Blockchain in Insurance

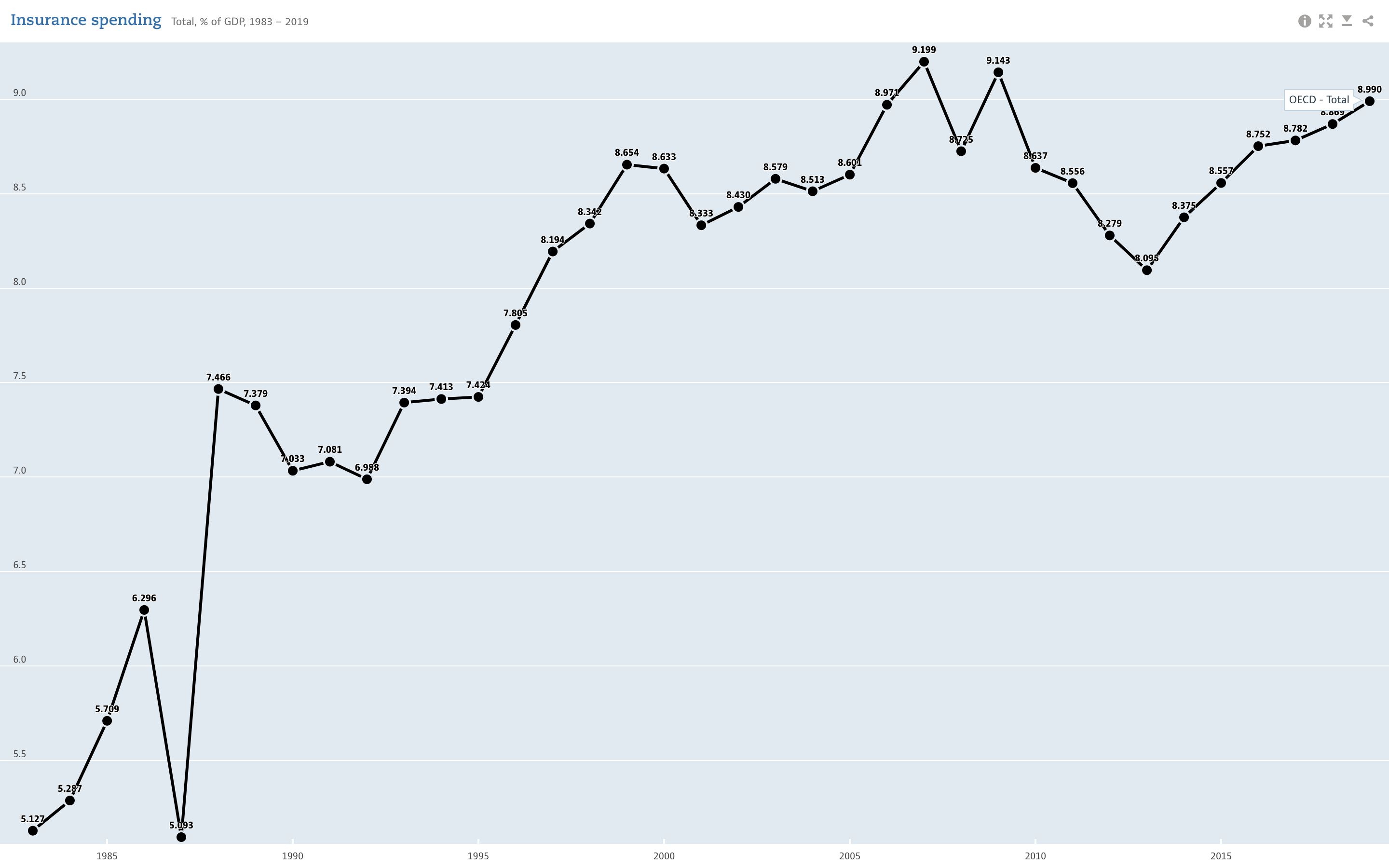

Insurance is currently a multi-trillion dollar global industry, providing vital risk management for everyone from the world’s largest corporations to individuals, covering everything from billion-dollar supply chain activities to the loss of individual electronic devices. In fact, insurance premiums account for close to one-tenth of the entire world’s economic activity; according to the Organisation for Economic Co-operation and Development (OECD), about 9% of worldwide GDP consists of direct gross insurance premiums.

On the macro scale, insurance plays a critical role in driving economic growth and jumpstarting innovation. In everyday life, insurance gives peace of mind to car owners, travelers, homeowners, farmers and more. It is both a necessity and an afterthought, as most who pay for insurance won’t ever have to claim on it. However, those who end up filing claims often find that the process is not as simple as it should be.

In recent years, technologies such as blockchain and smart contracts have emerged as tools with the potential to unlock untold value across a diverse range of sectors, providing more efficiency and transparency that can further a level playing field for all stakeholders. These technologies present opportunities that can enhance the mechanisms powering the traditional insurance industry, which has historically suffered from issues that blockchains and their related technologies can alleviate, such as an overreliance on trust, information asymmetry, cumbersome processes, and opaque practices.

Problems in the Insurance Industry Today

Though simple in concept, insurance has built-in complexities because it is a financial agreement between two parties, in which one wins and the other loses. Keeping that in mind, the root cause of many of the problems with how insurance currently works insurance can be boiled down to one word: transparency.

