Introducing DataLink: Bringing Institutional Market Data Onchain

We’re excited to introduce DataLink—the institutional-grade data publishing service powered by Chainlink. DataLink is a turnkey service that enables institutions to seamlessly publish data to blockchains and unlock the benefits of the onchain economy without the cost or complexity of building new infrastructure. By leveraging the Chainlink data standard to provide secure access to the same high-quality data institutions already rely on, DataLink accelerates institutional adoption of digital assets and enables organizations to rapidly scale onchain.

Deutsche Börse Market Data + Services has formed a strategic partnership with Chainlink to bring its multi-asset class market data to blockchains. For the first time, real-time data from the largest derivatives exchange in Europe, Deutsche Börse Group’s Eurex, along with Xetra, 360T, and Tradegate trading venues—spanning equities, derivatives, forex instruments, and more—is being made available onchain. This milestone sets a new standard for how institutional-grade market data is accessed and used in the digital asset economy.

DataLink is launching on 40+ blockchain mainnets, with many more to come.

With demand for tokenized real-world assets expected to reach $30.1 trillion, DataLink empowers banking and capital markets institutions to establish leadership in the onchain economy and unlock new revenue streams. At the same time, developers building with DataLink gain faster access to institutional-grade data, enabling them to build new products more rapidly, launch assets, and support robust markets underpinned by high-quality data.

Deutsche Börse Market Data + Services Partners With Chainlink To Publish Market Data Onchain Via DataLink

Deutsche Börse Market Data + Services is bringing its multi-asset class market data to blockchains for the first time. As one of the world’s largest exchange groups, Deutsche Börse Market Data + Services delivers four billion data points in real time every day and handled more than €1.3 trillion in securities trading last year. DataLink enables 2,400+ DeFi protocols across 40+ public and private blockchains in the Chainlink ecosystem to access data from Deutsche Börse Group, unlocking new opportunities for financial products and services backed by the high-quality data powering traditional finance.

The real-time, multi-asset class data Deutsche Börse Market Data + Services is bringing onchain includes:

- Eurex—Europe’s largest derivatives exchange, listing interest rate, equity/index, volatility, dividend, FX, and other futures and options. In 2024, Eurex recorded over 2.08 billion traded contracts in exchange-traded derivatives, with a capital open interest of €3.6 trillion.

- Xetra—Europe’s leading venue for ETFs and ETPs by turnover and listings, with around €230.8 billion in trading volume last year alone.

- 360T—Deutsche Börse Group’s global foreign exchange unit operates one of the biggest FX trading venues in the world, predominantly used by some of the world’s largest corporations to hedge currency exposures. 360T serves more than 2,900 buy-side customers and more than 200 liquidity providers across 75 countries.

- Tradegate—a stock exchange specialising in executing private investors’ orders. Over 30 trading participants from Germany, Austria, and Ireland are currently connected and offer access to their customers from their own country and abroad. Deutsche Börse Group holds a 43 percent stake in Tradegate Exchange. Since January, Tradegate has recorded a turnover of €247.8 billion with over 34 million transactions.

“Partnering with Chainlink to publish Deutsche Börse Group’s trusted market data onchain for the first time marks a major milestone in connecting traditional and blockchain-based financial markets. By making data from Xetra, Eurex, 360T, and Tradegate accessible onchain through the Chainlink data standard, we are empowering global financial institutions to build the next generation of regulated financial products on the same high-quality data that underpins today’s markets.” – Dr. Alireza Dorfard, Managing Director, Head of Market Data + Services at Deutsche Börse Group.

