Making Stablecoins More Stable With Chainlink Proof of Reserve

While stablecoins are not hard to grasp conceptually, they are difficult to implement practically, with algorithmic stablecoins presenting even more complexity. With Chainlink Proof of Reserve, stablecoin protocols are able to enhance their stability and transparency, providing real-time insight into their reserves and boosting user and market confidence.

What Makes Stablecoins Stable?

Let’s take a step back and consider exactly what stablecoins are. Stablecoins are cryptocurrencies for which the price is designed to be pegged to a cryptocurrency, fiat money, or an exchange-traded commodity (such as gold or industrial metals).

When various other asset prices in the market are fluctuating, and investors want to preserve their positions in something less volatile, they can use stablecoins. That’s why they’re often described as a kind of hedge (i.e. protection/insurance) against a loss of value. Stablecoins are meant to hold a stable value relative to a reference asset. This is what “pegged” means—the stablecoin must maintain a “peg” against another asset. Most commonly, the peg is denominated against the United States dollar, with one unit of a stablecoin meant to always be equal to one US dollar.

That said, a stablecoin’s backing asset can be any stable fiat currency or another stable store of value (for many years the US dollar itself was “backed” by real gold, but that’s another story), including other types of cryptocurrency.

But how does a stablecoin maintain its peg? One way of doing this is for the stablecoin issuer to hold assets with an equivalent or greater value to the stablecoin as “backing” or “reserves”. This is known as collateralization—the backing asset (asset sitting in reserves) acts as collateral. Pegging is different from collateralization—pegging is a way to measure the value of the stablecoin against a reserve currency, collateralization uses assets to defend that value.

One way to think about collateral is like this: If someone you don’t know very well asked you for \$100, you’d probably want to know how you’d get your money back. The loss of your capital is a risk you want to protect against, so it’s likely you’d ask this person to give you something of value to “secure” your loan to them. They might leave their car and car keys with you. If you needed to, you could sell the car and recover your money. If the car’s value is higher than \$100, then you are “over-collateralized.” If it’s less than $100, you’re “under-collateralized”—a position that’s riskier for you as the lender.

A stablecoin maintains its peg if its issuer has reserves of assets that have the same or greater value than the stablecoins that have been issued. That way, the holder of \$1 worth of stablecoins can exchange (i.e. redeem) those stablecoins and get back an asset or fiat currency that is worth $1. This is a 1:1 peg.

Types of Stablecoin

There are broadly three types of stablecoins, classified on the basis of the mechanisms they use to hold a stable value. They can be fiat-collateralized, crypto-collateralized, or algorithmic.

The first two types can be easily understood now that we have covered what collateral means, with the added observation that crypto-collateralized stablecoins are entirely on-chain, in the sense that their collateral is also natively on-chain.

Algorithmic stablecoins are slightly different. While stablecoins are backed by asset reserves, algorithmic stablecoins are primarily backed by math and incentive mechanisms (encoded in their smart contracts) that maintain their peg to a fiat currency. They may not have an underlying reserve asset—they are designed to regulate and stabilize their peg by using algorithms that control the supply (or inversely, demand) for their stablecoin. In fact, algorithmic stablecoins are usually under-collateralized because they don’t (in theory) need collateral to hold their “stable” value. Some algorithmic stablecoins have a pair of coins—one stablecoin and the other a cryptocurrency to back that stablecoin—that the algorithms manipulate to maintain a peg, making them, in a sense, a sub-species of crypto-collateralized stablecoins.

In the context of this, there are good reasons to adopt a different terminology to classify collateralized stablecoins. Terms like “regular,” “collateralized,” and “algorithmic” lose precision as they start to overlap. Some stablecoins, such as Maker DAO’s DAI and Terra’s UST, are crypto-collateralized and algorithmically stabilized against another cryptocurrency. A better classification may be exogenous vs. endogenous vs. implicit collateralization. Exogenous means “external to” and endogenous means “from within”. “Exogenous” collateral refers to collateral that has primary use cases outside the stablecoin project. “Endogenous” refers to collateral that is created specifically for the purpose of being collateral. “Implicit” is when the design lacks explicit collateralization. You can read more about this here. Thus Terra UST and Synthetix’s sUSD are stablecoins with endogenous collateral because their collateral tokens are created to back the stablecoin. Distinguish this from Maker DAO (for example) which is collateralized by ETH and USDT etc. which are exogenous collateral because they have primary use cases outside of backing DAI.

