Data

As the industry-standard Web3 services platform, Chainlink is extremely agile in the variety of datasets that can be delivered on-chain and how they’re delivered. With growing demand for both realized and implied volatility datasets, we have worked closely with the developer community to make available two new product solutions, currently on testnet, for each type of asset volatility measurement.

Chainlink Realized Volatility Data Feeds

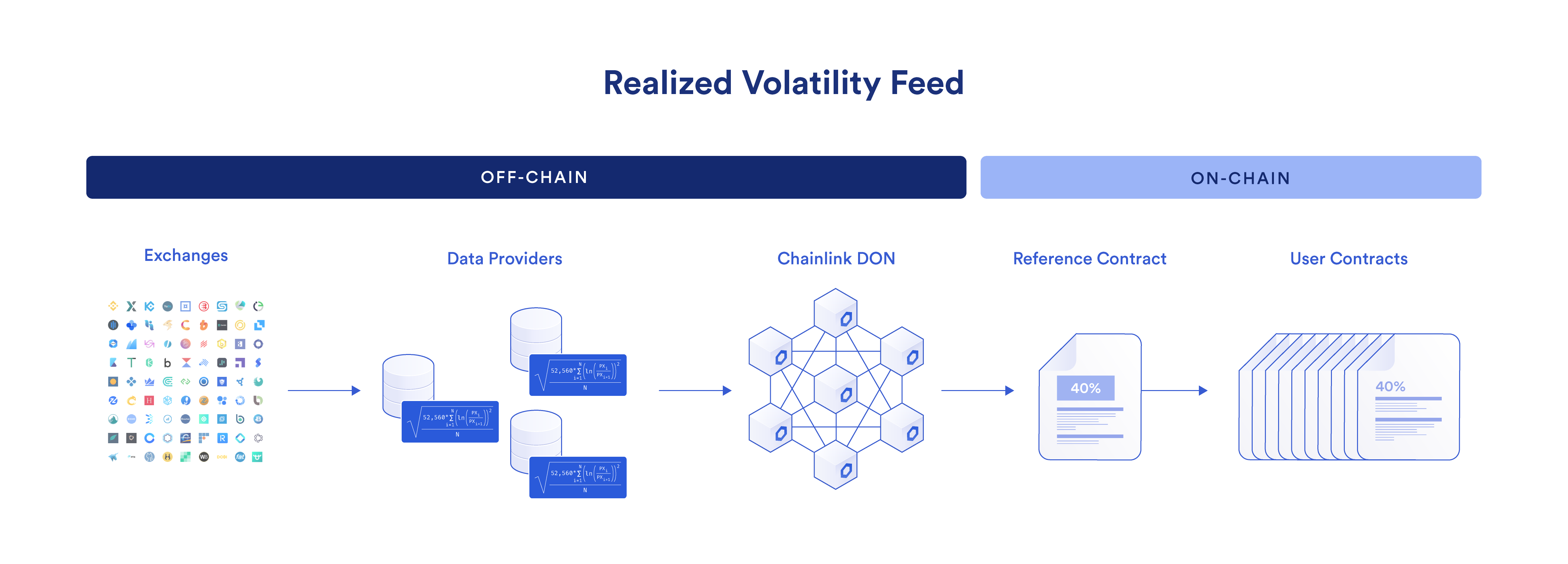

To enable DeFi developers to consume realized volatility data in their on-chain applications, a new category of Data Feed has been launched (Chainlink Realized Volatility Data Feeds) featuring the same decentralization and trust-minimization properties as existing Chainlink Price Feeds. Additionally, these new feeds leverage the same premium data providers used in existing Chainlink Price Feeds, which helps ensure consistency between an asset’s observed price and volatility.

These feeds are possible due to the fact that realized volatility is based upon historical data, allowing data providers in the Chainlink ecosystem to utilize consistent, collectively agreed-upon methodologies that are calculated in a deterministic manner. More specifically, these data providers have chosen to adapt the “close-to-close” methodology—an established standard in traditional finance—to reflect the 24/7/365 nature of cryptocurrency markets, resampling price data at ten-minute intervals. Using off-chain computation, the data providers then calculate realized volatility across three rolling time windows: 24 hours, 7 days, and 30 days. Finally, this data is fetched by multiple Chainlink node operators in an oracle network, combined into an aggregated oracle report, and published on-chain for consumption by DeFi applications.

Chainlink Realized Volatility Data Feeds spanning 24-hour, 7-day, and 30-day look-back periods are now live and available for testing across four blockchain testnets: Arbitrum Goerli, Avalanche Fuji, Ethereum Sepolia, and Polygon Mumbai. Initially supported feeds include realized volatility for BTC/USD, ETH/USD, LINK/USD, and more.