Opaque processes are the de-facto norm for many private organizations and companies around the world. Consumers don’t receive insight into why Netflix releases a particular television series, or how exactly companies price their items, and for the most part, that’s okay—not all processes need to be transparent. However, in the case of insurance, transparency should be a requirement. Unfortunately, this is currently not the case—with the incentives of both parties misaligned, the outcome is often an opaque and drawn-out claims process that serves neither side well.

Misaligned Incentives Between Policyholders and Providers

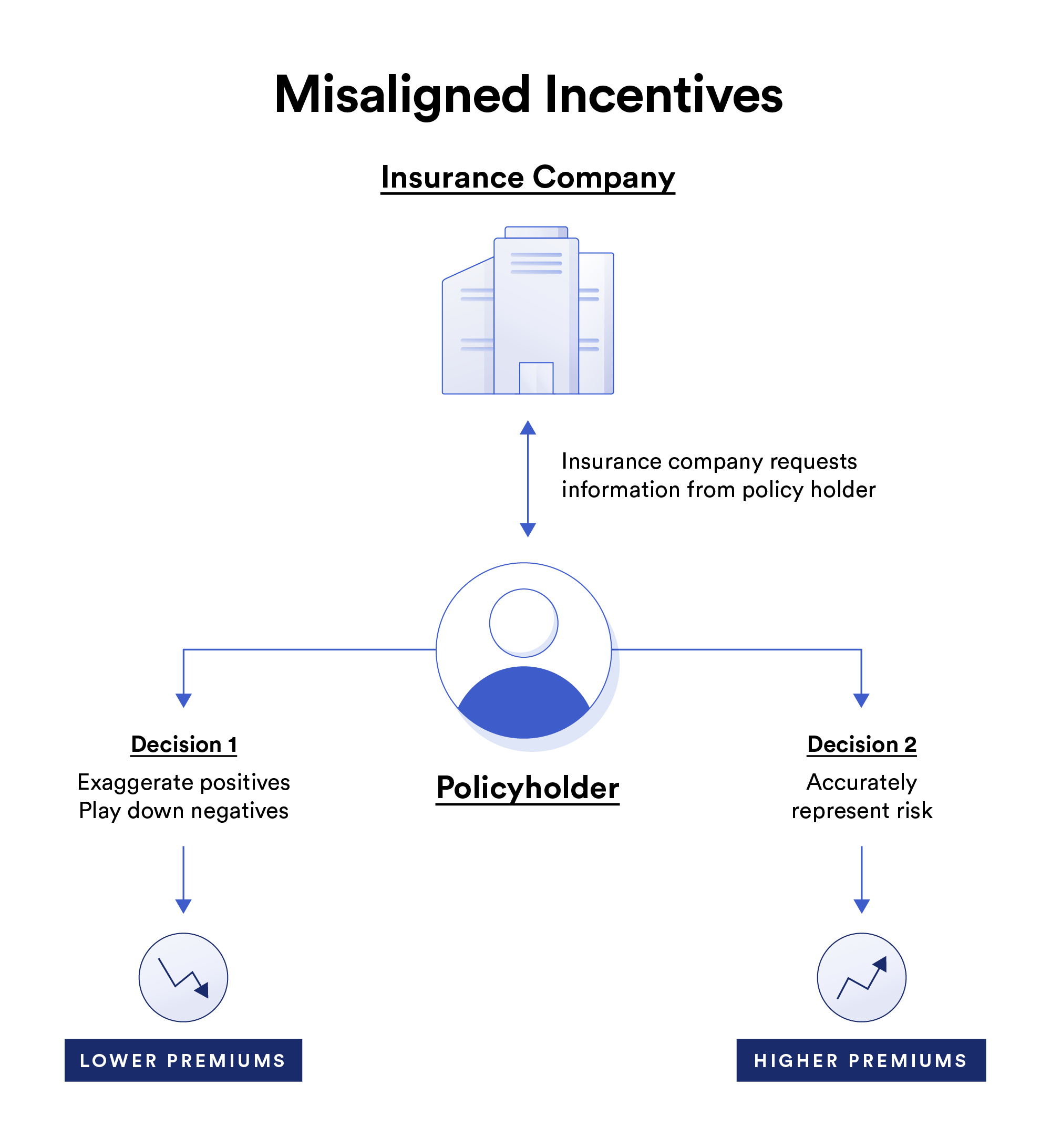

On the consumer side, policyholders have a better understanding of their situation than the insurance company. The insurance company must rely on information provided by the policyholder to determine their risk profile, premiums, and deductibles. This leads to a situation in which the insurance company would benefit immensely from transparent information provided by the policyholder while the policyholder is incentivized to withhold negative information and exaggerate positive information for lower premiums rates.

As a result of this lack of transparency from policyholders, insurance companies are constantly bombarded with fraudulent claims. In the U.S., it’s estimated that non-healthcare-related insurance fraud costs insurers $40 billion per year and represents up to 10% of total claims. The insurance industry expends a considerable amount of resources to fight fraud, which leads to higher policy premiums, more manual processes, and longer arbitration times that correspond to increases in administrative and labor costs, underwriting procedures, claims processing, and dispute resolution.

