Chainlink Quarterly Review: Q3 2025

“It has become clear to everyone in the TradFi and DeFi community that the Chainlink Stack is the only system where you can get all of your digital asset challenges solved using a single standard.“ —Sergey Nazarov, Swift’s 2025 Sibos Conference

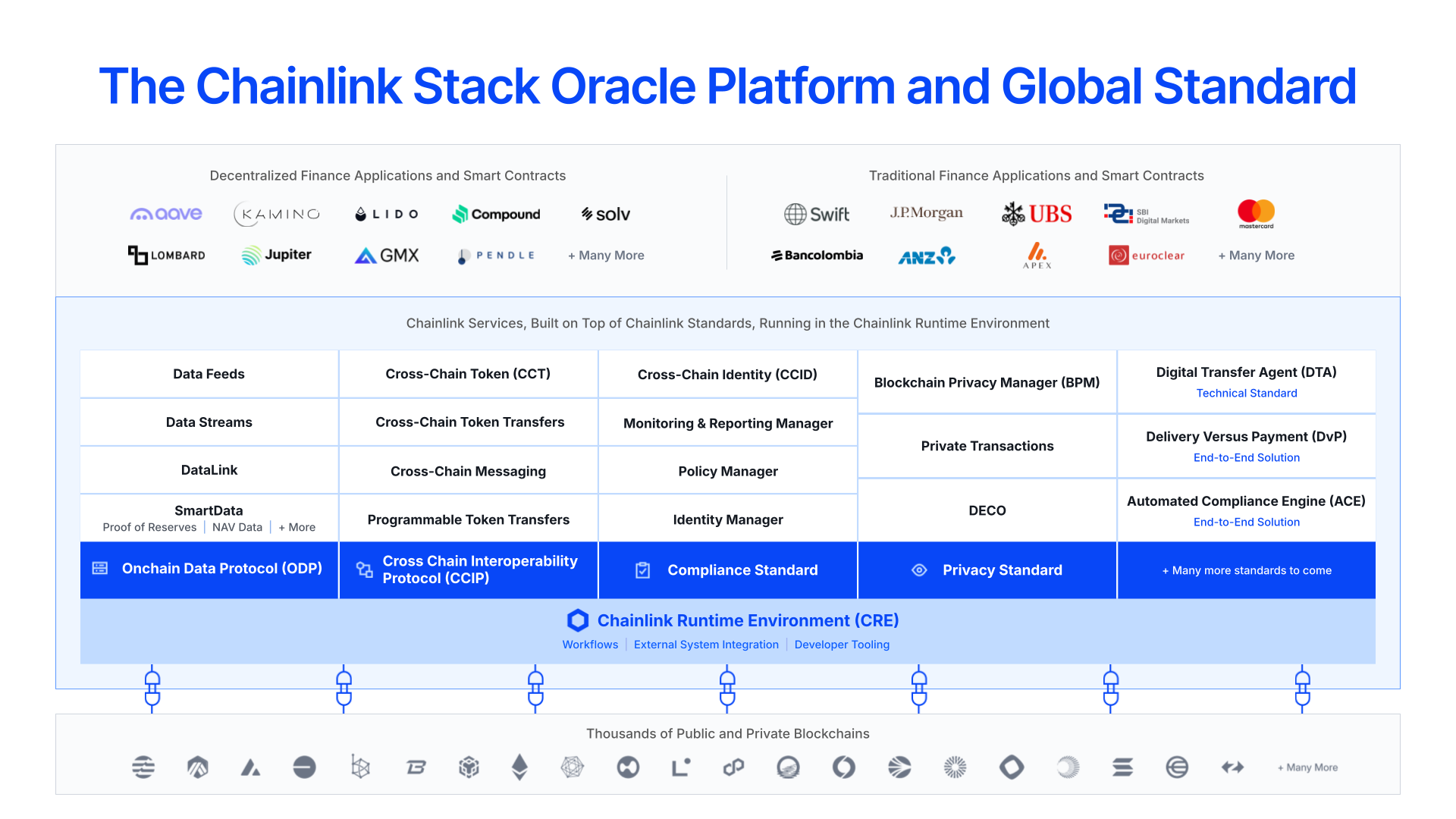

Q3 was another standout quarter for Chainlink. It saw the release of an updated platform vision, a partnership with the U.S. Department of Commerce to bring key government macroeconomic data onchain, continual inflows to the Chainlink Reserve from offchain and onchain revenue, new solutions launched with DataLink and the Digital Transfer Agent (DTA) technical standard, and a major presence at Sibos, Swift’s premier financial conference, where our work in onchain finance with leading financial institutions like Swift, UBS, Deutsche Börse, DTCC, Euroclear, and more was showcased.

Our work in Q3 highlights more than ever that Chainlink has evolved far beyond just a data oracle for DeFi, but into the only all-in-one platform and global set of standards providing the key data, interoperability, compliance, privacy, and orchestration capabilities needed to power the full lifecycle of onchain use cases. Only through Chainlink can asset servicing, DvP settlement, interoperable payments, asset management, and more be unlocked for onchain finance at global scale. The many accomplishments in Q3 serve as a springboard into this year’s upcoming SmartCon—Chainlink’s premier conference happening Nov 4-5 in New York City. To get your SmartCon tickets and see the full list of speakers, click here.

The following blog showcases all the progress made on Chainlink since the Q2 2025 Quarterly Review. Be sure to follow the recently launched DevHub Changelog as the go-to source for updates on every Chainlink product. You can also track key metrics across network usage and ecosystem adoption at Chainlink Metrics.

