Chainlink Quarterly Review: Q1 2025

In Q1 2025, our two main focuses were 1) shipping new products, upgrades, and integrations at unprecedented speeds, and 2) accelerating adoption of the Chainlink standard by the largest Web3 protocols, financial institutions, and governments in the world.

On the product side, Q1 saw 37 new blockchains integrated with the Chainlink Network, over 77 new Data Streams deployed on mainnet, the introduction of self-serve token onboarding and the Token Manager for CCIP, the mainnet launch of Smart Value Recapture (SVR) with Aave and Payment Abstraction, and the release of an internal MVP for the Chainlink Runtime Environment (CRE).

On the adoption front, Chainlink Co-Founder Sergey Nazarov and other Chainlink Labs leaders were extremely active in shaping legislation and regulatory policy around blockchain technology in the U.S. to support the industry’s growth. This included joining Blockchain Association and The Digital Chamber and hosting events with high-ranking U.S. senators and representatives, members of the executive branch, regulators, and more. Sergey also took part in fireside chats with the U.S. House Majority Whip Tom Emmer, U.S. Representative and Chair of the House Subcommittee on Digital Assets Bryan Steil, and Counselor to the Secretary of Treasury for Digital Assets Tyler Williams, along with numerous other private meetings, such as with Senator Gillibrand, Senator Moreno, Representative Emmer, Representative Thompson, and many more. Furthermore, Sergey was one of the select few industry leaders to attend the White House Summit on Digital Assets, where he spoke directly to U.S. President Donald Trump on behalf of the Web3 industry.

Q1 also involved continuing our work with some of the top financial institutions and market infrastructures in the world, with a focus on strategic alliances and moving into production with key banking and capital markets teams. The increasing development and adoption of Chainlink resulted in the Chainlink Network surpassing $20T in total value enabled (TVE) in Q1, which can be credited to Chainlink’s market-leading position in total verified messages (TVM)—the sum of all data outputs secured by consensus that are published to a smart contract, encompassing both offchain and cross-chain data transmissions. You can now track TVE, TVM, and other key Chainlink metrics across network usage and ecosystem adoption at metrics.chain.link. You can also visit the recently launched DevHub Changelog, as the go-to source for updates on every Chainlink product.

The following quarterly review will showcase the progress made since the end of 2024 and provide insight into ongoing and future developments.

Major Wins in Q1 2025

Government

We spent a considerable amount of time in Washington, D.C. throughout Q1, meeting with representatives across many different branches and departments of the U.S. government, ranging from Members of Congress and key committees like the Senate Banking Committee to the Executive Branch, including Treasury and the SEC. Sergey was also one of the key industry representatives to be invited to the White House Summit on Digital Assets hosted by President Donald Trump. View Sergey’s insights from the event below.

At the DC Blockchain Summit, Sergey outlined his thesis on what the U.S. government should care about when it comes to integrating Web3 technology and tokenized assets into their financial system. This same thesis is applicable to all governments looking to play a leading role in the Financial System 3.0, which represents the financial system’s transition from paper-based (1.0) to digital (2.0) to now onchain (3.0):

- Asset Issuance: Be the origination point from which tokenized assets are issued into the global financial system. Support these assets with a sensible and efficient regulatory framework that strengthens consumer trust in the assets and makes them easily accessible to investors around the world. This involves having a clear and reliable legal system for how tokenized assets are issued, transacted, and managed, along with incorporating new technologies such as proof of reserve and onchain golden records—where all the information about an asset is kept up-to-date and made available to all stakeholders at any time. The countries that become the most attractive jurisdictions to issue tokenized assets will gain market share in the Financial System 3.0. The U.S. has already become a popular country for stablecoin issuance, with over 90% of stablecoins today being backed by U.S.-issued assets (e.g., U.S. Treasuries).

- Automation of Compliance: Once tokenized assets are issued, governments should seek to make the cost of acquiring, holding, and reselling those assets as low as possible. With compliance being the number one transaction cost, automating compliance is critical to creating robust, frictionless markets for tokenized assets. Automating compliance in this new onchain format means reducing audit cycles from months to seconds through real-time, onchain proofs about the assets such as proof of reserve, proof of composition, proof of solvency, and more. It also means using oracles to support automated compliance, such as for identity checks as part of KYC/AML processes.

- Global Distribution: Tokenized assets supported by automated compliance will enable DeFi, fintechs, and financial institutions to easily wrap and rewrap these assets and move them across various blockchains, ultimately creating a large-scale global distribution network for the tokenized assets. The result is increased demand for the underlying financial assets, which in turn causes greater capital inflows.

Sergey’s thesis and participation in the summit resonated with a wide variety of audiences, earning major coverage from Bloomberg TV, Fox News, The New York Times, TIME, and many other media outlets. The coverage points to the accelerated adoption of blockchain technology by governments and capital markets, along with Chainlink’s role in this future financial infrastructure. To learn more about the three core requirements outlined above, check out Sergey’s talk below.

