Sibos 2024: Connecting the Future of Finance Onchain | Highlights, Coverage, and More

Key Takeaways

- Blockchain, oracles, and AI are redefining how financial data is structured.

- Chainlink unveiled a blockchain privacy suite helping institutions compliantly transact across the multi-chain economy.

- Standards for interoperability and identity can unify asset liquidity and participant verification for onchain finance.

- The Chainlink Labs team engaged dozens of financial institutions to solidify Chainlink as the industry-standard infrastructure for capital markets.

Sibos, the global financial services event organized by Swift, brings together thousands of finance industry leaders, decision makers, and experts from across the financial ecosystem, making it the perfect platform to help shape the future of financial services and educate key decision makers on the benefits of onchain finance and the Chainlink platform.

Chainlink had multiple leaders speak at Sibos, a large team of top capital markets representatives meeting with many of the top banks, asset managers, and financial market infrastructures, and a booth alongside the largest banks and financial institutions in the world.

Day 1

Major Announcement: Chainlink, Euroclear, Swift, and 6 Financial Institutions Launch AI Initiative

The industry initiative brings together leading financial and market infrastructures, Euroclear and Swift, and some of the world’s largest financial institutions, including UBS, Franklin Templeton, Wellington Management, CACEIS, Vontobel, and Sygnum Bank.

