Introducing Chainlink State Pricing for DEX-Traded Assets

We’re excited to introduce Chainlink State Pricing—a new pricing methodology optimized for long-tail crypto assets and tokenized assets that predominantly trade on decentralized exchanges (DEXs). This new methodology for asset pricing delivers best-in-class price accuracy, market resilience, and liquidity assessment for assets that have limited trading volume on centralized exchanges (CEXs) but notable onchain liquidity.

Chainlink State Pricing is currently available on mainnet as a push-based oracle solution via Chainlink Data Feeds or as a pull-based oracle solution via Chainlink Data Streams. The initial launch supports State Pricing for a variety of assets, such as wstETH, GHO, LBTC, cbBTC, ezETH, tBTC, and more, with coverage actively expanding to more assets, blockchains, and DEXs based on user demand. Top DeFi protocols are already supporting Chainlink State Pricing, including Aave, Lido, GMX, and Curve.

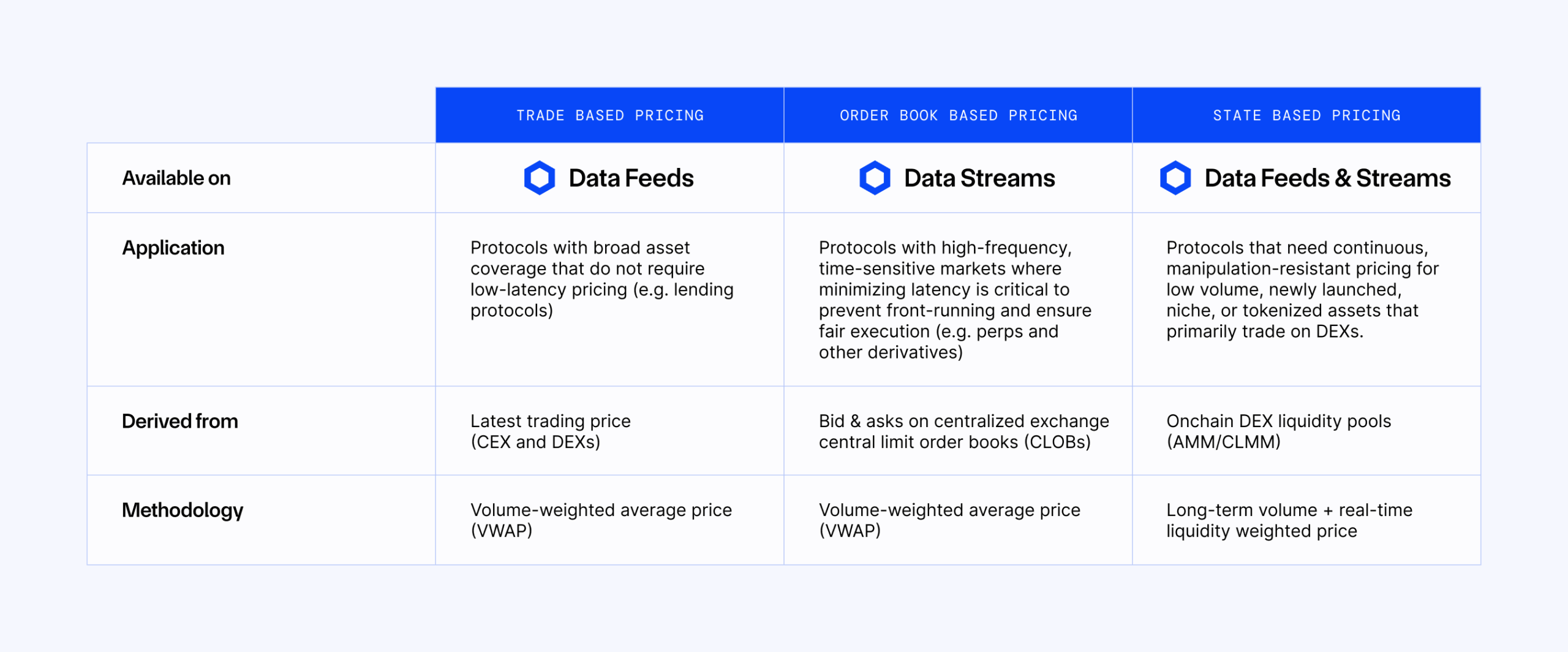

State Pricing complements the existing asset pricing methodologies on the Chainlink data standard, including volume-weighted average (VWAP) trade pricing and liquidity-weighted bid/ask (LWBA) pricing. Chainlink’s decentralized oracle networks serve as the secure infrastructure for reliably fetching, aggregating, and delivering financial market data onchain while DeFi users determine which data points and aggregation methodologies are the best suited for their specific onchain use cases.

