The Convergence Powering the Next Wave of Global Finance

Authored by Colin Cunningham, Head of Tokenization & Alliances, Chainlink Labs

Since the beginning of the year, we’ve seen world leaders like U.S. President Donald Trump make digital assets a central part of their administration’s national strategy, openly competing to become “the crypto capital of the world.” This marks a sharp shift from just a few years ago, when crypto was viewed as something to keep at arm’s length.

In a post I wrote last year, I mentioned being at the front lines of a seismic shift in the global financial system. That statement is even more true today. Digital assets, tokenization, and blockchain technology have moved into the spotlight, pushed forward by policy coming out of leading economies, adoption by the world’s largest financial institutions, and growing traction across the infrastructure that underpins global markets.

Spot Bitcoin ETFs now oversee more than $150 billion in assets after only eighteen months on the market, stablecoin issuers look to become one of the largest holders of U.S. treasuries, and perhaps most importantly, institutions are no longer experimenting; they’re actively building real financial products onchain.

This acceleration is due in part to advances in the infrastructure itself. Rather than requiring institutions to change how they operate, onchain infrastructure is adapting to integrate with the existing systems institutions already rely on. Over the past year, we’ve seen multiple successful demonstrations of public blockchains interoperating with legacy architecture, compliance controls embedded directly into tokenized workflows, and new efficiencies emerging in the way tokenized assets are settled and administered, including atomic settlement and automated fund servicing.

Chainlink is at the center of this convergence, working with leading banks, asset managers, market infrastructures, and DeFi protocols to connect traditional and onchain finance into a unified global ecosystem.

Catalysts Driving Convergence

Financial Infrastructure Needs to Modernize

Around the world, financial markets are working to shorten the time between trade execution and final settlement. In May 2024, the United States officially moved to T+1 settlement, meaning most securities now settle one business day after they’re traded. The goal is to reduce risk, free up capital more quickly, and create a more efficient post-trade environment. According to the DTCC, this change led to a $3.7 billion (29%) reduction in the NSCC Clearing Fund in just one quarter, reflecting a meaningful drop in the amount of capital institutions are required to hold to manage settlement risk.

Other major markets are also aligned on this modernization effort, with the largest APAC countries of China and India making the move in 2022 and 2023. Europe is preparing to transition by 2027, recognizing the significant benefits of moving from a T+2 system.

Stablecoins are also becoming an important tool in this broader effort to reduce the time between trade execution and ownership. Unlike traditional payment rails, which rely on delayed batch processing and limited settlement windows, stablecoins can settle transactions almost instantly, at low cost, and without being restricted by time zones or banking hours. That kind of efficiency makes them well-suited for a financial system that is increasingly operating onchain. As more value moves through stablecoin rails, the resulting liquidity and infrastructure are also helping to make other types of tokenized assets more attractive, especially for institutions looking to issue or trade in environments where settlement speed and market access matter.