Digging into the distinctions a bit deeper, it’s worth noting that stablecoins may also be decentralized to varying degrees. Vitalik Buterin refers to decentralized stablecoins as “automated stablecoins”. A notable example of a decentralized algorithmic stablecoin is the DAI stablecoin managed by the MakerDAO protocol. It is governed by a DAO, pegged to the US dollar, and backed by a basket of cryptocurrencies as collateral—a different design to most algorithmic stablecoins, which do not have collateral backing. DAI collateral is typically provided by its users, following which they can mint DAI. The DAI coin is treated as debt issued to the user and is issued at a rate that effectively over-collateralizes the DAI issued (i.e. the collateral deposited by the user is generally worth more than the DAI they get in return). That ratio of collateral to DAI is algorithmically calculated to maintain the stable pegged price of 1 DAI = $1.

You can contrast this stablecoin design with USDT (Tether), a stablecoin that is backed (almost entirely) by fiat-based assets and is centrally controlled (and not algorithmic). Another example of a centralized stablecoin pegged to the US dollar and backed by equivalent assets is USDC.

All this raises some very important questions around decentralization and stability with regard to stablecoins:

- How do we know that the reserves backing collateralized stablecoins exist (particularly exogenous collateral)?

- How do we trust that these reserves are of equal or greater value to the current market value of the stablecoin they’re meant to be backing?

- How do we get accurate, real-time price data to support an algorithmic stablecoin’s peg?

High-Quality On-Chain Data Is a Problem

The traditional, centralized, off-chain way of addressing these three problems would be for auditors to manually verify and validate the reserves and for centralized exchanges to provide price data. Manually verifying reserves has some drawbacks though—it’s manual, it’s expensive, it’s done on someone else’s schedule and not automatically.

Traditional third-party audits also lack transparency because they still require placing trust in the auditor and their integrity, taking their word that there’s no tampering. We count on the auditor’s self-interest in wanting to preserve their reputation, which is an “implicit incentive”.

Historically, when it comes to physical assets like gold or even centrally controlled fiat currencies managed by government treasuries, this mechanism can work well enough for its purpose and its context. But a superior version of this, enabled by modern technology and removing the need to place trust in intermediaries, would be to rely on cryptographic truth that is secured by decentralized oracle network.

