Chainlink Proof of Reserve for Strategic Bitcoin Reserves and Digital Asset Stockpiles

The concept of a strategic Bitcoin reserve—or more broadly, a digital asset stockpile—is gaining global momentum. Like gold or foreign exchange reserves, Bitcoin is increasingly being viewed as a sovereign-grade reserve asset.

Evidence of this includes U.S. President Donald Trump signing an executive order to establish a Strategic Bitcoin Reserve, multiple U.S. states—including Texas, Arizona, and more—advancing state strategic Bitcoin reserves, Abu Dhabi’s sovereign wealth fund Mubadala investing in Bitcoin ETFs, and the Czech National Bank exploring Bitcoin as a reserve asset. These moves signal that governments and institutions are beginning to treat Bitcoin as a macroeconomic instrument.

Maintaining strong operational security for a strategic Bitcoin reserve likely involves custodying Bitcoin across several wallets, rotating keys and public addresses regularly, and keeping address information confidential. So how can governments, institutions, and citizens trust that these reserves actually exist and are fully backed at all times?

In this blog post, we explore why Chainlink Proof of Reserve has become the standard for reserves verification in the onchain economy and how it could elevate security and transparency for strategic Bitcoin reserves and digital asset stockpiles.

Chainlink Proof of Reserve Explained

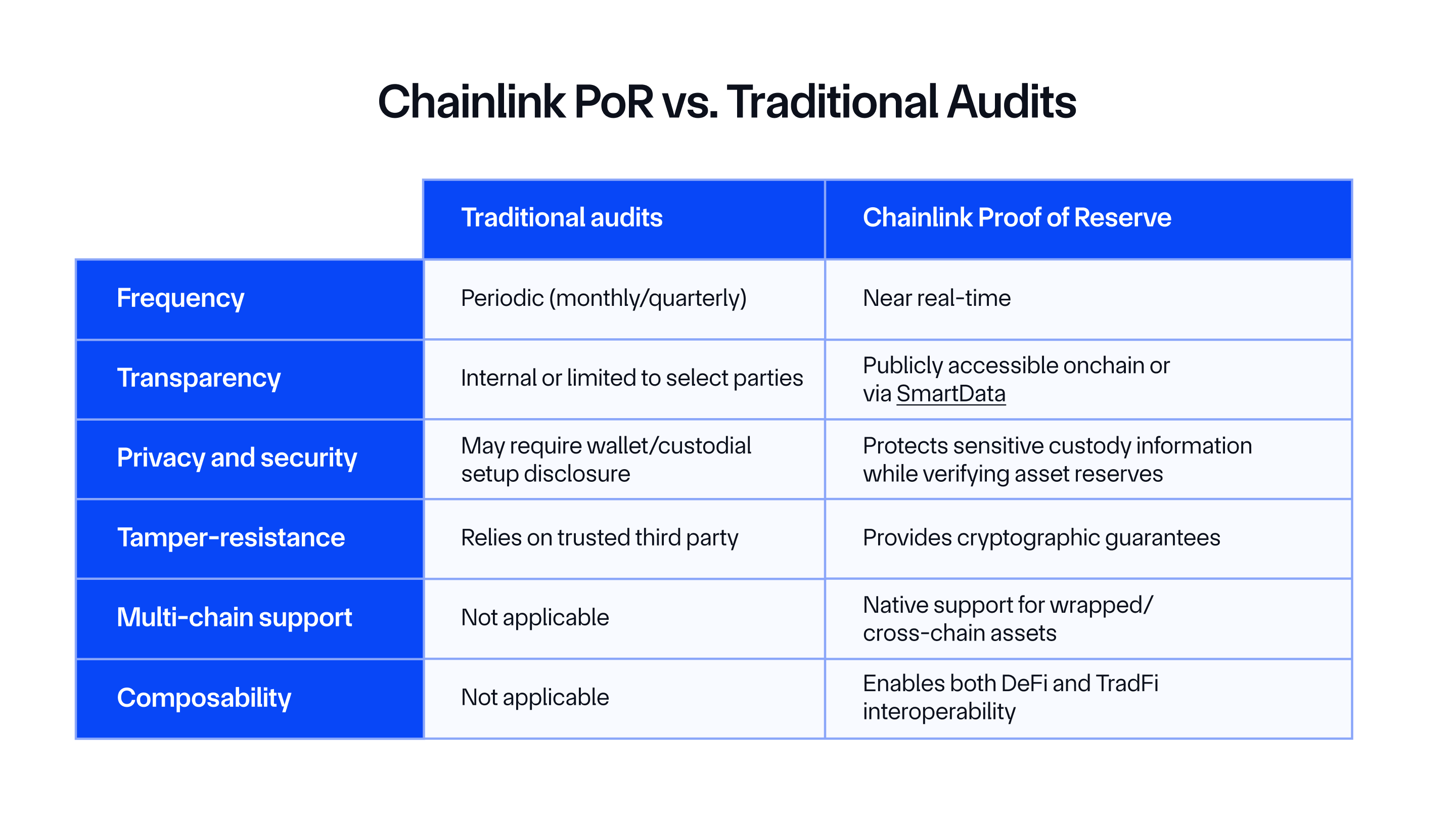

Chainlink Proof of Reserve enables the cryptographic verification of reserve assets. This enables custodians or asset issuers to prove onchain that they truly hold the assets they claim—providing transparency that goes far beyond traditional auditing methods.