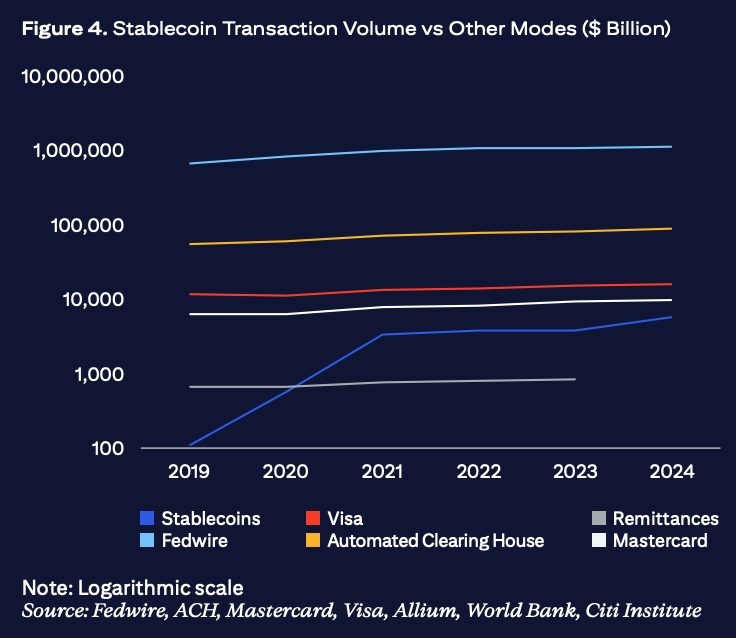

The scale is starting to reflect that shift. As the chart below shows, stablecoin transaction volumes have already surpassed remittances and are closing in on the levels processed by massive card payment networks like Mastercard and Visa.

These transitions aren’t just regulatory checkboxes. They reflect growing pressure from markets to reduce risk, unlock liquidity, and compress execution timelines. Firms are being asked to do more with less, and infrastructure that relies on manual processes is falling behind.

Onchain settlement systems, including atomic and T+0 models, offer a future where finality is achieved in seconds instead of days or weeks. For institutional investors, that means improved capital efficiency, lower operational risk, and better liquidity management.

The Regulatory Foundation Is Falling Into Place

Governments that once kept digital assets as a low priority are now racing to lead in innovation, and nowhere has that shift been more visible than in the United States this year.

The White House’s recent digital asset report outlines a sweeping national strategy to make the U.S. the global hub for blockchain and digital asset innovation. The 166-page document calls for streamlined regulation around digital asset custody, trading, and registration, urges Congress to embrace decentralized finance, and sets a clear objective: to unlock a “golden age” of American leadership in digital assets.

That strategy is already being backed by meaningful regulatory momentum. Most notably, the SEC recently announced “Project Crypto,” a Commission-wide initiative led by Chairman Paul Atkins to modernize securities regulations and support the transition of U.S. capital markets onchain. Describing the initiative as a “defining moment for American leadership in the crypto asset markets,” Atkins laid out plans to update legacy rules, establish clear guidelines for asset classification, and enable regulated platforms to operate across both traditional and digital asset markets. Alongside this, the GENIUS Act, now signed into law, creates the first federal framework for stablecoin oversight. The CLARITY Act is also gaining bipartisan support as a foundation for how digital assets should be classified and integrated into existing market structure.

In Asia, Hong Kong’s stablecoin licensing regime takes effect this August, with issuer approvals expected in 2026. Singapore continues to innovate through Project Guardian, advancing tokenization standards through real-world pilots involving major financial institutions.