Black Box Environments of Traditional Insurance Providers

On the other side, policyholders are unable to see into the black box of policy parameters, premium pricing, and claims processing. While they can make generalized assumptions, the truth is that many policyholders are largely unaware of why they have received certain pricing, the factors that played into that decision, and even why their claim was denied. They are subject to the decisions of the insurance company, which has the final say in insurance-related matters—barring lengthy and stressful legal challenges.

This lack of transparency causes imbalances in the pricing and value of insurance policies and incentivizes policyholders to game the system. While many policyholders are honest, insurance companies need to account for bad actors by raising the baseline costs on all premiums in order to reliably turn a profit. This makes underwriting policies and processing claims more time-consuming, manual, costly, and complicated for everyone, further eroding trust between insurers and policyholders and increasing the incentive for policyholders to commit fraud in an unhealthy cycle of mutual distrust that results from opaque processes and misaligned incentives.

The Benefits of Smart Contracts in Insurance

Recent technological innovations such as blockchains and smart contracts have shown the potential to help solve both the root problem of transparency that contributes to the cycle of mutual distrust described above.

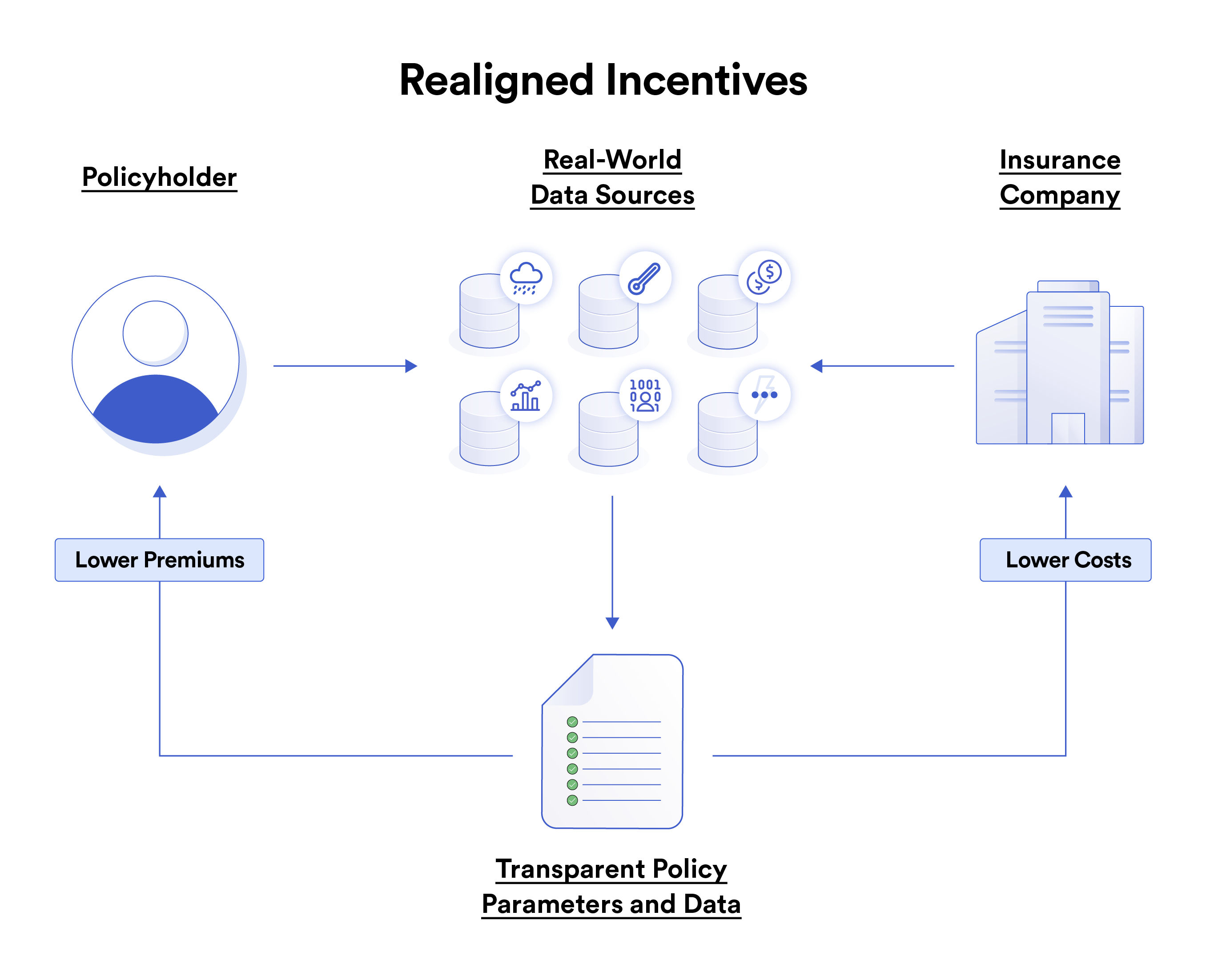

By combining blockchains, the smart contracts built on top of them, and decentralized oracles, it’s possible to upgrade the foundational infrastructure of insurance to not only solve the problem of transparency but also streamline the entire insurance process and make insurance globally accessible to disenfranchised consumers. Decentralized insurance protocols offer better, faster, cheaper, and more trust-minimized operational abilities, leading to faster insurance claims, arbitration, and payouts.