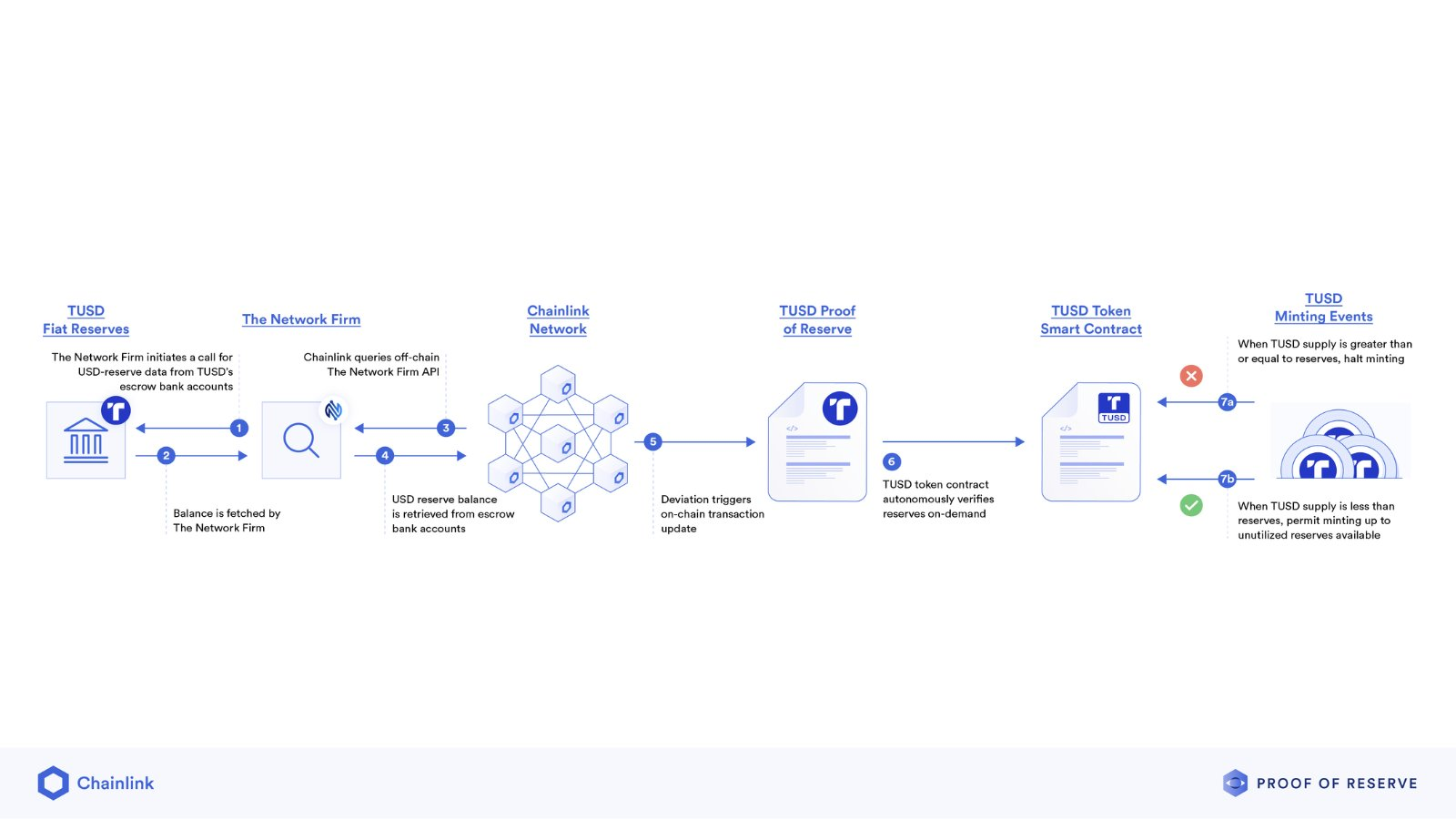

One issue with blockchains is that they’re natively unable to connect to external data, an issue known as the blockchain oracle problem. In order to verify reserves in a decentralized, secure, and cryptographically truthful way, blockchains need a reliable way to interact with off-chain data. Chainlink, the industry-leading decentralized oracle network, solves this problem, delivering off-chain data on-chain and helping secure billions of dollars in value across the DeFi space.

Oracles can play a powerful role in delivering data to protocols across the multi-chain ecosystem, with Chainlink able to validate the existence of reserves, value reserves accurately based on market conditions, deliver data inexpensively to blockchains, perform automated audits of reserves, and many other functions that help boost the security and stability of stablecoins.

Chainlink Proof of Reserve and Price Feeds to the Rescue

What if anyone, anywhere could verify that a stablecoin protocol is indeed backed by the reserves it claims to be backed by, and that the value (market price) of these reserves is sufficient to collateralize the supply of the stablecoin, even when the stablecoin and its reserves reside on different blockchains? Confidence in the stablecoin and its peg would dramatically increase.

Imagine if any smart contract could make two simple API calls—getLatestSupply() and getLatestReserves()—to a price feed that provides decentralized, aggregated, cryptographically secured, on-chain quantities and market values for the stablecoin and its reserve asset. As long as the reserve supply outnumbered the stablecoin supply, and the value of the reserves was at least as much as the value of the stablecoin quantity in circulation, we’d know that the stablecoin was fully collateralized and in a healthy state.