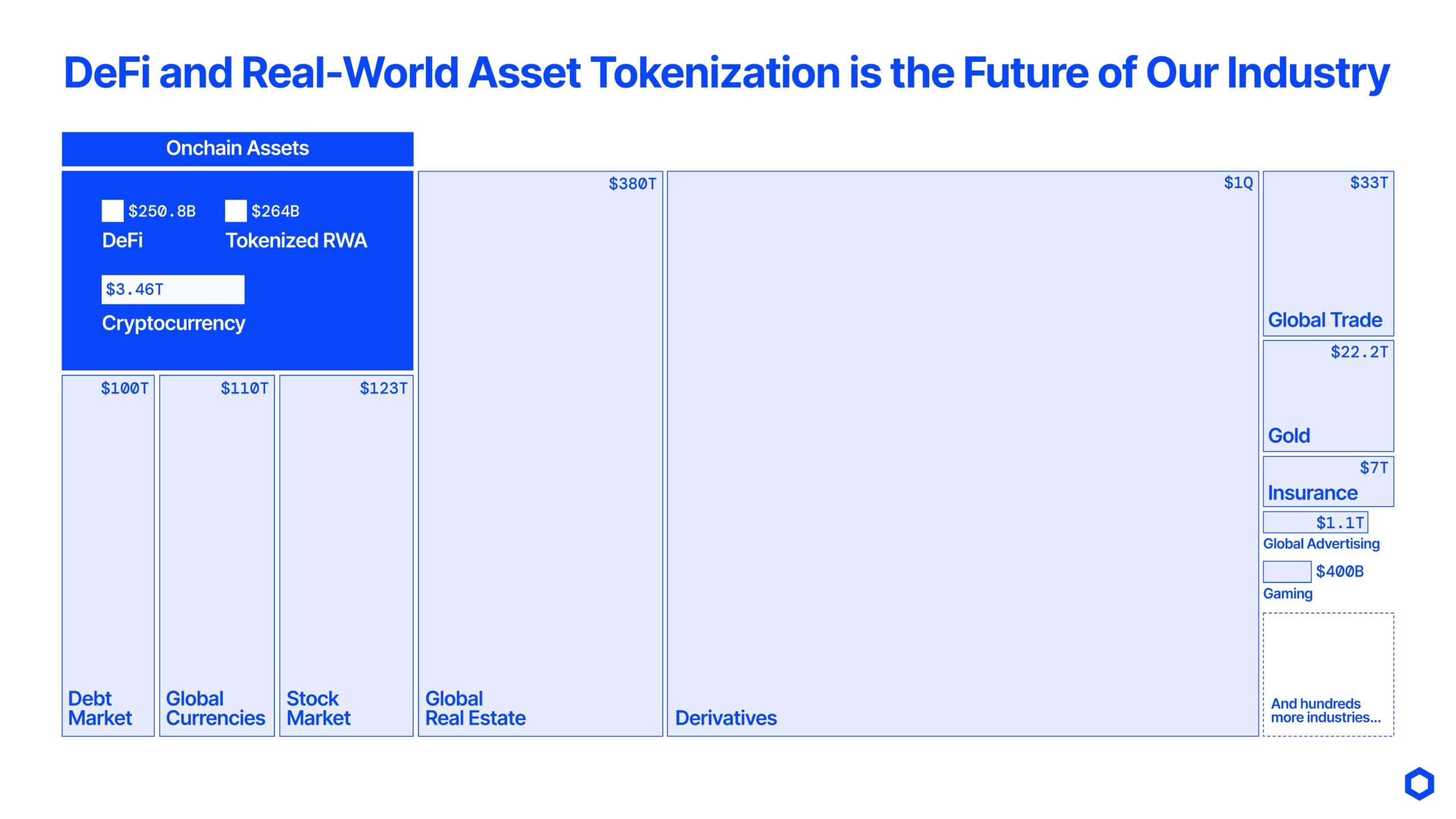

Asset Tokenization Is the Biggest Shift in Market Structure Since ETFs

What started as a niche innovation is now reshaping the foundation of capital markets, with tokenized assets being issued, traded, and adopted at a pace that’s hard to ignore. As of mid-2025, the total value of tokenized real-world assets has surpassed $25 billion, when excluding stablecoins, with over 60% growth year to date. Tokenized Treasuries now account for more than $5 billion of that total, led by funds from BlackRock, Franklin Templeton, and other leading asset managers. BlackRock’s BUIDL fund alone represents more than 40% of the tokenized Treasury market, becoming a central vehicle for institutional fixed-income exposure.

What began as a strategy primarily adopted by stablecoin-denominated treasuries and crypto-native funds is now gaining traction among traditional institutions looking for yield, efficiency, and faster distribution. In addition to Treasuries, tokenized money market funds, short-duration credit products, and cash-equivalent instruments are expanding in scope, with platforms like Ondo Finance, Maple Finance, Spiko, and OpenEden driving innovation across the space.

According to BCG, tokenization is projected to unlock over $18 trillion in value by 2033, potentially accounting for more than 10% of global GDP. The shift from offchain to onchain formats is already underway, and institutional capital is following quickly.

“Every stock, every bond, every fund—every asset—can be tokenized. If they are, it will revolutionize investing.”—Larry Fink, CEO of BlackRock

How Convergence Is Unfolding Across Key Use Cases Powered by Chainlink

The convergence of traditional and onchain finance has started with a set of high-impact use cases that solve real infrastructure challenges, from enabling cross-chain settlement of tokenized assets to integrating blockchain networks with legacy systems and modernizing how asset management products are administered and distributed. These early implementations are showing that blockchain infrastructure can meet institutional requirements while connecting directly to the core of global finance.