Unlocking Institutional Data Onchain

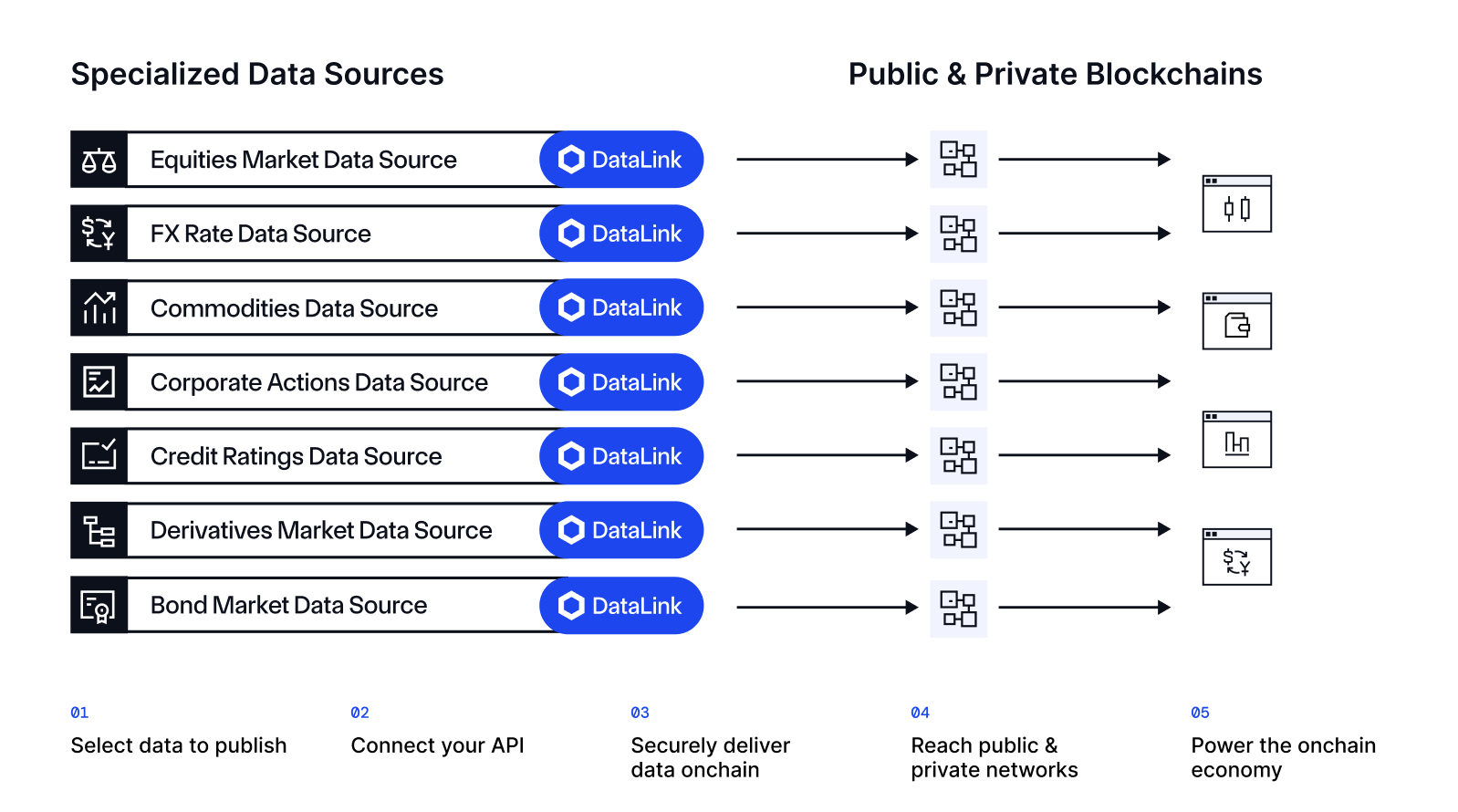

DataLink enables institutions to bring new types of data onchain to unlock more advanced blockchain use cases. Premium data providers are using DataLink to publish trusted data around:

- Credit Ratings—Independent assessments of issuers’ and instruments’ creditworthiness, default risk, and rating outlooks.

- Equities—Comprehensive data on global equity markets.

- FX Rates—Accurate and timely FX rate data across major, minor, and emerging market currency pairs.

- Bonds—Detailed market data including bond yields, maturities, issuer information, and historical pricing.

- Commodities—Extensive coverage of spot and futures prices for commodities such as metals, energy, and agriculture.