Chainlink is providing the key technological standards as part of a single platform offering to empower the U.S. and other forward-looking governments to capitalize on the massive opportunity that is onchain finance. The Chainlink Data standard supports automated compliance by enabling identity data to be made available onchain in a privacy-preserving manner. Furthermore, Chainlink Proof of Reserve empowers governments to strengthen consumer trust in the tokenized assets issued under their jurisdiction by providing consumers with key information and guarantees, such as reliable mark-to-market valuation of the assets and their reserves, enforcement of collateralization requirements, and more. The result is increased consumer demand for tokenized assets issued under their jurisdiction, which in turn drives more asset issuance.

The Chainlink interoperability standard supported by CCIP is key to global distribution as it enables the seamless flow of tokenized assets across public and private blockchains, along with support for more advanced features like programmable token transfers, which enable more advanced and efficient transactions. CCIP’s blockchain abstraction capabilities are also key to enabling existing legacy systems to connect to/from any blockchain via a single integration, removing the time and cost of having to do point-to-point integrations. The combination of Chainlink’s data and interoperability standards uniquely support the creation of onchain golden records, where assets are embedded with key data and that data remains with the assets and continues to be updated even as they move across blockchains. No other platform supports this feature.

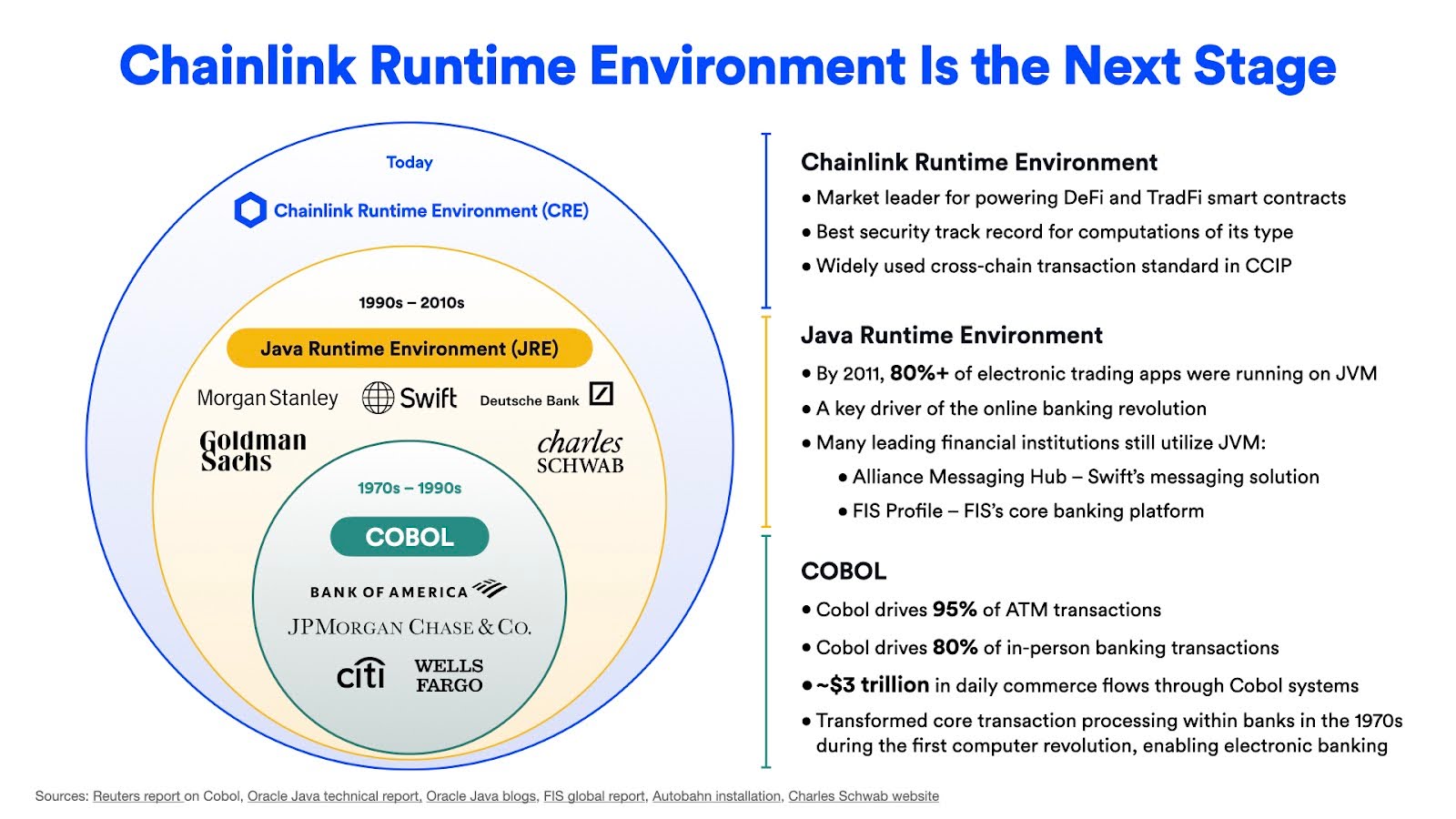

Finally, Chainlink is making all of its data, compute, and interoperability capabilities seamlessly composable through the Chainlink Runtime Environment (CRE). The CRE enables developers and institutions alike to combine any blockchain, any data, any computation, and any offchain system into a single workflow. The result is a seamless, compliant, and modular orchestration layer that extends existing financial and government systems, enabling secure digital asset operations, faster deployment, and interoperability without disrupting core systems.