Major Wins in Q3 2025

Capital Markets and Tokenized Assets

- Expanded Corporate Actions Industry Initiative: Chainlink, together with 24 of the world’s largest financial market infrastructures and institutions, including Swift, DTCC, Euroclear, UBS, BNP Paribas, Wellington Management, ANZ, Schroders, and DBS Bank, showcased its continued work on a new, unified infrastructure for streamlining corporate actions processing using oracles, blockchains, and AI. Phase 2 introduced substantial improvements to the speed, reach, and accessibility of corporate actions data, demonstrating the ability for institutions to receive structured, validated records with 100% data accuracy, integrate them directly into existing enterprise systems without workflow disruption, and process disclosures written in multiple languages. This included transforming structured outputs into an ISO 20022 message format and distributing them to DTCC’s blockchain ecosystem. [Full report]

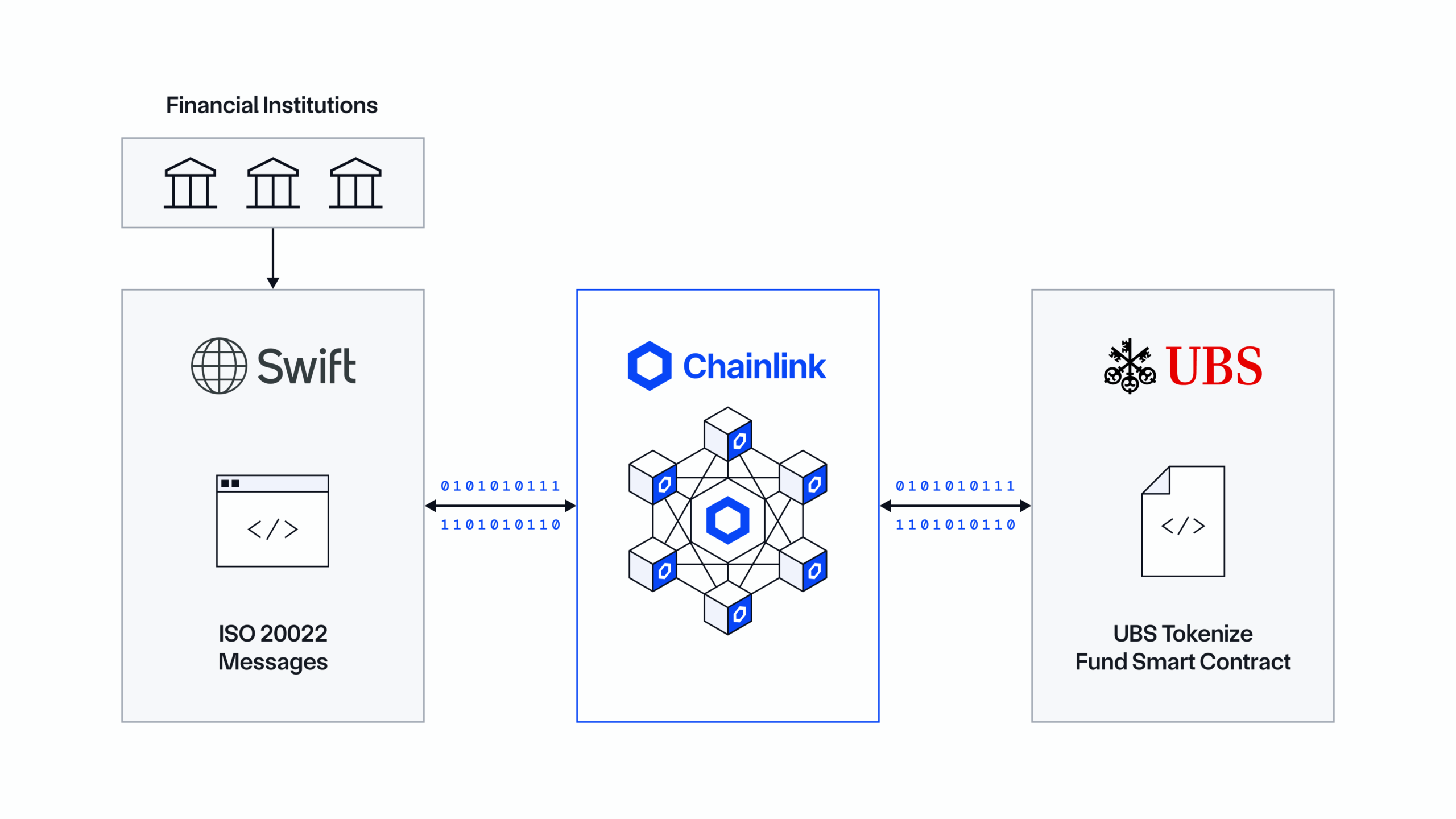

- Advancing Tokenized Fund Workflows With Swift & UBS: Chainlink announced a landmark technical solution enabling financial institutions worldwide to manage digital asset workflows directly from their existing systems using Swift messaging and the Chainlink Runtime Environment (CRE). A first use case involved a technical and operational pilot with UBS Tokenize, the in-house tokenization unit of UBS. [Announcement]

