Using Chainlink Proof of Reserve to Unlock Cross-Chain Liquidity With Wrapped Tokens

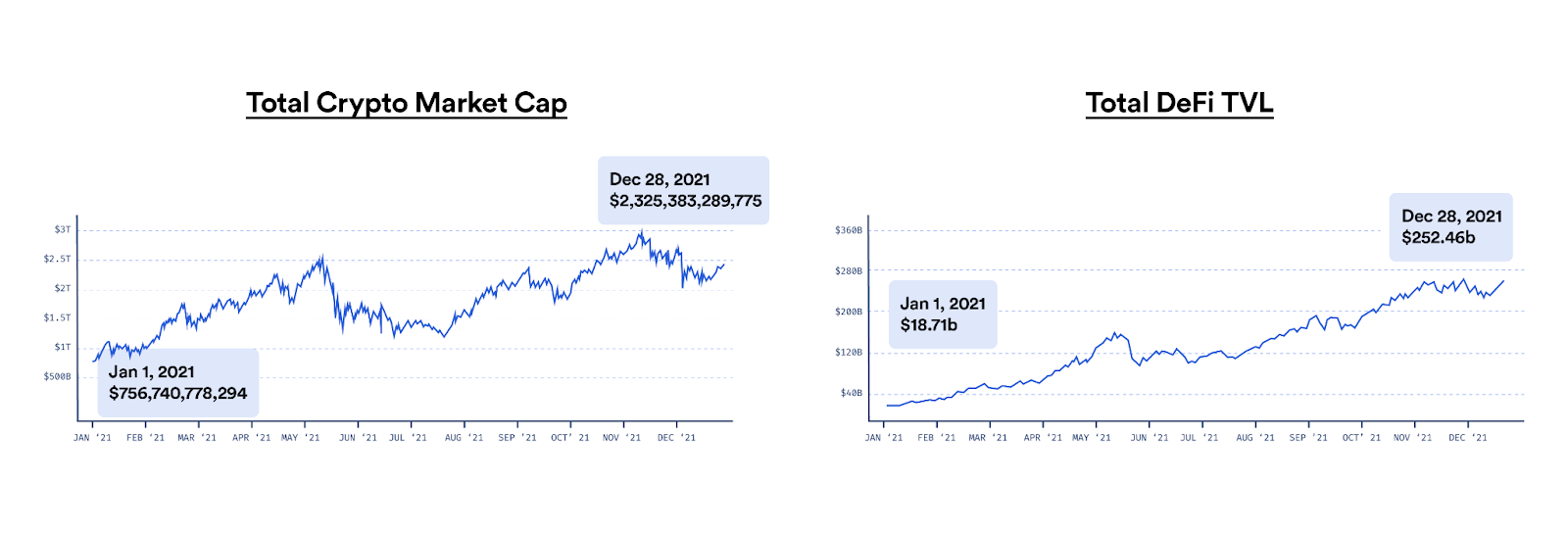

The blockchain industry is experiencing a period of rapid growth. Part of this growth can be attributed to the increased size of decentralized finance (DeFi) markets, which are unlocking new financial opportunities for a global user base. Yet, while DeFi is a cutting-edge, transformative industry, it still only represents a fraction of the wider blockchain industry’s total market capitalization.

Though multiple factors have contributed to the blockchain industry’s growth, one of the reasons for the latest surge is that more projects are leveraging real-world data and off-chain computation through Chainlink decentralized services, enabling the creation of more advanced smart contract applications across multiple chains. The mainnet launch of multiple chains and layer-2 networks in 2021 has further fueled industry growth, spurring rapid innovation by giving developers the ability to leverage new blockchain architectures to build novel smart contract use cases.

However, as users increasingly adopt new blockchains, liquidity becomes trapped across different smart contract platforms. Multiple projects have created or are building wrapped tokens that look to solve this problem. A notable example is WBTC, which was created by Bitgo in collaboration with Kyber Network and Ren. WBTC is currently the most widely used wrapped version of Bitcoin and its collateralization is made transparent via Chainlink Proof of Reserve.

The following blog post explores how wrapped tokens work and outlines how Chainlink Proof of Reserve is the most time-tested and tamper-proof solution to help secure and autonomously audit wrapped tokens.

What Are Wrapped Tokens?

