Mastercard and Chainlink: Unlocking the $3T Payments Opportunity by Onboarding Billions of Cardholders to DeFi

Blockchain technology is set to underpin the next era of global finance, transforming everything from stock trading to interbank settlement. While the underlying technology is ready to support mainstream adoption, the current user experience can be improved. A lack of secure infrastructure powering frontend tools has left users vulnerable and created a barrier to adoption.

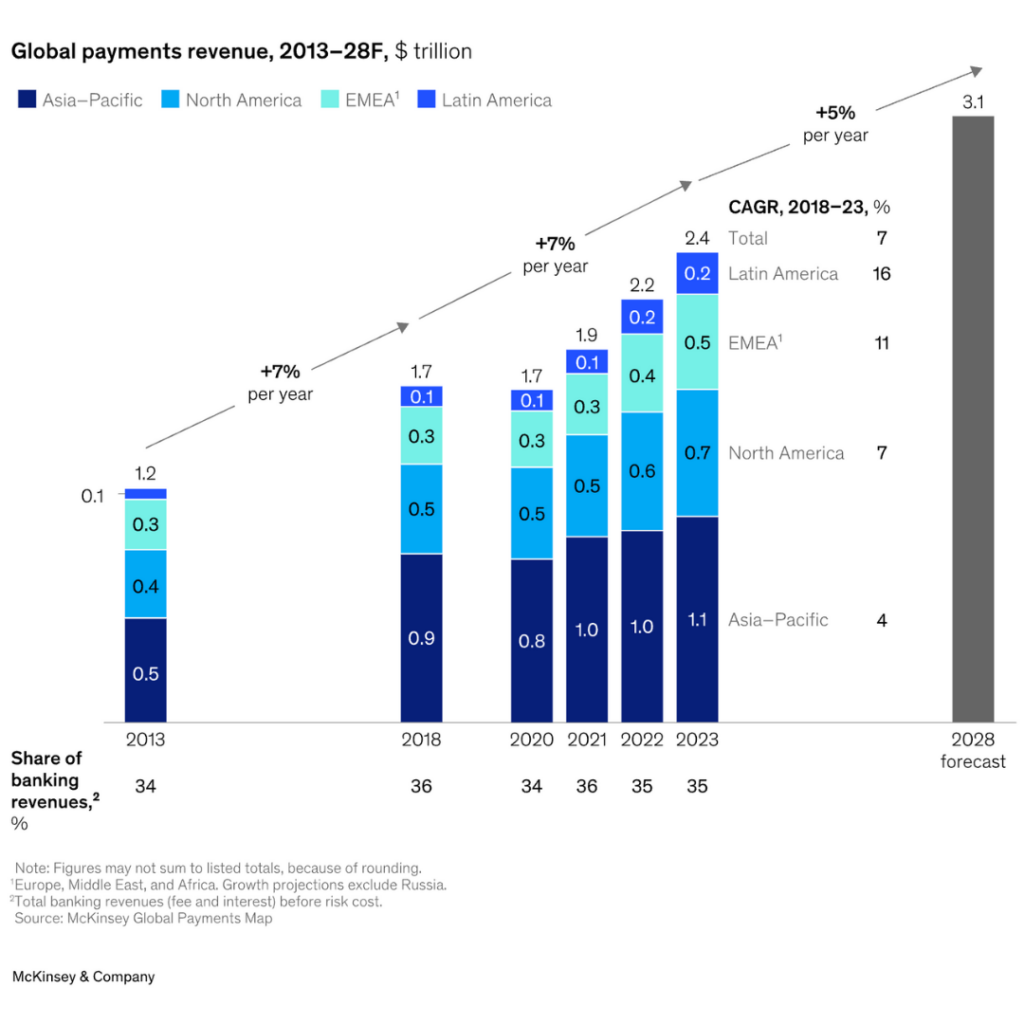

What’s needed are highly secure tools that build upon reliable infrastructure. Payments are a critical first step toward the broader adoption of the blockchain economy, as payments provide an entry point to the onchain economy and support the use of additional use cases. According to McKinsey & Company, global payments revenue will exceed $3 trillion by 2028.