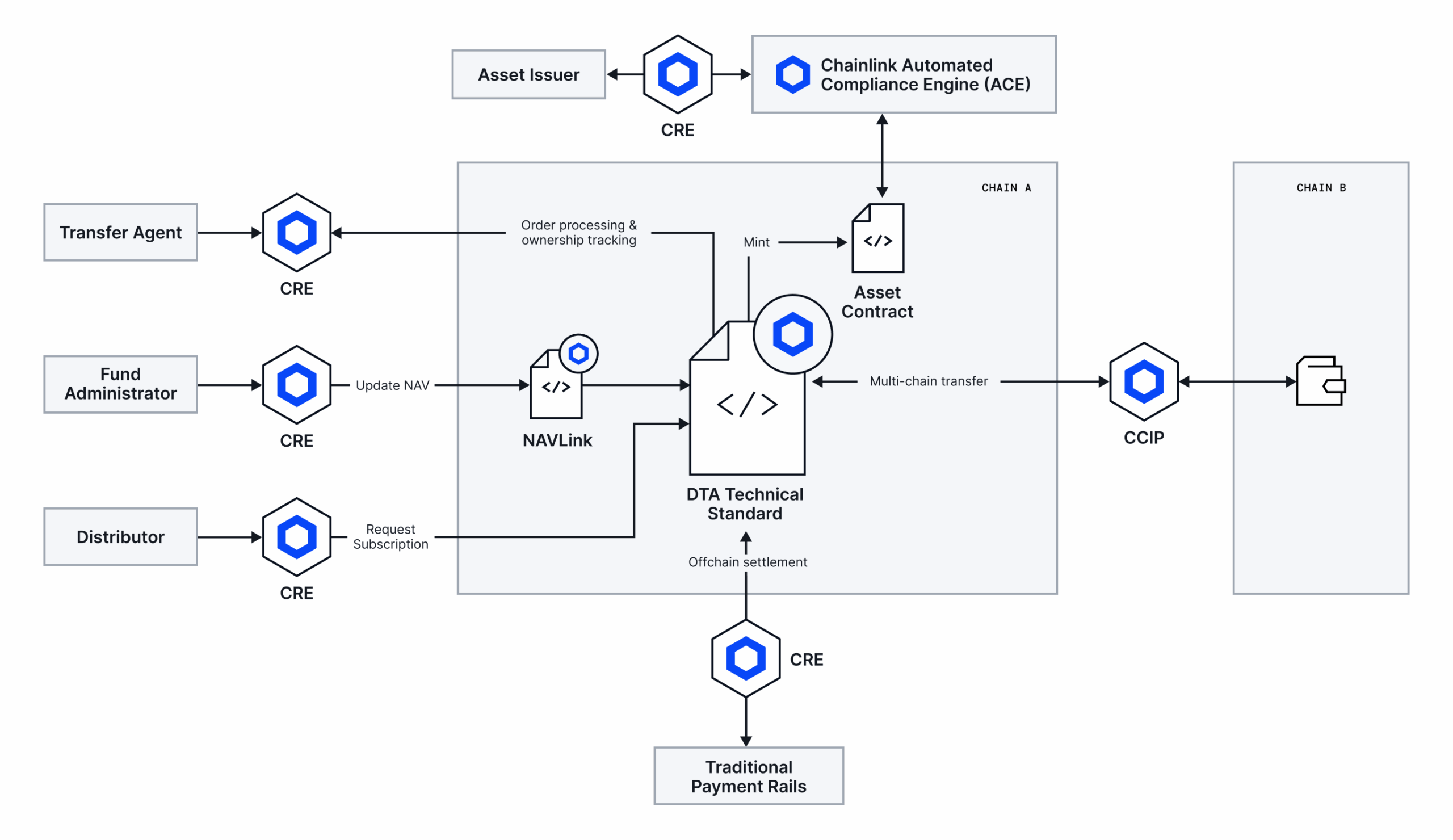

- Introduced the Chainlink Digital Transfer Agent (DTA) Technical Standard: DTA is a comprehensive set of technical standards that define how transfer agents and fund administrators can expand their operations onchain to support tokenized assets, while remaining aligned with existing regulatory frameworks. The Chainlink DTA technical standard is the easiest and most reliable path for market participants to launch their own onchain transfer agency services and capture the emerging opportunity of tokenized financial markets. UBS uMINT, the token corresponding to UBS Asset Management’s tokenized money market investment fund, is the first smart contract to begin adopting the DTA technical standard. [Announcement]