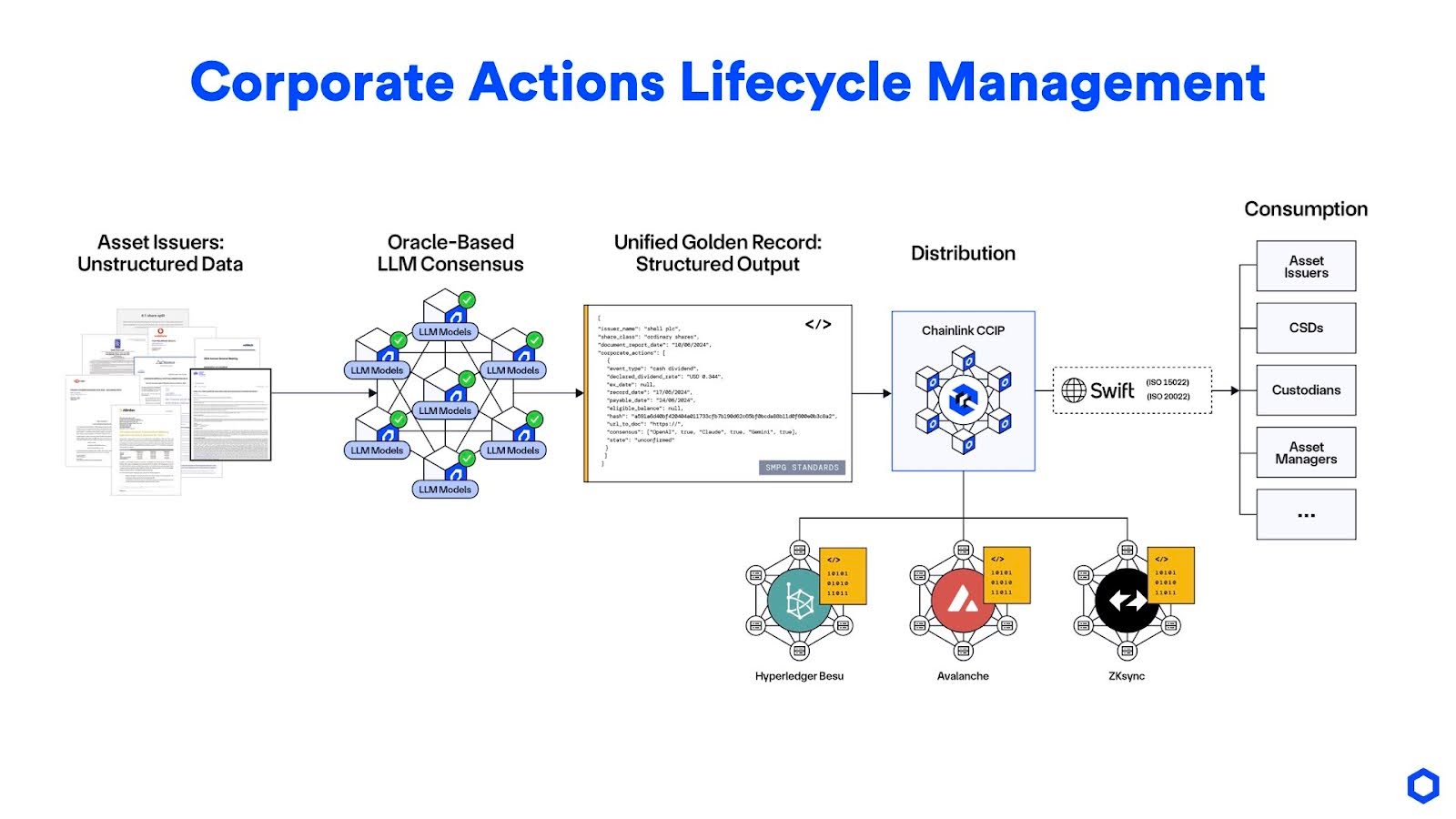

It aims to address today’s inefficient corporate action processes, which cost regional investor, broker, and custodian businesses approximately $3-5 million each annually, with 75% of firms re-validating custodian and exchange data manually. The initiative successfully demonstrated how LLMs can be used in combination with Chainlink for near real-time data distribution of corporate actions events across three blockchain networks. With its novel approach of creating an interoperable, onchain golden record, the initiative marks a significant architecture milestone in the ongoing journey to transform the management and dissemination of corporate actions data.

Read the full report.

Panel Discussion: Sustainable Securities Investment and Post-Trade Innovation

Chainlink Labs’ head of banking and capital markets, Angie Walker, kicked off Sibos 2024 in Beijing on a panel alongside ASIFMA, BMO Bank, CCDC (China Central Depository & Clearing Co., Ltd.), and DBS Bank.

Despite a “huge appetite on the buy side to invest in green instruments” and the growing adoption of tokenization, green digital assets have yet to attract the required capital flows to achieve corporate sustainability goals. The panel identified that a lack of secondary markets and industry standards, along with a “fear of greenwashing,” were limiting adoption.

“People tokenize assets all the time. What they don’t think about is, how do I get to the secondary market?”—Angie Walker

Angie Walker shared how Chainlink’s platform, in combination with technologies such as blockchains, smart contracts, and geospatial data providers, can “validate and verify” every aspect of a green digital asset’s lifecycle. One example referred to green digital bonds, which could “measure carbon emissions for the life of the bond.” Along with clear standards around green digital asset taxonomy and blockchain-based ownership records to mitigate greenwashing risks, thriving secondary markets could then emerge and commodify green digital assets.

An end vision was shared in which the financial system is harnessed to catalyze the creation of a robust green asset industry, in much the same way that funding initiatives enabled the development of the solar industry.

Watch the full video on Chainlink Today:

Live at Sibos

Accelerating Regulated Stablecoin Issuance With Fireblocks and Chainlink

Ryan Lovell and Tim Way from Fireblocks discuss the institutional adoption of regulated stablecoins and how the recent partnership between Fireblocks and Chainlink is accelerating this growing trend.

“Institutions now are in the phase where they want to drive commercialization with digital assets.”—Tim Way, Head of Business Solutions and Advisory, APAC & the Middle East, Fireblocks

Industry News

- Chainlink Partners With Major Financial Players to Improve Corporate Actions Data Reporting Using AI and Blockchain. CoinDesk.

- Chainlink using AI, oracles to bring market-moving corporate data onchain. Cointelegraph.

- Chainlink Partners with Financial Giants to Create AI Blockchain Record of Corporate Data. BeInCrypto.

Day 2

Sergey Nazarov Keynote: Chainlink Reveals Groundbreaking Digital Asset Solutions

Chainlink Co-Founder Sergey Nazarov took to the Sibos stage with a packed audience to reveal critical Chainlink infrastructure that enables banks to adopt digital assets at scale. In a live walkthrough, he showcased how banks can connect to blockchains using existing Swift standards and Chainlink infrastructure, introduced Chainlink’s new suite of privacy tools for institutions, and shared successful results from an industry initiative with Chainlink, Euroclear, Swift, and six institutions on how AI, oracles, and blockchains are transforming asset servicing.

Introducing the Chainlink Platform Privacy Suite

During his keynote, Sergey Nazarov also revealed Chainlink’s new blockchain privacy tools that enable financial institutions to maintain data confidentiality, data integrity, and support regulatory compliance when transacting across the multi-chain economy.