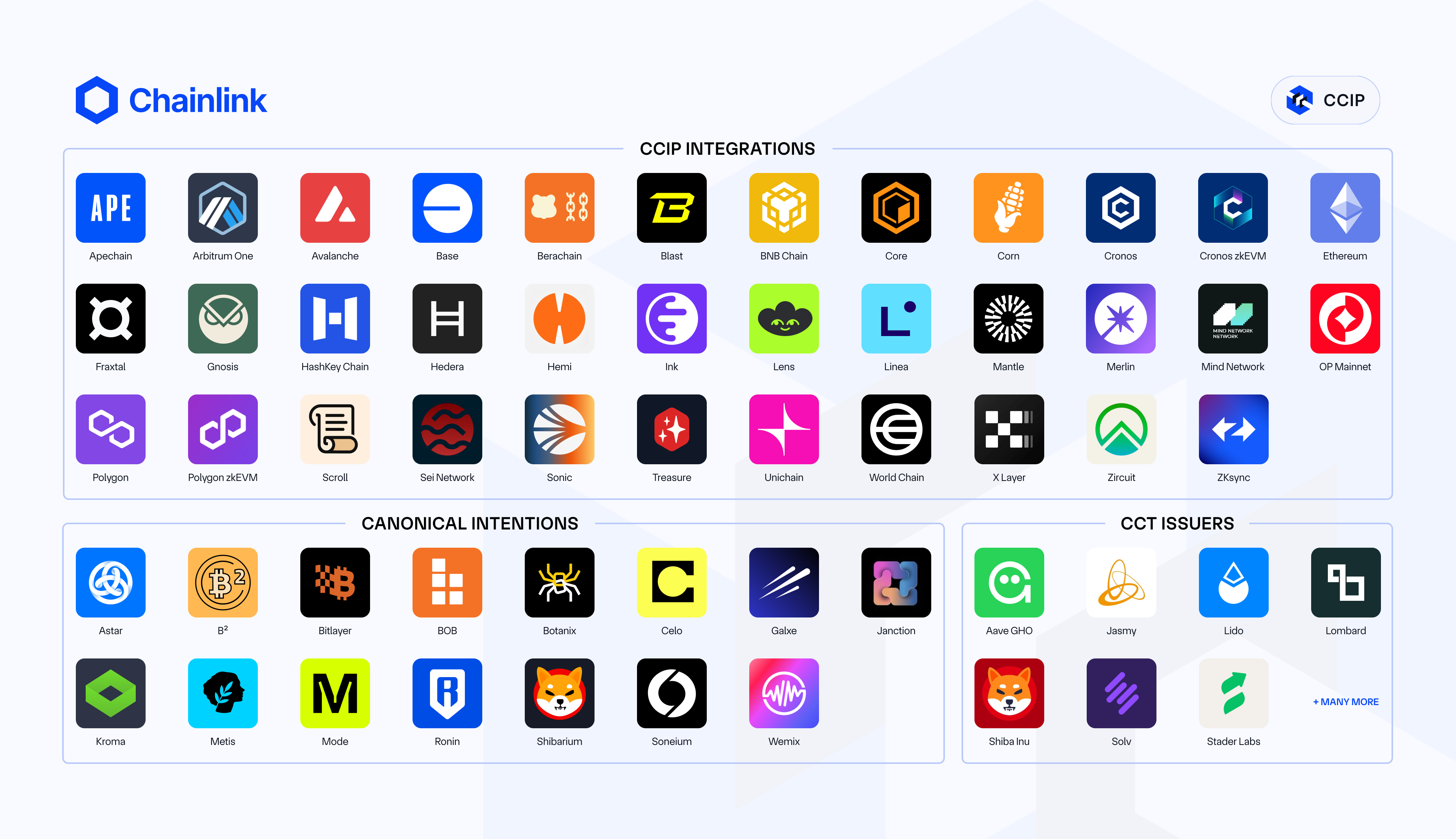

Cross-Chain

CCIP expanded to new blockchains faster than ever before, including the first-ever day-one deployment of CCIP to the recently launched Monad testnet. In Q1 alone, CCIP added support for 25 new blockchains, bringing the total number of blockchains in the CCIP network to 50. Moreover, 15 blockchains will leverage CCIP as their canonical cross-chain infrastructure, with Janction, Hashkey, Soneium, Bitlayer, and BoB being announced in Q1. The expansion to more blockchains has enabled CCIP to surpass $2.2B in total volume transferred, all without using artificial incentives that inflate usage metrics.