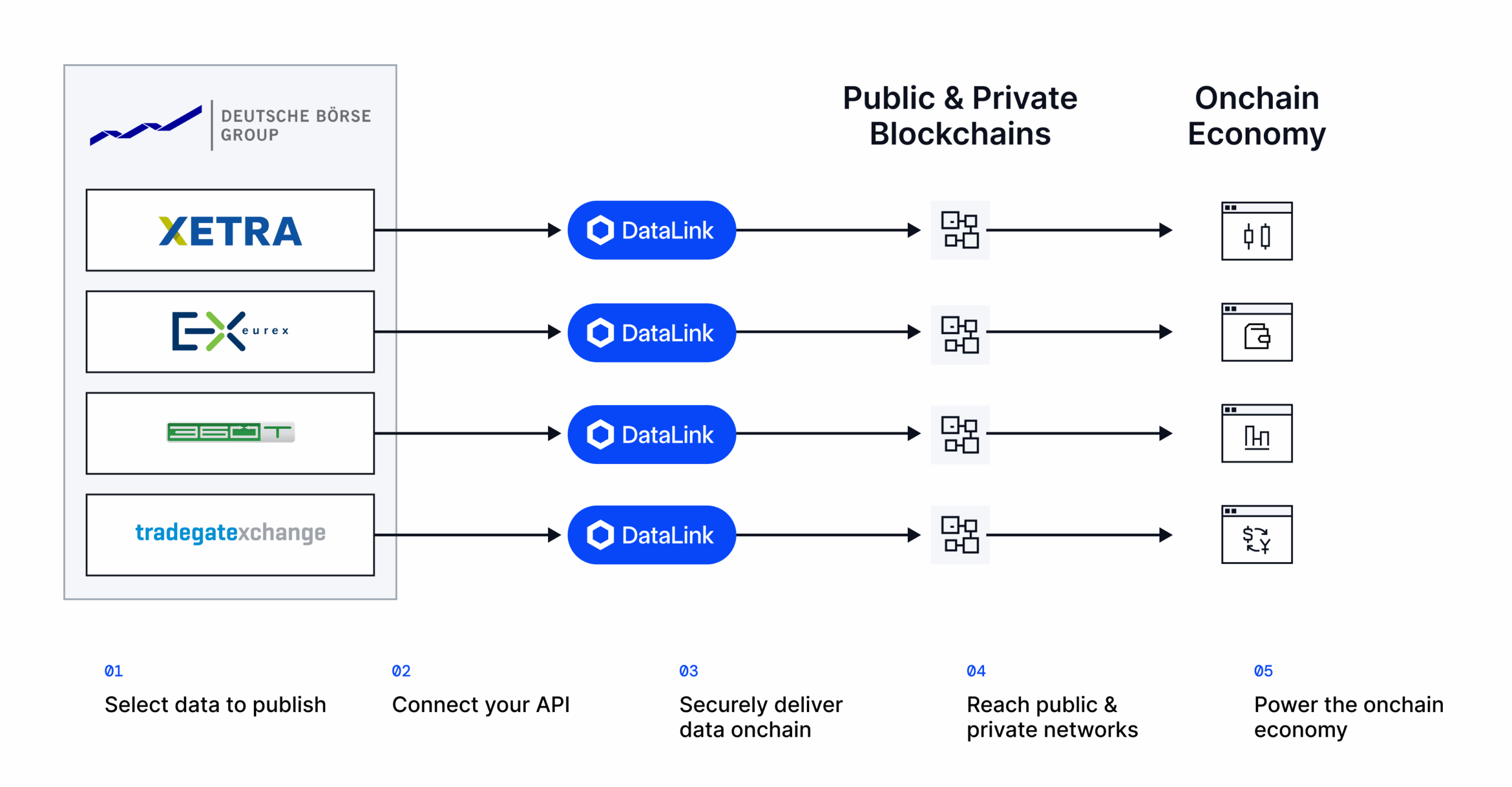

- Deutsche Börse Brings Data Onchain via Chainlink: Deutsche Börse Market Data + Services, a business unit of Deutsche Börse Group, one of the world’s largest exchange operators, formed a strategic partnership with Chainlink to publish its market data onchain for the first time via DataLink. Deutsche Börse Market Data + Services delivers four billion data points in real time every day and has handled more than €1.3 trillion in securities trading last year. [Announcement]

- Chainlink’s Major Presence at Sibos: Chainlink had a large presence at Sibos, the premier financial services event organized by Swift, which brings together thousands of finance industry leaders, decision makers, and experts from across the financial space. Chainlink had multiple leaders present at Sibos, a large team of top capital markets representatives meeting with many of the top banks, asset managers, and financial market infrastructures, and an exhibit alongside the largest banks and financial institutions in the world. [Recap blog]

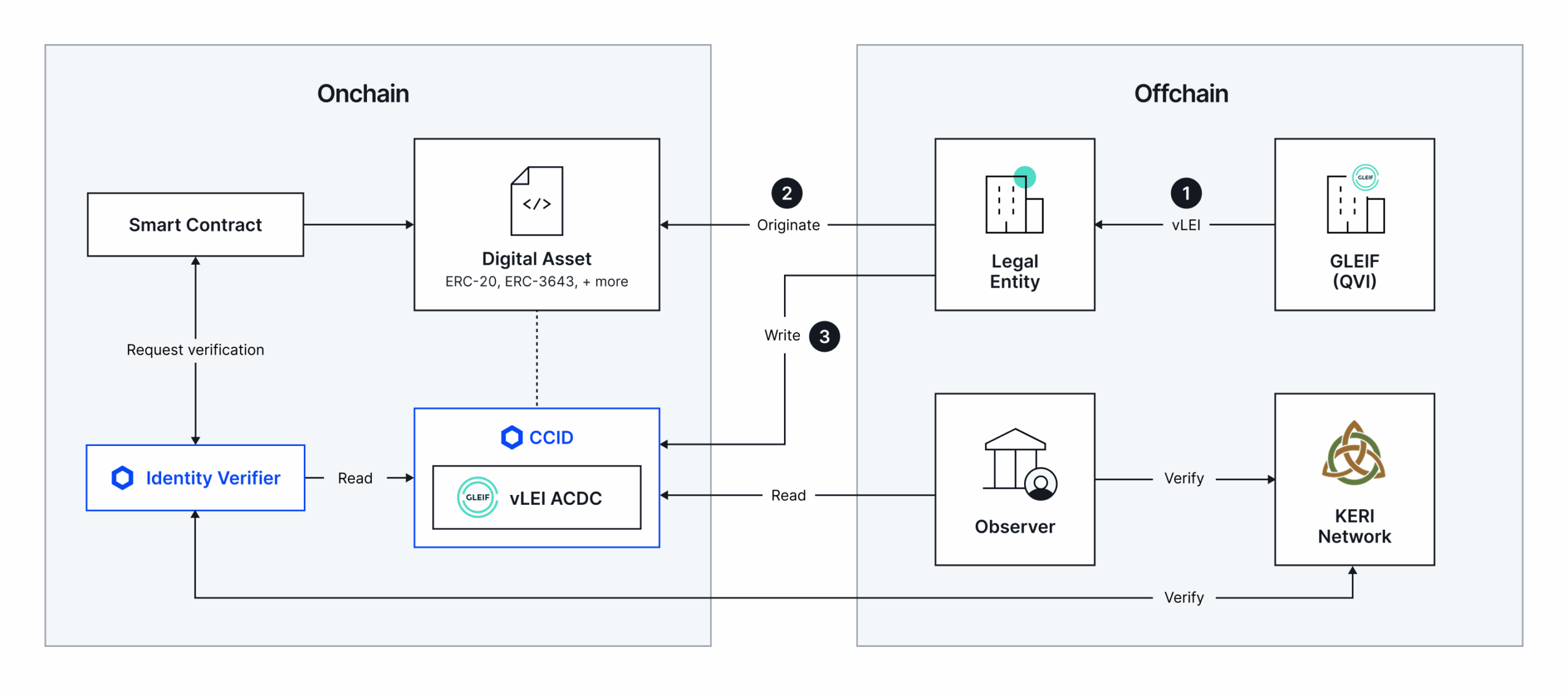

- GLEIF & Chainlink Partner on Institutional-Grade Identity Solution: The Global Legal Entity Identifier Foundation (GLEIF) entered into a strategic partnership with Chainlink to establish a new institutional-grade identity solution for the blockchain industry. The solution combines GLEIF’s verifiable Legal Identity Identifier (vLEI) with Chainlink’s infrastructure for Cross-Chain Identity (CCID) and Automated Compliance Engine (ACE) to enable digital asset transactions that are verifiable, compliance-focused, and trusted across jurisdictions while preserving user privacy. [Announcement]

- Chainlink Wins Swift Hackathon Business Challenge: Chainlink was selected as the winner of the Swift Hackathon 2025 Business Challenge. A record-breaking 104 entrants made this hackathon Swift’s largest yet, with premier financial institutions like Credit Agricole CIB, Deutsche Bank, and Standard Chartered among the finalists. Chainlink’s winning solution unlocked fast, compliance-focused, and privacy-preserving digital asset settlement across borders and blockchains. [Announcement]

- Saudi Awwal Bank Adopting Chainlink: SAB, one of Saudi Arabia’s largest banks with over $100 billion in total assets, is leveraging several Chainlink services to facilitate the deployment of next-generation onchain applications in Saudi Arabia. Under the innovation agreement, SAB is accelerating the adoption of onchain finance across the region by enabling developers to build with Chainlink CCIP and CRE. [Announcement]