Connecting Onchain Infrastructure to Existing Financial Systems

For capital markets to meaningfully adopt tokenized assets, blockchain infrastructure needs to meet institutions where they are. That means integrating with the messaging standards, payment networks, and operational systems already embedded in traditional finance. Replacing decades-old infrastructure is not an immediately viable path, and most institutions are under pressure to modernize without disrupting the workflows and regulatory frameworks they depend on.

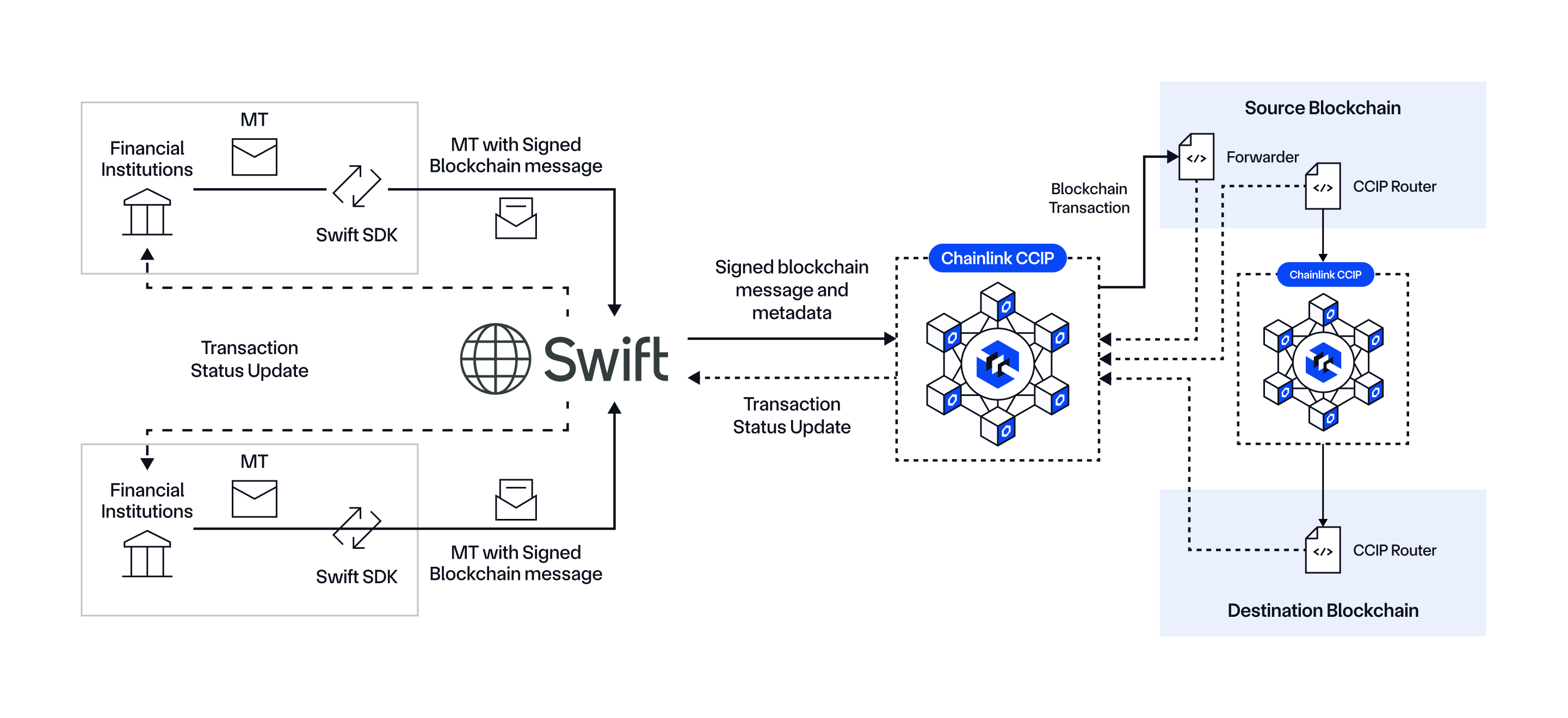

That’s why interoperability is critical and why Chainlink’s work with Swift has become a key example of how convergence can unfold in practice. In a multi-institutional initiative involving Euroclear, Clearstream, Citi, BNY Mellon, and others, tokenized asset transfers were executed across public and private blockchains using the same Swift messaging standards these banks and financial market infrastructures rely on today. Chainlink CCIP provided the connectivity between existing Swift infrastructure and blockchains, as well as cross-chain connectivity, enabling banks to interact with tokenized assets while continuing to rely on infrastructure they already trust. It’s a model for how traditional financial infrastructure and blockchain networks can interoperate with one another as adoption scales.

Atomic Settlement of Tokenized Assets Across DvP and PvP Workflows

One of the clearest signs that tokenized assets are moving into mainstream financial infrastructure is the ability to settle them atomically across independent systems. Whether delivering an asset for cash or settling a trade between two currencies, institutions need synchronized execution across both legs of a transaction.