If you want to use Chainlink State Pricing to support your onchain application, reach out to request an asset and visit the developer docs.

Addressing the Pricing Challenge for Primarily DEX-Traded Assets

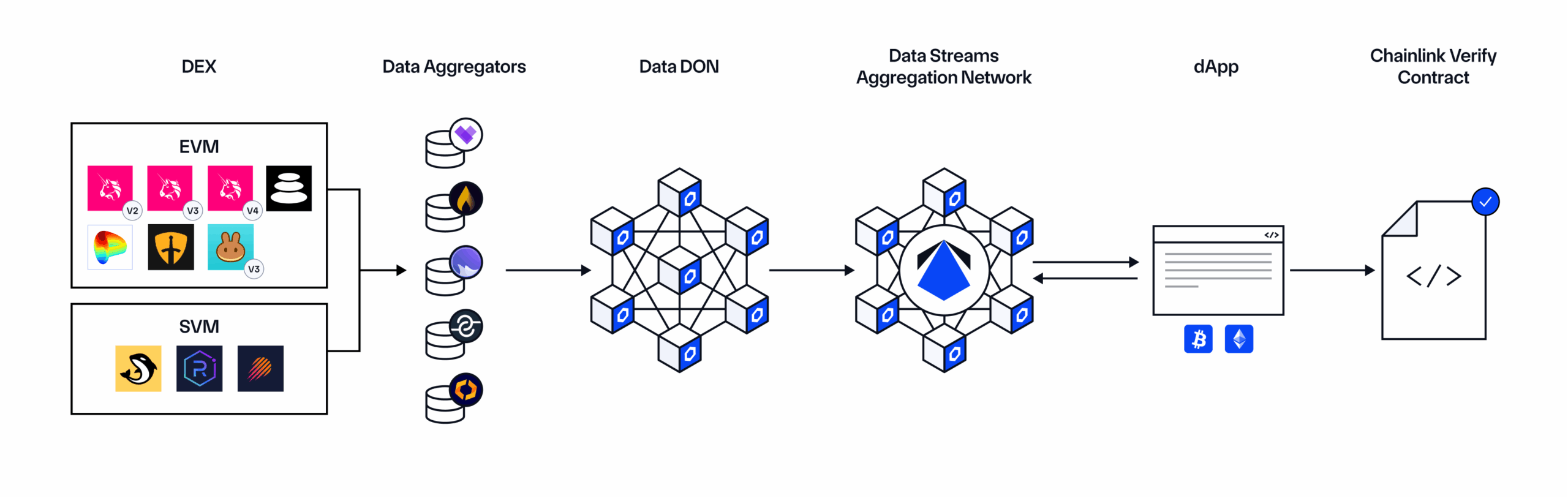

Today, Chainlink Data Feeds are a push-based oracle solution for pricing onchain assets. They support “trade pricing” based on the most recent transactions across centralized and decentralized exchanges. The trade pricing from Chainlink Data Feeds mostly leverages a volume-weighted average price (VWAP) methodology. In parallel, Chainlink Data Streams are a pull-based oracle solution for pricing onchain assets, and provide a liquidity-weighted bid/ask (LWBA) price based on quotes from exchange order books.

Chainlink infrastructure supplies asset prices in a secure and reliable manner using decentralized oracle networks (DONs), which aggregate data from premium data providers, who fetch data from across centralized and decentralized exchanges to achieve broad market coverage. These standard pricing methodologies are well-suited for pricing higher volume assets that commonly trade on traditional exchange central limit order books (CLOBs).

However, some onchain assets may have little to no daily trading volume on traditional CLOB/CEX exchanges. Instead, they primarily trade on decentralized exchanges or have limited trading volume overall but have notable liquidity depth onchain (i.e., little actual trading activity, but sufficient liquidity to support large trades with minimal slippage). This can be due to a variety of factors, such as the token being recently introduced to the market, meaning it’s not yet listed on major centralized exchanges or has insignificant trading volume. It can also be due to the nature of the token itself, such as with liquid staking tokens (LSTs) and liquid restaking tokens (LRTs), which are generally not highly traded because they’re redeemable for a more liquid underlying asset. These types of assets present unique challenges since they lack sufficient trading volume to enable continual, consistent price discovery.

Tokenized real-world assets (RWAs) may also be difficult to price using offchain sources. While tokenized RWAs represent an offchain asset—e.g., a stablecoin representing cash held at a custodian or a tokenized fund representing shares in a traditional money market fund—they trade exclusively onchain. Thus, their price must account for onchain trading activity and liquidity as opposed to simply hardcoding a price that’s pegged to the value of the offchain asset(s) they represent. This is important because legitimate market forces can cause the price of the token to dislocate from the price of the underlying asset(s), such as from the accrual of dividends or due to counterparty/redemption risks. As such, it is important to price the RWA token itself.