- 21X Goes Live with Chainlink Data: The first EU-regulated onchain exchange for tokenized securities officially went live with its Chainlink integration. Leveraging CRE, 21X is now delivering real-time, verifiable market data, including bid/ask spreads and last-traded prices, directly onchain via Polygon. [Announcement]

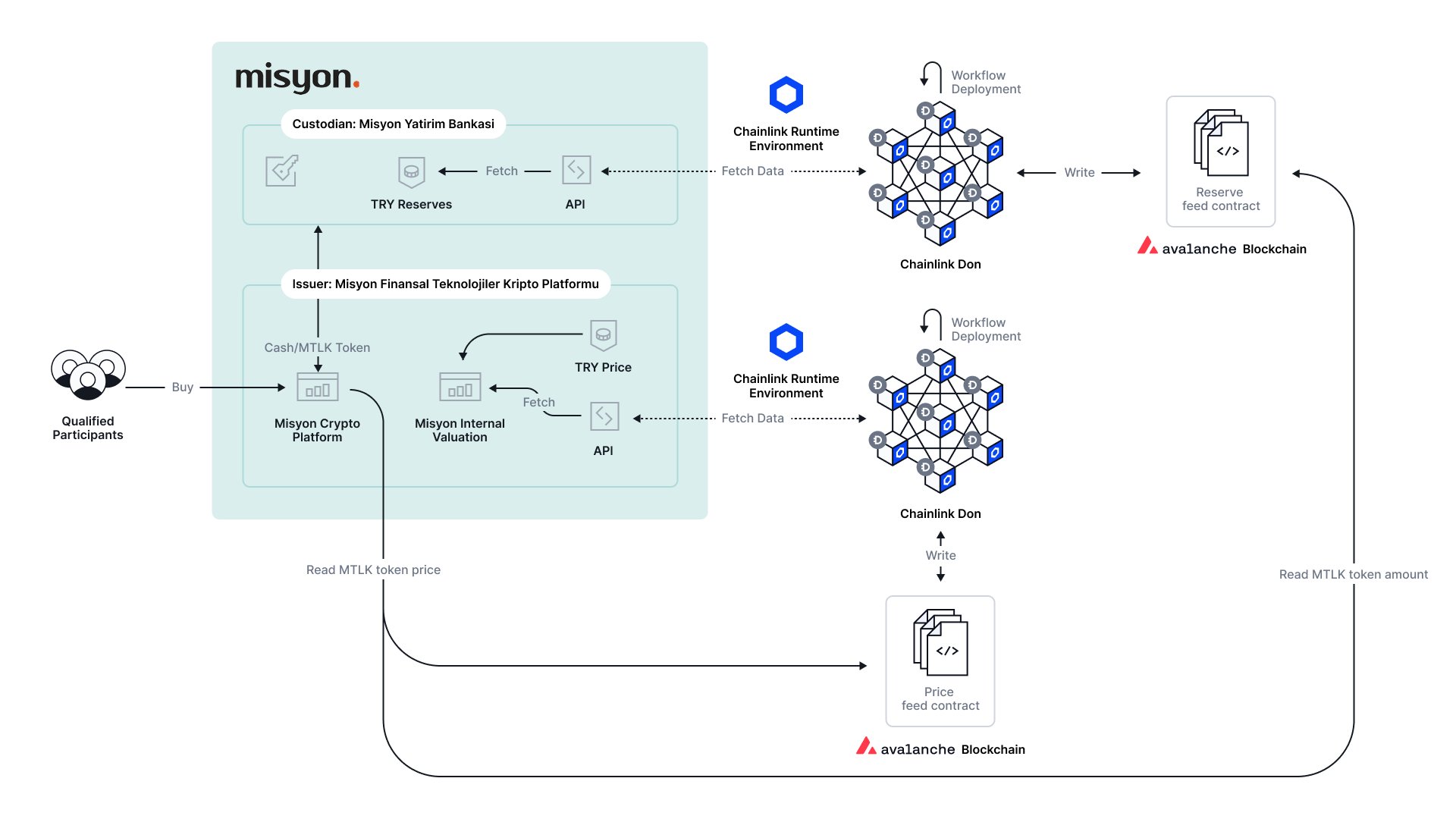

- Misyon Bank Adopts Chainlink Platform: One of Turkey’s first neobanks offering crypto custody and issuance is leveraging CRE to power custom workflows for its Turkish lira-backed MTLK token. CRE empowers Misyon to seamlessly publish the MTLK price onchain using Chainlink Price Feeds, verify Turkish lira reserves held by Misyon via Chainlink Proof of Reserve, and coordinate custom workflows and ensure real-time, onchain auditability. [Announcement]

- Zand Bank & Chainlink Strategic Collaboration: Zand Bank, the UAE’s first fully licensed, all-digital bank, is exploring collaborative opportunities with Chainlink to accelerate digital adoption and efficiency. With a shared vision, Zand and Chainlink aim to deliver innovative, secure, and fast solutions that seamlessly merge traditional finance and decentralized finance to advance the digital economy. [Announcement]