- Reference Data—Foundational datasets including security identifiers, classifications, corporate hierarchies, and market conventions to ensure consistency across financial instruments.

- Perpetual Funding Rates—Periodic payments exchanged between long and short traders in perpetual futures markets, designed to anchor perpetual contract prices closely to the underlying asset’s spot price.

- Corporate Actions Data—Events such as dividends, stock splits, mergers, acquisitions, rights issues, and reorganizations, with detailed terms and effective dates.

- Derivatives—Options, futures, swaps, and structured products, with data on pricing, implied volatility, and contract specifications.

- Any Custom Dataset—Tailored data solutions designed to meet unique specifications or requirements for specialized investment strategies or analytics.

Key Benefits for Data Providers and Web3 Protocols

Data Providers

DataLink offers a robust and secure gateway for institutions to commercialize high-value data onchain without requiring blockchain expertise.

This unlocks a range of benefits for data providers, including:

- New Revenue Streams—Commercialize proprietary data across 40+ blockchains using Chainlink’s enterprise-grade infrastructure, transforming valuable market data into new revenue streams.

- Access Control —Maintain control of your data with configurable access rights.

- Instant Distribution and Visibility—Reach 2,400+ dApps, RWA issuers, and tokenization platforms across public and private blockchains, along with Chainlink’s global network of institutional partners, including leading banks, tokenized asset platforms, and capital markets infrastructures.

- Seamless Integration—Leverage Chainlink’s push or pull delivery mechanisms across any supported chain through a single integration with DataLink, meaning no custom blockchain development or data re-architecture is required.

Interested in being a data provider for DataLink? Contact Chainlink Labs to learn more.

Data Consumers

Access to high-quality data via DataLink empowers Web3 protocols to deploy assets and launch new markets faster than ever before, further cementing Chainlink’s role as the backbone of the blockchain economy.

Key benefits for onchain applications include:

- Faster Market Launches— Access specialized, high-quality data to quickly deploy new assets and markets, gaining a first-mover advantage.

- Proven Infrastructure—DataLink is underpinned by Chainlink’s proven infrastructure, which has enabled tens of trillions in transaction value.

- Seamless Integration—Access the full DataLink catalog with one integration and easily combine multiple data subscriptions.

- Institutional-Grade Data—Leverage the same high-quality datasets trusted by global financial institutions, including equities, forex, bonds, commodities, derivatives, and more.

Interested in integrating DataLink into your DeFi protocol or onchain workflow? Reach out to learn more.

Connecting Institutions to the Onchain Economy via DataLink

With Deutsche Börse Market Data + Services as a launch partner, DataLink is enabling protocols to access institutional-grade data onchain, unlocking new opportunities for financial products and services backed by the high-quality data powering traditional finance. Through this trusted data infrastructure, DataLink is set to power a new era of growth across the onchain economy.

If you’re a data provider interested in learning more about commercializing your data via DataLink, or a DeFi protocol interested in integrating DataLink, explore the docs or reach out to our team.

—

Disclaimer: This post is for informational purposes only and contains statements about the future, including anticipated product features, development, and timelines for the rollout of these features. These statements are only predictions and reflect current beliefs and expectations with respect to future events; they are based on assumptions and are subject to risk, uncertainties, and changes at any time. There can be no assurance that actual results will not differ materially from those expressed in these statements, although we believe them to be based on reasonable assumptions. All statements are valid only as of the date first posted. These statements may not reflect future developments due to user feedback or later events, and we may not update this post in response. Please review the Chainlink Terms of Service, which provides important information and disclosures.

DataLink solely provides infrastructure for data providers to make their data available onchain. Chainlink does not verify, guarantee, or assume responsibility for the accuracy, reliability, availability, or quality of the data provided. Such responsibilities lie solely with the respective data providers. Protocols utilizing DataLink are strongly encouraged to independently validate that the quality and reliability of data received from data providers meet their use case requirements and implement comprehensive risk mitigation strategies, fallback mechanisms, and contingency plans to address potential inaccuracies or interruptions in data delivery from data providers. Contact the relevant data provider directly for more information on data quality provided through DataLink.