“Privacy has been a deeply lacking quality in the blockchain industry, and this is one of the limiting factors that has kept the capital markets from adopting digital assets and blockchains.”—Sergey Nazarov

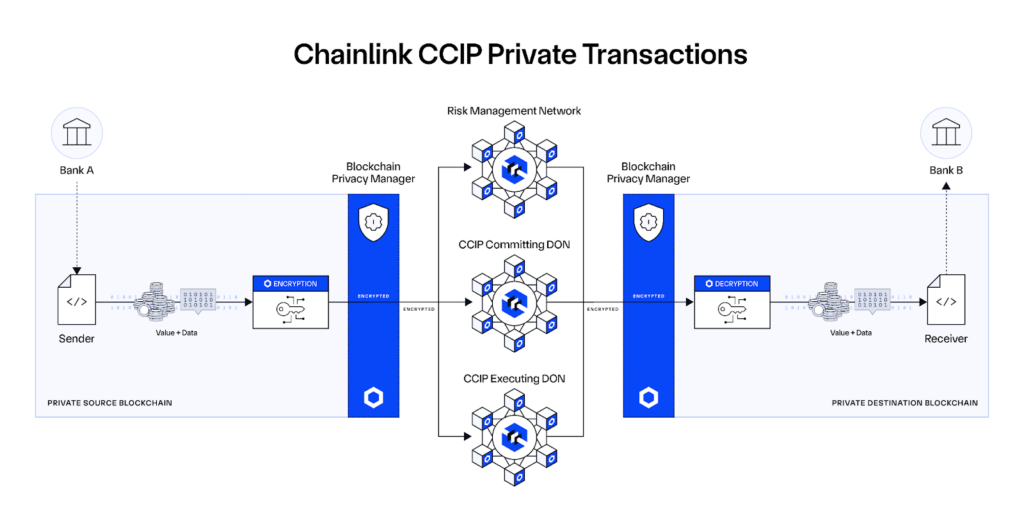

These new privacy-preserving capabilities include the Blockchain Privacy Manager and CCIP Private Transactions. These enable financial institutions to maintain data confidentiality, data integrity, and can support compliance obligations when transacting across the multi-chain economy.

The Blockchain Privacy Manager allows institutions to integrate their private blockchain networks with existing systems, such as traditional enterprise backends, while limiting onchain data exposure. This feature enables private chains to be integrated with the public Chainlink Platform without exposing sensitive private chain data to third parties. Using the Blockchain Privacy Manager, CCIP Private Transactions leverages a novel onchain encryption/decryption protocol to enable institutions to transact across multiple private blockchains using the public CCIP network, while keeping the transaction details fully confidential.

You can read more about these new privacy-preserving capabilities in the full product announcement blog: Introducing the Chainlink Platform Privacy Suite. If your organization is interested in adopting the Blockchain Privacy Manager and/or CCIP Private Transactions, reach out to an expert below.

Australia and New Zealand Banking Group (ANZ)—a leading Australian bank with over A$1 trillion in AUM—will be among the first financial institutions to demonstrate the capability for cross-chain settlement of tokenized real-world assets (RWAs) under the Monetary Authority of Singapore (MAS) Project Guardian initiative.

“Chainlink’s new cross-chain privacy capabilities have the potential to further accelerate institutional blockchain adoption by enabling end-to-end privacy between blockchain networks.”—Nigel Dobson, Banking Services Lead at ANZ

In addition to the Blockchain Privacy Manager and CCIP Private Transactions, the Chainlink Platform also offers an advanced privacy-preserving data verification system in the form of DECO, which uses zero-knowledge proofs (ZKPs) and existing web infrastructure to enable financial institutions, enterprises, and Web3 developers to verify sensitive information without exposing the underlying data.

In the very near future, Chainlink plans to make the DECO Sandbox publicly accessible, offering pre-configured use cases that showcase DECO’s privacy-preserving capabilities such as identity verification, proof of funds verification, and sanctions screenings verifications, while maintaining the privacy of sensitive data.

Panel Discussion: How AI and DLT Can Enhance Corporate Actions

Chainlink Labs’ Angie Walker joined Stephanie Lheureux of Euroclear and Kelli West of Swift to discuss how large language models (LLMs), blockchains, and Chainlink can solve the unstructured data problem in finance, beginning with corporate actions. As West highlighted, “corporate actions processing is deemed to be one of the most complex areas of post-trade and is one of the most complex and costly unstructured data problems in the financial world.”

The panel participants dove into their recently announced industry collaboration, which along with Chainlink, Euroclear, and Swift, featured 6 major institutions. Lheureux highlighted that the initiative is seeing significant interest from institutions, which she attributed to the initiative “really addressing a pain point.”