The Solution: Chainlink State Pricing

The state price of an asset is the price determined by the liquidity reserves of tokens within onchain DEX liquidity pools. Some notable features of a state price include:

- The state price always exists, even without the need for an actual transaction to take place, and represents a forward-looking price.

- The state price allows for continuous pricing of assets that trade less frequently than is required for a trade-based price.

- The state price is similar to the mid-price of an order book (as long as the order book exists) and is calculated based on the token reserves within selected, high-liquidity DEX pools (AMM/CLMM).

- The state price is resistant to flash loan attacks because it uses end-of-block state prices, applies a weighted average across multiple liquidity pools, and enforces robust outlier filters. The aggregated price feed is designed to mitigate short-term volatility and resist manipulation, including intra-block MEV and flash loan attacks.

Given the complexities of providing accurate market data about liquidity pool state, a robust methodology was implemented to mitigate specific risks inherent to DeFi. Below is an overview of different pricing methodologies available via Chainlink Data Feeds and Data Streams.

Core State Pricing Methodology

The methodology for State Pricing focuses on comprehensive DEX and blockchain coverage, aggregating state prices and liquidity metrics from a diverse range of decentralized exchanges and blockchains. By integrating real-time state pricing with historical liquidity-weighted trends, a robust price composite is constructed that accurately reflects true market conditions across the entire DeFi ecosystem.

Chainlink State Pricing involves a three-step process to produce a reliable data point:

- Dynamic Pool Selection and Hybrid Weighting

- Onchain data is systematically pre-screened to rank liquidity pools across multiple DEXs and ensure that the selected pools account for a substantial majority of observed market activity.

- Rather than relying on a singular metric, the approach implements a hybrid weighting model that adjusts weights based on both long-term trading volume trends and instantaneous liquidity depth around the market price. This mitigates the impact of transient price manipulation.

- State Price Computation

- Data providers leverage customized onchain queries that extract precise market conditions for each pool at the end of every block.

- A proprietary state price extraction algorithm is used to calculate pricing based on protocol-specific liquidity curve modeling, ensuring accuracy across diverse DEX mechanisms (e.g., concentrated liquidity, weighted pools, stableswap curves).

- To maintain consistency in unit accounting, the state price—typically the ratio between two tokens in a specific pool—is converted to a USD quote using cross-rate triangulation. This process leverages a blend of centralized exchanges with fiat on-ramps and prices from Chainlink Data Streams.

- To maintain the consistency-in-time dimension, price data is synchronized across varying blockchain update frequencies, incorporating a forward-filling technique for chains with longer block times.

- Aggregated Price Formulation with Intelligent Filtering and High-Frequency, Low-Latency Updates

- The final aggregated price feed is constructed through a multi-layered outlier detection system, incorporating statistical anomaly detection to eliminate short-term price distortions.

- Data providers ensure high-quality, tamper-proof market data through multiple layers of aggregation, a volume- and liquidity-weighted average price methodology, and a robust defense-in-depth approach for outlier detection.

- State prices are fetched at the end of each block—with updates at least once a second—and are made available with minimum latency, making them resistant to flash loan attacks.

Chainlink State Pricing Is Already Being Supported By Top DeFi Protocols

GMX, one of the largest DeFi perp protocols, is leveraging State Pricing on Data Streams to get a clear, second-to-second view of onchain liquidity. This helps them accurately price collateral and margin on their perp DEX.

“As more protocols and tokens are embracing a DeFi-first mindset and rely on DEX-native liquidity, Chainlink State Pricing offers a critical upgrade to asset pricing—giving real-time, onchain insights needed for our contracts to more reliably price collateral and positions on GMX.”—Coin, Ecosystem & Strategy Lead at GMX

Lido, the largest DeFi liquid staking protocol for ETH, will have State Pricing support for its wstETH token. This gives DeFi protocols access to highly reliable pricing for this primarily DEX-traded asset.

“State Pricing strengthens wstETH’s role as a core DeFi collateral asset. It delivers accurate, DEX-native pricing aligned with real-time liquidity, enhancing composability across the Lido staking ecosystem.”—Jakov Buratović, Master of DeFi at Lido

Aave, the largest DeFi lending protocol, will use State Pricing to price collateral and determine liquidations for DEX-traded assets used within Aave markets. This gives them more confidence around incorporating assets with lower trade volumes but high onchain liquidity.