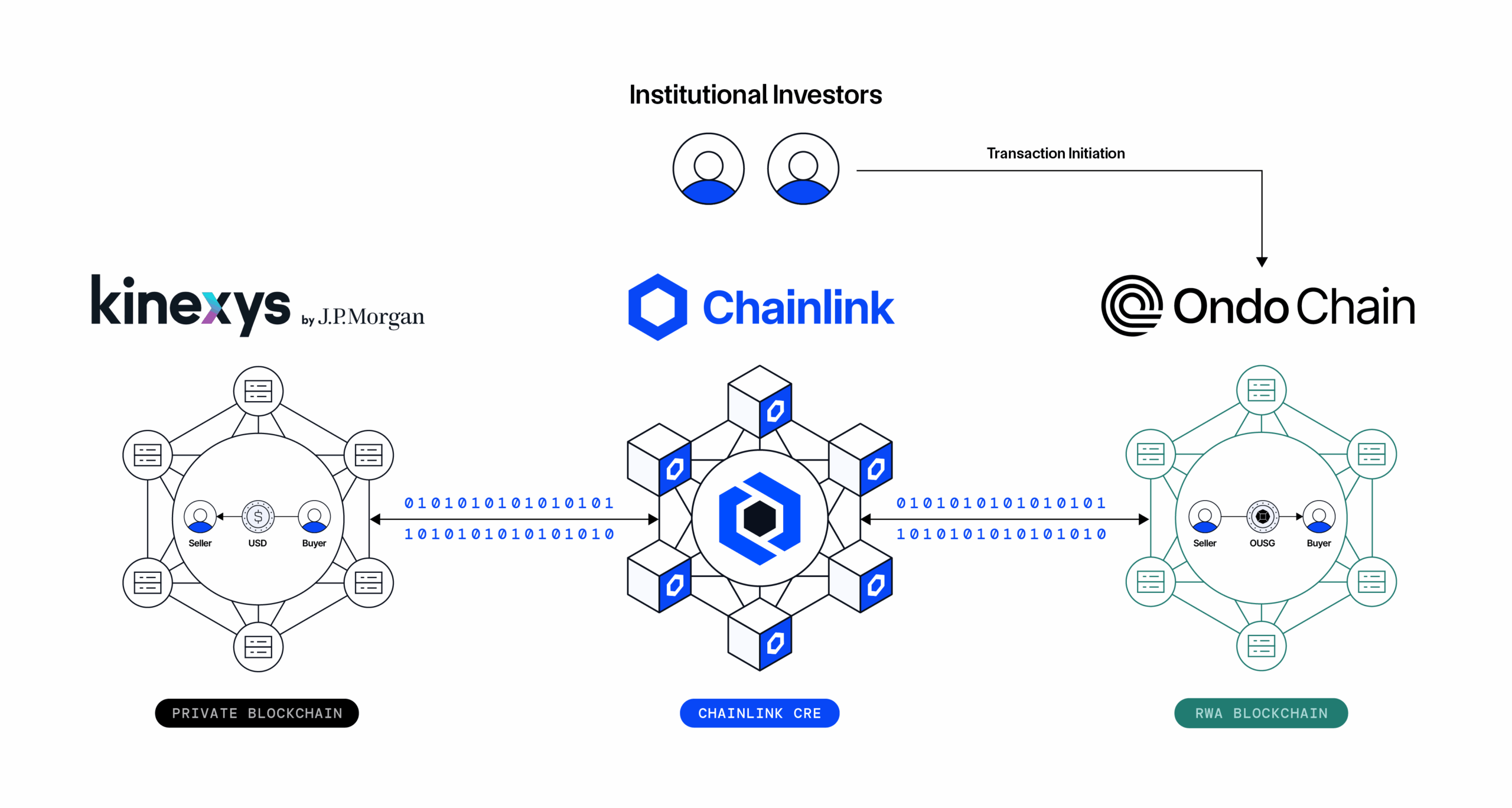

That’s exactly what Kinexys by J.P. Morgan, Ondo Finance, and Chainlink recently demonstrated. In a cross-chain Delivery versus Payment (DvP) transaction, tokenized U.S. Treasuries were exchanged for bank-issued digital cash, with Chainlink’s Runtime Environment (CRE) coordinating the full settlement process. The solution connected Kinexys Digital Payments’ permissioned blockchain network with Ondo’s public blockchain, enabling a secure and synchronized exchange of value between tokenized assets and digital payments.