Initially presented in human-readable formats like PDFs and press releases, corporate actions—covering mergers, dividends, and stock splits—undergo a complex journey through custodians, brokers, fund managers, exchanges, and ultimately investors. By using Chainlink oracles paired with multiple large language models (LLMs), the initiative was able to source unstructured, offchain data and convert it autonomously into structured, onchain data that is available in near real-time and into predefined standards of specific corporate action types, modeled on the ISO 20022 framework and aligned with the Securities Market Practice Group (SMPG) guidelines.

“It’s not just about corporate actions—the fact that it takes around a hundred people to issue a corporate action is pretty shocking, so we do need to improve that world—but there are lots of other datasets in regulated market activities that we could use this technology for.”—Angie Walker

Watch the full panel discussion on Chainlink Today:

Live at Sibos

Why Onchain Finance Needs Privacy

Chainlink Labs’ Niki Ariyasinghe discusses the convergence of payment networks and the importance of privacy for financial institutions.

“Regulated financial entities have the assurance now that if they send information using Chainlink CCIP, it will be fully private and not be shared with organizations that don’t need to see that information.”—Niki Ariyasinghe

Mainnet Production Opportunities

At the Chainlink booth, Thomas Trepanier talks about how blockchain technology is being adopted in production by large financial institutions and why the tokenization of RWAs is gaining traction in asset management.

“We’re no longer talking about proof of concept. Our customers are gravitating to real live mainnet production opportunities.”—Thomas Trepanier

Industry News

- Sibos 2024: Chainlink Unveils New Privacy and Interoperability Solutions for Blockchain Adoption. Finextra TV.

- Swift, Euroclear, and major financial institutions collaborate on Chainlink to digitalise asset servicing. Trade Finance Global.

- Industry Launches AI-Powered Corporate Actions Initiative. Markets Media.

- Chainlink Announces CCIP Private Transactions, Enabling Financial Institutions To Compliantly Connect Private Chains to the Multi-Chain Economy. Fintech Finance.

- Leading Financial Institutions Tackle Unstructured Data Challenges With AI-Powered Technology. Mondo Visione.

- ANZ to Kickstart Chainlink Private Transactions Protocol in RWA Boost. CoinDesk.

- Chainlink launches private blockchain transactions for institutions. Cointelegraph.

- Chainlink Unveils CCIP Private Transactions for Financial Institutions. Cryptonews.

Day 3

Panel Discussion: Interoperability Unlocks Network Effects for Global Payments

Today’s payment schemes across the globe are predominantly an array of domestic payment rails at various maturity levels, built to solve regional problems. Connecting all of these new and legacy systems to enable seamless international payment flows is challenging. To explore how interoperability unlocks opportunities for global payments, Chainlink Co-founder Sergey Nazarov joined a panel alongside BIS Innovation Hub, Caixin, NatWest, and Nium.

BIS Innovation Hub’s Maha El Dimachki predicted that the future of cross-border payment networks wasn’t “one platform to rule them all” because the challenges of local jurisdictions and local implementations are too great. Nazarov agreed with El Dimachki saying he does not predict a future where the global payments networks all exist on a single platform as “the fragmentation is just too great.”

“We do need to think about new technologies, and blockchain technologies can actually help with existing frameworks—and taking out the friction of existing frameworks.”—Maha El Dimachki, BIS Innovation Hub

“The Internet is a group of standards to interconnect information,” says Nazarov. “We talk to each other over a single, understood global protocol.” Like the Internet, the technology challenges of global payments will be overcome by a universal interoperability protocol. While there will be different chains and networks, they will transfer value and information across a universal standard—CCIP.

Watch the full video on Chainlink Today:

Panel Discussion: Identity and Digital Identity — Reshaping Cross-Border Ecosystems

The Global Legal Entity Identifier Foundation (GLEIF) is a supra-national, not-for-profit organization tasked with managing an open legal entity identification system. The system works with the Legal Entity Identifier (LEI), which serves as a “passport” for legal entities, enabling them to be recognized across borders for financial transactions and other business interactions. The LEI is a 20-character, alphanumeric code based on the ISO 17442 standard that links to key reference information—such as ownership structure—that ensures identification of legal entities globally. LEI plays an important role in solving identity challenges and improving transparency in the global marketplace, particularly in supply chains and trade finance.

In the landscape of onchain environments, identity is an unsolved opportunity. Public blockchains are inherently pseudonymous, which poses a challenge for facilitating advanced capital markets and business interactions that require robust identity layers. The lack of identity layers has historically hindered the institutional adoption of blockchains, creating fragmented ecosystems where individual chains attempt to create their own whitelists and other identity schemes. This fragmentation makes the interoperability of identity systems between chains a difficult problem. The introduction of LEI as an open, global standard can help address this issue by providing a unified identity scheme that can work across all blockchains.