The foundational starting point for blockchain insurance is smart contracts, software programs that run on and are stored in distributed and decentralized ledgers called blockchains. Smart contracts offer automated execution based on if/then parameters that can trigger and replace the claims processing portion of traditional insurance agreements in a way that is highly trustworthy, transparent, and offers tamper-proof policy arbitration.

These automatically executed if/then conditions can be extrapolated to insurance at large. If a policyholder has a flight canceled, then an insurance payout is automatically triggered. If an insurance smart contract is notified of a verifiable death certificate, then a life insurance claims process is started. Given robust implementations, smart contracts can automate a large portion of the insurance process in a way that promotes transparency and fairness while drastically reducing associated costs. From coverage against adverse weather to marine insurance, the possibilities for better insurance models are almost endless.

Data-Driven

Whereas current insurance agreements rely on the interpretation of a claims processor, a smart contract is executed directly from data. For example, crop insurance payouts can be triggered by weather data, creating an automatic process based on a relevant trigger rather than waiting for manual input from an employee.

Data-driven insurance smart contracts shift the information asymmetry closer to information parity. The insurance provider can receive verifiable proof that a claim occurred as it’s triggered by trusted data-generating entities, such as a multitude of IoT devices. This can substantially reduce costly manual claim verification, enabling insurance policies to receive definitive answers regarding claims and their legitimacy—ultimately removing the need for unverifiable information from either party by having a shared source of truth. Which, in this case, is location-specific weather data provided by satellites.

Streamlined

Because smart contracts are automated and redundantly stored across distributed networks, they are faster, cheaper, and less prone to error. Automation allows claims processing to be streamlined and digitally verified using real-time data. There are numerous insurance agreements that can use the Boolean logic of smart contracts to increasingly replace the backend work.

Through smart contracts, the insurance industry stands to substantially save on costs associated with claims processing, administration costs, legal fees, and manual labor for data entry. Many of these savings can be passed on to consumers in the form of lower premiums and faster settlements.

Digitized

Most insurance contracts—especially those in the corporate world—are written legal contracts signed between both parties. This creates a pressing need for dynamic contracts that are human and machine-readable, often referred to as Ricardian contracts. Not only do Ricardian contracts bring physical contracts into the digital world, but they can also enable quicker and composable amendments that further streamline processes and allow codable and non-codable clauses to co-exist.

Startups such as OpenLaw and Clause (which created a foundation for developing legal templates called Accord Project) are pioneering solutions that merge existing legal contracts with blockchain infrastructure.

Globally Accessible

Because traditional insurance models are based on trust and commonly enforced by legal systems, workers around the world may be unable to access a reliable source of insurance in developing nations with unreliable financial and legal infrastructure. Blockchain insurance represents an exceptional opportunity for disenfranchised workers, from fishermen to farmers, to access reliable insurance.

Externally Connected

In order to give smart contracts advanced capabilities that can replace and improve upon traditional insurance structures, there also needs to be secure, transparent, and privacy-preserving connections to external data. This is because blockchains are intrinsically unable to connect to external systems on their own, a limitation that is commonly known as the blockchain oracle problem.

An insurance smart contract operates by consuming and pushing external data. It needs both data inputs to trigger the smart contract and access to other systems for triggering a settlement. It is important that the external connection maintains the same valuable properties of the smart contract: determinism, security, and reliability.