Platform

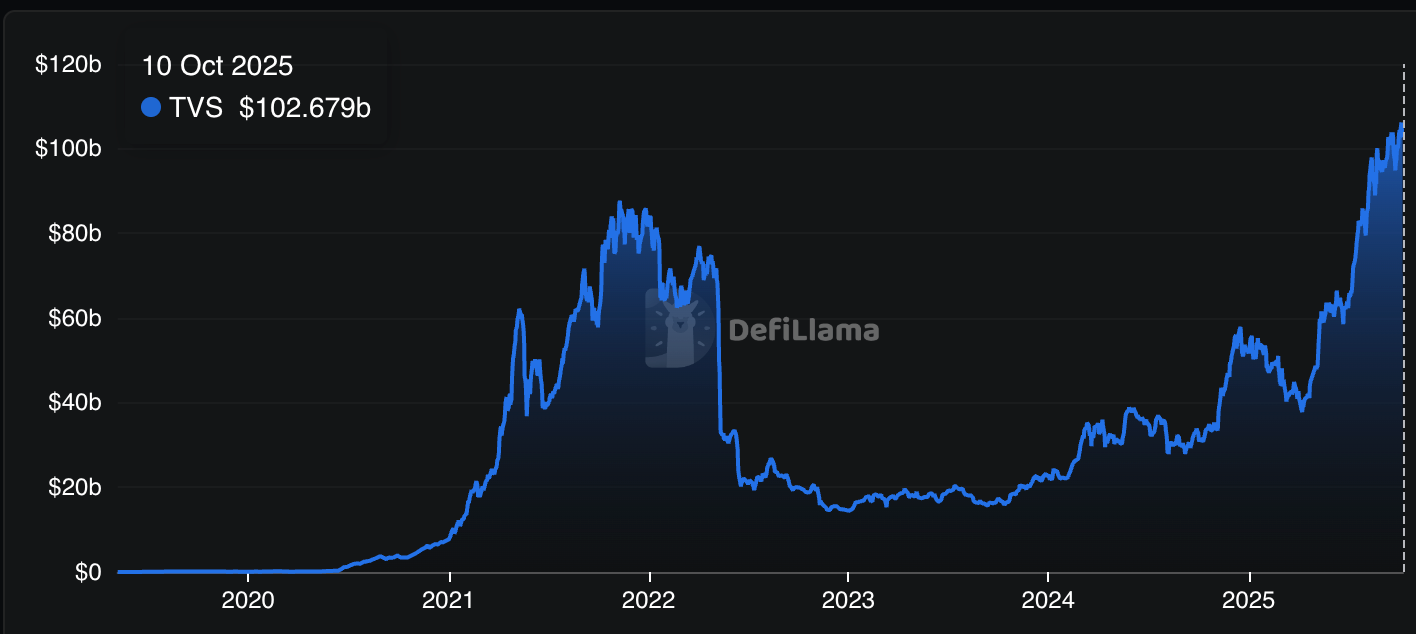

- Chainlink Reaches $100B TVS Milestone: Chainlink surpassed $100 billion in total value secured (TVS) across the onchain economy, a new all-time high. This was achieved thanks to the growth in the number of Chainlink integrations, as well as the growth of existing Chainlink users like Aave. Chainlink has reached approximately 70% in oracle market share dominance. [TVS]

- Chainlink Services Achieve ISO 27001 and SOC 2 Certification: Chainlink achieved two major security milestones: ISO 27001 certification and a SOC 2 Type 1 attestation. The scope of the assessments covers (i) Chainlink Data Feeds—specifically Price Feeds and SmartData (Proof of Reserve and Net Asset Value (NAV)) and (ii) Cross-Chain Interoperability Protocol (CCIP). The examinations were performed in accordance with attestation standards established by the American Institute of Certified Public Accountants (“AICPA”) by an independent accounting firm, Deloitte & Touche LLP. Certification of Chainlink oracle services under ISO 27001 and completion of the SOC 2 Type 1 attestation further validate Chainlink’s position as enterprise-grade infrastructure suitable for real-world, in-production use cases with the largest financial institutions. [Announcement]

- Updated the Chainlink Platform Vision: We announced our updated vision for Chainlink and its position in the blockchain industry. Chainlink is the only all-in-one oracle platform that supports the data, interoperability, compliance, privacy, orchestration, and legacy system integration needs of advanced blockchain applications. [Blog]

Growth

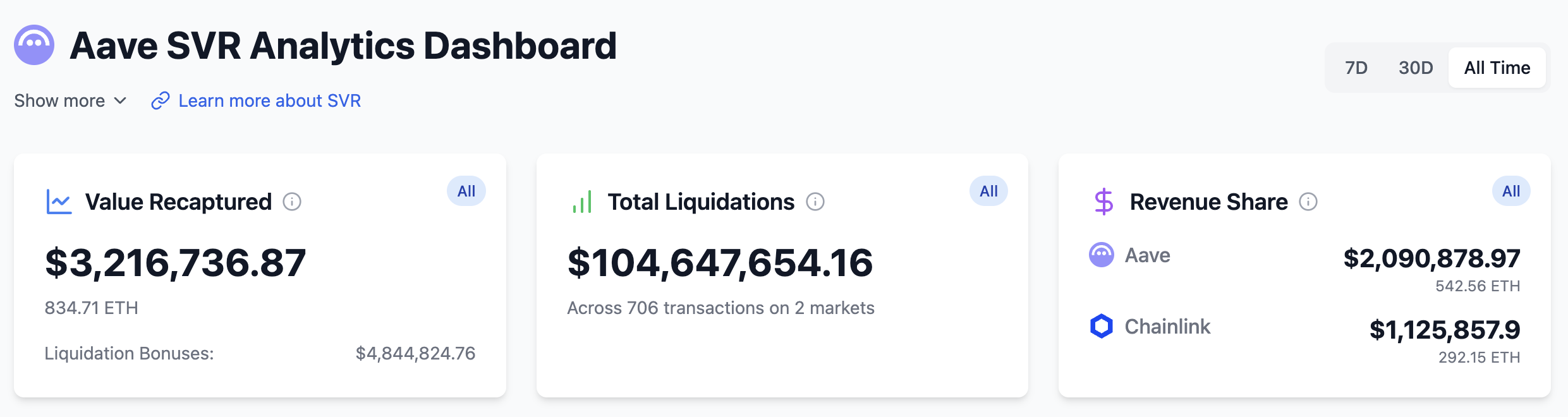

- Increasing Value Capture by Chainlink SVR: SVR recaptured over \$1.6 million in non-toxic liquidation MEV on Aave in Q3 (an over 15x increase from Q2) with an average recapture rate of ~80%. This brought the all-time SVR value recaptured to $1.77M, which has been split between Aave and Chainlink to further enhance their long-term economic sustainability. You can view analytics about Aave’s usage of SVR here. [Learn more]

- Expansion of Chainlink SVR to New Protocols: SVR was selected by Compound as its OEV solution for its upcoming deployments on Ethereum and Base. [Vote]