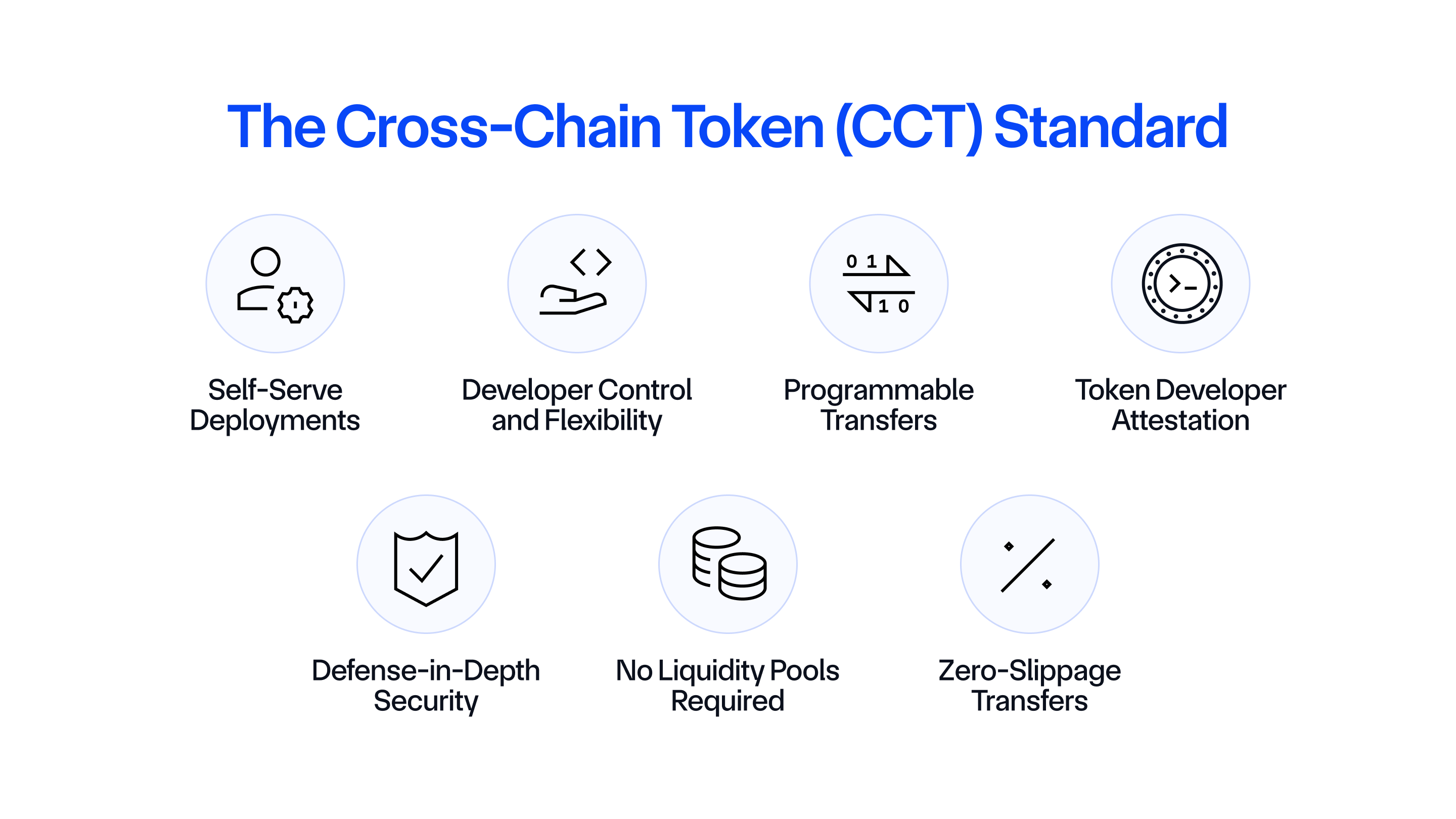

Q1 also saw the mainnet launch of CCIP v1.5, which featured self-serve onboarding of tokens to CCIP via the Cross-Chain Token (CCT) standard. Unlike other solutions, CCTs allow token developers to retain full ownership of their token contracts, CCIP token pools, and customized implementation logic, including rate limits across chains. This eliminates vendor lock-in, hard-coded logic, or reliance on third-party infrastructure—enabling developers to customize functionality without sacrificing security. CCTs don’t require token developers to inherit any CCIP-specific code within their token’s smart contract, as pre-audited token pool contracts can be used to turn any ERC20-compatible token into a CCT.

The CCT standard already secures $24B+ in total token value (measured by the FDV of CCTs), with several major tokens adopting the CCT standard, including Aave’s GHO, Jasmy, OpenUSDT, SolvBTC, Shiba Inu, and Lombard’s LBTC. As part of CCIP v1.5, we also introduced the CCIP Token Manager—a simple web interface that allows token developers to deploy, configure, and manage their own CCTs. Developers can learn more about the CCT standard and the CCIP Token Manager by checking out the Masterclass or the developer docs.

