United States Financial System 3.0

In his recent keynote speech at the D.C. Blockchain Summit, Sergey Nazarov explored how asset origination, automation of compliance, and global distribution are the three critical principles that will enable the U.S. to lead in the transition to a blockchain-based financial system. This post is based on his presentation. View the slides from this presentation here.

I’m very excited to be back here with you in D.C. and I’m very impressed by the massive shift that has happened towards our industry. I’ve taken multiple trips here this year, and I’ve seen a big, big shift not only in perception but also in the willingness to take action. I completely agree with Cody Carbone and the folks from The Digital Chamber that at the end of the day, this is a very unique opportunity for us and our industry to be formed in the right way. Since the U.S. occupies such a large position in the global financial system, I think it’ll reverberate from the U.S. into the larger global financial system. So the decisions that are going to be happening here over the next 18 to 24 months will indeed shape our industry both here in the U.S. and globally.

I’d like to share with you some of the principles that I use to think about how this should develop and how the United States might want to look at both its position and how it relates to the global financial system as it goes into the Web3 transactional format.

Three Fundamental Principles

I have three fundamental principles that I think the United States financial system and really any financial system should care about. But because of the U.S.’s current role in the global financial system, as the global financial system migrates into the Web3 format, I think these three things are the most critical for the U.S. financial system to achieve:

1. Asset Origination

The first one is to be the origination point and the source of issuances into the Web3 financial system. So it’s very valuable that teams come back to the United States, but what is even more valuable is where the assets are originated. If the assets are originated in the U.S. system because it is the source of the most reliable methods of issuance and origination, then the United States will be the place where everyone gets their digital assets, even if they wrap and rewrap and package and repackage them. This is the fundamental metric of success that I think all of us should have for the U.S. Financial system: what percentage of the Web3 financial system does the U.S.-issued base of assets occupy, what is its market share? For example, in the stablecoin world, it occupies well over 90% of the stablecoin underlying asset. That’s what you would want to see for all other digital asset classes. You would want to see the United States financial system being the underlying source of assets that backs all the other onchain assets.

2. Automation of Compliance

The second key principle is the automation of compliance. Compliance is basically the largest transaction cost. If you don’t lower the transaction cost, even if you do create the best asset, the friction introduced for acquiring that asset will be too high. And so even if the United States successfully generates all the best assets, it may not be the place that experiences the most demand to buy those assets. The automation of compliance is now possible in ways that have never been possible before. This doesn’t mean removing compliance requirements; it means automating them to be more efficient and reliable while also making them lower cost. The goal of this would be to make the acquisition of that asset, the ability to hold that asset, and the ability to resell that asset into a low-cost process. At this point, you would have the U.S. financial system having the best possible assets with the most reliability through things like proof of reserves, proof of composition, and high standards for what onchain real-world assets are. You would also have a low-cost and low-complexity way to acquire the asset for international buyers in places like Dubai, Singapore, and Hong Kong. This will result in net capital inflows into the U.S. economy, which is fundamentally what the U.S. financial system wants and what the transition to a Web3-powered global financial system can allow the U.S. to experience.

I think the fundamental questions are when the U.S. and global system went from a paper-based system to an internet and database-powered system, how did the U.S. acquire greater market share and leadership in the global financial system? And what will happen now for the United States as the global financial system transitions into this Web3 format? If the answer to both of these questions is affirmative and positive, then I think the answer is the U.S. financial system gains market share. If the answer is negative, then I think the answer is the U.S. system might lose market share.

3. Global Distribution

The final point is very critical in the United States’ relationship to DeFi, fintechs, and also institutions—it’s the question of distribution. All financial markets depend on demand, and so distribution and the ability for everyone to access the market globally is very, very valuable and powerful. The DeFi community, fintech community, and institutional community can all play a very large role in taking those assets with a low cost of transaction and a low cost of compliance and acting as global distribution to get that capital to flow into the U.S. financial system.