While different wrapped tokens have their own novel architectures, they are generally understood as on-chain assets pegged 1:1 to the value of another asset, be it a commodity, a real estate property, another blockchain token, or any other asset. One of the main reasons developers create wrapped tokens is to unlock asset liquidity across blockchains. Before wrapped tokens, native blockchain assets were isolated within their respective on-chain environments, since most blockchains do not feature native interoperability and often support different selections of tokens.

To overcome this hurdle, many traditional wrapped tokens backed by assets on another blockchain are created through a similar process. First, users send their token collateral to a custodian, who then mints a representation token on another blockchain. When users wish to redeem their wrapped assets, they send a request to the custodian, who burns the wrapped tokens in exchange for the user’s collateral.

Wrapped tokens can also be created to represent off-chain collateral using a similar process. However, a single institution often creates its tokens, in many cases by controlling the entire minting, redeeming, and burning process. This leads to a more opaque process, as users cannot verify real-world asset reserves directly on-chain. Furthermore, with a single party or a small number of parties controlling their issuance or supply, wrapped tokens are often centralized and subject to a single point of failure. This means users cannot audit wrapped token collateralization and verify whether or not tokens are being rehypothecated.

While some projects have opted to prepare traditional audits to offer more transparency into wrapped assets, these are typically lengthy, costly, and manual processes subject to error.

Securing and Auditing Wrapped Tokens With Chainlink Proof of Reserve

As developers continue to build wrapped tokens to unlock cross-chain liquidity, a highly reliable, transparent, and decentralized standard that enables wrapped tokens to be securely audited through an automated process is required—enter Chainlink Proof of Reserve.

Autonomous On-Chain Auditing Across Any Network

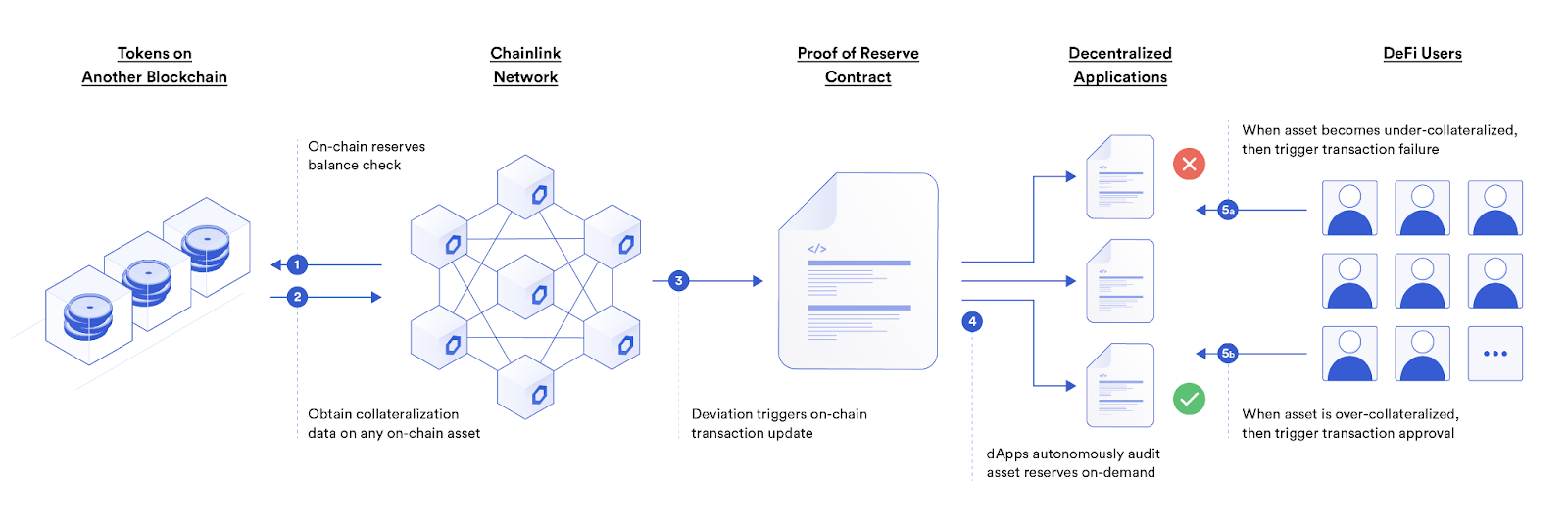

Rather than forcing users to trust paper guarantees made by custodians, Chainlink Proof of Reserve can be deployed for automated on-chain audits that give users a superior guarantee of a wrapped token’s true underlying collateralization. As a result, users gain transparency into their risk exposure and gain confidence in the backing of their wrapped tokens.