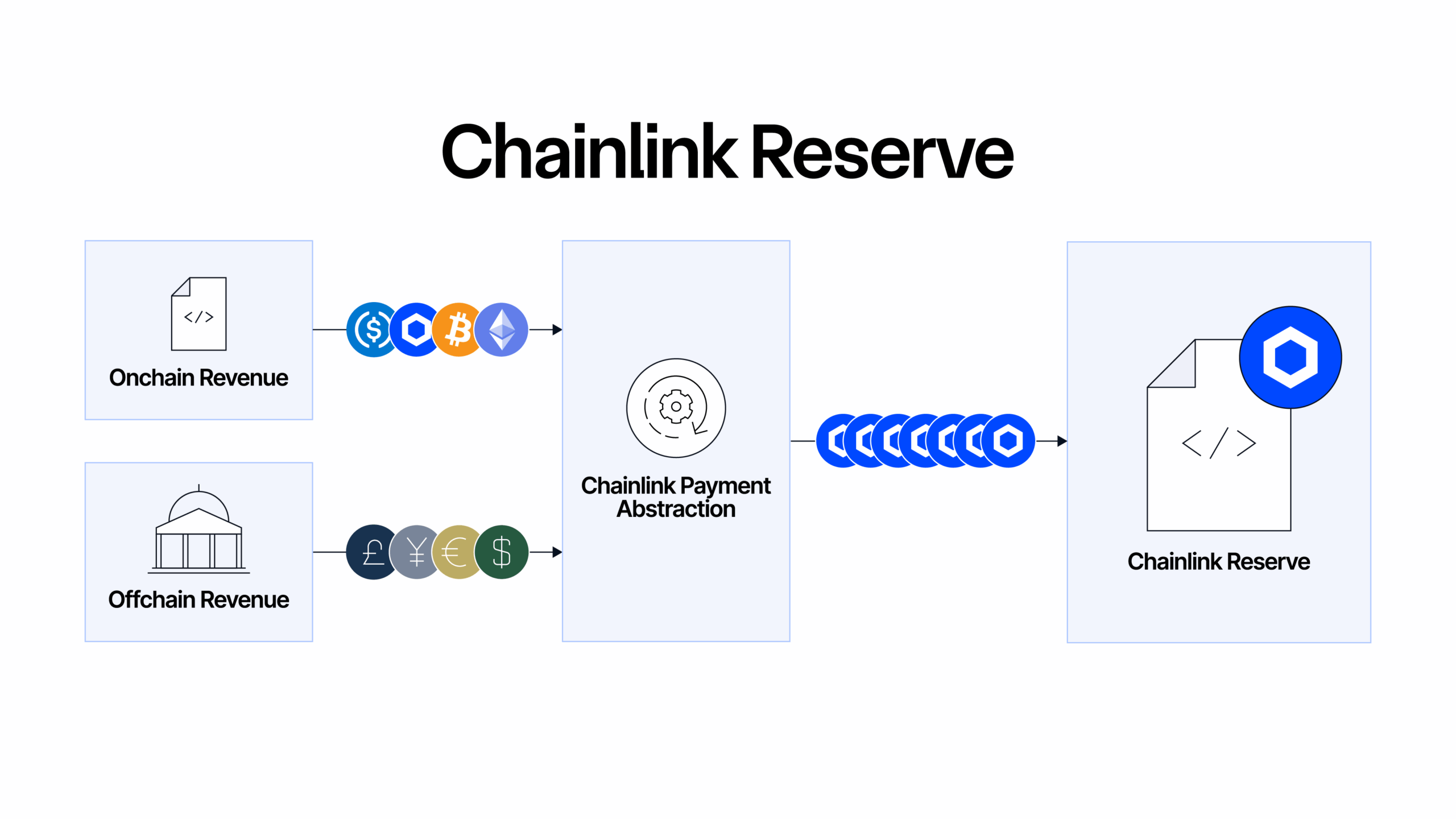

- Growth of the Chainlink Reserve: The Chainlink Reserve—a strategic onchain reserve of LINK tokens funded by offchain and onchain revenue—officially reached a total of 523,159 LINK accumulated since launch. [Learn more]

- New Build Projects Onboarded: Multiple new projects were added to the Build program, including: PublicAI, Demether, Xitadel, Lys Labs, DualMint, and Tokenyze.

- New Blockchains Join the Scale Program: Several blockchains joined the SCALE program, including Canton, Katana, BoB, and Plasma.