Data

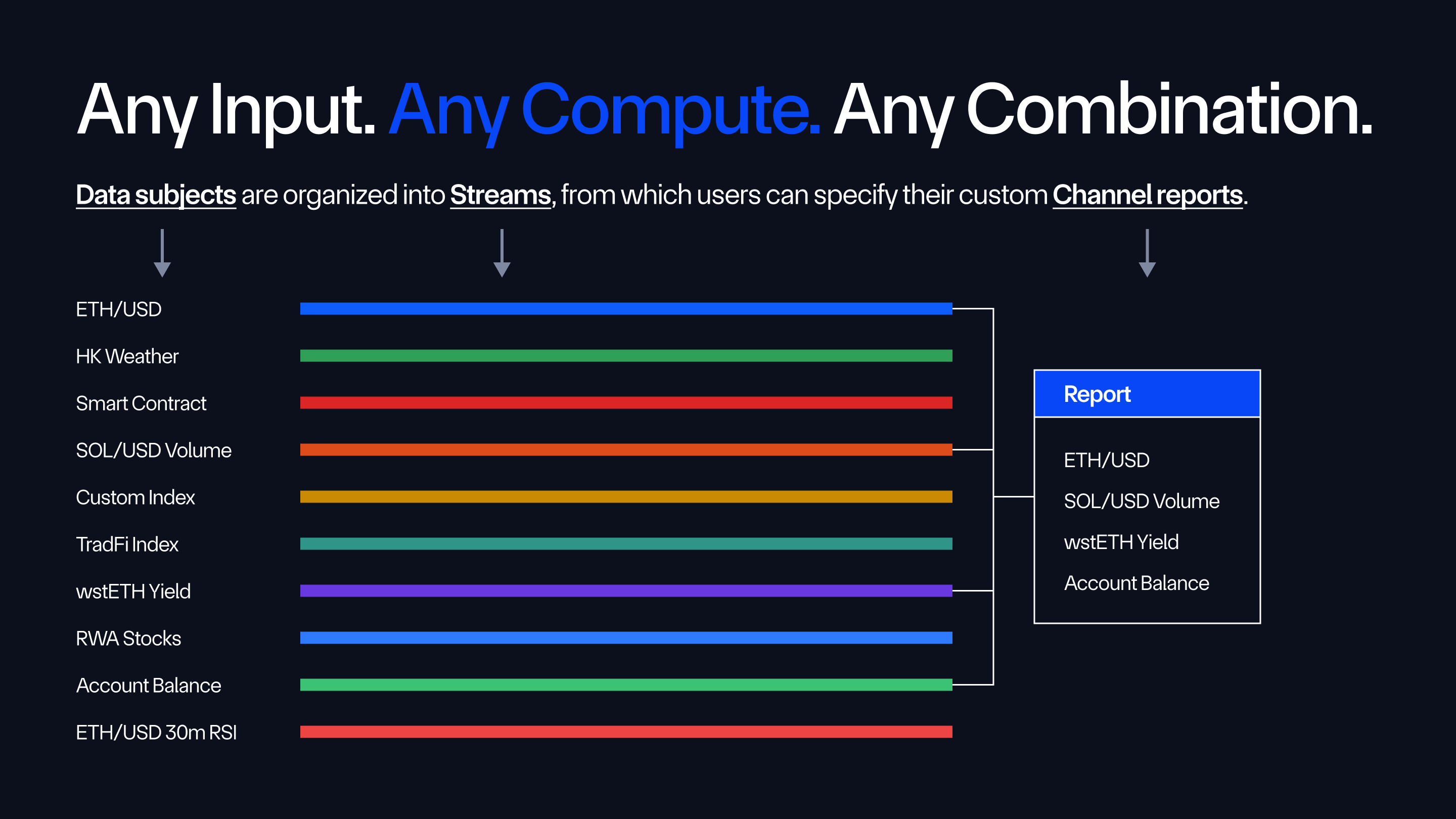

In Q1, we deployed the Multistream upgrade for Chainlink Data Streams. Multistream is a new parallelized architecture for Data Streams that enables a single decentralized oracle network (DON) to provide 1000s of unique data points for different assets at once—a 1000x increase in throughput for a single DON with oracle nodes geographically distributed around the world. The Multistream upgrade led to a 777%+ increase in the number of assets supported by Chainlink Data Streams, which included a range of asset types and blockchains—representing an unprecedented increase in speed from user request to mainnet deployment. Multistream also provides developers with enhanced programmability for how data is consumed, such as obtaining multiple unique data points for different assets in one channel report.

Multistream is underpinned by OCR3—the latest version of the Offchain Reporting protocol, which enables DONs to make independent observations about the world, form consensus, and deliver aggregated reports to the intended destination. OCR3 introduced major scaling, performance, and programmability upgrades, such as enabling plug-ins that allow enhanced customization to the signature schemes, aggregation methods, delivery schedules, and data transformations used within decentralized oracle networks. The OCR3 whitepaper was recently released to the academic community.

Beyond Multistream, Data Streams went live on Solana to support GMX-Solana, which did $1B+ in volume in the first 24 hours of going live. We also had the first day-one deployments of Data Streams, which included day-one support of the BERA token and day-one support of the Monad Testnet. In total, Data Streams expanded its support from 7 to 24 blockchains—an increase of ~242% in Q1.

Other data solutions saw increased traction too. A variety of institutions, projects, and developers began leveraging the DECO Sandbox in Q1, with 14 unique use case configurations submitted across areas like identity verification, proof of reserves, and sanctions screening. We also launched the DeFi Yield Index (CDY Index) and a deep dive data page for Chainlink SmartData—a suite of onchain data services designed to service and enhance the utility of tokenized RWAs through embedded security and programmability. The Smart Data page highlights proof of reserve, net asset value (NAV), and assets under management (AUM) feeds for tokenized funds, stablecoins, and native onchain assets.