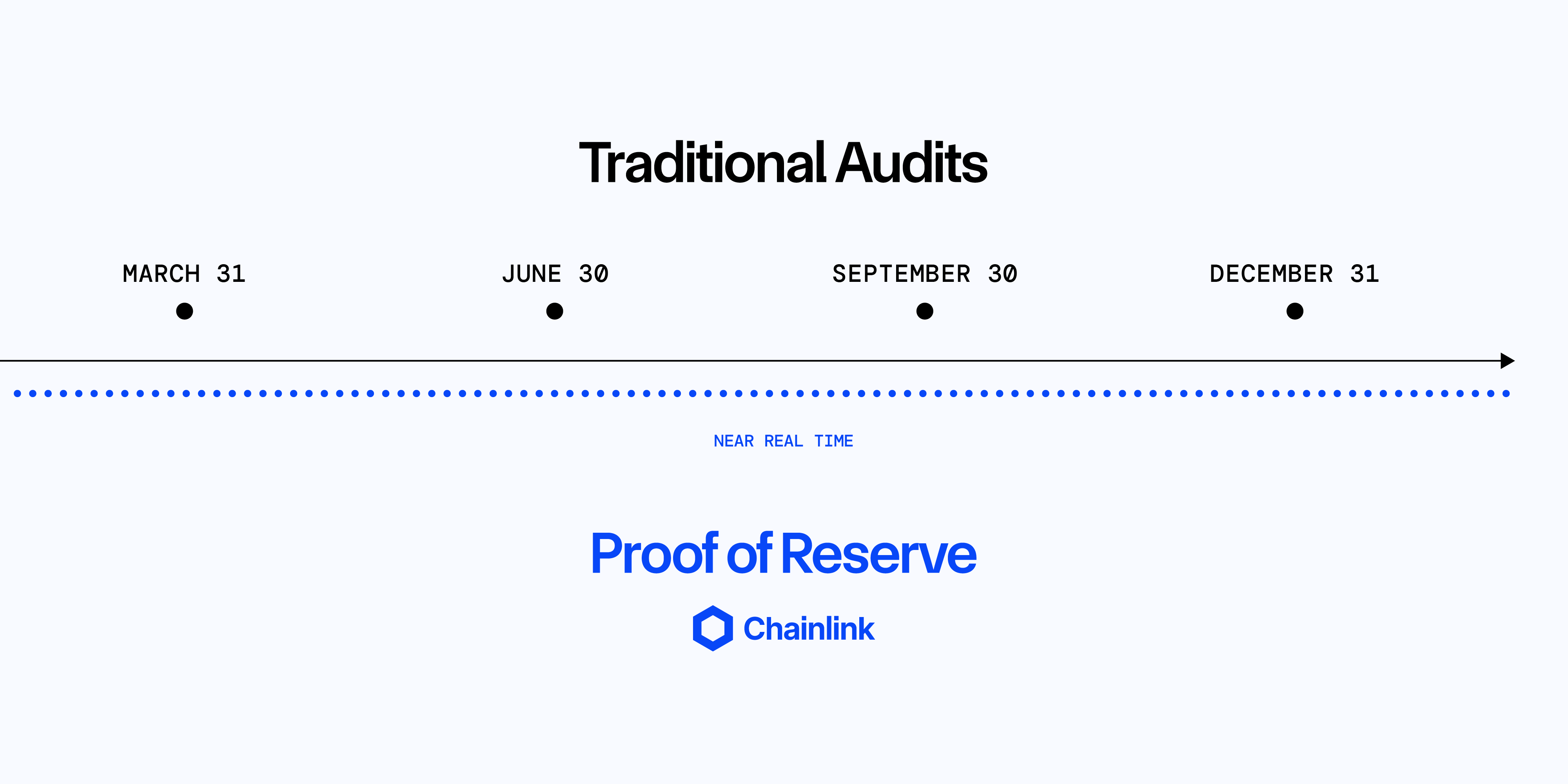

Rather than relying solely on delayed, opaque, or centralized auditing processes, Chainlink Proof of Reserve uses automated onchain verification, decentralized oracle networks, and near real-time availability to verify the status of reserves.

Chainlink Proof of Reserve is the largest provider of onchain proof of reserves, with users including ETF issuers 21Shares and Ark Invest, stablecoin issuer Ethena Labs, $2B+ TVL Bitcoin staking protocol Solv, and Wenia, a digital asset company from the Bancolombia Group, one of the largest financial conglomerates in Latin America.

Why Strategic Bitcoin Reserves or Digital Asset Stockpiles Need Chainlink Proof of Reserve

Even though Bitcoin wallets are public and viewable via block explorers, that alone isn’t enough to solve all the requirements of institutional-grade use cases. There are several reasons why strategic digital asset reserves need a more robust solution than simple address monitoring:

- Real-time transparency—Unlike traditional audits that happen monthly or quarterly, Chainlink Proof of Reserve enables automated, near real-time reserve verifications.

- Custodial abstraction—Governments and institutions may not want to publicly disclose wallet addresses for a variety of reasons, including security and the sensitivity of exposing a specific custodial setup. Chainlink Proof of Reserve allows them to verify reserves onchain without revealing sensitive operational details.