In this post, we explore the digital payments opportunity and how Chainlink and Mastercard’s partnership is providing over 3 billion cardholders secure access to the blockchain economy.

Opportunity: Global Digital Payments Revenue Projected to Exceed $3 Trillion by 2028

Blockchain technology is reshaping global payment networks. From the back-end plumbing of the world’s biggest banks to everyday consumer transactions, blockchain tech is enabling faster, more secure, and more cost-effective transactions. This is one of the most significant opportunities in finance, with global digital payments revenue projected to exceed $3.1 trillion by 2028.

Blockchain technology transforms various payment use cases:

- Retail: Faster checkouts, lower fees, and improved security are possible for merchants and consumers when transacting onchain.

- Cross-border: Faster and more efficient blockchain-based payments enable direct settlement on a distributed ledger.

- Remittances: Fees for remittance payments can be significantly lower as direct wallet-to-wallet transfers bypass intermediaries.

- Subscriptions: Smart contracts support automated recurring billing, which reduces administrative costs.

- Micropayments: Blockchains can efficiently process minute payments, eliminating the need for comparatively high fees.

- Supply chain: Combining blockchains, smart contracts, and IoT devices can support automated, secure payments along supply chains.

- Settlement: Blockchain technology can power near-instant settlements, reducing counterparty risk and freeing up capital tied in long settlement cycles.

Major institutions recognize the opportunity to realize significant cost savings, unlock faster transaction times, and access new markets using blockchain technologies.

Challenge: Secure Access To The Blockchain Economy Is Critical for Widespread Adoption of Blockchain-Based Payments

In order to capture this $3 trillion opportunity, institutions must lower barriers to entry, making it a secure experience for users to enter the onchain economy and adopt blockchain-based payment systems.

While global crypto ownership now exceeds 560 million people as of 2024, the vast majority of the world still doesn’t interact with the blockchain economy. Even among current crypto users, engagement is often limited to trading and speculation rather than utilizing blockchain for payments or other real-world use cases.

One of the core problems holding back adoption is Web3 frontends and other tools required to use blockchain-based systems don’t meet the high levels of security that adoption from everyday users requires. Additionally, there has been limited integration with existing financial systems that people are more familiar with. By integrating with trusted platforms that enhance the user experience, blockchain payments and the broader blockchain economy can help drive adoption by billions across the globe.

Solution: Chainlink and Mastercard Partner To Enable Secure Crypto Purchases Directly Onchain