Economics

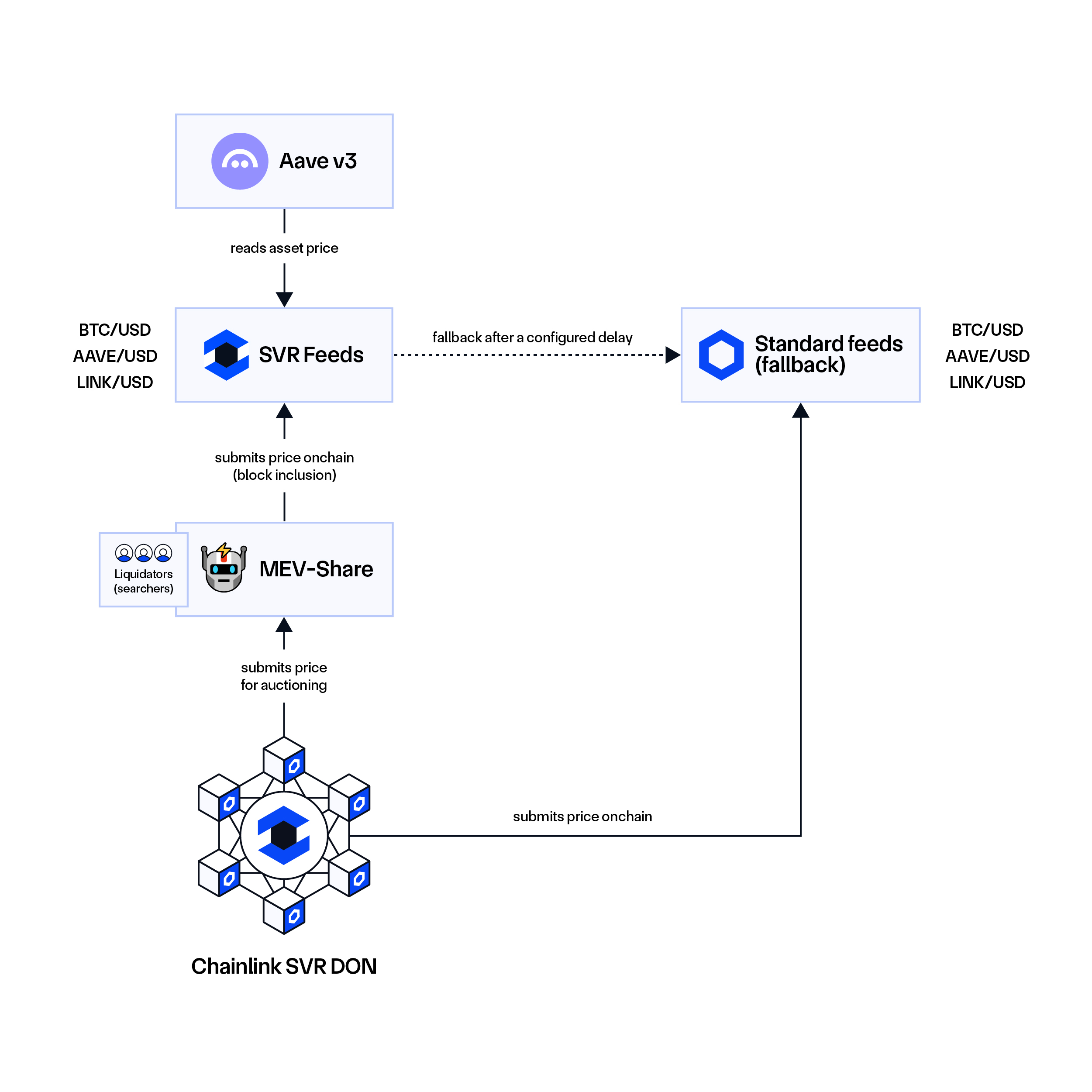

Chainlink launched Smart Value Recapture (SVR) on Ethereum mainnet, which featured Aave as the first user. Built in collaboration with BGD Labs, Flashbots, and participants of the Aave DAO, Chainlink SVR was integrated by Aave for an initial set of markets on its V3 Ethereum deployment, with plans to expand to more asset markets in the future.

SVR is a novel oracle solution that enables DeFi apps to recapture the non-toxic MEV derived from their use of Chainlink Price Feeds. The launch of SVR established a new industry standard in cryptoeconomics, empowering DeFi apps to reclaim value previously leaked to third parties.

For DeFi protocols like Aave, SVR is used to recapture liquidation MEV, which is commonly referred to as Oracle Extractable Value (or “OEV”). Recaptured MEV from SVR is split between the integrating DeFi applications and the Chainlink Network. As a long-term ecosystem partner and initial user of SVR, Aave’s use of SVR involves an initial 6-month discounted rate of 65% to the Aave ecosystem and 35% to the Chainlink ecosystem. This split not only provides Aave with new revenue streams, it supports the long-term economic sustainability of Chainlink oracles.