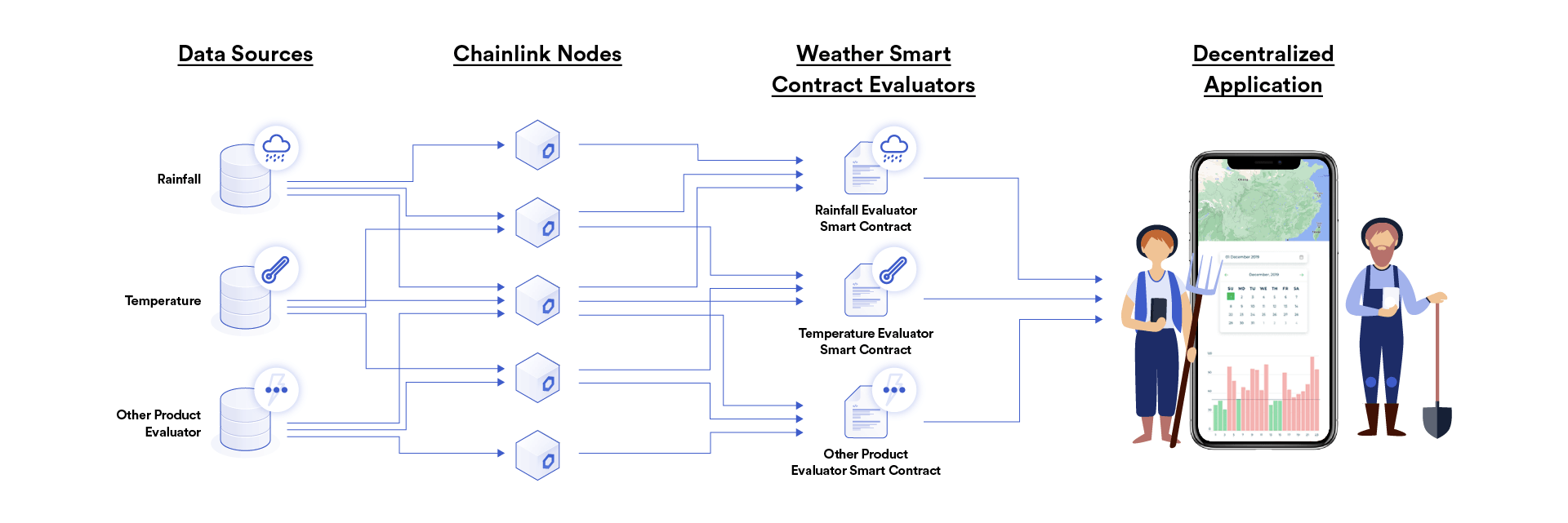

As the most widely used decentralized oracle network, Chainlink facilitates bidirectional data flow into and out of the smart contract with the same properties of its decentralized backend. Chainlink can give insurance contracts access to data inputs, such as IoT sensors, web APIs, and satellite/drone imagery—each able to trigger a smart contract. It also gives smart contracts access to many settlement outputs, such as payment systems, other blockchains, and backend databases. Any API can be reliably and securely leveraged by a smart contract through a Chainlink oracle.

Transparent

In addition to providing external connectivity, data that is passed to smart contracts through Chainlink oracles field a high degree of transparency on all levels—helping further bridge the transparency gap between insurance providers and policyholders for all forms of insurance.

On one side, insurance providers will no longer have to take a policyholder’s word at face value. As in the example above, a definitive source of truth can be established based on connected IoT devices and trusted data feeds. For example, IoT devices connected to automobiles can definitively prove a car insurance policyholder’s actions and behavior immediately before an accident. Combined with the autonomous nature of smart contracts, insurance providers can build, price, and execute claims based on transparent sources of relevant policyholder data.

On the policyholder side, insurance contracts can become exponentially more transparent, from pricing and policy parameters to claims approvals or denials. The smart contract details exactly how the process will run its course, allowing for shorter wait times, increased security in payout details, and a truly fair and transparent process that is openly agreed upon by all.

Smart contracts are the core of blockchain insurance. By running end-to-end, autonomously executed pieces of code, there is no manual labor required after the initial coding and the payout process is automatic and transparent, based on tamper-proof factors that are verifiable by both the policyholder and the insurance provider.

Blockchain Insurance Use Cases

If smart contracts were fully connected to external data with adequate confidentiality and security, numerous current insurance models could be replaced by smart contracts, while other new models could be brought to market. Below are a few examples of how blockchain-based projects are currently working to innovate upon traditional insurance models with smart contracts and Chainlink oracles.

Parametric Insurance

Parametric insurance, or insurance for the occurrence of a specific event, is a compelling use case that currently exists in blockchain insurance today. Below are two examples of how Chainlink oracles and smart contracts can be used to optimize insurance processes in the case of readily verifiable events, such as weather and flight outcomes.

Crop Insurance

Take the example of blockchain-powered parametric insurance platform Arbol, which uses smart contract technology to offer globally accessible weather insurance.

Imagine you’re a farmer who needs weather insurance to hedge against the risk of drought. Your crops need at least 20 inches of rain in order to be market-ready, and you want to buy insurance that will give you a payout if there are less than 20 inches of rain. With Arbol’s smart contract insurance offering, this process becomes as simple as it can get.

If there are more than 20 inches of rain, the farmer doesn’t get paid. If there are less than 20 inches, the farmer automatically gets paid. Because smart contracts are run on decentralized infrastructure, there is no way to tamper or manipulate this prearranged agreement. Rather, the contract already has all of the parameters defined: the farmer’s location, risk parameters, and the coverage amount. Once set, the insurance payout is deterministically executed based on the pre-set parameters and the weather outcome.

This process is not just exclusive to crop insurance. On a fundamental level, blockchain insurance based on real-world data sources breaks down the imbalanced power dynamics between insurance providers and policyholders that contribute to a lack of trust. Now, processing times, policy parameters, and even pricing can all happen on-chain in a way that is completely transparent to all parties. The policyholder no longer has to wait for the insurance company to complete manual processes. By leveraging the increased efficiency and transparency that blockchains and decentralized oracle networks offer, Arbol’s parametric insurance products have expanded to cover energy, maritime, and leisure.

In this video, Chainlink Co-founder Sergey Nazarov further explains how hybrid smart contracts enable technologically-enforced agreements with real-world inputs that empower users in emerging markets with new solutions such as crop insurance for hedging economic risk:

Flight Insurance

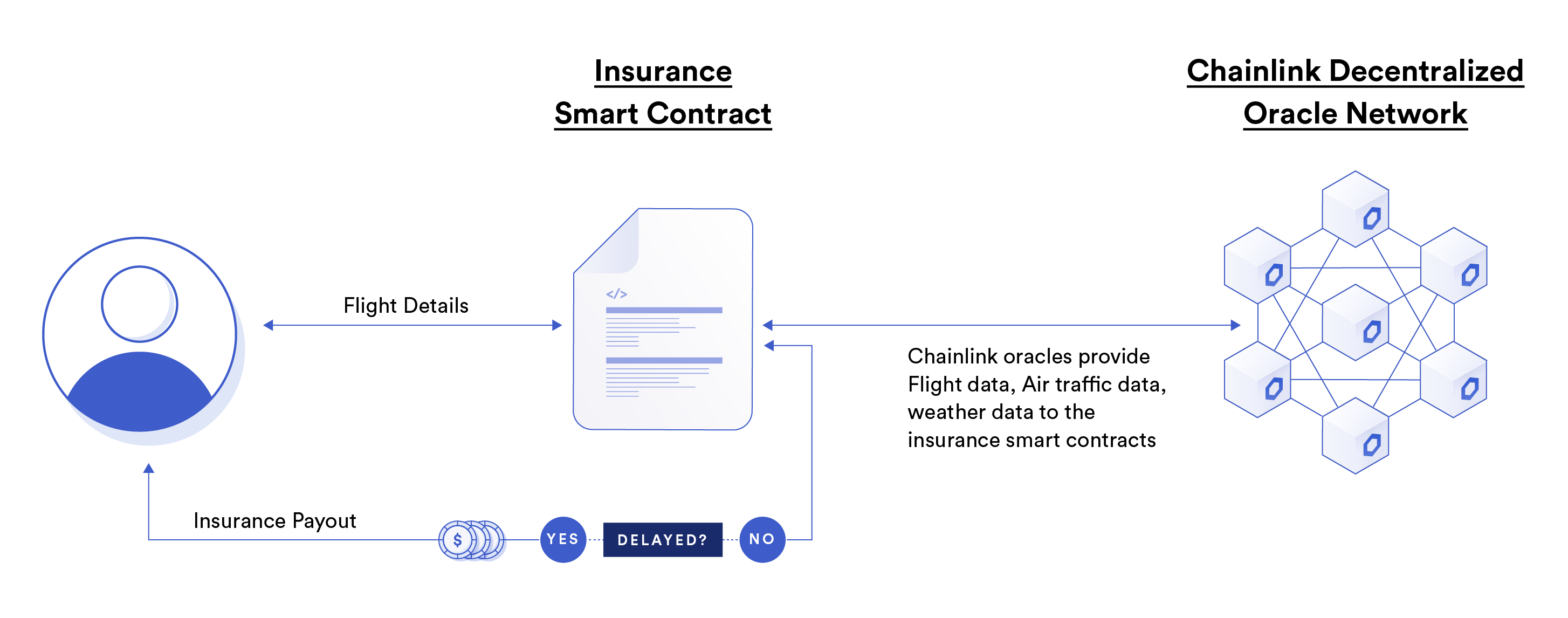

Etherisc is a blockchain insurance project that offers numerous products, from flight and hurricane insurance to weather insurance. In this case, we’ll focus on its flight insurance product to understand the three core processes needed to build a robust blockchain-based parametric insurance product.

- The first core insurance process that Etherisc needed to figure out was how to gather policy parameters and deliver data regarding consumer risk on-chain to its smart contract. In this case, the flight insurance, as well as the origin and destination airports, must be added to the smart contract. This is easily accomplished by connecting frontend infrastructure with Chainlink oracles, which submits the flight number, date, time, and more to the insurance contract in a secure, trust-minimized, and reliable manner.

- Insurance policy pricing must also be established on-chain for the consumer. Etherisc needed to securely deliver the price quote in a manner that still ensures the policy buyer of a fair and unbiased process. Whether calculating the price on-chain or off-chain, Chainlink oracles are able to submit the results into the smart contract in a tamper-proof manner that verifies pricing was calculated through the use of the on-chain parameters detailed in the first process.

- Finally, Etherisc needed to figure out how to automate claims processes and issue a payout if relevant. In order to make an automated payout, actual flight delay data from the FlightStats API (or any real-world third-party claims adjuster) must be delivered to the on-chain smart contract. The smart contract schedules another query of the Chainlink oracle for the time of the scheduled flight arrival. If the flight was delayed, the smart contract automatically issues a payout.

Without leveraging Chainlink oracles, Etherisc would be unable to fulfill critical functions that require trust-minimized off-chain data and computation. This is because blockchain insurance use cases are dependent on the availability of secure, reliable off-chain data from sources such as Internet of Things (IoT) devices and Web APIs. The more granular, secure, accurate, and transparent the data, the more effective blockchain-based insurance becomes at reducing costs associated with verifying details and processing claims.