- Aggregated verification—For operational security, governments or custodians may spread their holdings across multiple wallets. Chainlink Proof of Reserve can verify and publicly report the aggregated total of these distributed holdings without revealing the individual wallet addresses. Even if funds are moved for key rotation or other routine purposes, Chainlink Proof of Reserve helps reassure stakeholders that reserves remain fully intact.

- Tamper-proof reporting—Every reserve verification is recorded onchain with a cryptographically timestamped, tamper-proof record, providing a high degree of transparency that is crucial for building long-term trust among stakeholders.

- Multi-chain compatibility—Chainlink Proof of Reserve supports reserve verification across multiple public or private blockchains, for example if a digital asset stockpile includes assets on multiple blockchains, and can relay that data across both onchain and offchain systems.

Conclusion

Over the past 15+ years, Bitcoin has grown from a niche project into a potential macroeconomic reserve asset. But for this new paradigm to scale securely, the supporting infrastructure must be equally robust and transparent.

Chainlink’s work with global monetary authorities and central banks, and strategic partnerships with digital asset custodians showcase how it is unifying global markets onchain by delivering secure and reliable infrastructure for digital assets.

As governments explore Bitcoin as part of their reserve strategy, transparency and security become critical. Chainlink Proof of Reserve is emerging as the standard for providing the onchain transparency needed to integrate Bitcoin and other digital assets into sovereign and institutional strategies.