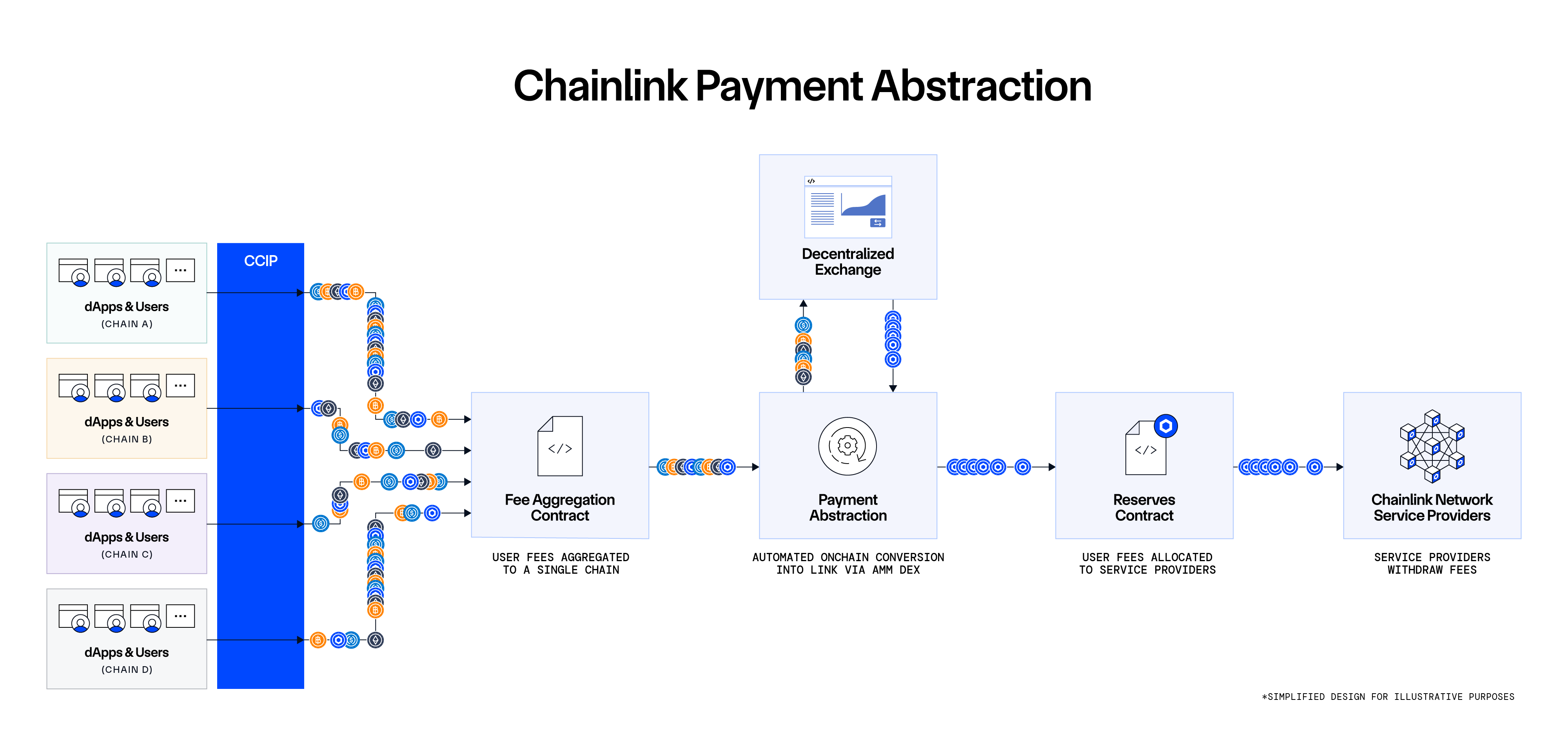

SVR is the first Chainlink service connected to Payment Abstraction—a cross-chain-enabled payment system recently launched on mainnet that enables network service fees to be automatically converted into LINK, ultimately reducing payment friction in the Chainlink Network. Payment Abstraction allows users to pay for Chainlink services in alternative assets (e.g., gas tokens and stablecoins), which are then automatically converted into LINK using a combination of Chainlink Automation, Price Feeds, CCIP, and decentralized exchanges (DEXs). Refer to the announcement blog for more information on the use of SVR fees in the Chainlink Network.

Ecosystem

Q1 featured numerous ecosystem integrations. Beyond the projects mentioned previously, the list includes Trump Token, TheStandard, StakeStone, Cryptex, Lympid, OKX, Liquity, Aave, Dolomite, Solv Protocol, Liquid Collective, Virtuals, Compound, Bonzo, and many more, along with Mantle joining the Chainlink Scale program. The integrations further entrenched Chainlink as the data and interoperability standard while expanding Chainlink’s presence in key markets, such as BTCFi, DeFi derivatives, and new verticals like AI agents via the JOJO Exchange integration.