“With State Pricing, Chainlink shows once again its commitment to continuously improving the pricing algorithms of assets, along with the infrastructure to deliver them onchain—enabling Aave to support a wider range of natively DEX-traded assets with the high standard of security and reliability the protocol is known for.”—Ernesto Boado, Co-Founder of BGD Labs (Core Contributor to Aave)

Curve, the leading AMM for stablecoin price discovery, is being used as a data source for State Pricing. This brings a critical onchain liquidity source to Chainlink’s State Pricing methodology.

“Chainlink State Pricing builds on an idea we implemented and tested at Curve and scales it to all DEXs, bringing us closer to a world where all liquidity can safely migrate onchain. I’m excited to see Chainlink fully ready to support this tectonic shift, which is already underway.”—Michael Egorov, Founder of Curve

Risk Mitigation

State Prices can be accessed through Chainlink’s existing Data Feeds and Data Streams services. Although these services are powered by Chainlink decentralized oracle networks—which have a long track record of being highly secure, reliable, and accurate, even during times of extreme volatility or congestion—users must ensure that they understand each feed’s unique update parameters (and the liquidity/volume profiles of the corresponding assets) and implement relevant risk mitigation techniques based on the intended use case.

It should be noted that utilizing DEX state introduces specific risks inherent to DeFi:

- Smart Contract Risk: Smart contracts, operating on certain blockchains like Ethereum, are autonomous code segments designed to execute transactions in a decentralized manner without the need for intermediaries. Despite their simplicity and intended security, they remain susceptible to bugs and exploitations. A flaw within the smart contract code can be exploited by malicious entities to manipulate the state price or other liquidity metrics. Such occurrences may lead to oracle price abnormality.

- Layer 2 and Cross-Chain Bridge Hack Risk: A bridge in the context of DeFi consists of smart contracts that enable the transfer of assets between different blockchains or layers. Bridges hold significant reserves of tokens to facilitate these transfers. However, they can become targets for hacks. An unauthorized withdrawal from the bridge depletes the reserves necessary for users to redeem their assets. This can lead to the implied price of the tokens—essentially the price that is expected based on available reserves and pool ratios—no longer accurately reflecting the true state or market price of the tokens.

- External Dependency Risk: Some DEX pool state prices rely on external exchange rates, which can come from an oracle, a ratio of queryable balances, or another calculation method. Bad actors might attempt to manipulate these exchange rates to influence the outcome of the state price or profit from the price discrepancies. This can lead to unintended consequences, such as liquidations or arbitrage opportunities for attackers.

Mitigation strategies implemented by Chainlink include:

- Aggregation: Aggregating across multiple, vetted DEXs mitigates reliance on a single point of failure.

- Outlier Detection: Chainlink’s network applies filters to discard anomalous price points from individual pools.

- Consumer Diligence: Crucially, consumers of State Pricing must perform their own risk assessments. They should consider factors like market depth, underlying asset security, and bridge dependencies, and then adjust protocol parameters (e.g., LTV, liquidation thresholds, supply caps) accordingly. The provided market depth metrics (when available) will aid in this assessment.

Chainlink: The Data Standard for All of DeFi and TradFi

The introduction of Chainlink State Pricing complements the existing data services offered through the Chainlink data standard, providing developers with access to a wide range of data solutions for their onchain applications.

- Two data delivery methods:

- Push-based oracles for onchain reference data that is consistently updated at predefined frequencies, supporting use cases such as lending markets, decentralized stablecoins, and payments.

- Pull-based oracles for low-latency data that can be available onchain at any time, supporting high-frequency markets, such as DeFi perps.

- Different pricing methodologies:

- Trade prices and liquidity-weighted bid/ask for pricing liquid assets that trade across centralized and decentralized exchanges.

- State prices for long-tail crypto assets and tokenized RWAs with deep onchain liquidity but low transactional volume on centralized exchanges.

- Chainlink Functions for fetching data from any API and running any custom computation on it before consuming it.

Check out the developer docs to get started with Chainlink State Pricing. To learn more about Chainlink, visit chain.link, subscribe to the Chainlink newsletter, and follow Chainlink on Twitter, YouTube, and Reddit.

—

Disclaimer: This post is for informational purposes only and contains statements about the future, including anticipated product features, development, and timelines for the rollout of these features. These statements are only predictions and reflect current beliefs and expectations with respect to future events; they are based on assumptions and are subject to risk, uncertainties, and changes at any time. There can be no assurance that actual results will not differ materially from those expressed in these statements, although we believe them to be based on reasonable assumptions. All statements are valid only as of the date first posted. These statements may not reflect future developments due to user feedback or later events, and we may not update this post in response. Please review the Chainlink Terms of Service, which provides important information and disclosures.