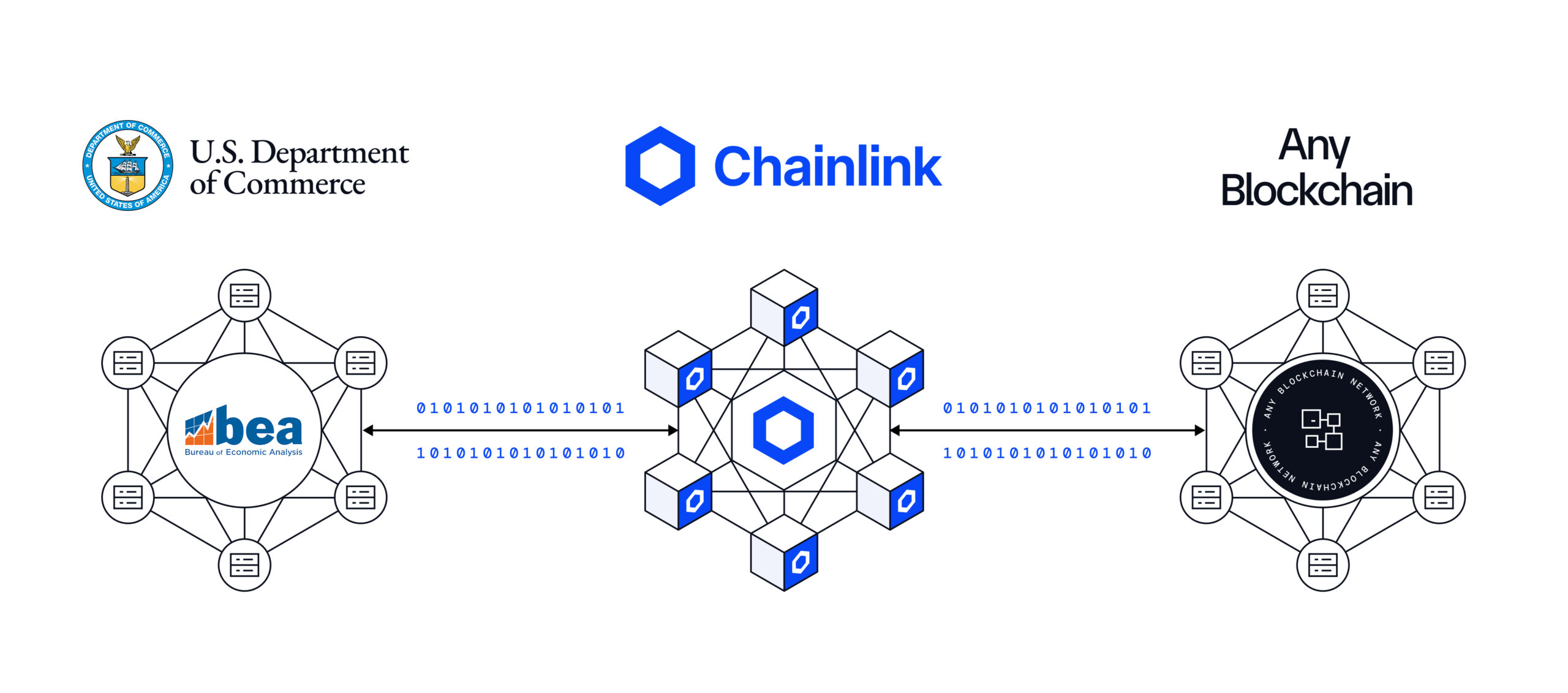

Data

- U.S. Government Brings Data Onchain Through Chainlink: Chainlink and the United States Department of Commerce partnered to bring U.S. government macroeconomic data onchain. These new Chainlink Data Feeds securely deliver critical information around key U.S. economy metrics onchain to multiple blockchains, sourced from the Bureau of Economic Analysis. Metrics include the Real Gross Domestic Product (GDP), Personal Consumption Expenditures (PCE) Price Index, and Real Final Sales to Private Domestic Purchasers. [Announcement]

- Polymarket Integrates Chainlink To Secure Its Prediction Markets: The leading onchain prediction markets platform, Polymarket, officially partnered with Chainlink to launch new 15-minute crypto markets featuring near-instant settlement and industry-leading security. Starting with asset pricing, the integration combines Chainlink Data Streams and Automation to speed up market resolutions and provide robust defense-in-depth security. [Announcement]

- Aave Horizon Adopts Chainlink SmartData: Aave’s new institutional initiative, Aave Horizon, adopted Chainlink SmartData, starting with NAVLink feeds, to enable institutional investors to borrow against tokenized real-world assets. This establishes the foundation for a broader integration strategy of Chainlink services into Aave Horizon, including Proof of Reserve and SmartAUM to enhance risk management. [Announcement]

- Launched New LlamaGuard NAV Oracle: Introduced a new dynamic risk-adjusted oracle solution purpose-built for pricing tokenized real-world assets, built through a collaboration between Chainlink, Llama Risk, and Aave Horizon. The initial implementation is already live and integrated with Aave Horizon—the largest onchain RWA lending market. The next major upgrade to LlamaGuard NAV will leverage CRE for enhanced modularity and extensibility. [Announcement]

- Launched New Institutional-Grade Data Publishing Solution: Introduced DataLink, the institutional-grade data publishing service powered by Chainlink. DataLink is a turnkey service that enables institutions to seamlessly publish data to 40+ blockchains and unlock the benefits of the onchain economy without needing to build or deploy new infrastructure. [Announcement]

- Ondo Finance Adopts Chainlink Data: Ondo Finance adopted Chainlink as its official oracle platform for trusted asset price data on its newly launched Ondo Global Markets—an initiative bringing 100+ tokenized U.S. stocks and ETFs onchain. [Announcement]

- Data Feeds on Aptos Go Live: Chainlink Data Feeds were launched on Aptos mainnet, powering Aave’s lending markets across the multi-chain ecosystem. Chainlink Data Feeds were also integrated by three other prominent Aptos protocols: Echo, Echelon, and Thala. The collective adoption immediately vaulted Chainlink to the #1 oracle by TVS on Aptos. [Announcement]

- Created the Calculated Streams Feature: Unlocked the ability to do cross-feeds, complex exchange rates, NAV calculations, and other custom computations directly within a DON.

- Launched New Types of Data Streams: Launched ‘total returns’ US equities on Data Streams in partnership with Backed Finance, tracking dividends, stock splits, and other corporate actions beyond market price, as well as expanded SmartData to the Data Streams architecture.

Interoperability

- Expanded Chain Support With CCIP: CCIP expanded to its first MoveVM-based chain with Aptos while continuing momentum across EVM-based chains and featuring emerging ecosystems like Plasma. CCIP is now available on over 65 networks.

- Major Assets Deployed as CCTs: Cross-Chain Tokens (CCTs) continue to be adopted by prominent stablecoin and tokenized asset issuers, with notable adoptions including WLFI ($6.1B MCap), the open version of Tether’s XAUT (oXAUT with a $830M MCap), and Bitpanda’s Vision ($503M MCap). USDC support is also available for cross-chain transactions to/from Solana.

- The Chainlink Effect Continues for CCTs: A growing number of CCTs exceeded cross-chain volume milestones, with assets like SolvBTC, LBTC, and syrupUSDC all eclipsing $500M in cross-chain volume since integrating Chainlink.

SmartCon 2025 Is Rapidly Approaching

Want to hear about what’s coming next for Chainlink? Stay tuned, this year’s SmartCon is only a few weeks away. Taking place in New York City from November 4-5, SmartCon will feature more updates on the Chainlink platform and various services, along with insights into our ongoing work with leading global financial institutions, Web3 protocols, and world governments around unlocking institutional onchain finance at global scale. Get your tickets today.

To learn more about Chainlink, visit chain.link, subscribe to the Chainlink newsletter, and follow Chainlink on Twitter, YouTube, and Reddit.