Crypto Insurance Products

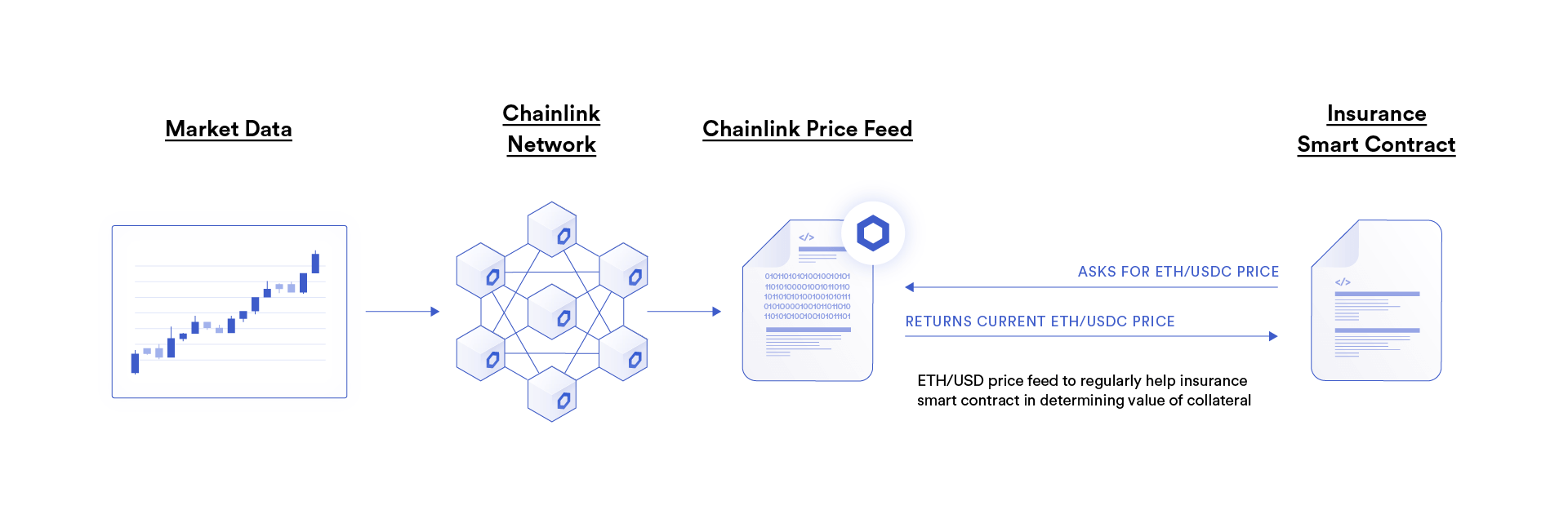

Another class of insurance rising within the blockchain industry is cryptocurrency-based financial insurance. An illuminating example can be seen in another one of Etherisc’s products: lender insurance to hedge against default and systemic risk for on-chain loans.

Numerous on-chain protocols specialize in connecting cryptocurrency lenders and borrowers. The process is simple and familiar. Borrowers put up a certain amount of collateral, often more than the borrowed amount due to the lack of financial data and personal accountability, and pay interest at a regular rate to the lender. On the flip side, lenders earn a steady, relatively low-risk yield for lending out their funds.

However, cryptocurrency markets are degrees more volatile than traditional markets, and the emergent nature of decentralized lending platforms leaves unknown systemic risk in the form of code vulnerabilities—resulting in a pressing need for lender’s insurance. Etherisc is currently working to launch lender’s insurance that is dependent on steep declines in a borrower’s collateral value, protecting the lender against unexpected events.

This is possible through the combination of smart contracts and Chainlink Price Feeds, real-time price reference data delivered directly to smart contracts. Price data can be continuously delivered to the insurance smart contract by Chainlink oracles to accurately calculate a borrower’s collateral value. If the value drops below a certain amount, a payout is automatically issued to the lender, substantially reducing systemic risk involved with using decentralized lending protocols.

In this case, a robust source of off-chain price data underpins a well-functioning insurance smart contract. If a faulty price is ever delivered to the smart contract, the entire system falls apart. The on-chain price reference data must be tamper-proof and unerringly reliable. This is why Chainlink Price Feeds field multiple layers of decentralization on the data source, oracle node, and price aggregation level, ensuring price data delivered to the smart contract is as secure and accurate as possible.

Financial security is necessary for the adoption of decentralized financial products, and cryptocurrency-based insurance is poised to help a wide range of risk-averse individuals and organizations begin entering this emerging market.