Following the launch of three successful use cases under the Monetary Authority of Singapore’s Project Guardian, Q1 saw us continue our work with these institutions to move their use cases forward. These efforts mark a shift from experimentation to real-world deployment, with a concerted effort on delivering tangible business impact across asset classes ranging from stablecoins to money market instruments and other capital markets products. There were also several other capital market institutions and tokenized assets that adopted the Chainlink standard in Q1, including:

- ADGM, Abu Dhabi’s premier international financial center, and Chainlink forged an alliance to support innovative projects under ADGM’s Registration Authority, specifically by leveraging Chainlink’s technical expertise, industry insights, and suite of advanced services to maximise the utility of tokenized assets while ensuring regulatory compliance.

- Usual, a decentralized fiat-backed stablecoin protocol, adopted the Chainlink standard across CCIP, Data Feeds, and Proof of Reserve to enhance the utility and liquidity of USD0 and USD0++.

- BX Digital and BX Swiss announced a partnership with Chainlink to bring critical pricing data for Swiss-based equities onchain. BX Digital is a sister company of the Swiss exchange BX Swiss, and both are part of Boerse Stuttgart Group—the sixth largest exchange group in Europe. BX Digital also became the first regulated market infrastructure for trading and settlement of digital assets in Switzerland.

- OpenEden, a leading Real-World Asset (RWA) tokenization platform, integrated CCIP and Proof of Reserve to provide USDO with secure cross-chain interoperability and real-time verifiable data.

- Fasanara, an institutional investment manager and global leader in digital finance with over $4 billion in assets under management (AUM), launched its first tokenized Money Market Fund and will employ the Chainlink standard, including Proof of Reserve and Data Feeds, to verify AUM and bring net asset value (NAV) data onchain. They also intend to leverage CCIP to enhance connectivity and scalability across blockchain networks.

- Ripple is leveraging Chainlink Price Feeds to bring high-quality pricing data onchain around the Ripple USD (RLUSD) stablecoin.

- Spiko integrated Chainlink NAV data into its Dune dashboard to enable synchronized, real-time tracking of its tokenized money market funds.

- Mountain Protocol’s USDM yield-bearing stablecoin adopted the CCT standard across 6 blockchains.

We also hosted and attended a variety of public and private events around the world featuring senior executives from leading financial institutions, with the goal of educating them on the opportunity and latest trends in onchain finance and tokenized assets.

Looking Toward Q2 and Beyond

A core focus moving into the next few quarters is the continued expansion of Chainlink services across more chains, in particular CCIP and Data Streams. For CCIP, we are rapidly moving toward support for non-EVM chains, such as Solana and Aptos, along with realizing further chain and lane scalability through the upcoming CCIP v1.6 launch. For Data Streams, we are integrating more chains and adding more specialized data types. Data expansion is also underway in SmartData, such as enabling asset issuers and DeFi protocols to bring a broader set of asset characteristics, credit ratings, portfolio composition information, and more to support tokenized assets, tokenized funds, and other TradFi use cases.

Since the announcement at SmartCon 2024, we’ve been heads down building and conducting early testing of the Chainlink Runtime Environment (CRE) by multiple users. This includes strong interest from leading financial institutions, with early access requests from a wide range of entities, such as banks, asset issuers, tokenization platforms, asset managers, custodians, market infrastructure providers, DeFi Protocols, and Web3 Projects. In Q1, we successfully completed a CRE internal MVP, which is allowing us to efficiently scale our SmartData offerings by enabling solutions architects to launch Proof of Reserve and NAV feeds. This milestone also empowered us to begin transitioning existing Chainlink services to the CRE framework, starting with SmartData offerings before moving to Data Feeds to unlock even more scaling. Our next milestone involves launching a CRE enterprise sandbox as a way to better engage banks and capital market customers for feedback.

We’re also excited to share that the first phase of the Chainlink Build claims mechanism is code-complete and expected to launch this year. This mechanism will make Build tokens claimable by Chainlink ecosystem participants, including stakers. More information will be provided as the launch approaches. Simultaneously, we are looking to expand Chainlink SVR across more markets and chains.

As with Q1, accelerating capital markets, banking, and government adoption of the Chainlink standard will continue to be a top priority. This means moving our institutional partners’ use cases into production and continuing to aid the U.S. and other forward-looking governments such as Hong Kong, Singapore, and the United Arab Emirates in their adoption of blockchain technology. It also involves educating them on how to establish effective onchain market infrastructure, helping them think about sensible legislation for managing risk (such as with Proof of Reserve), and playing a key role in connecting the world’s biggest financial institutions, governments, and Web3 innovators together so our industry can realize the end goal of creating a single, global Internet of Contracts.

To learn more about Chainlink, visit chain.link, subscribe to the Chainlink newsletter, and follow Chainlink on Twitter, YouTube, and Reddit.

—

Disclaimer: This post is for informational purposes only and contains statements about the future, including anticipated product features, development, and timelines for the rollout of these features. These statements are only predictions and reflect current beliefs and expectations with respect to future events; they are based on assumptions and are subject to risk, uncertainties, and changes at any time. There can be no assurance that actual results will not differ materially from those expressed in these statements, although we believe them to be based on reasonable assumptions. All statements are valid only as of the date first posted. These statements may not reflect future developments due to user feedback or later events and we may not update this post in response. Please review the Chainlink Terms of Service, which provides important information and disclosures.