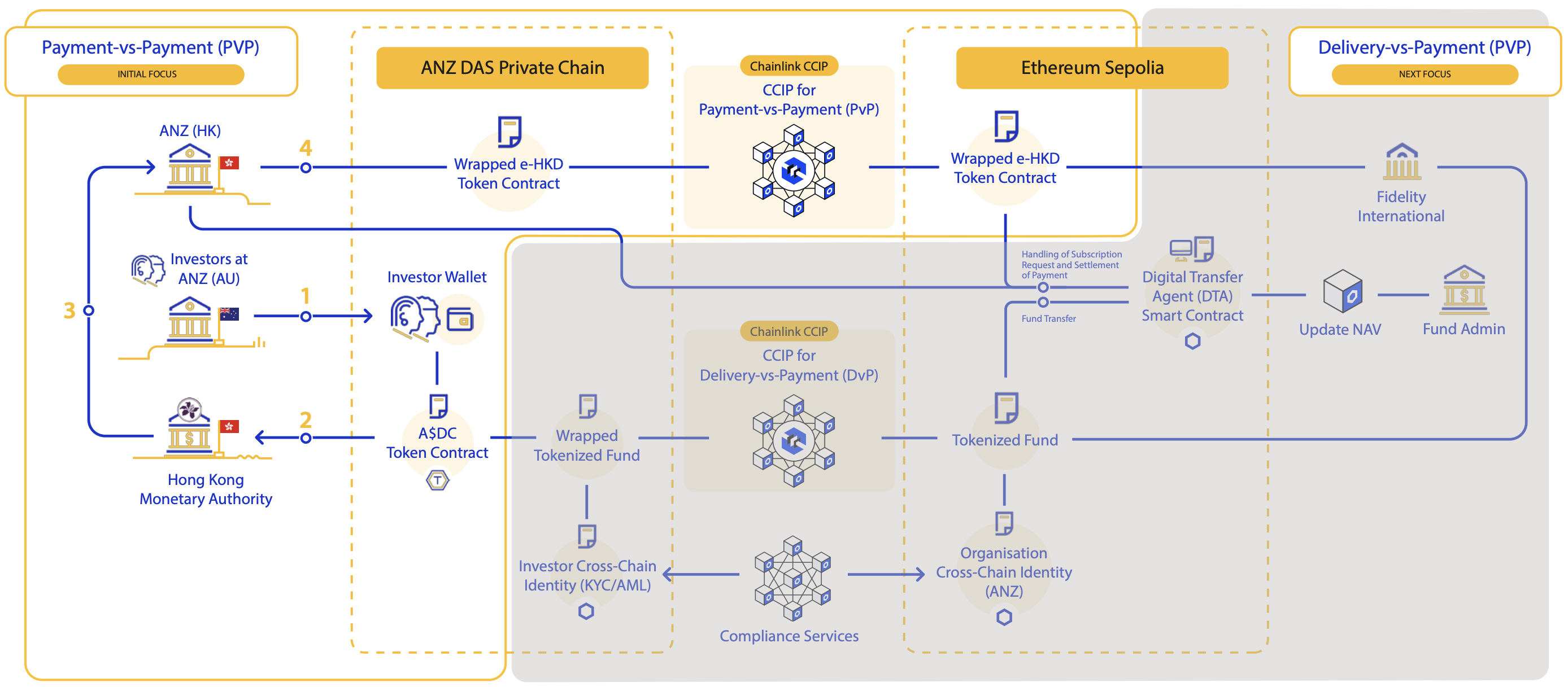

In another recent collaboration under the Hong Kong Monetary Authority’s e-HKD program, ANZ Bank and Fidelity International executed a Payment versus Payment (PvP) transaction between an Australian dollar stablecoin and a wrapped version of the Hong Kong CBDC (e-HKD). The settlement took place across ANZ’s permissioned chain and a public blockchain, using Chainlink to enable secure cross-chain messaging and compliance verification. The workflow demonstrated how tokenized currencies can be exchanged across jurisdictions in a way that is both secure and policy-aligned.

Tokenized Funds with Built-In Lifecycle Automation

As tokenization evolves, institutions are no longer just putting traditional fund structures onchain. They’re beginning to re-architect how funds operate—embedding core functions like subscriptions, redemptions, transfer agency, compliance, and reporting directly into smart contracts. The result is a new model of fund infrastructure that reduces friction, lowers operational costs, and enables more flexible, cross-chain distribution.