Monetizing Data for On-Chain Insurance Products

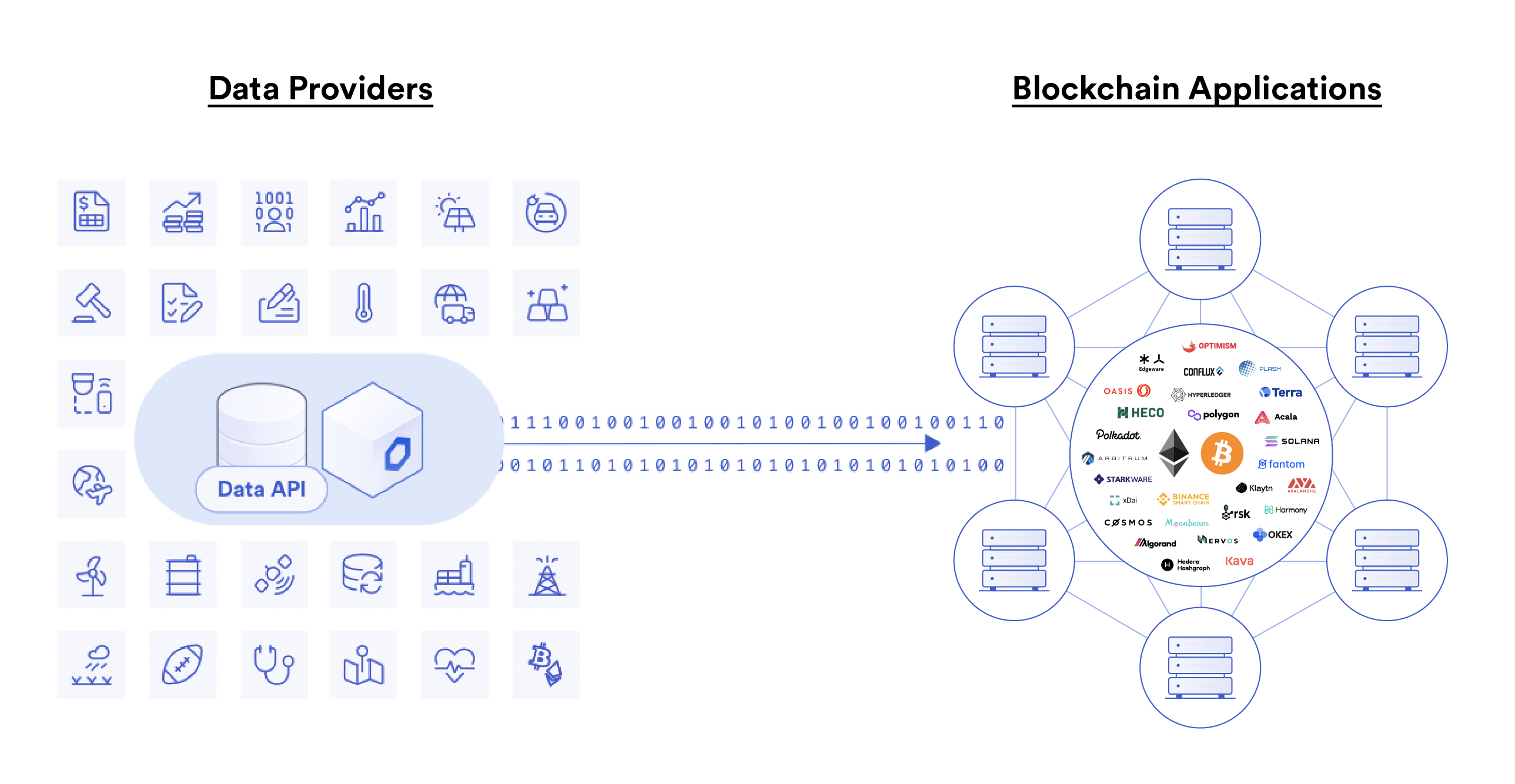

As evidenced, on-chain insurance requires infrastructure that delivers high-quality, trusted data sources to insurance smart contracts in order to keep the underlying security infrastructure offered by blockchains and the smart contracts built on top of them. In this, Chainlink leads the market for decentralized oracle networks that securely connect data providers and smart contracts with each other.

Through Chainlink, any data provider can easily monetize their Web APIs and begin directly selling data to the blockchain applications that need them. This represents an opportunity to enter a growing market and establish new revenue streams. Leading organizations such as Accuweather, The Associated Press, and Swisscom have already entered the Chainlink Network for exactly this reason.

Additionally, the wealth of data that traditional insurance organizations have garnered over a hundred years can enable blockchain insurance projects to better price and underwrite insurance contracts. Finely tuned machine learning models and proprietary data sets give emerging projects a strong base to begin operations, while data analytics offerings allow traditional insurance companies to specialize in ready-made underwriting models. Through Chainlink and smart contracts, traditional insurance firms now have a unique opportunity to monetize 100+ years of proprietary data and make their data offerings an invaluable component of future blockchain insurance projects.

As the blockchain industry grows and new smart contract insurance use cases emerge, high-quality insurance data providers will become increasingly important to decentralized applications as they look to differentiate themselves and offer a world-class experience for their customers. If you’re an organization that has relevant data for smart contract use cases, explore what it means to join the Chainlink Network as a data provider.

The Next Generation of Insurance Models

Chainlink-enabled smart contracts offer a way for the insurance industry to move from a manual, trust-based system to a more automated, trust-minimized system. Information asymmetry is reduced as the industry shifts toward a 1:1 information equilibrium between insurance providers and policyholders. Information is delivered from third-party sources that provide a source of truth, rather than the unverifiable hearsay that’s the case in the current model.

The claims process changes focus from personal interpretation to the execution of an “incident,” deterministically verified through IoT data and sourced with user privacy in mind. Trust is re-established because neither party can tamper with the outcome once it’s sent to the blockchain. Efficiency increases as everything is automated. Both policyholders’ premiums and insurance companies’ costs decrease because fraud is drastically reduced. In this newfound system, the only stakeholders that are punished are bad actors.

Blockchains, smart contracts, and decentralized oracles are set to ignite a paradigm shift towards trust-minimized insurance models refocused around information parity—and many insurance companies are monitoring the trend. In a survey by Deloitte, 58% of insurers expected to increase spending for blockchain and distributed ledger technologies over the next year. Though it’s unlikely to happen overnight, it’s advantageous for insurance companies and data providers to begin actively investigating what Chainlink-enabled smart contracts can bring to their business, and how they can stay up-to-date with the emerging blockchain insurance industry.

To learn more about the benefits of smart contracts and oracles for the insurance industry, visit Chainlink’s insurance use cases page or reach out to an expert.