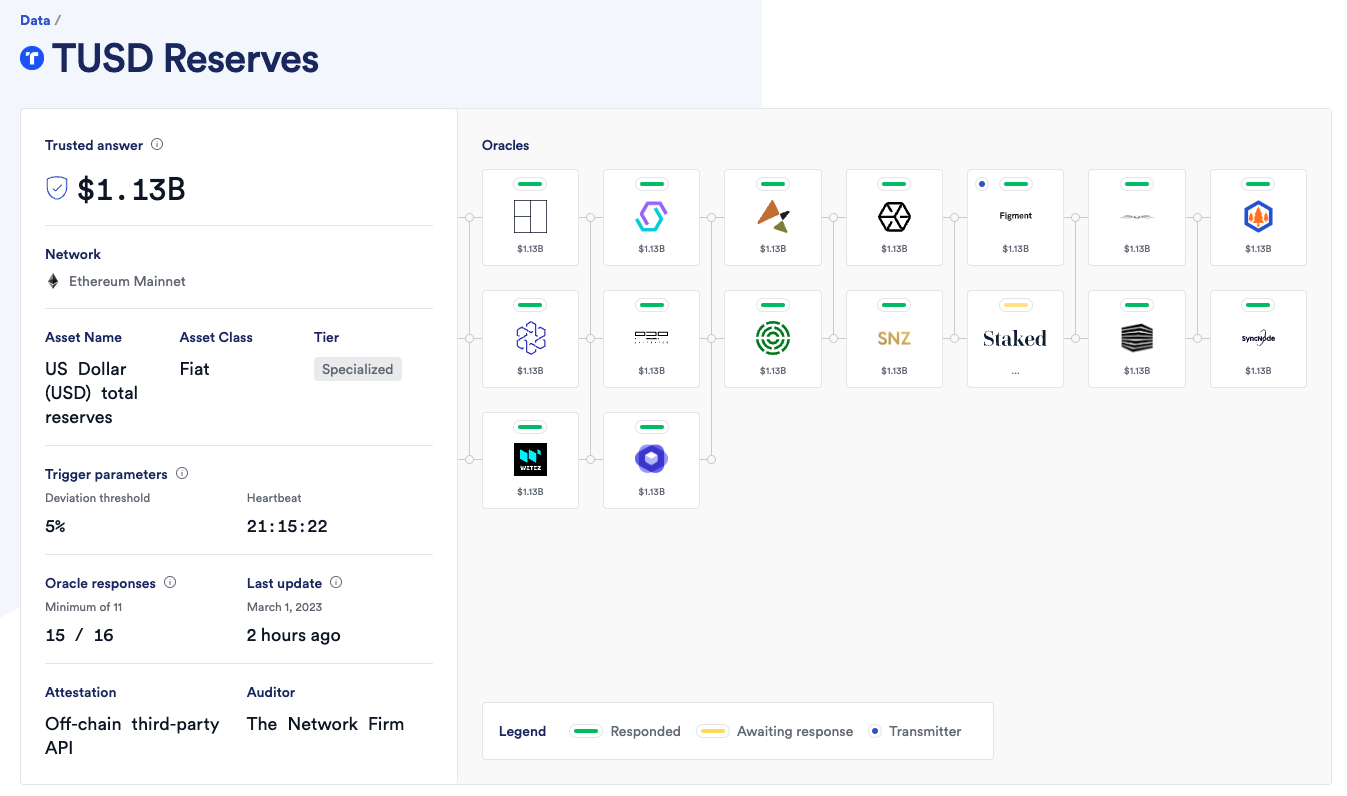

Chainlink Proof of Reserve powers exactly this sort of functionality. Proof of Reserve provides transparency to the users of stablecoins, enabling them to directly and at any time confirm that the stablecoin asset they are using is sufficiently backed by off-chain or cross-chain asset reserves.