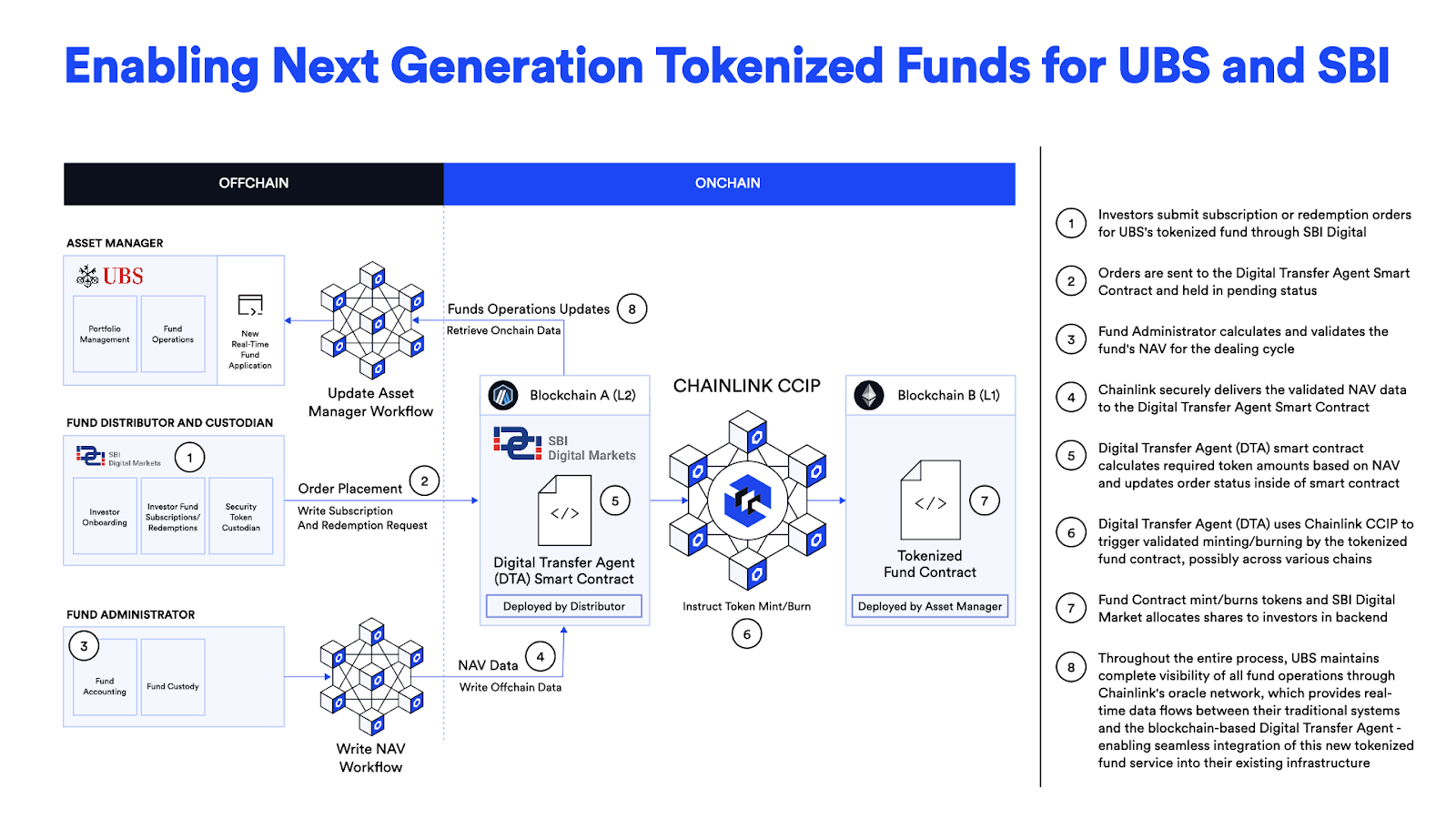

Under the Monetary Authority of Singapore’s Project Guardian, UBS Asset Management and SBI Digital Markets collaborated with Chainlink to demonstrate a next-generation tokenized fund structure. Using Chainlink CCIP and a Digital Transfer Agent smart contract, the fund was able to maintain its share register on one blockchain while processing subscriptions and redemptions on another. Tokenized funds are already attracting serious interest from asset managers, and the ability to automate key aspects of the fund operations process makes them significantly more enticing in an institutional setting.

“This architecture creates a foundation for our own onchain financial products and services to meet immediate user demand for tokenization and tokenized funds in particular. This new way of launching fund structures and administering them via smart contracts empowers both fund managers and their service providers to deliver new onchain financial products and lower operational costs to investors, both things they are actively looking for.”—Winston Quek CEO at SBI Digital Markets

What Comes Next: A Unified Financial Ecosystem

This is why I’m excited to help lead the work we’re doing at Chainlink Labs. For years, the idea of bridging traditional financial systems with onchain infrastructure felt like a long-term ambition. Today, it’s a reality. The conversations are more serious, the questions more technical, and the willingness to collaborate far greater than it was even a year ago.

We’re helping define how traditional and onchain finance come together in ways that institutions can actually use. That work is happening in partnership with global banks, asset managers, market infrastructure providers, and the most advanced teams building in onchain finance. The alignment we’re seeing today between policy, infrastructure, and institutional demand is unlike anything I’ve seen before.

If you’re looking to dive deeper, learn more about how we power the full tokenized asset lifecycle, provide the foundation stablecoin issuers need to operate at scale, and deliver the infrastructure that underpins the majority of DeFi.

If you’re thinking through what this shift means for your company, reach out to our team.