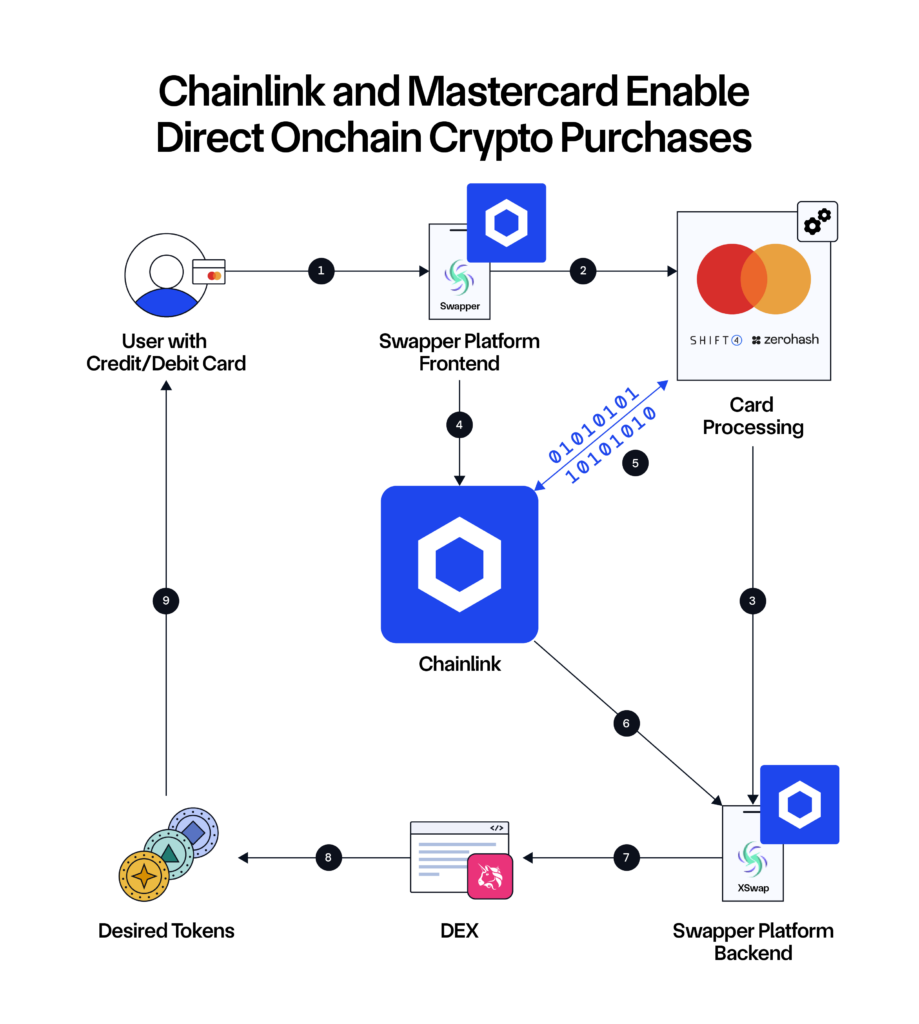

Chainlink and Mastercard are connecting the offchain payments world directly to the onchain DeFi world. This breakthrough is powered by Chainlink’s secure interoperability infrastructure and Mastercard’s trusted global payments network, removing long-standing barriers that have kept mainstream users from accessing the onchain economy.

“There’s no doubt about it – people want to be able to easily connect to the digital assets ecosystem, and vice versa. That’s why we continue to leverage our proven expertise and global payments network to bridge the gap between onchain commerce and offchain transactions. In coming together with Chainlink, we’re unlocking a secure and innovative way to revolutionize onchain commerce and drive the broader adoption of crypto assets.”—Raj Dhamodharan, executive vice president, Blockchain & Digital Assets at Mastercard

Swapper Finance leverages XSwap, the leading DEX built out of the Chainlink ecosystem that uses the Chainlink standard for data and interoperability, via an integration between zerohash and Shift4 Payments. zerohash provides the core compliance, custody, and transaction infrastructure, making it possible to convert fiat into crypto for smart contract consumption in a regulated manner.

“We are excited to be the infrastructure partner alongside Chainlink and Mastercard on the Swapper Finance platform. zerohash’s flexible crypto and stablecoin infrastructure powers seamless, compliant crypto-to-crypto swaps. zerohash provides the infrastructure to make access to decentralized exchanges simple through seamless compliant onboarding, abstracting away the complexities of smart contracts and low-latency onchain transactions.”—Edward Woodford, CEO & Co-Founder, zerohash

By bridging the gap between traditional and decentralized finance, the app makes blockchain-based payments feel like an extension of systems users already know, rather than an unfamiliar or unproven alternative.

Ultimately, this solution helps the blockchain industry to overcome challenges around user adoption and realize the $3 trillion payment opportunity. Moreover, the solution will enhance liquidity onchain and drive further growth.

Conclusion

Payments are just the tip of the iceberg. Blockchain technology is set to transform the entire financial system, from equities trading to automated corporate actions. Payments are a critical first step towards the wider adoption of blockchain-based solutions and can bring billions of users into the ecosystem.