“The fundamental problem is synchronizing identity information in regards to different transactions across different chains. It’s basically a data reconciliation problem in a very fragmented technical landscape, which is solved by the Cross-Chain Interoperability Protocol, which functions similarly to TCP/IP for the Internet.”—Sergey Nazarov

With its long history of providing secure inputs to smart contracts, Chainlink has the potential to support this vision by enabling verified identity layers that increase interoperability across different blockchain networks. With the verifiable LEI (vLEI)—the digital counterpart of LEI—Chainlink could make vLEI information accessible across thousands of blockchain networks. This would allow users to query vLEI information through smart contracts, creating a unified identity layer in a world where blockchain interactions are otherwise fragmented across many chains. By incorporating vLEI, the blockchain ecosystem can evolve to include identity as a critical building block, which is essential for enabling high-quality securities, payments, and trade use cases, ultimately enabling the flow of more transaction volume into onchain environments.

Watch the full discussion on Chainlink Today:

Industry News

- The Real Future of Digital Assets. Fintech Finance.

- Chainlink partners with Swift and Euroclear to Securely Transfer between Blockchains. TheStreet.

- Chainlink introduces CCIP Private Transactions. The Paypers.

- Chainlink co-founder unveils blockchain payments for TradFi. Cointelegraph.

- Chainlink Co-Founder Unveils TradFi Integration with Swift Messaging. Coinspeaker.

- How Chainlink’s Private Transactions Change the Game for Institutions. DailyCoin.

Day 4

Chainlink Roundtable: How TradFi Benefits From a Multi-Chain World

On Day 4 of Sibos, Chainlink Labs hosted an invite-only roundtable with global financial institutions to showcase how traditional finance can successfully navigate a multi-chain world.

As digital asset adoption continues to grow, the integration of traditional finance with the increasing number of private and public blockchains presents both challenges and opportunities. The roundtable explored how TradFi can seamlessly transact across the multi-chain economy and fully capitalize on the digital asset opportunity.

The discussion focused on regional blockchain adoption, the importance of using established standards like the Swift network and Legal Entity Identifiers (LEIs), and the growing interest in digital assets among asset managers. Sergey Nazarov emphasized the importance of integrating digital assets with traditional networks to reduce fragmentation and enhance payment security.

Live at Sibos

Blockchain and Tokenized Asset Adoption: “When, Not If”

Angie Walker shares her main takeaways from Sibos, including the noticeable shift in sentiment toward the institutional adoption of blockchain technology and tokenized assets, the importance of integrating with existing standards such as Swift and vLEI, and the corporate actions initiative with Swift, Euroclear, and six major market participants.

“People are talking about the when not the if. They are much more focused on production-grade projects, on moving into production, on driving adoption. It’s a very different mindset.”—Angie Walker

How Cross-Chain Identity Spurs Institutional Adoption

Chainlink Co-Founder Sergey Nazarov sits down with GLEIF CEO Alexandre Kech to discuss the introduction of a verifiable Legal Entity Identifier (LEI), vLEI, and how it supports the need for a new global ecosystem for organizational digital identity, and Chainlink’s role in supporting this development.

“What I’ve seen [Chainlink] doing for digital assets, enabling portability of assets from chain to chain, I see it the same way in identity—being able to port identity from traditional infrastructure to blockchain A, blockchain B, blockchain C.”—Alexandre Kech

Industry News

- Big Financial Institutions Solve A $3.1 Trillion Problem With AI And Blockchain. Forbes.

- Sibos 2024: The convergence of TradFi and DeFi with Chainlink. Fintech Futures.

- Tokenisation use cases to be excited about. Finextra TV.

Next: Chainlink SmartCon in Hong Kong

Chainlink SmartCon is the industry-leading conference that serves as the convergence point for TradFi and DeFi, uniting Web3 leaders and experts from the world’s largest financial institutions and market infrastructures. This premier event addresses the critical intersection of these two industries, enabling participants to explore how blockchain technology can unlock the $867T tokenization opportunity. Attendees will gain insights into the future of onchain finance, discovering how tokenization can enhance liquidity, transparency, efficiency, and more across numerous sectors.

Join us at SmartCon to be a part of this pivotal moment in finance, where innovation meets opportunity, and explore how we can collectively shape the future of financial systems worldwide.