This is my high-level definition of success for how the United States financial system should evolve into the Web3 form that it’s now taking. My view is that this question of whether or not we care about Web3 formatted assets will only accelerate, and the reason for that will not be political, it will be economic. The point at which stablecoins became a very hot topic here in D.C. was when there was a sufficient amount of U.S. treasuries held in the Web3 format, such as a stablecoin. A sufficiently large amount of treasuries were formatted into this Web3 smart contract stablecoin container and that will only increase. Right now the amount of U.S. treasuries is somewhere between Saudi Arabia and South Korea, or maybe even higher now, but it’s only increasing. Eventually, I think stablecoins could become the largest holder of U.S. treasuries as the most common form of owning and using the U.S. dollar.

That is also a realization that will happen for all other assets—tokenized funds, tokenized equities, tokenized commodities, tokenized real estate—all asset types. Once they get high enough as a percentage of the market, the political system and the government has to address it because it’s either a risk or an opportunity. Our job here as the key industry participants that have been driving this for many years is to get together and to make sure that the governments of the world see our industry as an opportunity by working with them to create regulations and laws and pathways for all of this economic activity to benefit their economies. That is the right and logical path, in my opinion, and what we’re all doing at this conference.

How These Principles Are Met

Now, how do we actually achieve this, and what are the key requirements that need to be met? Well, the first requirement of any asset issuance is that it’s reliable, and the U.S. system is known for being highly reliable. So the first problem is how do you do primary initial minting? So how do you generate an asset to begin with? When you generate a cryptocurrency, it’s often disconnected from anything in the real world. It’s just a thing that was generated on a chain that has value because there is a market. Some of them have utility value, and they can be used to pay for various systems, but many of them do not.

Proofs of Asset Verification

In the digital asset world, we are talking about real assets being represented onchain. And so we have to make sure that the representation of the asset on the chain is properly connected back to the underlying value such that you can’t generate more of the onchain representation than you have in the real world. That’s why you need to create systems that make something called infinite minting impossible, and that ensure that the assets issued in the U.S. financial system can only be created to the degree that they represent real underlying value. For this to happen, you need various technologies like proof of reserves, proof of composition, and the ability to prove and connect the underlying real world back to the token. You basically need to synchronize the offchain reserves with the onchain representation of those reserves.