Taking Proof Over Promises A Step Further

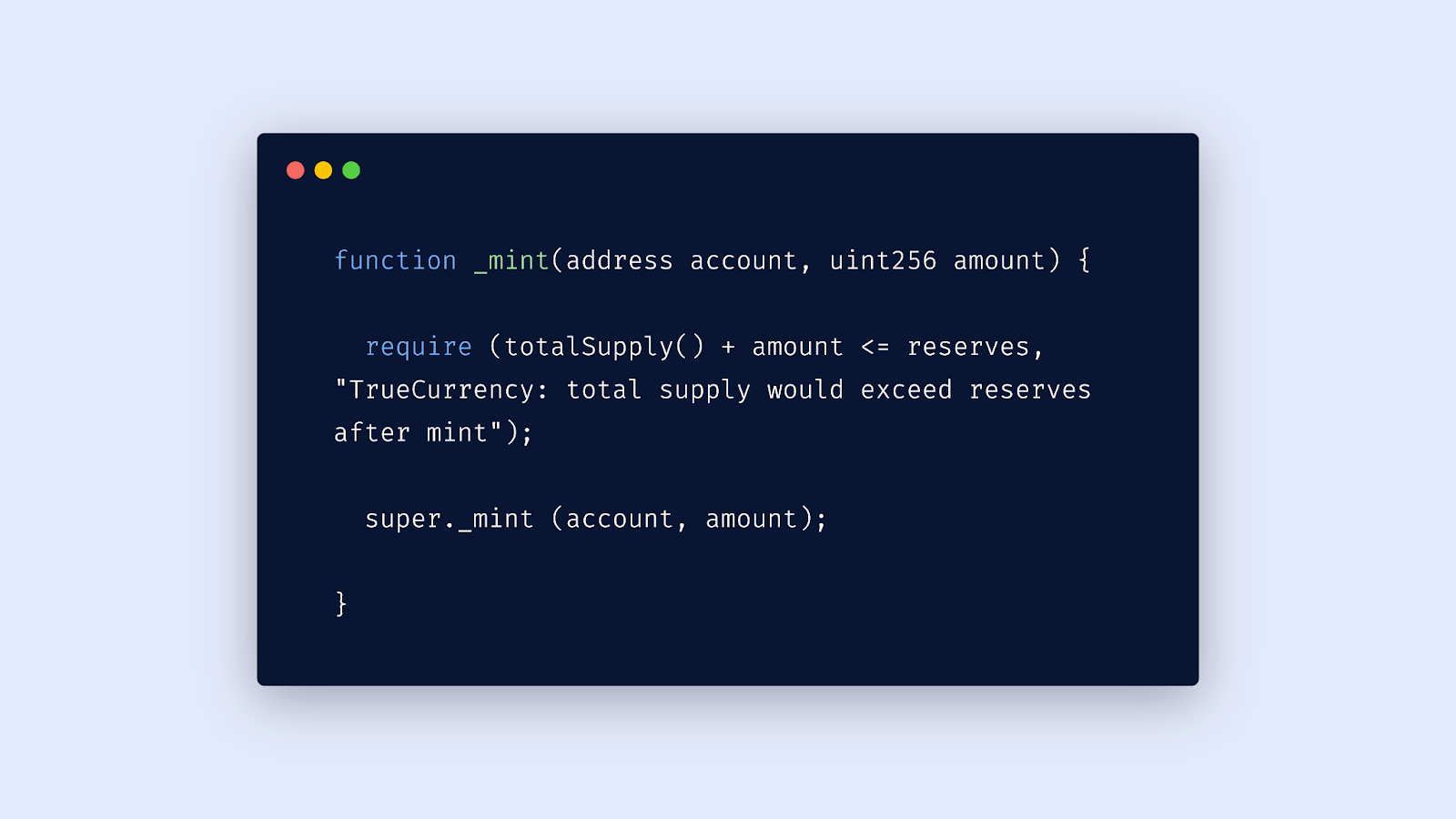

Now, what if we wanted to add even more enhanced security and transparency to the stablecoin minting process? To not just promise, but programmatically require the reserve value to be greater than or equal to the supply being minted. Enter Chainlink Proof of Reserve Secure Mint. Secure Mint is being integrated by stablecoins and tokenized assets in their minting smart contracts to help ensure reserves are sufficient before minting new tokens.

TrueUSD uses Chainlink Proof of Reserve with Secure Mint to further increase collateral transparency and help secure the minting of its fiat-backed stablecoin, TUSD. By programmatically controlling TUSD minting with real-time on-chain verification of off-chain reserves using Proof of Reserve, TrueUSD is demonstrating a new paradigm for stablecoin transparency and reliability.

Paxos, a financial market infrastructure and crypto brokerage platform, uses Chainlink to provide highly available, tamper-proof, and accurate pricing data needed by smart contracts to verify the USD reserves that back the stablecoin Pax Dollar (USDP) and the gold reserves that back the PAX Gold token (PAXG). This is done through the Chainlink Proof of Reserve Data Feeds for Paxos tokens which empower DeFi dApps to verify that Paxos tokens are indeed backed 1:1 by US Dollars and gold bars held in off-chain reserves in Paxos’ custody.

As Central Bank Digital Currencies (CBDCs) start to emerge, they may need to be backed by on-chain and off-chain assets. This would necessitate accurate and secure price data regarding their reserve assets. These government-issued stablecoins would be well served by Chainlink Proof of Reserve, which can provide the pricing data needed to help secure their pegs as well as the reserve data needed to verify collateralization—all this in a way that guarantees cryptographic truth through decentralized oracle networks.

Chainlink Proof of Reserve helps to not only validate and verify underlying assets but also to protect against systemic shocks. For example, with Chainlink Proof of Reserve data, DeFi smart contracts can implement “circuit breakers” as a failsafe in case collateralization drops outside normal healthy ranges, helping mitigate potentially calamitous market movements and the destruction of value.

Summary

Stablecoins are a vital pillar in the DeFi ecosystem, enabling users to store and transfer stable value. There are many implementations of stablecoins, but the stability and transparency of all stablecoins can be enhanced by better quality data and the ability to prove reserves. With Chainlink Price Feeds and Chainlink Proof of Reserve, stablecoin protocols have two powerful tools with which to boost their security and stability.

If you’re a developer and want to integrate Chainlink into your smart contract applications, check out the blockchain education hub, developer documentation or reach out to an expert. You can also see live Chainlink Proof of Reserve data feeds here and dive right into implementing them in your smart contract.