Chainlink is blockchain-agnostic, meaning Proof of Reserve can help secure wrapped tokens across any on-chain or layer-2 network. Chainlink Proof of Reserve feeds are also secured by oracle nodes run by leading blockchain DevOps teams, data providers, and traditional enterprises, helping ensure robust data quality even during adverse market and external network conditions.

Circuit Breakers to Mitigate Fractional Reserves

Beyond providing users and dApps on-chain audits of collateralization, Chainlink Proof of Reserve is also increasingly being used to help secure the minting, redeeming, and burning of wrapped assets. Chainlink Proof of Reserve eliminates inefficient manual auditing processes by replacing them with on-chain real-time audits. This enables developers to use Proof of Reserve as a circuit breaker that halts minting/burning if fractional reserve activity is detected, helping mitigate against the minting of unbacked wrapped tokens.

Once Chainlink Proof of Reserve determines that wrapped tokens are undercollateralized, Chainlink Automation can be used to halt the minting, redeeming, and burning of wrapped tokens, giving developers the ability to fix the underlying problems without putting users at risk.

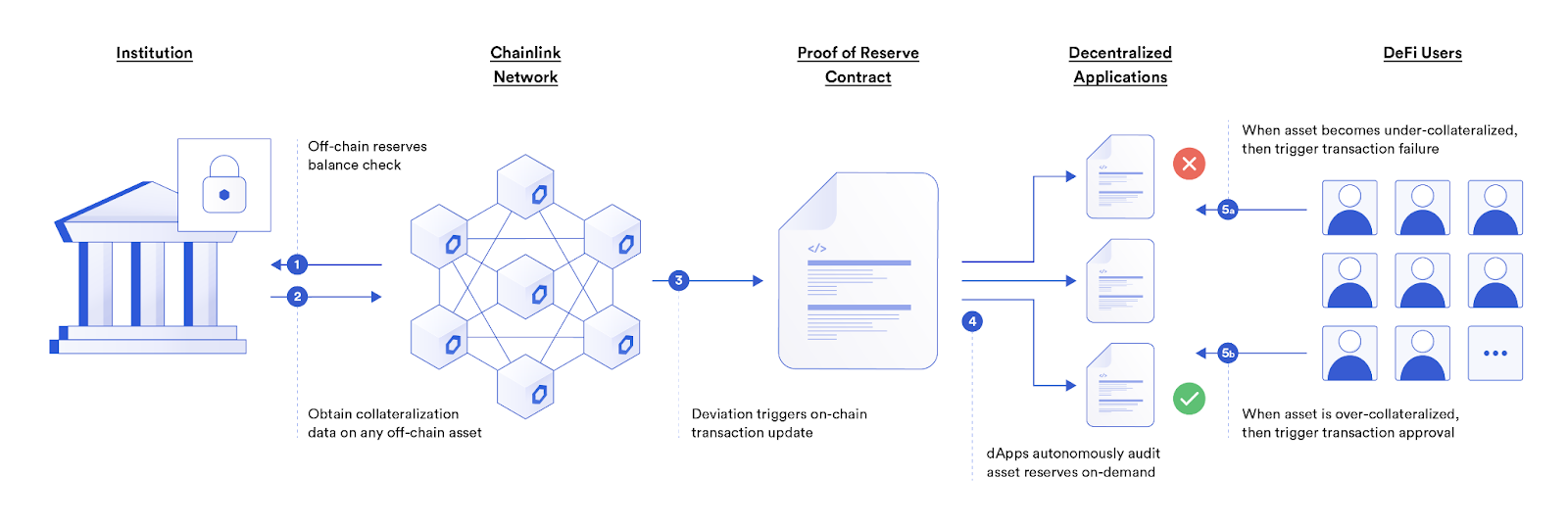

Transparency Around Real-World, Off-Chain Reserves

Another unique aspect of Chainlink Proof of Reserve is that its flexible architecture enables the auditing of both real-world and on-chain reserves through tailormade External Adapters. Chainlink Proof of Reserve can also be monitored by anyone in real-time, allowing users to verify the current collateralization of assets.

Conclusion

Chainlink Proof of Reserve will play a key role in the continued growth of the blockchain industry by providing real-time, automated audits that enable wrapped tokens to be more securly used across chains, increasing their liquidity and utility. Ultimately this will improve the transparency of on-chain protocols and help prevent systemic failures in DeFi.