Cross-Chain Minting

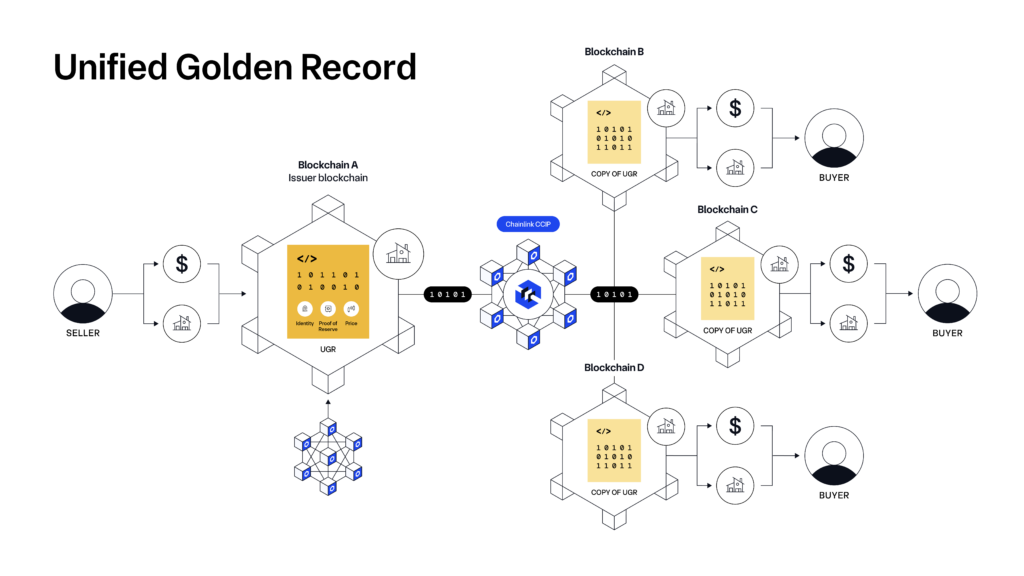

The second problem is secondary or cross-chain minting. So because the blockchain industry is highly fragmented, we will not be having a single blockchain—just like we do not have a single global database that everyone uses. Everyone has at this point millions of their own separate databases, and all the databases are connected over TCP/IP to interact with each other in this thing called the Internet—it’s a very similar situation now with blockchains. So if you generate a token, if you initially generate a token and you connect it back to the underlying value in a way that’s reliable, then your next task will be distribution, which will be getting the token to many other chains. That task requires something called a cross-chain protocol. That cross-chain protocol will have to basically mint that token on hundreds and thousands of other chains. If somebody manipulates that process of minting, you have something called a bridge hack. That bridge hack will reduce the reliability or the actual reliability and the perception of the reliability of the underlying asset. So you have to solve the problem of how to actually get the asset that was initially generated in the U.S. system to many other chains and many other financial systems.

For this, there are systems like CCIP and various ways to make sure that there are compliant transactions that work across chains. This is a problem that also absolutely needs to be solved for the distribution of the asset to be reliable. If you mint the asset initially, but then it gets lost in a bridge hack, that’s not a reliable asset. You want a reliable asset tied back to real value, and then you want that asset to move somewhere on another chain in a way that can’t be stolen.

Onchain Golden Records

The last key dimension of creating reliable assets, in my opinion, is Onchain Golden Records. Onchain Golden Records house all the critical information about the asset within the token itself. By putting all of the data about the asset within the token itself, you are turning the token not only into a method of ownership transfer but also a method of transferring critical data. Most market issues are about lack of information: Bernie Madoff was about lack of information, FTX was about lack of information, SVB was about lack of information. If you can get the relevant information onchain, you can eliminate situations similar to Bernie Madoff, FTX, and SVB.

So, the third dimension of making a reliable asset is that the asset doesn’t just give you access to ownership; it gives you access to critical data about the asset. If you own something from SVB, you know the yield of their Treasury, not just that they have a Treasury or if you have some relationship with FTX, their balance sheet is validated in real-time, and there’s no opportunity for it to be released as a surprise to the market. This dynamic of creating a Onchain Golden Record is the critical next stage of how to manage risk and reduce the overall risk of assets in any financial system. We’re actively working here with folks in D.C. to get better and better standards for how assets in the U.S. financial system can be created to prove critical things and, therefore, be a superior asset compared to others.

By the way, this isn’t just a concept we have. This is from a recent presentation at the end of last year from the Treasury, where they describe what they call a core layer and a services layer to every token, describing them as having different information.

So we are now in a world where if we want our industry to graduate from cryptocurrencies that are not connected to any real-world asset into a world where all the real world’s underlying value is turned into a token that is reliable—if we want that token representing underlying value generated in the U.S. financial system and the U.S. to be the leading place generating those tokens and experiencing the most demand for them—then I think we will have to build all these tokens significantly differently. We must solve the problems of ownership and data transfer, as both are fundamentally critical for this compliant digital asset world. One of the key things in the service layer of a token is compliance. Fundamentally, we need to collaborate with governments on this. We need to figure out an efficient, low-cost, superior way to comply with various legal requirements while making it much cheaper than the traditional system.

In an ideal world, in a few years, you could buy a tokenized equity or you could buy a traditional financial equity and the tokenized equity would have much better liquidity, more global access to capital, critical information available without costly data subscriptions, and could be acquired, held, and resold by you at a low compliance cost. Fundamentally, what we want, if we want our industry to succeed, is to make DeFi and tokenized assets fundamentally better than traditional assets. I think we can achieve that, but we must collaborate with governments and the legal system. We’re in a unique moment where this is finally possible, so we should make the most of it. The time is now, and we can make it happen. I’m very excited about that.

To learn more about Chainlink, visit chain.link, subscribe to the Chainlink newsletter, and follow Chainlink on X, LinkedIn, and YouTube.