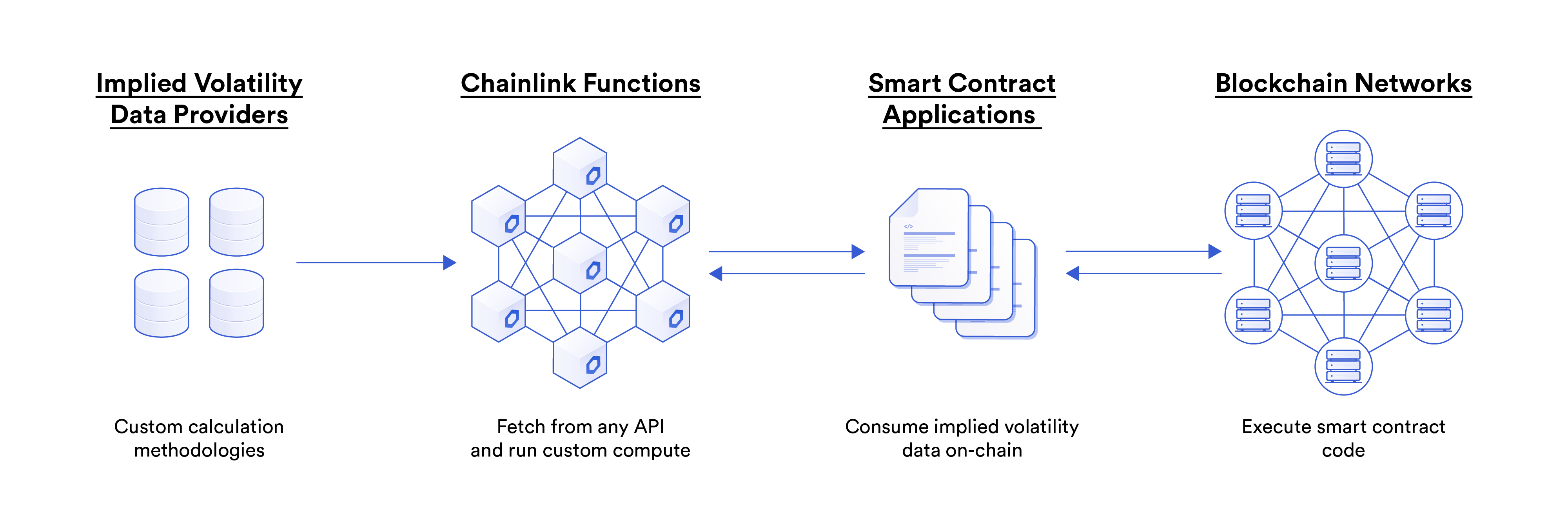

Implied Volatility With Chainlink Functions

To obtain access to implied volatility datasets, DeFi developers can use Chainlink Functions—a Web3 serverless developer platform that can fetch data from any API and run custom compute. With dApps able to make a direct connection to a data provider’s implied volatility API, users have the ultimate discretion on the consumption and calculation of implied volatility for their protocol’s specific requirements.

Supporting implied volatility data via Chainlink Functions, as opposed to launching aggregated data feeds, was a deliberate design decision given that implied volatility is a prediction of future asset price movements. Unlike realized volatility or reference price data, there is no observable ground truth, only predictions. Furthermore, given the current market structure of crypto options, with variability in expiration dates and strike prices across exchanges, there is additional variation in methodologies taken by data providers. As such, there is no single standardized calculation methodology for implied volatility.

Therefore, Chainlink Functions provides the ideal infrastructure solution, with dApps able to draw implied volatility data from as many or as few data providers as they desire, providing the ultimate discretion for their in-house calculations—all without having to deal with managing their own oracle node infrastructure.

Implied volatility data can be brought on-chain via Chainlink Functions today on the Avalanche Fuji, Ethereum Sepolia, and Polygon Mumbai testnets. DeFi developers can apply for beta access via the following Typeform before Functions’ full release on mainnet.

Integrating Asset Volatility Data Throughout DeFi

Asset volatility metrics are critical inputs to financial risk models. With both realized and implied volatility data available on-chain through Chainlink’s decentralized oracle networks, DeFi applications can dynamically adjust their risk parameters to reflect changing market conditions. By leveraging additional Chainlink services, such as Chainlink Automation, risk management processes can take place in a highly efficient and reliable manner without manual human intervention.

With realized and implied volatility data sets available on-chain, the following DeFi use cases can be enhanced with greater functionality or safety measures.

- Lending Protocols: Improved capital efficiency of collateralized loans by dynamically and automatically tuning risk parameters such as loan sizes, liquidation incentives, and closing factors to match the volatility and liquidity of the deposited collateral.

- Margin Trading: When volatility exceeds expectations, parameters such as leverage ratios and/or maintenance margins can be adjusted to limit protocol risk until market conditions return to baseline “normal” levels.

- Options Pricing: Seed a volatility surface with realized volatility in cases where an illiquid options market will not support reliable measurement of implied volatility.

- Treasury Management: More effectively manage portfolio allocations and risk exposure by taking into account historical and future predicted volatility.

The introduction of Chainlink Realized Volatility Data Feeds and the ability to obtain implied volatility with Chainlink Functions ultimately provides the DeFi ecosystem with access to additional high-quality data points that further the ability of protocols to manage risk and create more sophisticated financial products.

If you’d like to integrate Chainlink for realized volatility or implied volatility, read the official documentation or connect with an expert.